MoneyMall 2025 Review: Everything You Need to Know

Executive Summary

MoneyMall has been identified as an illegal broker with significant regulatory deficiencies and fraud risks. Multiple industry watchdogs have confirmed these serious concerns about the company. This comprehensive moneymall review reveals critical problems about the broker's legitimacy and how it operates day-to-day.

WikiFX has classified MoneyMall as an unlicensed entity with expired credentials. User feedback shows major issues with platform reliability and customer service response times. Despite offering the MetaTrader 4 trading platform, MoneyMall's negative reputation far outweighs any potential benefits it might provide.

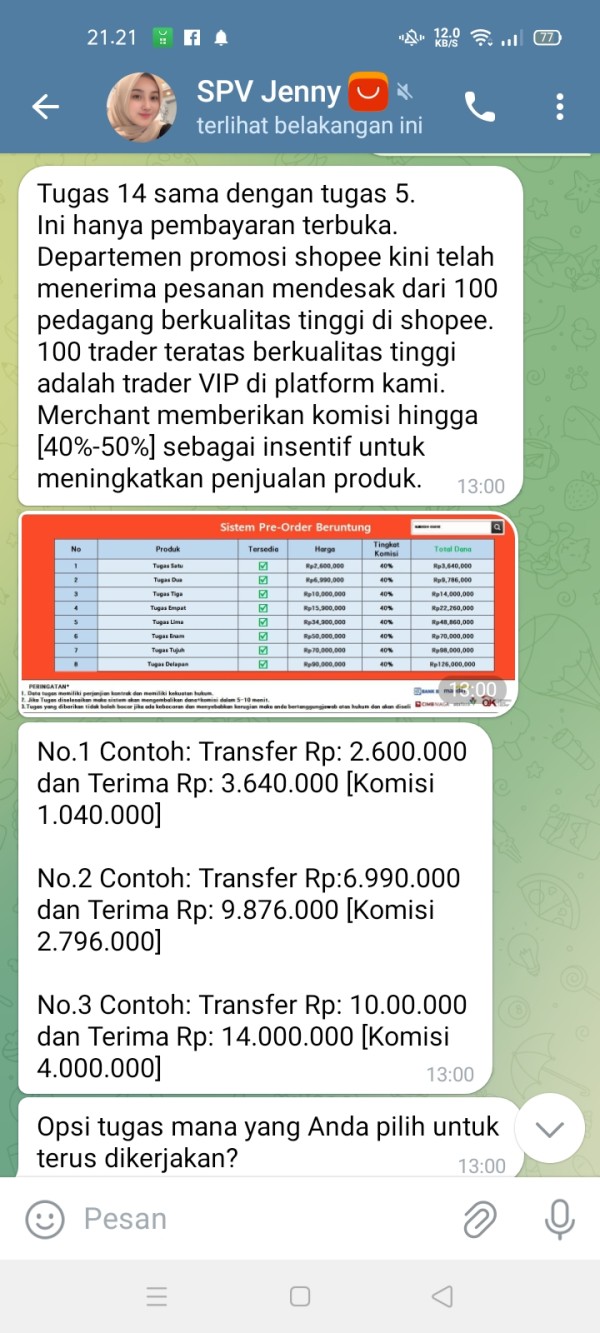

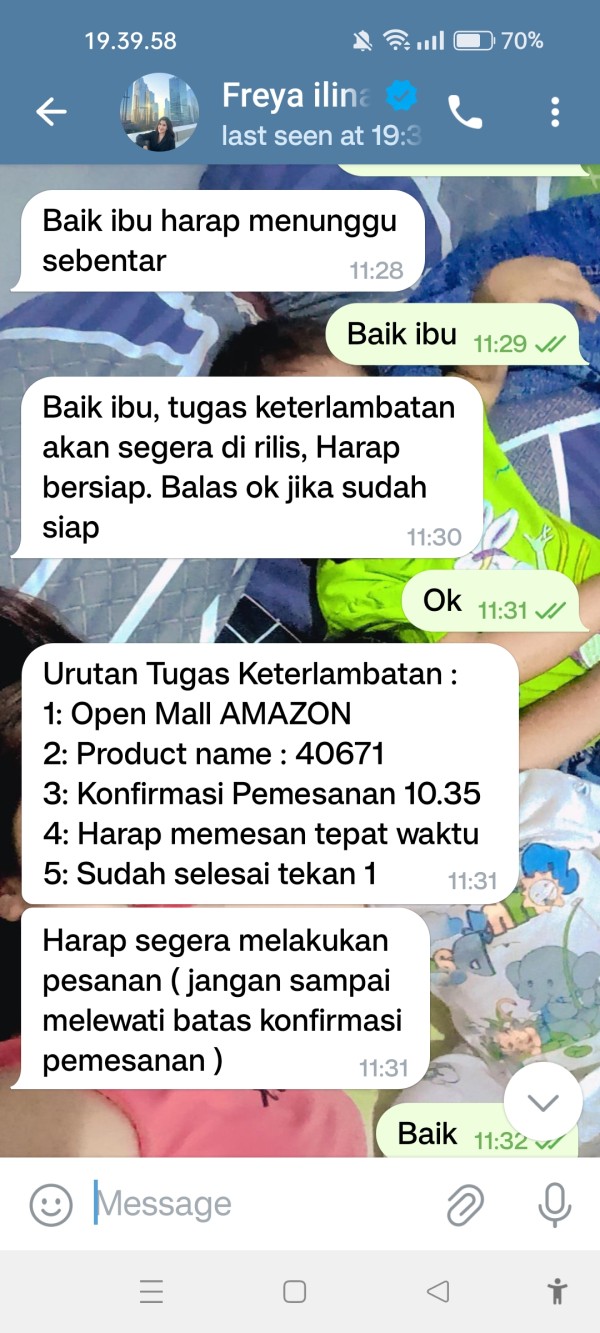

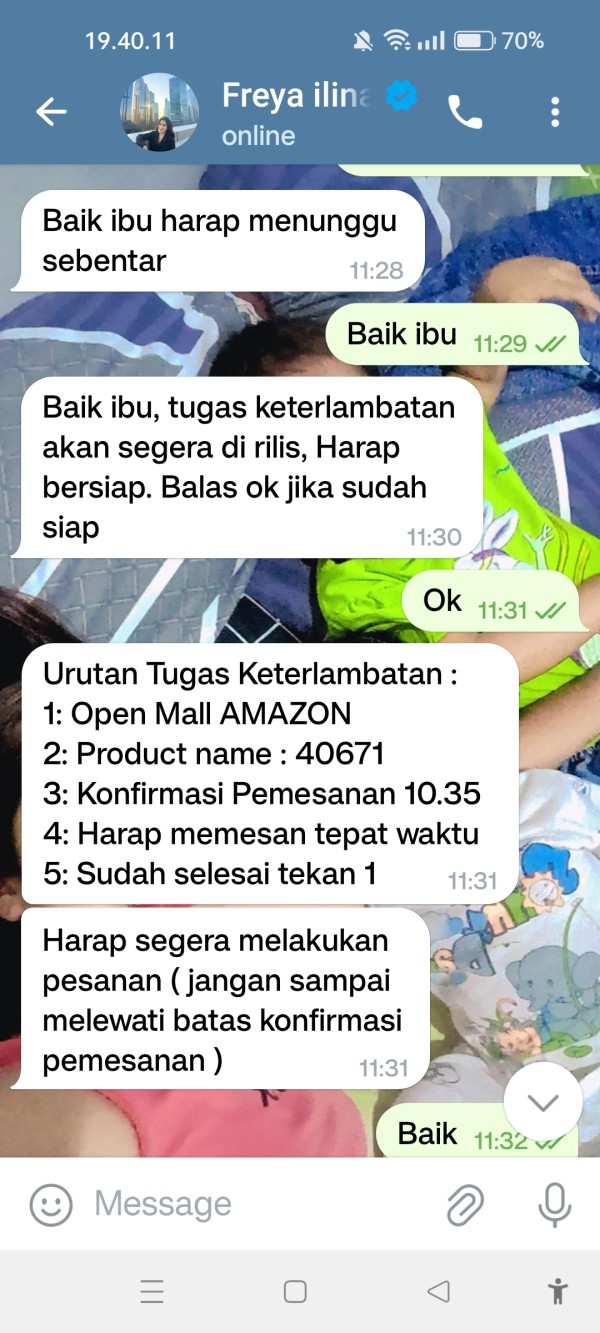

The broker mainly targets new forex traders who may not know how to spot regulatory red flags. User reviews on Trustpilot show a concerning 3.3-star rating with multiple reports about fraudulent activities and poor customer support. Our analysis shows that MoneyMall operates without proper NFA licensing and has been flagged by regulatory monitoring services.

The broker's lack of transparency about account conditions, fee structures, and safety measures raises serious concerns. These issues create major questions about trader fund security and operational integrity.

Important Notice

Regional Entity Differences: MoneyMall's legal status and regulatory compliance vary significantly across different jurisdictions. The company may claim to operate legally in certain regions, but our investigation reveals substantial gaps in proper licensing and oversight. Traders should know that regulatory protection may be limited or non-existent depending on their location.

