Energy Markets Review 2

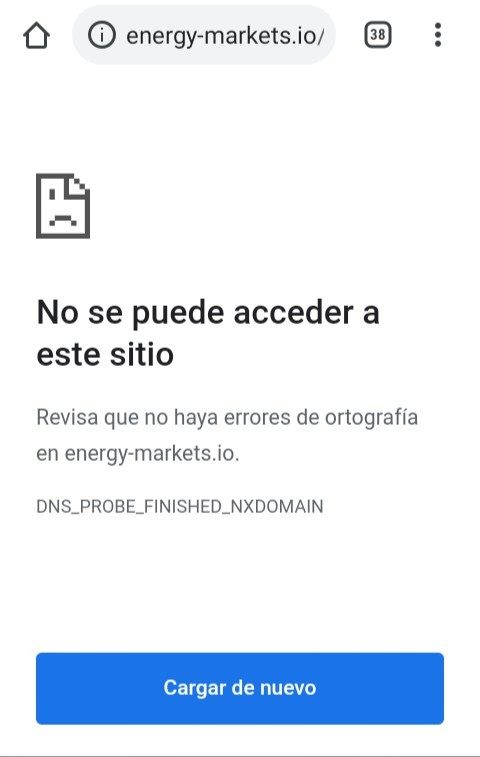

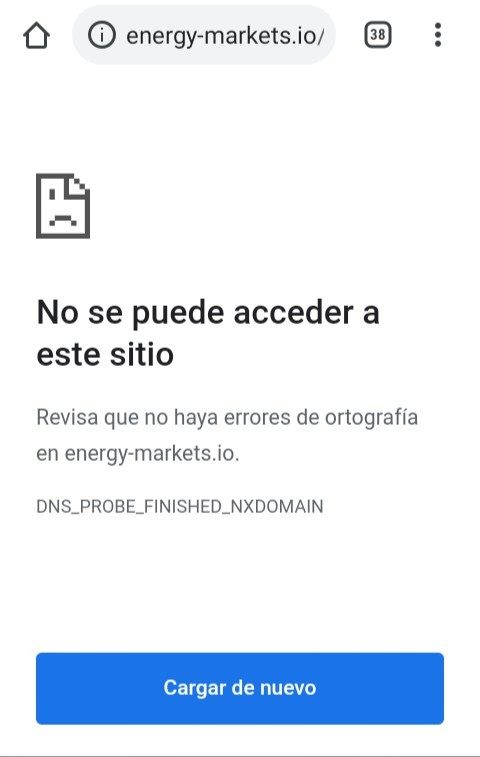

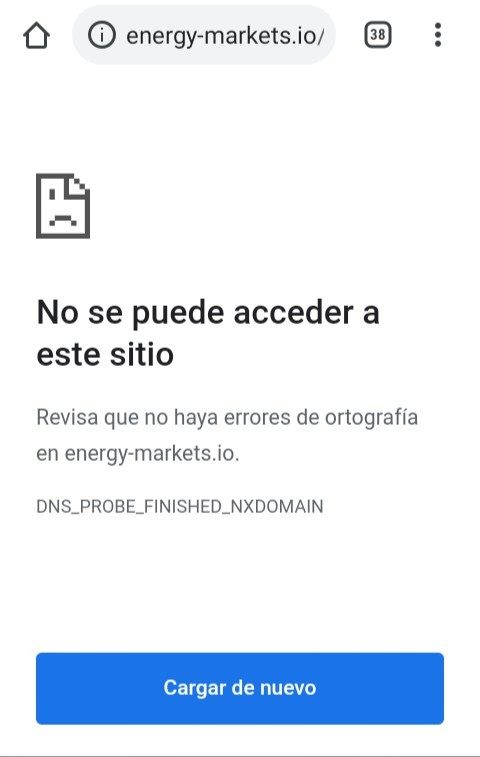

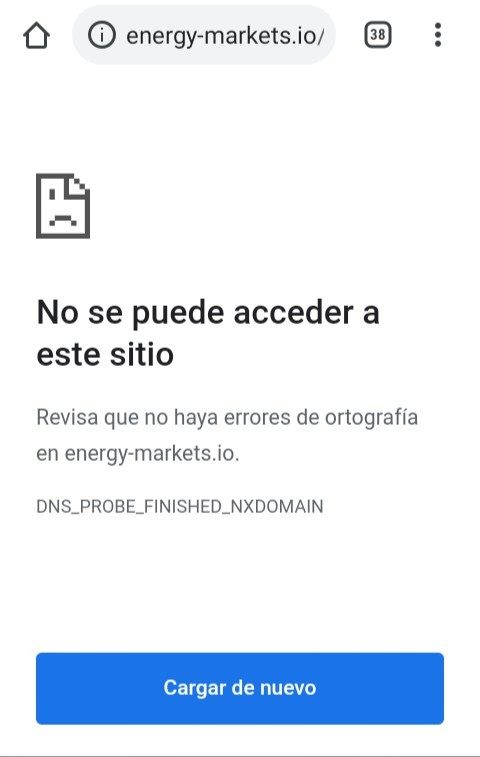

I deposited $1275 but my account was blocked.

