Summary: MultiBank Group Limited is generally regarded as a reliable and well-regulated broker, offering a wide range of financial instruments and competitive trading conditions. Key features include a low minimum deposit requirement and access to multiple trading platforms, including MT4 and MT5. However, users should be aware of the varying regulations across different jurisdictions.

Note: It is important to recognize that MultiBank operates through various entities across different regions, which can affect the regulatory framework and trading conditions applicable to clients. The methods used to ensure fairness and accuracy in this review are based on comprehensive evaluations of available data.

Ratings Overview

How We Rated the Broker: Ratings are based on a combination of user feedback, expert opinions, and factual data regarding MultiBank's services and offerings.

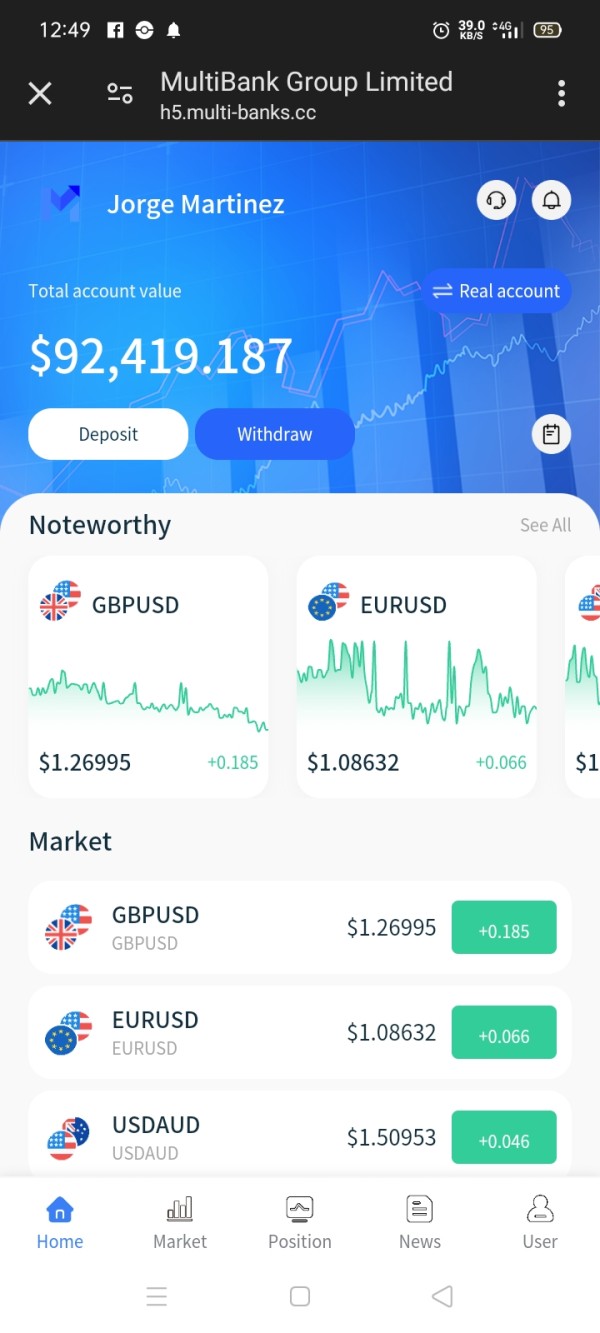

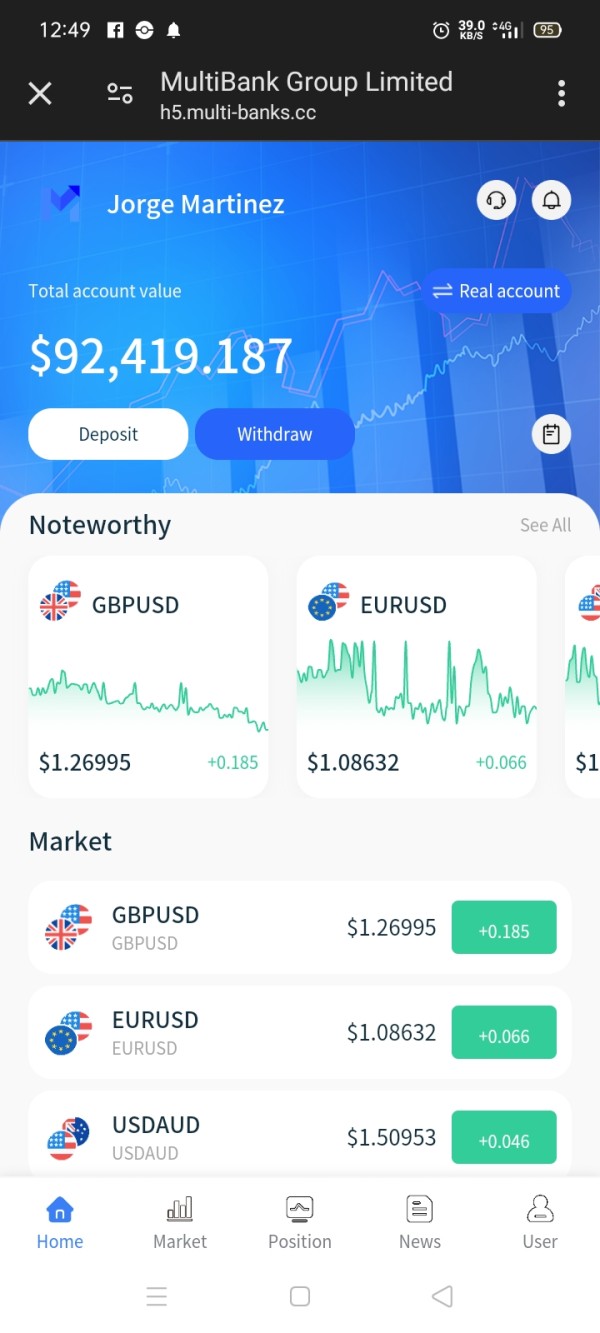

