DBS Vickers 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

DBS Vickers, part of the esteemed DBS Bank, positions itself as a significant brokerage platform across Asia. Leveraging the trust associated with its parent bank, it aims to provide a comprehensive range of financial instruments and access to multiple markets, particularly appealing to retail investors. However, the brokerage also faces serious concerns regarding regulatory compliance, particularly in light of numerous user complaints about withdrawal issues and customer service shortcomings. Investors and traders must carefully navigate these trade-offs, balancing the benefits associated with a reputable banking giant against the risks linked to potential operational and regulatory barriers.

⚠️ Important Risk Advisory & Verification Steps

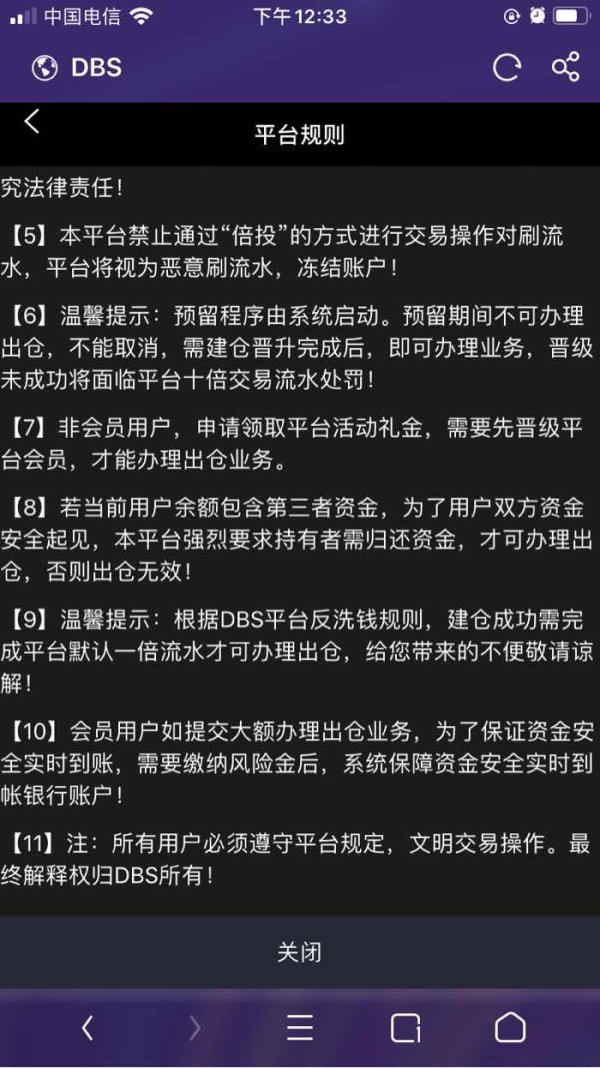

Risk Statement: Potential investors should be aware that there are significant risks associated with trading using DBS Vickers, including but not limited to withdrawal issues, regulatory ambiguity, and mixed customer support experiences.

- Potential Harms:

- Account withdrawal obstacles leading to inability to access funds.

- Regulatory non-compliance risks affecting the safety of investor capital.

- Lack of adequate customer support in resolving trade-related issues.

How to Self-Verify:

- Visit the official websites of the Monetary Authority of Singapore (MAS) and the Securities and Exchange Commission (SEC) for regulatory standing.

- Search for user reviews and complaints on credible financial forums and review sites.

- Contact DBS Vickers customer support directly to obtain current information on operational limitations or compliance queries.

- Check for recent news articles discussing DBS Vickers to gauge its reputation in the market.