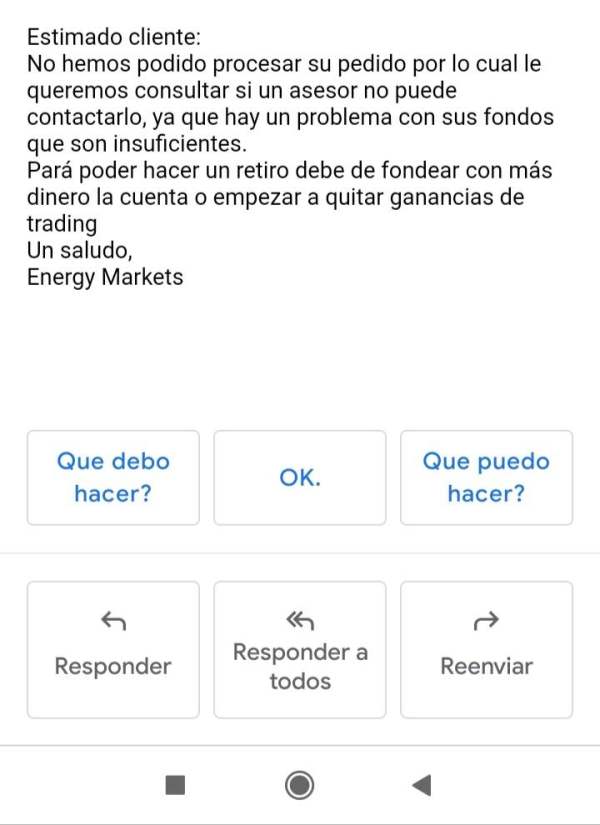

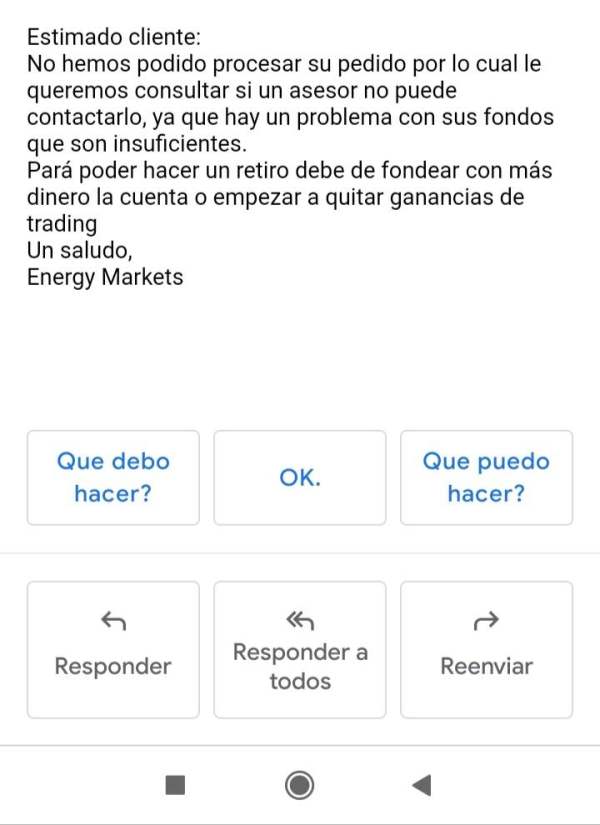

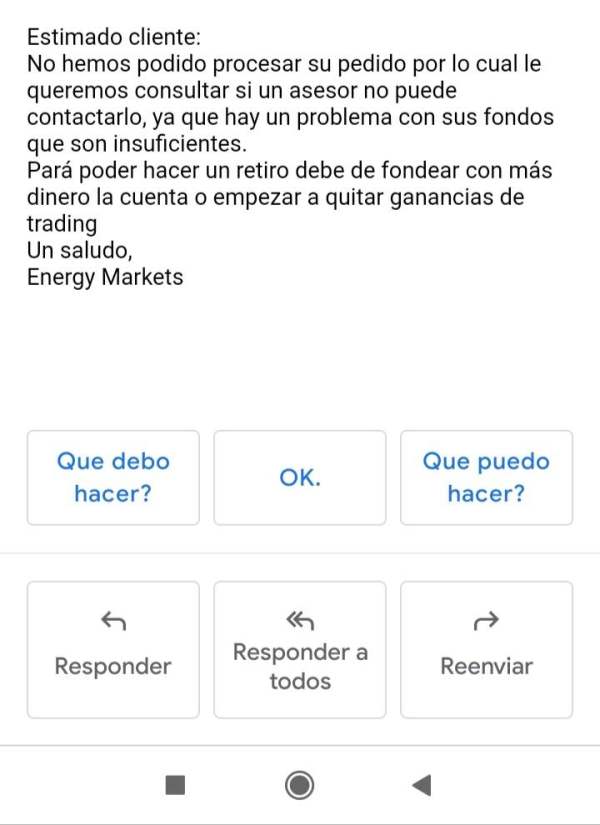

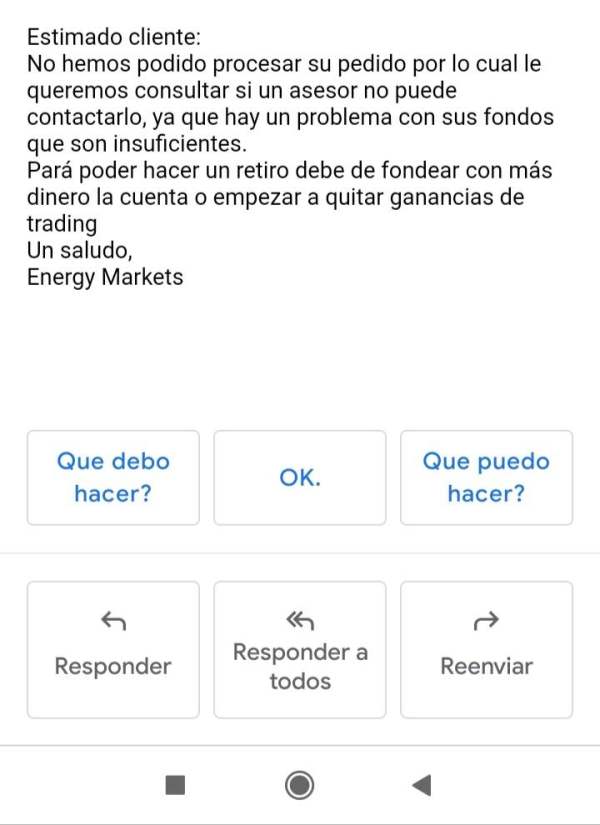

They will pursuade u to deposit more money but you can not get your money

Energy Markets Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

I deposited $1275 but my account was blocked.

They will pursuade u to deposit more money but you can not get your money

This energy markets review shows a complete analysis of global energy markets and energy brokerage services in 2025. The global energy system keeps changing because of renewable energy growth and market ups and downs. The Energy Institute Statistical Review of World Energy says that major events over the past five years have greatly affected international energy markets. These events caused supply chain problems, energy shortages, record prices, and more volatility.

Energy brokers help clients navigate complex energy markets by working with suppliers, checking contracts, and making sure agreements match client needs. The market shows big shifts toward renewable energy, with countries supporting solar and wind projects. Our assessment finds limited information about individual energy brokerage firms' trading conditions, platforms, and rules. This review helps investors interested in renewable energy and traders who need professional market support. Potential clients should be careful because operational details lack transparency.

Regional Entity Variations: Investors should be extra careful when choosing energy market brokers because available sources lack specific regulatory information. Different areas may have different rules and consumer protections that current market information does not clearly explain.

