Eddid 2025 Review: Everything You Need to Know

Executive Summary

Eddid Financial is a Hong Kong-based financial company. The trading community has mixed opinions about this broker, with some positive feedback and some concerning reports. The company has proper licensing from the Hong Kong Securities and Futures Commission, which means it follows important financial rules. However, this eddid review shows that traders should be careful because some users have reported fraud warnings.

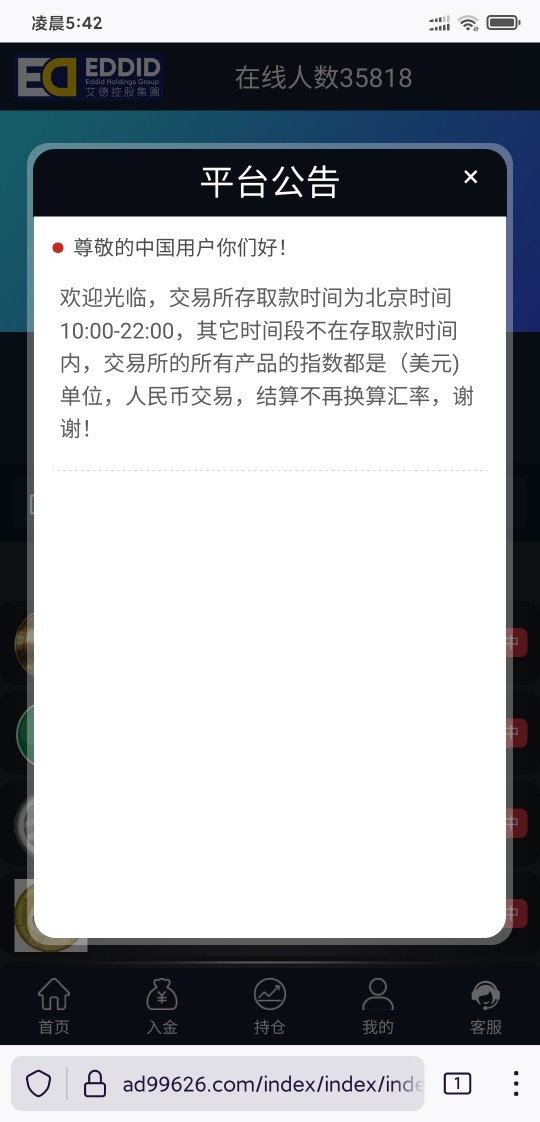

The broker focuses on virtual asset trading and helps distribute financial products. Eddid Financial uses the Eddid ONE USA trading platform for its main operations, serving both regular investors and large institutions since 2015. The company targets people who want to trade digital assets and traditional financial products, though service quality reports vary significantly. While Eddid Financial has proper regulatory credentials, our overall assessment stays neutral due to conflicting user reports. The firm works in multiple countries, including Hong Kong and the United States, with each location having different rules and services.

Important Notice

Traders must know that Eddid operates in different regions with separate business entities. Each location follows different financial rules, which can mean different service quality, available trading options, and customer protection. Users should check carefully which company entity they work with and understand what legal protections apply in their area.

This review uses public information, regulatory documents, and user feedback from many sources. The goal is to give an honest assessment while recognizing that individual experiences can be very different based on account type, how much you trade, and local regulations.

Rating Framework

Broker Overview

Eddid Financial started in 2015 as a Hong Kong-based financial services company. The company built itself as a technology-focused financial institution that specializes in online financial services and modern financial technology solutions. Regulatory documents show that Eddid Financial has proper licensing from the Hong Kong Securities and Futures Commission, which means it follows strict Asian financial rules.

The company's main business focuses on virtual asset trading and traditional product distribution services. This approach lets the company serve different types of clients, from people who like cryptocurrency to those who prefer conventional investments. The company works in multiple countries, with important operations in both Hong Kong and the United States, where each location follows its own financial rules.

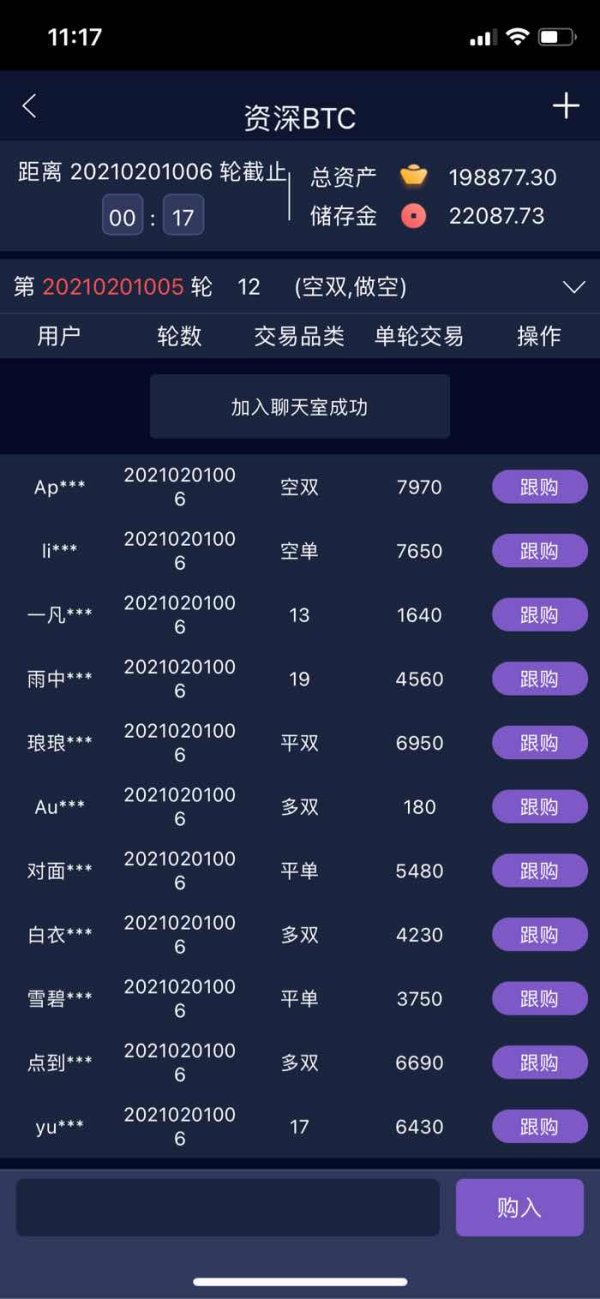

Eddid Financial provides services through the Eddid ONE USA trading platform, which is the main system clients use. The platform handles virtual asset transactions and gives access to various financial products through the company's network, though specific details about available assets are limited in public documents. This comprehensive eddid review shows that the broker tries to connect traditional finance with new digital asset markets, but service quality varies according to user reports.

Regulatory Jurisdiction: Eddid Financial works under Hong Kong Securities and Futures Commission supervision. This provides regulatory oversight and client protection that meets Hong Kong's financial standards.

Deposit and Withdrawal Methods: Information about available deposit and withdrawal options is not detailed in public materials. Clients need to contact the broker directly for complete payment information.

Minimum Deposit Requirements: The exact minimum deposit amount is not listed in available documents. This suggests requirements might change based on account type and regional operations.

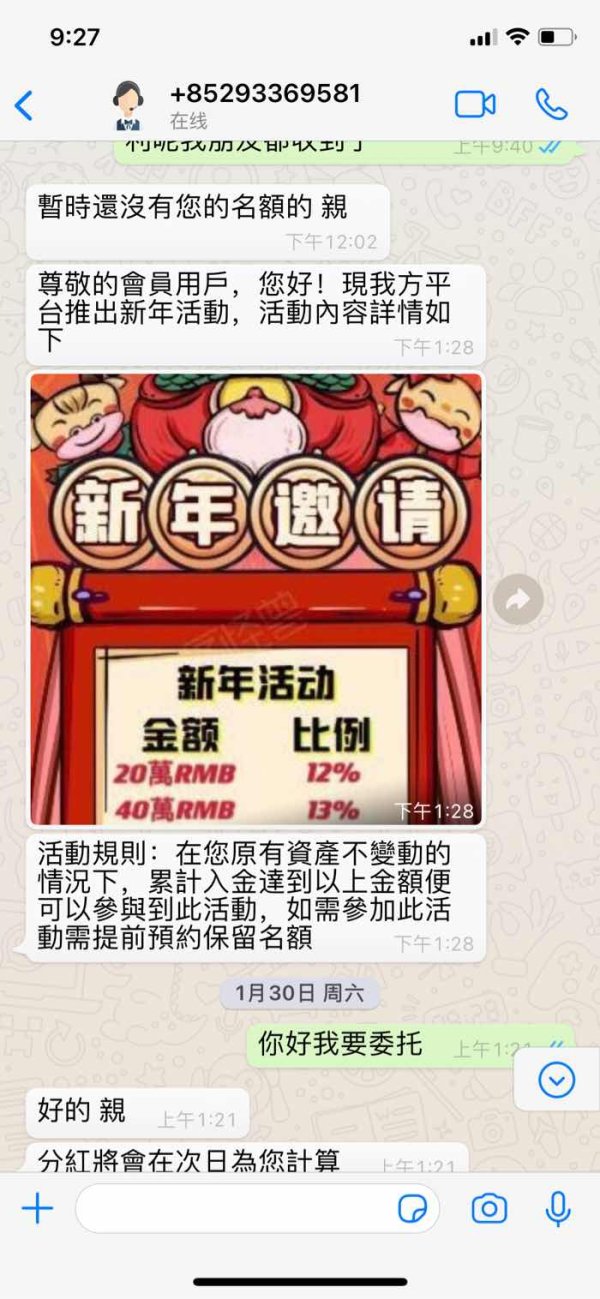

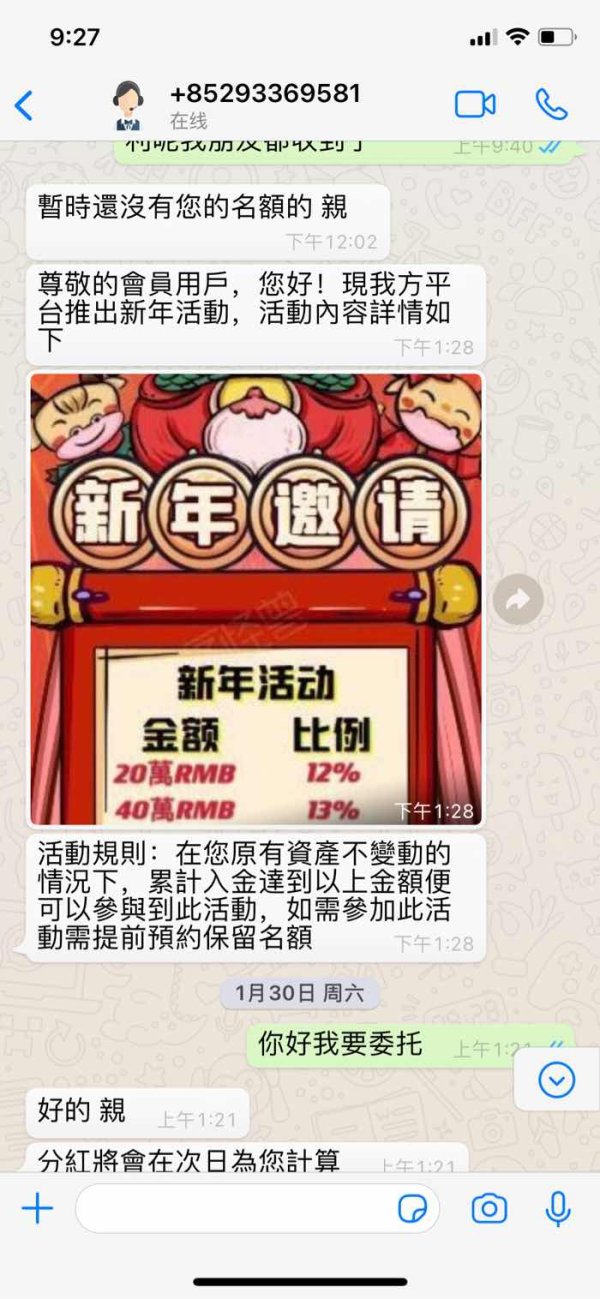

Bonus and Promotions: Current promotional offers and bonus programs are not outlined in accessible broker information. This indicates either no such programs exist or the company does not publicly share this information.

Tradeable Assets: The platform focuses on virtual asset trading and product distribution services. Specific instrument categories and availability need clarification directly from the broker.

Cost Structure: Detailed information about spreads, commissions, and fees is not available in public materials. Clients need to contact the broker directly for accurate cost analysis.

Leverage Ratios: Specific leverage options are not detailed in available information. These likely vary based on asset type and regulatory jurisdiction.

Platform Options: Trading happens through the Eddid ONE USA platform. This serves as the main trading interface for client operations.

Geographic Restrictions: Specific regional limitations are not clearly outlined in accessible materials. Operations span Hong Kong and United States jurisdictions.

Customer Service Languages: Available customer support languages are not specified in current documentation. Direct verification with the broker is required.

This eddid review highlights important information gaps that potential clients should address through direct broker communication before opening accounts.