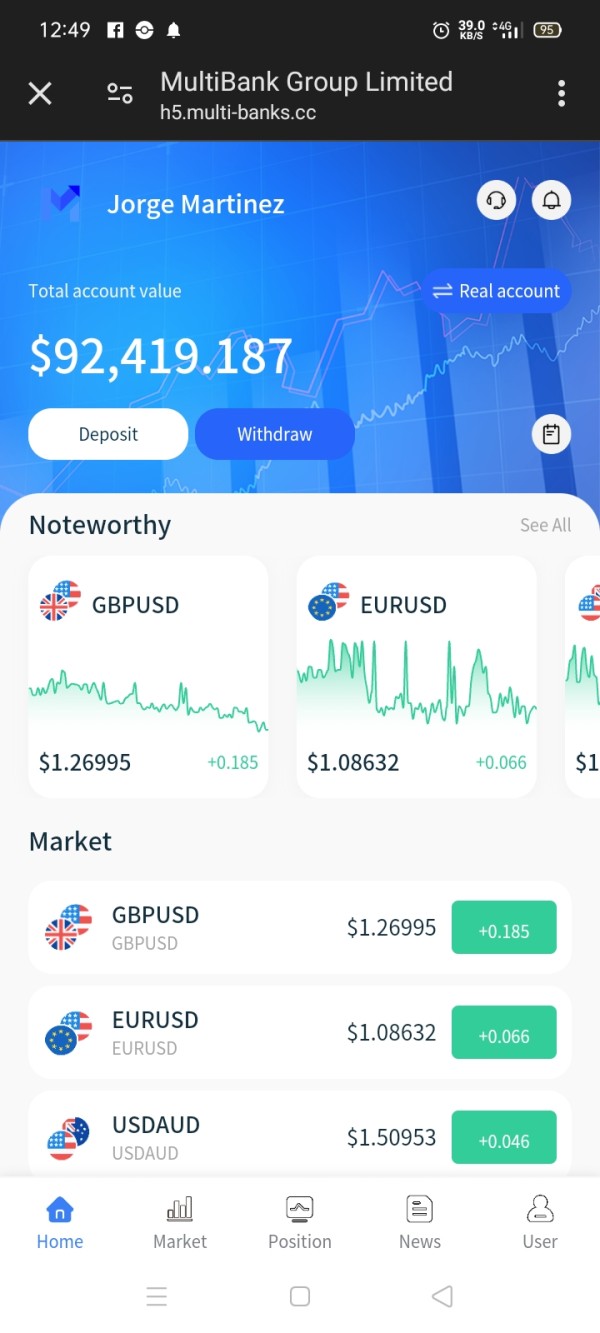

Broker Overview

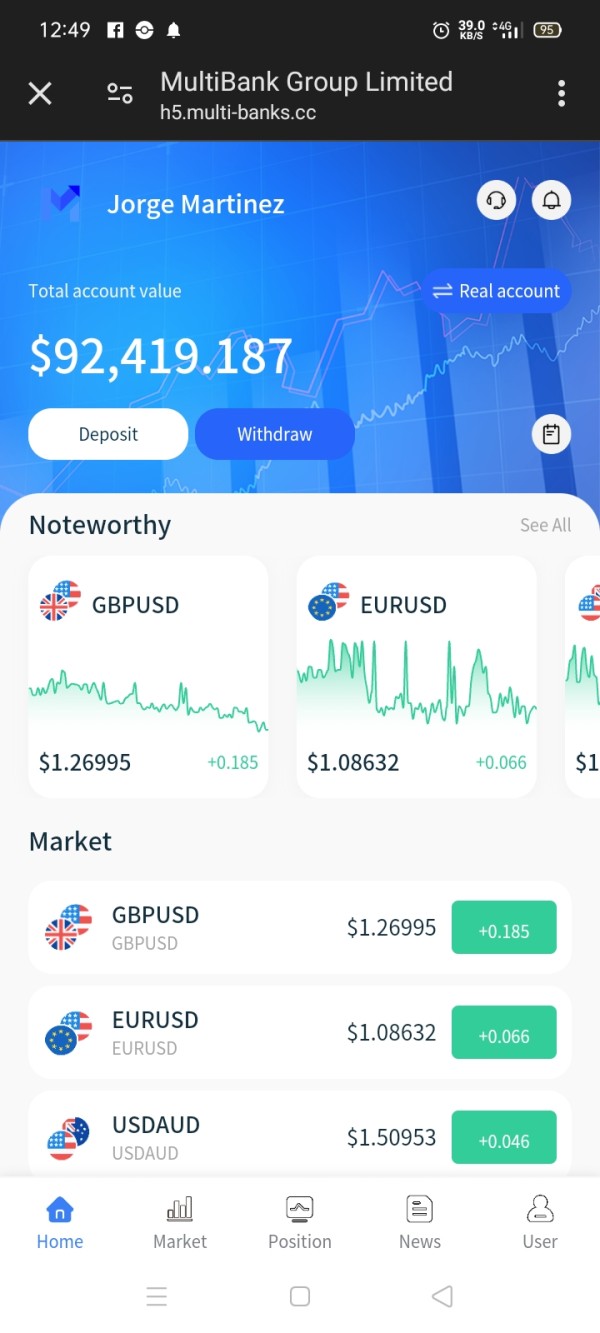

Founded in 2005, MultiBank Group Limited has established itself as a significant player in the online trading industry, boasting a paid-up capital of over $322 million. The broker offers access to a wide array of financial instruments, including forex, commodities, indices, shares, and cryptocurrencies. MultiBank operates on popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), catering to both beginner and experienced traders. The firm is regulated by several authorities, including ASIC (Australia), BaFin (Germany), and the Monetary Authority of Singapore (MAS), ensuring a robust compliance framework.

Detailed Breakdown

Regulatory Areas

MultiBank operates under multiple regulatory jurisdictions, enhancing its credibility. Key regulators include:

- ASIC (Australia): A tier-1 regulator known for stringent compliance requirements.

