Ajman Bank 2025 Review: Everything You Need to Know

Executive Summary

This Ajman Bank review presents a detailed analysis of the UAE-based Islamic financial institution. The bank has positioned itself as a major player in the Shariah-compliant banking sector. Ajman Bank PJSC operates as a fully Islamic bank listed on the Abu Dhabi Securities Exchange. It offers a range of financial services that follow Islamic principles. The bank has shown notable growth in recent years through its expansion in SME financing and commitment to digital transformation.

Key highlights include the bank's specialized focus on providing halal investment options. The institution also offers a comprehensive Sukuk trading platform that provides access to Shariah-compliant securities from various global markets. The Wakala-based Sukuk platform allows investors to select from diverse industry sectors, regions, and maturities. This potentially maximizes returns beyond traditional deposit products. Ajman Bank primarily targets Shariah-conscious investors seeking ethical investment alternatives in the financial sector. The bank also serves small and medium enterprises requiring Islamic financing solutions. The bank's strategic positioning in the UAE's growing Islamic finance market makes it particularly appealing to investors who prioritize religious compliance in their financial dealings.

Important Notice

This evaluation is based on publicly available information, regulatory filings, and market analysis as of 2025. Readers should note that financial institutions may have different service offerings and terms across various jurisdictions. The assessment methodology used in this review incorporates multiple data sources, including official company communications, market performance data, and industry reports. Potential investors should conduct their own due diligence and consult with qualified financial advisors before making investment decisions. Regulatory compliance and service availability may vary depending on your location and investor status.

