Emarlado 2025 Review: Everything You Need to Know

Executive Summary

This emarlado review gives you a complete look at Emarlado, a new forex broker that works under the Mwali International Services Authority. The company shows mixed results in today's market, and users have very different opinions about their services and how reliable they are.

Emarlado offers several account types including Classic, Silver, Gold, and VIP options that work for traders with different experience levels and money to invest. The platform lets you trade many different assets like forex pairs, indices, stocks, cryptocurrencies, and commodities through their WebTrader system. The company says it serves "traders at all skill levels" and focuses on CFD contract trading.

The broker targets people who want CFD contract trading chances, letting them guess on price changes without owning the actual assets. But user reviews show big worries about how clear they are and how good their service is. Trustpilot gives them a 4/5 score, but this good rating doesn't match the many bad reviews and fraud claims from some users, making it hard to judge if you should use them.

Important Disclaimer

Emarlado works under the Mwali International Services Authority with license number T2023397. You should know that rules are very different in different places, and how much protection you get as an investor can change a lot. The Mwali International Services Authority might not watch over things as well as big financial regulators in major markets.

This review uses information that anyone can find, user feedback from different websites, and official company reports. Market conditions and broker services can change, so you should do your own research before making investment choices.

Rating Framework

Broker Overview

Emarlado works as a modern trading company, though they don't share details about when they started in the information we can find. The company says it provides complete trading services and focuses on customization, reliability, and lots of support for clients at all skill levels. Company materials show that Emarlado focuses on CFD trading services, letting clients guess on prices without owning the actual assets.

The broker's business plan centers on giving access to world financial markets through contract for difference (CFD) trading. This lets users possibly make money from both rising and falling market prices across many types of assets. The company says it serves both regular and professional traders, though they don't explain what makes someone a professional trader in the sources we can find.

Emarlado's trading system works through the WebTrader platform, giving browser-based access to financial markets. The platform supports trading across five main asset types: foreign exchange pairs, market indices, individual stocks, cryptocurrencies, and commodities. The broker works under Mwali International Services Authority rules with license number T2023397, though this system might not protect investors as well as major financial centers.

Regulatory Jurisdiction: Emarlado works under Mwali International Services Authority watch with license number T2023397. This system provides basic oversight but might not offer the complete investor protection found in major financial areas.

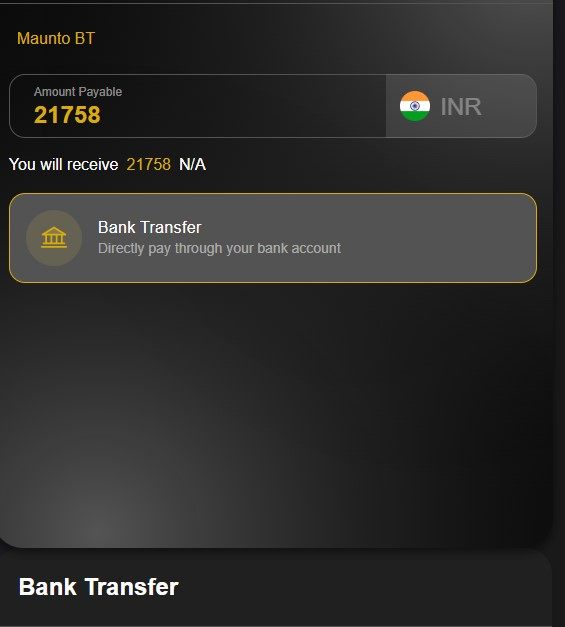

Deposit and Withdrawal Methods: Specific details about payment methods and how they process things are not explained in available documents, which is a transparency problem for potential clients.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not listed in company materials we can access, limiting transparency for future traders.

Bonus and Promotional Offers: Current promotional programs and bonus structures are not detailed in available sources, though such offerings may exist.

Tradable Assets: The platform gives access to over 160 trading instruments across forex, indices, stocks, cryptocurrencies, and commodities, offering good variety for traders.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not fully detailed in available materials, creating uncertainty about total trading expenses.

Leverage Ratios: Maximum leverage ratios and margin requirements are not specified in accessible documentation, which is concerning for risk management planning.

Platform Options: Trading happens only through the WebTrader platform, which provides browser-based access suitable for various devices and operating systems.

Geographic Restrictions: Specific country restrictions and availability limitations are not detailed in available sources.

Customer Support Languages: Available support languages are not specified in accessible company documentation.

This emarlado review finds big information gaps that potential clients should address through direct broker communication before opening accounts.