Rating Framework

Broker Overview

Company Background and Positioning

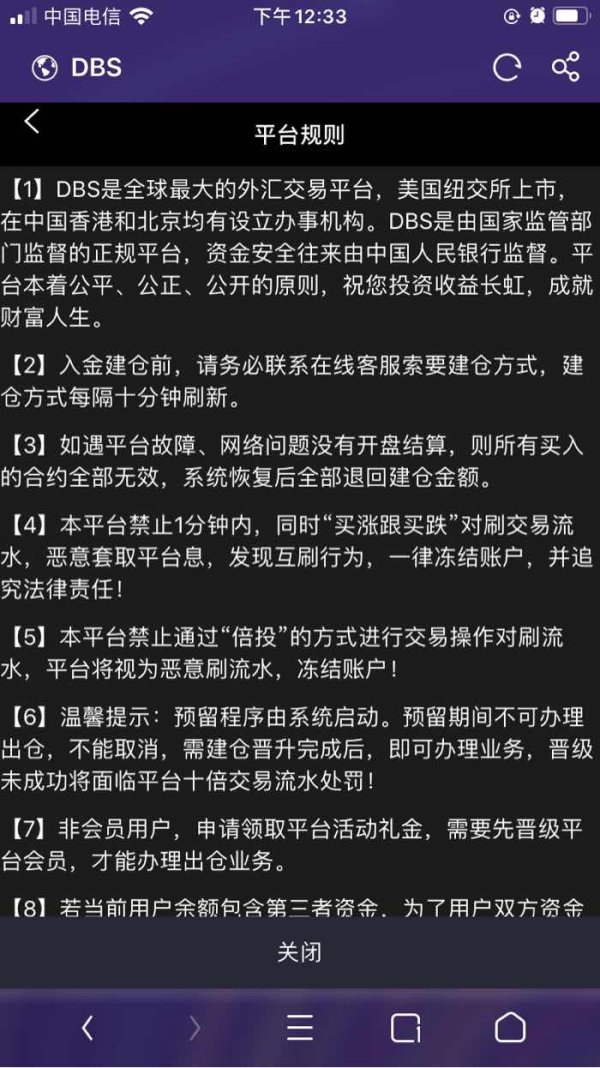

Founded in 1996 and headquartered in Bangkok, Thailand, DBS Vickers operates under the umbrella of DB Group Holdings, the largest financial institution in Singapore. This affiliation bestows significant credibility upon DBS Vickers, allowing it to serve as a reputable brokerage within a competitive Asian market. However, its rapid growth and virtual market positioning have led to concerns regarding regulatory clarity and operational integrity, particularly as it expands across various nations.

Core Business Overview

DBS Vickers caters to diverse trading needs, offering access to a wide range of financial instruments such as stocks, options, contracts for differences, and structured products, facilitating investors ability to engage in futures and equity trading on a multitude of global exchanges, including the U.S., U.K., Hong Kong, and Japan. However, there is a noted lack of clarity regarding its regulatory compliance across these markets, especially affecting user trust.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty.

