1. Abstract

This tradition services limited review looks at a new online forex broker that has been running for less than one year. The company offers a low minimum deposit of $50 and provides many trading options like forex and cryptocurrencies, but it lacks clear regulatory information which creates big risk concerns. New traders who want to start with small amounts of money might like the low entry cost. However, the missing oversight information means potential clients should be very careful before signing up. This review uses market data, user feedback about account freezes, and product features to give you the full picture.

The low deposit and multiple assets are good points, but the hidden regulatory details are a major problem. This tradition services limited review gives you an unbiased look based only on current data and real user experiences. We want to help you make smart trading decisions with accurate information.

2. Important Notes

The lack of regulatory information means trading experiences can vary a lot between different regions. This review uses only public information and user feedback, so our analysis might change when new data comes out. You should check any missing regulatory and operational details yourself before risking your money.

Missing details about deposit methods, withdrawal options, trading platforms, and bonus offers make this broker risky. This review relies mainly on summarized market data without confirmed regulatory oversight. We encourage you to do more research since the risk level may change based on your location and over time.

3. Rating Framework

4. Broker Overview

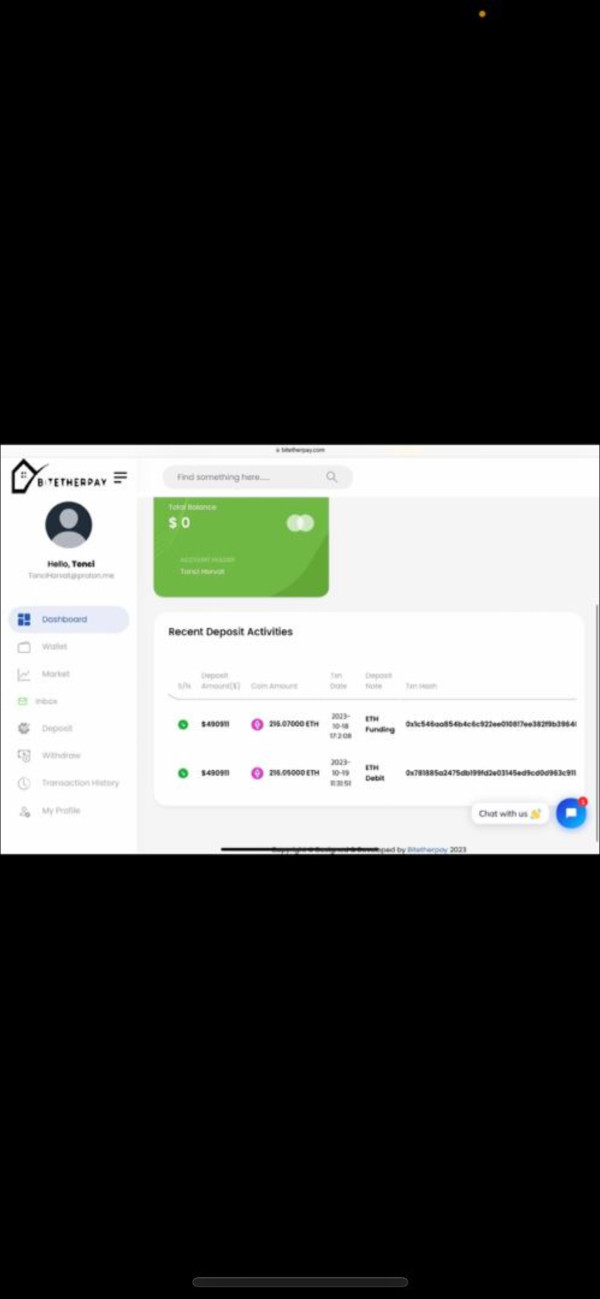

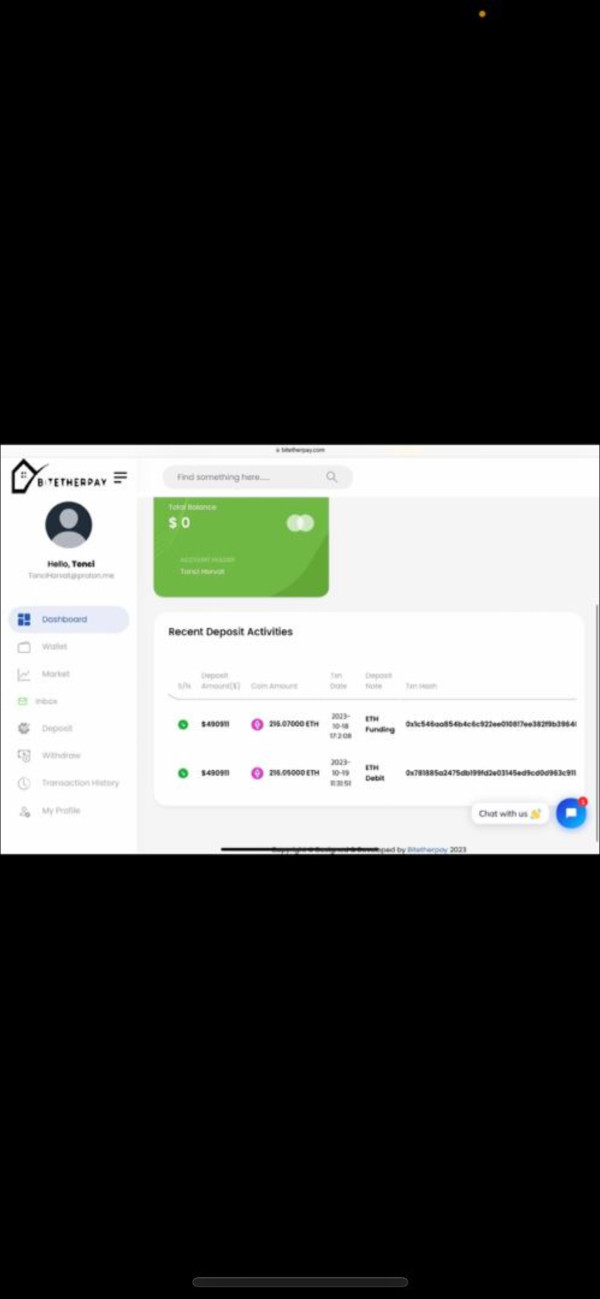

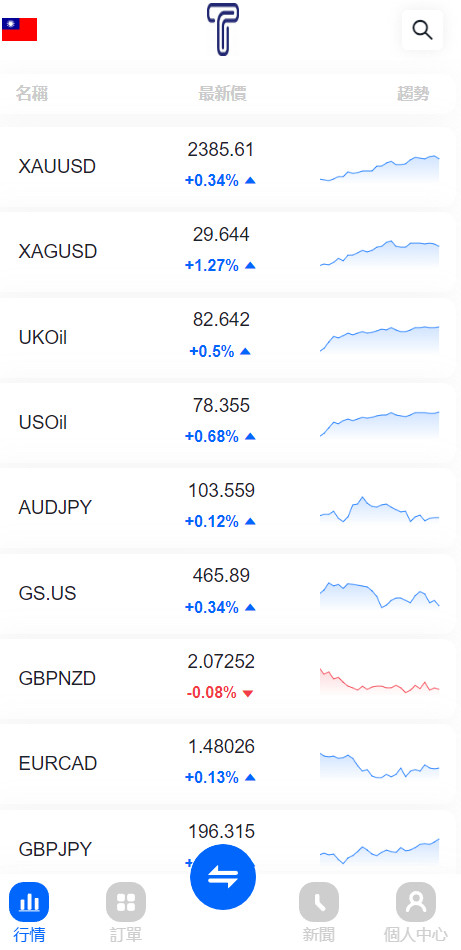

