Deere 2025 Review: Everything You Need to Know

Executive Summary

This deere review presents a unique challenge. Deere & Company appears to focus mainly on agricultural equipment and financial services rather than traditional forex trading. The company is widely known for its John Deere brand and emphasizes shareholder services, dividend reinvestment options, and personalized financial solutions through its John Deere Financial division. While the company shows strong relationships with dealers and merchants and offers over 45 years of dedicated service support, the lack of specific forex trading information makes it hard to provide a complete evaluation as a forex broker.

The available information suggests Deere & Company operates with a focus on long-term relationships based on trust, particularly in the agricultural and equipment financing sectors. However, critical forex trading elements such as regulatory compliance, trading platforms, spreads, and leverage options are notably absent from the available materials. This presents a neutral to cautious outlook for potential forex traders seeking detailed trading conditions and regulatory transparency.

Important Notice

This review is based on limited information available about Deere & Company's financial services. The evaluation does not identify specific regional entity differences or comprehensive forex trading operations. Our assessment methodology relies on publicly available information, which appears to focus primarily on agricultural equipment financing rather than traditional forex brokerage services. Readers should exercise caution and seek additional information before making any trading decisions. Standard forex trading metrics and regulatory details are not readily apparent in the available documentation.

Rating Framework

Broker Overview

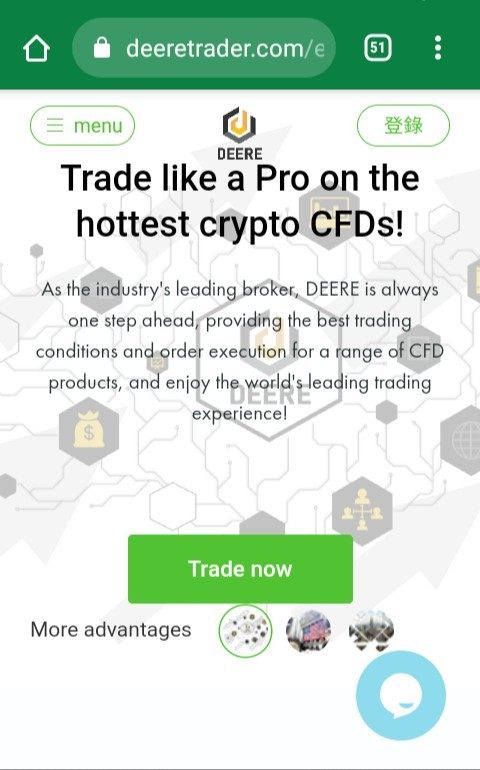

Deere & Company operates as a well-established corporation with a significant focus on agricultural equipment and related financial services. The company has built its reputation around the John Deere brand. According to available information, the company emphasizes personalized financial solutions that can be quickly arranged through authorized dealers, demonstrating a business model centered on equipment financing rather than traditional forex trading.

The company's approach to financial services appears to prioritize long-term relationships with merchants and dealers. Their Multi-Use Account system and dividend reinvestment programs suggest a sophisticated financial infrastructure, though these services seem oriented toward equipment financing and shareholder services rather than forex trading operations. This deere review must note that the traditional forex broker characteristics such as currency pair offerings, trading platforms, and regulatory compliance specific to forex operations are not clearly outlined in the available materials.

Regulatory Jurisdiction: Specific regulatory information for forex trading operations is not detailed in available sources. The company operates as a publicly traded corporation with shareholder services.

Deposit and Withdrawal Methods: Available information focuses on dividend payments and direct deposit options for shareholders. Specific trading account funding methods are not specified.

Minimum Deposit Requirements: No minimum deposit requirements for trading accounts are mentioned in the available documentation.

Bonuses and Promotions: The available information does not reference any trading bonuses or promotional offers typically associated with forex brokers.

Tradeable Assets: While the company provides financial services, specific forex currency pairs or other tradeable instruments are not detailed. The available information lacks these crucial details.

