ba capital 2025 Review: Everything You Need to Know

Summary

BA Capital is an investment firm that focuses on risky ventures in consumer-related industries. The firm mainly works in the Chinese market, putting money into sectors like food and beverage, retail, and hospitality. According to available data, they target companies from early stages to later stages, especially those that work well in smaller Chinese cities. This focus on consumer sectors forms the core of their business model. However, we found no specific details about forex trading conditions, which makes our overall evaluation of BA Capital neutral with limited insights into trading platforms or account conditions.

The firm's focus on China's growing consumer market may interest investors who like these industries. Still, the lack of detailed information means investors should be careful. This is our first "ba capital review," and it shows that potential investors need to get more details before fully engaging with the firm.

Important Considerations

BA Capital operates through multiple companies across different regions like China and the United States. This could create differences in their business models and regulatory oversight. Our evaluation uses only the information we can currently access, so some parts of this review might be incomplete or could change later.

The lack of clear regulatory and operational details means investors should do more research on their own. This review relies strictly on available information and should be considered as one view among many when looking at BA Capital's offerings. Due to missing details about trading conditions, platform specifics, and other key features, we cannot provide a complete picture of what this firm offers.

Rating Framework

Broker Overview

Company Background

BA Capital started in 2016 with its China-based company. The US-based operation, BA Capital Management LLC, began in 2019, and the firm mainly works as a venture capital business that puts money into consumer-related sectors across China.

Its investment portfolio covers many industries, including food and beverage, retail, and hospitality, showing its commitment to helping consumer-driven companies grow from early stages to more advanced phases. BA Capital focuses strongly on finding highly efficient companies in emerging smaller cities in China. This positions the firm as an attractive partner for businesses that want to deliver great on-the-ground experiences, but the firm does not provide clear information about foreign exchange trading or related account offerings.

This forms part of our broader "ba capital review," where we focus on the firm's venture capital activity rather than traditional brokerage services.

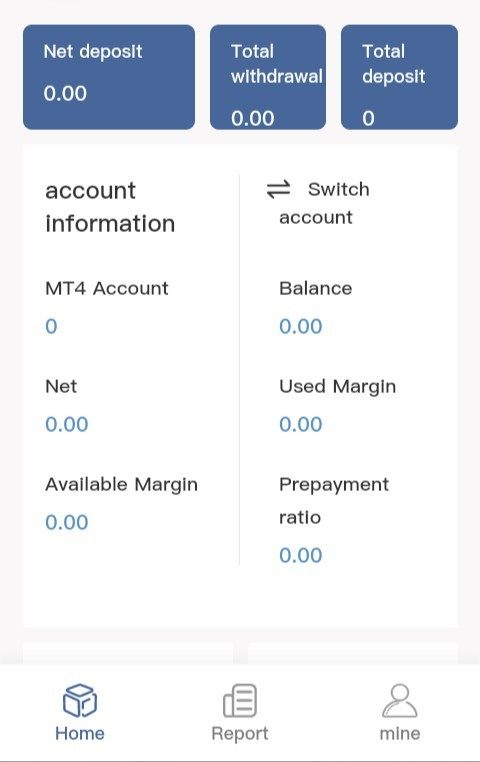

BA Capital works well in the venture capital area, but specific details about its trading platform are not available. There is no clear information on the types of assets available for trading, and there is no mention of specific trading platforms or execution systems they use.

Similarly, we don't know which regulatory authorities oversee them, as detailed regulatory oversight and licensing details are not provided in available materials. The focus stays on its role as an investment advisor and risk venture specialist in the consumer sector rather than an active forex broker. This lack of clear information about operational details and trading environments is noted in this second "ba capital review" and means those seeking more complete brokerage features should ask more questions.

Regulatory Regions

The available information does not name specific regulatory bodies that oversee BA Capital's operations. The firm works under different companies in both China and the United States, which may put it under different regulatory rules, but no detailed regulatory credentials or licenses have been provided.

This gap makes it hard for investors to check the degree of oversight given by local financial authorities. As such, the regulatory environment remains unclear in the current review of BA Capital.

Deposit and Withdrawal Methods

There is no detailed information on deposit and withdrawal methods available for BA Capital. The firm focuses on investment and capital management rather than retail trading, and specifics about payment systems, accepted currencies, or transaction speeds are not detailed in accessible sources.

Therefore, potential investors should expect to ask more questions about the firm's financial transaction capabilities.

Minimum Deposit Requirements

The review found no information about minimum deposit requirements for starting an account or investment with BA Capital. The lack of specified entry amounts reinforces that the firm's main area is risk capital investments rather than regular trading accounts.

This leaves a gap for those interested in traditional deposit models.

No bonus or promotional offers have been disclosed in available documentation for BA Capital. While many brokers include incentives to attract new clients, BA Capital does not appear to provide such promotions, which might be due to the firm's focus on venture capital in the consumer sector rather than establishing a traditional brokerage model.