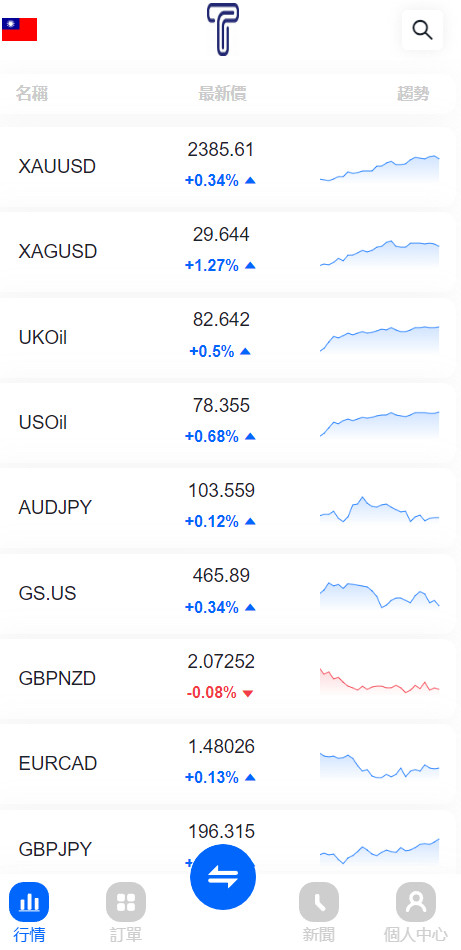

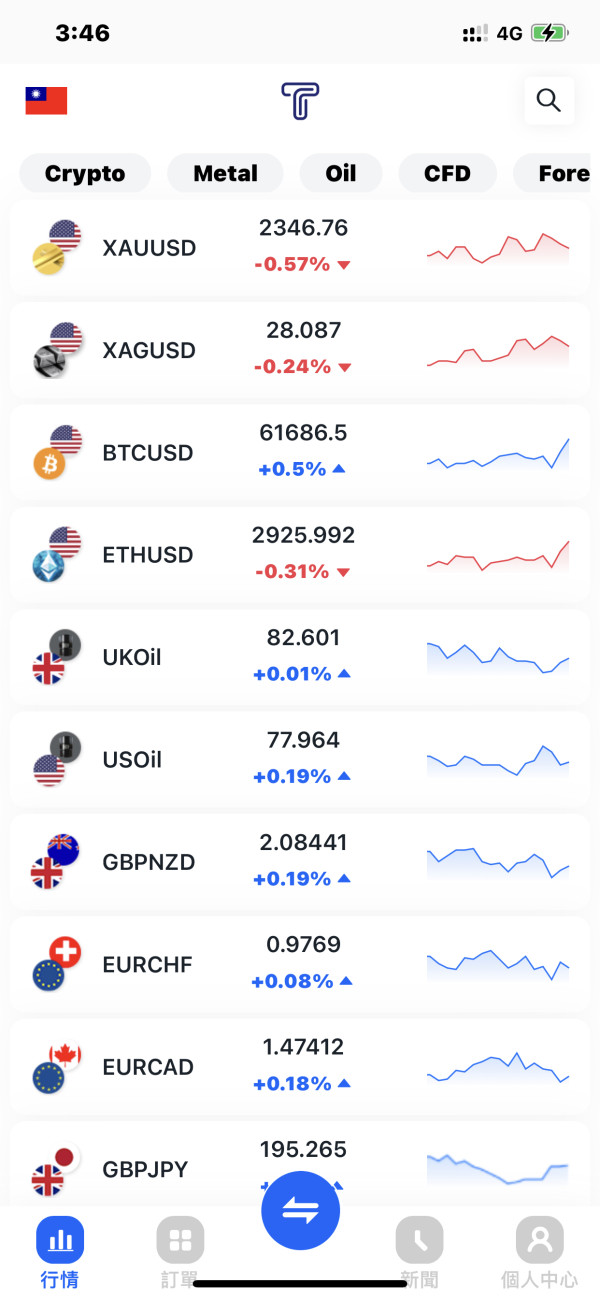

Tradition services limited started less than one year ago as a broker in the online forex and derivative trading space. This tradition services limited review shows that the company has quickly gotten attention by offering a very low minimum deposit of just $50, which appeals to traders who want to start with small amounts of money. The broker gives access to many financial instruments including forex, indices, energy commodities, precious metals, stocks, and cryptocurrencies.

Even with this wide range of assets, the broker's honesty is questionable because it lacks clear regulatory oversight. This creates concerns about client fund safety and trading environment integrity. Available information shows that while the broker offers broad trading options, the risks from missing regulatory details cannot be ignored.

Tradition services limited has built its business model around giving online access to multiple financial markets. This includes forex, indices, energy, precious metals, stocks, and cryptocurrencies. However, as this tradition services limited review shows, details about trading platform technology are limited with no clear descriptions of platform design or trading tools provided.

The broker does not name any regulatory bodies, leaving potential investors without key information about investor protection and oversight. This problem leads to concerns about operational honesty and strong risk management practices. The company seems to target active and risk-tolerant traders who understand the potential for big risks without formal regulatory commitments and who are willing to deal with the changing experience that such a trading environment may bring.