Cost Structure: Specific information about spreads, commissions, or other trading costs is not available in the current documentation. This makes it impossible to assess the competitiveness of trading conditions.

Leverage Options: No leverage ratios or margin requirements are specified in the available materials.

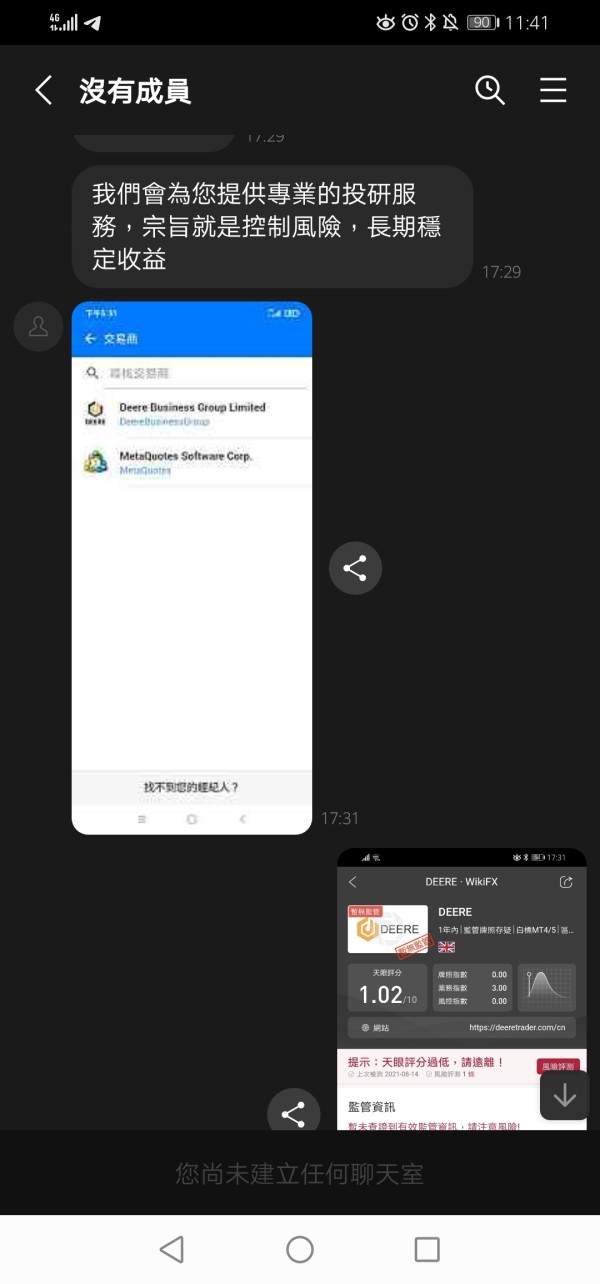

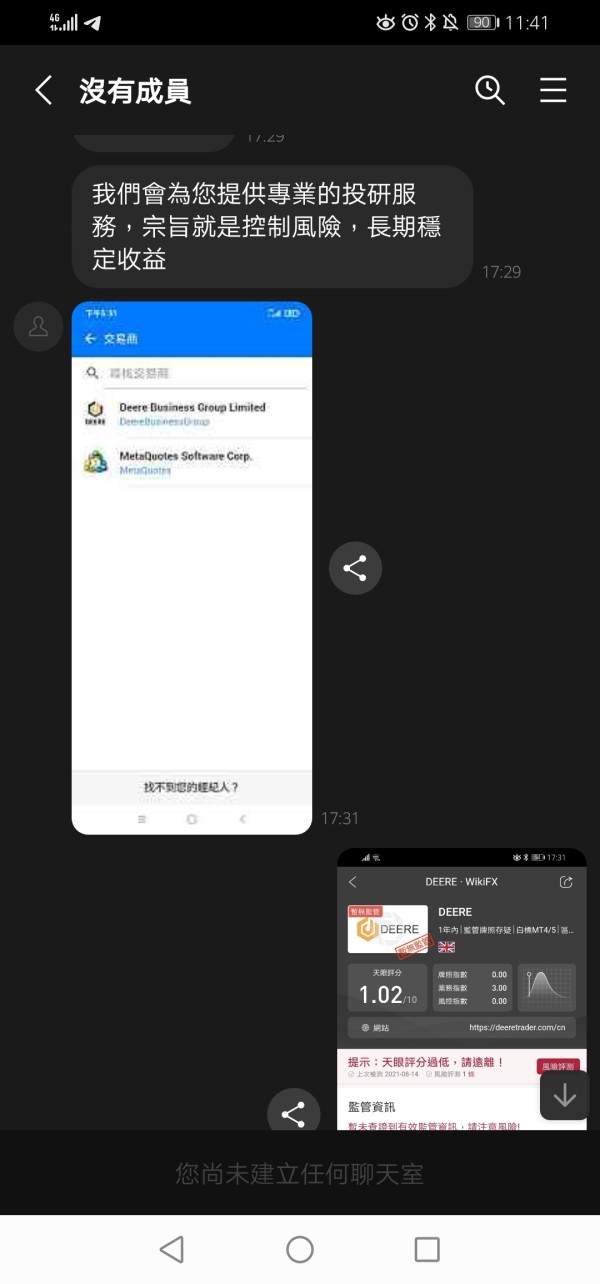

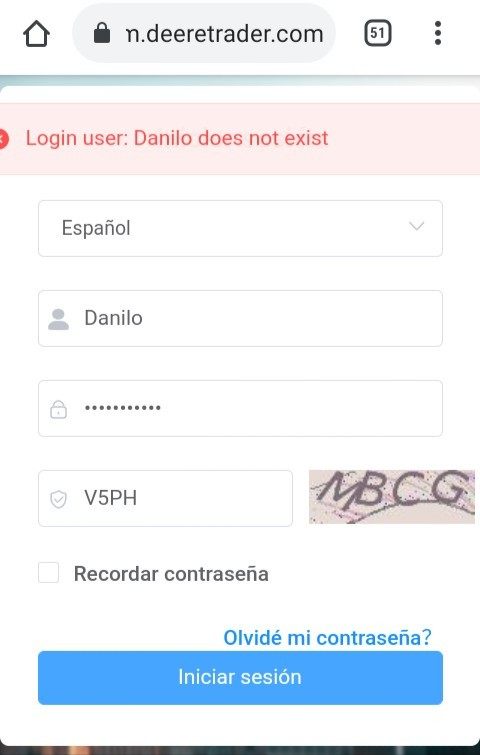

Platform Selection: Specific trading platforms are not mentioned. The company does offer online account access through secure portals.

Geographic Restrictions: Regional limitations for trading services are not specified in available information.

Customer Service Languages: Multiple communication options are mentioned. Specific language support details are not provided.

