OpenMarkets Review 1

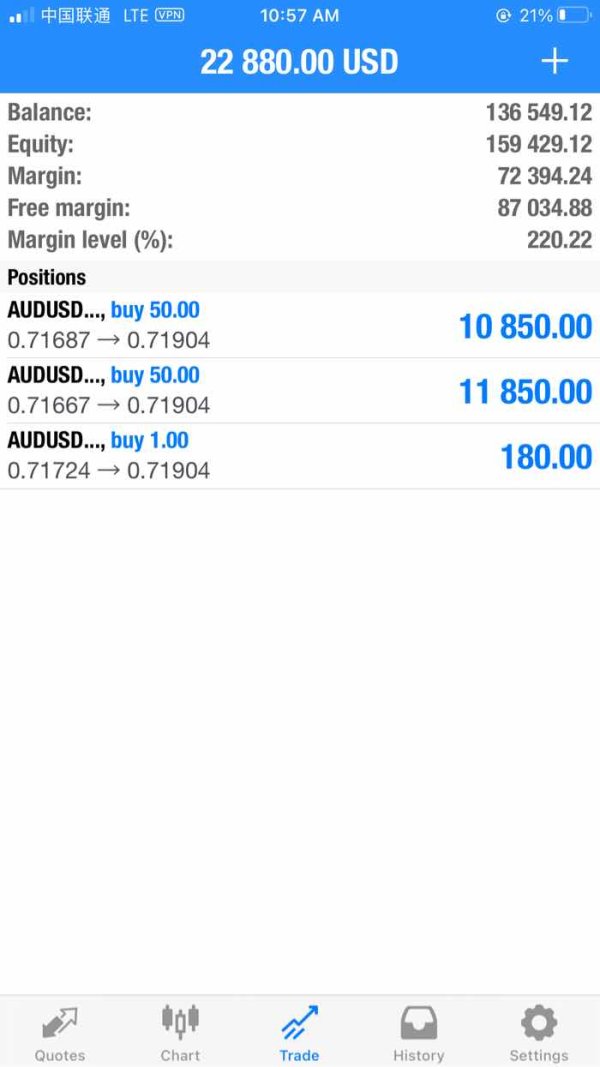

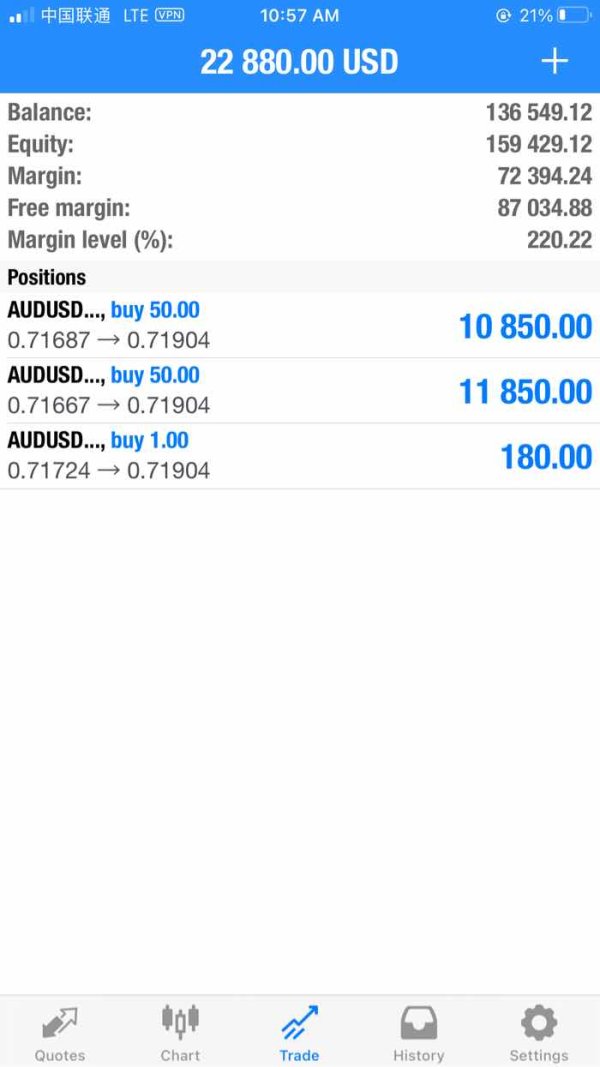

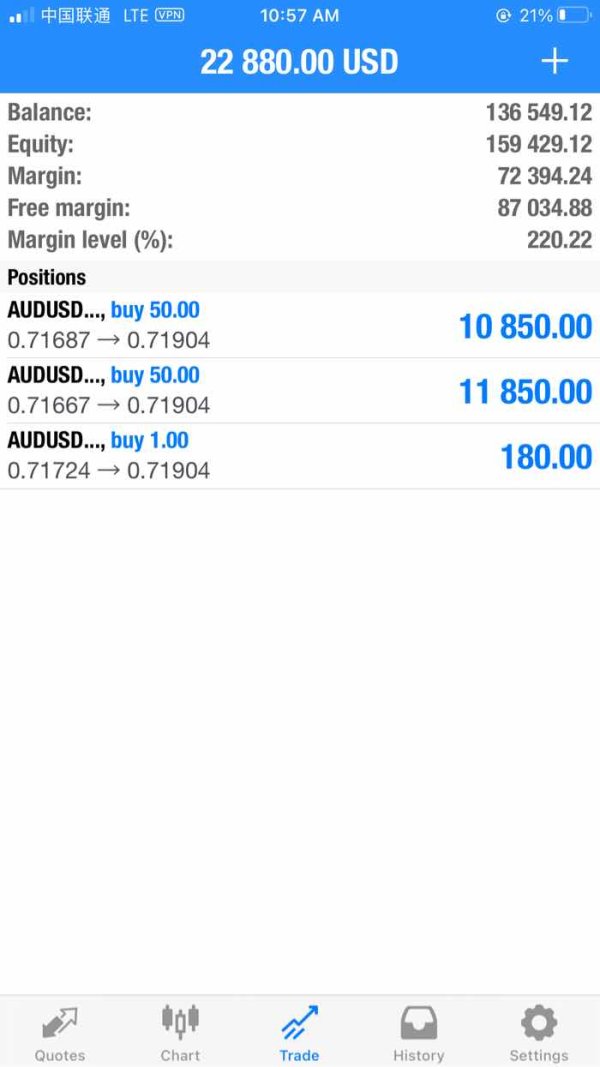

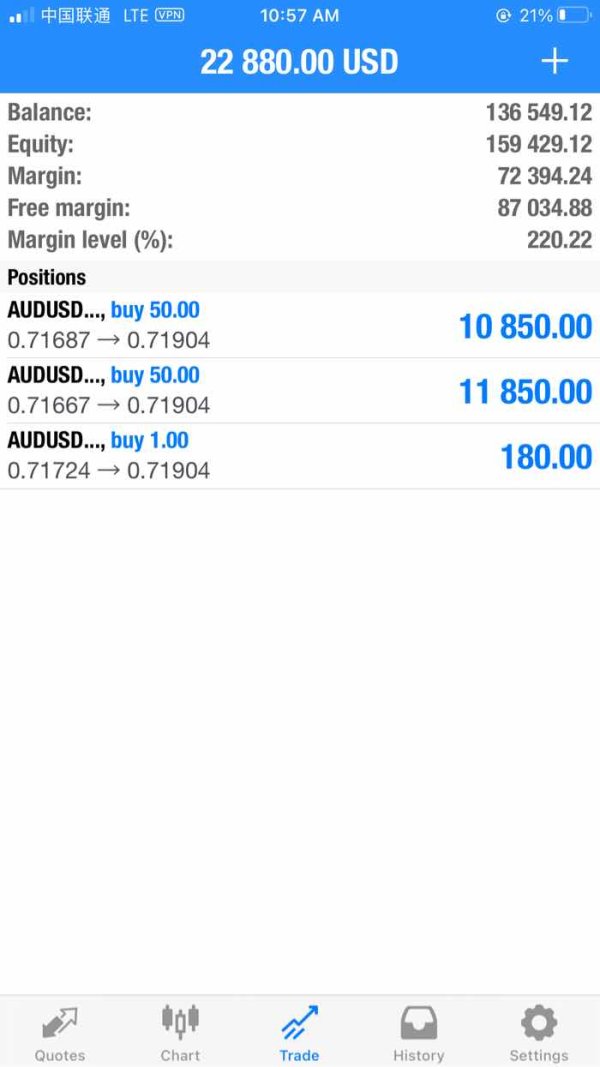

This is my profit, but it never reach my account after several withdrawal. Please solve it asap

OpenMarkets Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

This is my profit, but it never reach my account after several withdrawal. Please solve it asap

Openmarkets, an offshore brokerage, has raised significant concerns among traders and experts alike. The overall sentiment from various reviews indicates that this broker is not a safe choice for investment. Key findings include a lack of regulatory oversight, insufficient transparency regarding trading conditions, and numerous complaints from users about withdrawal issues.