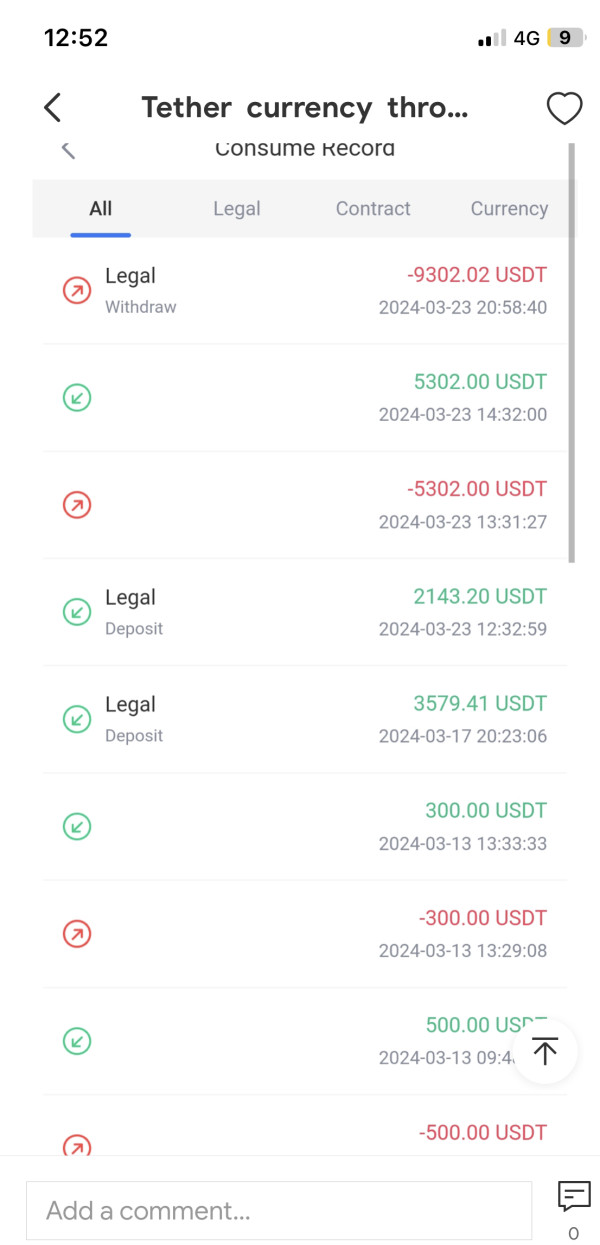

Based on available information, several aspects of tradition services limited remain unclear. No specific regulatory body or licensing information is mentioned, which raises concerns for traders worldwide. Details about deposit and withdrawal methods are not provided, leaving users without guidance on how easy it is to manage their funds.

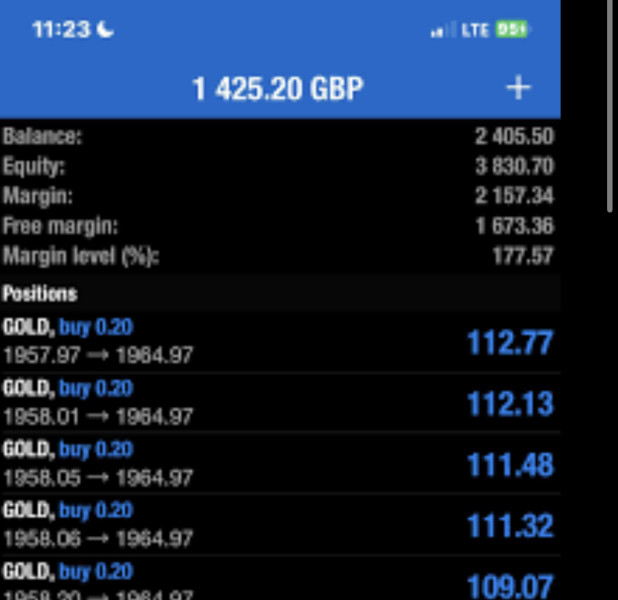

The minimum deposit requirement is clearly set at $50, €50, or £50, offering an easy entry point for beginner traders. However, no information about bonus promotions or incentives comes with this simple structure. The range of tradable assets is quite broad, covering forex, indices, energy commodities, precious metals, stocks, and cryptocurrencies, which provides diverse access to global markets.

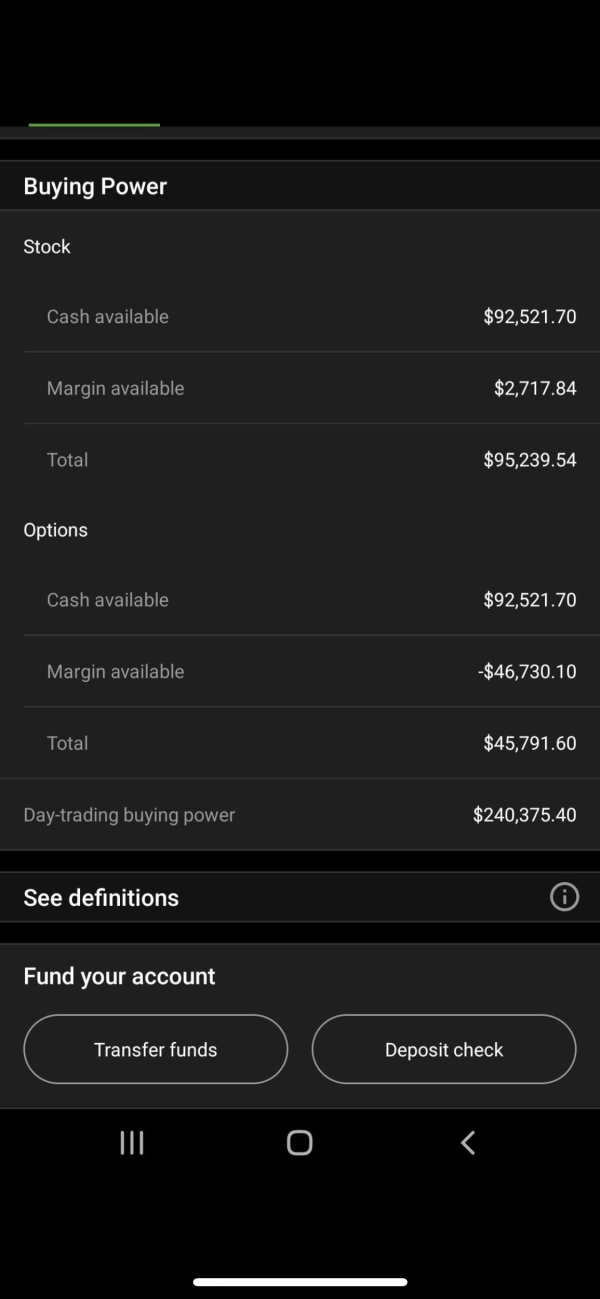

Details on spreads, commissions, or other trading fees are not mentioned, preventing traders from fully judging the cost efficiency of their trades. Leverage levels or available margin guidelines are also missing, creating an information gap for risk management during volatile market conditions. Choice of trading platforms is another gray area since no particular software or proprietary platform options are specified, and platform reliability or additional features are not explained.

Region-specific restrictions are not detailed, leaving potential clients unsure about whether their country affects their eligibility. The available information does not specify which languages the customer service team supports, further complicating matters for non-English speaking users. Overall, this information gap requires careful thought by prospective traders before committing capital to tradition services limited.

