Is FinX Brokers safe?

Business

License

Is Finx Brokers Safe or a Scam?

Introduction

Finx Brokers is an offshore trading platform that positions itself within the Forex and CFD markets, purportedly offering a range of trading instruments including cryptocurrencies, commodities, and forex pairs. As with any broker, it is crucial for traders to carefully evaluate the legitimacy and safety of Finx Brokers before committing their funds. The Forex market is rife with both legitimate and fraudulent entities, which necessitates a thorough assessment of any broker's regulatory status, company background, trading conditions, and customer feedback. This article employs a structured approach, analyzing key aspects of Finx Brokers to determine whether it is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its credibility and safety. Finx Brokers claims to operate from Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory framework. Upon investigation, it becomes evident that Finx Brokers lacks any valid regulatory oversight, which raises significant red flags.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that Finx Brokers is not subject to the stringent oversight typically imposed by reputable financial authorities. This lack of scrutiny can lead to risky trading practices and potential fraud. Furthermore, the company has not demonstrated any historical compliance with regulatory requirements, further questioning its legitimacy. Traders should always prioritize brokers that are regulated by recognized authorities to ensure their investments are protected.

Company Background Investigation

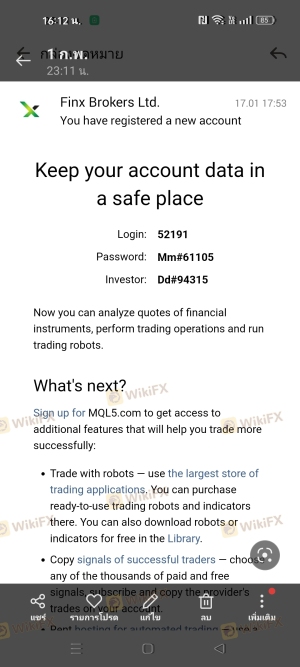

Finx Brokers was established in 2022, making it a relatively new player in the trading industry. The company claims to be registered under Finx Brokers Ltd, but information regarding its ownership and corporate structure remains opaque. The management team behind Finx Brokers is not publicly disclosed, which is a significant concern regarding transparency.

The lack of information on the company's leadership raises questions about the experience and professionalism of the individuals managing the platform. A transparent company typically provides details about its team, including their qualifications and backgrounds in the financial industry. In this case, the insufficient disclosure of information about Finx Brokers management team and ownership structure adds to the skepticism surrounding its operations.

Trading Conditions Analysis

Finx Brokers presents a variety of trading accounts with different minimum deposit requirements, but the overall fee structure remains unclear. Traders should be wary of any broker that does not provide transparent information about its fees and commissions.

| Fee Type | Finx Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unspecified | 1-2 pips |

| Commission Model | Unspecified | Varies |

| Overnight Interest Range | Unspecified | 0.5-2% |

The lack of clarity around the trading costs at Finx Brokers is concerning. Industry standards typically involve transparent fee structures, and any hidden fees can lead to unexpected losses. Furthermore, the absence of information on spreads and commissions suggests that traders might encounter unfavorable trading conditions, potentially impacting their profitability.

Client Fund Security

The safety of client funds is paramount when evaluating a broker's reliability. Finx Brokers does not provide adequate information regarding its fund security measures. Crucially, the broker does not mention segregated accounts, which are essential for protecting client funds from being misappropriated.

Moreover, there is no indication of investor protection mechanisms or negative balance protection policies. The lack of these safety nets could expose traders to significant financial risks, especially in volatile market conditions. Historical data on Finx Brokers does not reveal any major incidents related to fund security, but the absence of safeguards is a considerable risk factor.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of Finx Brokers reveal a mixed bag of experiences, with numerous complaints highlighting issues such as withdrawal problems and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Promotions | High | Poor |

Case studies from users indicate that many have faced difficulties in withdrawing their funds, with some reporting that their requests were ignored or delayed indefinitely. Such patterns suggest a potential scam, as legitimate brokers typically have efficient withdrawal processes and responsive customer service.

Platform and Trade Execution

The trading platform offered by Finx Brokers is another critical aspect to consider. While the broker claims to provide a proprietary platform, there is limited information available regarding its performance, stability, and user experience. Traders should be cautious of platforms that lack transparency and do not utilize well-known trading software like MetaTrader 4 or 5.

The quality of order execution is also a major concern. Without sufficient data on slippage rates and order rejection occurrences, it is difficult to assess the reliability of trade execution on the Finx Brokers platform. Any signs of manipulation or poor execution can severely impact a trader's experience and profitability.

Risk Assessment

Engaging with Finx Brokers carries several risks that potential clients should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud potential. |

| Financial Risk | High | Lack of transparency in fees could lead to losses. |

| Operational Risk | Medium | Complaints about withdrawal issues indicate operational weaknesses. |

To mitigate these risks, traders should consider conducting thorough research and potentially seeking alternative, regulated brokers. Utilizing demo accounts and starting with minimal investments can also help in assessing the broker's reliability without significant exposure.

Conclusion and Recommendations

In conclusion, after evaluating the various aspects of Finx Brokers, it is evident that the broker raises numerous concerns regarding its safety and legitimacy. The absence of regulation, unclear trading conditions, and negative customer feedback strongly suggest that Finx Brokers is not a safe choice for traders.

For those considering trading in the Forex market, it is advisable to seek out regulated brokers with transparent practices and positive reputations. Alternatives such as brokers regulated by the FCA, ASIC, or CySEC should be prioritized for a more secure trading environment. Ultimately, the question remains: Is Finx Brokers safe? Based on the available evidence, it is prudent to approach with caution and consider more reputable options.

Is FinX Brokers a scam, or is it legit?

The latest exposure and evaluation content of FinX Brokers brokers.

FinX Brokers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FinX Brokers latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.