Is Humble Forex Investment safe?

Business

License

Is Humble Forex Investment Safe or Scam?

Introduction

Humble Forex Investment has emerged as a player in the forex trading market, claiming to offer traders a range of services designed to enhance their trading experience. However, as with any investment platform, it is crucial for traders to conduct thorough evaluations before committing their funds. In the volatile world of forex trading, where scams and fraudulent schemes are prevalent, understanding the legitimacy of a broker is essential. This article aims to provide a comprehensive assessment of Humble Forex Investment, utilizing various sources to analyze its regulatory status, company background, trading conditions, customer experiences, and overall safety.

Regulation and Legitimacy

One of the primary indicators of a forex broker's reliability is its regulatory status. Regulatory bodies ensure that brokers adhere to strict guidelines, offering a layer of protection for traders. Unfortunately, Humble Forex Investment operates without any valid regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The lack of regulation raises significant concerns regarding the safety of funds and the overall legitimacy of Humble Forex Investment. Regulatory bodies, such as the Financial Conduct Authority (FCA) and the Commodity Futures Trading Commission (CFTC), provide oversight that helps protect traders from potential scams. Without such oversight, traders may find it challenging to recover funds in the event of a dispute. The absence of a regulatory framework for Humble Forex Investment suggests a high-risk environment for traders, making it imperative to exercise caution.

Company Background Investigation

Humble Forex Investment is operated by Humble Security and Trading (Pty) Ltd, a company registered in South Africa. However, the details surrounding its ownership structure and management team are not readily available, leading to questions about transparency. The company appears to have been in operation for a few years, but the lack of accessible information about its history and the backgrounds of its executives raises concerns about its credibility.

A transparent company typically provides insights into its management team and operational history, which helps establish trust with potential clients. In this case, the limited information available about Humble Forex Investment could indicate a lack of transparency, further exacerbating the uncertainties surrounding its legitimacy.

Trading Conditions Analysis

When evaluating whether Humble Forex Investment is safe, it is essential to consider the trading conditions it offers. The broker claims to provide various trading accounts with different features, but specific details regarding fees and spreads are not clearly outlined.

| Fee Type | Humble Forex Investment | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information about trading costs can be a red flag for potential traders. Typically, reputable brokers are upfront about their fee structures, enabling traders to make informed decisions. The lack of transparency in this area could indicate hidden fees or unfavorable trading conditions that may not be immediately apparent.

Client Fund Safety

The safety of client funds is a critical factor when assessing whether Humble Forex Investment is safe. Reputable brokers typically implement measures such as segregated accounts and investor protection schemes to safeguard client funds. However, there is limited information available regarding Humble Forex Investment's approach to fund security.

Without clear policies on fund segregation and protection against negative balances, traders may be at risk of losing their investments. Furthermore, any historical issues related to fund security or disputes could significantly impact the broker's reputation. The absence of documented safety measures raises concerns about the overall security of client funds at Humble Forex Investment.

Customer Experience and Complaints

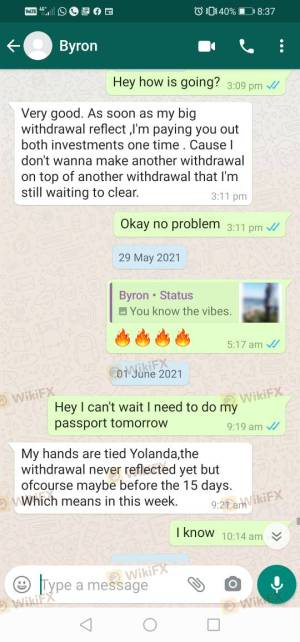

Customer feedback is invaluable when assessing the reliability of a broker. Reviews and testimonials can provide insights into the experiences of other traders. In the case of Humble Forex Investment, there are mixed reviews, with some users reporting difficulties in withdrawing funds and experiencing poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Inconsistent |

Common complaints include difficulty in accessing funds and unresponsive customer service. Such issues can be indicative of a broker that may not prioritize client satisfaction. In one notable case, a trader reported being unable to withdraw their funds despite multiple attempts to contact customer support. This raises significant concerns about the broker's commitment to resolving client issues.

Platform and Trade Execution

The trading platform's performance is another crucial aspect to consider. Traders rely on stable and efficient platforms to execute their trades effectively. However, there is limited information available regarding the performance and reliability of Humble Forex Investment's trading platform.

Without user testimonials or detailed performance metrics, it is challenging to assess the quality of order execution, potential slippage, or any signs of market manipulation. A reputable broker will typically provide detailed information about its platform capabilities, ensuring traders can make informed decisions.

Risk Assessment

Using Humble Forex Investment carries inherent risks, primarily due to its unregulated status and lack of transparency.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of clear fund protection measures |

| Customer Support Risk | Medium | Inconsistent support responses |

Traders considering this broker should be aware of the significant risks involved. To mitigate these risks, it is advisable to conduct thorough research, limit initial deposits, and consider alternative brokers with established regulatory oversight and positive customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that Humble Forex Investment raises several red flags regarding its safety and legitimacy. The absence of regulatory oversight, limited transparency, and mixed customer feedback indicate a high-risk environment for traders. While the broker may offer enticing trading conditions, the lack of fundamental protections makes it a potentially unsafe option.

For traders seeking reliable alternatives, it is advisable to consider brokers with established regulatory frameworks, transparent fee structures, and positive customer experiences. Brokers such as [insert recommended brokers] are worth exploring for those who prioritize safety and reliability in their trading endeavors. Ultimately, exercising caution and conducting thorough due diligence is essential when navigating the forex market, especially with brokers like Humble Forex Investment that exhibit signs of potential risk.

Is Humble Forex Investment a scam, or is it legit?

The latest exposure and evaluation content of Humble Forex Investment brokers.

Humble Forex Investment Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Humble Forex Investment latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.