6. Detailed Score Analysis

6.1 Account Conditions Analysis

A detailed analysis of account conditions shows several important aspects that potential traders need to consider. The information clearly states that the minimum deposit is set at $50, which could attract new traders looking for low capital investment. However, details about leverage options, commission structures, and account type variety are missing.

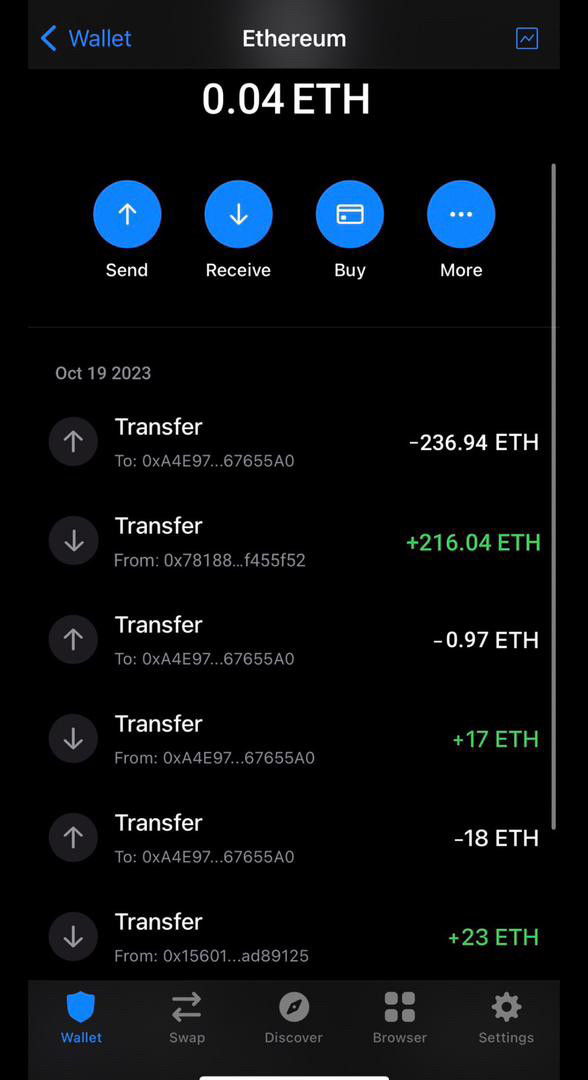

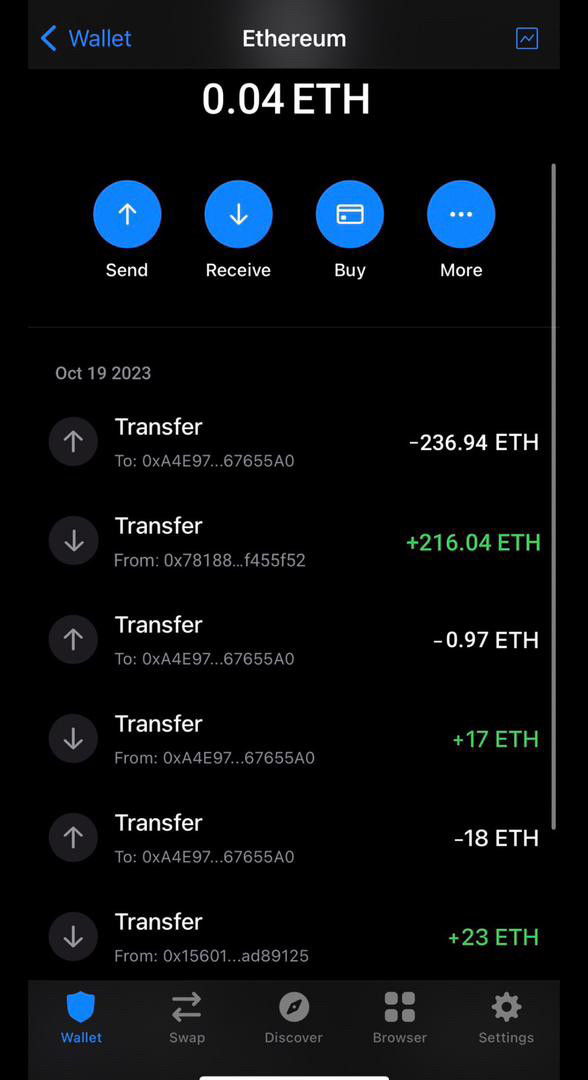

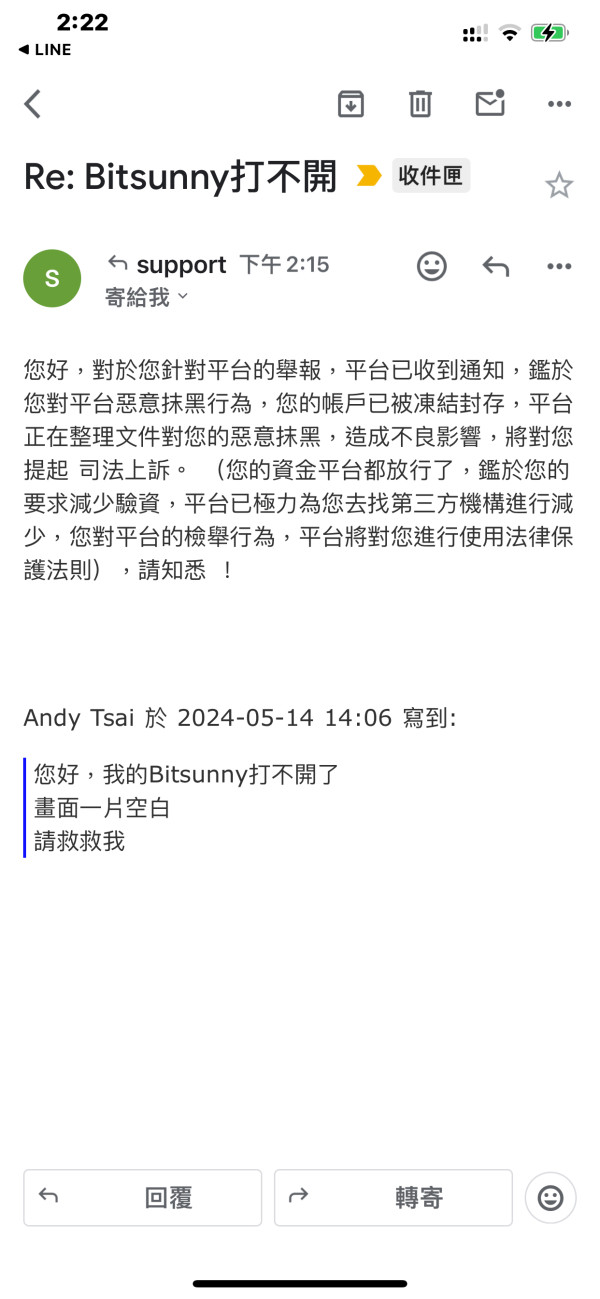

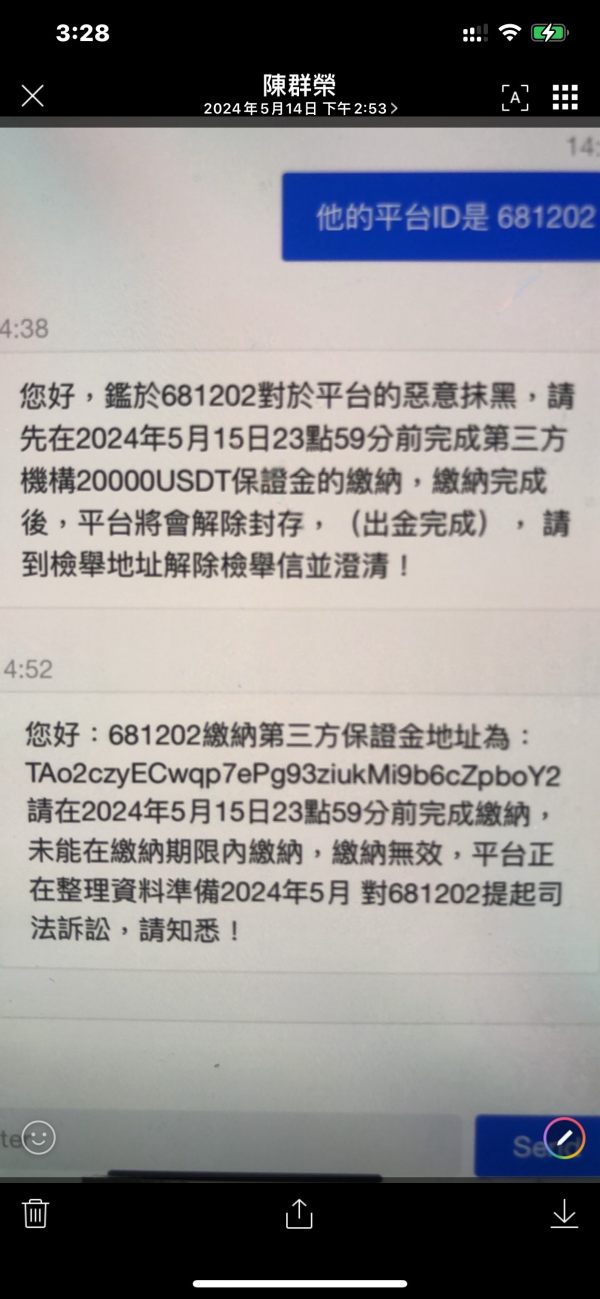

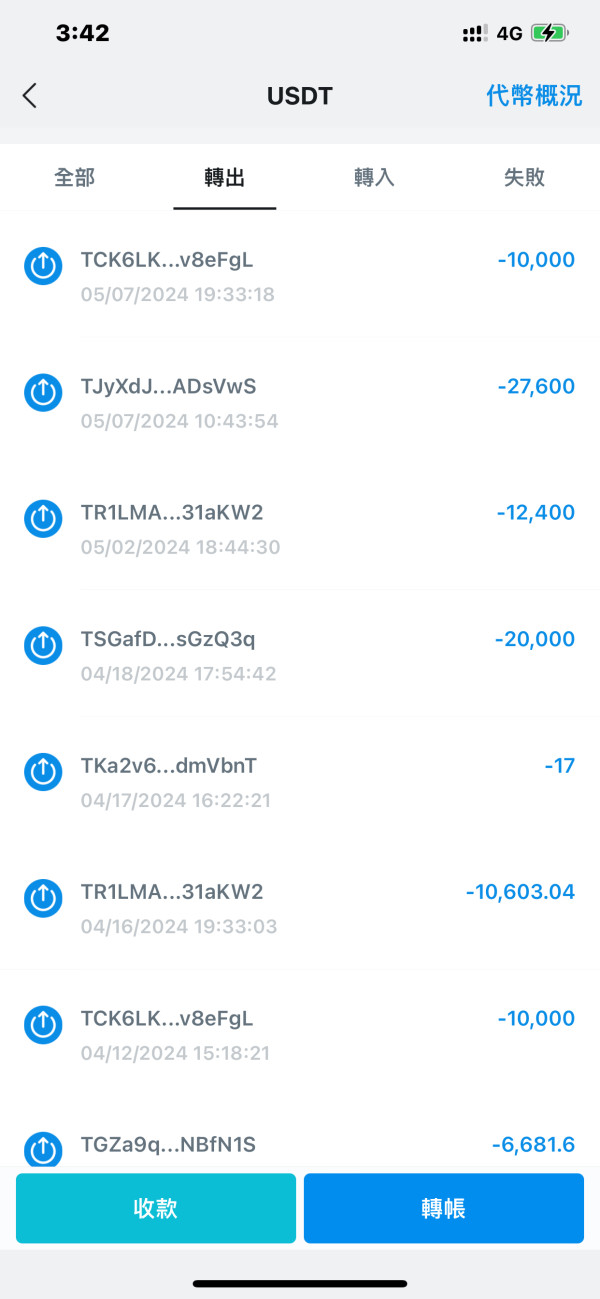

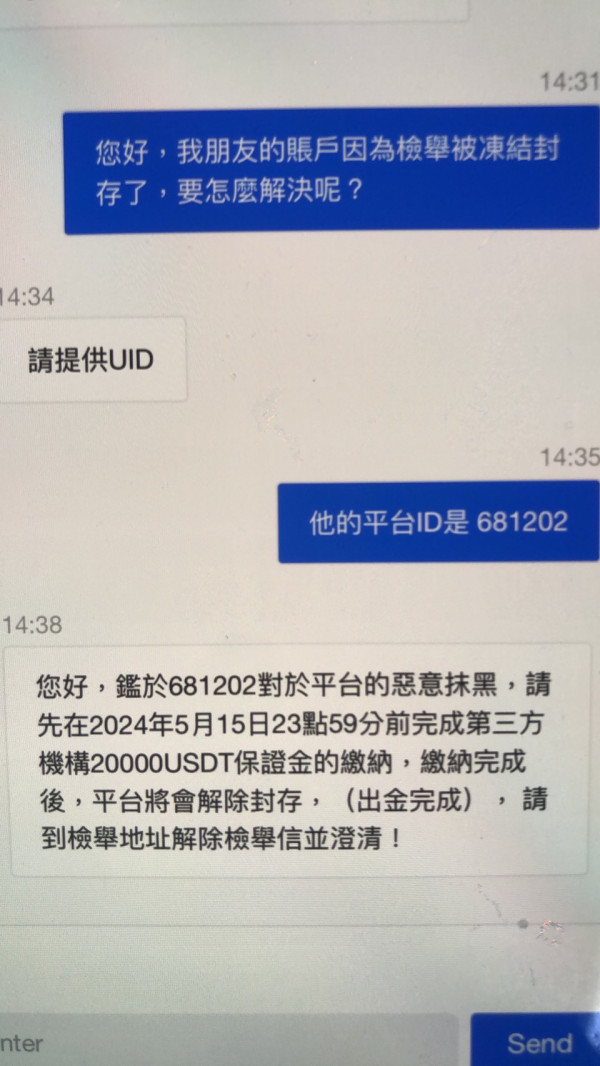

