Enticecapital 2025 Review: Everything You Need to Know

Executive Summary

This enticecapital review shows major concerns about this online trading platform. Entice Capital Limited is registered in Saint Lucia and has received lots of negative attention from users and industry watchers because of many red flags and possible scam activities. The platform says it offers forex trading opportunities and passive income generation, mainly targeting investors who want to trade currencies.

Our investigation shows that Entice Capital works with very little regulatory oversight and lacks transparency in how it does business. Many user reports point to suspicious activities, withdrawal problems, and questionable business practices. The platform has been operating for only 2-5 years, and it doesn't have proper regulatory credentials, which raises serious concerns about fund safety and platform reliability.

Users thinking about this platform should be extremely careful. The available evidence suggests significant risks with putting money in or trading through Entice Capital. The overwhelming negative feedback and lack of regulatory protection make this platform unsuitable for serious traders who want legitimate investment opportunities.

Important Notice

Regional Entity Variations: This review focuses on Entice Capital Limited, which is registered in Saint Lucia. Investors should know that the company operates without clear regulatory oversight from recognized financial authorities. The Saint Lucia registration does not provide the same level of investor protection that you typically find with brokers regulated by major financial authorities such as the FCA, ASIC, or CySEC.

Review Methodology: This assessment is based on available information from multiple sources, user reviews, and publicly accessible data. The evaluation has not been done through direct platform testing or verification with the company. Potential investors should do their own research and seek advice from qualified financial professionals before making any investment decisions.

Rating Framework

Broker Overview

Entice Capital Limited presents itself as an online trading platform registered in Saint Lucia. Specific information about when it was founded remains unclear from available documentation. The company claims to provide access to forex markets and opportunities for passive income generation, targeting retail investors interested in currency trading.

However, the platform's business model and operational structure lack the transparency typically expected from legitimate financial service providers. The platform's official website is https://enticecapital.com, where potential clients can access basic information about their services. Despite claims of offering forex trading opportunities, detailed information about trading conditions, platform features, and regulatory compliance remains notably absent from public documentation.

This lack of transparency has contributed to growing concerns about the platform's legitimacy and operational integrity. According to available information, Entice Capital has been operational for about 2-5 years, positioning itself as a relatively new entrant in the competitive online trading space. However, this enticecapital review reveals that the platform has failed to establish the credibility and trust typically associated with legitimate brokers during this operational period.

The absence of proper regulatory oversight and the mounting negative user feedback suggest significant operational and ethical concerns.

Regulatory Status: Entice Capital Limited is registered in Saint Lucia, a jurisdiction that does not provide comprehensive regulatory oversight for financial services. The platform lacks authorization from major regulatory bodies such as the Financial Conduct Authority, Australian Securities and Investments Commission, or Cyprus Securities and Exchange Commission.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available documentation. This raises concerns about transparency and operational procedures.

Minimum Deposit Requirements: The platform has not disclosed minimum deposit requirements in publicly available information. This makes it difficult for potential clients to assess entry barriers.

Bonuses and Promotions: No specific bonus or promotional offerings are mentioned in available documentation. This lack of information may indicate either absence of such programs or poor communication practices.

Available Trading Assets: The platform primarily focuses on forex markets, including major and minor currency pairs. However, the exact range of available instruments remains unspecified in public documentation.

Cost Structure: Critical information about spreads, commissions, and other trading costs is notably absent from available sources. This prevents potential clients from making informed decisions about trading expenses.

Leverage Ratios: Specific leverage offerings are not detailed in available documentation. This is concerning given the importance of this information for risk management.

Platform Options: The trading platform technology and available interfaces are not specified in public information. This raises questions about technological capabilities and user experience.

Geographic Restrictions: Information about geographic limitations or restricted territories is not clearly communicated in available documentation.

Customer Support Languages: Available customer service languages are not specified in accessible information. This potentially indicates limited support capabilities.

This enticecapital review highlights the concerning lack of transparency across fundamental operational aspects that legitimate brokers typically disclose clearly.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Entice Capital represent one of the most significant weaknesses in their service offering. They earn a disappointing score of 1/10. The platform fails to provide clear information about account types, minimum deposit requirements, or specific features that differentiate various account tiers.