Detailed Rating Analysis

Account Conditions Analysis

Available information about Eddid Financial's account conditions shows significant gaps that potential traders must consider. Current documentation does not give clear details about account types, tier structures, or specific features for different client categories, which raises questions about the broker's commitment to clear client communication.

Without specific information about minimum deposits, account fees, or tier-based benefits, prospective clients cannot make smart decisions about account suitability. The absence of details about Islamic accounts or other specialized account types further limits access for diverse trading communities, and the account opening process, required documents, and verification timelines remain unclear from available sources.

The lack of comprehensive account condition information in this eddid review suggests that potential clients must talk directly with broker representatives to understand available options. This communication requirement may indicate either poor public disclosure practices or deliberately unclear account structures that need careful examination before commitment.

Eddid Financial's tool and resource offerings appear limited based on available information. The Eddid ONE USA platform serves as the primary trading interface, but specific details about analytical tools, research capabilities, and educational resources remain largely unknown in public materials. This lack of transparency about available trading tools creates challenges for traders seeking comprehensive market analysis capabilities.

The absence of information about automated trading support, API access, or third-party platform integration suggests potential limitations in advanced trading functionality. Educational resources, market research, and analytical tools are essential parts of modern trading environments, yet their availability through Eddid Financial remains unclear from current documentation, and user feedback about tool quality and platform functionality is limited, making objective assessment difficult.

The lack of detailed information about charting capabilities, technical indicators, and market data feeds raises questions about the platform's suitability for serious trading activities. Without comprehensive tool documentation, traders cannot properly assess whether the platform meets their analytical and execution requirements.

Customer Service and Support Analysis

Customer service quality at Eddid Financial remains unclear based on available user feedback and documentation. The lack of specific information about support channels, availability hours, and response times creates uncertainty about the broker's commitment to client assistance, and this absence of clear customer service standards may indicate potential challenges in getting timely support when needed.

Available information does not specify whether support comes through multiple channels like live chat, phone, email, or ticket systems. The lack of documented response time commitments or service level agreements suggests potential inconsistencies in support quality, and the availability of multilingual support remains unconfirmed, which could limit access for international clients.

User experiences with customer service appear mixed based on limited available feedback, with some reports suggesting unclear support quality. The absence of detailed customer service information in public materials may indicate either insufficient disclosure practices or variable service standards that require careful evaluation before account opening.

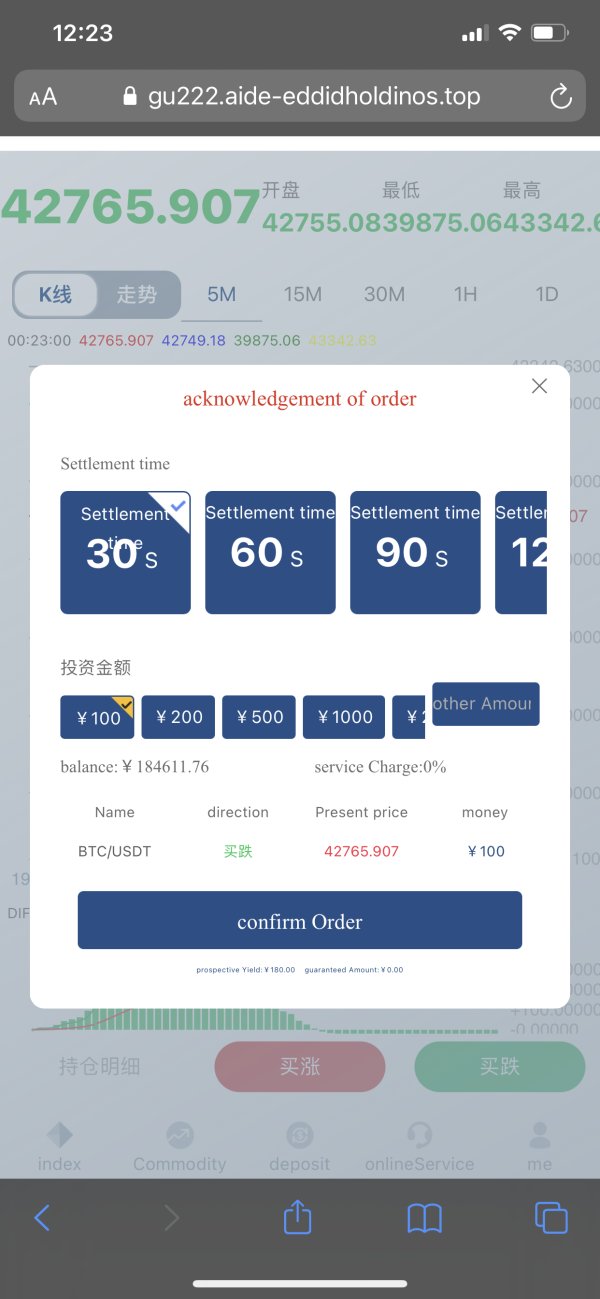

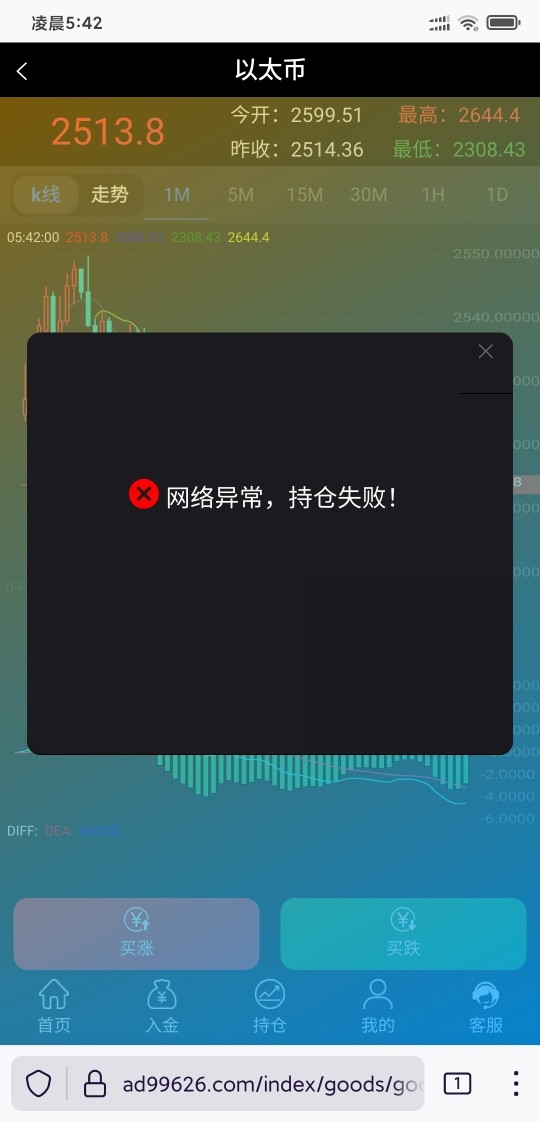

Trading Experience Analysis

The trading experience offered by Eddid Financial through its Eddid ONE USA platform lacks detailed documentation in available materials. Platform stability, execution speed, and order processing quality remain unclear from current sources, making objective assessment challenging for potential users, and this information gap presents significant concerns for traders who prioritize reliable execution environments.

Available documentation does not provide specific details about platform functionality, user interface design, or mobile trading capabilities. The absence of information about order types, execution methods, and slippage characteristics limits traders' ability to assess platform suitability for their trading strategies, and platform uptime statistics and technical performance metrics are not publicly available.

User feedback about trading experience appears limited and mixed, with insufficient data to draw comprehensive conclusions about platform performance. The lack of detailed trading experience information in this eddid review suggests that potential users must rely on direct platform testing or broker communication to evaluate execution quality and overall trading environment suitability.

Trustworthiness Analysis

Eddid Financial's trustworthiness presents a mixed picture that requires careful consideration by potential clients. On the positive side, the company holds regulatory authorization from the Hong Kong Securities and Futures Commission, which provides a foundation of regulatory oversight and compliance standards, and this regulatory status indicates adherence to established financial industry standards and client protection measures.

