Gomax 2025 Review: Everything You Need to Know

Executive Summary

Gomax operates as a forex broker in the financial markets. This gomax review reveals significant concerns about its overall reputation and service quality, particularly regarding CFD trading practices and customer service issues that have persisted over time. The broker has faced various allegations and negative user feedback. Established in 2015, Gomax offers trading services with spreads starting from 0.0 pips and operates under NFA regulation, though these competitive features don't address underlying service problems. However, the broker's standing in the trading community remains questionable due to persistent negative reviews and trust-related concerns. The platform primarily targets investors interested in forex, futures, and CFD trading. Potential clients should exercise considerable caution when considering this broker, as numerous red flags surrounding customer experiences and service reliability significantly impact the overall assessment. While the competitive spread structure may appear attractive to cost-conscious traders, the serious issues with customer satisfaction and operational transparency create substantial risks for anyone considering this platform.

Important Notice

This review is based on available information from multiple sources and user feedback reports. Gomax may operate through different regional entities, which could result in varying service levels and regulatory oversight across different jurisdictions, creating inconsistency in user experiences. The regulatory status mentioned in this review specifically refers to NFA oversight. Traders should verify current regulatory standing before making any investment decisions, as regulatory compliance can change over time and may not guarantee satisfactory service quality. This assessment reflects information available as of late 2023, and conditions may have changed since then. Prospective traders are strongly advised to conduct their own due diligence and consider the significant negative feedback patterns identified during this evaluation process, particularly given the serious concerns about customer service and operational transparency.

Rating Framework

Broker Overview

Gomax entered the forex trading market in 2015. The company positioned itself as a provider of forex, futures, and index CFD trading services, though its journey has been marked by considerable controversy and negative user experiences that raise serious questions about its operations. According to available information, Gomax operates as a financial services provider focusing on derivative products and foreign exchange trading. Specific details about company ownership and corporate structure remain limited in publicly available sources, which creates transparency concerns for potential clients seeking to understand the company's background and leadership.

The broker's business model centers around providing access to various financial instruments including foreign exchange pairs, futures products, and contracts for difference on indices. However, this gomax review must note that the company has faced significant challenges in maintaining a positive reputation within the trading community, with ongoing issues that appear to be systemic rather than isolated incidents. Reports suggest ongoing issues with customer satisfaction and service delivery. These problems have contributed to a generally negative perception among users and industry observers, making it difficult to recommend this broker for serious trading activities.

The regulatory framework under which Gomax operates includes oversight by the National Futures Association. This provides some level of regulatory compliance for US-based operations, though the effectiveness of this regulatory oversight in addressing user concerns remains questionable based on available feedback from actual users. However, the effectiveness of this regulatory oversight in addressing user concerns remains questionable. The platform's target market appears to be retail traders seeking access to leveraged financial products, though the company's ability to serve this market effectively has been consistently challenged by user experiences and market feedback that suggest serious operational problems.

Regulatory Jurisdiction: Gomax operates under NFA regulation. This provides compliance with United States financial market regulations and establishes certain operational standards and consumer protection measures, though user feedback suggests implementation may be inconsistent with expected standards. This regulatory framework establishes certain operational standards and consumer protection measures. However, user feedback suggests implementation may be inconsistent, raising questions about the practical effectiveness of this oversight in protecting client interests.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available sources. This represents a significant transparency gap that potential clients should investigate thoroughly before account opening, as unclear funding procedures can create problems for traders who need reliable access to their money.

Minimum Deposit Requirements: The minimum deposit amount required to open a trading account with Gomax is not specified in available documentation. This raises concerns about transparency in account opening procedures and makes it difficult for potential clients to plan their initial investment properly.

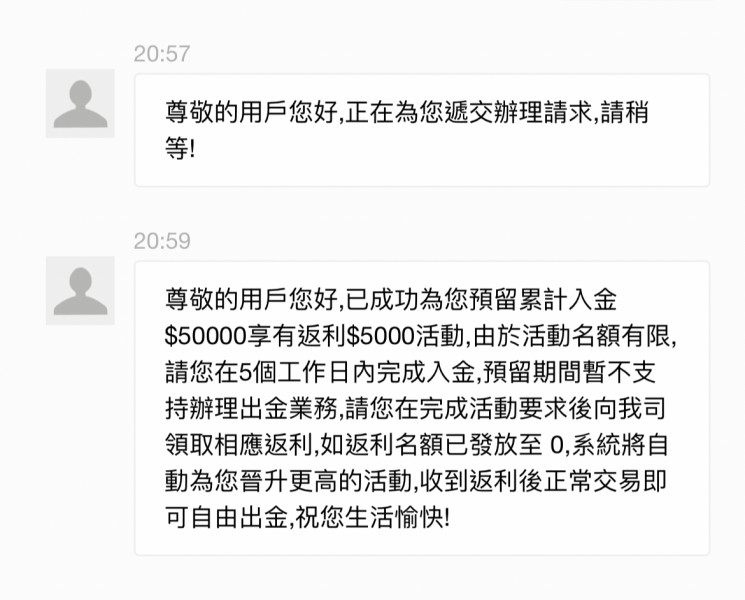

Bonus and Promotional Offers: No specific information about welcome bonuses, promotional campaigns, or incentive programs is available in current sources. This suggests limited marketing initiatives or poor communication of available offers, which may indicate broader communication problems within the organization.

Tradeable Assets: The platform supports trading in foreign exchange pairs, futures products, and index CFDs. This provides some diversification opportunities for traders interested in multiple asset classes and market exposure strategies, though the quality of execution and service delivery remains questionable based on user feedback.

Cost Structure: Spreads begin at 0.0 pips according to available information. However, commission structures and additional fees are not clearly outlined, creating uncertainty about total trading costs and fee transparency that could lead to unexpected expenses for traders.

Leverage Ratios: Specific leverage offerings are not detailed in available sources. This represents another significant information gap that traders would need to clarify directly with the broker, adding to the overall transparency concerns surrounding this platform.

Platform Options: Trading platform details are not comprehensively covered in available information. This requires potential clients to investigate software options and technological capabilities independently, which is unusual for established brokers who typically provide detailed platform information.