Review Methodology: This evaluation is based on comprehensive analysis of publicly available information, regulatory databases, user feedback from multiple platforms, and industry reports. All assessments reflect current available data and may change as new information becomes available.

Rating Framework

Broker Overview

MoneyMall presents itself as a comprehensive financial services provider offering forex trading and personal financial management solutions. The company claims to deliver multiple trading services through various platforms, positioning itself as a gateway for retail traders seeking exposure to foreign exchange markets. However, significant concerns exist regarding the broker's legitimacy and regulatory standing.

The broker's business model centers around providing MetaTrader 4 platform access for forex trading. It also appears to offer financial coaching and credit monitoring services. MoneyMall markets itself to individuals interested in forex trading, particularly those who may be new to the financial markets and seeking accessible trading solutions.

Critical regulatory issues have emerged regarding MoneyMall's operations. According to WikiFX, MoneyMall does not hold valid NFA licensing and has been classified as an illegal broker with expired credentials. This regulatory deficit represents a fundamental concern for potential clients, as it indicates the absence of proper oversight and consumer protection mechanisms that legitimate brokers must maintain.

The broker's target demographic appears to include novice traders attracted to forex markets but lacking experience to properly evaluate broker credentials. This positioning raises additional concerns given the regulatory deficiencies and negative user feedback patterns identified in our moneymall review analysis.

Regulatory Status: MoneyMall operates without valid NFA licensing according to regulatory monitoring services. WikiFX has specifically flagged the broker as illegal with expired credentials, indicating serious compliance failures. This regulatory deficit means traders lack standard protections typically provided by properly licensed brokers.