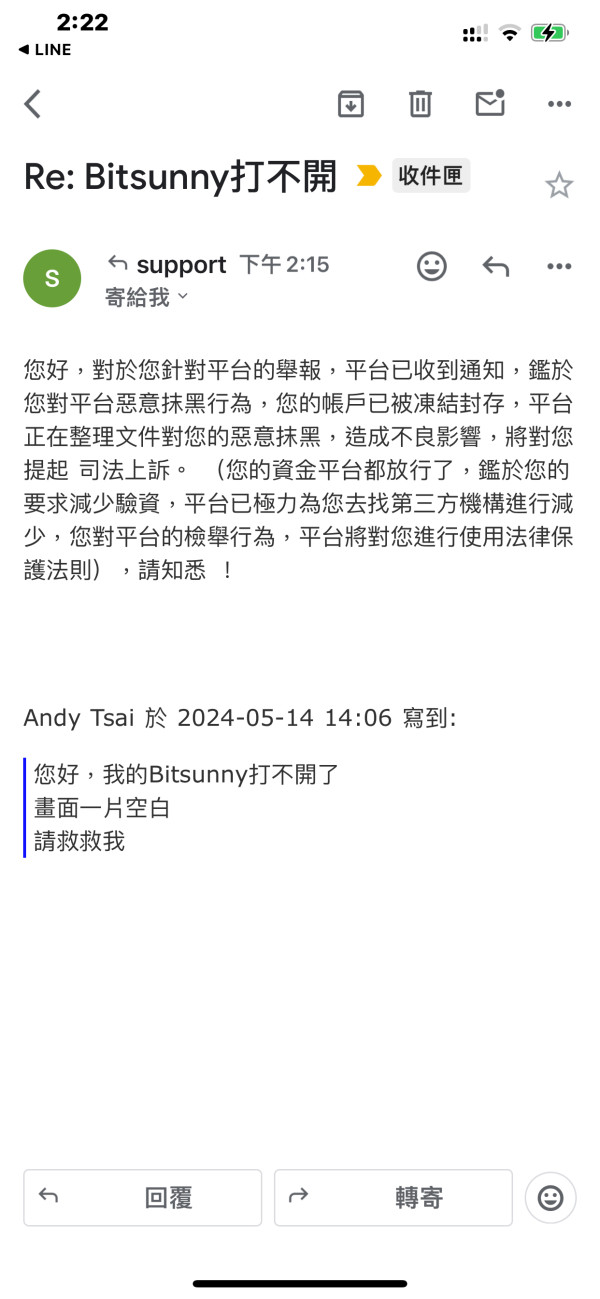

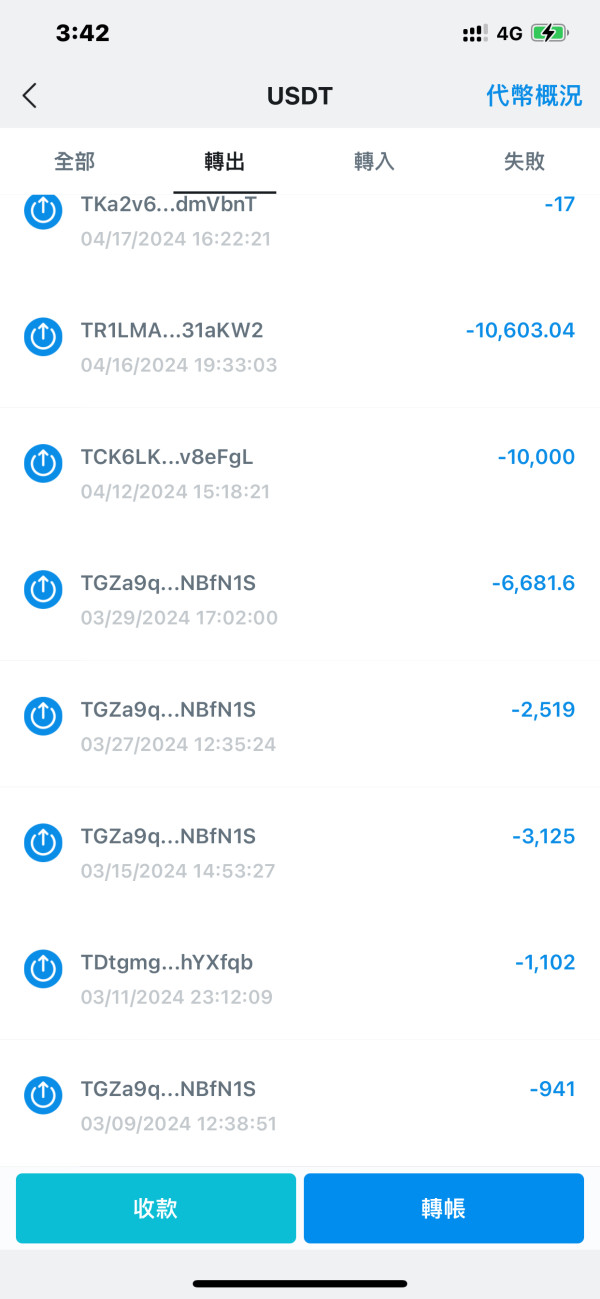

This lack of complete detail creates confusion about the overall appeal of the account offering. There have also been reports of accounts being frozen, an issue that has hurt user confidence and contributed to the poor account conditions rating. This tradition services limited review suggests that while the low deposit requirement is attractive, the limited information about additional account features and user experience issues make it a less secure option compared to more established brokers.

Given the limited disclosure of the account setup process and the absence of specialized accounts like Islamic or VIP accounts, prospective traders must take extra care when dealing with this broker. All of these factors contribute to a moderate score of 5/10 from our analysis.

When looking at the tools and resources provided by tradition services limited, the review finds that the reported offerings seem minimal. There is no detailed information about the types or quality of trading platforms available or whether advanced analytical tools are supported by the broker. Research and educational materials are not mentioned, leaving traders without structured guidance or analysis resources.