- BaFin (Germany): Another tier-1 authority offering strong investor protection.

- MAS (Singapore): Provides regulatory oversight, ensuring fair trading practices.

- FMA (Austria) and CySEC (Cyprus): Both are tier-1 regulators contributing to the broker's solid reputation.

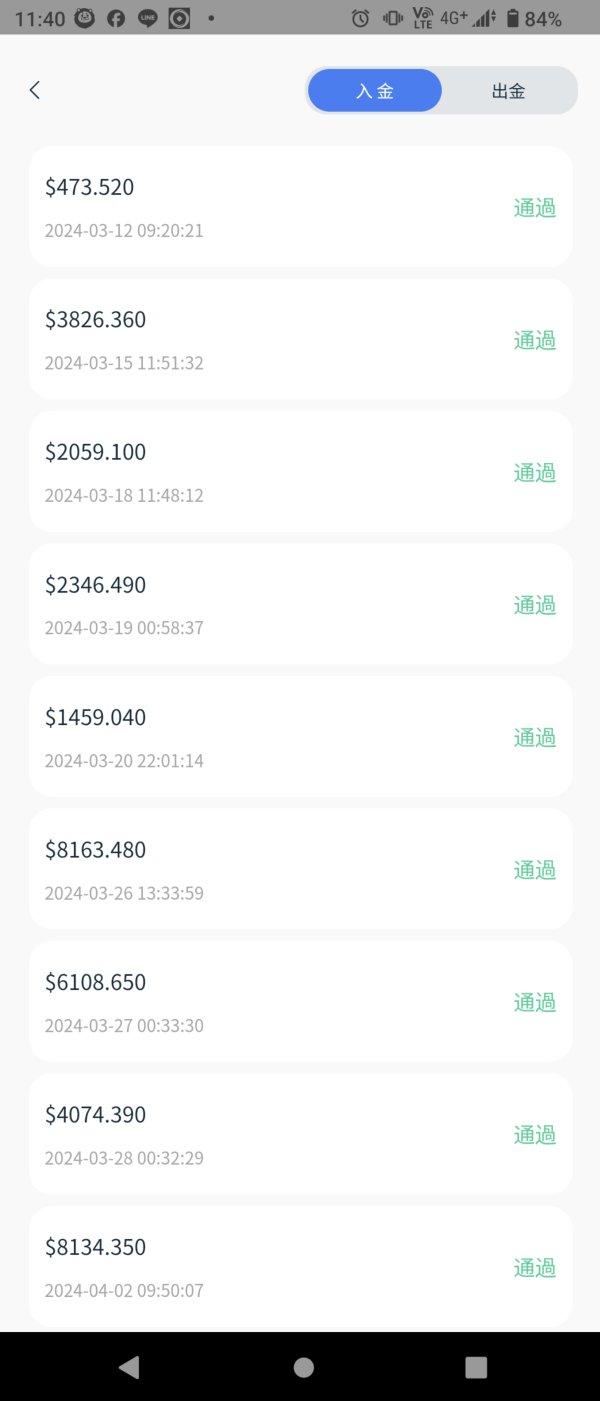

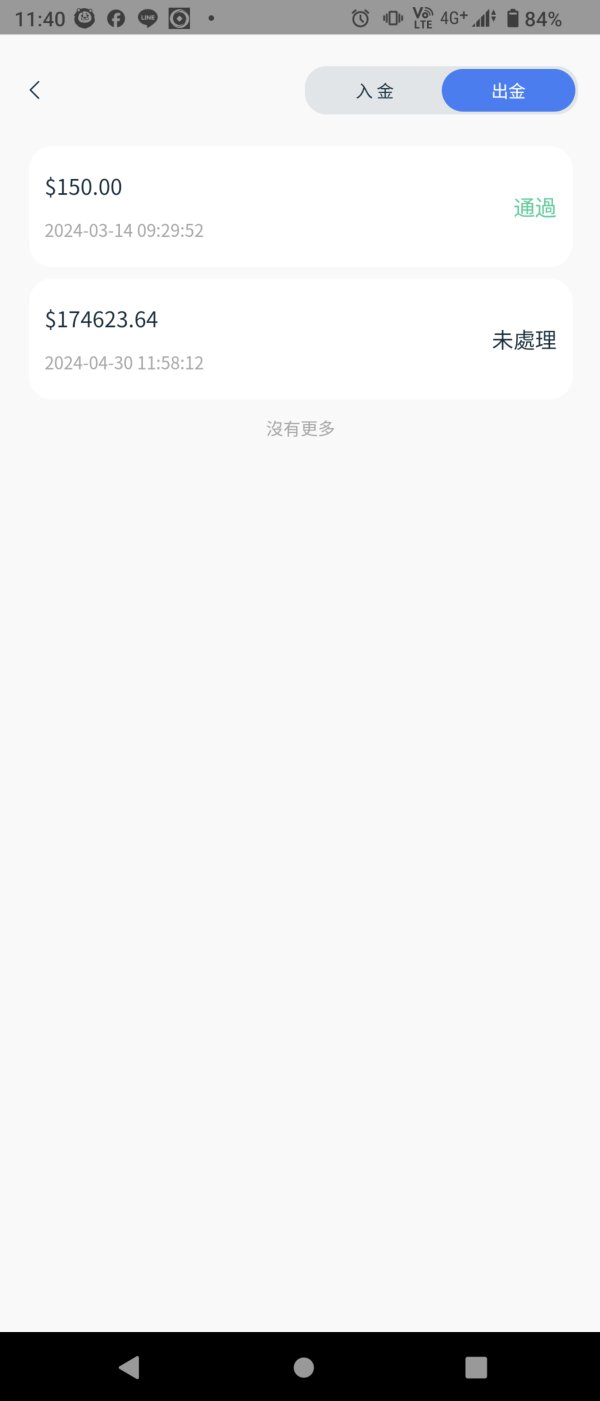

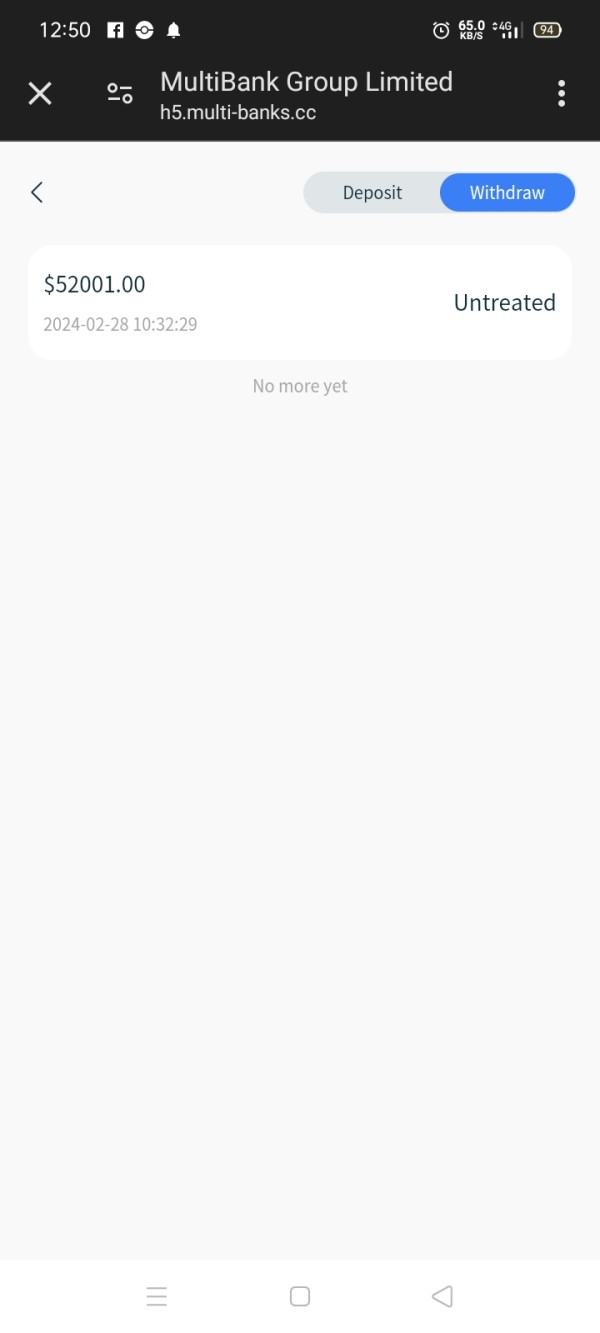

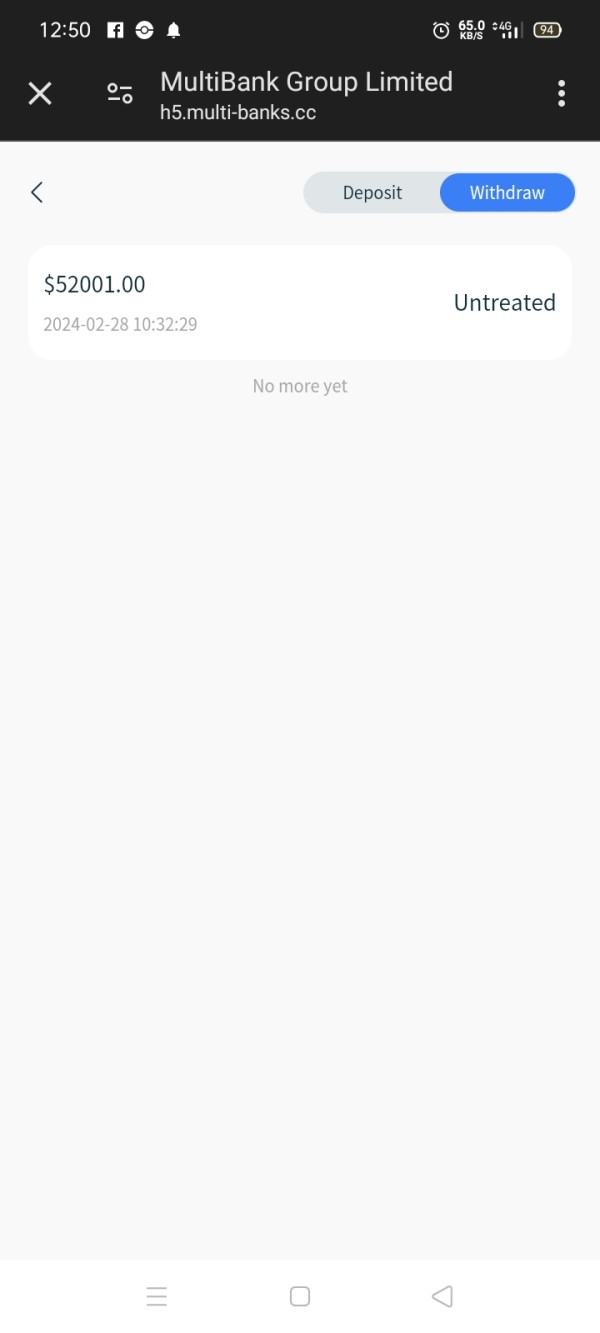

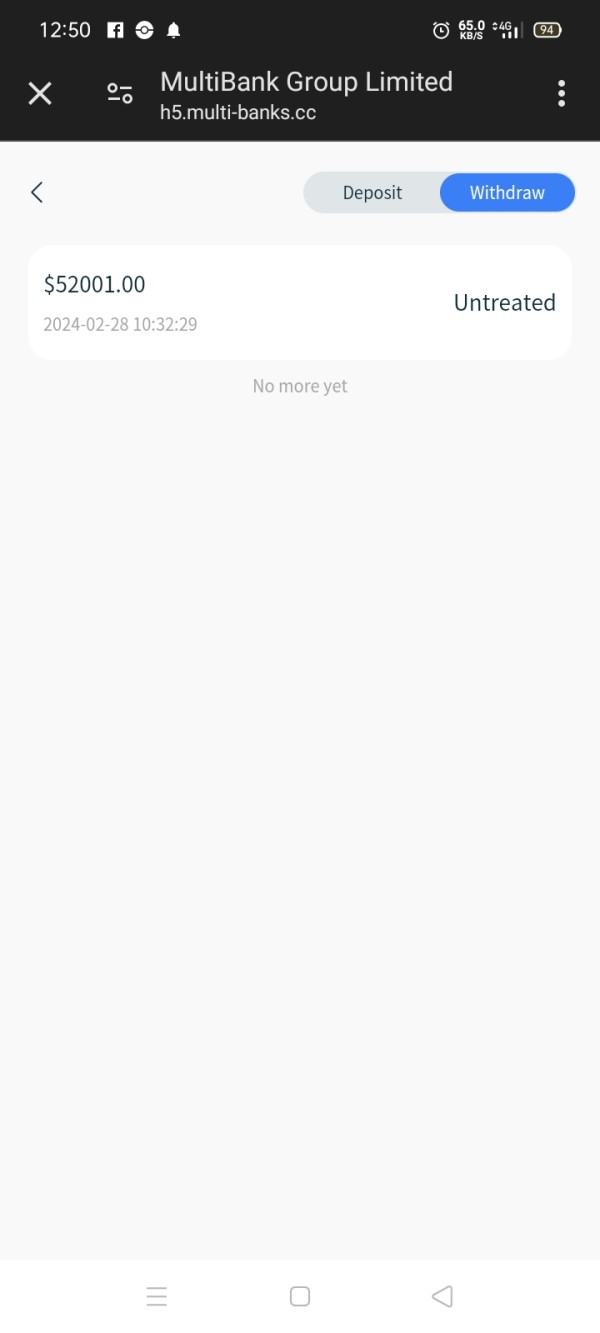

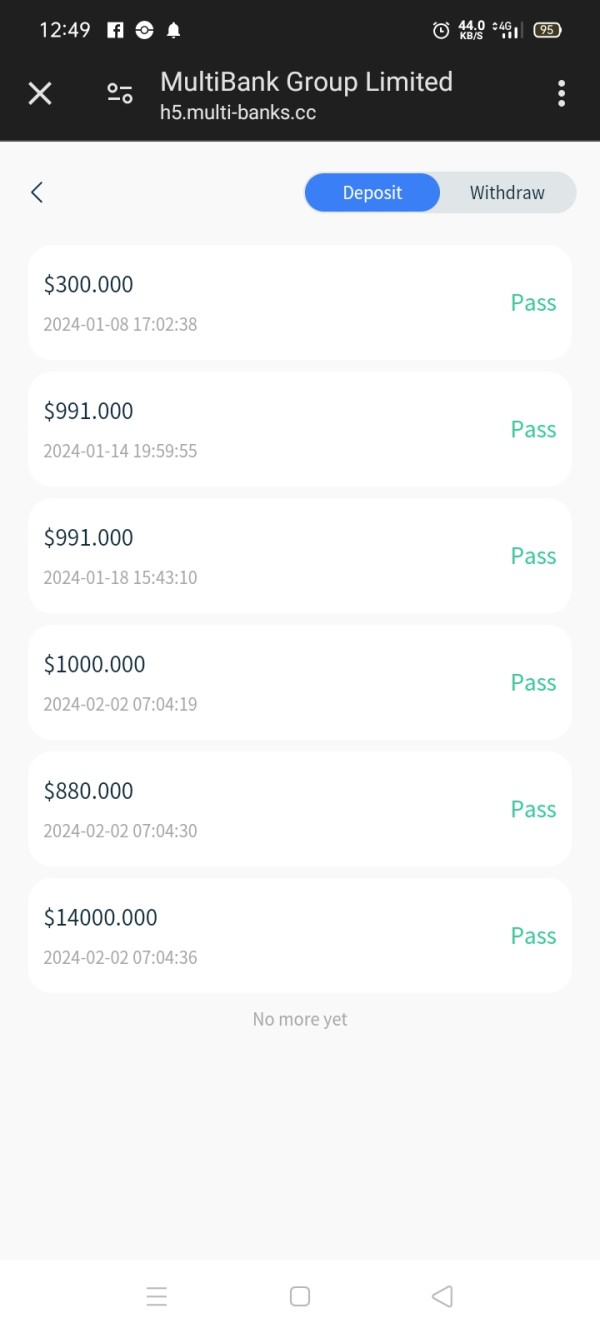

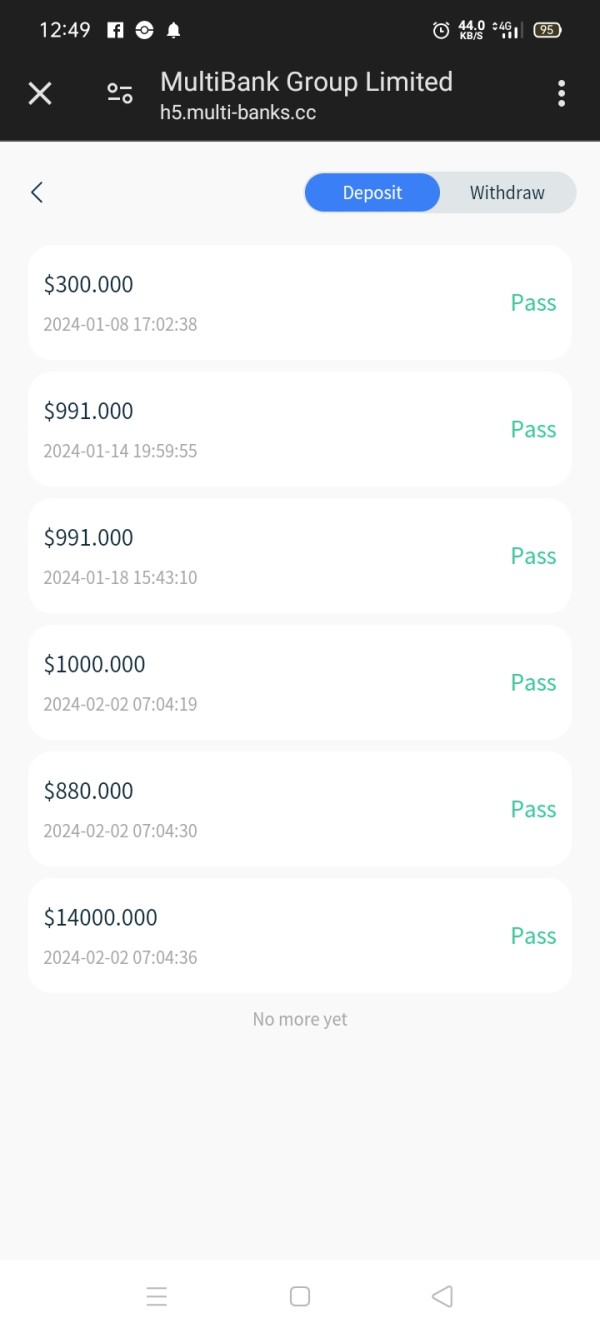

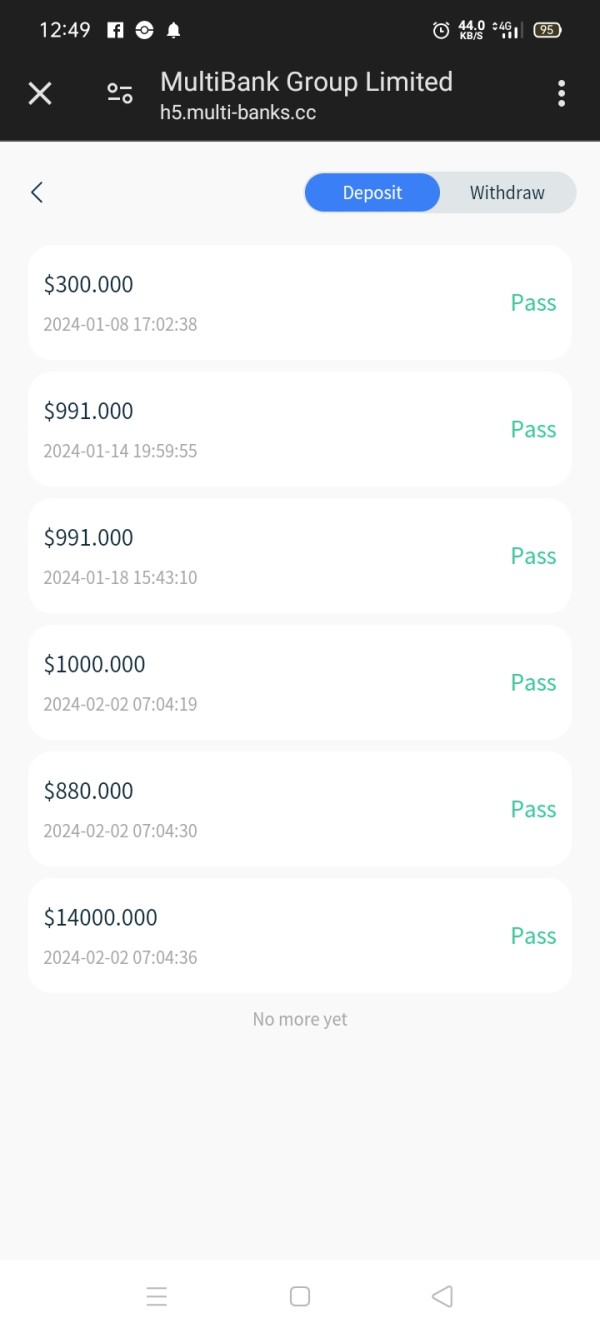

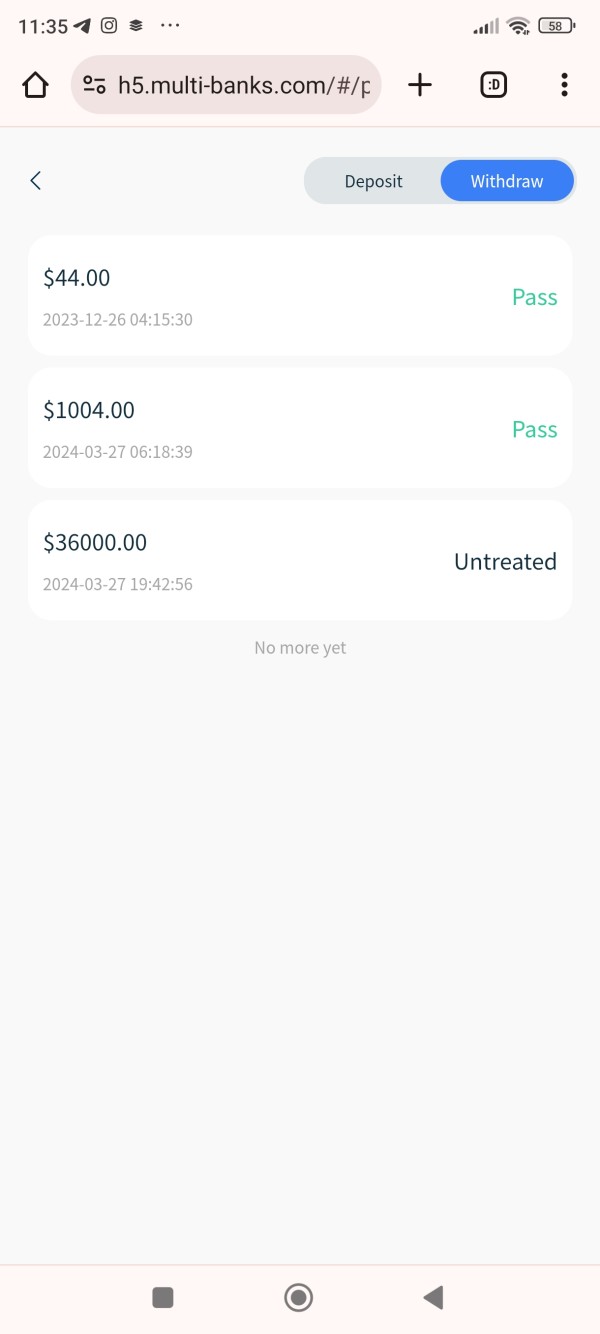

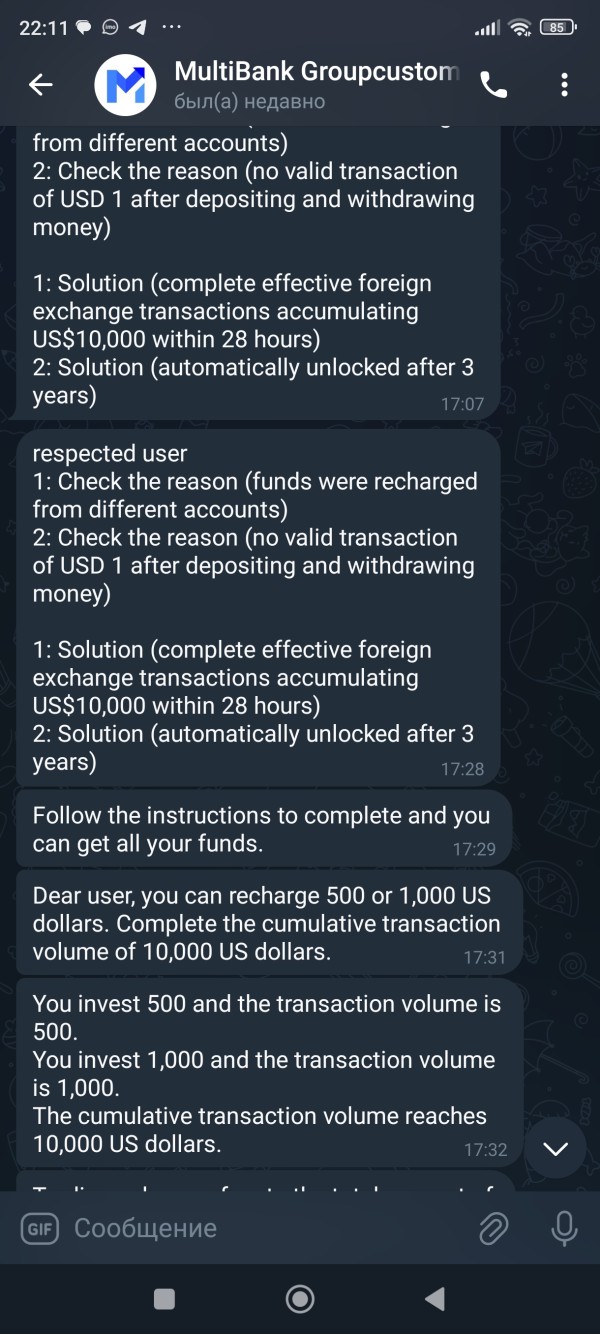

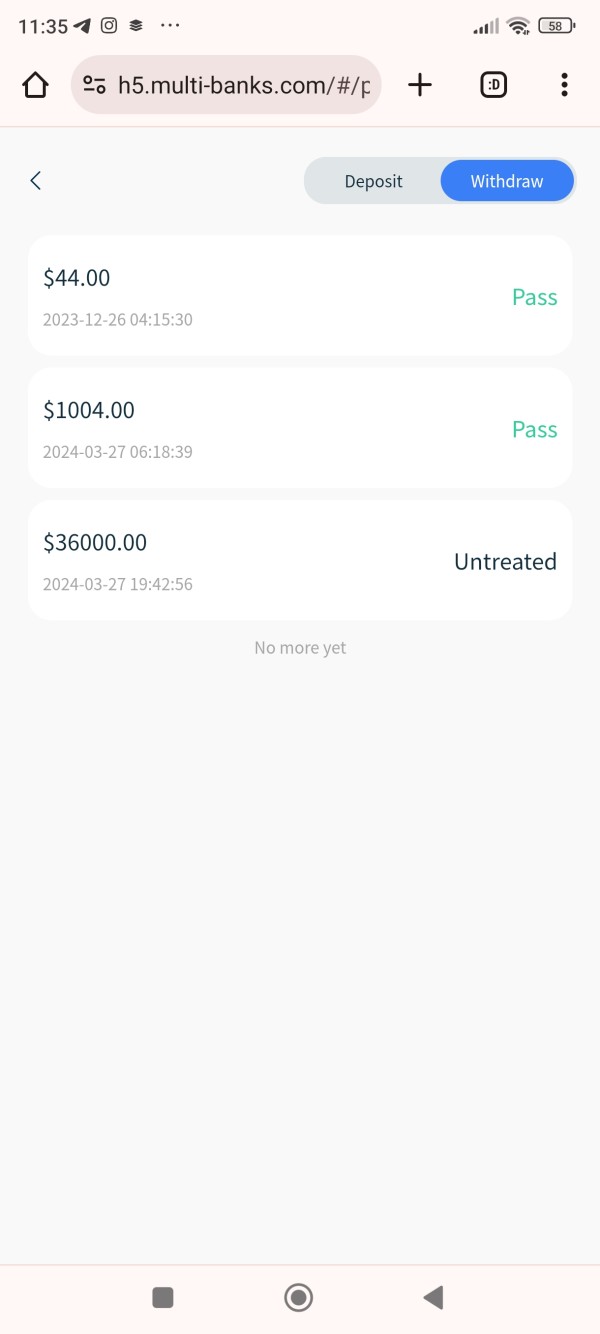

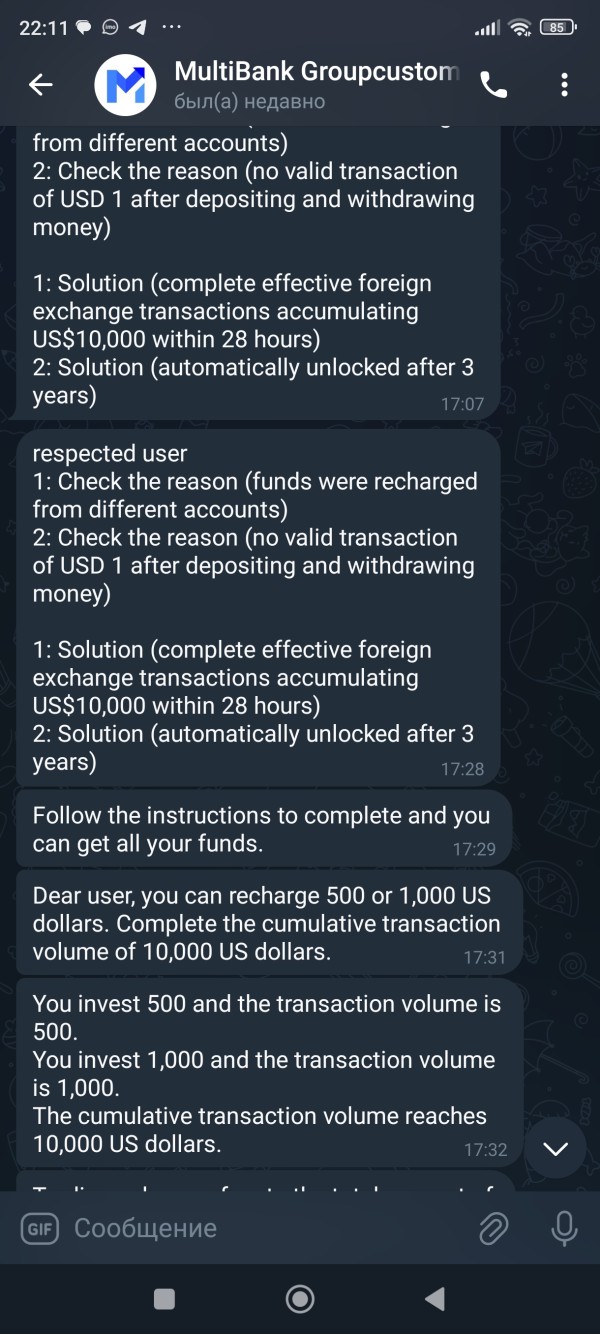

Deposit/Withdrawal Currencies/Cryptocurrencies

