Aeto 2025 Review: Everything You Need to Know

Executive Summary

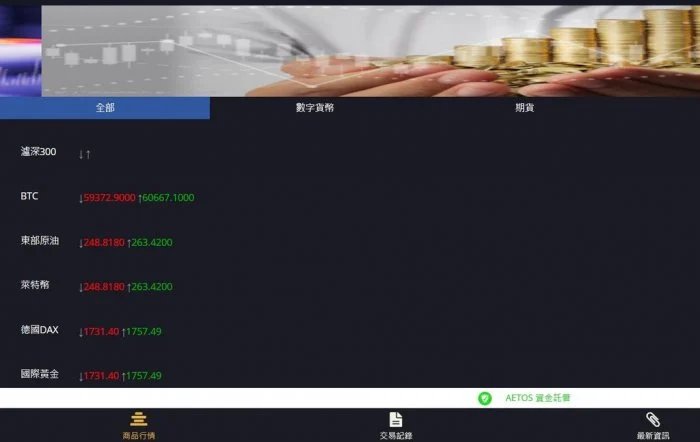

This comprehensive Aeto review examines AETOS Financial. AETOS Financial is a financial services provider that has operated in the financial planning sector for over 10 years. The company positions itself as a specialist in providing comprehensive financial planning services for both individual and corporate clients. AETOS Financial distinguishes itself through its multi-awarded team of financial advisors who bring extensive experience to personal and business financial planning.

The company's primary focus appears to be on financial advisory services rather than traditional retail trading. This sets it apart from many other financial service providers in the market. AETOS Financial emphasizes its decade-plus experience in helping clients navigate complex financial decisions and develop personalized investment strategies. However, our analysis reveals significant gaps in publicly available information regarding regulatory oversight, trading conditions, and specific service offerings. These gaps may impact investor confidence and decision-making processes for potential clients seeking transparent financial service providers.

Important Notice

Regional Entity Differences: Due to limited regulatory information available in our research, potential clients should be aware that services and legal protections may vary significantly across different jurisdictions. Investors are strongly advised to verify regulatory status and applicable investor protections in their specific region before engaging with any financial services.

Review Methodology: This evaluation is based on publicly available information and company materials. The assessment does not include independent user surveys, platform testing, or direct service evaluation. Potential clients should conduct their own due diligence and consider seeking independent financial advice before making any investment decisions.

Rating Framework

Broker Overview

Company Background and Business Model

AETOS Financial operates as a financial planning specialist with over 10 years of experience in the industry. The company has built its reputation around providing comprehensive financial planning services tailored to meet the diverse needs of both individual clients and business entities. According to available company information, AETOS Financial employs a multi-awarded team of financial advisors who work closely with clients to develop personalized financial strategies and investment approaches.

The company's business model appears to focus primarily on advisory services rather than direct trading facilitation. This positioning suggests that AETOS Financial operates more as a financial consultancy firm, helping clients navigate investment decisions and long-term financial planning rather than providing direct market access trading platforms. The emphasis on personalized service and experienced advisory teams indicates a premium service model targeting clients who value professional guidance over self-directed trading options.

Service Scope and Market Position

While specific details about trading platforms and asset classes are not clearly documented in available materials, AETOS Financial's positioning suggests a focus on comprehensive wealth management and financial planning services. The company's decade of experience and award-winning advisory team suggest an established presence in the financial services sector. However, the exact scope of services and regulatory framework remains unclear from publicly available information.

The absence of detailed information about specific trading platforms, asset classes, and regulatory oversight may indicate either a more traditional advisory model or limited public disclosure practices. This Aeto review notes that potential clients may need to engage directly with the company to obtain comprehensive details about available services and regulatory protections.

Regulatory Framework: Specific regulatory oversight and licensing information is not clearly documented in available materials. This may raise questions for clients seeking transparent regulatory protection.

Deposit and Withdrawal Methods: Payment processing options and fund transfer mechanisms are not detailed in publicly available company information.