Rating Framework

Broker Overview

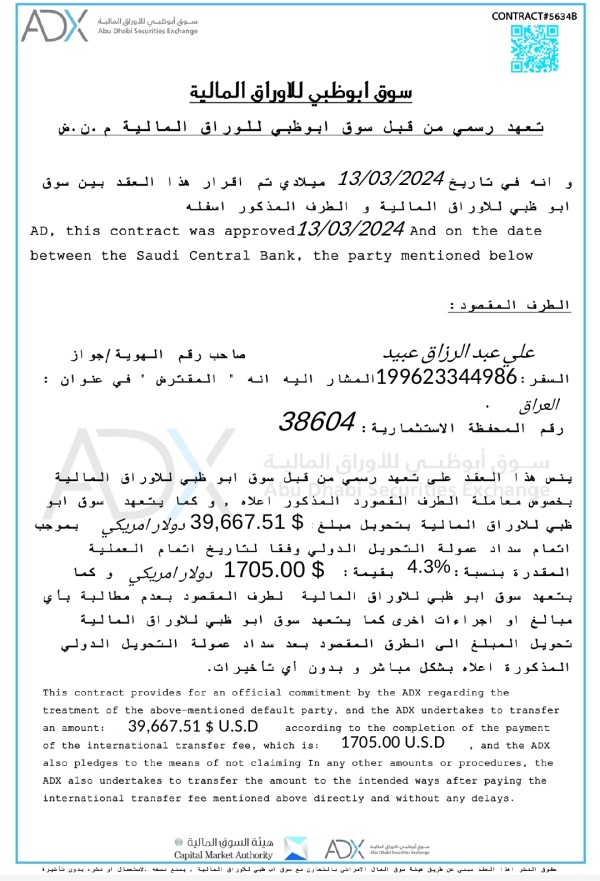

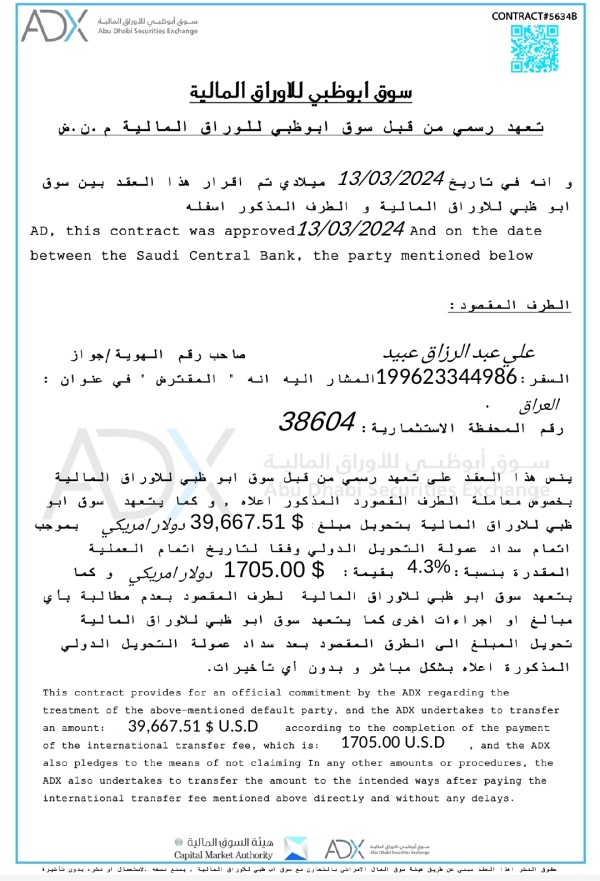

Ajman Bank Public Joint Stock Company represents a prominent Islamic financial institution operating within the United Arab Emirates' dynamic banking sector. The bank has established itself as a comprehensive provider of Shariah-compliant financial services. It caters to both individual consumers and wholesale banking clients. As a publicly listed entity on the Abu Dhabi Securities Exchange, Ajman Bank maintains transparency standards required for public companies while following Islamic banking principles. The institution's business model centers on providing ethical financial solutions that align with Islamic law. These include consumer banking, wholesale banking, and specialized investment products. The bank's strategic focus on small and medium enterprise financing has positioned it as a key facilitator of economic growth within the UAE's business ecosystem.

The bank's operational framework encompasses multiple service verticals. These include consumer banking services for individual clients and comprehensive wholesale banking solutions for corporate entities. According to available information, Ajman Bank offers specialized Sukuk trading services through its Shariah-compliant Wakala-based platform. This provides investors access to Islamic securities from various global markets. This platform enables clients to diversify their investments across different industry sectors, geographical regions, and maturity periods while maintaining compliance with Islamic financial principles. The institution's commitment to digital transformation reflects its adaptation to evolving customer expectations and technological advancement in the financial services sector.