MultiBank accepts deposits in various currencies, including USD, EUR, GBP, and more, facilitating ease of access for international clients. Additionally, the broker allows cryptocurrency deposits, including Bitcoin and USDT, providing flexibility for traders who prefer digital assets.

Minimum Deposit

The minimum deposit required to open a standard account with MultiBank is just $50, making it accessible for novice traders. However, for the ECN account, the minimum deposit requirement is significantly higher at $5,000, which may deter some potential clients.

MultiBank offers a range of promotional bonuses, including a 20% deposit bonus, which can be an attractive feature for new traders looking to increase their trading capital. However, it is crucial to read the terms and conditions associated with these bonuses, as they often come with specific trading volume requirements.

Tradable Asset Categories

MultiBank provides an extensive selection of over 20,000 tradable instruments across various asset classes, including:

- Forex: A wide range of currency pairs, including major, minor, and exotic pairs.

- Commodities: Including gold, silver, and oil.

- Indices: Access to major global indices.

- Cryptocurrencies: A growing selection of crypto assets available for trading.

Costs (Spreads, Fees, Commissions)

MultiBank's cost structure is competitive, with spreads starting as low as 0.0 pips on ECN accounts. However, standard accounts have higher spreads, starting from 1.5 pips. The broker does not charge withdrawal fees, although third-party fees may apply. An inactivity fee of $60 per month is charged after three months of inactivity, which is higher than the industry average.

Leverage