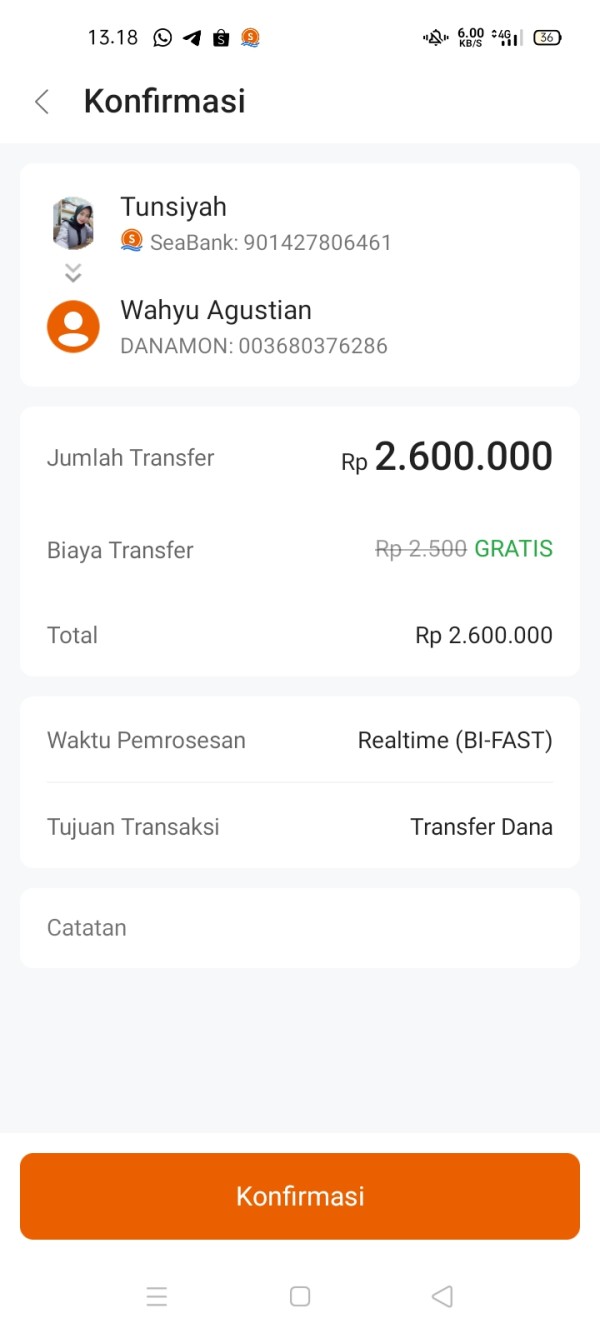

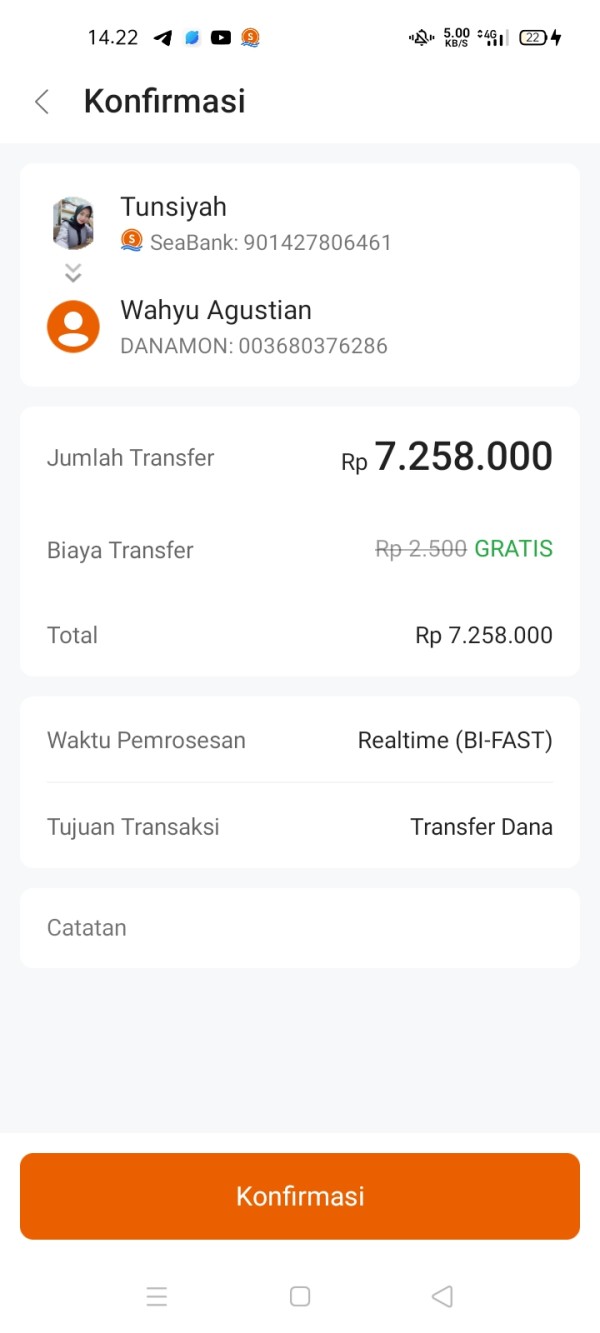

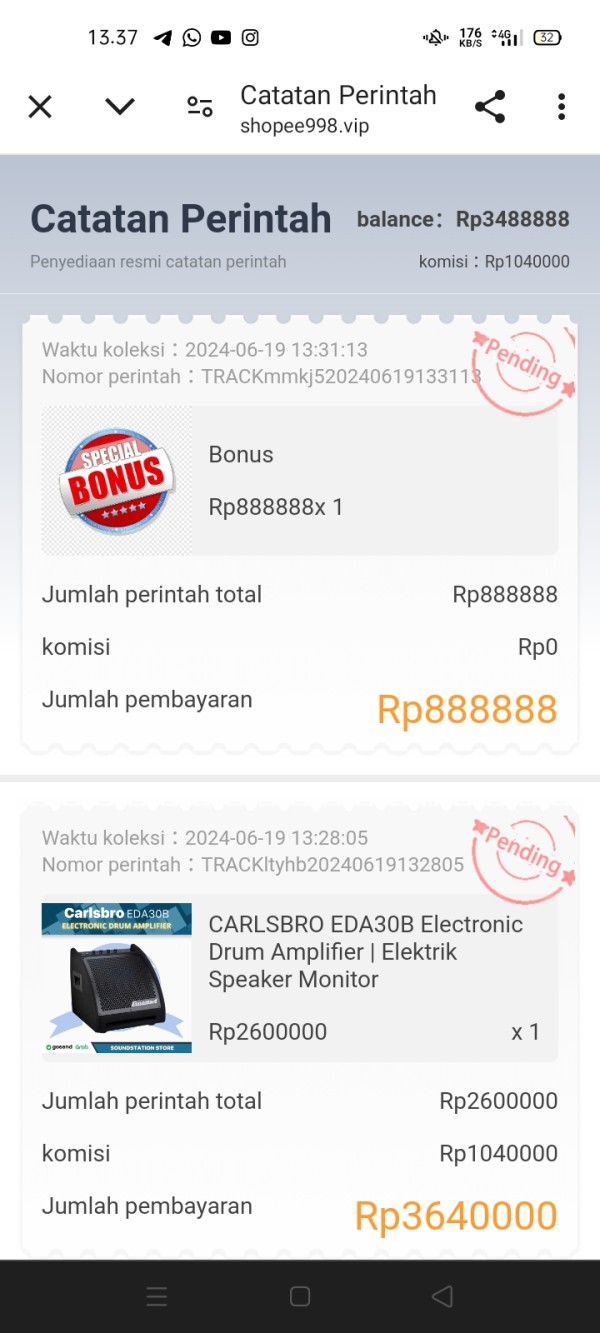

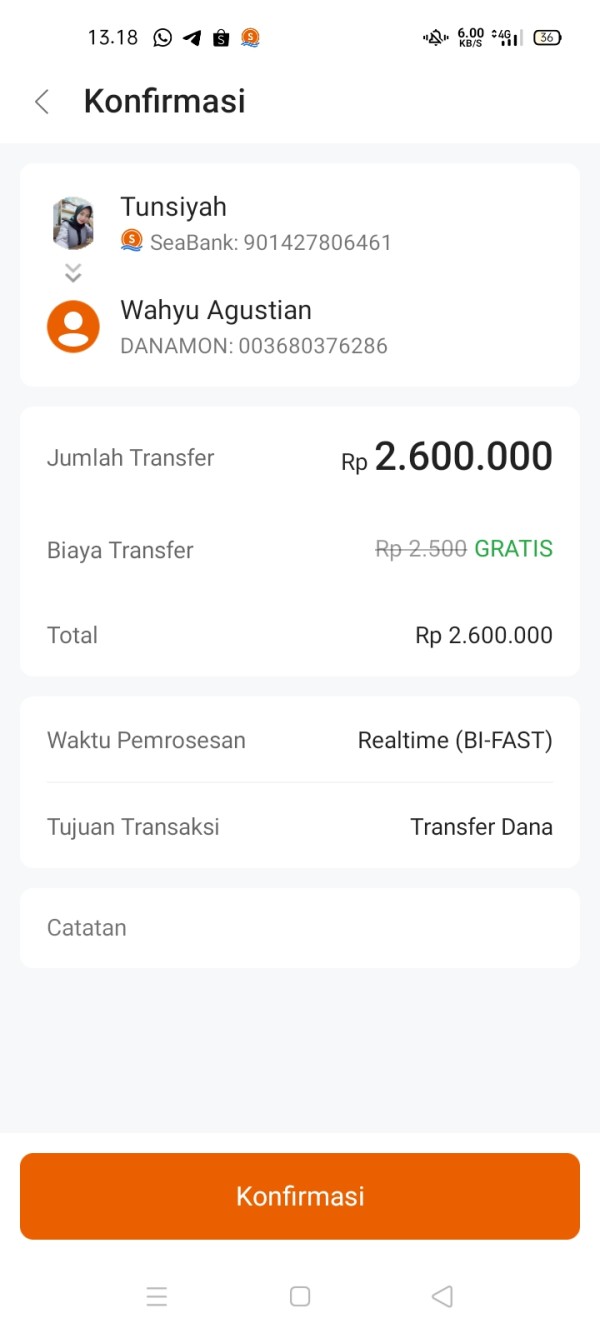

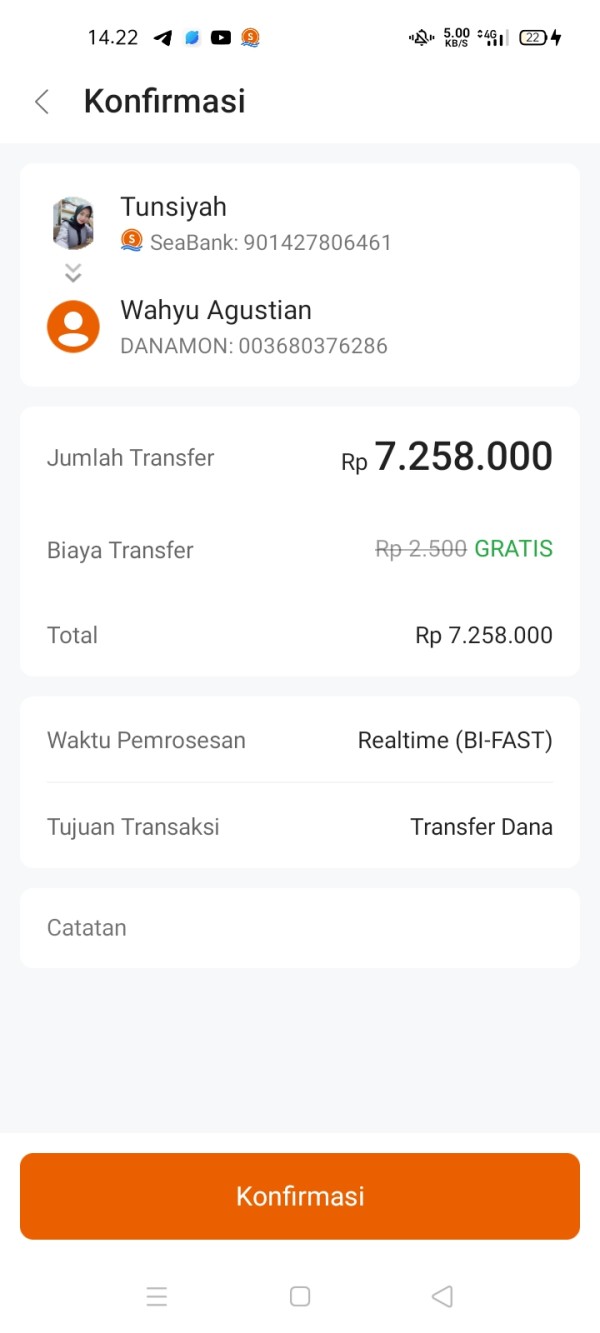

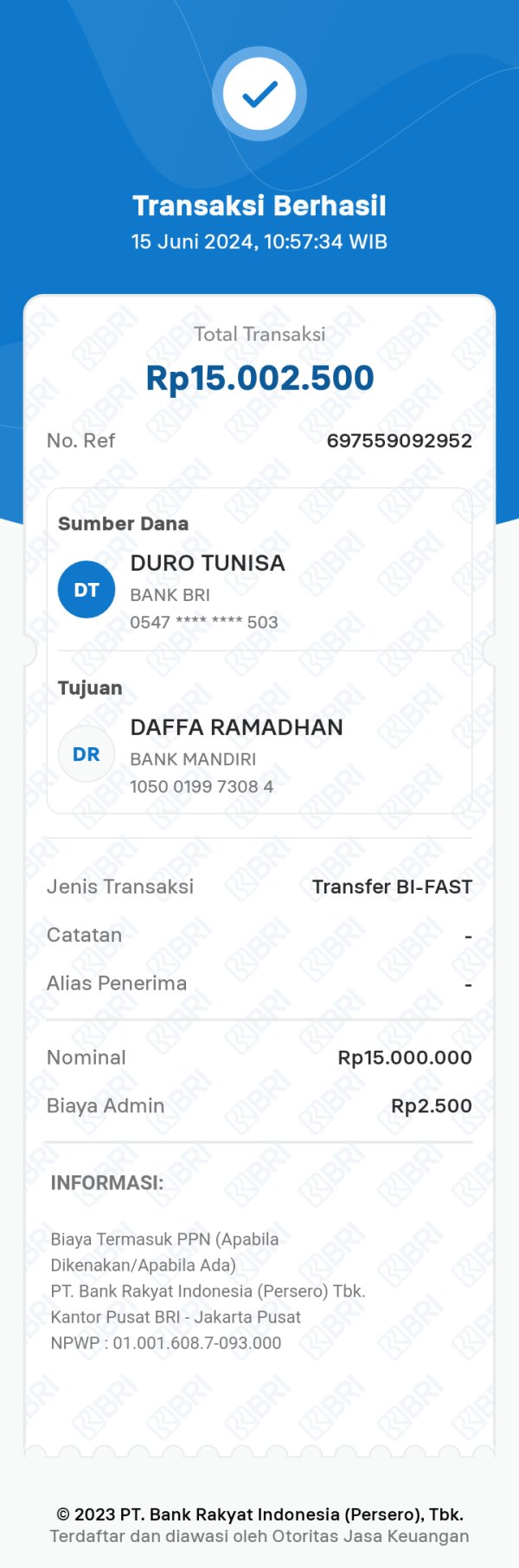

Deposit and Withdrawal Methods: Specific information regarding supported payment methods and processing procedures was not detailed in available documentation. This represents a transparency concern for potential clients.

Minimum Deposit Requirements: Concrete minimum deposit amounts were not specified in accessible materials. This makes it difficult for traders to properly evaluate account accessibility and cost structures.

Promotional Offers: Details regarding bonus promotions, trading incentives, or special offers were not identified in available broker information. This suggests limited promotional activity or poor transparency.

Available Assets: The broker primarily focuses on forex trading. However, the complete range of available currency pairs and other tradeable instruments lacks detailed specification in public materials.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs was not comprehensively detailed. This creates uncertainty about the true cost of trading with MoneyMall.

Leverage Options: Maximum leverage ratios and margin requirements were not explicitly stated in available documentation. This represents important missing information for risk assessment.

Platform Selection: MoneyMall offers MetaTrader 4 as its primary trading platform. Additional platform options or proprietary solutions were not identified in our moneymall review research.

Geographic Restrictions: Specific countries or regions where services are restricted or unavailable were not clearly outlined in accessible materials.