Note: It is crucial to recognize that Openmarkets operates under different entities in various jurisdictions, which may complicate matters further. The methods employed to evaluate this broker have been aimed at ensuring fairness and accuracy in reporting.

| Category | Rating (Out of 10) |

|---|---|

| Account Conditions | 2 |

| Tools and Resources | 3 |

| Customer Service and Support | 2 |

| Trading Experience | 3 |

| Trustworthiness | 1 |

| User Experience | 2 |

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user experiences, expert opinions, and factual data regarding the broker's offerings.

Openmarkets claims to be based in Australia but operates without any regulatory oversight from the Australian Securities and Investments Commission (ASIC), raising significant red flags. Established in 2022, Openmarkets offers a web-based trading platform, primarily using MetaTrader 5 (MT5). Traders can access a limited range of assets, including forex, commodities, and cryptocurrencies. However, the absence of a legitimate license makes it difficult for users to trust the integrity of the platform.

Openmarkets is unregulated, which poses a considerable risk to potential investors. The broker has faced warnings from financial authorities, including the Comisión Nacional del Mercado de Valores (CNMV) in Spain and ASIC in Australia. This lack of regulation means that traders have limited recourse in the event of disputes or financial losses.

The broker only accepts bank transfers for deposits and withdrawals, limiting flexibility for traders. There is no clear information regarding the minimum deposit requirements, which adds to the uncertainty. Withdrawals typically take 5-7 business days, but many users have reported difficulties in accessing their funds, leading to frustrations and claims of potential scams.

Information regarding the minimum deposit is vague. While some sources suggest that no specific amount is required, this lack of clarity can lead traders to enter a financial commitment without fully understanding the risks involved.

Openmarkets does not appear to offer any significant bonuses or promotions, which is often a tactic used by brokers to attract new clients. The absence of such incentives, combined with the broker's questionable practices, further diminishes its appeal.

Openmarkets claims to provide trading opportunities in forex, commodities, and cryptocurrencies. However, the lack of transparency regarding the specific instruments available and their associated costs raises concerns about the broker's reliability.

The broker does not specify spreads or commissions clearly, which can lead to unexpected costs for traders. This lack of transparency is a significant drawback, as traders typically prefer brokers that provide clear and upfront information regarding costs.

Openmarkets advertises leverage up to 500:1, which can be attractive to traders looking for high-risk, high-reward opportunities. However, such high leverage is often associated with increased risk and potential losses, particularly for inexperienced traders.

The primary trading platform offered by Openmarkets is MetaTrader 5, which is generally well-regarded in the trading community. However, the broker's overall reliability and trustworthiness overshadow the platform's capabilities.

Openmarkets is not authorized to operate in several jurisdictions due to its unregulated status. This lack of authorization can complicate matters for traders residing in these regions, as they may have limited options for recourse in the event of disputes.

Customer service appears to be limited, with users reporting difficulties in reaching support. The availability of assistance in multiple languages is not explicitly stated, which could hinder non-English speaking traders from resolving issues effectively.

| Category | Rating (Out of 10) |

|---|---|

| Account Conditions | 2 |

| Tools and Resources | 3 |

| Customer Service and Support | 2 |

| Trading Experience | 3 |

| Trustworthiness | 1 |

| User Experience | 2 |

Account Conditions: Openmarkets lacks clarity on account types and minimum deposit requirements, leading to a low score.

Tools and Resources: The broker provides limited educational resources, which is a significant drawback for novice traders.

Customer Service and Support: Users have reported difficulties in accessing customer support, contributing to a poor overall experience.

Trading Experience: While the MT5 platform is robust, the broker's lack of transparency and regulatory oversight diminishes the overall trading experience.

Trustworthiness: With multiple warnings from regulatory bodies and numerous user complaints, Openmarkets scores the lowest in this category.

User Experience: Overall user experience is marred by withdrawal issues and a lack of clear communication from the broker.

In summary, the Openmarkets review presents a cautionary tale for traders considering this broker. The lack of regulation, transparency, and numerous user complaints suggest that Openmarkets may not be a reliable option for trading.

FX Broker Capital Trading Markets Review