Account Conditions Analysis

Emarlado offers four different account types: Classic, Silver, Gold, and VIP, suggesting a tiered service structure designed to work for different trader profiles and capital levels. But the specific features, benefits, and requirements for each account type are not fully detailed in available documentation, creating transparency concerns for potential clients.

The lack of clear minimum deposit requirements across account tiers represents a big limitation in judging account accessibility. This lack of transparency makes it hard for traders to understand entry barriers and plan their trading capital accordingly. User feedback suggests that account opening processes exist, with some users commenting on convenience, though specific procedural details remain unclear.

Account functionality appears to focus on CFD trading across multiple asset classes, though advanced features such as Islamic account options, professional trader classifications, or institutional services are not mentioned in available sources. The broker's emphasis on serving "all skill levels" suggests flexibility in account structures, but without detailed specifications, potential clients cannot adequately assess suitability.

The scoring of 5/10 for account conditions reflects these transparency limitations and the lack of detailed information about account features, benefits, and requirements. When compared to established brokers who provide comprehensive account specifications, Emarlado's documentation appears insufficient for informed decision-making.

This emarlado review emphasizes the importance of getting detailed account information directly from the broker before proceeding with account opening, given the limited publicly available specifications.

Emarlado's trading infrastructure centers on the WebTrader platform, providing browser-based market access without requiring software downloads. This web-based approach offers convenience and compatibility across different operating systems and devices, though the platform's specific features and capabilities are not comprehensively detailed in available documentation.

The broker provides access to over 160 trading instruments across five asset categories, indicating reasonable market coverage for diversified trading strategies. But detailed information about analytical tools, charting capabilities, technical indicators, and market research resources is not specified in accessible sources, limiting assessment of the platform's analytical depth.

Educational resources, which are crucial for trader development, are not mentioned in available company materials. The absence of detailed information about webinars, tutorials, market analysis, or educational content represents a potential limitation for traders seeking comprehensive learning support. Similarly, automated trading support, expert advisors, or API access are not addressed in available documentation.

Market research and analysis capabilities, including economic calendars, news feeds, or professional market commentary, are not detailed in accessible sources. This information gap makes it difficult to assess the broker's commitment to providing comprehensive market intelligence to support trading decisions.

The 7/10 rating reflects the basic functionality of the WebTrader platform and asset diversity, while acknowledging the limitations in detailed tool specifications and educational resource availability. User feedback suggests moderate satisfaction with available tools, though comprehensive assessments are limited by information availability.

Customer Service and Support Analysis

Customer service quality represents a critical concern based on available user feedback, with experiences ranging from satisfactory to highly problematic. User reviews reveal inconsistent service quality, with some clients reporting adequate support while others express significant frustration with response times and problem resolution effectiveness.

Available customer service channels are not fully detailed in accessible documentation, creating uncertainty about support accessibility and availability. Response time commitments, service level agreements, and escalation procedures are not specified, limiting transparency about support quality expectations. This lack of detailed service information contrasts unfavorably with established brokers who typically provide comprehensive support specifications.

Multilingual support capabilities are not detailed in available sources, though the broker's international focus suggests some language accommodation. But without specific information about supported languages and regional support hours, international clients cannot adequately assess service accessibility for their needs.

User feedback includes concerning reports about customer service quality, with some clients expressing dissatisfaction with problem resolution and communication effectiveness. These negative experiences, combined with limited transparency about service procedures, contribute to uncertainty about support reliability. Some users have reported difficulties in reaching customer service representatives and delays in addressing account-related issues.

The 6/10 rating reflects mixed user experiences and limited transparency about service procedures and availability. While some users report satisfactory interactions, the presence of negative feedback and limited service documentation suggest areas requiring improvement for enhanced client satisfaction and confidence.

Trading Experience Analysis

Trading experience quality shows considerable variation based on user feedback, with platform stability and execution quality receiving mixed reviews from clients. Some users report satisfactory trading conditions, while others express concerns about platform reliability and order execution consistency, creating uncertainty about overall trading environment quality.

Platform stability represents a key concern, with user feedback indicating occasional technical issues that can impact trading activities. But specific performance metrics, uptime statistics, or technical specifications are not provided in available documentation, limiting objective assessment of platform reliability. The WebTrader platform's browser-based nature may contribute to performance variations depending on internet connectivity and browser compatibility.