This lack of transparency makes it impossible for potential clients to make informed decisions about which account structure might suit their trading needs. Unlike established brokers who typically offer multiple account types with clearly defined features, benefits, and requirements, Entice Capital's approach lacks the sophistication and clarity expected in the modern trading environment. The absence of detailed information about account opening procedures, verification requirements, and ongoing maintenance conditions raises serious questions about the platform's operational maturity and commitment to client service.

User feedback consistently highlights confusion and frustration regarding account setup and management processes. Many reports indicate that clients struggle to understand the terms and conditions governing their accounts, with some suggesting that important information is either withheld or communicated poorly. The lack of specialized account features, such as Islamic accounts for Muslim traders or professional accounts for experienced investors, further demonstrates the platform's limited service offering.

This enticecapital review reveals that the platform's account conditions fall significantly short of industry standards, making it unsuitable for traders seeking professional-grade account management and clear, transparent terms of service.

Entice Capital's tools and resources offering receives a low score of 2/10. This reflects the platform's minimal provision of trading support materials and analytical tools. While the platform mentions access to forex markets, the specific tools, indicators, and analytical resources available to traders remain largely unspecified in available documentation.

This lack of detail suggests either a limited toolset or poor communication of available resources. Professional traders typically require access to comprehensive charting tools, technical indicators, economic calendars, market analysis, and educational resources to make informed trading decisions. However, available information about Entice Capital suggests a significant gap in these essential trading support features.

The platform appears to lack the sophisticated analytical tools and research resources that serious traders expect from legitimate brokers. Educational resources, which are crucial for developing trader skills and understanding market dynamics, appear to be either absent or inadequately promoted. User feedback indicates frustration with the limited availability of learning materials, market insights, and trading guidance.

This deficiency is particularly concerning for novice traders who rely on educational content to develop their trading capabilities safely and effectively. The absence of automated trading support, advanced charting capabilities, and third-party tool integration further limits the platform's appeal to experienced traders who require sophisticated trading environments. These limitations contribute to the overall poor assessment of Entice Capital's tools and resources offering.

Customer Service and Support Analysis

Customer service and support represent another area of significant concern for Entice Capital. They earn a score of 2/10 based on available user feedback and operational evidence. Multiple user reports indicate serious deficiencies in customer support responsiveness, problem resolution capabilities, and overall service quality.

These issues have contributed to growing concerns about the platform's commitment to client welfare and operational integrity. Users frequently report difficulties in contacting customer support representatives, with many experiencing prolonged response times or complete lack of communication when seeking assistance. This poor responsiveness becomes particularly problematic when clients encounter account issues, withdrawal difficulties, or technical problems requiring immediate attention.

The absence of multiple communication channels and limited support availability further worsen these service deficiencies. The quality of support interactions, when they do occur, appears to be substandard according to user feedback. Many reports suggest that support representatives lack the knowledge, authority, or willingness to resolve client concerns effectively.

This has led to frustration and suspicion among users, with some questioning whether poor support is intentional to discourage withdrawal requests or complaint resolution. Language support limitations and unclear escalation procedures add additional barriers to effective customer service. The lack of comprehensive support documentation and self-service resources forces clients to rely heavily on direct support interactions, which are already problematic.

These service deficiencies contribute significantly to the negative perception and trust issues surrounding the platform.

Trading Experience Analysis

The trading experience offered by Entice Capital receives the lowest possible score of 1/10. This reflects serious concerns about platform functionality, reliability, and overall trading environment quality. Available user feedback suggests significant problems with trade execution, platform stability, and the overall trading infrastructure that make professional trading extremely difficult or impossible.

User reports indicate frequent technical issues, including platform downtime, slow order execution, and connectivity problems that can severely impact trading outcomes. These technical deficiencies are particularly concerning in the fast-paced forex market, where timing and reliability are crucial for successful trading. The absence of detailed information about platform specifications and performance metrics further raises questions about the technological capabilities.

Order execution quality appears to be problematic, with users reporting unexpected slippage, delayed fills, and pricing discrepancies that can significantly impact trading profitability. These execution issues, combined with the lack of transparency about trading conditions and pricing models, create an environment where traders cannot rely on consistent, fair execution of their trading strategies. Mobile trading capabilities and cross-platform synchronization, which are essential features for modern traders, appear to be either absent or poorly implemented based on available information.