Customer Support Languages: The range of languages supported by customer service teams was not specified in available broker documentation.

Account Conditions Analysis

Account Type Variety: Available information does not provide clear details about different account tiers, their specific features, or qualification requirements. This lack of transparency makes it difficult for potential clients to understand what account options may be available and how they differ in terms of features, costs, or minimum requirements.

Minimum Deposit Assessment: Without specific deposit amount information, traders cannot properly evaluate whether MoneyMall's account accessibility aligns with their financial capacity. Industry standards typically range from $100 to $1,000 for retail accounts, but MoneyMall's requirements remain unclear.

Account Opening Process: User experience descriptions regarding the registration and verification process were not detailed in available materials. This information gap prevents assessment of how streamlined or complex the onboarding experience might be for new clients.

Special Account Features: Advanced account functionalities, VIP services, or premium features that might differentiate various account levels were not identified in accessible documentation. This suggests either limited account variety or poor communication of available features.

The absence of clear account condition information represents a significant transparency concern in our moneymall review analysis. Legitimate brokers typically provide detailed account specifications to help traders make informed decisions about their trading relationships.

Trading Platform Quality: MoneyMall provides access to MetaTrader 4, which is an industry-standard platform known for its reliability and comprehensive charting capabilities. MT4 offers essential technical analysis tools, automated trading support through Expert Advisors, and a user-friendly interface suitable for both novice and experienced traders.

Research and Analysis Resources: Available documentation does not indicate comprehensive market research, daily analysis, or economic calendar features. This limitation may disadvantage traders who rely on broker-provided market insights for their trading decisions.

Educational Materials: Specific educational resources such as trading guides, webinars, video tutorials, or market education programs were not identified in available information. This absence is concerning for brokers targeting inexperienced traders who typically require educational support.

Automated Trading Support: While MT4 inherently supports automated trading through Expert Advisors, additional automation tools, signal services, or copy trading features were not detailed in accessible materials.

Despite offering a reputable trading platform, the apparent lack of comprehensive educational and research resources limits MoneyMall's value proposition for traders seeking a full-service broker relationship. The platform choice represents one of the few positive aspects identified in our analysis.

Customer Service and Support Analysis

Service Channel Availability: Available contact information shows limited communication options, with primary contact appearing to be through email and phone. The range of available support channels seems restricted compared to industry standards that typically include live chat, multiple phone lines, and comprehensive FAQ sections.

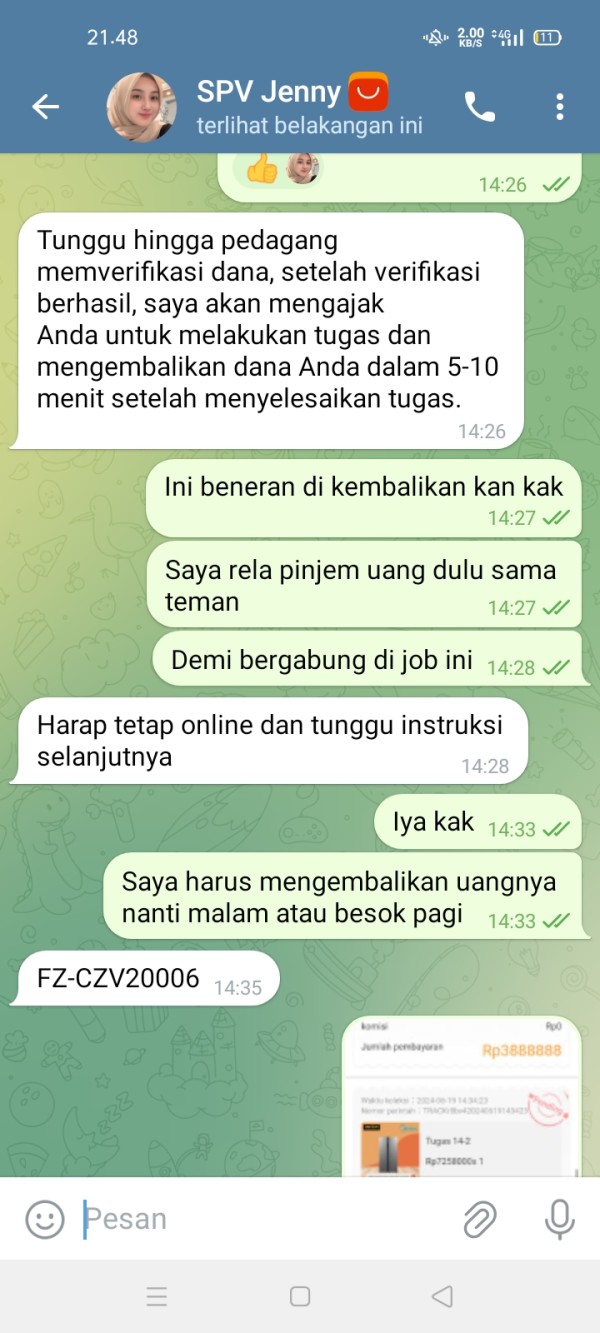

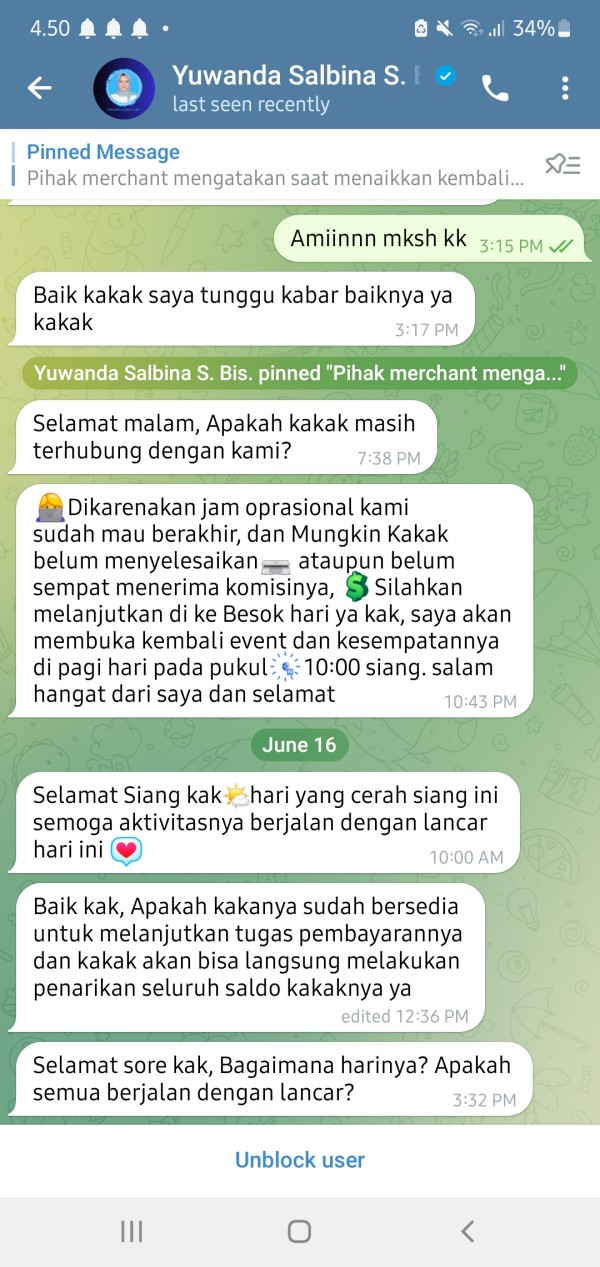

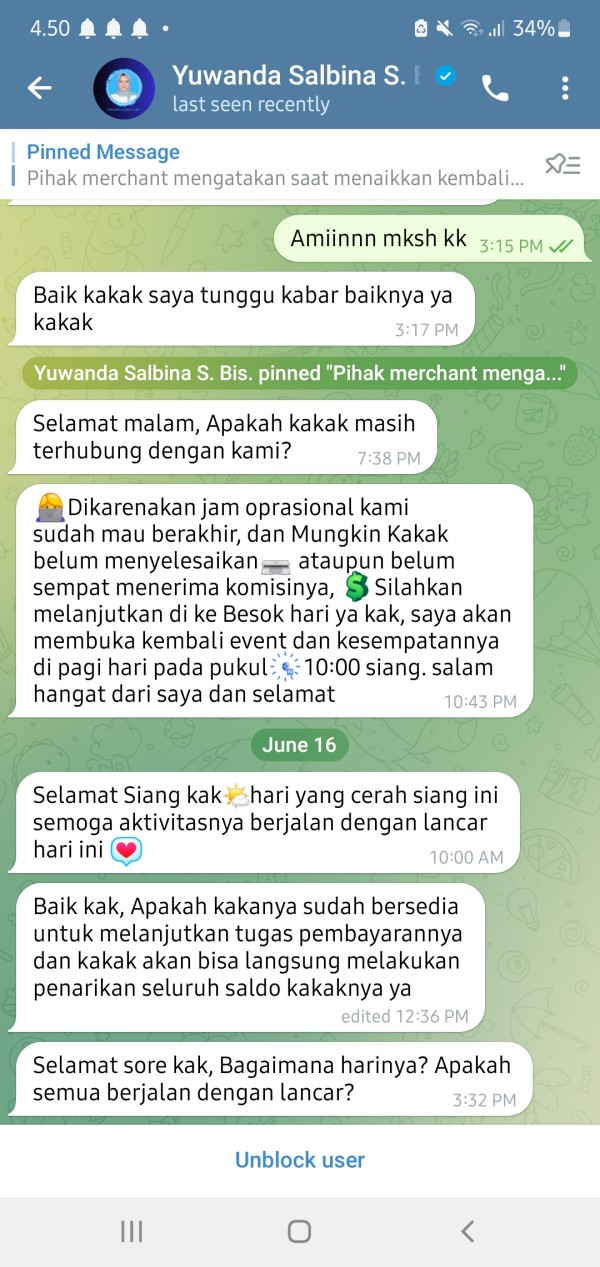

Response Time Performance: User feedback indicates significant concerns about response times, with multiple reports suggesting slow customer service reactions to client inquiries and issues. This responsiveness deficit creates frustration for traders requiring timely support.