Order execution quality, including fill rates, slippage characteristics, and execution speeds, is not detailed in available company materials. User feedback suggests inconsistent execution experiences, with some traders reporting satisfactory performance while others indicate concerns about order handling quality. Without specific execution statistics or performance benchmarks, traders cannot adequately assess execution reliability.

Mobile trading experience details are not specified in accessible documentation, though WebTrader's browser-based design suggests mobile compatibility. But dedicated mobile applications, mobile-specific features, or optimized mobile interfaces are not mentioned in available sources, potentially limiting trading flexibility for mobile-focused traders.

Trading environment factors such as spreads, liquidity, and market depth are not comprehensively detailed, though user feedback suggests variable conditions. The 6/10 rating reflects mixed user experiences and limited transparency about trading conditions, execution quality, and platform performance specifications.

Trust and Reliability Analysis

Trust and reliability concerns represent significant challenges for Emarlado, with user feedback revealing substantial credibility issues that potential clients must carefully consider. Multiple user reviews include serious allegations, with some clients explicitly labeling the broker as fraudulent, creating major red flags for prospective traders considering the platform.

Regulatory oversight through Mwali International Services Authority provides basic supervision with license number T2023397, though this jurisdiction may not offer the comprehensive investor protection found in major financial centers. The regulatory framework's limitations may contribute to reduced investor confidence compared to brokers operating under more established regulatory authorities.

Fund security measures and client money protection procedures are not detailed in available documentation, representing a critical transparency gap for investor protection assessment. Established brokers typically provide comprehensive information about segregated accounts, deposit insurance, and fund safety measures, while Emarlado's documentation lacks these crucial details.

Company transparency issues extend beyond regulatory concerns, with limited disclosure about company ownership, financial statements, operational procedures, and risk management practices. This lack of transparency contrasts unfavorably with industry standards and contributes to credibility concerns among potential clients.

Negative event handling and dispute resolution procedures are not specified in available sources, though user feedback suggests problematic experiences with complaint resolution. The presence of fraud allegations and limited transparency about dispute handling mechanisms significantly impact trust assessments.

The 5/10 rating reflects serious credibility concerns, regulatory limitations, and transparency deficiencies that potential clients must carefully evaluate before engaging with the platform.

User Experience Analysis

Overall user satisfaction presents a complex picture, with Trustpilot ratings showing 4/5 stars while simultaneously featuring numerous negative reviews and fraud allegations. This contradiction between aggregate ratings and individual feedback creates confusion about actual user experience quality and suggests potential manipulation or polarized experiences among different user groups.

Interface design and usability feedback is limited in available sources, though the WebTrader platform's browser-based approach suggests basic accessibility across different devices. But specific information about user interface quality, navigation efficiency, or design aesthetics is not detailed in accessible documentation, limiting comprehensive user experience assessment.

Registration and account verification procedures are not comprehensively detailed in available sources, though user feedback suggests these processes exist. The lack of detailed information about required documentation, verification timeframes, and procedural requirements creates uncertainty for prospective clients planning account opening activities.

Fund management experiences, including deposit and withdrawal procedures, processing times, and user satisfaction with financial transactions, are not detailed in available documentation. This represents a significant information gap given the importance of fund management efficiency for overall user satisfaction and platform credibility.

Common user complaints focus on customer service quality, transparency concerns, and reliability issues based on available feedback. These complaints, combined with fraud allegations from some users, suggest significant user experience challenges that contrast with the positive aggregate ratings reported on some platforms.

The 6/10 rating reflects the contradiction between reported ratings and negative feedback, limited transparency about user experience procedures, and mixed satisfaction reports that potential clients should carefully consider when evaluating the platform.

Conclusion

This emarlado review reveals a broker facing significant challenges in transparency, credibility, and user satisfaction despite some positive aspects such as asset diversity and account tier options. While Emarlado offers multiple account types and access to various trading instruments across forex, indices, stocks, cryptocurrencies, and commodities, serious concerns about reliability and transparency overshadow these potential benefits.

The broker may suit traders specifically seeking CFD contract trading opportunities across diverse asset classes, though extreme caution is advised given the credibility concerns and fraud allegations from multiple users. The regulatory framework through Mwali International Services Authority provides basic oversight but may not offer adequate investor protection compared to major financial jurisdictions.

Primary advantages include multiple account tiers and diversified asset access, while significant disadvantages encompass transparency deficiencies, credibility concerns, limited regulatory protection, and concerning user feedback including fraud allegations. Potential clients should conduct extensive due diligence and consider alternative brokers with stronger regulatory oversight and user satisfaction records before making platform decisions.