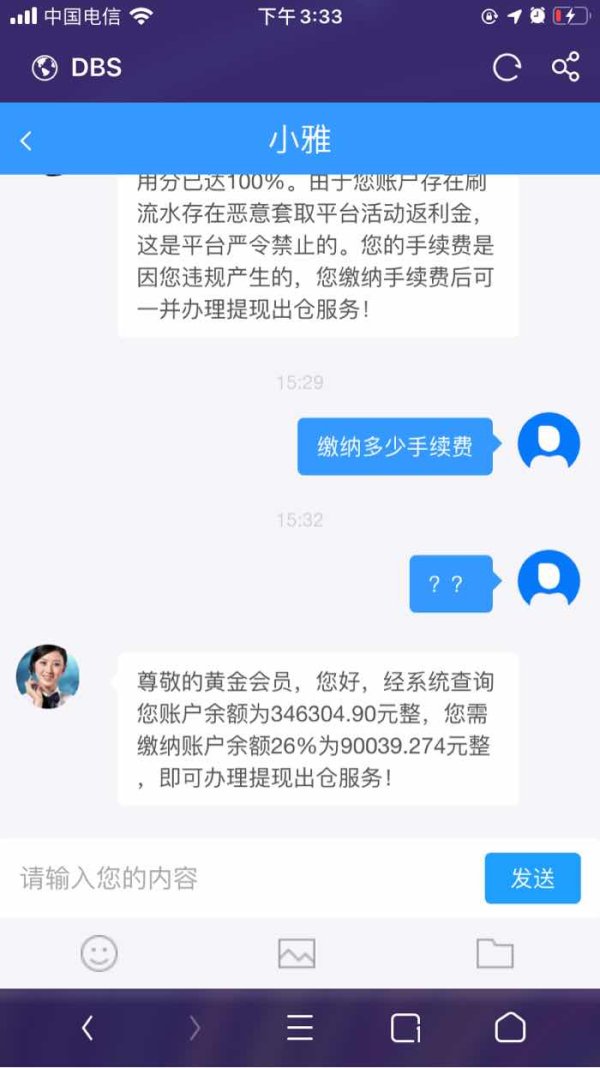

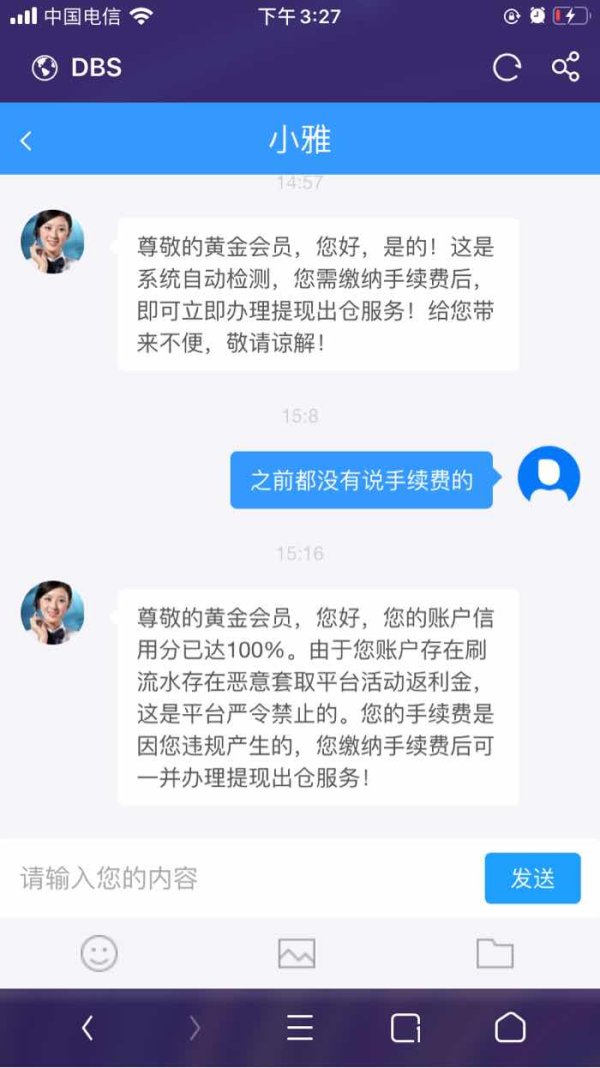

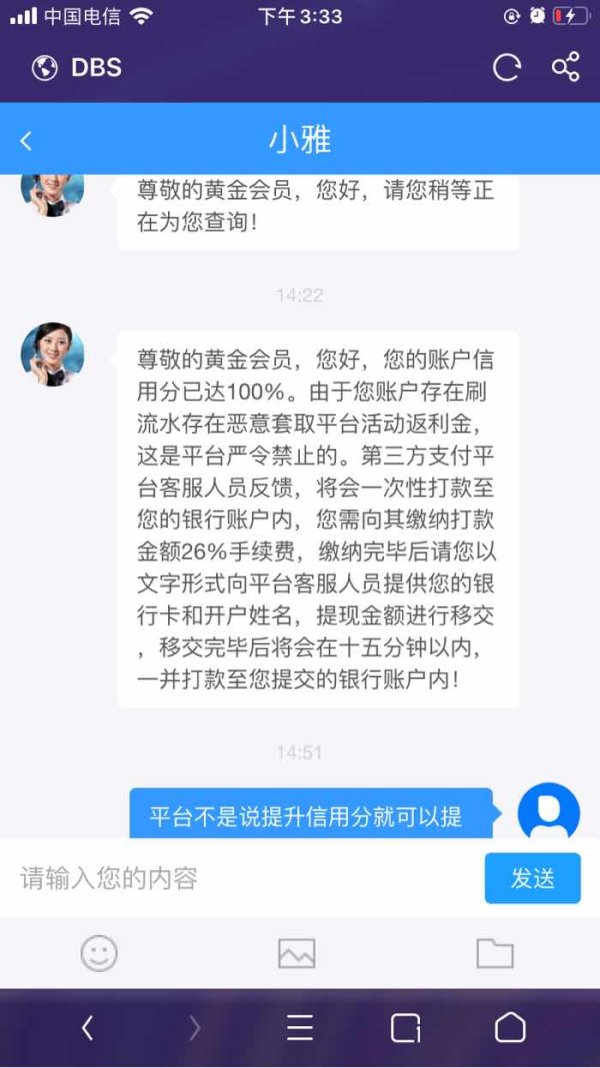