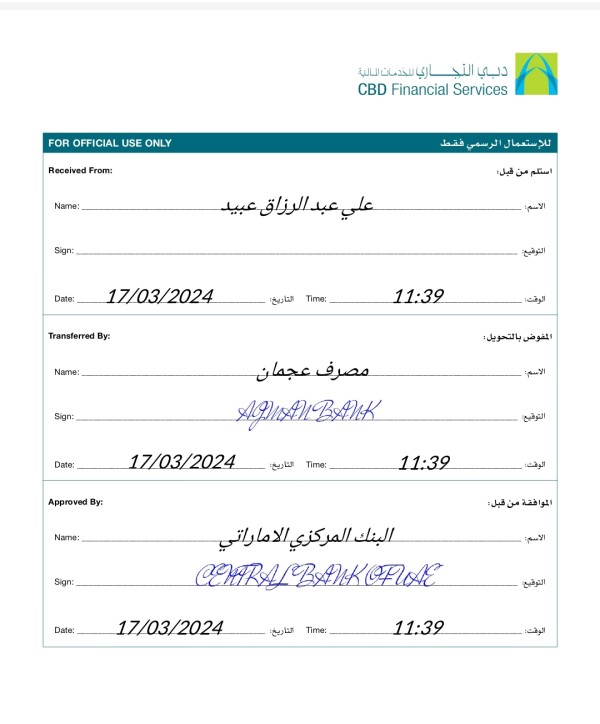

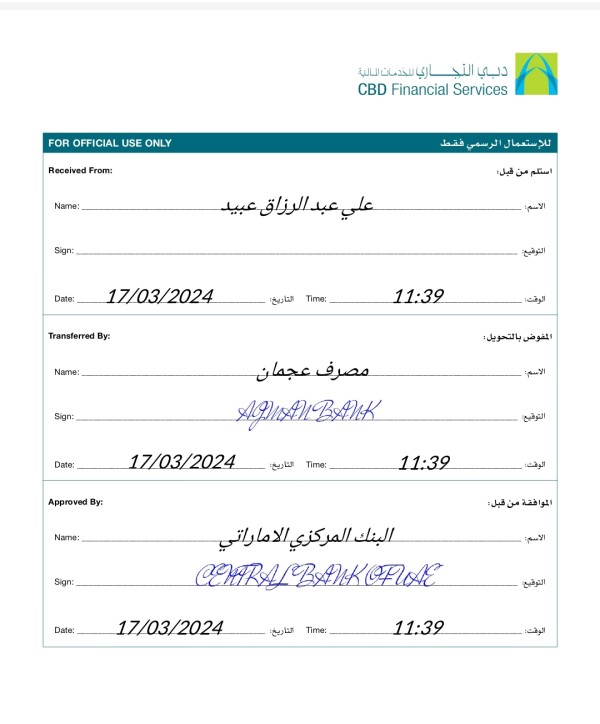

Regulatory Status: As an ADX-listed Islamic bank, Ajman Bank operates under the regulatory oversight of UAE financial authorities. This ensures compliance with both conventional banking regulations and Islamic finance standards. The bank's public listing status provides additional transparency and accountability measures.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available materials. However, as a full-service Islamic bank, standard banking transfer methods are expected to be available in compliance with Shariah principles.

Minimum Deposit Requirements: Detailed minimum deposit requirements for various account types are not specified in publicly available information. Potential clients should contact the bank directly for specific account opening requirements.

Promotional Offers: Current promotional offers and incentive programs are not detailed in available public information. The bank may offer competitive terms on Sukuk investments and other Islamic financial products.

Tradeable Assets: The bank's Sukuk trading platform provides access to a diverse range of Islamic securities across multiple industry sectors, regions, and maturity periods. This Ajman Bank review notes the institution's focus on Shariah-compliant investment vehicles that offer alternatives to traditional interest-based products.

Cost Structure: Specific fee structures and pricing details for various services are not comprehensively detailed in available public materials. As an Islamic bank, fee structures would comply with Shariah principles, avoiding interest-based charges.

Leverage Options: Information regarding leverage options is not specified in available materials. Islamic banking principles may limit certain leveraged products depending on their compliance with Shariah law.

Platform Options: The bank offers digital banking services and a specialized Sukuk trading platform. This indicates technological investment in customer service delivery.

Regional Restrictions: As a UAE-based institution, services may be primarily focused on the regional market. However, specific geographical restrictions are not detailed in available information.

Customer Service Languages: Customer service is available through the dedicated hotline +971600555522. However, specific language support details are not comprehensively outlined.

Account Conditions Analysis

The account conditions offered by Ajman Bank reflect the institution's commitment to Islamic banking principles while serving diverse customer segments. As a full-service Islamic bank, the institution likely provides various account types designed to meet different customer needs. These range from basic consumer banking to sophisticated wholesale banking solutions. The bank's focus on SME financing suggests specialized business account offerings that cater to small and medium enterprises seeking Shariah-compliant banking services. However, specific details regarding minimum balance requirements, account maintenance fees, and eligibility criteria are not comprehensively detailed in publicly available materials.

The account opening process for Ajman Bank would typically involve standard KYC procedures required by UAE banking regulations. These are combined with any additional requirements specific to Islamic banking compliance. The bank's digital transformation initiatives suggest efforts to streamline account opening and management processes. This potentially offers online application capabilities and digital account management tools. This Ajman Bank review notes that prospective customers should directly contact the institution for detailed information regarding specific account terms, conditions, and requirements. These may vary based on account type and customer profile.

Ajman Bank's technological infrastructure centers around its Sukuk trading platform. This represents a significant resource for investors seeking Shariah-compliant investment opportunities. The Wakala-based platform provides access to Islamic securities from various global markets. It allows investors to diversify across different industry sectors, geographical regions, and maturity periods. This specialized platform demonstrates the bank's commitment to providing sophisticated investment tools while maintaining Islamic finance compliance. The platform's ability to offer securities from multiple regions indicates robust technological capabilities and international market access.

The bank's emphasis on digital transformation suggests ongoing investment in technological resources and customer-facing tools. While specific details about research resources, analytical tools, and educational materials are not comprehensively outlined in available information, the institution's focus on digital advancement indicates potential development in these areas. The availability of online banking services and digital platforms would be expected from a modern Islamic bank operating in the competitive UAE market. However, detailed information about specific trading tools, research capabilities, and educational resources would require direct inquiry with the institution.

Customer Service and Support Analysis

Customer service at Ajman Bank is accessible through multiple channels. The primary contact number +971600555522 provides direct access to customer support representatives. As a full-service bank operating in the diverse UAE market, the institution would be expected to provide multilingual support capabilities to serve its varied customer base effectively. The bank's commitment to both consumer and wholesale banking suggests differentiated support services tailored to different customer segments. These range from individual account holders to complex corporate clients.

