Asia Capitals Review 1

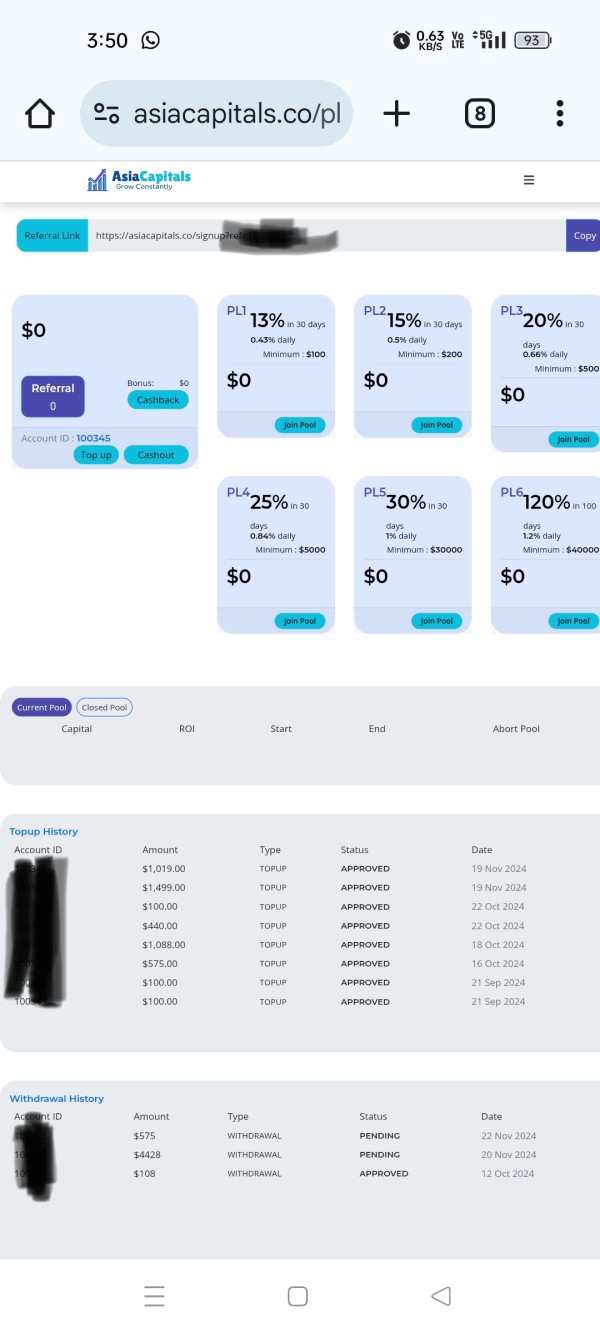

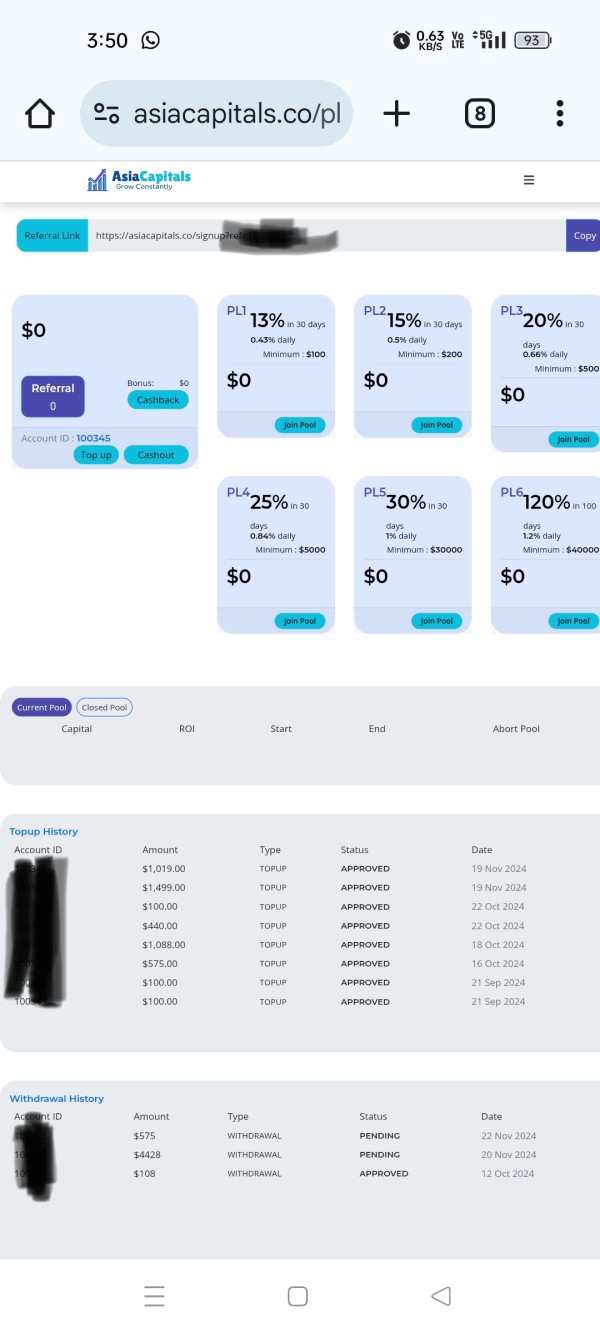

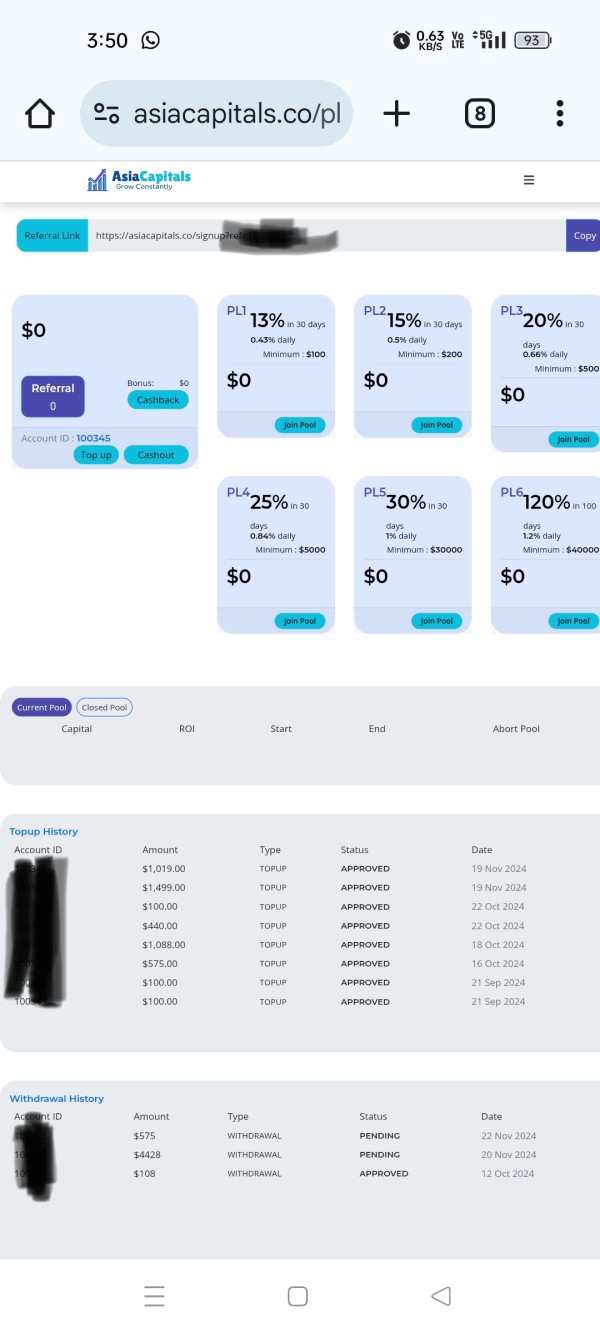

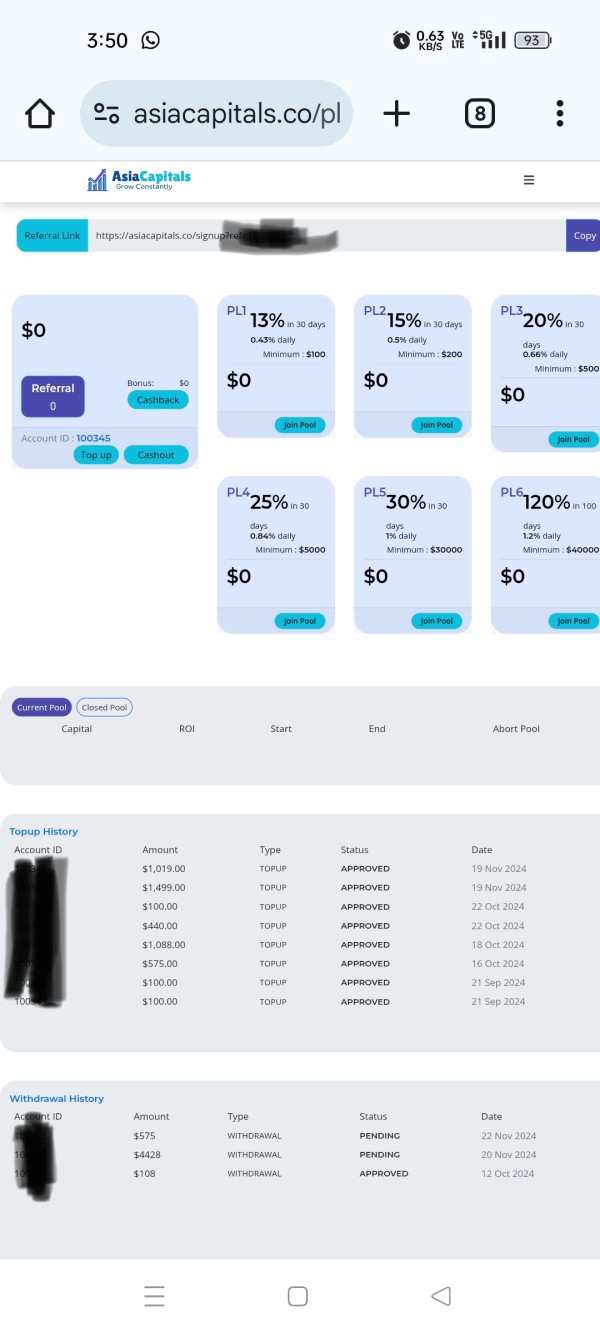

Dont invest this website is totally scam not withdraw money

Asia Capitals Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Dont invest this website is totally scam not withdraw money

Asia Capitals presents itself as a low-cost forex broker promising attractive trading opportunities, primarily targeting experienced traders who are well-versed in managing high-risk investments. However, the absence of valid regulation poses significant concerns regarding fund security and withdrawal processes, creating a precarious trading environment for its users. Traders who are comfortable navigating unregulated markets may find value in the cost savings, yet those less experienced are advised to exercise caution. Ultimately, potential users must weigh the lure of low trading costs against the serious risks associated with fund safety and operational transparency.

Warning: Asia Capitals operates without valid regulatory oversight, raising substantial concerns about fund safety and the potential for withdrawal difficulties. Traders considering this broker should be fully aware of these risks.

Potential Harms:

Self-Verification Steps:

| Dimension | Rating | Justification |

|---|---|---|

| Trustworthiness | 1.5 | No valid regulation, high risk of fraud. |

| Trading Costs | 3.5 | Low commissions, but high non-trading fees. |

| Platforms & Tools | 3.0 | Standard platforms but lacking advanced tools. |

| User Experience | 2.0 | Mixed reviews on service and usability. |

| Customer Support | 2.5 | Limited support options and slow response times. |

| Account Conditions | 3.0 | Flexible account types but unclear terms. |

Asia Capitals, founded in recent years, is headquartered in St. Vincent and the Grenadines. It has positioned itself in the market as a low-cost trading venue for forex enthusiasts. However, the lack of an authoritative regulatory framework significantly undermines its legitimacy, causing potential traders to question its reliability and safety.