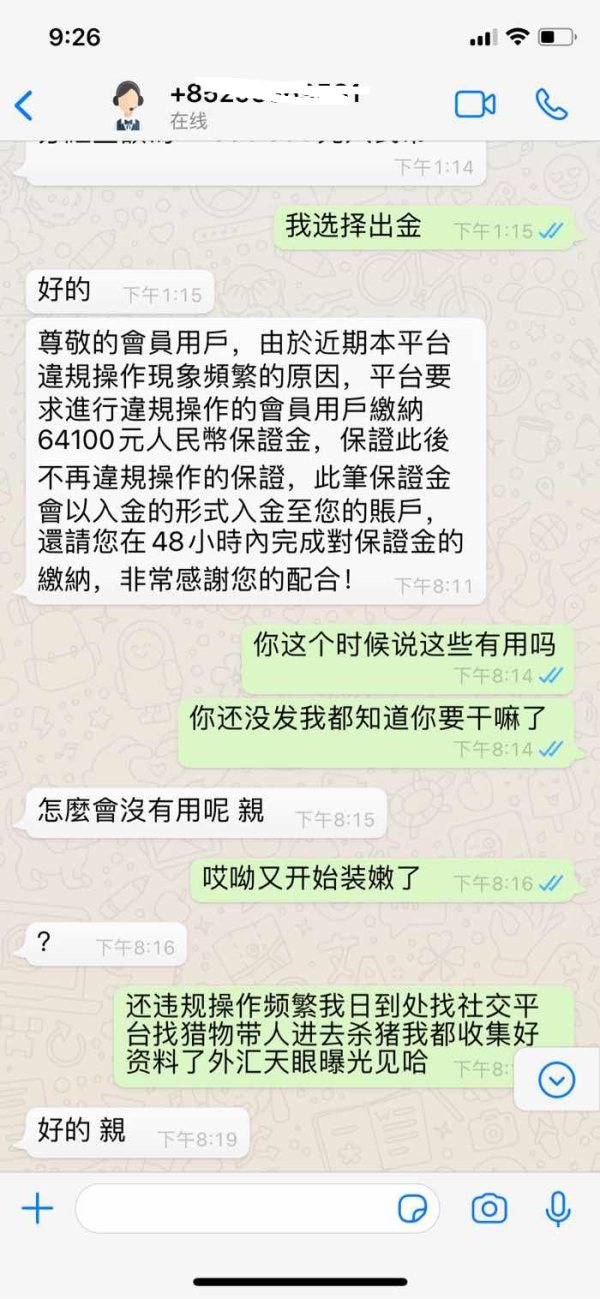

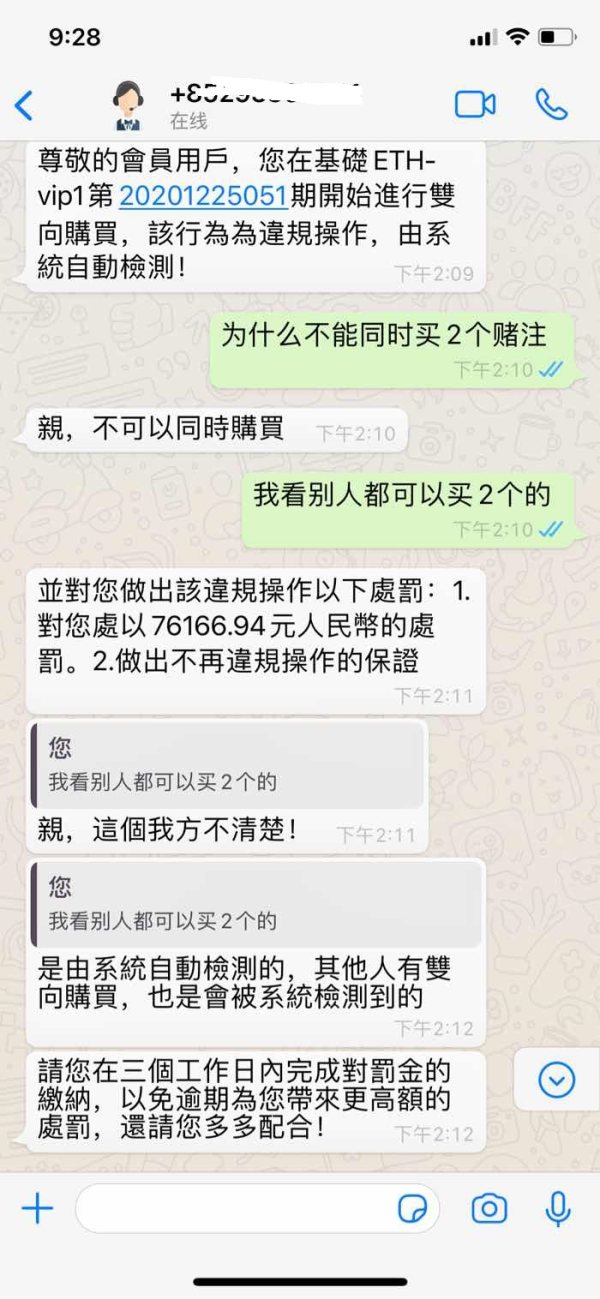

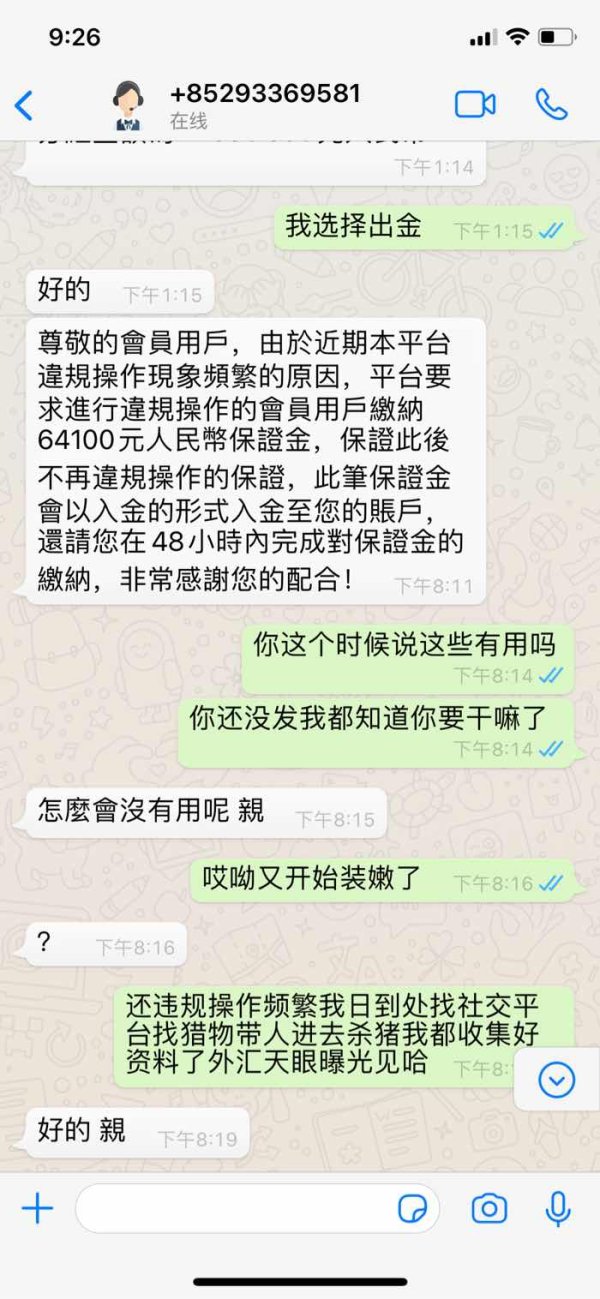

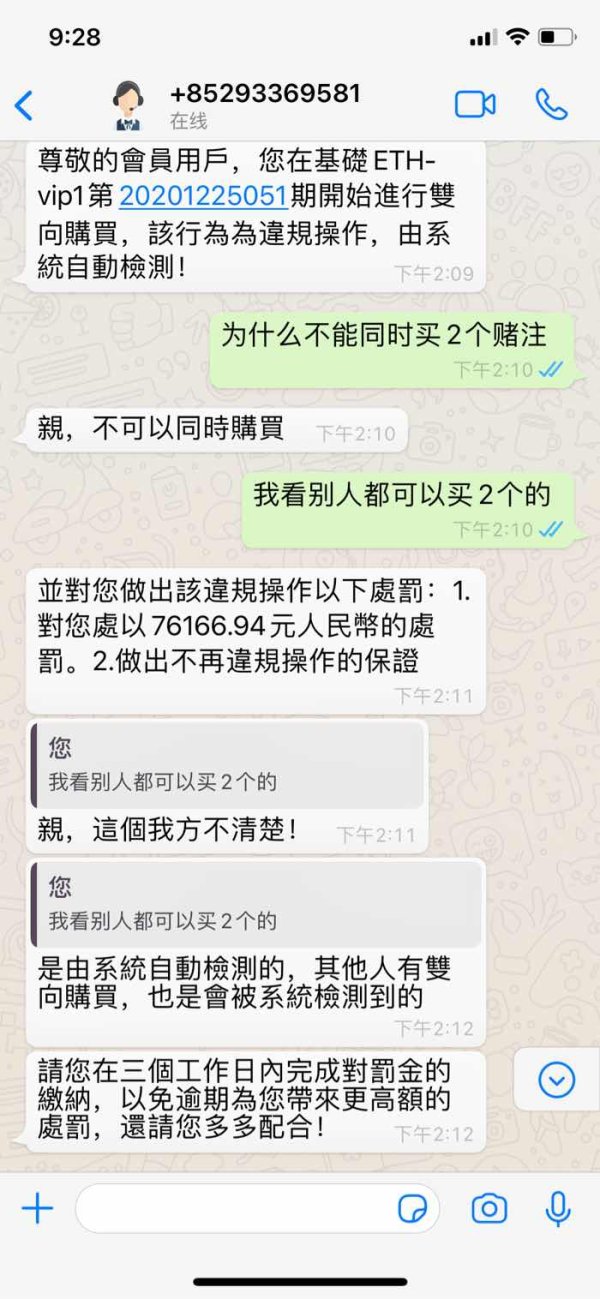

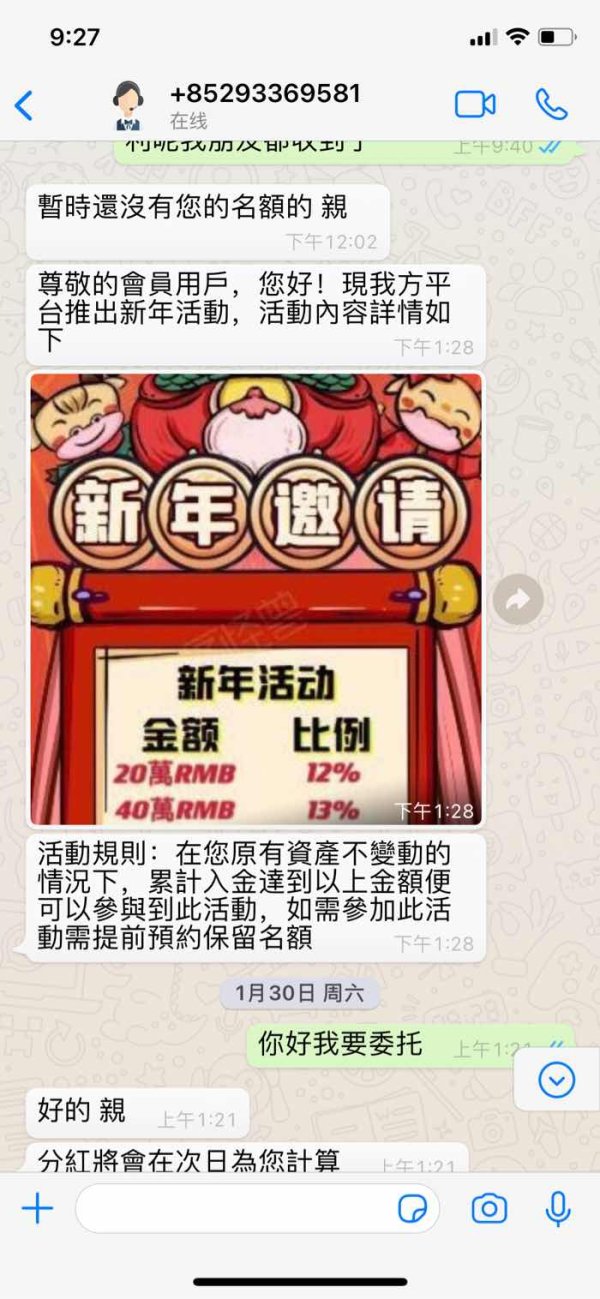

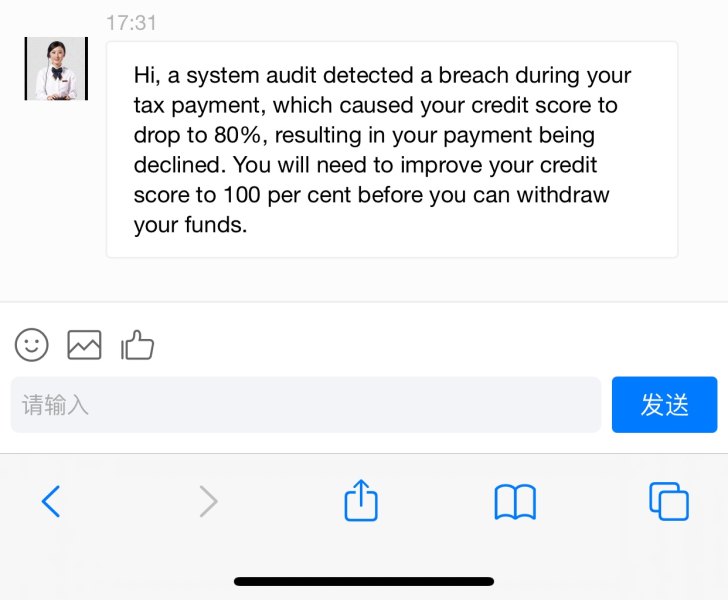

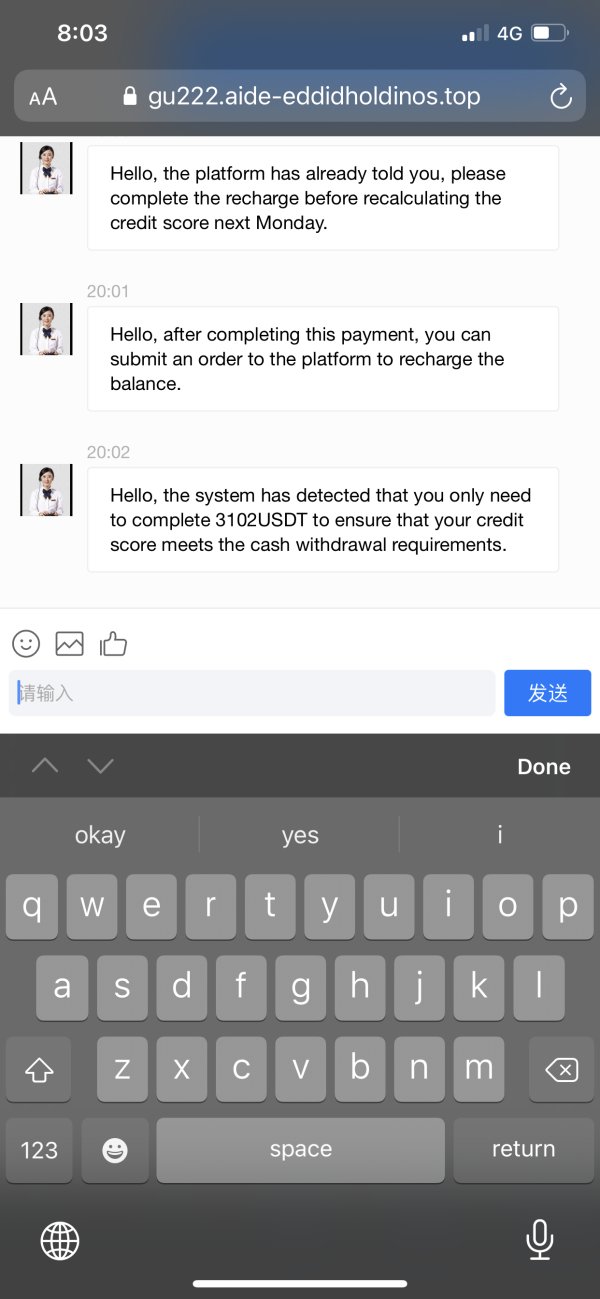

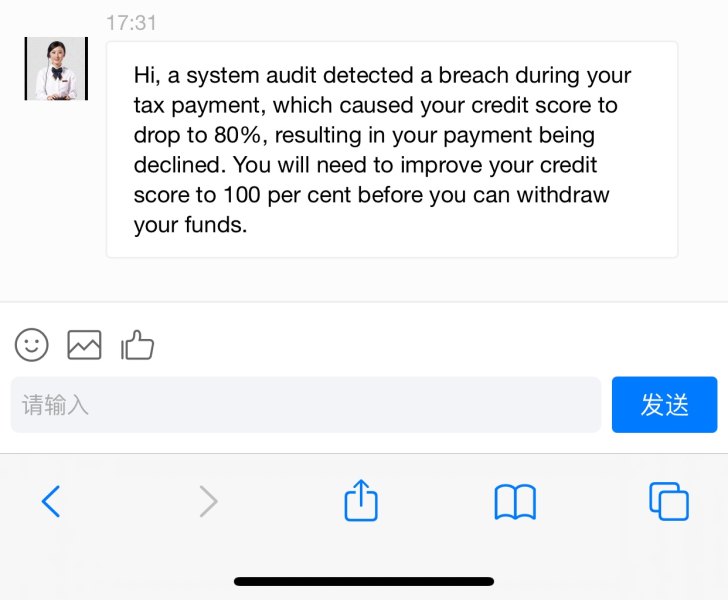

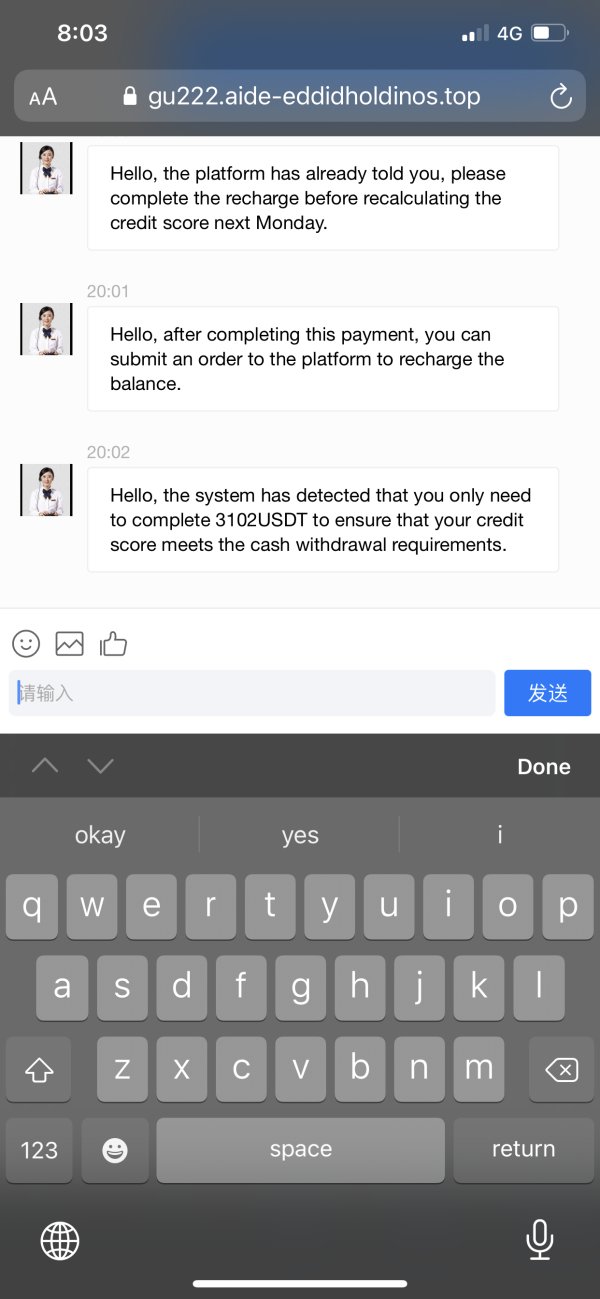

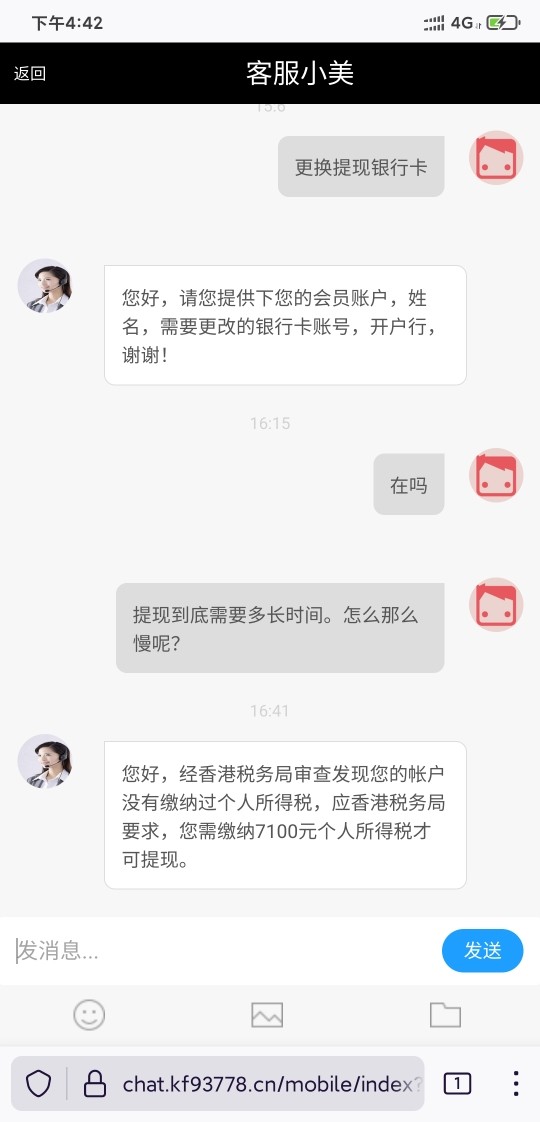

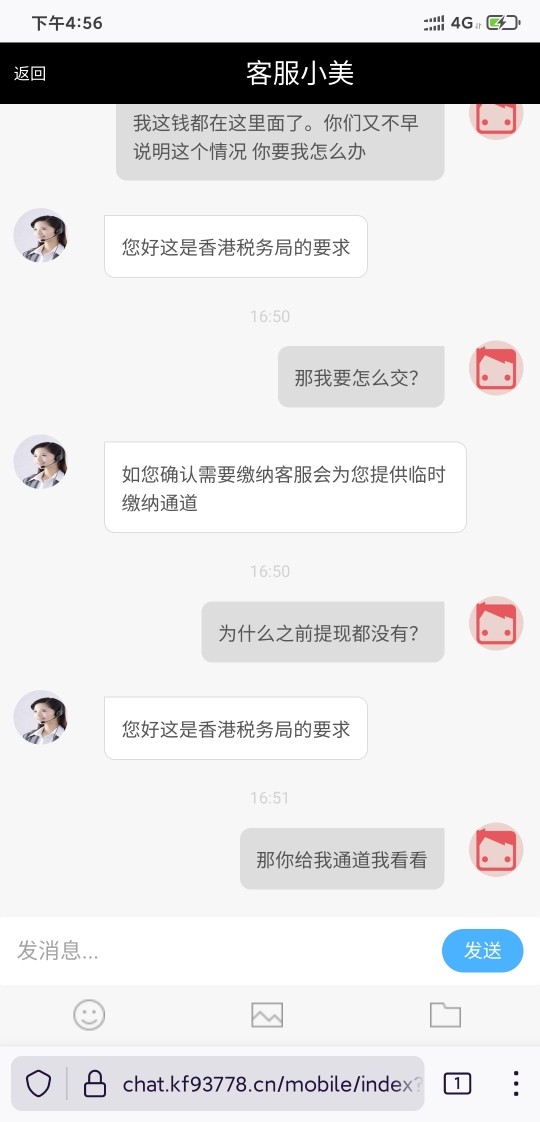

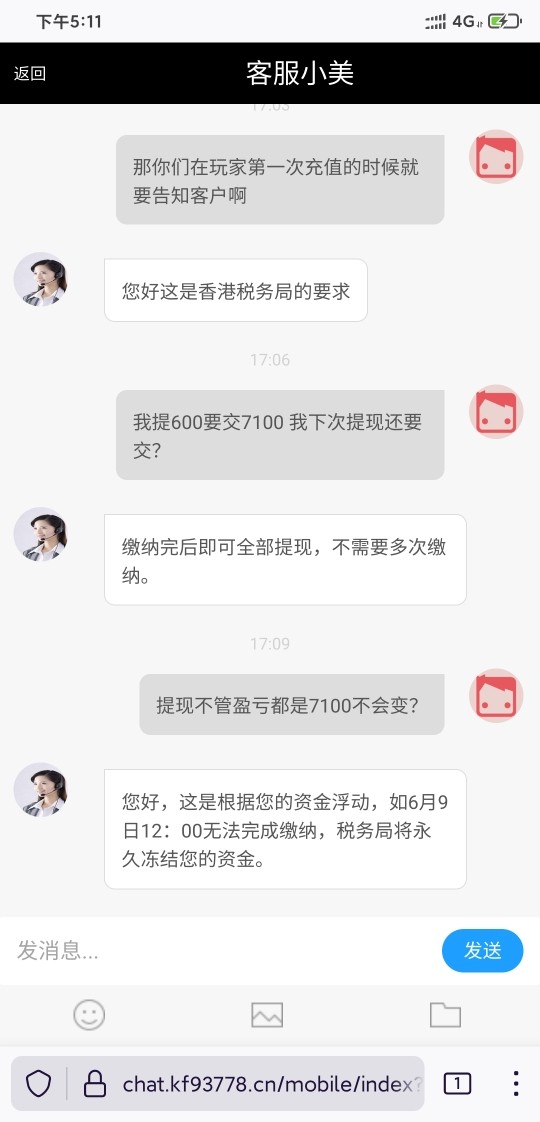

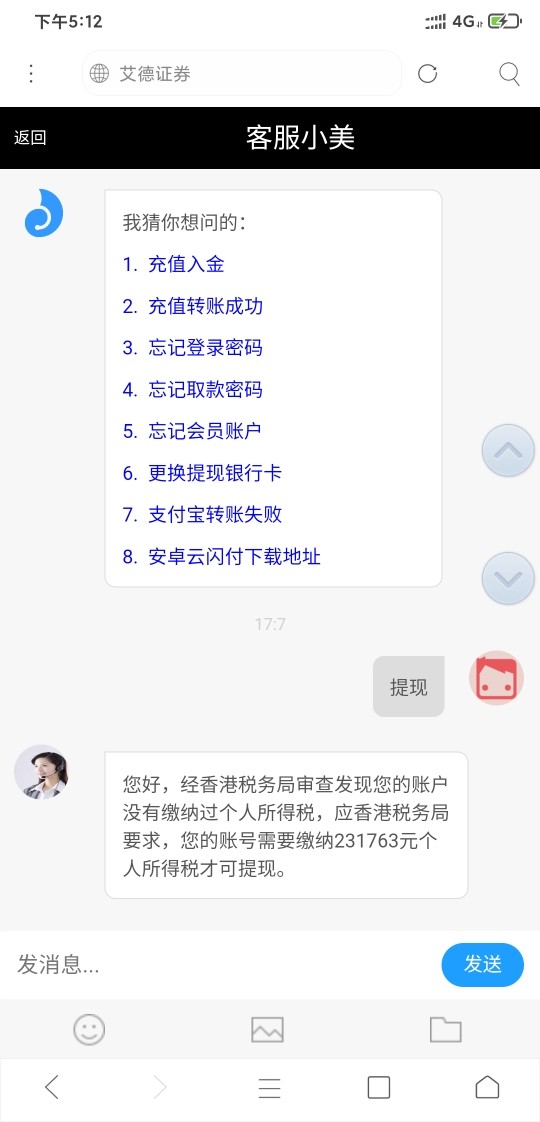

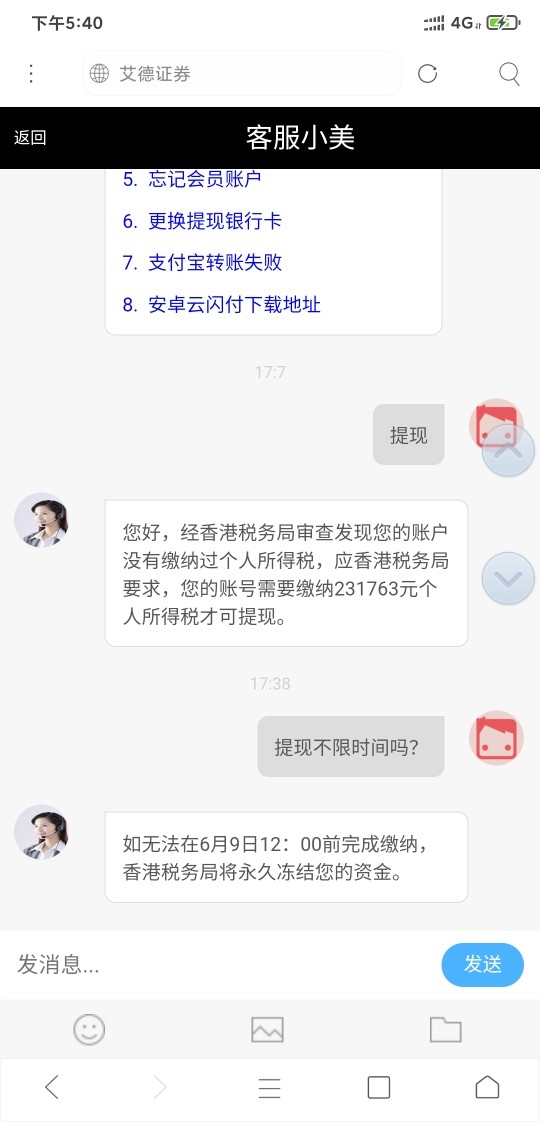

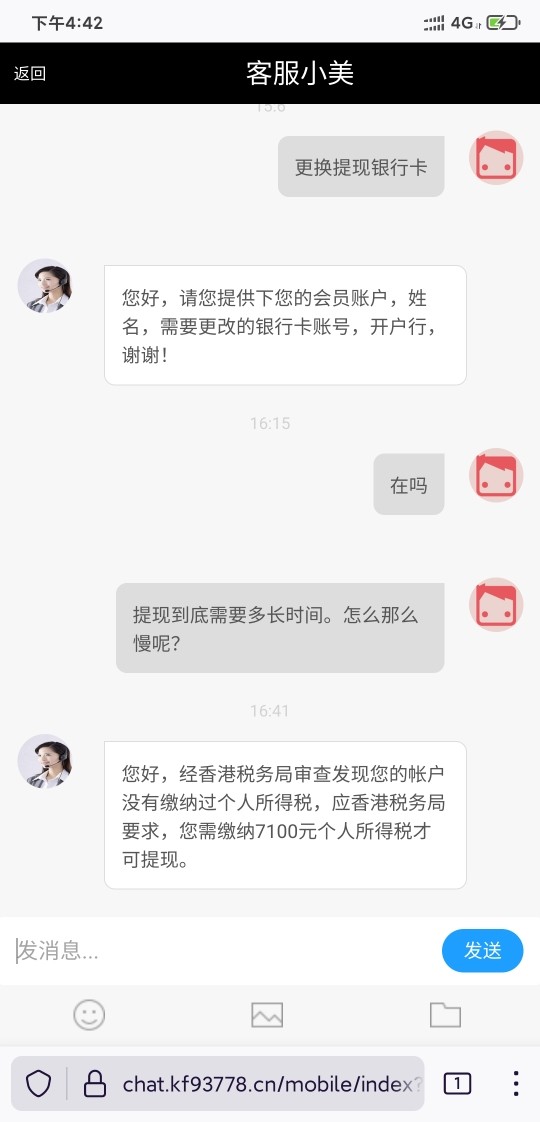

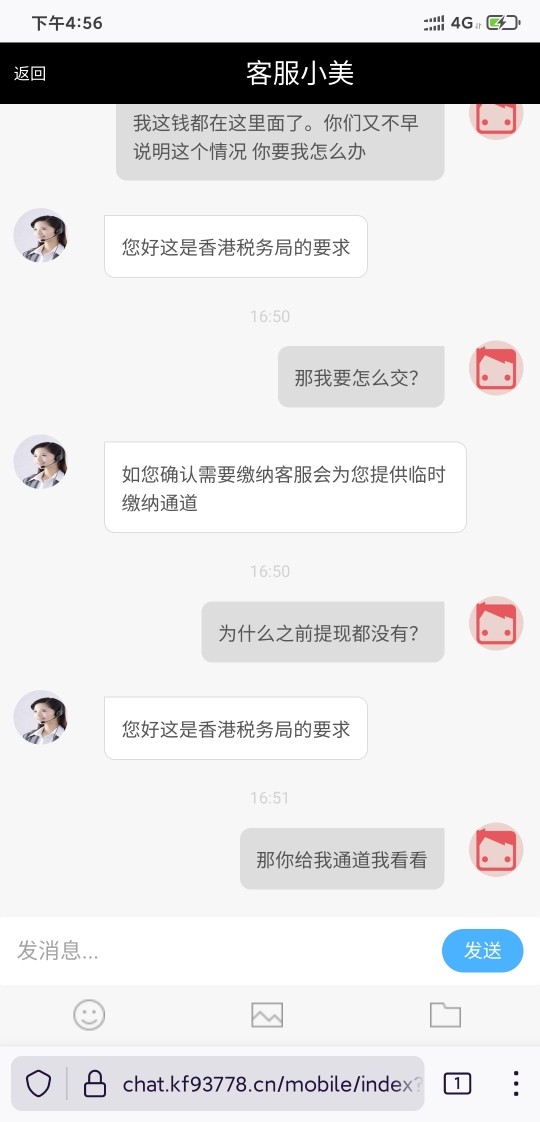

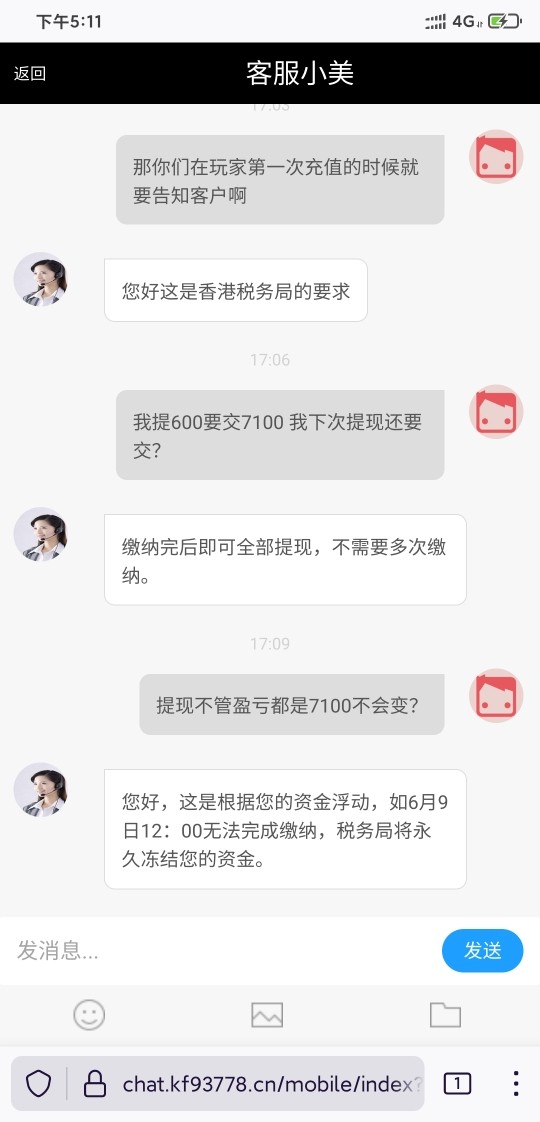

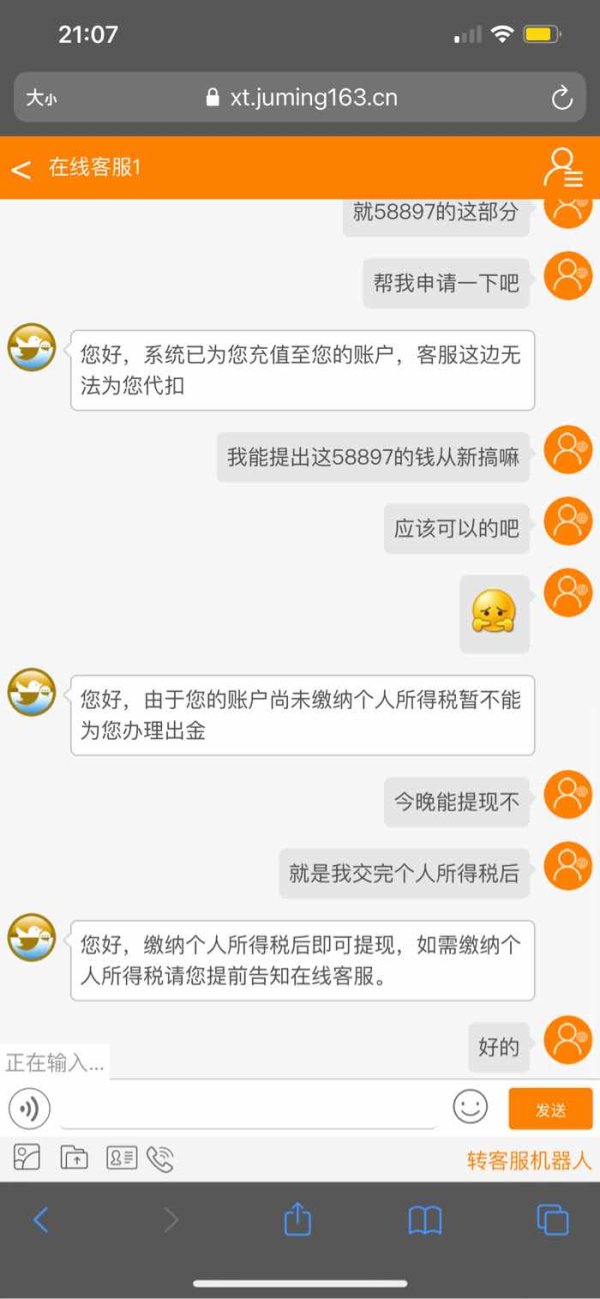