Geographic Restrictions: Regional trading restrictions are not specified in current documentation. However, regulatory compliance requirements may limit service availability in certain jurisdictions, and traders should verify their eligibility before attempting to open accounts.

Customer Support Languages: Multi-language support capabilities are not detailed in available sources. This potentially limits accessibility for international clients seeking native language assistance and may create communication barriers for non-English speaking traders.

This gomax review highlights significant information gaps that prospective traders should address through direct inquiry before making any commitment to this broker.

Account Conditions Analysis

The account structure and conditions offered by Gomax present several areas of concern for potential traders. Available information does not provide clear details about different account types, their specific features, or the requirements for accessing various service levels, which is unusual for established brokers who typically offer comprehensive account information. This lack of transparency in account offerings represents a significant weakness. The broker's service presentation makes it difficult for traders to make informed decisions about account selection, creating unnecessary confusion and uncertainty for potential clients.

Minimum deposit requirements remain unspecified in available documentation. This is unusual for established brokers who typically provide clear information about account funding requirements and creates planning difficulties for potential clients who need to understand their financial commitment. This information gap makes it challenging for potential clients to plan their initial investment. The absence of clear deposit information also raises questions about the broker's transparency and communication practices, suggesting broader organizational problems.

Account opening procedures and verification processes are not detailed in available sources. User feedback suggests these processes may not meet standard industry expectations for efficiency and clarity, potentially creating frustration and delays for new clients from their first interaction with the company. This gomax review notes that unclear account opening procedures can lead to frustration and delays for new clients. Such problems potentially impact the overall customer experience from the initial interaction and may indicate broader service quality issues throughout the organization.

Special account features such as Islamic accounts, VIP services, or institutional offerings are not mentioned in available information. This suggests either limited product diversity or poor communication of available options, both of which represent significant weaknesses in the broker's service offering. The lack of specialized account types may limit the broker's appeal to specific trader segments. Traders with particular requirements or preferences may find this broker unable to meet their needs effectively.

The trading tools and resources available through Gomax appear to be limited based on available information. This presents significant concerns for traders who rely on comprehensive analytical and educational support to make informed trading decisions and develop their skills over time. Market analysis tools, research capabilities, and educational resources are not detailed in current documentation. This suggests either minimal offerings in these areas or poor communication of available services, both of which represent serious limitations for serious traders.

Technical analysis tools and charting capabilities are not specifically outlined in available sources. This is problematic for traders who depend on sophisticated analytical tools for market evaluation and decision-making, as modern forex trading typically requires access to advanced charting and analysis capabilities. The absence of clear information about analytical resources makes it difficult to assess whether the platform can support serious trading activities effectively. Traders who rely on technical analysis may find this broker inadequate for their needs.

Educational resources and training materials are not mentioned in available documentation. This represents a significant gap for newer traders who require guidance and learning support to develop their trading skills and understanding of market dynamics. Quality educational content is typically considered essential for responsible broker operations. The apparent absence of such resources raises concerns about the broker's commitment to client development and success, suggesting a focus on short-term profit rather than long-term client relationships.

Automated trading support and algorithmic trading capabilities are not detailed in current sources. This potentially limits options for traders who prefer systematic or automated approaches to market participation and may indicate outdated technology infrastructure. The lack of information about advanced trading features suggests the platform may not cater effectively to sophisticated trading strategies. Professional-level requirements may not be met by this broker's current offerings.