This deere review highlights significant information gaps that potential forex traders would typically expect to find when evaluating a broker.

Detailed Rating Analysis

Account Conditions Analysis

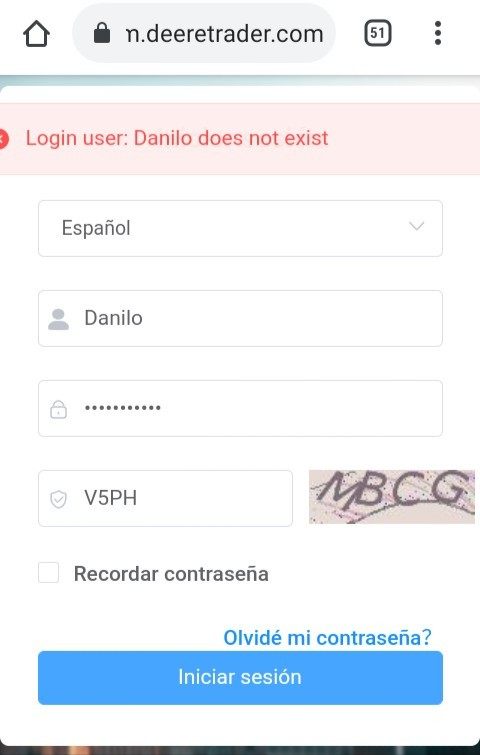

The available information regarding account conditions for forex trading is notably limited in this deere review. While Deere & Company offers sophisticated financial services including shareholder accounts with dividend reinvestment options and Multi-Use Accounts for merchants, specific forex trading account types are not detailed. The company's shareholder portal allows access to account information through secure login systems. They offer direct deposit functionality for dividend payments and sales proceeds.