The lack of advanced trading features, risk management tools, and portfolio analysis capabilities further diminishes the platform's suitability for serious trading activities. This enticecapital review confirms that the trading experience falls far below industry standards, making the platform unsuitable for both novice and experienced traders seeking reliable trading environments.

Trust and Security Analysis

Trust and security represent the most critical weaknesses in Entice Capital's offering. They earn a score of 1/10 due to numerous red flags and concerning user reports. The platform operates without proper regulatory oversight from recognized financial authorities, leaving clients without the protection and recourse typically available through regulated brokers.

This regulatory gap creates significant risks for client fund safety and platform accountability. The absence of clear information about fund segregation, client money protection, and financial safeguards raises serious concerns about asset security. Legitimate brokers typically maintain client funds in segregated accounts with tier-one banks and provide clear documentation about fund protection measures.

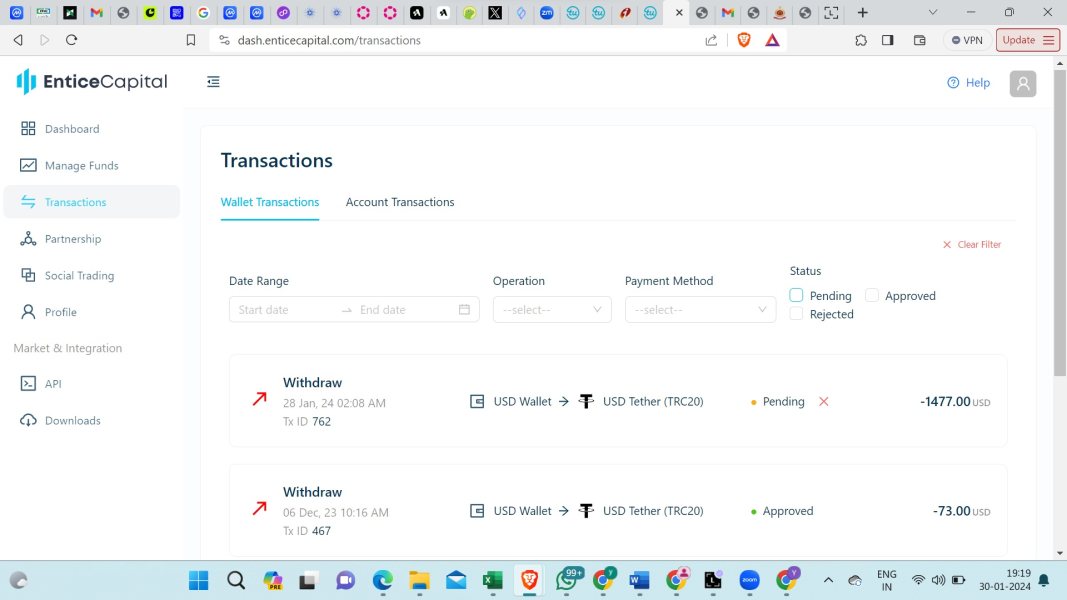

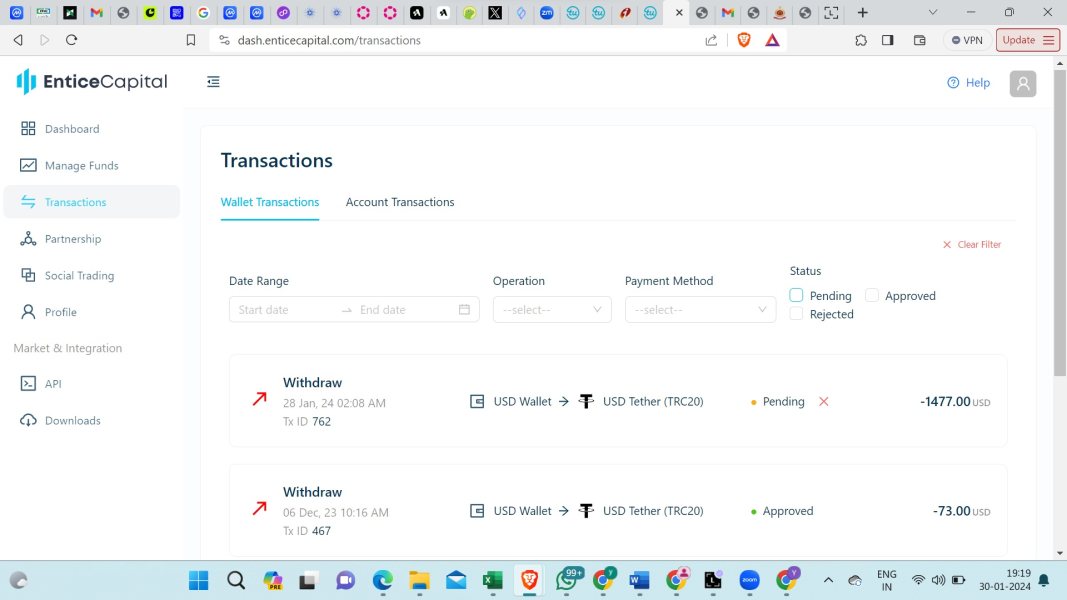

The lack of such transparency from Entice Capital suggests inadequate financial safeguards and potential risks to client deposits. User reports consistently highlight concerns about potential fraudulent activities, withdrawal difficulties, and suspicious business practices. Multiple sources indicate that clients have experienced problems retrieving their funds, with some reporting complete inability to access their accounts or process withdrawals.

These reports align with patterns commonly associated with fraudulent trading platforms and investment scams. The platform's industry reputation has been severely damaged by negative reviews, scam warnings, and user testimonials describing problematic experiences. Third-party review sites and industry watchdogs have flagged Entice Capital as a platform requiring extreme caution, with some explicitly warning against depositing funds with the company.

These warnings from independent sources provide additional validation of the trust and security concerns surrounding the platform.

User Experience Analysis

The overall user experience with Entice Capital receives a score of 1/10. This reflects widespread dissatisfaction among users and numerous operational deficiencies that impact client interactions with the platform. User feedback consistently indicates frustration with various aspects of the platform, from initial registration through ongoing account management and eventual withdrawal attempts.