Customer Service and Support Analysis

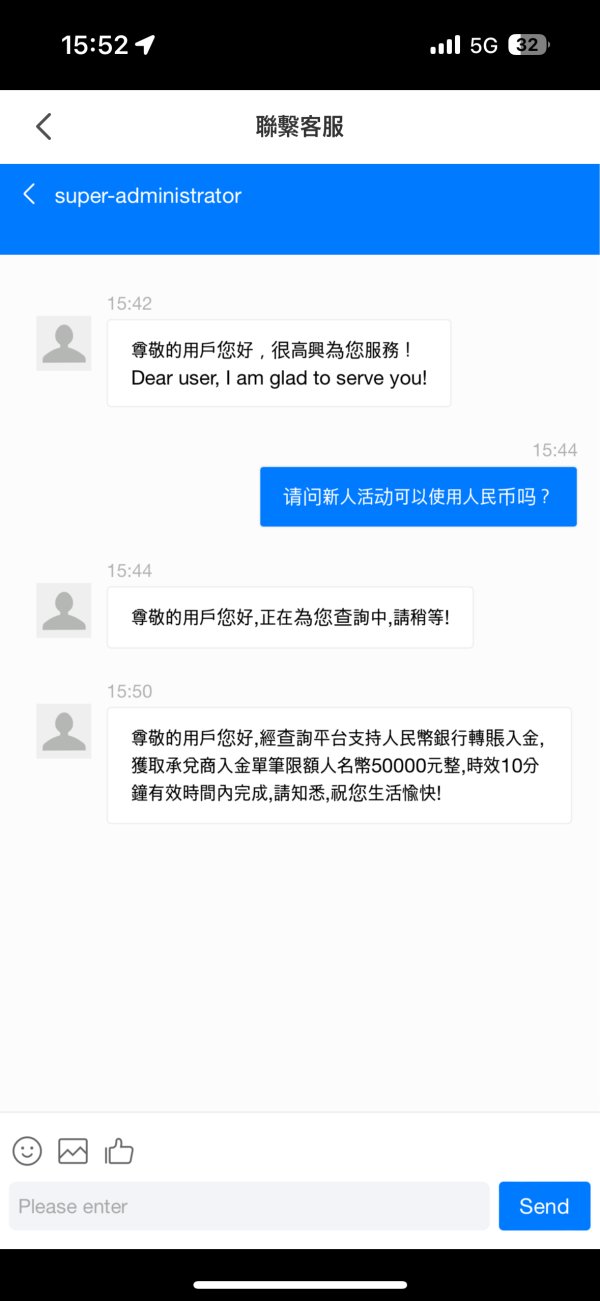

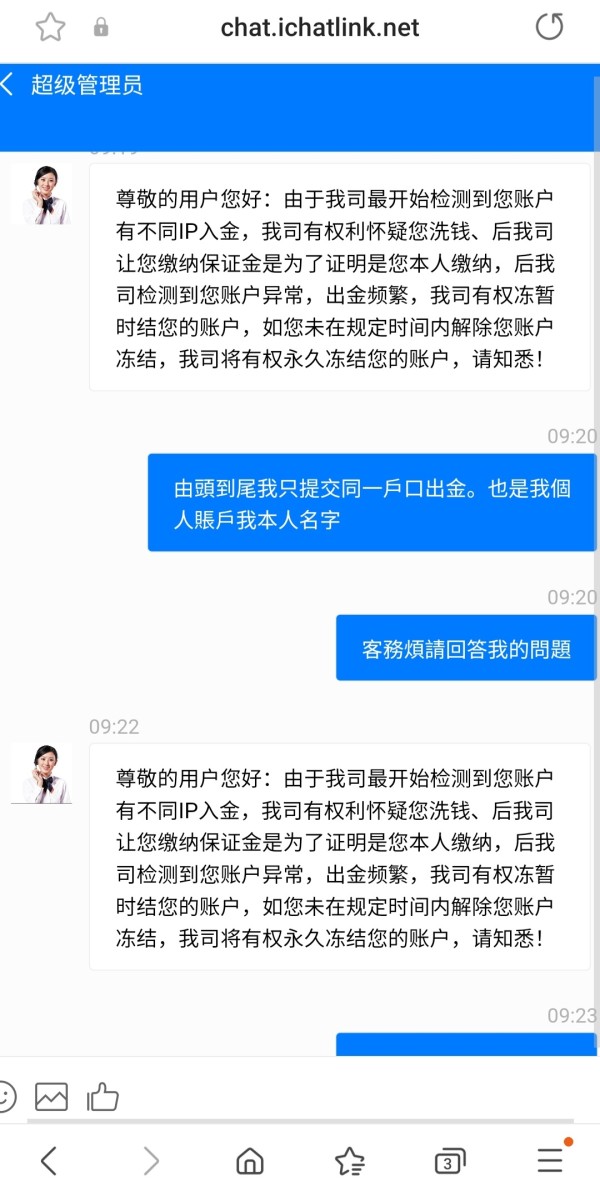

Customer service quality emerges as one of the most concerning aspects of Gomax operations based on available user feedback and reports. Multiple sources indicate significant problems with customer support responsiveness, professionalism, and problem resolution capabilities that create serious obstacles for clients seeking assistance with their accounts or trading activities. These service quality issues represent major red flags for potential clients. Anyone considering this broker for their trading activities should be aware of these persistent problems that appear to affect many users.

Response times for customer inquiries appear to be problematic according to user reports. Complaints about delayed responses and inadequate follow-up on client concerns are common, creating frustration and potentially costly delays for traders who need timely assistance. Effective customer support is crucial in forex trading where market conditions can change rapidly. Traders may need immediate assistance with account or trading issues, making slow response times particularly problematic in this industry.

Service quality concerns extend beyond response times to include questions about staff competence and ability to resolve complex issues effectively. User feedback suggests that support staff may lack the expertise necessary to address technical problems or account-related concerns satisfactorily, leading to prolonged resolution times and client frustration that can impact trading performance. User feedback suggests that support staff may lack the expertise necessary to address technical problems. This leads to prolonged resolution times and client frustration that can significantly impact the overall trading experience.

Communication channels and availability are not clearly detailed in available sources. This makes it difficult to assess how clients can reach support when needed and may indicate limited support options for traders who encounter problems. The lack of clear information about support options, hours of operation, and contact methods represents another transparency issue. These communication problems could impact client experience and satisfaction levels significantly.