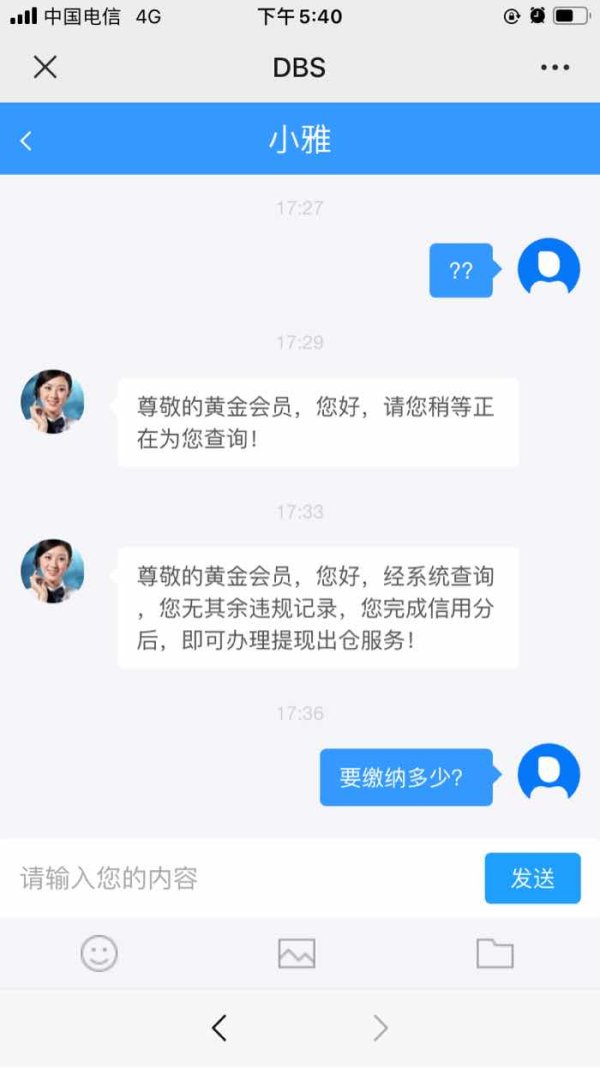

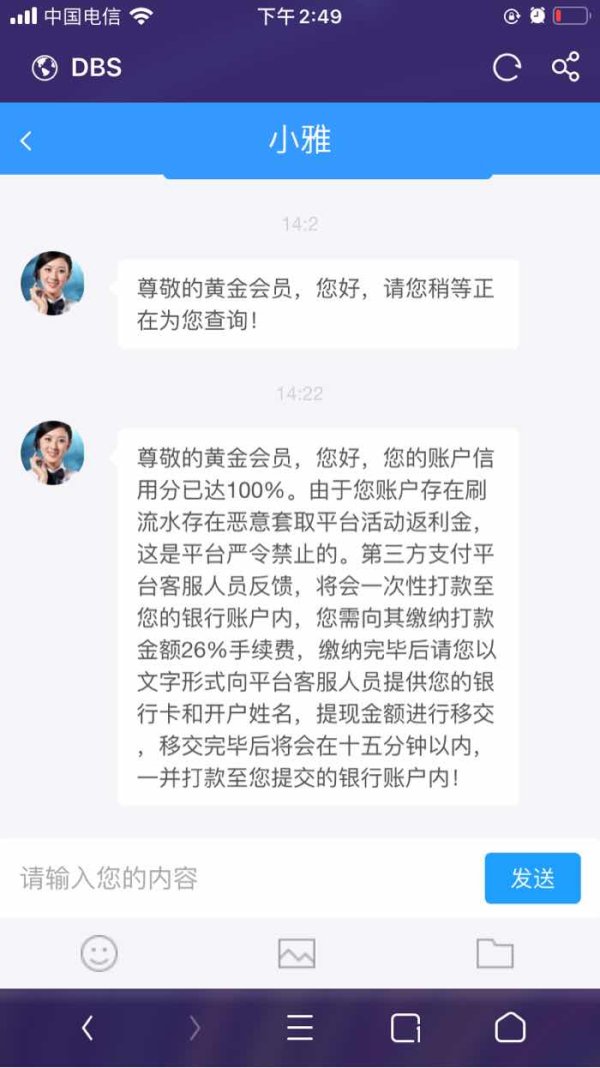

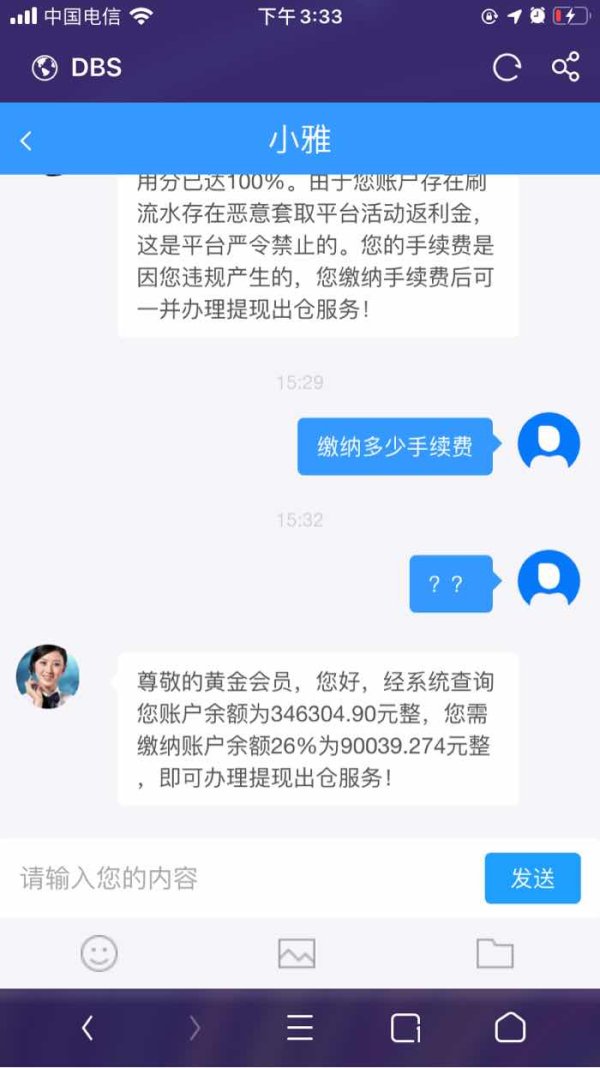

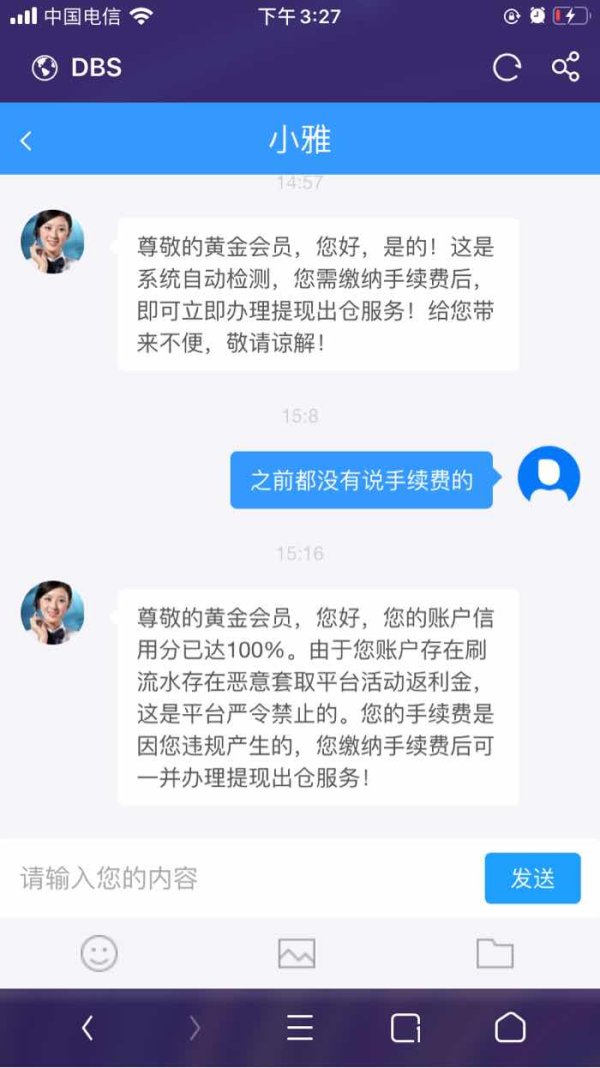