The registration and account verification process appears to be problematic, with users reporting unclear requirements, delayed approvals, and poor communication during onboarding. These initial difficulties set a negative tone for the client relationship and suggest inadequate operational procedures for client acquisition and management. The lack of clear guidance and support during the setup process creates barriers to platform adoption and use.

Interface design and usability appear to be substandard based on available user feedback, with reports of confusing navigation, limited functionality, and poor overall design quality. Modern traders expect intuitive, responsive interfaces that facilitate efficient trading and account management. The apparent deficiencies in these areas suggest either outdated technology or insufficient investment in user experience development.

Fund management experiences represent a particular area of user dissatisfaction, with numerous reports of withdrawal difficulties, unclear procedures, and poor communication regarding fund transfers. These problems create significant stress for users and raise questions about the platform's operational integrity and commitment to client service. The target user demographic appears to be retail investors interested in forex trading and passive income opportunities.

However, the poor user experience makes the platform unsuitable for any serious trader or investor, regardless of experience level or investment goals. Improvements in transparency, communication, regulatory compliance, and operational procedures would be necessary to address the fundamental user experience deficiencies.

Conclusion

This comprehensive enticecapital review reveals significant concerns about the platform's legitimacy, safety, and suitability for trading activities. Entice Capital Limited operates with minimal regulatory oversight, lacks transparency in crucial operational areas, and has accumulated substantial negative feedback from users and industry observers. The platform's poor performance across all evaluated dimensions makes it unsuitable for serious traders or investors.

The primary user group potentially interested in Entice Capital consists of retail investors seeking forex trading opportunities and passive income generation. However, the overwhelming evidence of operational deficiencies, trust issues, and potential fraudulent activities makes this platform inappropriate for any investor category. The absence of proper regulatory protection and the numerous user reports of withdrawal difficulties create unacceptable risks for potential clients.

The main disadvantages significantly outweigh any potential benefits, with concerns including lack of regulatory oversight, poor customer service, technical deficiencies, withdrawal problems, and overall trust issues. The platform fails to meet basic industry standards for safety, transparency, and operational integrity, making it impossible to recommend for any legitimate trading or investment purposes.