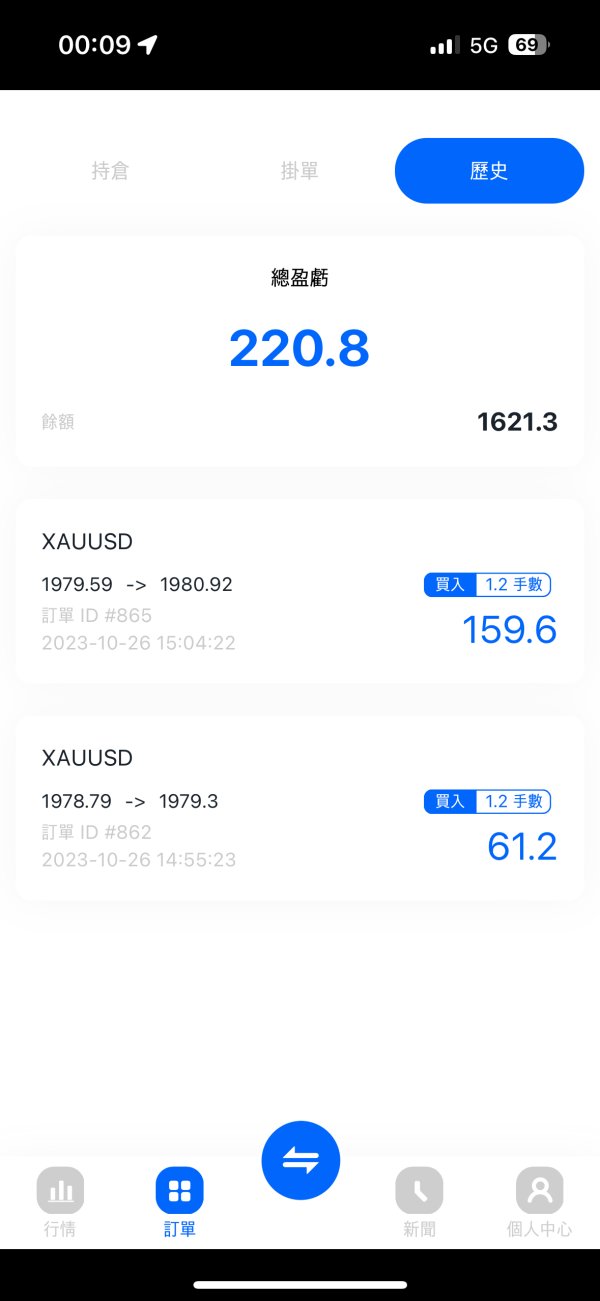

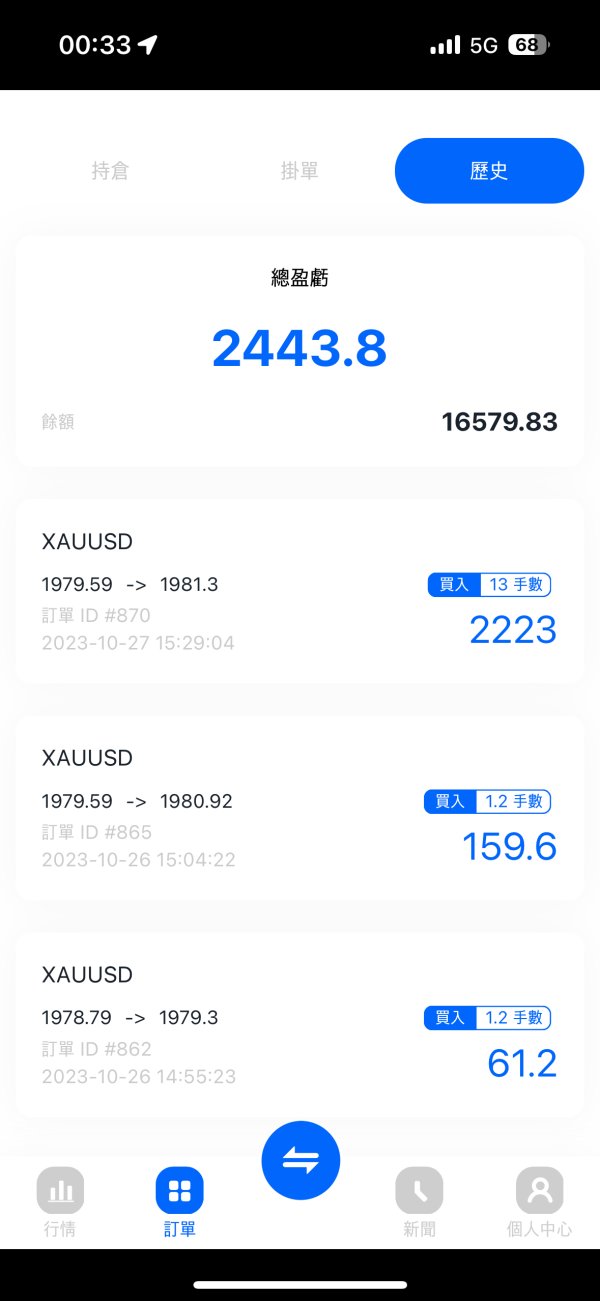

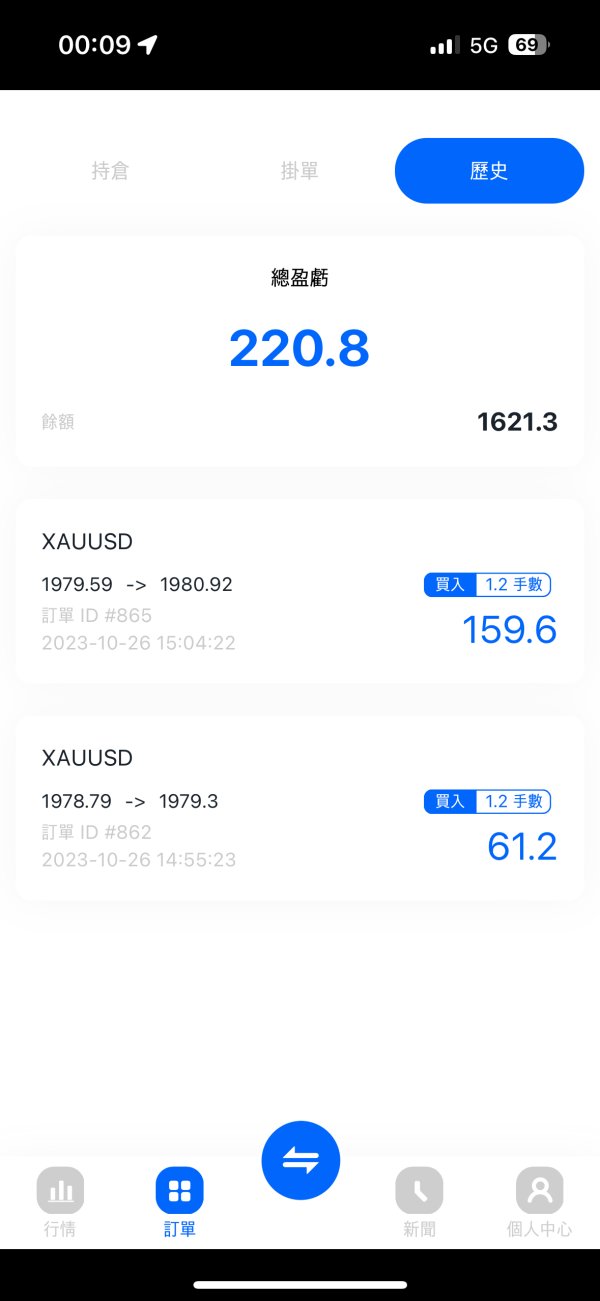

Trading Experience Analysis

The trading experience offered by Gomax presents mixed signals based on available information and user feedback. While the broker advertises spreads starting from 0.0 pips, which could be attractive to cost-conscious traders, other aspects of the trading environment raise significant concerns about overall execution quality and platform reliability that may offset any cost advantages. Other aspects of the trading environment raise significant concerns. Overall execution quality and platform reliability issues may create hidden costs that exceed any savings from low spreads.

Platform stability and performance data are not comprehensively available in current sources. This makes it difficult to assess whether the trading infrastructure can support reliable order execution during various market conditions, which is crucial for successful forex trading. Platform stability is crucial for forex trading where rapid market movements require consistent system performance. Reliable order processing becomes essential during volatile market periods when trading opportunities may be time-sensitive.

Order execution quality information is limited in available documentation. However, user feedback suggests potential issues with trade processing and execution reliability that could significantly impact trading results and create additional costs for traders. Problems with order execution can significantly impact trading results. These issues create additional costs through slippage or requotes, making this a critical area of concern for potential clients who depend on reliable trade execution.

Mobile trading capabilities and platform functionality are not detailed in current sources. This represents another information gap that modern traders would typically expect to be clearly addressed, as mobile access has become essential for many market participants. Mobile trading access has become essential for many market participants. The lack of clear information about mobile platform features suggests potential limitations in this area that could restrict trading flexibility.