Therefore, bonus details remain unreported in this "ba capital review."

Tradable Assets

There is no specific information about the types of tradable assets available through BA Capital. Unlike traditional brokerage firms that advertise many asset classes including forex, indices, and commodities, BA Capital's communications focus on its investments in consumer companies.

As a result, potential traders should note that the platform does not clearly state any offerings in regular asset classes from a trading perspective.

Cost Structure

Details about the cost structure, including commission fees, spreads, or other transaction-related charges, are not provided. In typical forex broker reviews, cost transparency is crucial for evaluating trading viability, but BA Capital's focus appears to be on high-level investment in consumer sectors.

Accordingly, investors should be aware that the absence of a detailed cost structure can make it hard to fully assess potential trading expenses. The information gap here shows BA Capital's venture investment approach over retail brokerage operations.

Leverage Ratios

There is no disclosure of leverage ratios or margin requirements in current data on BA Capital. The lack of information on such key trading parameters further shows the firm's difference from standard brokerage service models.

Investors interested in leveraged trading should note that this aspect is not addressed by BA Capital, reflecting its core focus on long-term investments rather than short-term speculative trading.

The firm does not provide details on available trading platforms that investors might use. There is no information on whether BA Capital supports web-based platforms, mobile trading applications, or proprietary trading software, and the absence of such specifics suggests that trading platform options are not the firm's main area of focus.

Therefore, thorough platform comparisons are difficult to make based on current available data.

Regional Restrictions

There is no mention of any regional restrictions regarding trading or account management with BA Capital. Given that the firm operates in multiple regions, potential investors should remain careful and seek clarification on any geographical limitations or specific requirements related to their location.

The lack of detailed geographic restriction information leaves a notable gap in this review.

Customer Service Language

The specifics regarding customer service language options offered by BA Capital are not provided. Whether they provide multi-language support, especially for international investors, remains unclear, so investors may find it necessary to contact the firm directly for clarification on the languages in which customer support is available.

Detailed Rating Analysis

2.6.1 Account Conditions Analysis

The available information on BA Capital does not include specifics about account types, minimum deposit amounts, or the detailed process for opening an account. This makes a complete evaluation challenging, and in traditional broker reviews, these elements are critical for understanding the suitability of trading conditions offered.

BA Capital's profile focuses mainly on investment in consumer sectors rather than retail forex trading. The absence of detail about specialized account features, such as Islamic accounts or dedicated investment streams, further limits our ability to perform an in-depth analysis, and user feedback and comparative studies with other traditional brokers are not available either.

Hence, the complete picture of account conditions is unclear. This limitation is a significant factor in this "ba capital review," highlighting the need for potential clients to seek additional details if traditional trading conditions are a decisive factor in their investment strategy.

There is very limited information about the range and quality of trading tools provided by BA Capital. In typical broker evaluations, one expects to find details on charting software, real-time data feeds, economic calendars, and other analytical resources that help in making informed trading decisions, but BA Capital's focus appears to be on long-term venture investments rather than facilitating an active trading environment.

There is no mention of educational materials or automated trading functions that many forex brokers offer. Additionally, the absence of strong research and analysis tools, as well as any multi-functional trading platforms, significantly hurts the ability to assess the practical benefits for an active trader, and without user feedback or expert analyses available, this deficiency forms a notable gap in our review.

This makes it challenging to compare BA Capital directly against traditional brokers who offer complete trading tools. As a result, the evaluation of its resources remains unclear in this "ba capital review."

2.6.3 Customer Service and Support Analysis

Customer support is a vital aspect of any brokerage service, yet BA Capital provides no clear details about its customer service channels or support availability. There is no evidence of live chat, telephone support, or email communication, and there is no information on response times and service quality.

This absence of data extends to details on multi-language support which is generally important for a diverse investor base. Moreover, there have been no reported user feedback or case studies showing how customer issues are resolved, making it challenging to gauge the efficiency and dependability of the support system, and without this key information, the overall customer support experience remains unclear.

The lack of any operational details on how customer service is managed further complicates the evaluation of this essential aspect. This affects this segment of the "ba capital review" negatively.

2.6.4 Trading Experience Analysis

When assessing the trading experience, many factors including platform stability, speed of execution, order processing, and the overall user interface play critical roles in determining service quality. However, BA Capital's materials do not cover these aspects, leaving potential investors with an incomplete picture of the efficiency and responsiveness of their trading environment.

There is no information available on the consistency of order execution speeds, potential slippage issues, or even the reliability of trade connectivity. Moreover, mobile trading or the integration of innovative trading features appears undocumented, and in the absence of concrete performance metrics and specific user experiences, evaluating the true trading experience becomes a matter of guesswork.

