Manulife 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Manulife Financial Corporation has established itself as a major player in the financial services sector in Canada, offering a wide array of insurance and investment products to a diverse clientele. With roots dating back to 1887, it operates from its headquarters in Toronto, Ontario, and manages nearly $1 trillion in assets for over 20 million customers worldwide. The companys strengths lie in its comprehensive range of financial offerings and its reputation for financial stability, underscored by robust regulatory oversight.

However, potential clients should remain cautious due to growing concerns over customer service quality and withdrawal difficulties, reflected in numerous negative reviews. Reports of inefficiencies in claims processing and a lack of clear communication contribute to a mixed reputation that can overshadow the company's otherwise impressive portfolio of services. In a marketplace increasingly characterized by competitive alternatives, prospective clients are advised to carefully weigh the benefits against the risk of encountering service-related challenges.

⚠️ Important Risk Advisory & Verification Steps

When considering an engagement with Manulife, it's critical to be aware of potential service issues. Maintaining a prudent approach can help mitigate exposure to these risks.

Risk Statement: Recent feedback indicates numerous complaints regarding withdrawal challenges and overall customer service responsiveness. Clients have reported delays and difficulties in obtaining timely information, leading to frustration.

Potential Harms: Clients may face obstacles when attempting to withdraw funds or access timely service support, leading to delays in critical insurance claims or investment returns.

How to Self-Verify:

- Research Reviews: Investigate testimonials on platforms like social media, insurance chat forums, and third-party review sites.

- Consult with Peers: Engage with current or former clients to gather anecdotal experiences regarding customer service.

- Contact Customer Service: Perform a "test" inquiry with customer service to evaluate response times and the clarity of the information provided.

- Review Regulatory Standing: Check for any recent regulatory findings or advisories concerning Manulife's business practices.

Rating Framework

Company Background and Positioning

Manulife Financial Corporation, founded in 1887, has evolved into one of the largest financial service companies in Canada and a prominent global player. With headquarters in Toronto, Ontario, this formidable institution has secured its status as a trusted provider of insurance and investment products. The companys reputation is bolstered by its extensive presence in the financial services landscape, presenting a wide spectrum of products tailored for both personal and commercial clients.

Historically significant, Manulife operates under strict regulatory supervision, providing users with a sense of security regarding their financial investments. Despite this, it grapples with challenges related to customer service quality, casting a shadow over its otherwise impressive credentials and market positioning.

Core Business Overview

Manulifes primary offerings encompass a comprehensive suite of financial products, including life insurance, health insurance, investment management, retirement planning, and group benefit plans. It adheres to regulatory frameworks set forth by the Office of the Superintendent of Financial Institutions (OSFI) in Canada and the Canadian Investment Regulatory Organization (CIRO), ensuring that its operations align with industry standards and regulations.

The company markets a variety of insurance products, including term life, whole life, and critical illness insurance. Alongside these traditional offerings, Manulife has strengthened its portfolio through the provision of investment products and accounts, appealing to a broad range of client needs—from individuals seeking personal growth to businesses looking for sophisticated financial planning solutions.

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The trustworthiness of Manulife as a financial service provider is backed by its longstanding history and regulatory oversight; however, there are noted conflicts in regulatory information related to client complaint resolutions. These inconsistencies pose a significant risk for potential users, as they highlight areas in which clients have raised valid grievances without adequate institutional response.

User Self-Verification Guide

To ensure regulatory compliance and verify the trustworthiness of Manulife:

- Review Disclosures: Check platforms like the OSFI or CIRO for recent regulatory findings or any advisories.

- Analyze Company Policies: Investigate how Manulife addresses complaints and whether the processes comply with industry standards.

- Continuous Monitoring: Stay updated on news and reports involving Manulife and its regulatory decisions.

- Seek External Insight: Reach out to independent financial service analysts for an unbiased perspective on Manulife's standing.

Industry Reputation and Summary

Despite its historical stature, user feedback indicates a notable concern regarding the safety of funds held with Manulife. As noted in various reviews, clients feel compelled to corroborate safety through independent verification, emphasizing the need for due diligence when entrusting funds to larger financial entities.

Trading Costs Analysis

Advantages in Commissions

Manulife boasts a competitive commission structure amid streams of complex financial products and services. The accessibility of high-quality financial solutions combined with reasonable commission rates usually attracts clients seeking to maximize their investment.