This gomax review emphasizes that while competitive spreads may appear attractive, the overall trading experience depends on numerous factors beyond cost. Execution quality, platform reliability, and system performance during various market conditions all play crucial roles in determining the true value of a trading platform.

Trust and Reliability Analysis

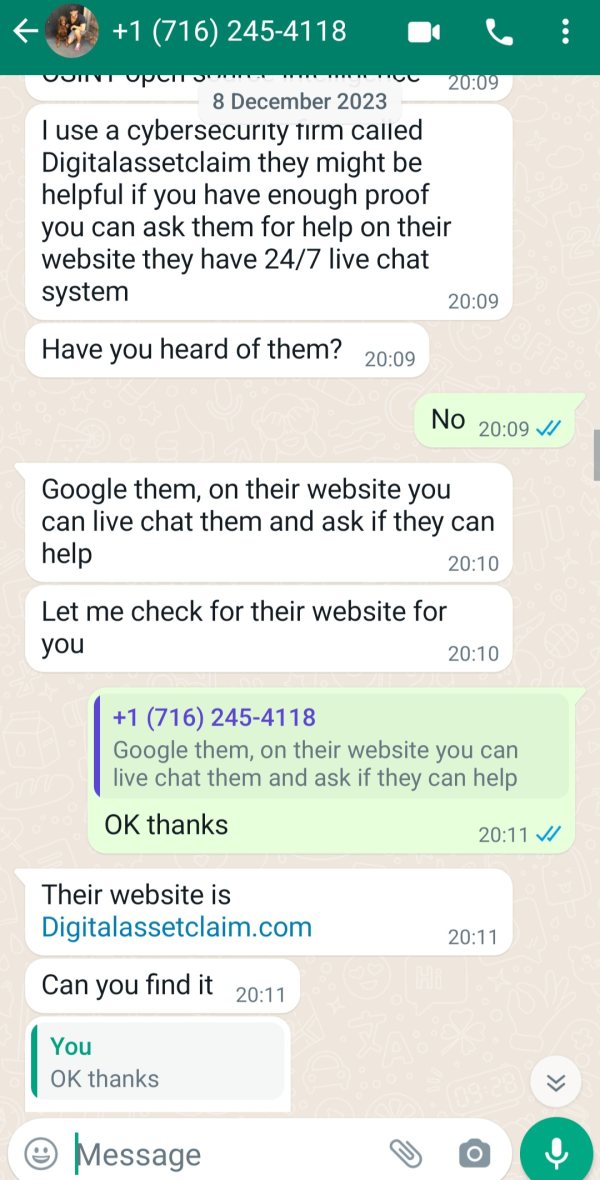