Service Quality Assessment: Professional competency and problem-solving capabilities appear limited based on available user feedback. Reports suggest that customer service representatives may lack the expertise needed to effectively address technical trading questions or account-related concerns.

Multilingual Support: Specific information about supported languages for customer service was not detailed in available materials. This represents an important consideration for international clients seeking support in their native language.

Operating Hours: Customer service availability schedules were not clearly specified. This makes it difficult to assess whether support aligns with global trading hours or different timezone requirements.

The customer service evaluation reveals significant deficiencies that compound other concerns identified in this analysis. Poor support quality can severely impact trader experience, particularly during critical trading situations or account issues.

Trading Experience Analysis

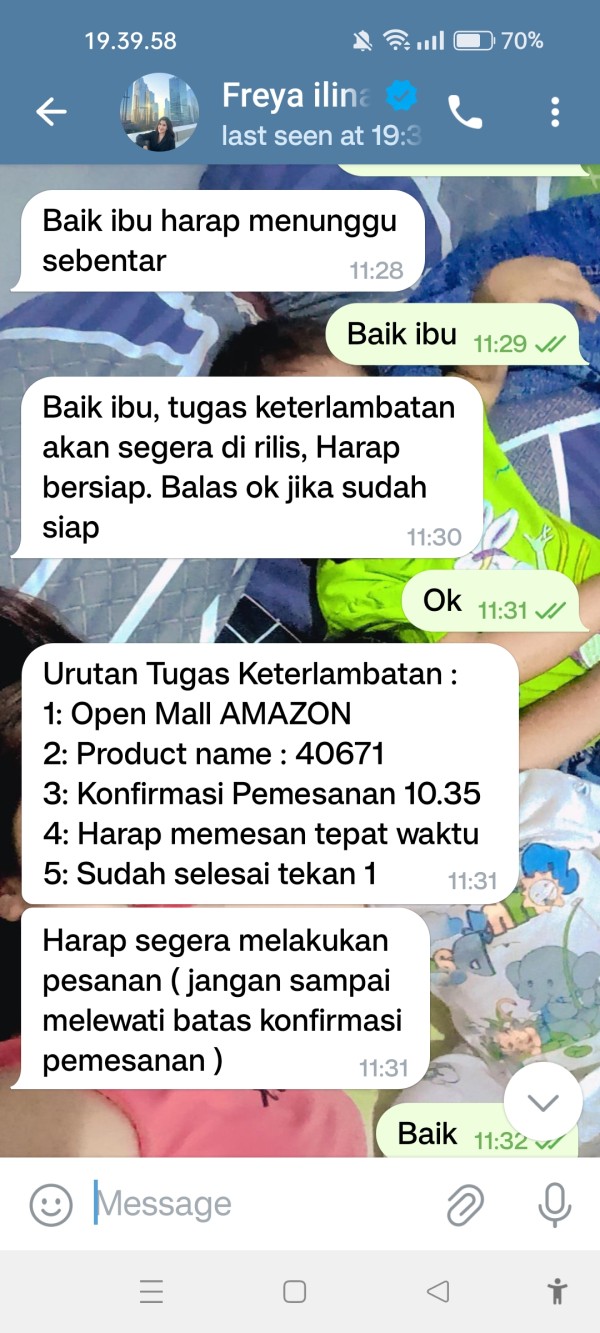

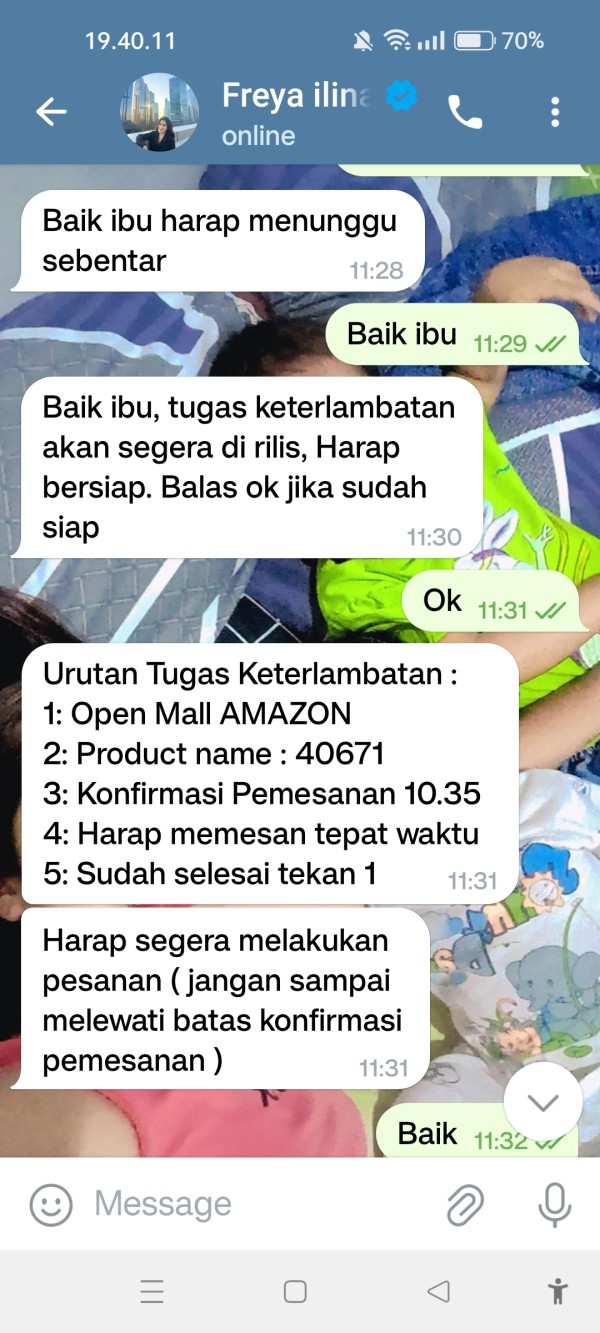

Platform Stability Concerns: User feedback indicates notable issues with platform reliability and stability. Reports suggest that traders have experienced technical difficulties that can interfere with normal trading operations, potentially impacting trade execution and account management.

Order Execution Quality: Multiple user reports highlight concerns about slippage during trade execution, which can significantly impact trading profitability. Slippage issues suggest potential problems with liquidity provision or order routing that may disadvantage traders, particularly during volatile market conditions.

Platform Functionality: While MetaTrader 4 provides comprehensive trading functionality, additional platform features or enhancements specific to MoneyMall were not identified. The basic MT4 offering appears standard without notable customizations or improvements.

Mobile Trading Experience: Specific information about mobile platform quality, app availability, or mobile-optimized features was not detailed in available documentation. This represents a gap in modern trading accessibility expectations.

Trading Environment: User feedback suggests concerns about spread stability and overall trading conditions. Some reports indicate inconsistent pricing or execution quality that may impact trading performance.

The trading experience analysis reveals significant concerns that extend beyond regulatory issues to practical operational problems. These execution and stability issues compound the risks associated with MoneyMall's regulatory deficiencies, creating a challenging environment for effective trading in our moneymall review assessment.