However, critical information such as account tier structures, minimum balance requirements for trading, Islamic account options, or specific account opening procedures for forex trading are not addressed in the available materials. The company's emphasis on personalized financial solutions suggests flexibility in their service offerings. Without specific details about trading account conditions, spreads, or margin requirements, potential forex traders cannot adequately assess whether the account structures meet their trading needs. The score of 5/10 reflects this significant information gap while acknowledging the company's established financial service infrastructure.

Regarding trading tools and resources, the available information for Deere & Company does not provide specific details about forex trading platforms, analytical tools, or educational resources typically expected from forex brokers. While the company offers online account management through secure portals and emphasizes over 45 years of dedicated service support, these features appear focused on equipment financing and shareholder services rather than trading tools.

The absence of information about charting software, technical analysis tools, economic calendars, or automated trading capabilities significantly limits the assessment of their trading resources. Educational materials, market research, or trading signals that are standard offerings from established forex brokers are not mentioned in the available documentation. The company's focus on merchant relationships and equipment expertise suggests industry-specific knowledge. This doesn't translate to forex market analysis or trading education. Without clear evidence of comprehensive trading tools or educational resources, the evaluation remains limited, reflecting the company's apparent focus on agricultural and equipment financing rather than traditional forex trading services.

Customer Service and Support Analysis

Customer service appears to be a relative strength for Deere & Company. Available information indicates a commitment to long-term relationship building based on trust. The company emphasizes making communication easy for clients and promises prompt responses to inquiries. Multiple communication methods are mentioned, though specific channels such as live chat, phone support hours, or ticket systems are not detailed in the available materials.

John Deere Financial specifically highlights over 45 years of dedicated service support and long-lasting relationships with merchants. The company provides secure online account access and email communication options for account-specific inquiries. However, crucial details such as 24/7 support availability, multilingual customer service capabilities, response time guarantees, or specialized forex trading support are not specified.

The emphasis on dealer relationships and merchant support indicates a business model built around ongoing client partnerships rather than transactional relationships. While this suggests potential for quality support, the lack of specific information about forex trading support, problem resolution procedures, or customer service metrics limits the ability to fully assess their support quality for trading clients. The score reflects the company's apparent commitment to client relationships while acknowledging the absence of forex-specific support details.

Trading Experience Analysis

The trading experience evaluation for Deere & Company faces significant limitations due to the absence of specific trading platform information in available materials. While the company offers secure online account access through shareholder portals, details about trading platforms, order execution speed, platform stability, or mobile trading capabilities are not provided. The available documentation lacks these essential details.

Standard forex trading experience metrics such as execution speed, slippage statistics, platform uptime, or order types supported cannot be assessed based on current information. The company's focus appears to be on financial account management and equipment financing rather than active trading platforms. Mobile application functionality, charting capabilities, one-click trading, or platform customization options that traders typically evaluate are not addressed.

Without specific user feedback about trading platform performance, execution quality, or technical issues, it's impossible to provide meaningful insights into the actual trading experience. The company's emphasis on secure online access and prompt communication suggests technical capability. This doesn't necessarily translate to sophisticated trading platform functionality. This deere review must note that the absence of trading platform details significantly impacts the ability to assess trading experience quality, resulting in a low score that reflects the lack of available information rather than necessarily poor performance.