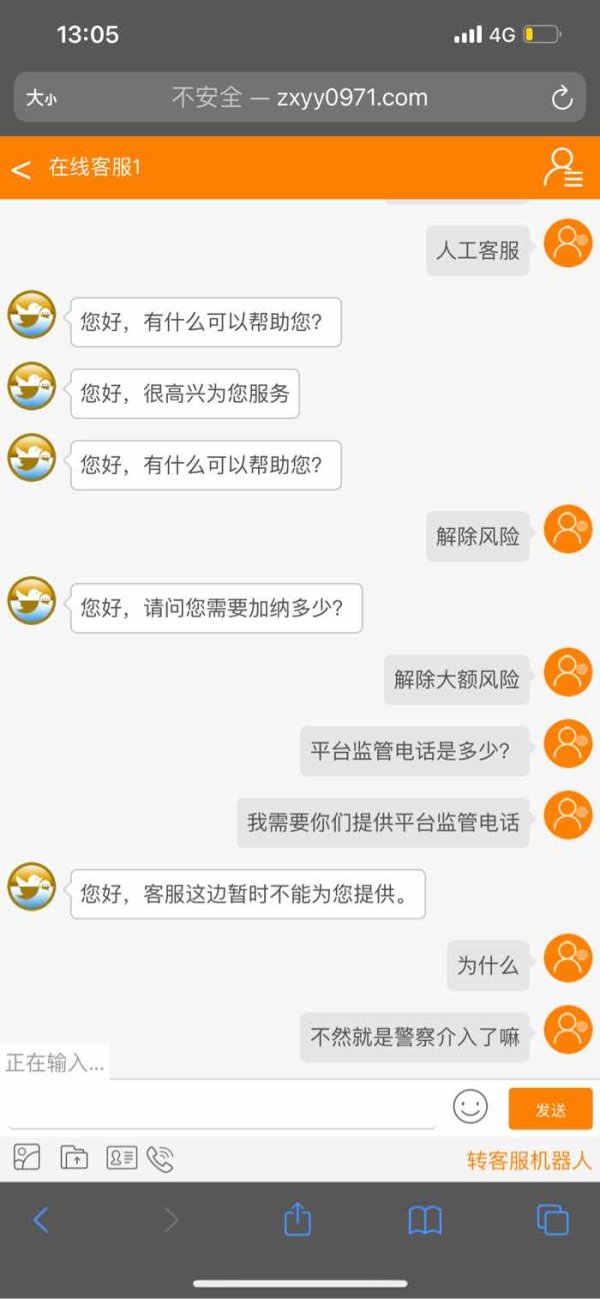

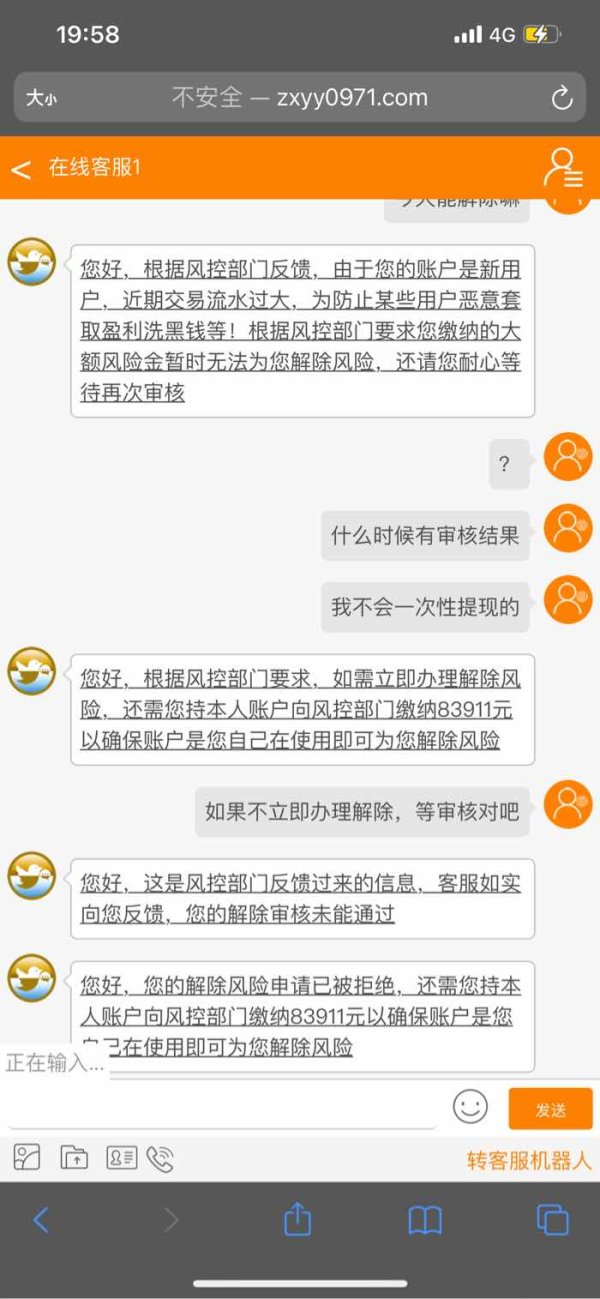

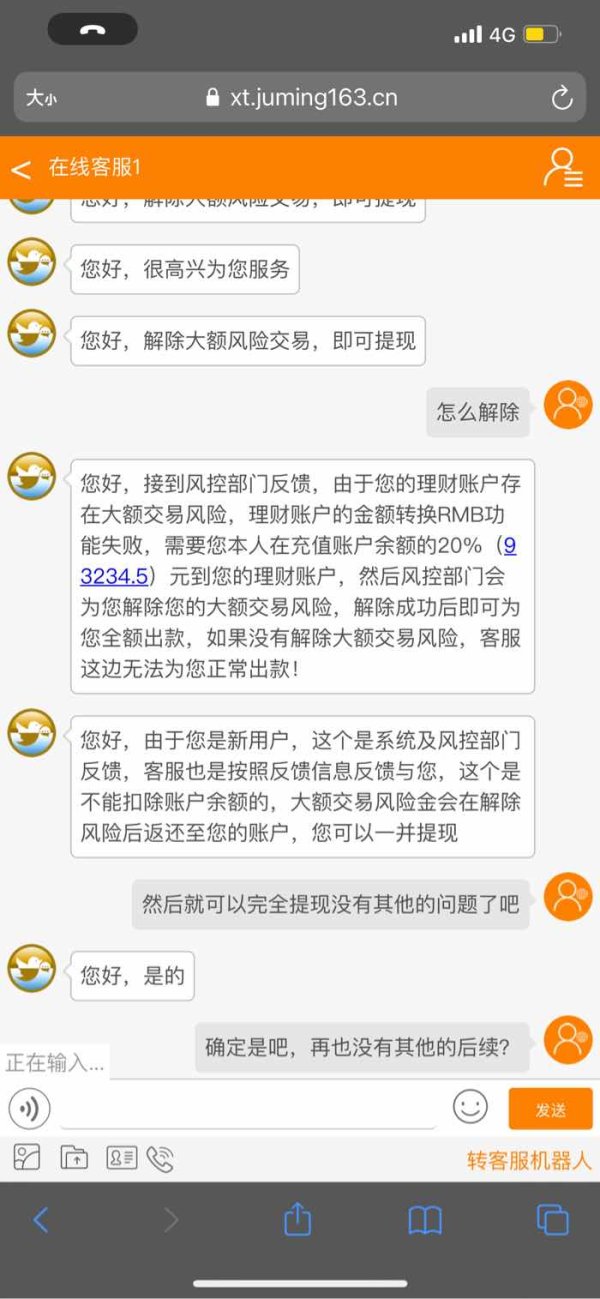

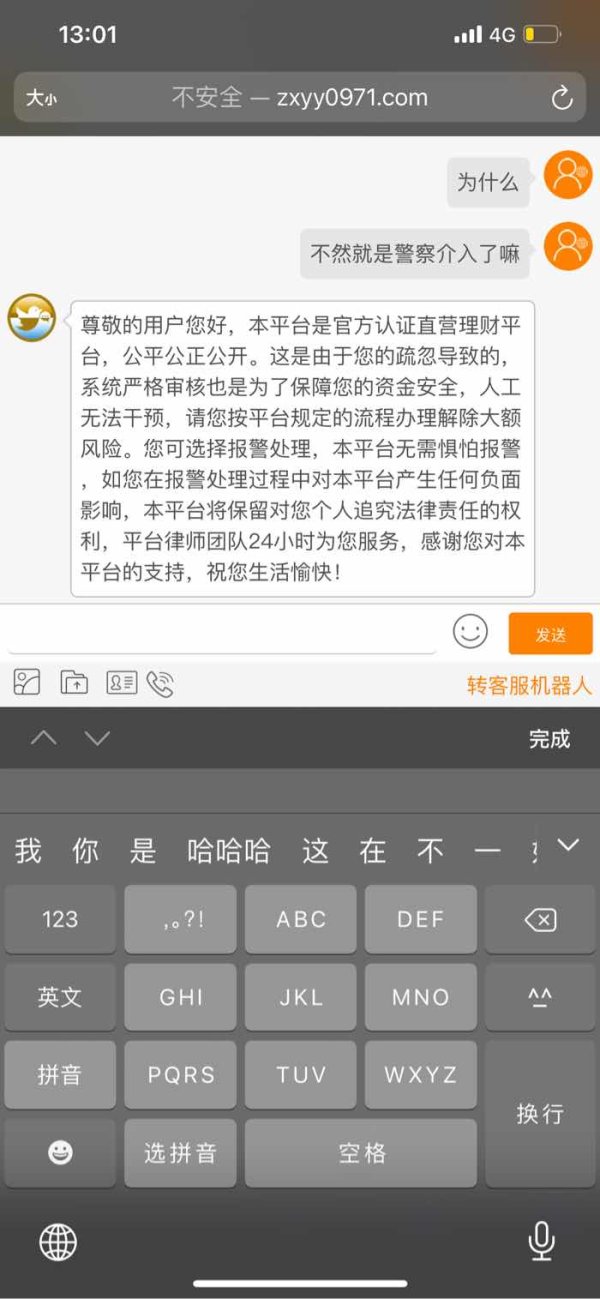

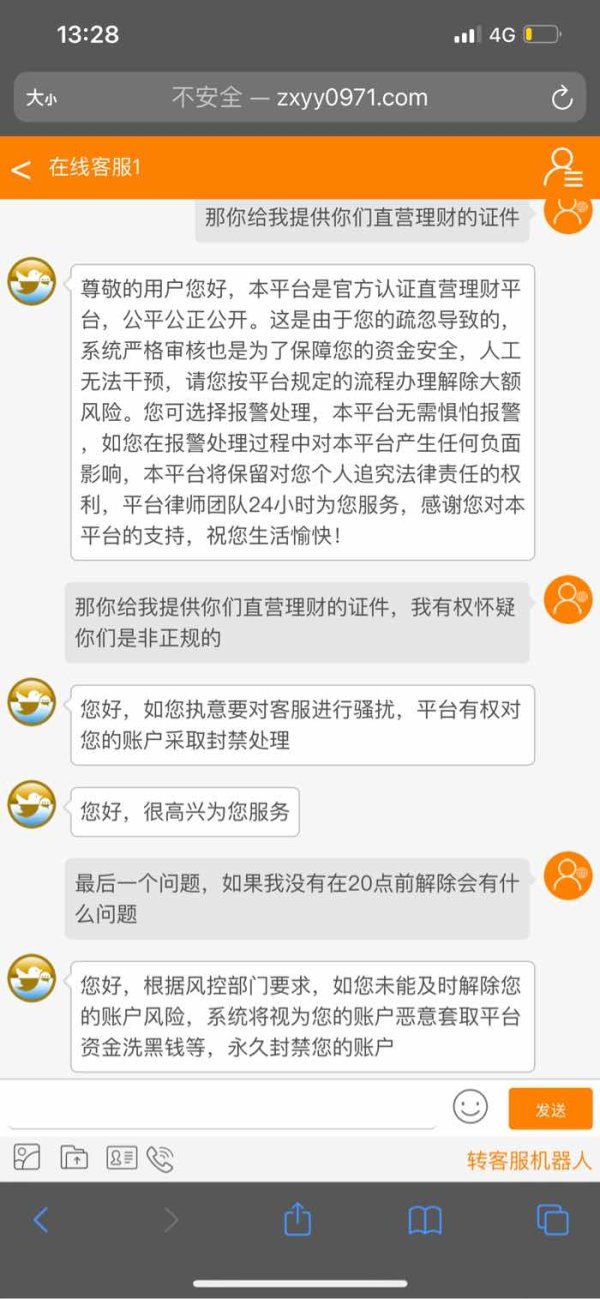

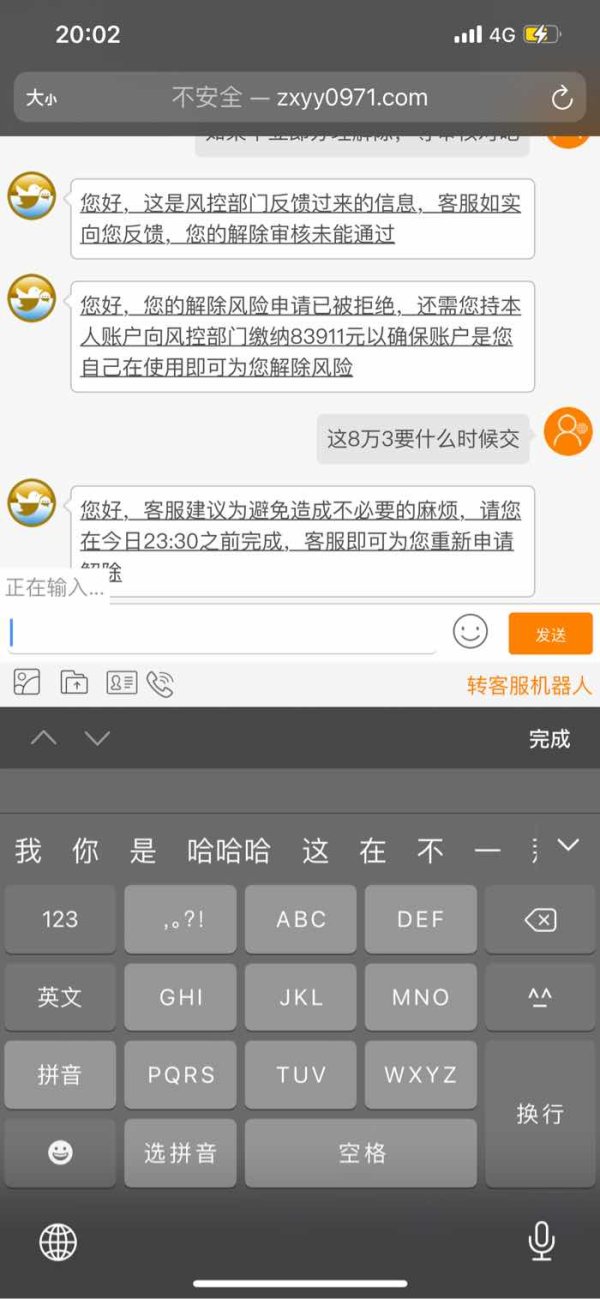

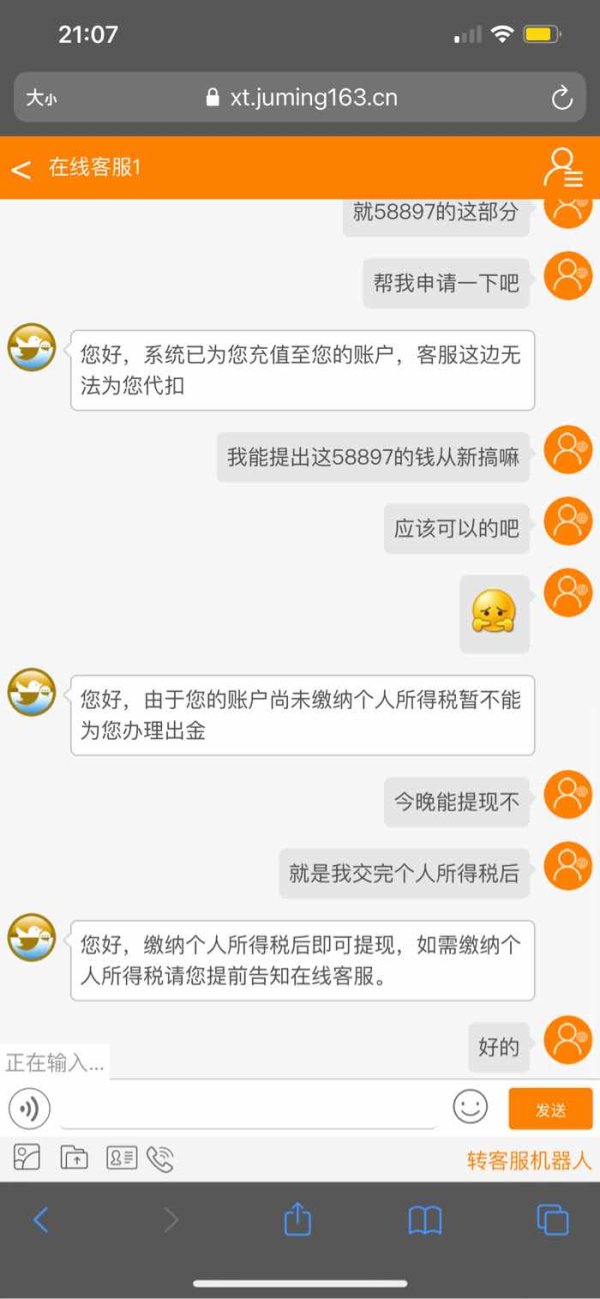

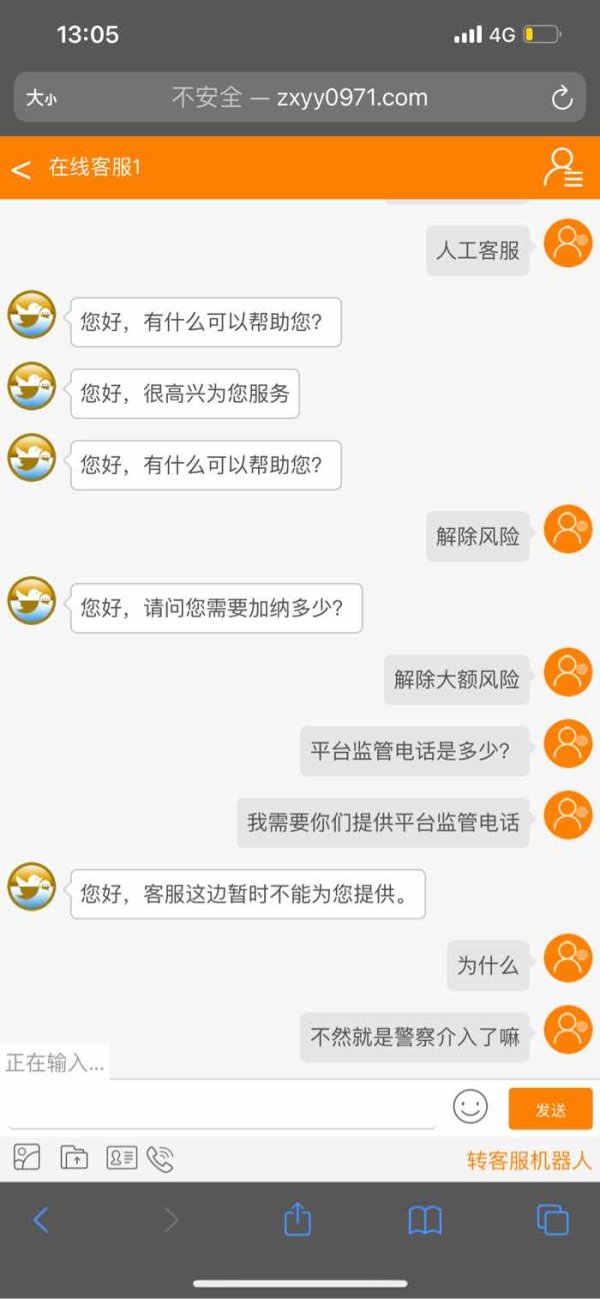

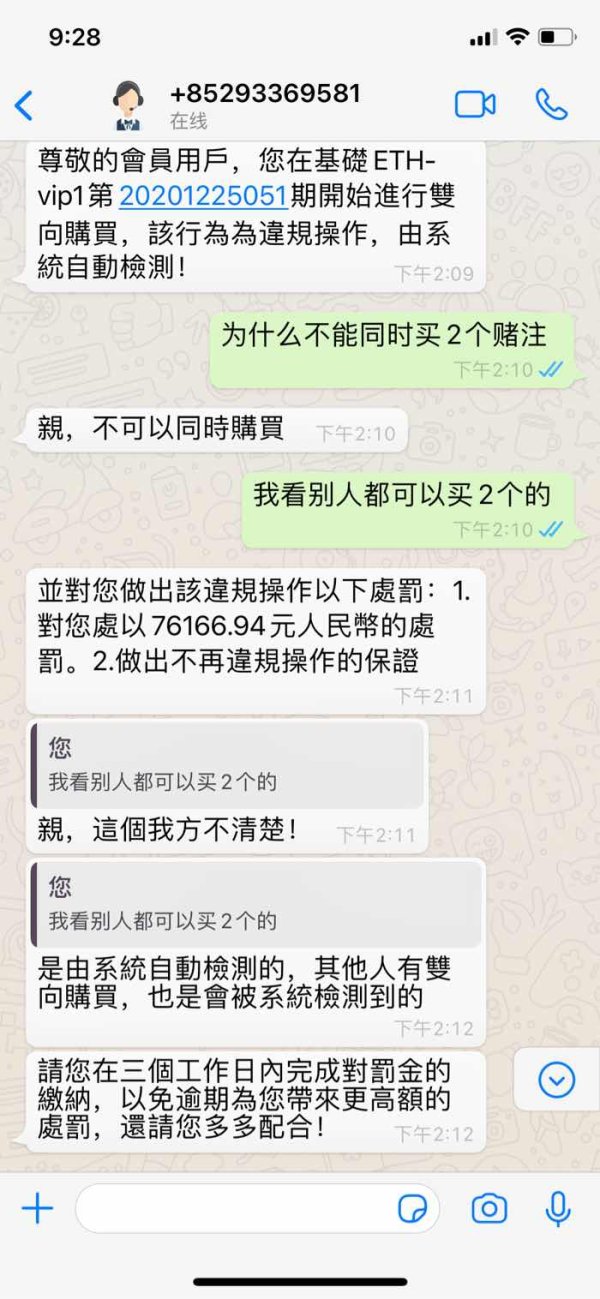

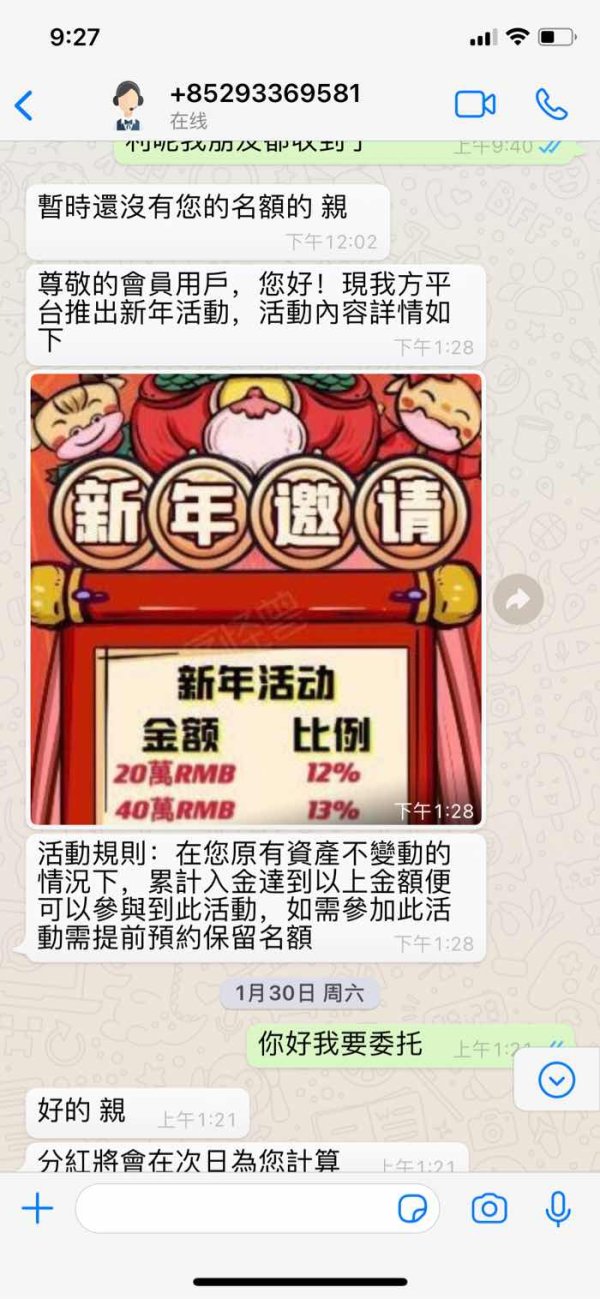

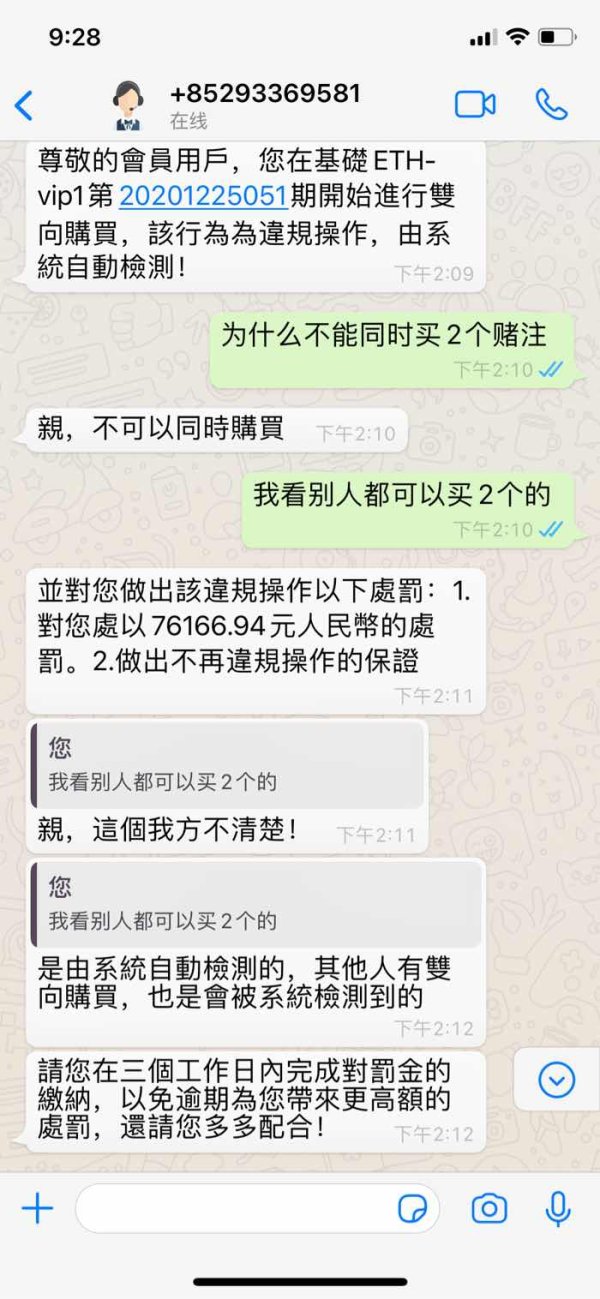

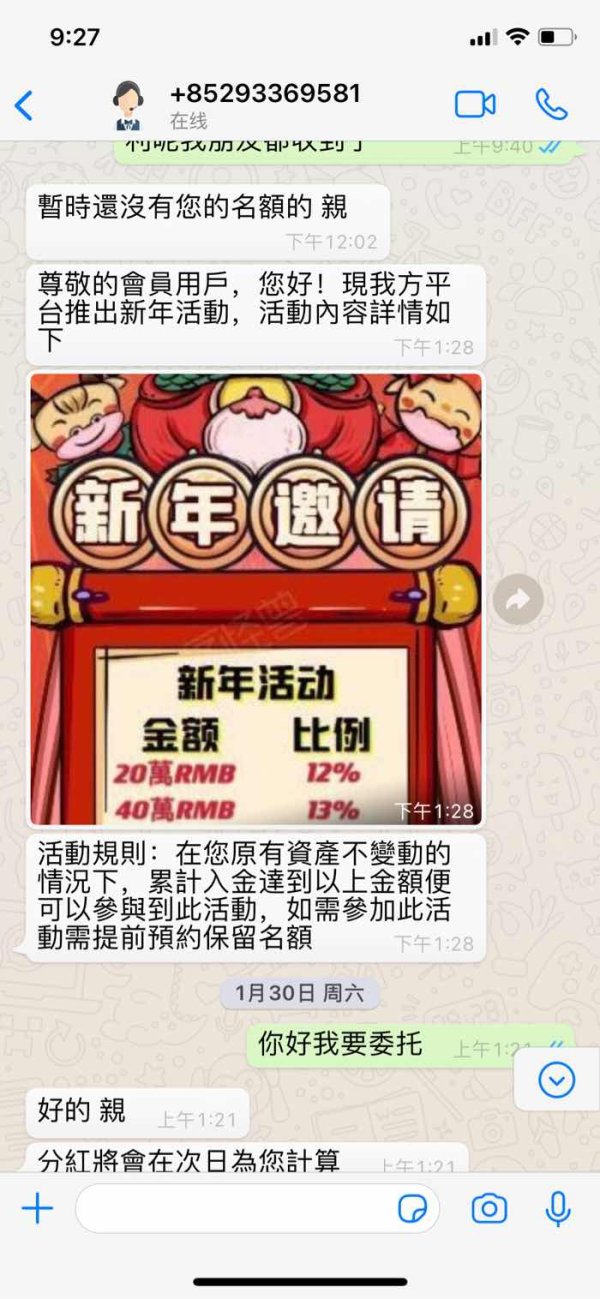

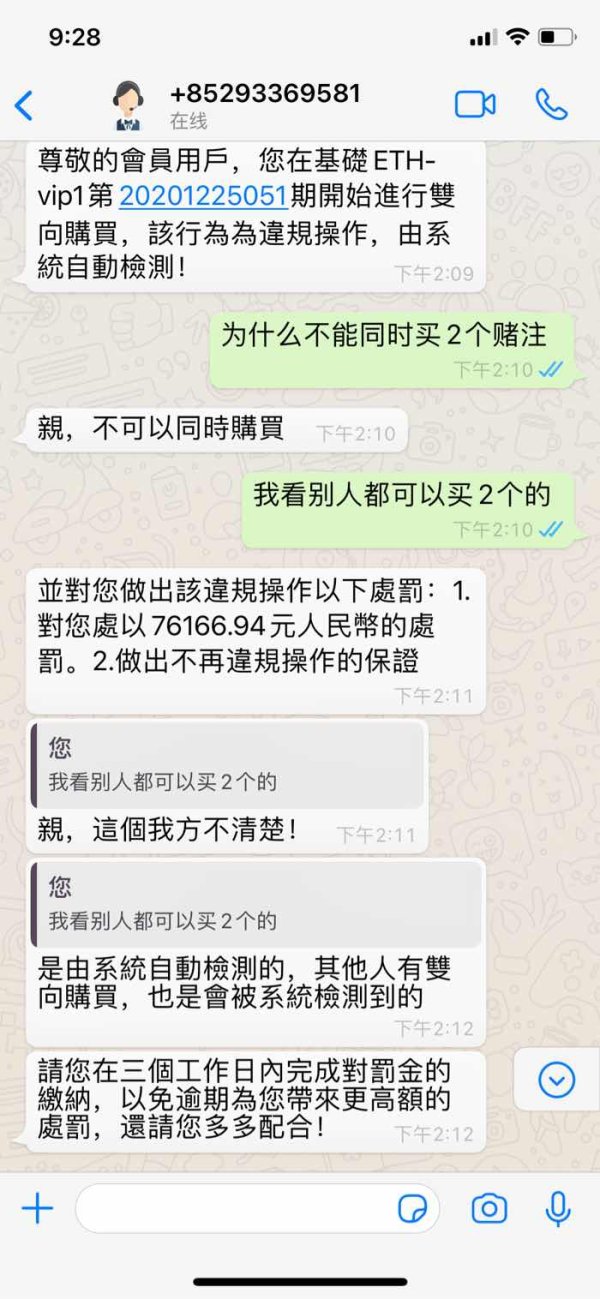

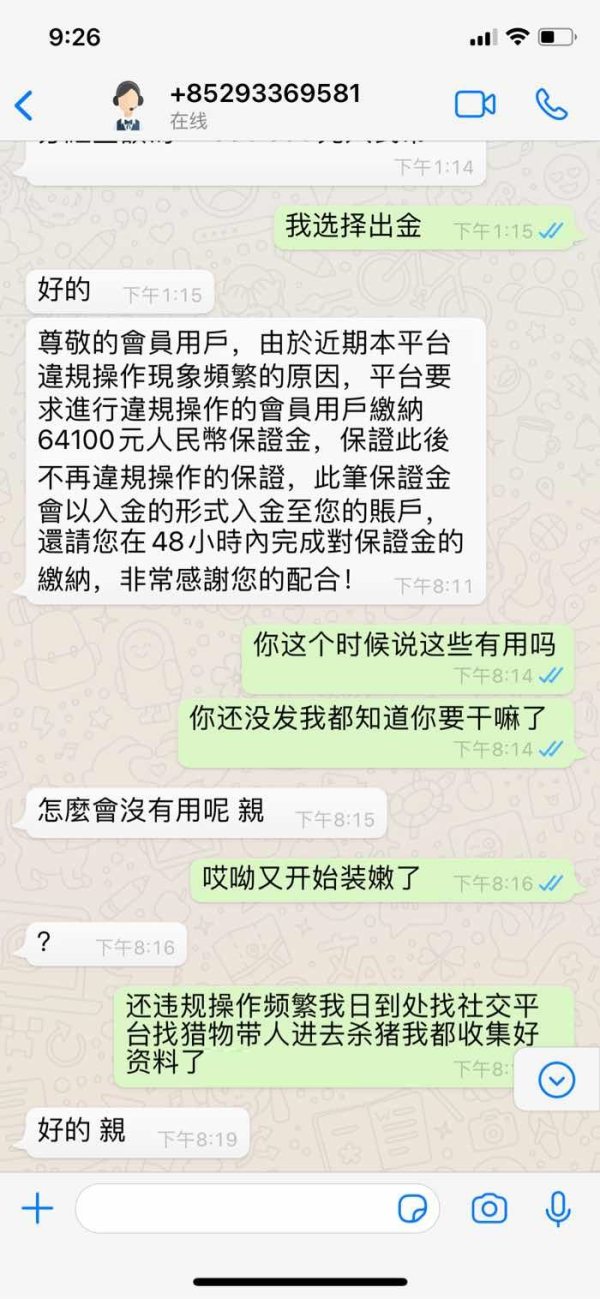

However, user reports have raised fraud warnings that cannot be ignored in any comprehensive assessment. These warnings, while not definitively proven, suggest