Trust and Safety Analysis

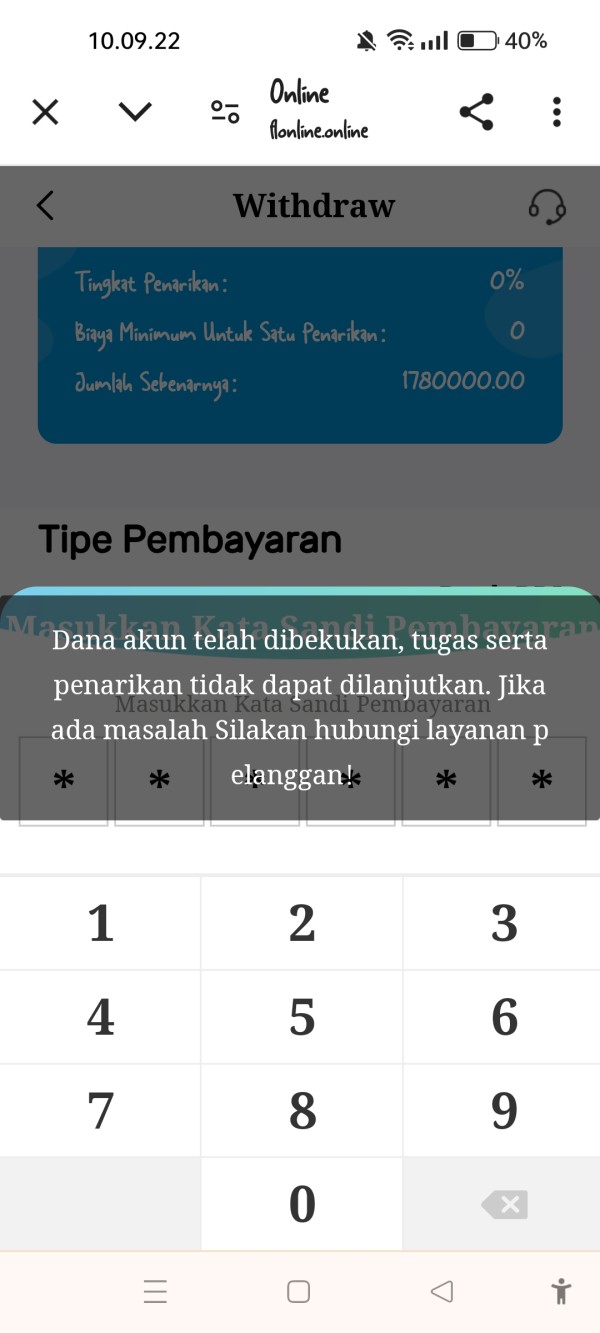

Regulatory Compliance Status: MoneyMall has been definitively identified as an illegal broker by WikiFX, with expired licensing credentials and no valid NFA registration. This regulatory failure represents the most critical concern for potential clients, as it indicates the absence of standard investor protections and oversight mechanisms.

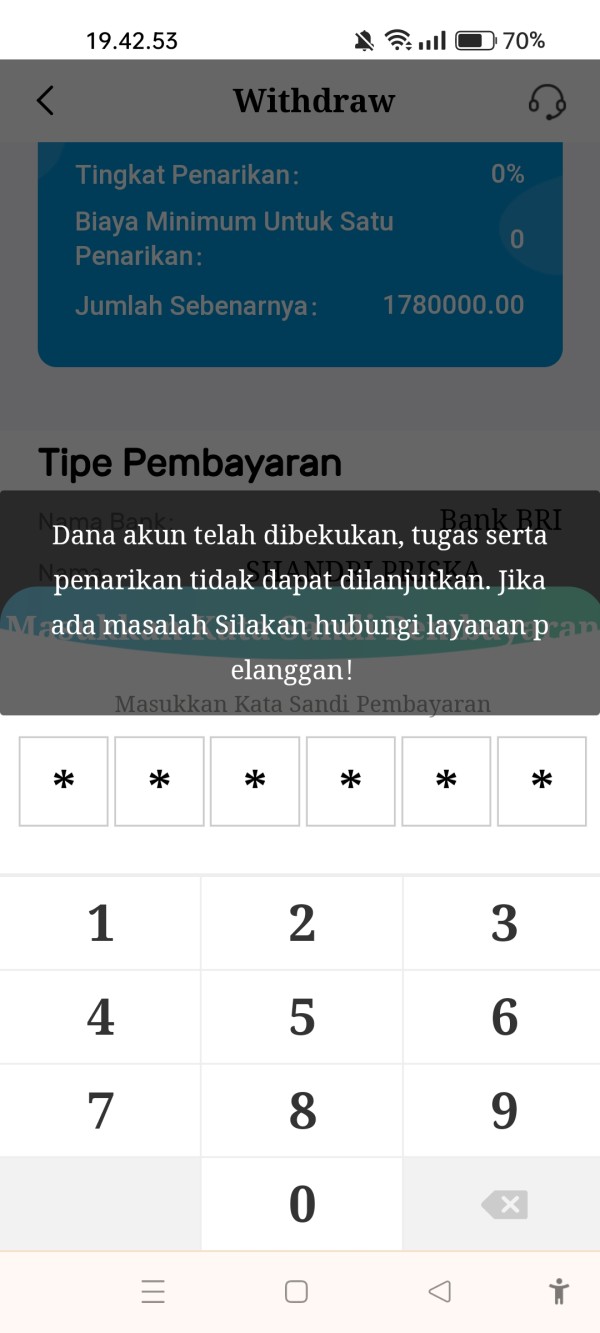

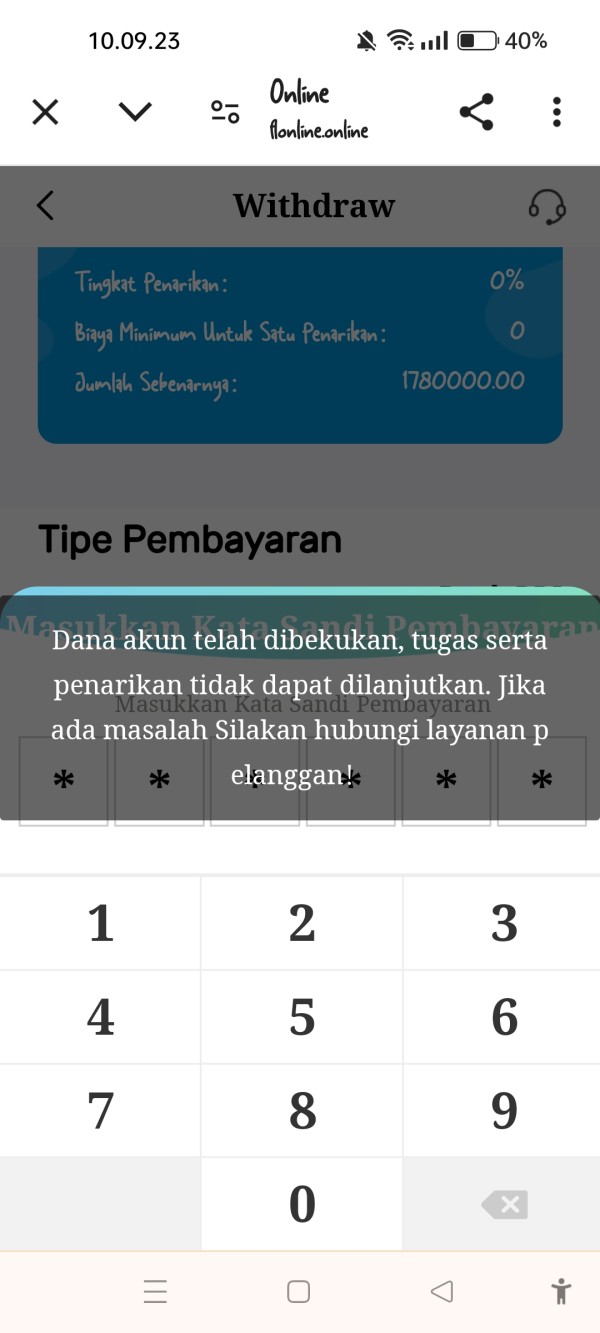

Fund Security Measures: Specific information about client fund segregation, insurance coverage, or other safety protocols was not detailed in available materials. This lack of transparency regarding fund protection measures compounds existing regulatory concerns and raises questions about asset security.

Company Transparency: Limited disclosure about company structure, ownership, financial backing, or operational details creates additional uncertainty about MoneyMall's legitimacy and stability. Legitimate brokers typically provide comprehensive company information to build client confidence.

Industry Recognition: No evidence of industry awards, certifications, or positive recognition from reputable financial organizations was identified. The absence of third-party validation contrasts sharply with the negative regulatory findings.