Minimum Investment Requirements: Entry-level investment thresholds and account opening requirements are not specified in accessible materials.

Promotional Offerings: Current bonus structures, promotional campaigns, or new client incentives are not documented in available sources.

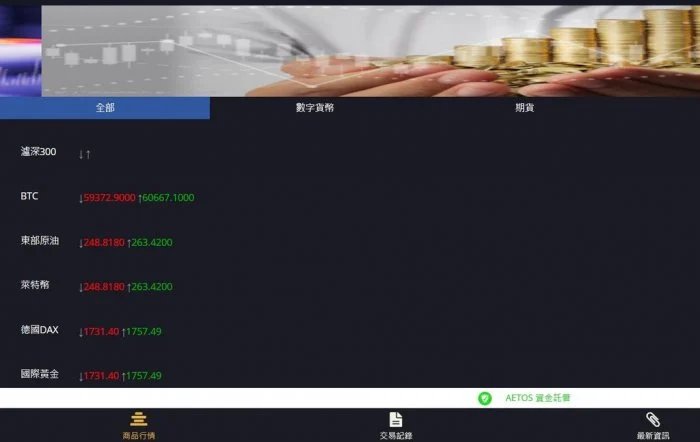

Available Asset Classes: Specific investment products, tradeable instruments, and market access options are not clearly outlined in public materials.

Fee Structure: Detailed cost breakdowns, commission rates, and service fees are not transparently disclosed in available information. This may require direct inquiry.

Leverage Options: Maximum leverage ratios and risk management parameters are not specified in accessible documentation.

Platform Selection: Trading platform options, software choices, and technological infrastructure details are not provided in available materials.

Geographic Restrictions: Service availability and regional limitations are not clearly documented in public information.

Customer Support Languages: Multilingual support options and communication preferences are not specified. However, contact information includes phone and email channels.

This Aeto review identifies significant information gaps that potential clients should address through direct communication with the company before making service decisions.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions for AETOS Financial presents significant challenges due to limited publicly available information. Traditional account analysis typically examines factors such as minimum deposit requirements, account tier structures, Islamic account availability, and special features designed for different client segments. However, our comprehensive Aeto review finds that specific account terms and conditions are not detailed in accessible company materials.

The absence of clear account structure information may indicate that AETOS Financial operates on a more personalized advisory model where account conditions are tailored to individual client needs rather than standardized packages. This approach could benefit clients seeking customized solutions but may lack the transparency that many investors expect when comparing financial service providers. The company's focus on financial planning services suggests that account structures may be more flexible and consultation-based rather than following traditional trading account models.

Without specific information about account opening procedures, verification requirements, or ongoing account maintenance terms, potential clients cannot make informed comparisons with other service providers. This information gap represents a significant limitation for clients who prefer to understand all terms and conditions before engaging with financial services.

The assessment of trading tools and analytical resources available through AETOS Financial is constrained by limited public information about the company's technological infrastructure and research capabilities. Typically, financial service providers offer various tools including market analysis software, economic calendars, research reports, and educational materials to support client decision-making processes.

Given AETOS Financial's positioning as a financial planning specialist with a multi-awarded advisory team, it's reasonable to expect that the company provides sophisticated analytical resources and planning tools. However, specific details about proprietary research capabilities, third-party analytical tools, or educational resources are not documented in available materials. This may suggest either a more personalized consultation-based approach or limited public disclosure of available resources.

The decade of experience claimed by the company implies accumulated expertise and potentially sophisticated analytical capabilities. However, without specific information about tools and resources, clients cannot evaluate the technological infrastructure supporting their financial planning services. This represents another area where direct inquiry with the company would be necessary to understand available support tools.

Customer Service and Support Analysis

Customer service evaluation for AETOS Financial reveals basic contact information including telephone and email support channels. The company provides a specific phone number 0905-FINANCE or 0905-3462623 and email address customercare@aetosfph. However, comprehensive service quality metrics, response time guarantees, and support availability hours are not documented in available materials.

