Is CME GROUP safe?

Pros

Cons

Is CME Group Safe or a Scam?

Introduction

CME Group is a prominent player in the financial markets, known primarily for its futures and options trading. Established in 1898, it has evolved into one of the largest and most liquid derivatives exchanges globally, facilitating trade across various asset classes including commodities, interest rates, and foreign exchange. As trading in the foreign exchange market becomes increasingly accessible, traders must exercise caution when choosing a broker. Evaluating the safety and legitimacy of a broker is crucial to protect ones investment from potential scams. This article aims to provide a comprehensive analysis of CME Group, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety.

Regulation and Legitimacy

Understanding the regulatory framework of a broker is fundamental in assessing its safety. CME Group operates under the oversight of the Commodity Futures Trading Commission (CFTC) in the United States. However, it is essential to note that CME Group does not hold a traditional brokerage license as it functions primarily as a self-regulatory organization (SRO). This lack of a conventional regulatory license raises questions about its oversight and accountability.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFTC | N/A | United States | Verified |

The regulatory quality is paramount, as it ensures that brokers adhere to industry standards, safeguarding traders' interests. While CME Group is subject to CFTC regulations, it operates with a level of autonomy that might not provide the same level of consumer protection as fully licensed brokers. Historical compliance with regulatory standards is also a critical factor. CME Group has maintained a relatively clean regulatory history, which adds to its credibility. However, potential traders should remain vigilant and conduct thorough research before engaging with any financial institution.

Company Background Investigation

CME Group's history is rich and extensive, having been established over a century ago. Originally founded as the Chicago Butter and Egg Board, it has undergone several mergers and acquisitions, culminating in its current form. The company is publicly traded and has a diverse ownership structure, which includes institutional investors and individual shareholders. This broad ownership base contributes to its operational transparency.

The management team at CME Group is composed of experienced professionals from various sectors of finance and trading. Their backgrounds include extensive experience in derivatives trading, risk management, and financial regulation. This expertise is vital in navigating the complexities of the financial markets and ensuring that the company adheres to best practices.

In terms of transparency, CME Group provides a wealth of information through its website and investor relations materials. This includes detailed reports on trading volumes, financial performance, and regulatory compliance. Such openness is a positive indicator of the companys commitment to maintaining trust with its clients, suggesting that CME Group is safe for potential traders.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fee structures is essential. CME Group offers a diverse range of trading products, including futures and options on various asset classes. However, the fee structure can be complex, and traders should be aware of the costs involved.

| Fee Type | CME Group | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | 0.5% - 2% | 0.5% - 1.5% |

CME Group's spreads, particularly on major currency pairs, tend to be higher than the industry average, which could impact profitability for active traders. Additionally, the commission model is variable, meaning that costs can fluctuate based on trading volume and the specific contracts traded. Traders should carefully review the fee schedule and consider how these costs will affect their trading strategy.

Customer Fund Security

The safety of customer funds is a critical consideration when evaluating a broker. CME Group implements several measures to protect client funds, including segregation of client accounts from company funds. This practice ensures that traders money is not at risk in the event of the company facing financial difficulties.

Furthermore, CME Group provides certain investor protections, such as negative balance protection, which prevents clients from losing more than their initial investment. However, it is essential to note that, as with any financial institution, there have been historical disputes and concerns regarding fund security. Traders should remain informed and cautious, ensuring that they understand the protections in place before depositing funds.

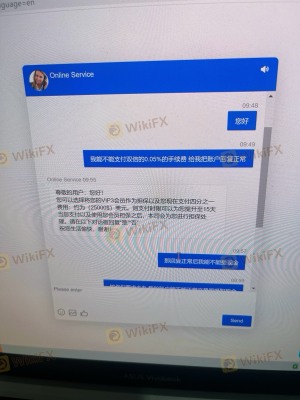

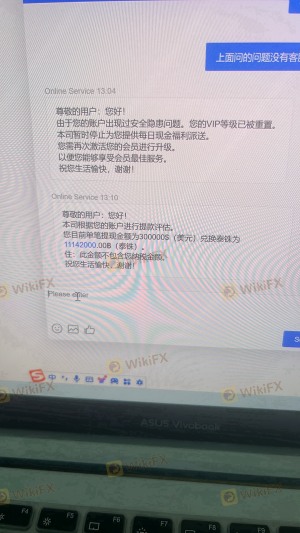

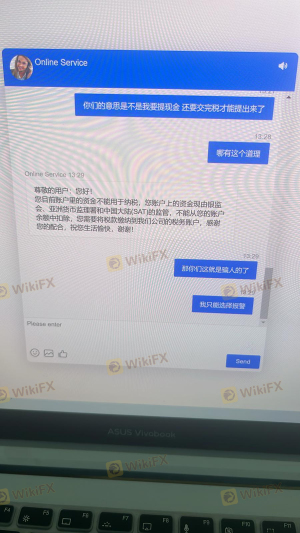

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of CME Group reveal a mixed bag of experiences. While many users praise the platform's functionality and the breadth of trading options, complaints often revolve around high fees, slow customer service responses, and withdrawal issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| High Fees | Moderate | Addressed |

| Slow Customer Service | High | Unresolved |

| Withdrawal Delays | High | Unresolved |

Common complaints include difficulties in withdrawing funds and delays in customer service responses, which can be particularly frustrating for traders. One typical case involved a trader who faced significant delays in processing a withdrawal request, leading to dissatisfaction with the overall service. Such issues raise concerns about the operational efficiency of CME Group and whether it is entirely safe for traders.

Platform and Execution

CME Group offers a sophisticated trading platform that is generally regarded as stable and user-friendly. However, the quality of order execution is a crucial factor for traders. Reports of slippage and order rejections have surfaced, leading some users to question the reliability of the platform.

The platform's performance during high volatility periods is particularly critical, as traders need assurance that their orders will be executed promptly and accurately. Although CME Group has implemented several safeguards to ensure execution quality, any signs of manipulation or inefficiency could significantly impact trader confidence.

Risk Assessment

Engaging with CME Group involves several inherent risks that traders should carefully consider. While the company has a reputable history and regulatory oversight, the lack of a traditional brokerage license and mixed customer feedback present potential red flags.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Operates as a self-regulatory entity |

| Financial Risk | High | High fees and potential withdrawal issues |

| Operational Risk | Medium | Customer service delays and execution issues |

To mitigate these risks, traders are advised to conduct thorough due diligence, utilize demo accounts where available, and only invest capital they can afford to lose. Additionally, exploring alternative brokers with stronger regulatory frameworks could provide safer trading environments.

Conclusion and Recommendations

In conclusion, while CME Group is a well-established entity in the financial markets, potential traders should approach with caution. The evidence suggests that CME Group is not a scam, but there are several areas of concern, particularly regarding fees, customer service, and withdrawal processes. It is crucial for traders to weigh these factors against their trading goals and risk tolerance.

For those seeking a broker with a more robust regulatory framework and better customer service, alternatives such as Interactive Brokers or TD Ameritrade may be worth considering. Ultimately, thorough research and a careful evaluation of personal trading needs are essential to ensuring a safe trading experience with CME Group or any other broker.

Is CME GROUP a scam, or is it legit?

The latest exposure and evaluation content of CME GROUP brokers.

CME GROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CME GROUP latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.