Asia Capitals primarily offers forex trading, coupled with various types of accounts tailored for different trading preferences. The broker promotes trading through popular platforms like Metatrader 4 (MT4) and claims to provide access to a variety of asset classes, including forex, CFDs, and precious metals. One of its notable assertions is to operate under a common financial service license, which, however, lacks recognition from reputable regulatory authorities.

| Aspect | Details |

|---|---|

| Regulation | Not regulated |

| Minimum Deposit | $0 |

| Leverage | Up to 1:500 |

| Major Fees | Withdrawal fees and commission unclear |

| Trading Platforms | MT4 |

Trustworthiness is a paramount consideration for potential traders. Asia Capitals' claims of operating under regulatory oversight lack verification, with various independent reviews indicating a contrary narrative.

The regulatory conflicts are blatant, as numerous sources highlight that the broker has no valid licensing:

“It has been verified that this broker currently has no valid regulation. Please be aware of the risk!”

— WikiBit

The feedback from users reflects a concerning pattern regarding fund safety:

“Dont invest! This website is totally a scam. I cannot withdraw my money.”

— Independent user reviews

Trading costs are a vital aspect of any broker's appeal. While Asia Capitals touts low commission rates, it conceals additional non-trading fees that could significantly impact profitability.

The advantage in commission structure can be enticing for active traders:

However, caution is warranted due to hidden fees:

“I tried to withdraw $1,200, but they asked for an additional deposit of $120 first.”

— User review highlighting withdrawal issues.

The mixed cost structure creates a dilemma for traders — while some may benefit from lower trading costs, others face hidden expenses that might erode profits.

Asia Capitals provides a standard trading experience through its platforms, but does it cater to advanced users?

The platform diversity mainly revolves around MT4, which allows both novice and experienced traders to execute trades efficiently. However, this means there may be limited access to premium tools that higher-tier brokers might offer.

The quality of tools and resources remains basic and not tailored for those looking for advanced analytics. The educational materials and resources seem lacking, which could disenfranchise novice traders:

“The platform is user-friendly, but it lacks advanced trading tools and resources.”

— General user feedback.

The user experience at Asia Capitals presents a picture of inconsistency, which is often reported by its clients.

Many users have conveyed dissatisfaction regarding service:

“The customer service is slow, and my queries took forever to get a response.”

— User testimonial.

The experience is marred by mixed reviews on service, indicating that while some procedures are straightforward, issues arise concerning usability and reliability.

Customer support plays a crucial role in maintaining trader confidence. Reports indicate that Asia Capitals has limited customer support options.

Users often lament slow response times, which can lead to heightened frustration, especially among those needing immediate assistance during trading hours.

Additionally, the lack of comprehensive support channels further complicates the situation for users from regions with local languages or needs.

While Asia Capitals provides various account types to cater to diverse trading strategies, the terms and conditions are largely vague, leading to confusion for prospective clients.

Traders are offered three types of accounts: Islamic, Platinum, and Standard, each with unique characteristics but lack detailed information on spreads, commissions, and available instruments.

This lack of clarity can deter potential clients who require a transparent and informative trading environment.

In conclusion, while Asia Capitals markets itself as a low-cost trading solution within the forex market, the significant lack of valid regulation poses substantial risks to traders. The brokers mixed reviews regarding its operational integrity, unmet withdrawal requests, and unclear fee structures raise red flags about its legitimacy. It is essential for prospective traders to carefully assess these issues and consider more reliable alternatives before committing their funds to an unregulated broker.

Q: Is Asia Capitals a regulated broker?A: No, Asia Capitals operates without valid regulation, which increases risks for traders.

Q: What trading platforms does Asia Capitals offer?A: Asia Capitals provides access to the popular trading platform Metatrader 4 (MT4).

Q: What trading instruments can I use at Asia Capitals?A: The broker allows trading in forex, CFDs, and precious metals, although details on specific instruments remain unclear.

Q: What account types does Asia Capitals offer?A: Asia Capitals offers Islamic, Platinum, and Standard accounts, yet lacks full transparency regarding their features and terms.

Q: What should I be aware of when considering withdrawals?A: Customer reviews have indicated significant challenges when attempting withdrawals, with potential requirements for additional deposits before processing.

Traders are urged to proceed with caution and remain vigilant against potential scams, prioritizing the safety of their investments at all times.

FX Broker Capital Trading Markets Review