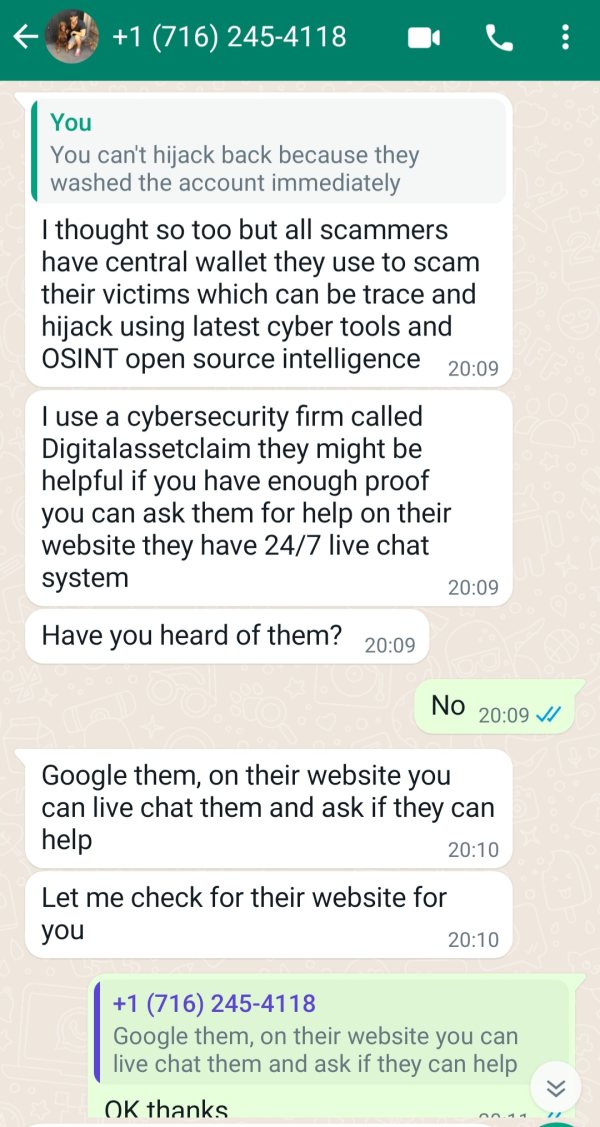

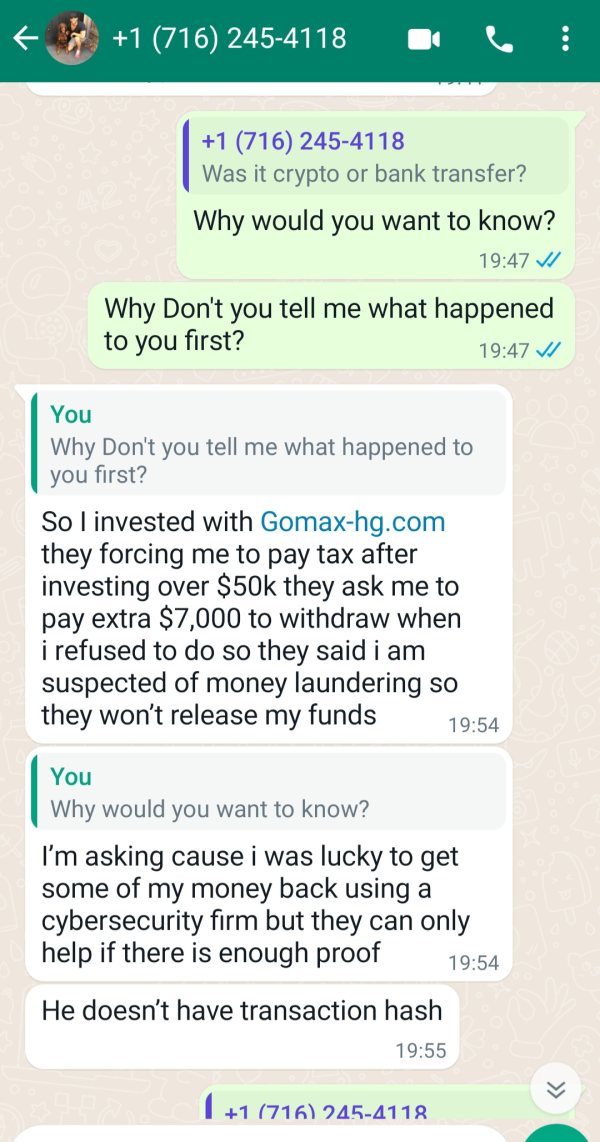

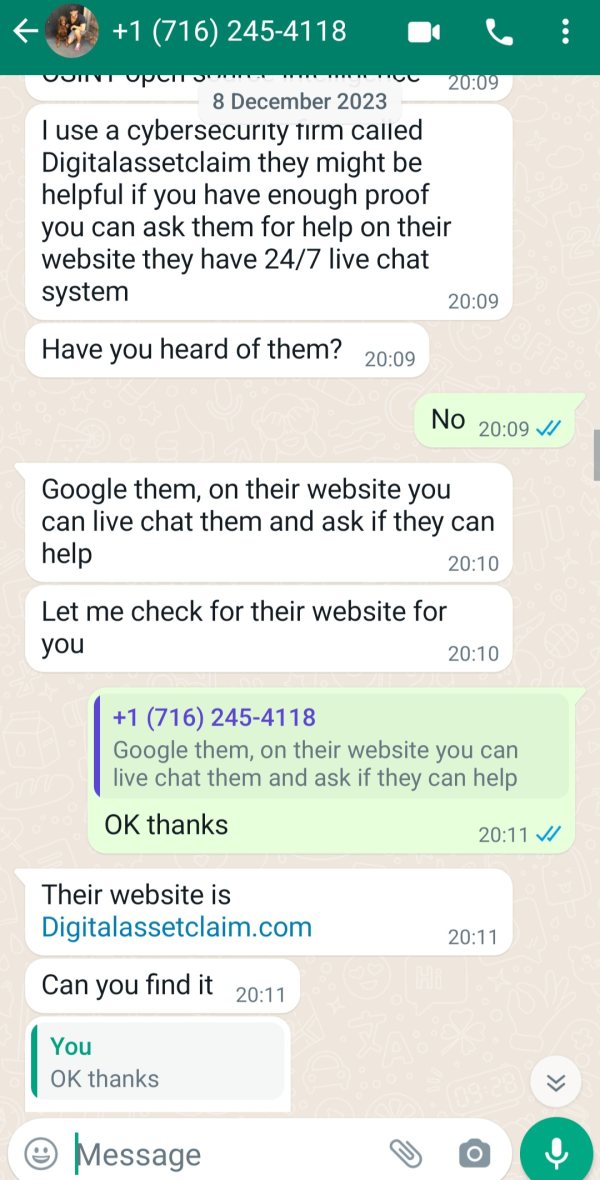

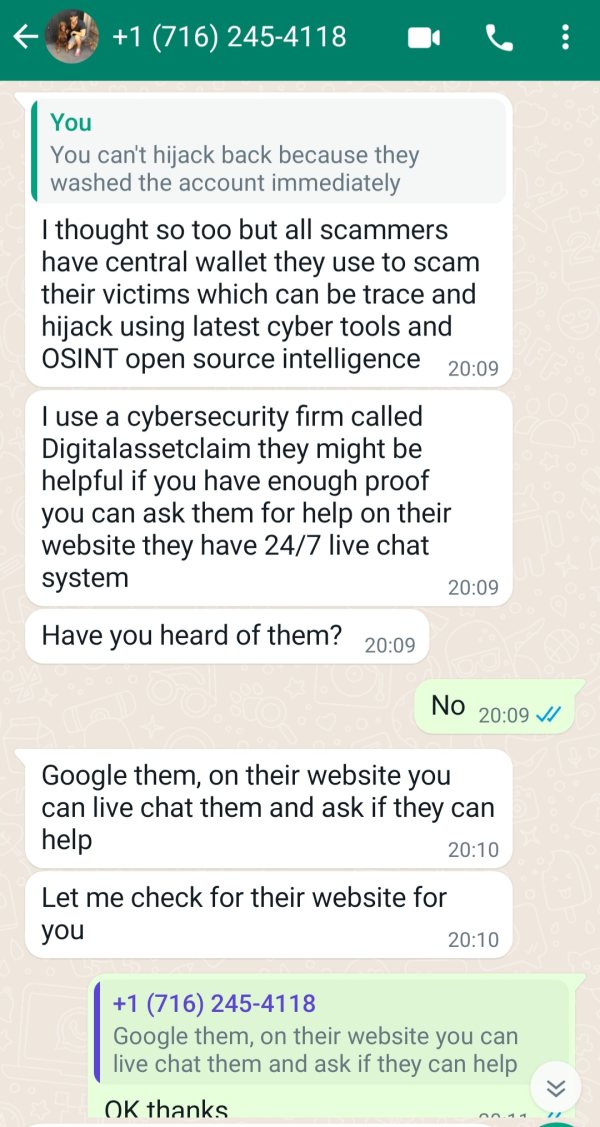

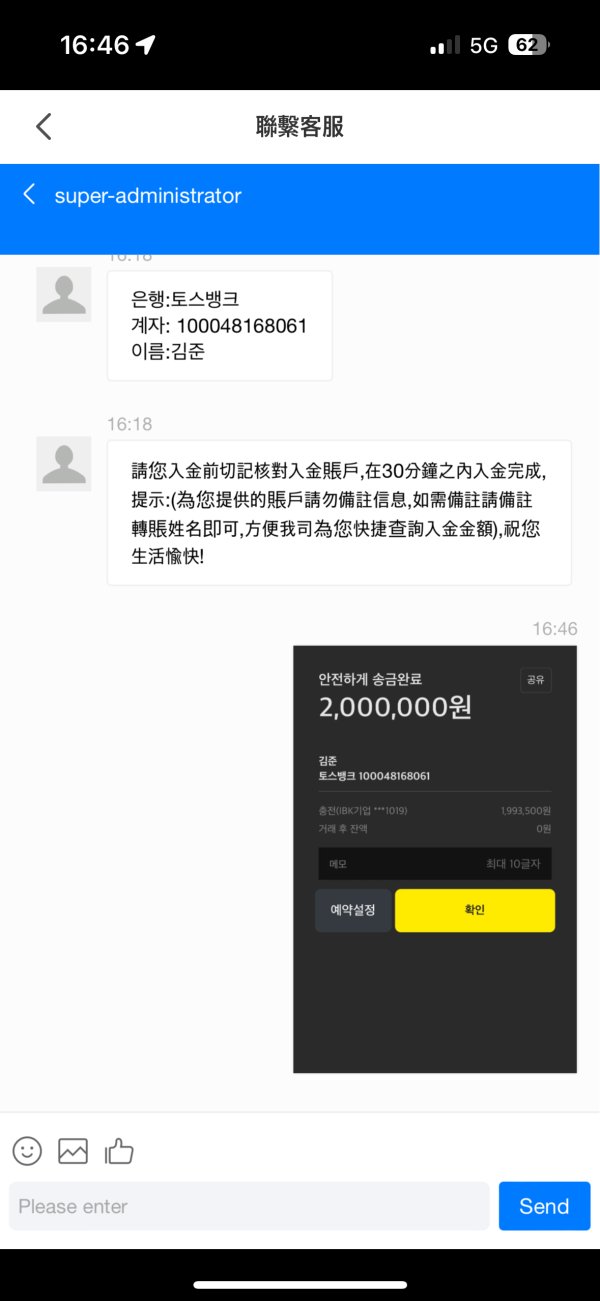