The provision of dedicated customer care contact information suggests an established support infrastructure. However, the quality and responsiveness of these services cannot be assessed without user feedback data or service level commitments. The company's emphasis on personalized financial planning services may indicate a more consultative support approach compared to traditional trading platforms that focus on technical support and order execution assistance.

The absence of information about multilingual support, 24/7 availability, or online chat options may indicate limitations in service accessibility for international clients or those requiring immediate assistance. The focus on phone and email support suggests a more traditional communication approach that may suit clients preferring direct personal contact but could be insufficient for clients expecting immediate digital support options.

Trading Experience Analysis

Evaluating the trading experience with AETOS Financial proves challenging due to the absence of specific information about platform stability, execution quality, and trading infrastructure. Traditional trading experience assessment examines factors such as order execution speed, platform reliability, mobile application functionality, and overall trading environment quality.

The company's positioning as a financial planning specialist suggests that direct trading may not be the primary service focus. This could explain the limited information about trading platform features and execution capabilities. If AETOS Financial operates primarily as an advisory service, the "trading experience" may be more accurately characterized as a consultation and planning experience rather than direct market access.

This Aeto review notes that without specific platform performance data, user experience feedback, or technical infrastructure details, potential clients cannot assess the quality of any trading services that may be available. The emphasis on financial planning and advisory services suggests that clients may receive guidance and recommendations rather than direct trading platform access. This represents a fundamentally different service model.

Trust Factor Analysis

Trust factor assessment for AETOS Financial reveals mixed indicators that require careful consideration. On the positive side, the company claims over 10 years of experience in financial planning and promotes a "multi-awarded team of financial advisors." This suggests industry recognition and established expertise. These credentials, if verified, could support confidence in the company's professional capabilities and track record.

However, significant trust concerns arise from the absence of clear regulatory information in publicly available materials. Regulatory oversight represents a fundamental trust factor for financial service providers. The lack of transparent regulatory credentials may raise questions about investor protection and compliance standards. Without specific regulatory licensing information, clients cannot verify the legal framework governing their relationship with the company.

The combination of claimed industry experience and awards alongside limited regulatory transparency creates a complex trust profile that requires individual client assessment. Potential clients should prioritize verifying regulatory status and industry credentials through independent sources before engaging with the company's services.

User Experience Analysis

User experience evaluation for AETOS Financial is significantly limited by the absence of documented client feedback, satisfaction surveys, or user experience metrics in available materials. Comprehensive user experience assessment typically includes factors such as ease of registration, platform usability, customer satisfaction ratings, and common user complaints or compliments.

The company's focus on personalized financial planning services suggests a potentially high-touch user experience that emphasizes direct advisor interaction rather than self-service digital platforms. This approach may appeal to clients who value personal relationships and customized service but may not suit users who prefer independent platform access and automated services.

Without specific user feedback data or experience metrics, this Aeto review cannot provide definitive conclusions about client satisfaction levels or service quality from the user perspective. The absence of public testimonials or case studies may indicate either privacy-focused service delivery or limited public engagement. Both of these present challenges for prospective clients seeking user experience insights.

Conclusion

This comprehensive evaluation of AETOS Financial reveals a company with claimed industry experience and professional credentials but significant information gaps that impact assessment reliability. The company's positioning as a financial planning specialist with over 10 years of experience and a multi-awarded advisory team suggests potential value for clients seeking personalized financial guidance and planning services.

However, the absence of transparent regulatory information, detailed service terms, and user feedback data presents notable limitations for potential clients seeking comprehensive service evaluation. AETOS Financial appears most suitable for clients who prioritize personalized advisory relationships and are comfortable conducting thorough due diligence through direct company engagement rather than relying on publicly available information.

The primary advantages appear to be experienced advisory personnel and a decade of claimed industry presence. The main disadvantages include limited transparency regarding regulatory oversight and service terms. Prospective clients should prioritize verifying regulatory credentials and obtaining detailed service information through direct consultation before making engagement decisions.