Is aeto safe?

Pros

Cons

Is Aeto A Scam?

Introduction

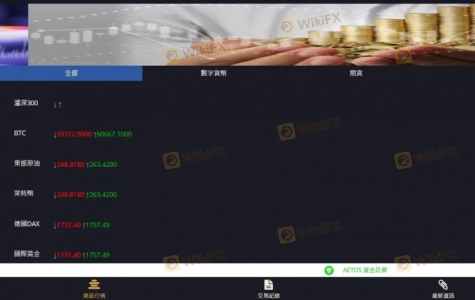

Aeto is a global forex and CFD broker that has established itself as a player in the financial markets since its inception in 2007. With its headquarters in Sydney, Australia, and additional offices in the UK and China, Aeto aims to provide traders with access to a diverse range of financial instruments, including currencies, indices, and commodities. In an industry rife with unregulated entities and potential scams, it is crucial for traders to conduct thorough due diligence before selecting a broker. This article seeks to answer the question, "Is Aeto safe?" by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a comprehensive review of various online resources, user testimonials, and expert analyses.

Regulation and Legitimacy

Aeto operates under several regulatory frameworks, which enhances its credibility in the forex trading landscape. Regulation is a key factor in ensuring that brokers adhere to strict operational guidelines, providing a level of security for traders. Aeto is regulated by the Australian Securities and Investments Commission (ASIC) and the UK's Financial Conduct Authority (FCA), both of which are recognized as top-tier regulatory bodies. Below is a summary of Aeto's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 313016 | Australia | Verified |

| FCA | 592778 | United Kingdom | Verified |

| VFSC | 700450 | Vanuatu | Verified |

The importance of such regulation cannot be overstated. ASIC and FCA impose stringent compliance requirements, including the segregation of client funds and regular audits, which significantly reduce the risk of fraud. Aeto's adherence to these regulations indicates a commitment to maintaining a trustworthy trading environment. However, it is worth noting that while Aeto is regulated in Australia and the UK, it also operates under the Vanuatu Financial Services Commission (VFSC), which is considered a lower-tier regulator. This dual-regulatory structure raises questions about the consistency of investor protection across different jurisdictions.

Company Background Investigation

Aeto was founded in 2007 and has since grown to become a significant player in the online trading space. The company is a wholly-owned subsidiary of Aeto Capital Group, which operates under multiple brands across various regions. The management team at Aeto comprises experienced professionals with backgrounds in finance, trading, and technology, which adds to the broker's credibility. The company emphasizes transparency, offering clear information about its services and fees on its website.

Aeto's operational history reflects a commitment to providing quality trading services. However, the company has faced criticism for its limited educational resources, which may be a disadvantage for novice traders seeking comprehensive training materials. Despite this, Aeto does provide some market analysis and research tools, which can aid traders in making informed decisions. Overall, the company's transparent ownership structure and experienced management team contribute positively to its reputation, answering the question of whether Aeto is safe for traders.

Trading Conditions Analysis

When evaluating whether Aeto is a safe choice for trading, it is essential to examine its trading conditions. Aeto offers a competitive fee structure, but it is crucial to understand the specifics of its costs. The broker operates on a spread-based model, with spreads starting from 1.8 pips for major currency pairs like EUR/USD. Below is a comparison of Aeto's core trading costs:

| Cost Type | Aeto | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies by broker |

| Overnight Interest Range | Varies | Varies by broker |

While Aeto's spreads are slightly higher than the industry average, it is important to note that the broker does not charge commissions on trades, which can make trading more cost-effective for some traders. However, potential hidden fees, such as withdrawal fees and inactivity charges, may apply, which traders should be aware of. Overall, Aeto's trading conditions appear reasonable, but traders should always read the fine print to avoid unexpected costs.

Customer Funds Security

The safety of client funds is a paramount concern for any trader. Aeto employs several measures to ensure the security of its clients' funds. The broker keeps client funds in segregated accounts with reputable banks, which protects traders' capital in the event of the company's insolvency. Additionally, Aeto provides negative balance protection, ensuring that clients cannot lose more than their deposited amounts.