Review Methodology: This assessment uses available industry information and market background analysis. The evaluation may not cover all operational details because of limited specific data about individual energy brokerage services and their offerings.

| Evaluation Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Below Average |

| Tools and Resources | 5/10 | Average |

| Customer Service | 4/10 | Below Average |

| Trading Experience | 5/10 | Average |

| Trust and Reliability | 3/10 | Poor |

| User Experience | 4/10 | Below Average |

The energy markets sector includes everything from power generation to final consumer delivery. Available industry information shows that energy brokers work within this broad framework, focusing on connecting clients with the best energy supply agreements. However, specific details about individual brokerage firms' start dates, company backgrounds, and main business models are not clearly documented in accessible sources.

The industry landscape shows major transformation, with the Global Electricity Review 2025 by Ember highlighting big shifts in market dynamics. Energy brokers use their expertise to review contracts, discuss terms with suppliers, and ensure alignment with client requirements. Despite this important role, concrete information about specific trading platforms, asset categories, and regulatory oversight remains limited in current market documentation.

This energy markets review finds a critical information gap about the operational structure of energy brokerage services. The World Economic Forum reports six major shifts reshaping global energy markets, yet specific details about how individual brokers adapt to these changes, their technology infrastructure, and regulatory compliance frameworks are not readily available in public sources.

Regulatory Regions: Available sources do not specify particular regulatory authorities overseeing energy brokerage operations. This creates uncertainty about consumer protection frameworks.

Deposit and Withdrawal Methods: Specific information about payment processing options and financial transaction procedures is not detailed in accessible documentation.

Minimum Deposit Requirements: Concrete minimum investment thresholds are not specified in available industry sources.

Bonuses and Promotions: Current promotional offerings and incentive structures are not documented in accessible market information.

Tradeable Assets: While the broader energy market includes renewable and traditional energy sources, specific asset categories available through individual brokers remain unspecified.

Cost Structure: Detailed fee schedules, commission rates, and pricing models are not clearly outlined in available sources. This represents a significant transparency gap.

Leverage Ratios: Information about leverage options and risk management parameters is not provided in current documentation.

Platform Options: Specific trading platform technologies and interface options are not detailed in accessible sources.

This energy markets review reveals big information gaps that potential clients should carefully consider before engaging with energy brokerage services.

The evaluation of account conditions reveals significant information problems that impact our assessment. Available sources do not specify account type varieties, their distinctive features, or operational characteristics. The absence of minimum deposit requirement details makes it impossible to assess the accessibility and reasonableness of entry barriers for potential clients.

Account opening procedures and verification processes are not documented in accessible sources. This creates uncertainty about onboarding experiences. Special account functionalities, if any exist, remain unspecified in current industry documentation. This lack of transparency about fundamental account structures represents a big concern for potential clients seeking clear operational frameworks.

User feedback specifically addressing account conditions is not available in current sources. This prevents comprehensive evaluation of client satisfaction with account management services. Comparative analysis with other energy brokerage providers cannot be conducted due to insufficient data availability. The absence of concrete information about account features, requirements, and management procedures significantly impacts the reliability of this energy markets review regarding account conditions.

Without clear documentation of account structures, minimum requirements, and special features, potential clients face uncertainty about basic operational parameters essential for informed decision-making.

The assessment of available trading tools and analytical resources faces big limitations due to insufficient specific information in accessible sources. While the broader energy market context suggests the need for sophisticated analytical capabilities given market volatility and complexity, concrete details about tool varieties and quality remain unspecified.

Research and analysis resource availability is not documented in current sources, despite the critical importance of market intelligence in energy trading decisions. Educational resource offerings, which would be particularly valuable given market complexity, are not detailed in accessible documentation. Automated trading support capabilities, increasingly important in modern energy markets, remain unspecified.

User feedback about tool effectiveness and utility is not available in current sources. This prevents assessment of practical application experiences. Expert evaluations of tool quality and functionality are similarly absent from accessible documentation. The Energy Institute Statistical Review highlights significant market volatility and complexity, suggesting robust analytical tools would be essential, yet specific offerings remain undocumented.

This information gap represents a significant concern for traders requiring sophisticated analytical capabilities to navigate complex energy market conditions effectively.

Customer service evaluation faces big challenges due to limited available information about support infrastructure and service quality. Available sources do not specify customer service channels, accessibility options, or operational frameworks that would enable comprehensive assessment of support capabilities.