potential concerns about business practices or client experiences that warrant careful investigation, and the presence of such warnings alongside legitimate regulatory status creates a complex trust environment requiring thorough due diligence.

The company's transparency about fund security measures, segregation practices, and client protection protocols is not clearly documented in available materials. This lack of detailed security information, combined with existing fraud warnings, suggests that potential clients should exercise enhanced caution and conduct thorough research before engaging with the broker.

User Experience Analysis

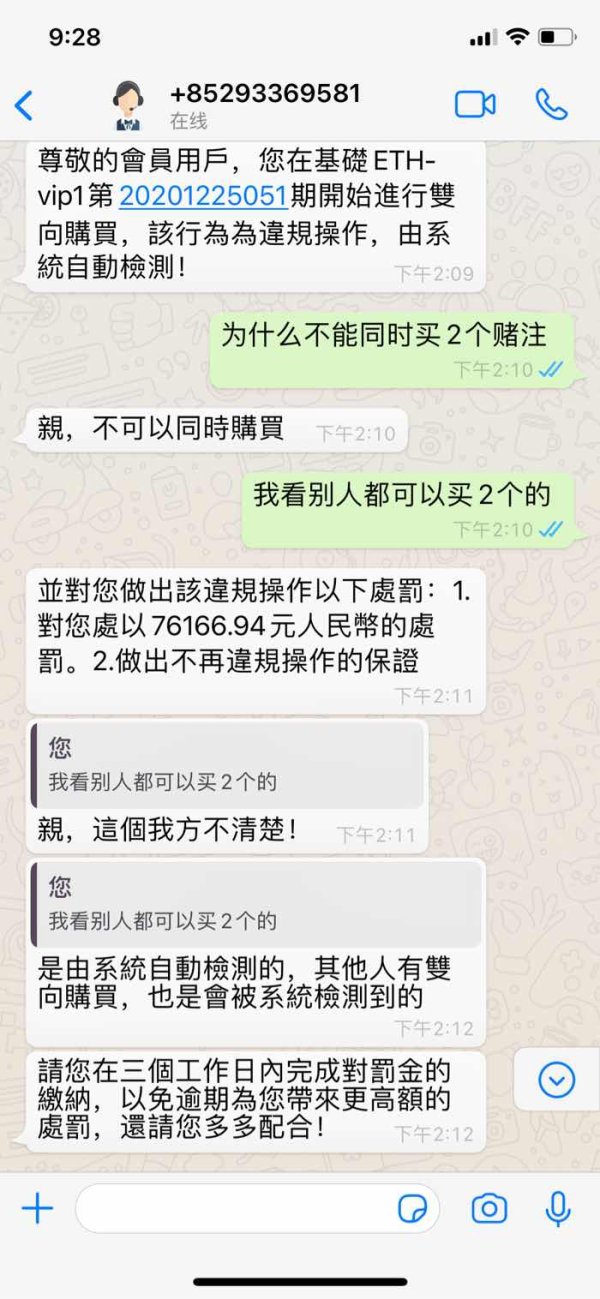

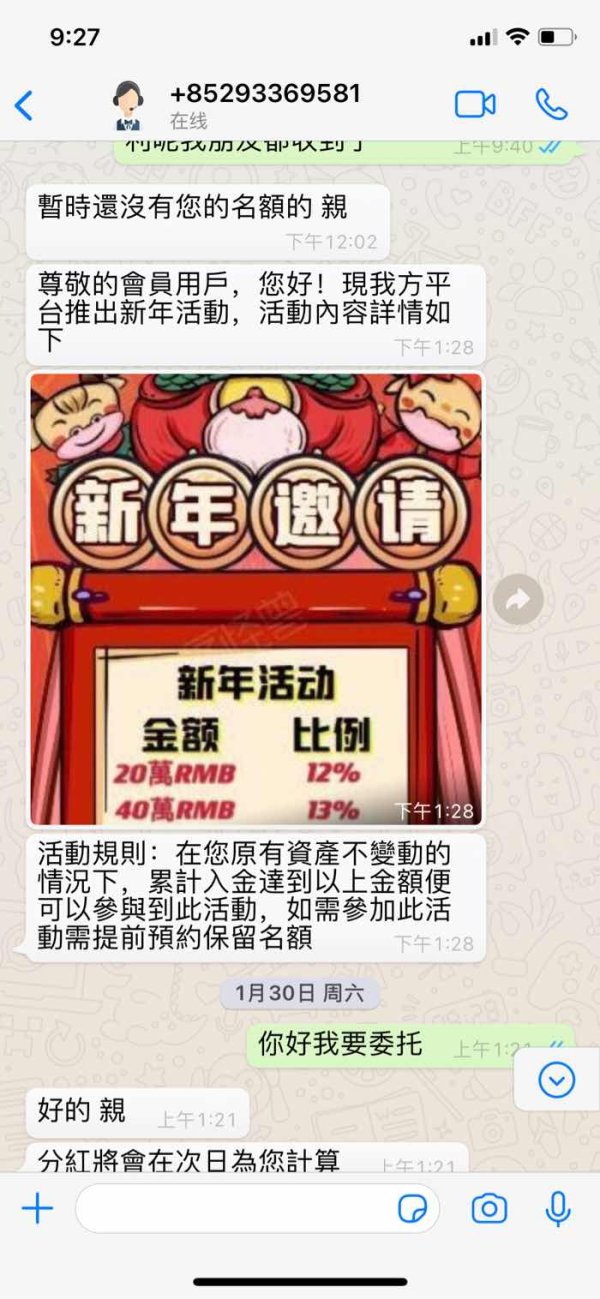

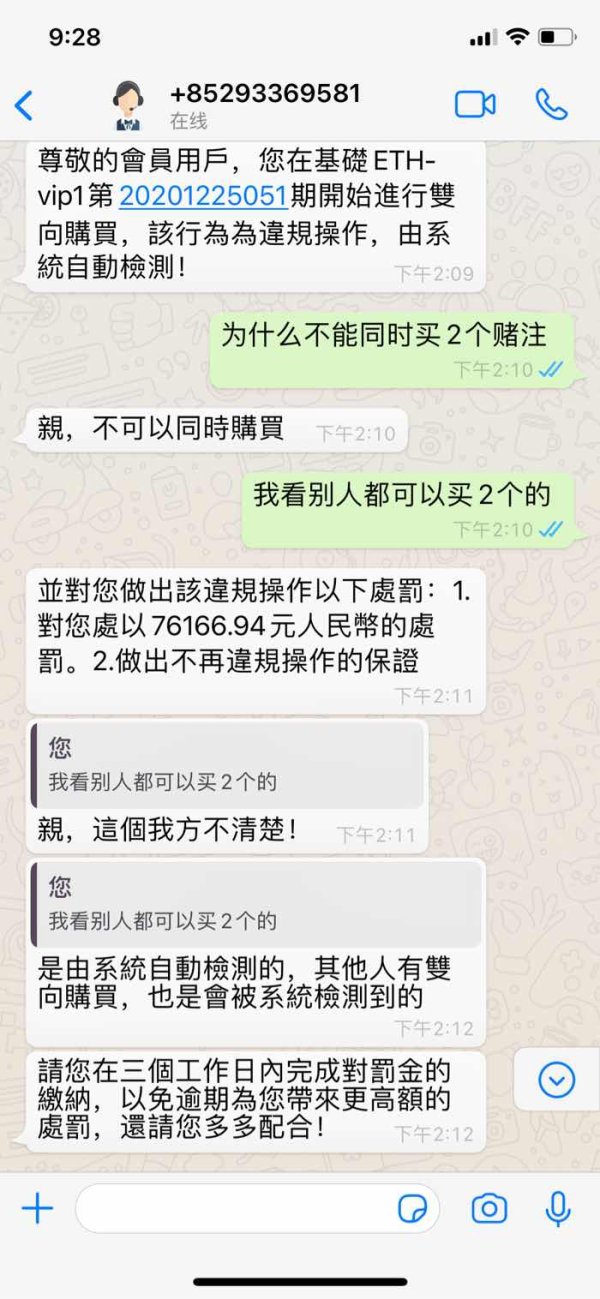