Trust and Regulation Analysis

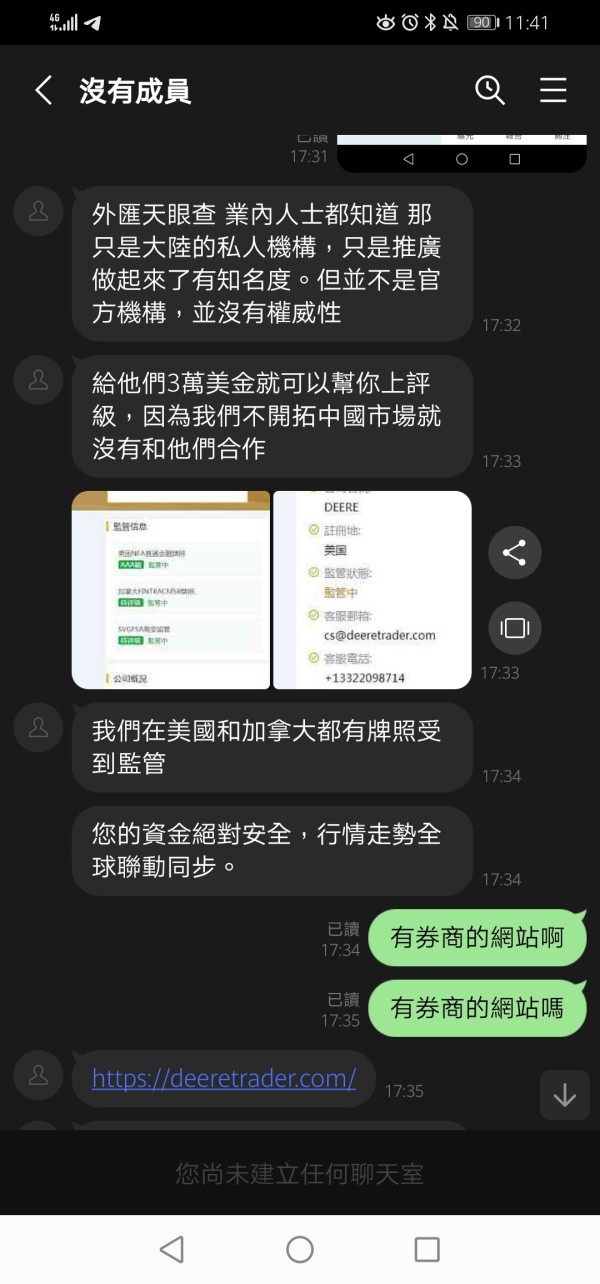

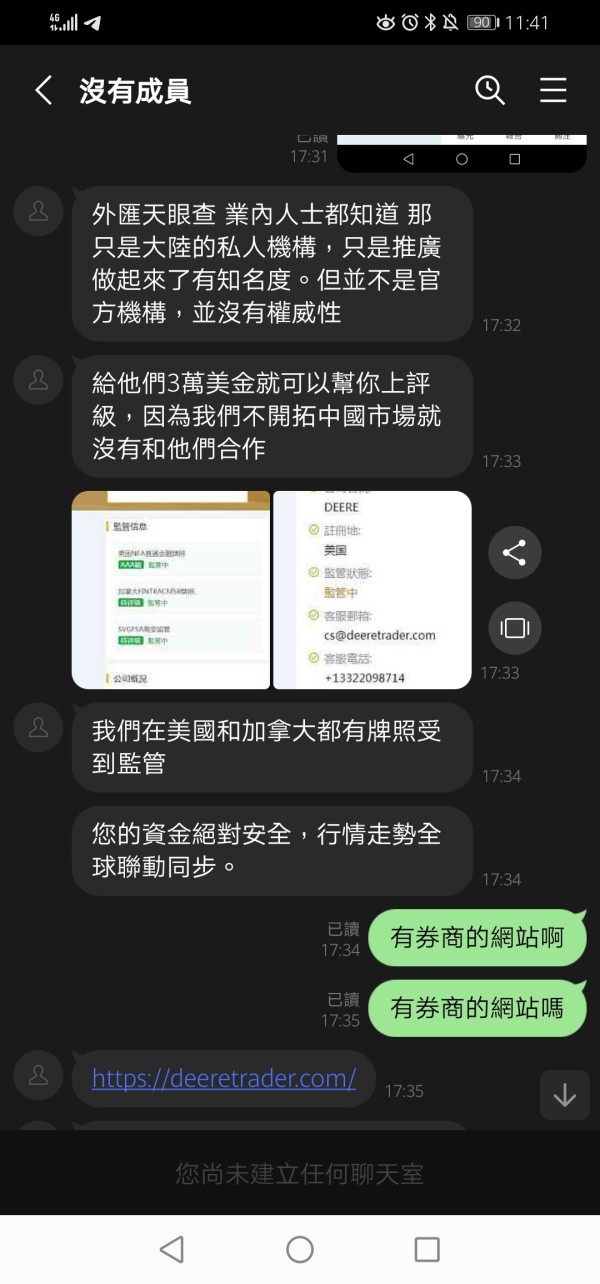

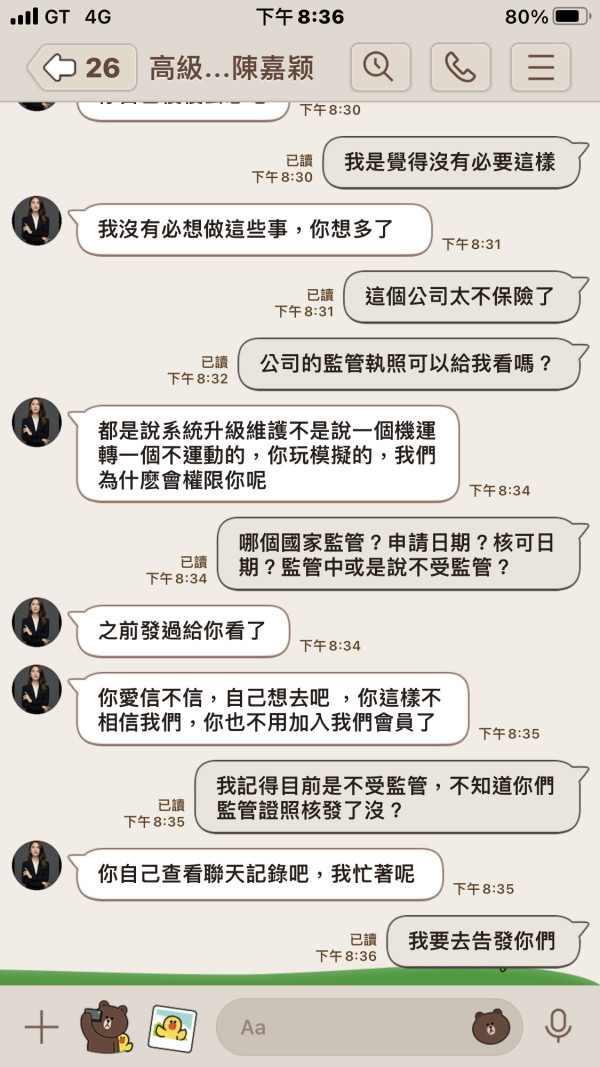

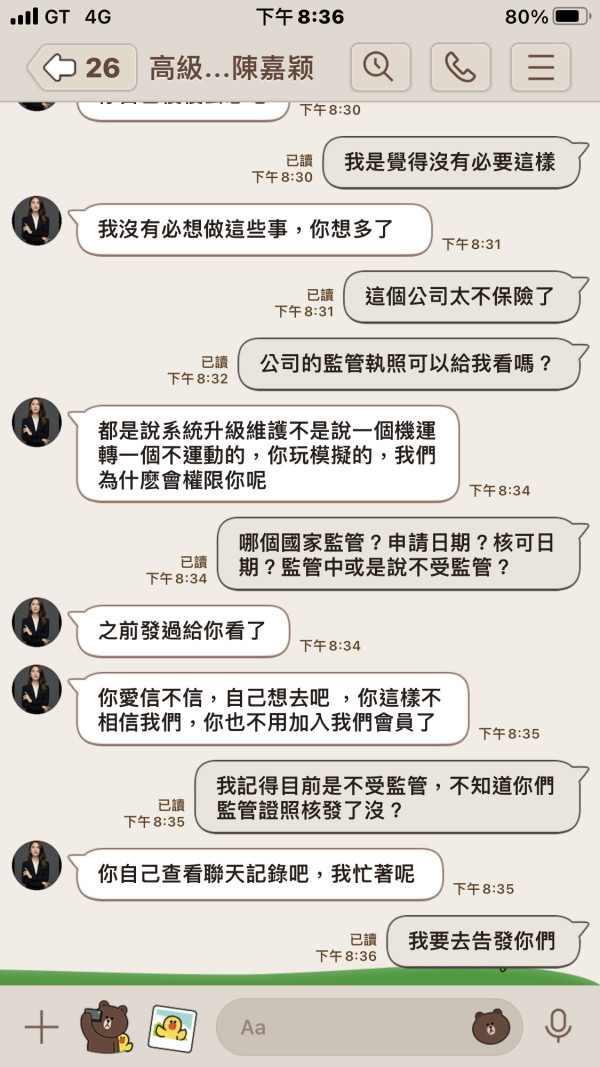

Trust and regulatory assessment presents challenges in this evaluation due to limited specific regulatory information available for Deere & Company's forex trading operations. While Deere & Company operates as a publicly traded corporation, which implies certain regulatory oversight and financial reporting requirements, specific forex broker regulatory licenses or compliance details are not evident in the available materials.

The company's emphasis on trust-based relationships and over four decades of operation suggests stability and reliability in their core business operations. However, critical regulatory elements such as segregated client funds, regulatory protection schemes, or specific financial services authorizations for forex trading are not detailed. The absence of information about regulatory bodies such as CFTC, NFA, or other international forex regulators makes it difficult to assess client protection levels.

Transparency regarding company financial health, regulatory compliance, or third-party auditing is not specifically addressed in available materials. While the company's long operational history and public corporation status provide some level of institutional credibility, the lack of specific forex