The "Traps" of Non-Trading Fees

Despite competitive commission offerings, its essential to be vigilant regarding non-trading fees:

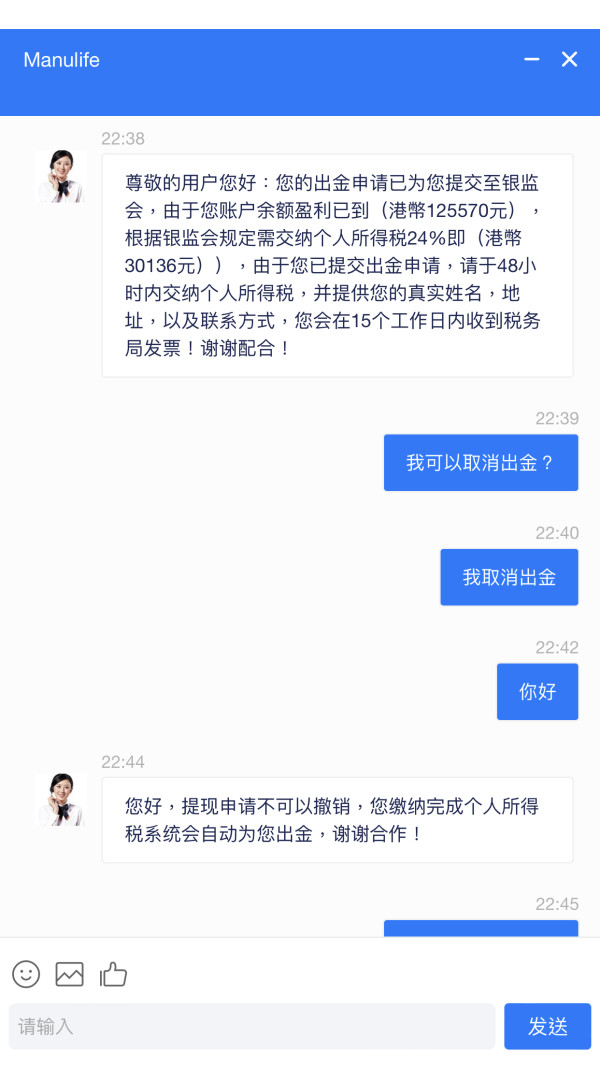

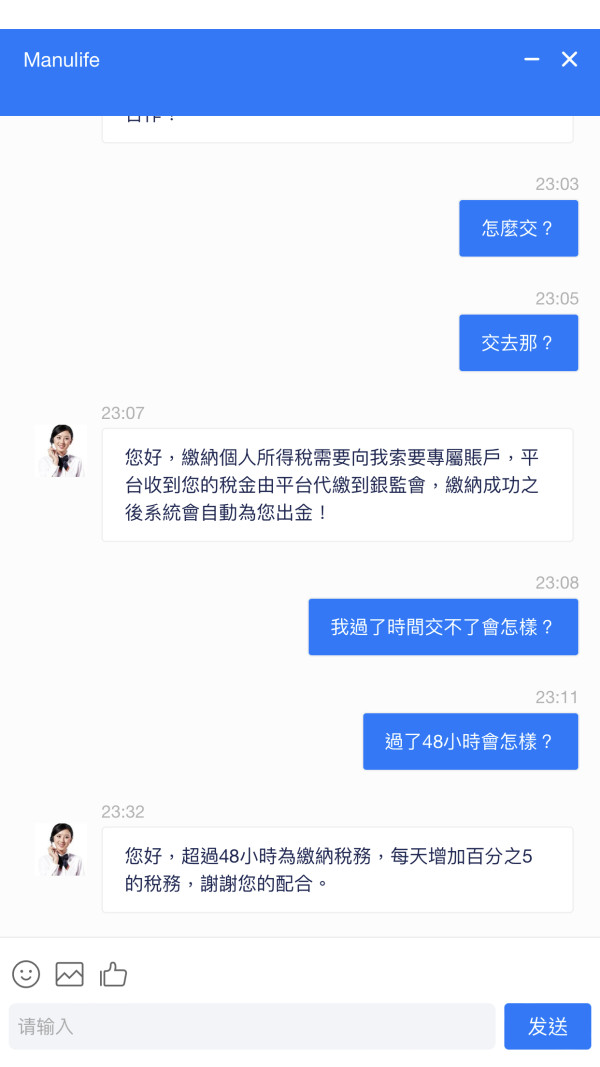

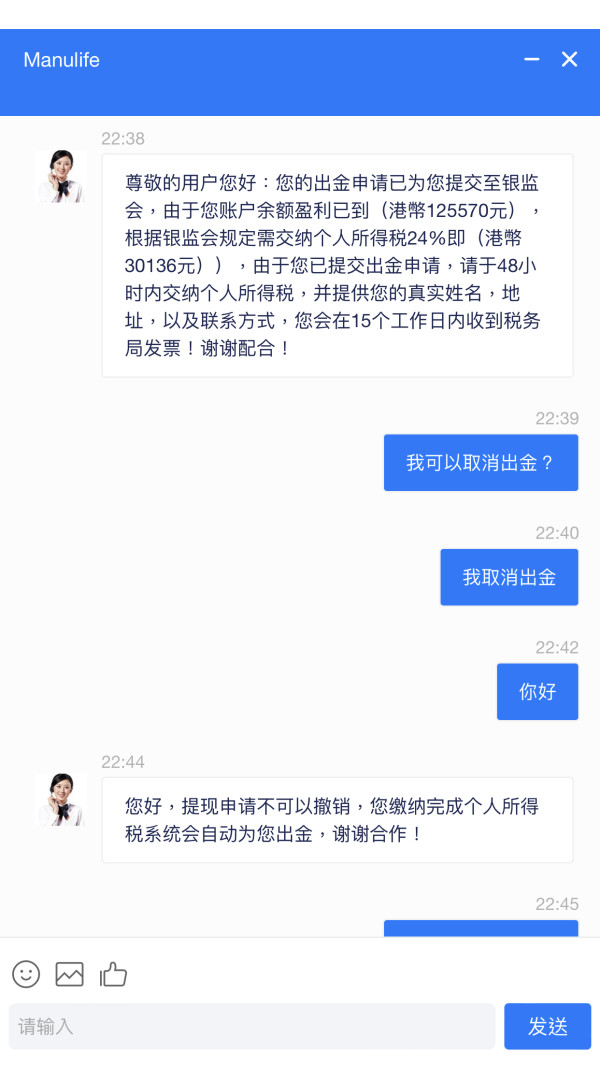

"They required taxes before withdrawal. Beware of this scam."

— User complaint highlighting a $30 hidden fee during withdrawal

Such fees, often hidden or poorly communicated, can significantly impact the overall cost to clients, leading to a potentially lower return on investments than clients anticipate.

Cost Structure Summary

In summary, while Manulife offers benefits through its commission structure, clients must carefully navigate hidden fees and should account for potential non-transparent costs associated with fund withdrawal and access to services.

Manulife provides clients access to a variety of platforms, although it notably lacks support for some popular trading tools like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). This limitation may dissuade a segment of potential clients who prefer these platforms for their trading activities.

The tools available for trading are adequate, offering clients the basic functionality needed, but competitive firms may provide more advanced resources that could enhance trading capabilities.

User feedback regarding usability has been mixed. Many users express frustration over the lack of intuitive interface design and functionality:

“Their app rating is poor; worse than 0% of brokerage firms.”

— User feedback illustrating poor experiences with the platform

This suggests a critical need for Manulife to invest in enhancing its technological platforms to secure a competitive edge.

User Experience Analysis

User experience ratings reflect significant discontent among clients regarding service interactions. Complaints frequently include extended wait times and a lack of meaningful resolutions, emphasizing the need for improvements in support services.

Customer Support Analysis

The customer support domain has consistently received subpar feedback. Clients report excessive wait times and poor resolution rates during customer interactions. Due to these challenges, many recommend seeking alternative providers where customer service is prioritized, underscoring the overarching risk associated with Manulife's perceived service issues.

Account Conditions Analysis

Manulife offers various account types catering to diverse investor needs. However, some clients have expressed dissatisfaction regarding clarity in fees, which can result in unexpected costs impacting their overall experience. A clearer articulation of account conditions, including fee structures, could improve user satisfaction.

Conclusion

In summary, Manulife Financial Corporation represents both opportunity and potential pitfalls for prospective clients. Its rich legacy and administrative heft provide an attractive selection of financial products, yet user experiences indicate a salient need for enhanced customer service and transparency to maintain its competitive standing.

Clients who weigh entry into this prominent financial institution should proceed cautiously, conducting due diligence and self-verification to ascertain the alignment of services with their specific financial needs. Ultimately, examining both the strengths and weaknesses will arm potential clients with the information necessary to make informed decisions about engaging with Manulife Financial Corporation.