Trade automation or expert advisors, common features in many modern trading platforms, are also not discussed. The poor description in the information summary leads to a situation where user feedback suggests a lack of confidence in the broker's technology offerings. The absence of dedicated research portals or mobile trading applications further reduces the overall value in this category.

With limited data supporting enhancements that could boost the trader's information advantage, this absence of functional depth reflects poorly on the broker's ability to keep up with industry standards. In light of these factors, our overall rating in this category remains low at 4/10.

6.3 Customer Service and Support Analysis

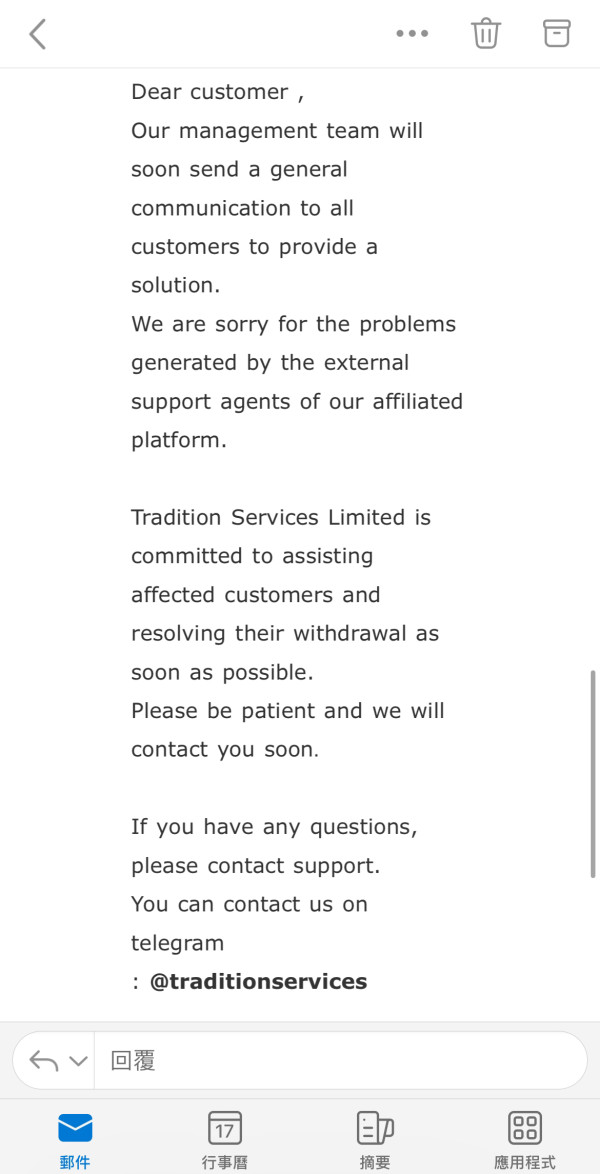

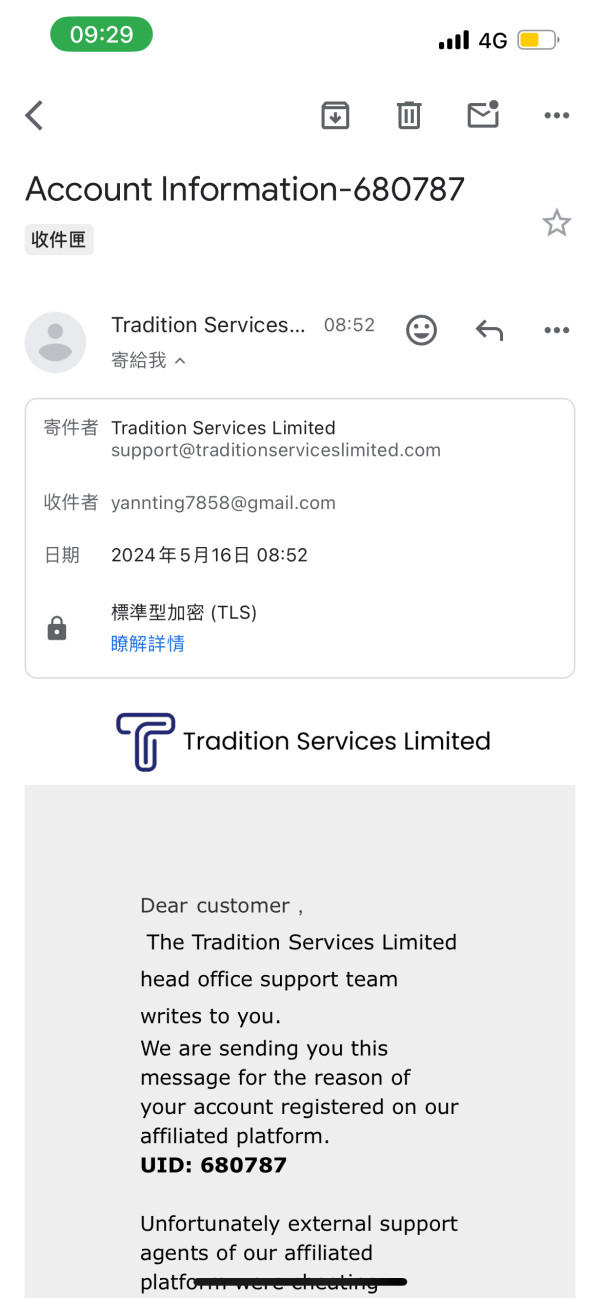

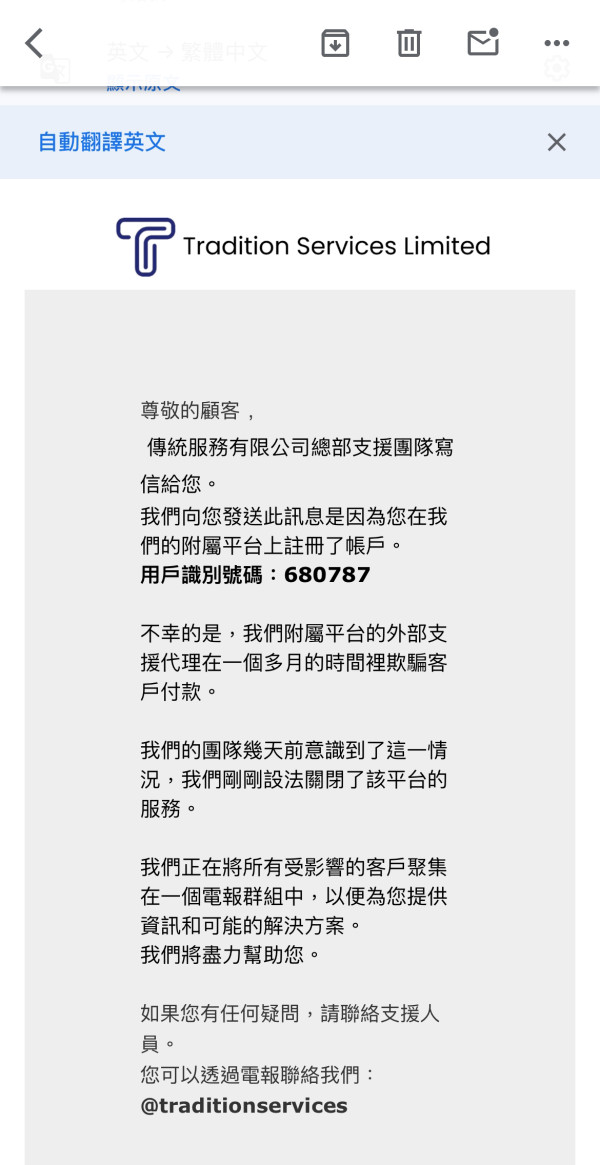

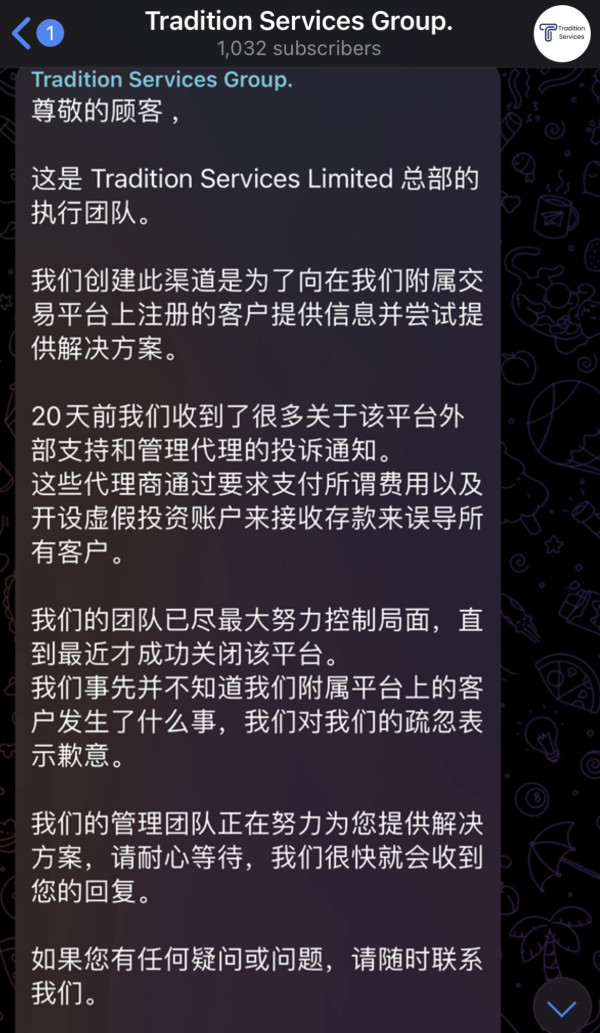

Customer service is a critical part of any broker, and in the case of tradition services limited, the review finds several concerning issues. The support channels are limited to email correspondence and a basic FAQ section, which hurts quick issue resolution and effective customer engagement. There is no information about live chat support, telephone assistance, or extended operational hours that might be expected from a supportive customer service platform.

No mention is made of multi-language support, leaving non-English speakers potentially disadvantaged. User reviews have noted slow response times and an overall lack of attention to resolving account issues, particularly regarding complaints of account freezes. The lack of third-party recognition or customer service awards further shows the deficiency in support services.

Combined with unclear details about resolution tracks for escalated issues, the overall standard of customer service falls short of modern expectations. This tradition services limited review therefore concludes with a rating of 3/10 in this area, emphasizing the need for a more robust and transparent support system.

6.4 Trading Experience Analysis

The overall trading experience offered by tradition services limited leaves much to be desired based on available data. Despite offering access to a wide range of asset classes, there is minimal information about the technical performance of the trading platform. Factors such as platform stability, speed of execution, and quality of order execution are not detailed in the source materials.

Users have provided limited feedback about the actual trading environment, and the absence of any mention of mobile trading options further adds to the uncertainty. The lack of documented success stories or positive testimonials suggests that traders may not be getting the level of service needed to ensure optimal performance, especially during high market volatility periods. The absence of enhanced features or even a complete user guide contributes to an underwhelming trading experience overall.

This dimension receives a rating of 4/10. In summary, as reported in this tradition services limited review, while the variety of available trading instruments might appeal to some, the practical execution and reliability of the trading environment remain below industry expectations.