regulatory information creates uncertainty about client fund protection and regulatory compliance standards. Without clear evidence of appropriate forex broker licensing and regulatory oversight, the trust assessment remains limited. This emphasizes the need for additional regulatory clarity before considering any trading relationship.

User Experience Analysis

User experience assessment for Deere & Company's services reveals mixed indicators based on available information. The company provides secure online account access through shareholder portals, suggesting attention to digital user interface design. Direct deposit functionality and online dividend management options indicate user-friendly financial service features. These relate to shareholder services rather than trading platforms.

The emphasis on personalized financial solutions and dealer relationships suggests a service model designed around individual client needs. This could translate to positive user experience if applied to trading services. However, specific user feedback about trading platform interfaces, account opening procedures, or overall satisfaction with trading services is not available in the current materials.

Critical user experience elements such as platform intuitive design, registration process complexity, verification timeframes, or common user complaints cannot be assessed due to information limitations. The company's focus on making communication easy and providing prompt responses indicates awareness of user experience importance. Without specific trading-related user feedback or platform usability information, the assessment remains incomplete. The score reflects the apparent attention to client service quality while acknowledging the significant information gaps regarding actual trading user experience and satisfaction levels.

Conclusion

This deere review concludes with a neutral assessment primarily due to insufficient information about forex trading services. While Deere & Company demonstrates strong credentials in agricultural equipment financing and shareholder services, the absence of specific forex trading details, regulatory compliance information, and trading platform specifications prevents a comprehensive evaluation as a forex broker.

The company appears most suitable for clients seeking equipment financing solutions and agricultural industry expertise rather than traditional forex trading services. The main advantages include established institutional credibility and long-term client relationship focus. Significant disadvantages include the lack of transparent forex trading information, unclear regulatory status for forex operations, and absence of specific trading conditions. Potential clients should seek additional detailed information about forex trading capabilities before considering this option for currency trading needs.