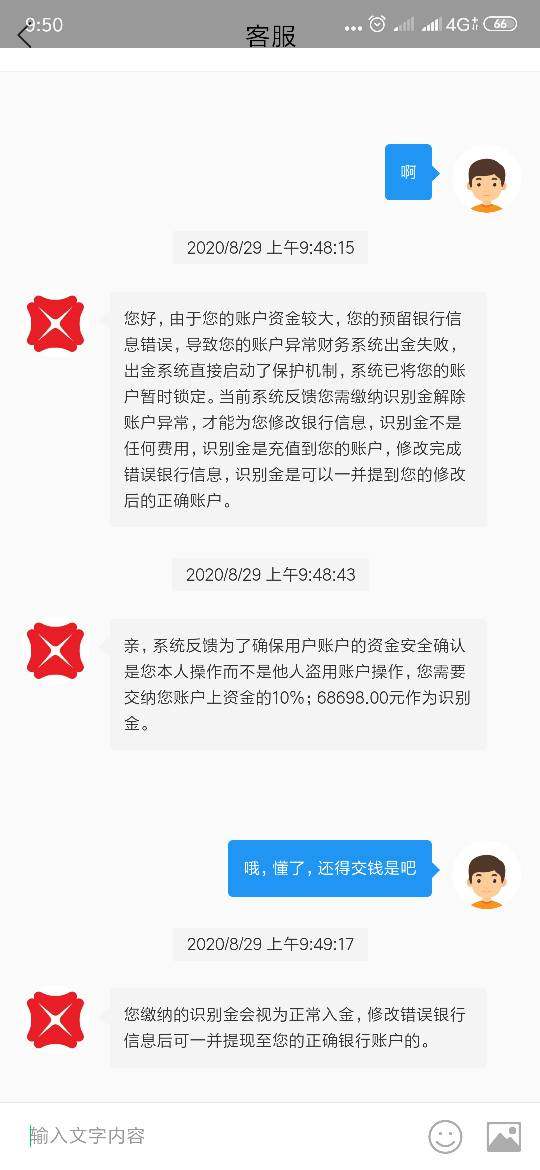

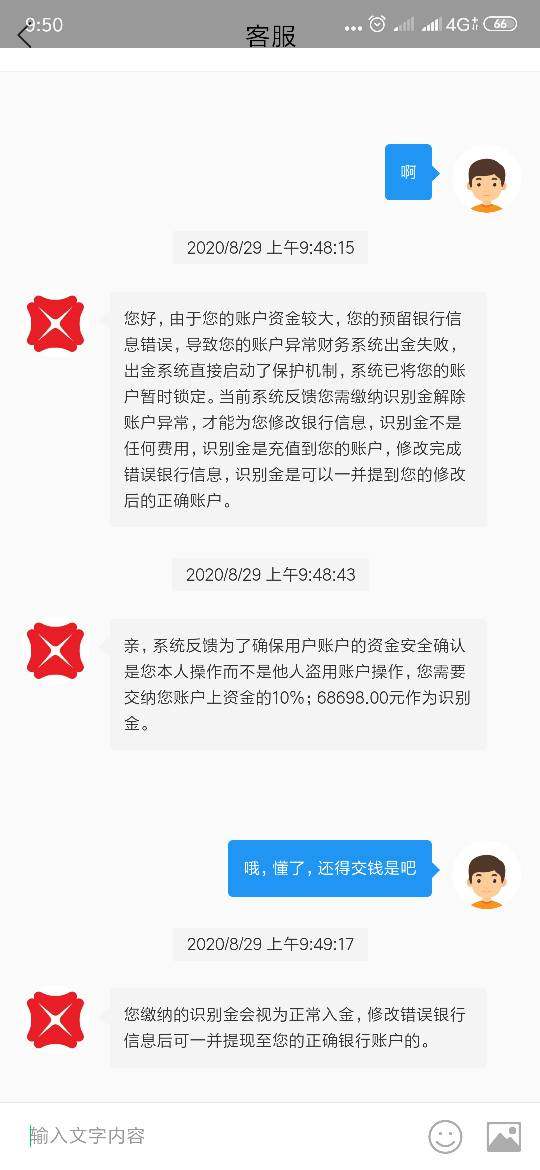

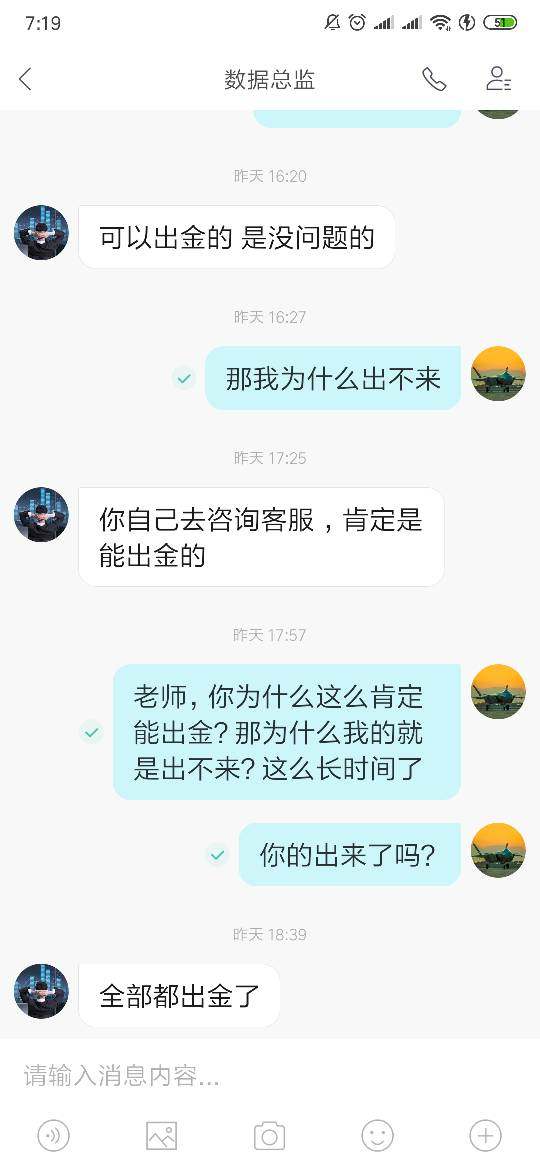

DBS Vickers trustworthiness has been called into question due to contradictory regulatory information and multiple user complaints regarding event withdrawals. Users report significant frustration when attempting to retrieve their funds, leading to questions about regulatory oversight.