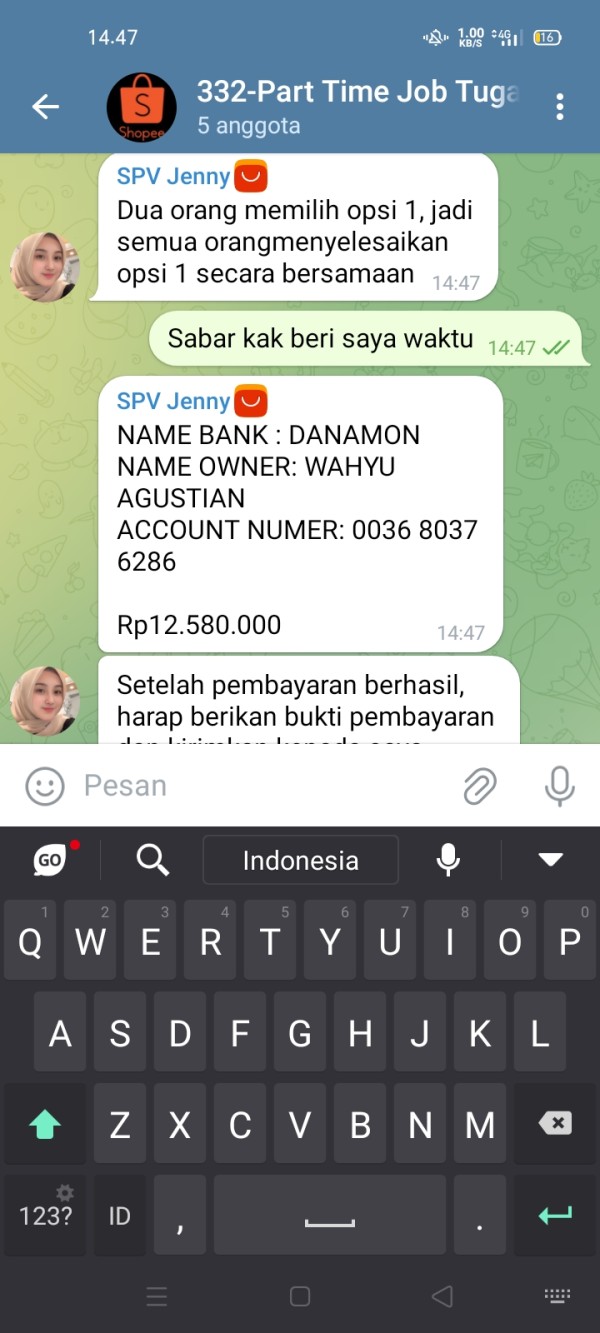

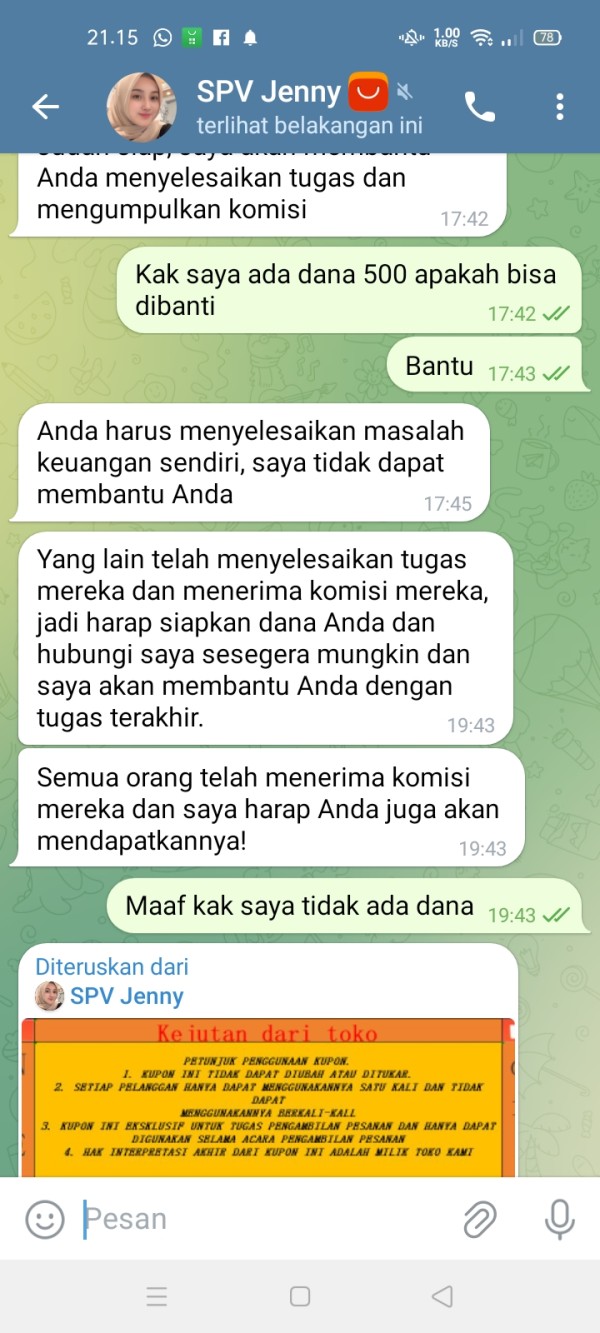

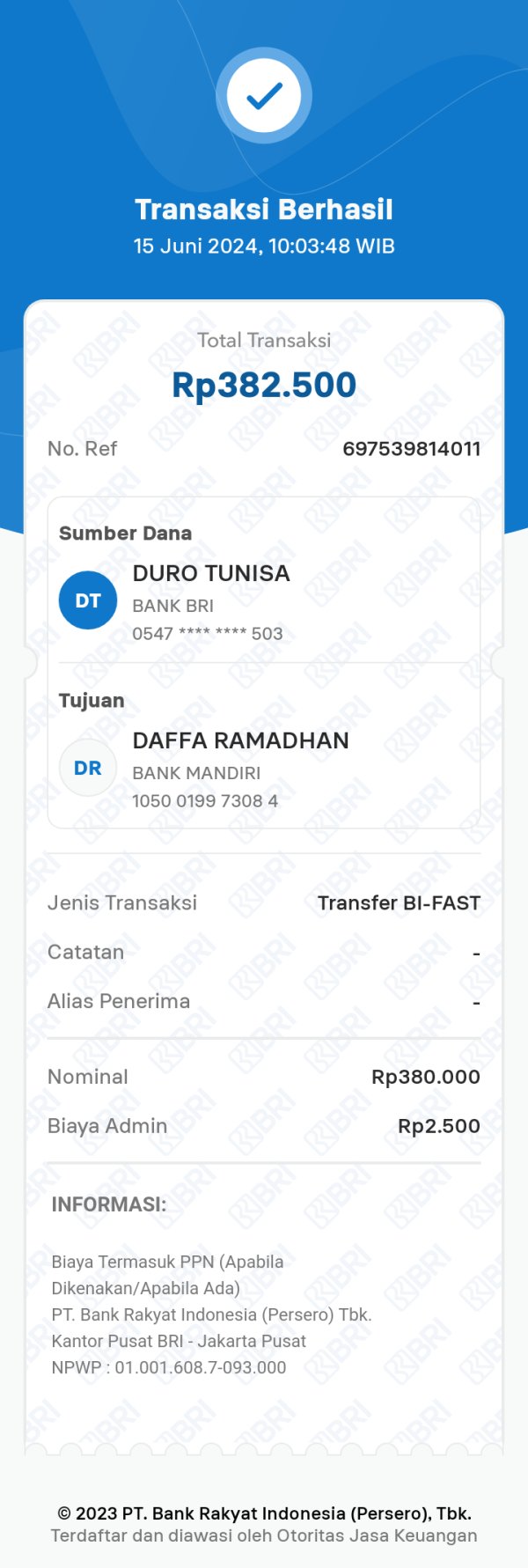

Risk Management: Reports of fraud risks and the illegal broker classification indicate fundamental failures in risk management and regulatory compliance. These issues suggest that standard consumer protections may not be available to MoneyMall clients.

The trust and safety evaluation reveals critical deficiencies that should serve as major warning signs for potential clients. The combination of regulatory violations and fraud risk reports creates an unacceptable risk environment for trader funds and operations.

User Experience Analysis

Overall Satisfaction Metrics: Trustpilot ratings of 3.3 stars indicate below-average user satisfaction, with the rating suggesting that a significant portion of users have experienced problems or dissatisfaction with MoneyMall's services. This rating is particularly concerning given the limited number of reviews, which may indicate either low user volume or selective feedback patterns.

Interface and Usability: Specific feedback about platform interface design, navigation ease, or user-friendly features was not comprehensively detailed in available materials. However, the standard MT4 platform provides familiar functionality for experienced traders.

Registration and Verification: Detailed user experiences regarding account opening procedures, document verification requirements, or onboarding efficiency were not specified in accessible documentation. This creates uncertainty about the initial client experience.

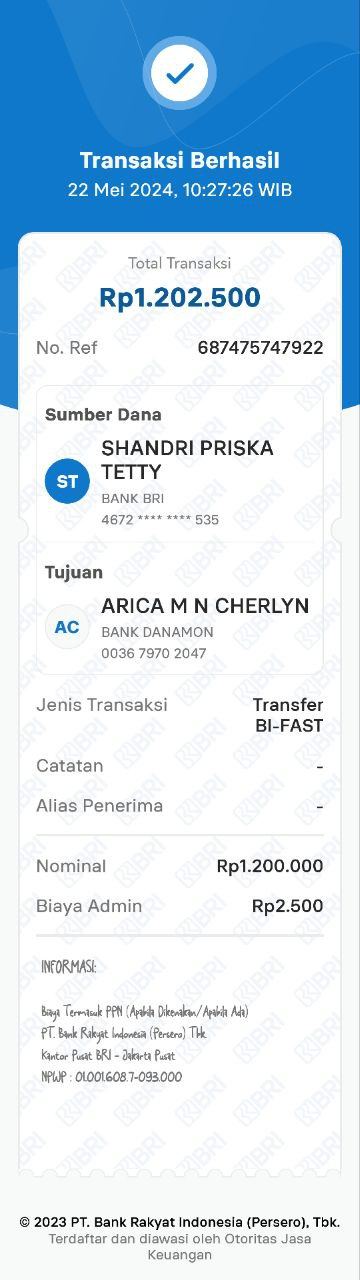

Funding Operations: User feedback regarding deposit and withdrawal experiences, processing times, or payment method reliability was not detailed in available materials. Such experiences significantly impact overall user satisfaction.

