Is CITIBANK safe?

Pros

Cons

Is Citibank A Scam?

Introduction

Citibank, a prominent global financial institution, has established a significant presence in the forex market. As one of the largest banks in the world, it offers a variety of financial services, including currency trading. However, the complexities and risks associated with forex trading necessitate that traders exercise caution when evaluating brokers. The potential for scams and fraudulent activities in the forex market is high, making it essential for traders to conduct thorough due diligence before engaging with any broker. This article aims to provide an objective analysis of Citibank's credibility as a forex broker, utilizing various data sources, regulatory information, and customer feedback to determine whether Citibank is safe or a scam.

Regulation and Legitimacy

The regulatory framework surrounding a broker is crucial in assessing its legitimacy and safety. A well-regulated broker is more likely to adhere to industry standards, ensuring the protection of client funds and fair trading practices. Citibank claims to operate under the regulations of various financial authorities, but the specifics can often be unclear. Below is a summary of Citibank's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFTC | N/A | United States | Verified |

| FCA | N/A | United Kingdom | Not Verified |

| ASIC | N/A | Australia | Not Verified |

While Citibank is regulated in the United States by the Commodity Futures Trading Commission (CFTC), it lacks specific licenses from other major regulatory bodies like the FCA or ASIC, which raises concerns about its operations in those regions. The absence of a top-tier regulatory license could indicate potential risks for traders, as brokers regulated by stringent authorities are generally subject to more rigorous compliance and oversight. Furthermore, the lack of transparency regarding Citibank's regulatory status in various regions suggests that traders should exercise caution and conduct further research to determine if Citibank is safe for forex trading.

Company Background Investigation

Citibank has a rich history dating back to its establishment in 1812, making it one of the oldest banking institutions in the United States. Over the years, it has evolved into a multinational corporation, providing a wide range of financial services, including investment banking, wealth management, and retail banking. Citibank is a subsidiary of Citigroup Inc., which is publicly traded and has a diverse ownership structure. The management team comprises experienced professionals with extensive backgrounds in finance and banking, contributing to Citibank's reputation as a reputable institution.

Despite its long-standing presence in the financial sector, there are concerns regarding the transparency of its operations. Some users have reported difficulty accessing information about the company's internal policies and practices, raising questions about its commitment to transparency. This lack of clarity may lead traders to wonder if Citibank is safe for their investments. As such, potential clients are encouraged to seek out additional information and reviews from reliable sources to gain a comprehensive understanding of Citibank's operations and reputation.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for traders looking to maximize their trading potential. Citibank's fee structure and trading conditions have been a point of contention among users. While it advertises competitive trading fees, some users have reported hidden costs and unclear pricing models. Below is a comparison of Citibank's core trading costs:

| Fee Type | Citibank | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 2-4 pips | 1-3 pips |

| Commission Model | None | $5 - $10 per trade |

| Overnight Interest Range | 0.5% - 1% | 0.2% - 0.5% |

The spreads offered by Citibank are higher than the industry average, which could diminish profit margins for traders. Additionally, the absence of a clear commission model may lead to confusion and unexpected costs, prompting traders to question if Citibank is safe in terms of cost transparency. Such discrepancies can impact trading strategies and overall profitability, making it essential for traders to fully understand the fee structure before committing to Citibank.

Client Funds Security

The safety of client funds is a paramount concern for traders. Citibank claims to implement various security measures to protect client assets, including segregated accounts and investor protection policies. However, the effectiveness of these measures is often scrutinized. Citibank does not provide comprehensive information regarding its fund segregation practices or the extent of investor protection available to clients.

