Is KDFX safe?

Pros

Cons

Is KDFX Safe or a Scam?

Introduction

KDFX is an online forex broker that has been gaining attention in the trading community. Operating under the name KDFX Company Limited, it claims to offer various trading instruments, including forex pairs, stocks, and CFDs. However, with the rise of online trading platforms, it has become increasingly important for traders to conduct thorough research before engaging with any broker. This is particularly true for KDFX, as there are numerous reports questioning its legitimacy and safety. In this article, we will investigate KDFX's regulatory status, company background, trading conditions, customer experiences, and overall risk profile to determine whether KDFX is safe for traders or if it operates as a scam.

Our analysis is based on information gathered from multiple credible sources, including regulatory databases, user reviews, and expert assessments. By employing a structured evaluation framework, we aim to provide a comprehensive overview of KDFX's operations, ultimately answering the pressing question: Is KDFX safe?

Regulatory and Legitimacy

One of the most critical factors in assessing the safety of any broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to industry standards and practices. KDFX claims to be registered in the UK and also states that it operates under the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. However, a closer examination reveals a troubling lack of valid regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Not Registered |

| SVG FSA | N/A | Saint Vincent and the Grenadines | Not Licensed |

The Financial Conduct Authority (FCA) has no record of KDFX being registered or regulated, which raises significant concerns about the broker's legitimacy. Furthermore, the SVG FSA does not issue licenses to forex and CFD brokers, making KDFX's claims misleading. Without proper regulation, traders are left vulnerable to potential fraud and mismanagement of their funds. This lack of oversight is a major red flag, indicating that KDFX may not be a safe option for traders.

Company Background Investigation

KDFX Company Limited is based in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. This raises questions about the company's transparency and commitment to ethical practices. The lack of detailed information regarding the company's ownership structure and management team further complicates the assessment of its credibility.

KDFX's website provides minimal insight into its history and operational framework, leaving potential clients in the dark about who is managing their investments. This lack of transparency is concerning, as it hinders traders from making informed decisions. A reputable broker typically discloses information about its founders, management team, and operational history, which is crucial for establishing trust.

Additionally, the absence of clear communication channels and customer support options limits the ability of traders to seek assistance or clarification about their accounts. This opacity raises concerns about KDFX's reliability and whether it can be considered a safe trading environment.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fee structures is vital. KDFX presents itself as an attractive option with low spreads and high leverage, but the reality may be more complicated. The broker advertises spreads as low as 0.3 pips, but it is essential to verify these claims against industry standards.

| Fee Type | KDFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

While KDFX's spreads may seem competitive, the lack of clarity regarding commissions and overnight interest rates raises concerns. Traders should be wary of hidden fees that could significantly affect their profitability. Additionally, KDFX's high leverage offerings, up to 1:1000, can amplify both gains and losses, increasing the overall risk of trading with this broker.

Customer Funds Security

The safety of customer funds is paramount when choosing a broker. KDFX claims to implement various security measures, but the lack of regulatory oversight raises questions about the effectiveness of these protections. Typically, regulated brokers are required to maintain client funds in segregated accounts, ensuring that traders' money is protected in case of insolvency.

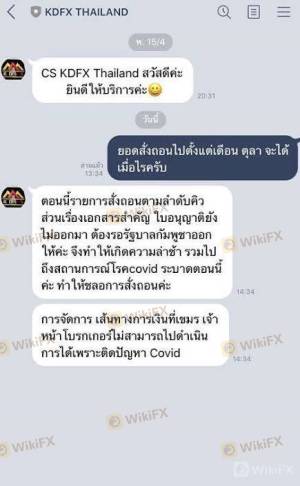

Unfortunately, KDFX does not provide clear information regarding its fund protection policies, including whether it offers negative balance protection or investor compensation schemes. This lack of information is alarming, especially given the broker's unregulated status. Historical complaints regarding withdrawal issues and fund mismanagement further exacerbate concerns about the security of customer funds.

Customer Experience and Complaints

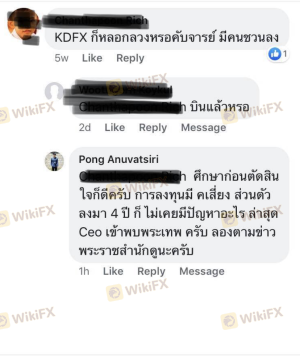

Analyzing customer feedback is crucial in assessing a broker's reliability. Reviews of KDFX indicate a troubling pattern of dissatisfaction among users. Many traders report difficulties in withdrawing funds, with some claiming that their requests were ignored or delayed.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Response | Medium | Inadequate |

| Transparency Concerns | High | Poor |

Typical complaints include unresponsive customer support, withdrawal delays, and a lack of transparency regarding fees and trading conditions. One user recounted their experience of being unable to access their funds after repeated attempts to withdraw, highlighting the potential risks associated with trading through KDFX.

Platform and Trade Execution

The trading platform offered by KDFX is a critical aspect of the trading experience. The broker claims to provide access to the popular MetaTrader 4 platform, known for its user-friendly interface and advanced trading tools. However, user reviews suggest that the platform may suffer from stability issues and slow execution speeds.

Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. Additionally, the lack of transparency regarding order execution policies raises concerns about potential manipulation or unfair practices. These issues further contribute to the overall risk associated with trading on the KDFX platform.

Risk Assessment

Engaging with KDFX carries inherent risks that potential traders should consider. The lack of regulation, unclear fee structures, and negative customer feedback create a precarious trading environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Financial Risk | High | Potential for hidden fees and losses |

| Operational Risk | Medium | Platform stability and execution issues |

To mitigate these risks, it is advisable for traders to conduct thorough research and consider alternative, regulated brokers with a proven track record. Engaging with a broker that offers clear communication, transparent fees, and robust customer support is essential for a safer trading experience.

Conclusion and Recommendations

In summary, KDFX presents numerous red flags that indicate it may not be a safe trading option. The lack of regulatory oversight, transparency issues, and negative customer experiences suggest that traders should exercise extreme caution.

For those considering trading with KDFX, it is crucial to weigh the risks carefully and explore alternative brokers that are fully regulated and have established a reputation for reliability. Reputable options include brokers regulated by the FCA or ASIC, which provide greater security for traders' funds and a more trustworthy trading environment.

Ultimately, the question remains: Is KDFX safe? Based on the evidence presented, it is prudent for traders to approach KDFX with skepticism and consider more secure alternatives in the forex market.

Is KDFX a scam, or is it legit?

The latest exposure and evaluation content of KDFX brokers.

KDFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KDFX latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.