MultiBank offers a maximum leverage of up to 1:500, allowing traders to amplify their positions significantly. However, it is essential to note that high leverage also increases the risk of substantial losses.

Traders at MultiBank can choose from several platforms, including:

- MT4 and MT5: Widely recognized for their robust features and user-friendly interfaces.

- Proprietary Platforms: MultiBank also offers its web-based trading platform, enhancing accessibility for traders.

Restricted Regions

MultiBank does not accept clients from specific countries, including the United States, Japan, and several others. This restriction may limit access for some potential traders looking to engage with the platform.

Available Customer Support Languages

MultiBank provides multilingual customer support, available in languages such as English, Arabic, Spanish, and Chinese. This feature is particularly beneficial for its diverse client base.

Ratings Overview (Repeat)

Detailed Breakdown of Ratings

Account Conditions (7.5/10)

MultiBank offers a variety of account types, including standard, pro, and ECN accounts, catering to different trading styles. The low minimum deposit for the standard account is appealing, but the higher minimum for ECN accounts may deter some traders.

While MultiBank provides access to popular trading platforms and some basic tools, the educational resources and research materials are limited compared to competitors. This area could benefit from further development.

Customer Service & Support (8.0/10)

The broker's customer support is generally well-rated, with multiple channels available for assistance. However, the response time may vary depending on the inquiry.

Trading Experience (7.5/10)

Traders report a satisfactory experience with MultiBank's trading platforms, particularly MT4 and MT5. The execution speed is generally good, but some users have noted occasional delays.

Trustworthiness (8.5/10)

MultiBank's regulatory framework is robust, with oversight from multiple tier-1 authorities. This enhances its credibility and trustworthiness among traders.

User Experience (7.0/10)

Overall, users find the platforms user-friendly, but there is room for improvement in terms of educational offerings and research content.

Cost Structure (6.5/10)

While the broker offers competitive spreads, the inactivity fee and higher spreads on standard accounts may be drawbacks for some traders.

In conclusion, MultiBank Group Limited presents a compelling choice for traders seeking a well-regulated broker with a wide range of financial instruments. However, potential clients should carefully consider the varying conditions based on their location and the specific account type they choose.