The quality and responsiveness of customer service would be critical factors for clients engaged in Sukuk trading and other investment activities. Timely support and accurate information are essential in these areas. The bank's digital transformation initiatives suggest potential development of online customer service capabilities. These include digital chat support and comprehensive FAQ resources. However, specific information regarding service hours, response times, and the range of issues handled through different support channels is not detailed in available materials. The effectiveness of customer service in handling Islamic banking-specific inquiries and Sukuk trading support would be particularly relevant for the bank's target market of Shariah-conscious investors.

Trading Experience Analysis

The trading experience at Ajman Bank centers primarily around its Sukuk trading platform. This offers a specialized environment for Islamic securities investment. The Wakala-based platform provides investors with access to a diverse range of Sukuk instruments across various industry sectors, geographical regions, and maturity periods. This specialization in Islamic securities represents a focused approach to serving Shariah-conscious investors who require compliant investment alternatives to conventional bond markets. The platform's ability to offer global Sukuk access suggests robust technological infrastructure and international market connectivity.

The user interface and functionality of the Sukuk trading platform would be critical factors in determining overall trading experience quality. While specific details about platform performance, execution speed, and user interface design are not comprehensively available, the bank's digital transformation focus suggests ongoing improvements in these areas. The platform's capacity to handle diverse Sukuk instruments from multiple markets indicates sophisticated backend systems capable of managing complex Islamic financial products. This Ajman Bank review emphasizes that the specialized nature of Sukuk trading requires particular attention to Shariah compliance verification and transparent pricing mechanisms. These would be essential components of the trading experience.

Trust Factor Analysis

Ajman Bank's trust credentials are anchored by its status as a publicly listed company on the Abu Dhabi Securities Exchange. This provides transparency and regulatory oversight that enhances institutional credibility. The ADX listing requires compliance with stringent disclosure requirements and corporate governance standards. This offers investors additional assurance regarding the bank's operational transparency. As a UAE-based Islamic bank, the institution operates under the regulatory framework established by UAE financial authorities. This ensures adherence to both conventional banking regulations and Islamic finance standards.

The bank's full commitment to Islamic banking principles provides an additional trust dimension for Shariah-conscious investors who prioritize religious compliance in their financial dealings. The institution's focus on SME financing and its established presence in the UAE market demonstrate operational stability and market acceptance. However, specific information regarding deposit insurance coverage, segregation of client funds, and detailed risk management procedures is not comprehensively outlined in available materials. The bank's regulatory compliance and public listing status provide foundational trust elements. However, detailed assessment of specific security measures and client protection protocols would require additional investigation.

User Experience Analysis

The user experience at Ajman Bank reflects the institution's ongoing digital transformation efforts. These aim to modernize service delivery while maintaining Islamic banking compliance. The availability of digital banking services suggests investment in user-friendly interfaces and streamlined customer interactions. The bank's Sukuk trading platform represents a specialized user experience designed for investors seeking Shariah-compliant securities. This requires intuitive navigation and clear presentation of complex Islamic financial products.

The registration and account opening process would typically involve standard banking procedures enhanced by Islamic banking compliance requirements. The bank's focus on serving both consumer and wholesale segments suggests differentiated user experiences tailored to varying levels of financial sophistication and service requirements. While specific details about mobile banking applications, online platform functionality, and user interface design are not comprehensively available, the institution's digital transformation initiatives indicate ongoing improvements in user experience delivery. The effectiveness of these digital services in serving the bank's target market of Shariah-conscious investors and SME clients would be crucial factors in overall user satisfaction.

Conclusion

This Ajman Bank review reveals an Islamic financial institution with specialized strengths in Shariah-compliant banking and investment services. The bank particularly excels through its Sukuk trading platform. The bank's ADX listing and regulatory compliance provide foundational credibility, while its focus on SME financing and digital transformation demonstrates strategic market positioning. The institution appears well-suited for Shariah-conscious investors seeking halal investment alternatives and small to medium enterprises requiring Islamic financing solutions.

However, the limited availability of detailed information regarding specific account conditions, fee structures, and service terms represents a significant consideration for potential clients. While the bank's specialized Sukuk platform and Islamic compliance offer clear advantages for targeted market segments, prospective customers should conduct thorough due diligence and direct consultation with the institution to fully understand available services and terms.