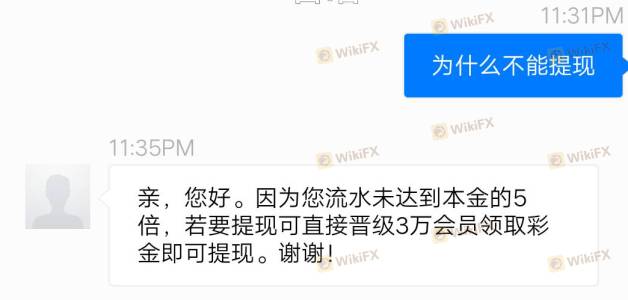

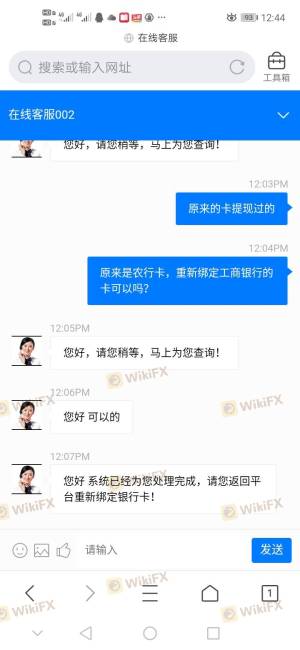

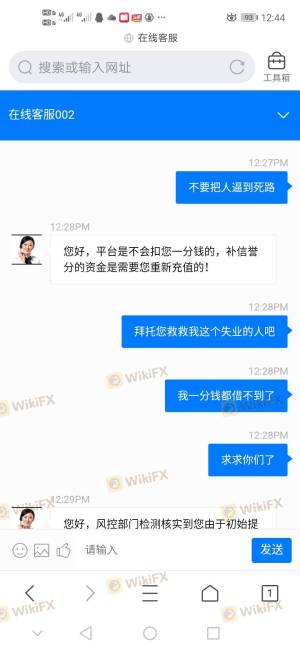

Historically, there have been reports of clients facing difficulties in withdrawing funds, which raises red flags regarding the security of their investments. A detailed analysis of Citibank's fund security policies reveals a lack of clarity, leading potential clients to question if Citibank is safe for their trading activities. It is crucial for traders to assess the bank's financial stability and any historical issues related to fund security before proceeding with their investments.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability and service quality. Citibank has received mixed reviews from clients, with some praising its user-friendly platform and responsive customer service, while others have raised concerns about withdrawal issues and unaddressed complaints.

The following table summarizes common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Hidden Fees | Medium | Unclear Policies |

| Customer Service Quality | Low | Generally Positive |

Notably, many clients have reported difficulties in accessing their funds, which is a significant concern for traders. A few cases highlight instances where clients were unable to withdraw their capital despite repeated requests. These experiences lead to skepticism about if Citibank is safe for forex trading. The bank's ability to address and resolve these complaints effectively is crucial for maintaining customer trust.

Platform and Execution

The performance and reliability of a trading platform are critical factors for traders. Citibank's trading platform has been generally well-received, with users noting its ease of use and accessibility. However, concerns have been raised regarding order execution quality, including instances of slippage and rejections.

Traders have reported mixed experiences with execution times, leading to questions about the platform's reliability during high-volatility periods. Signs of potential platform manipulation have not been substantiated, but traders should remain vigilant and monitor their trades closely to ensure fair execution. The overall user experience suggests that while Citibank's platform is functional, the execution quality may not meet the expectations of more experienced traders, prompting further inquiries about if Citibank is safe for serious trading.

Risk Assessment

Trading with any broker carries inherent risks, and Citibank is no exception. The following risk assessment summarizes key risk areas associated with using Citibank as a forex broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Lack of clear regulation in some regions. |

| Fund Security | High | Historical issues with fund withdrawals. |

| Customer Support | Medium | Mixed reviews on responsiveness. |

To mitigate these risks, traders should conduct thorough research, remain informed about regulatory updates, and consider diversifying their trading activities across multiple brokers. Additionally, traders should maintain clear documentation of their transactions and communications with Citibank to protect their interests.

Conclusion and Recommendations

In conclusion, while Citibank is a well-established financial institution, there are significant concerns regarding its regulatory status, trading conditions, and client fund security. The evidence suggests that Citibank is not entirely safe for forex trading, particularly for those who may be sensitive to hidden fees and withdrawal issues. Traders are advised to exercise caution and consider alternative brokers with stronger regulatory oversight and a proven track record of customer satisfaction.

For those seeking reliable alternatives, brokers regulated by top-tier authorities such as the FCA or ASIC may offer more robust protections and transparent trading conditions. Ultimately, the decision to engage with Citibank should be made with careful consideration of the potential risks and the overall trading environment.

Is CITIBANK a scam, or is it legit?

The latest exposure and evaluation content of CITIBANK brokers.

CITIBANK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CITIBANK latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.