Response time metrics, crucial for evaluating service efficiency, are not documented in accessible sources. Service quality indicators, including problem resolution effectiveness and customer satisfaction measures, remain unspecified. Multi-language support availability, important for international energy market participants, is not detailed in current documentation.

Customer service operational hours and availability schedules are not provided in accessible sources. This creates uncertainty about support accessibility during critical market periods. User feedback specifically addressing customer service experiences is absent from available documentation, preventing assessment of real-world service quality and effectiveness.

Problem resolution case studies and service effectiveness examples are not available in current sources. The absence of concrete information about customer support infrastructure, service quality metrics, and user satisfaction indicators significantly limits the reliability of this evaluation component.

Trading experience evaluation encounters significant limitations due to insufficient information about platform performance, execution quality, and operational reliability. Platform stability metrics and execution speed data are not specified in accessible sources, despite their critical importance for effective energy market participation.

Order execution quality indicators, including slippage rates and fill accuracy, remain undocumented in available sources. Platform functionality completeness, covering essential trading tools and market access capabilities, is not detailed in current documentation. Mobile trading experience quality, increasingly important for modern market participation, is not specified.

Trading environment characteristics, including market access scope and execution conditions, are not clearly outlined in accessible sources. User feedback specifically addressing trading experience quality is absent from available documentation, preventing assessment of practical trading conditions and user satisfaction levels.

Technical performance data, including system uptime, execution speeds, and platform reliability metrics, are not provided in current sources. This energy markets review identifies big information gaps that impact the ability to assess actual trading experience quality and operational effectiveness comprehensively.

Trust and reliability assessment faces the most significant challenges due to absent regulatory information and transparency concerns. Available sources do not specify regulatory qualifications, licensing authorities, or compliance frameworks that would establish credibility and consumer protection standards.

Fund security measures, including client asset protection protocols and segregation procedures, are not documented in accessible sources. This represents a critical concern for potential clients considering significant energy market investments. Company transparency levels, including operational disclosure and financial reporting practices, remain unspecified.

Industry reputation indicators and third-party evaluations are not available in current documentation. This prevents assessment of market standing and peer recognition. Negative event handling procedures and crisis management capabilities are not outlined in accessible sources, raising concerns about operational resilience.

Regulatory authority verification cannot be conducted due to absent licensing information. Third-party assessment reports and independent evaluations are not available in current sources. User trust feedback and confidence indicators are similarly absent from accessible documentation. The big lack of transparency and regulatory clarity significantly impacts trust and reliability evaluation in this assessment.

User experience evaluation encounters big limitations due to absent user feedback and operational detail deficiencies. Overall user satisfaction indicators are not available in accessible sources, preventing comprehensive assessment of client experience quality and service effectiveness.

Interface design quality and usability characteristics are not documented in current sources, despite their importance for efficient market participation. Registration and verification process details remain unspecified, creating uncertainty about onboarding experience quality. Fund operation procedures and transaction experience quality are not outlined in available documentation.

Common user complaints and satisfaction concerns are not documented in accessible sources. This prevents identification of potential service issues and operational challenges. User demographic analysis and trader type suitability assessments cannot be conducted due to insufficient information availability.

User feedback compilation, including both positive and negative evaluation summaries, is not available in current sources. Service improvement recommendations cannot be formulated without adequate user experience data and feedback mechanisms. The absence of concrete user experience information significantly limits the reliability of this assessment component and raises concerns about service transparency and accountability.

This energy markets review concludes with a neutral assessment, primarily due to big information gaps about operational details, regulatory frameworks, and user experiences. While the broader energy market context shows significant transformation toward renewable energy adoption and increased market sophistication, specific information about energy brokerage services remains insufficient for comprehensive evaluation.

The assessment identifies potential opportunities for investors interested in renewable energy market participation, given the documented global shift toward sustainable energy infrastructure. However, the lack of transparent information about trading conditions, regulatory oversight, and operational frameworks presents significant concerns for potential clients. The primary advantage lies in the market transformation potential and growing renewable energy sector opportunities, while the main disadvantage centers on insufficient operational transparency and regulatory clarity.

Potential clients should exercise considerable caution and conduct additional due diligence before engaging with energy brokerage services. This is particularly important given the absence of clear regulatory information and operational details essential for informed decision-making.

FX Broker Capital Trading Markets Review