User experience with Eddid Financial appears varied based on limited available feedback, with notable concerns affecting overall perception. The absence of comprehensive user satisfaction data makes it difficult to assess overall client sentiment and identify common experience patterns, and available feedback suggests mixed experiences that range from satisfactory to concerning.

The user registration and verification process details are not clearly documented, potentially creating uncertainty for new clients about onboarding requirements and timelines. Additionally, the lack of information about platform usability, interface design, and navigation efficiency limits assessment of overall user experience quality, and common user complaints appear to center around the fraud warnings mentioned in various feedback channels, which significantly impact user confidence and trust.

The absence of detailed positive user testimonials or case studies further complicates assessment of typical user experiences. Without comprehensive user experience documentation, potential clients must rely on direct interaction to evaluate platform suitability and service quality.

Conclusion

This comprehensive eddid review reveals a broker with legitimate regulatory credentials but significant transparency challenges that potential clients must carefully consider. While Eddid Financial maintains proper licensing from the Hong Kong Securities and Futures Commission, the presence of fraud warnings and limited public information creates a complex evaluation environment requiring enhanced due diligence, and the broker may suit investors specifically seeking virtual asset trading capabilities and willing to conduct thorough research before engagement.

However, the lack of detailed information about account conditions, trading tools, and customer service standards suggests that this broker is most appropriate for experienced traders capable of independent assessment and risk management. The primary advantages include legitimate SFC regulatory status and focus on emerging virtual asset markets, while significant disadvantages include fraud warnings, limited transparency, and insufficient public information about key service aspects.