Aeto is also a member of the Financial Services Compensation Scheme (FSCS) in the UK, which offers additional protection for clients in case of broker failure. This compensation scheme covers eligible claims up to a certain limit, providing peace of mind for traders. However, it is essential to note that not all regulatory bodies provide the same level of investor protection, and Aeto's operations under the VFSC may not offer the same safeguards as those under ASIC or FCA.

Customer Experience and Complaints

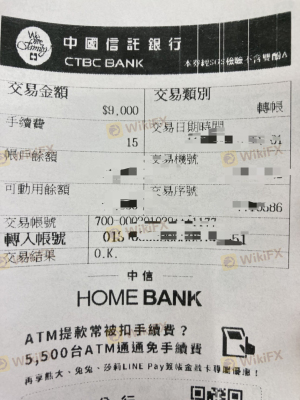

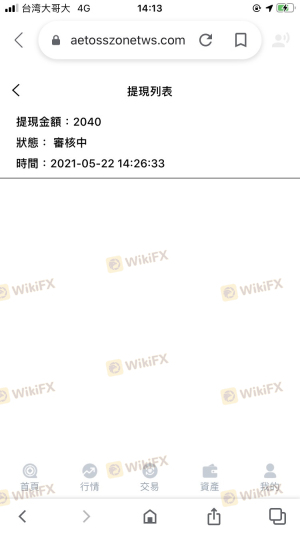

Customer feedback is a valuable indicator of a broker's reliability. Aeto has received mixed reviews from users, with some praising its trading conditions and customer support, while others have raised concerns about withdrawal processes and responsiveness. Common complaint patterns include delays in withdrawals and issues with customer service communication. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed responses |

| Customer Service Issues | Medium | Slow response time |

| Platform Stability | Low | Generally stable |

For instance, several users have reported difficulties in withdrawing funds, claiming that they faced delays and unresponsive customer service. While Aeto has made efforts to address these issues, the recurring nature of such complaints raises questions about the broker's operational efficiency. Overall, while Aeto does provide a generally reliable trading environment, potential clients should consider these user experiences and proceed with caution.

Platform and Trade Execution

Aeto utilizes the widely respected MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are known for their advanced features and user-friendly interfaces. The performance and stability of these platforms are generally well-regarded, providing traders with a reliable environment for executing trades. However, some users have reported instances of slippage and rejected orders, which can be frustrating for traders.

The execution quality at Aeto is generally good, but traders should be aware that market conditions can impact order fulfillment. During periods of high volatility, slippage may occur, leading to differences between the expected and actual execution prices. While this is a common occurrence across many brokers, it is essential for traders to be mindful of these risks when trading with Aeto.

Risk Assessment

Using Aeto as a trading platform does come with its risks. While the broker is regulated and offers several protective measures, potential clients should be aware of the following risk factors:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Lower-tier regulation in Vanuatu may not offer the same protection as ASIC or FCA. |

| Withdrawal Issues | High | Reports of withdrawal delays and customer service responsiveness. |

| Trading Costs | Medium | Slightly higher spreads compared to industry averages. |

To mitigate these risks, traders are advised to start with a demo account to familiarize themselves with the trading platform, ensure they understand the fee structure, and keep abreast of any regulatory changes affecting Aeto.

Conclusion and Recommendations

In conclusion, Aeto is not a scam; it is a regulated broker with a solid operational framework. However, potential clients should remain vigilant and consider the mixed reviews regarding customer service and withdrawal processes. The regulatory oversight from ASIC and FCA provides a level of security, but traders should be cautious of the risks associated with operating under the VFSC.

For traders seeking alternatives, consider brokers with strong reputations, such as IG, OANDA, or Pepperstone, which offer competitive trading conditions and robust customer support. Ultimately, whether Aeto is the right choice for you depends on your trading needs and risk tolerance. Always conduct thorough research and consider starting with a smaller investment to gauge the broker's reliability before committing significant capital.

Is aeto a scam, or is it legit?

The latest exposure and evaluation content of aeto brokers.

aeto Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

aeto latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.