Analysis of Regulatory Information Conflicts: DBS Vickers operates with a lack of clear regulatory guidance, which raises concerns about investor safety. Numerous reviews indicate a pattern of unaddressed user complaints surrounding withdrawal issues.

User Self-Verification Guide:

Verify DBS Vickers registration status via the MAS official site.

Look for regulatory disclosures on major financial platforms.

Engage with community forums to gather real-time user experiences.

Directly contact the broker for inquiries regarding their compliance with local regulations.

Industry Reputation and Summary: User sentiment suggests that while DBS Vickers benefits from the parent bank's reputation, operational integrity is disputed.

"I faced difficulties withdrawing my funds, which raised alarming red flags about their legitimacy," noted one frustrated user.

Trading Costs Analysis

The double-edged sword effect.

DBS Vickers positions itself competitively in terms of trading costs, often attracting users with low commission rates. However, this is offset by higher withdrawal charges.

Advantages in Commissions: The commission structure benefits users trading volumes above SGD 100,000, reducing the online commission rate to 0.18%.

The "Traps" of Non-Trading Fees: User complaints have surfaced regarding significant withdrawal fees of S$50 per counter, leading some to feel trapped by unforeseen costs despite attractive trading commissions.

"I was hit with a S$50 withdrawal fee, which I didnt expect after trading for so long," expressed another user.

- Cost Structure Summary: Overall, while trading costs may seem appealing, non-trading fees can significantly erode the profitability of trading with DBS Vickers.

Professional depth vs. beginner-friendliness.

DBS Vickers boasts platform diversity, supporting both web and mobile access, catering to different trading preferences.

Platform Diversity: The brokerage offers multiple platforms including the DBS Vickers online platform and mobile app, which provide varied trading functionalities across key global markets.

Quality of Tools and Resources: While the trading tools offered are sufficient for basic users, advanced traders have noted the need for more comprehensive resources.

Platform Experience Summary: User feedback generally suggests that the interface may feel outdated and complicate the trading process.

"The app could use a refresh—it feels clunky," stated one frequent user.

User Experience Analysis

Navigating the platform can be cumbersome.

Navigating the DBS Vickers platform has drawn critical user feedback primarily focused on ease of use and overall interface design.

User Interface Issues: Frequent reports highlight an outdated interface that does not meet contemporary design standards, leading to potential frustrations for new users.

Navigation Challenges: Users express frustration with the usability of both the web and mobile platforms, which could deter potential investors who seek an intuitive experience.

Feedback on User Experience: Overall ratings suggest a need for a significant overhaul of interface design to improve accessibility and user satisfaction.

Customer Support Analysis

Mixed reviews signal room for improvement.

Despite providing various customer support channels including phone and email, user experiences indicate that responsiveness is lacking.

Service Availability & Responsiveness: Customers have reported long wait times when seeking help, which can be detrimental during critical trading moments.

Quality of Support: Users have expressed dissatisfaction with the assistance received, often stating that representatives lacked substantial solutions to problems.

Support Summary: While the support framework is established, active user sentiment suggests a need for improvements in service responsiveness and quality.

Account Conditions Analysis

User-friendly conditions with caveats.

DBS Vickers offers flexible account conditions with no minimum deposits, appealing to new investors and traders.

Account Opening Process: The process to open an account is generally straightforward and allows a diverse range of investors to engage without significant initial investment.

Withdrawal Conditions: Users report that while account opening conditions are lenient, high fees on withdrawals can detract from overall investor experience.

Overall Conditions Summary: The conditions for basic account management are sound, but users must be wary of associated fees, particularly concerning withdrawals.

Conclusion

DBS Vickers stands at a crossroads, marrying the reputable legacy of DBS Bank with a modern brokerage platform offering diverse investment opportunities. However, potential investors must tread carefully, weighing the competitive trading cost structure against the risks posed by regulatory uncertainties and user complaints. Given the mixed reviews surrounding customer support and operational pitfalls, thorough research and self-verification are essential before committing funds to this platform. Investors who value stability and ongoing operational clarity may find alternative brokers more suited to their needs. As always, prudent investors should remain vigilant and conduct extensive due diligence to navigate these complexities effectively.