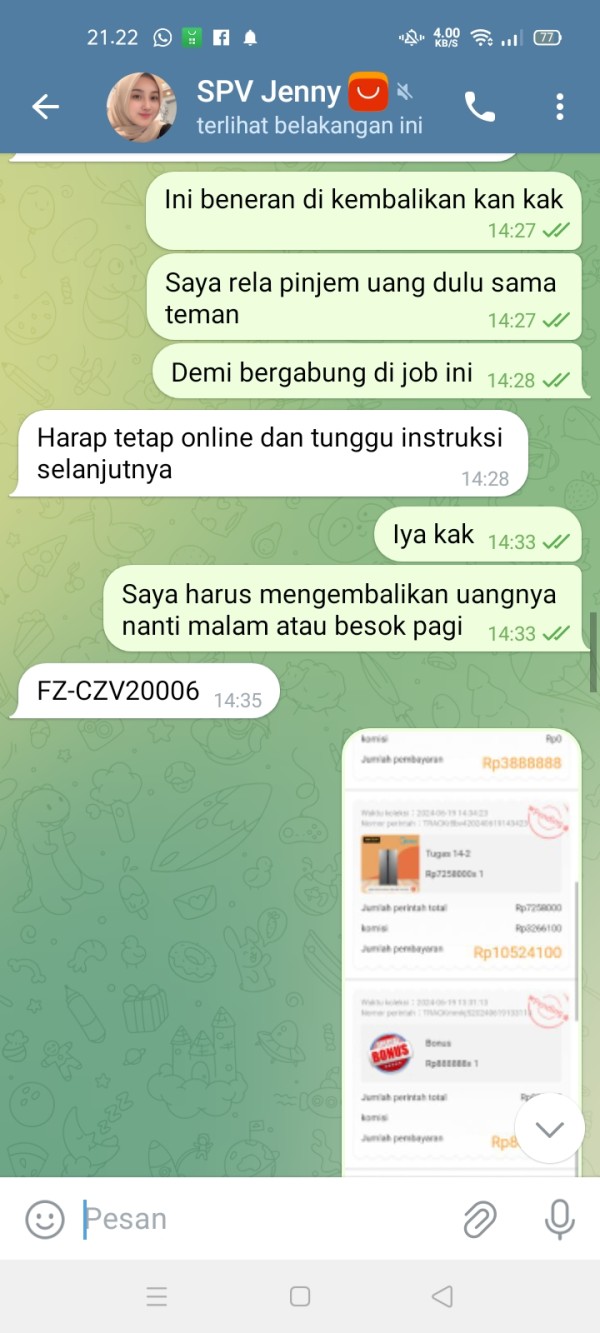

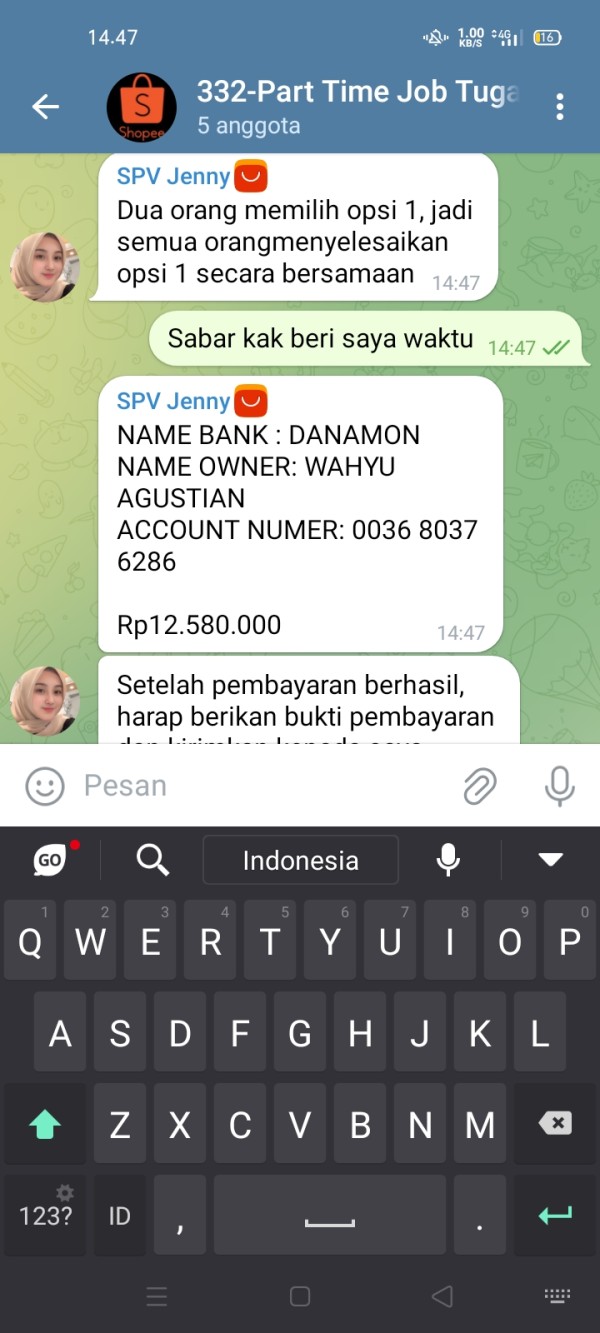

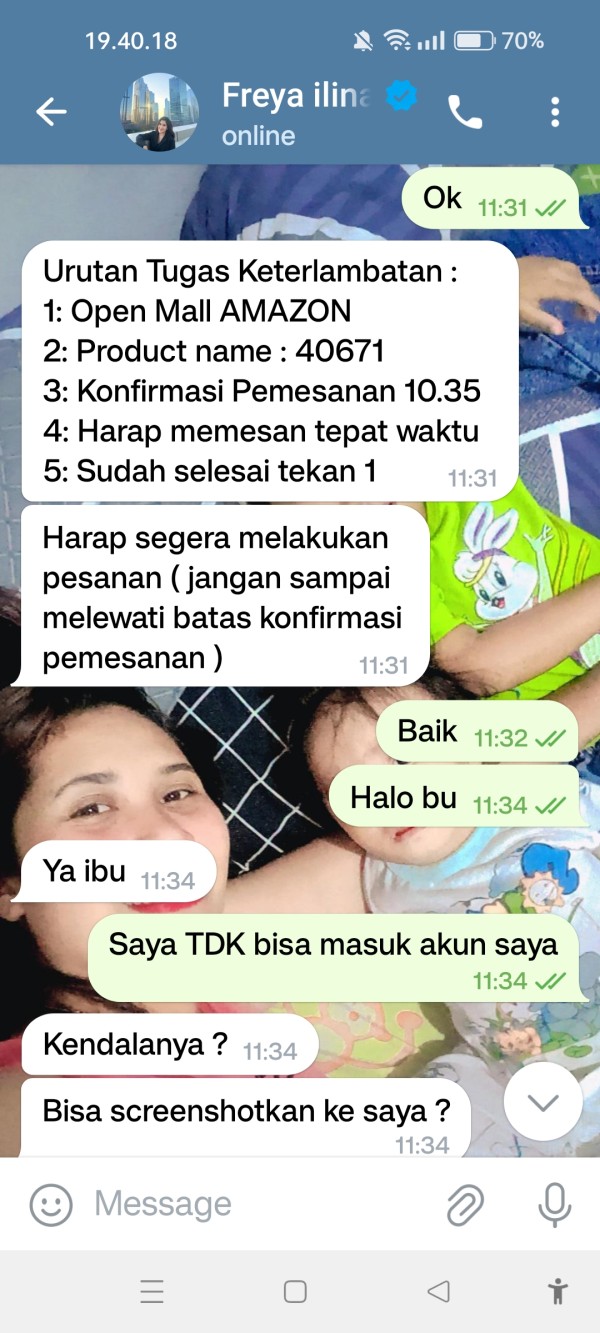

Common User Complaints: Fraud risk concerns appear prominently in negative feedback, along with reports of poor customer service and platform stability issues. These consistent complaint patterns suggest systemic operational problems rather than isolated incidents.

User Demographics: The broker appears to attract individuals interested in forex trading but lacking experience to properly evaluate broker credentials and regulatory compliance. This demographic targeting raises ethical concerns given the identified regulatory deficiencies and fraud risks.

The user experience analysis confirms negative patterns identified throughout this evaluation. Low satisfaction ratings and concerning complaint patterns align with regulatory and operational issues identified in other assessment areas.

Conclusion

MoneyMall presents significant regulatory and operational concerns that make it unsuitable for serious forex trading activities. The broker's classification as an illegal entity with expired licensing credentials represents a fundamental disqualification that overrides any potential benefits from platform offerings or service features.

This broker is not recommended for any trader category, particularly inexperienced individuals who may be targeted by MoneyMall's marketing efforts. The combination of regulatory violations, fraud risk reports, and poor user feedback creates an unacceptable risk environment that could result in financial losses beyond normal trading risks.

While MoneyMall offers MetaTrader 4 platform access, this single positive feature cannot compensate for the critical deficiencies in regulatory compliance, customer service quality, and operational transparency. Traders seeking legitimate forex trading opportunities should prioritize properly regulated brokers with strong industry reputations and comprehensive consumer protections.