6.5 Trustworthiness Analysis

Trustworthiness is a fundamental criterion when evaluating a broker, and it is in this area that tradition services limited appears most lacking. The critical problem is the complete absence of clear regulatory information since the broker does not provide any licensing details or regulatory oversight from a respected authority. This omission is alarming and suggests that there is minimal strict monitoring of the broker's operations.

The information summary fails to disclose any risk management protocols or measures aimed at protecting client funds. The presence of user complaints related to frozen accounts further increases doubts about the overall security and reliability of the broker. With no third-party endorsements or reputable industry reviews available to balance these concerns, the overall transparency of the firm is severely questioned.

Based on regulatory, operational, and customer feedback elements, this tradition services limited review assigns a trustworthiness score of 2/10. Prospective traders are strongly advised to exercise caution given these substantial red flags in the broker's operational framework.

6.6 User Experience Analysis

The final dimension, user experience, reflects the overall ease and satisfaction that traders get from interacting with the platform. In the case of tradition services limited, the collected feedback points towards a mostly negative experience. Users report difficulties with account registration and verification processes, made worse by several instances of account freezes that have severely hurt trust.

The interface design and ease of navigation are not explained in the available materials, leaving an information gap about the broker's user-friendliness. There is no evidence of streamlined procedures for managing funds or effective communication channels for resolving issues. The overall sentiment collected from user testimonials indicates dissatisfaction, driven mainly by the lack of proactive customer support and inefficient problem resolution protocols.

In this context, the user experience is considerably underwhelming, resulting in a rating of 3/10. This tradition services limited review emphasizes that while some traders may be willing to accept these shortcomings in exchange for low cost entry, the value delivered overall in terms of a smooth and reliable trading journey remains inadequate.

7. Conclusion

In summary, tradition services limited emerges in this review as a new and ambitious broker with some attractive features, notably its low minimum deposit. However, significant risks are highlighted by the absence of proper regulatory oversight and ongoing customer service issues. The limited information about trading platforms, cost structures, and additional features further adds to the uncertainty, which has led to numerous user complaints, including account freezes.

While this tradition services limited review recognizes the broker's potential appeal for high-risk traders looking to experiment with low initial investments, it is not recommended for traders seeking stability and security. Prospective clients should exercise extreme caution and seek additional, verifiable information before committing to trading with this broker.