This lack of operational detail is a critical shortfall in the current "ba capital review," as it fails to address fundamental aspects that affect both casual and experienced traders. As a result, investors seeking a detailed, performance-based trading assessment may find the available information insufficient for making an informed decision.

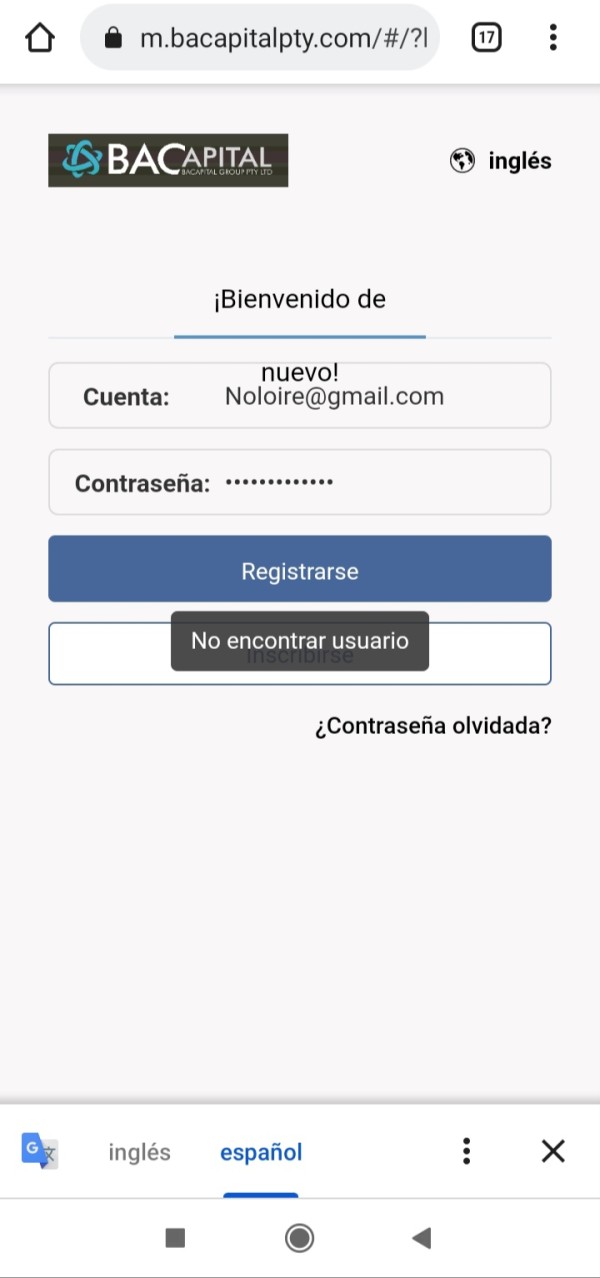

2.6.5 Trustworthiness Analysis

Trust and transparency are extremely important in the financial services industry, yet BA Capital does not provide clearly accessible information about regulatory oversight or security measures. There is no disclosure of a regulatory license or any association with well-known financial authorities, which leaves questions about fund safety and investor protection unanswered.

Investors usually rely on rigorous regulatory validation and third-party evaluations to establish trust, but in this instance, such assurances are missing. Additionally, there are no specific details about how client funds are separated or protected in the event of financial instability, and the absence of historical user feedback or independent third-party ratings further complicates the trust evaluation.

As such, while BA Capital does show a focused investment strategy, the current lack of transparent trust measures constitutes a significant drawback in this "ba capital review." This is particularly true for investors prioritizing safety and regulatory reliability in their investment decisions.

2.6.6 User Experience Analysis

The overall user experience typically includes aspects such as ease of navigation, registration processes, intuitive platform design, and the simplicity of executing financial transactions. Unfortunately, BA Capital does not offer sufficient detail about these elements, and there is no mention of the efficiency or user-friendliness of its trading interface.

There is also no description of the account verification process, which is crucial for ensuring an efficient user journey. In addition, there is a lack of commentary on common user complaints, difficulties encountered during fund operations, or even general satisfaction levels, and this absence of feedback and quantifiable data makes it challenging to form a complete picture of the end-user experience.

Such a gap is particularly important given that a straightforward, user-friendly platform is essential for both novice and experienced investors. Consequently, from a user interface and design perspective, the practical details remain unclear, which detracts from the overall assessment in this "ba capital review." This calls for more complete insights to truly gauge user satisfaction.

Conclusion

In summary, BA Capital's focus on risk venture investments in China's consumer sector sets it apart from traditional forex brokers. However, the clear absence of detailed information about trading conditions, account types, regulatory oversight, and customer support complicates a definitive recommendation.

This review suggests that BA Capital may be more suitable for investors interested in China's consumer market rather than those seeking strong forex trading platforms. While the firm's advantages lie in its strategic investment focus, the significant information gaps pose notable limitations, so investors are advised to conduct further research before proceeding.