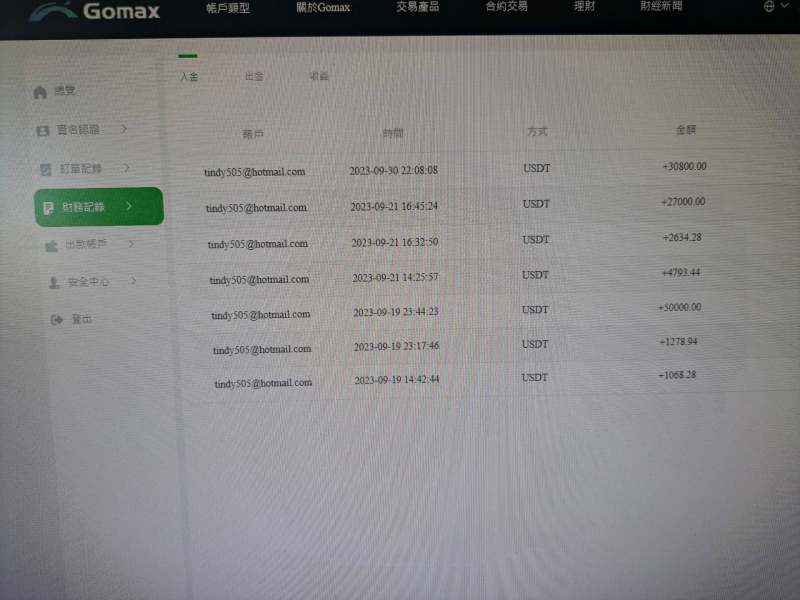

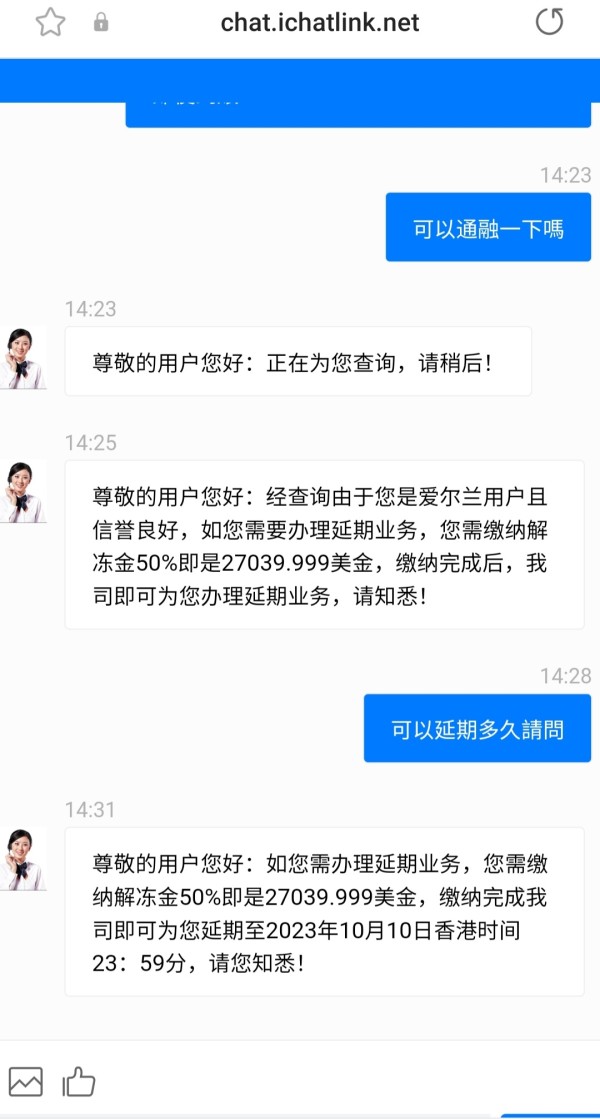

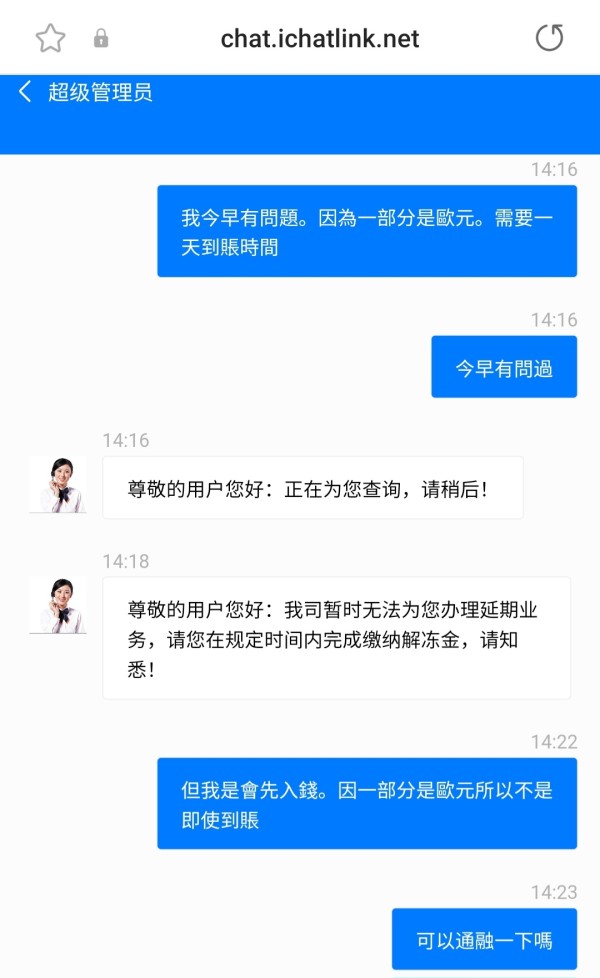

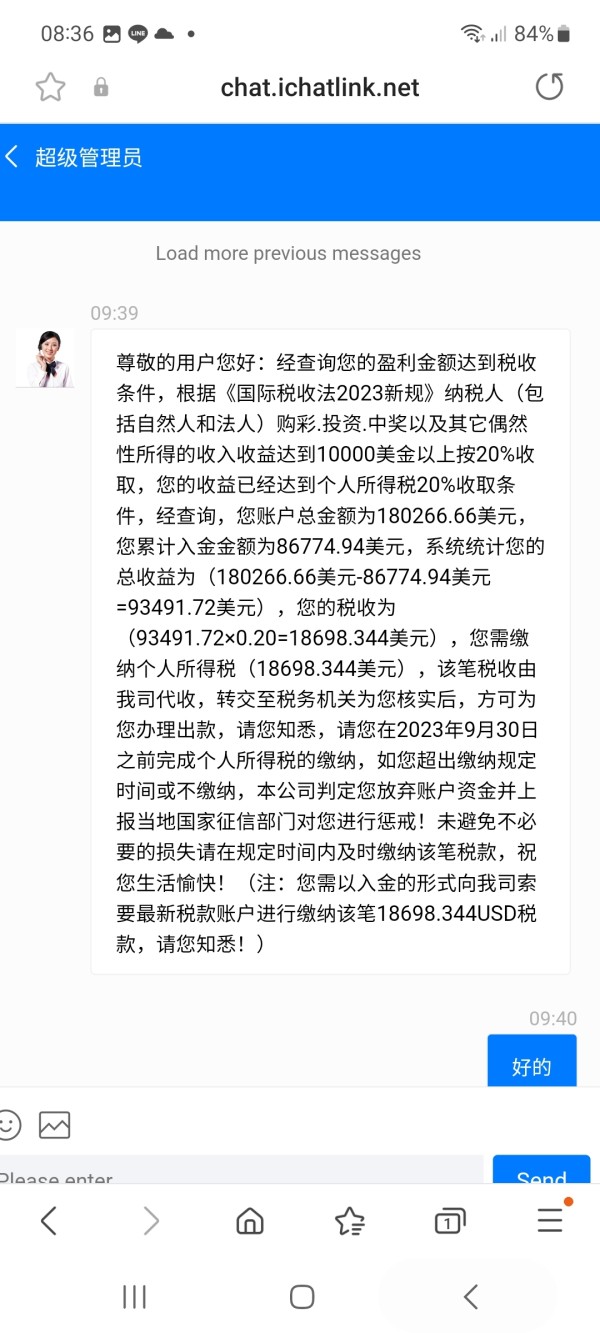

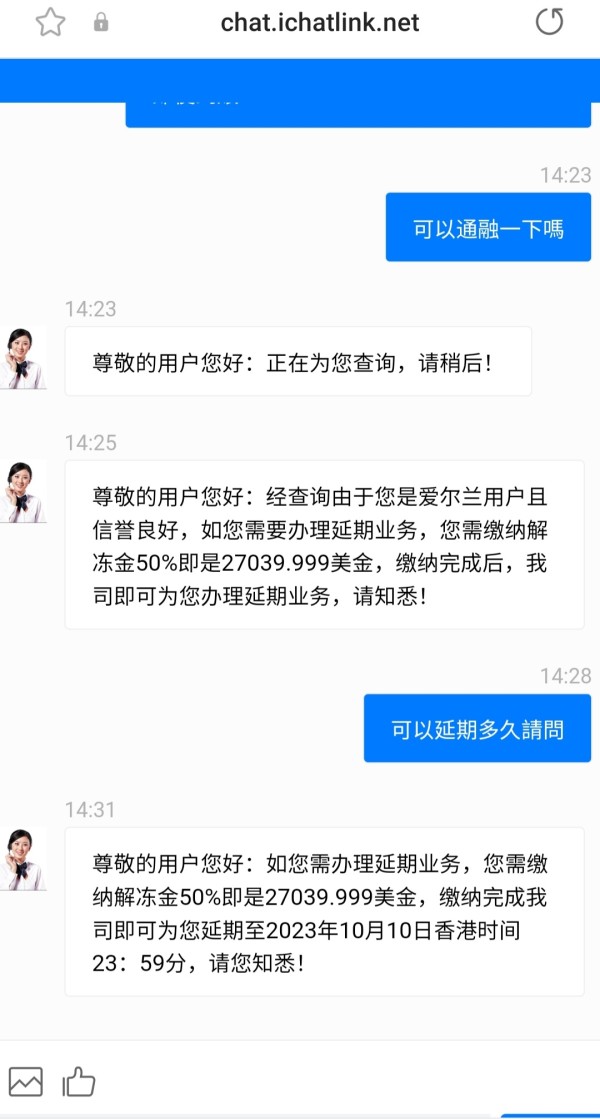

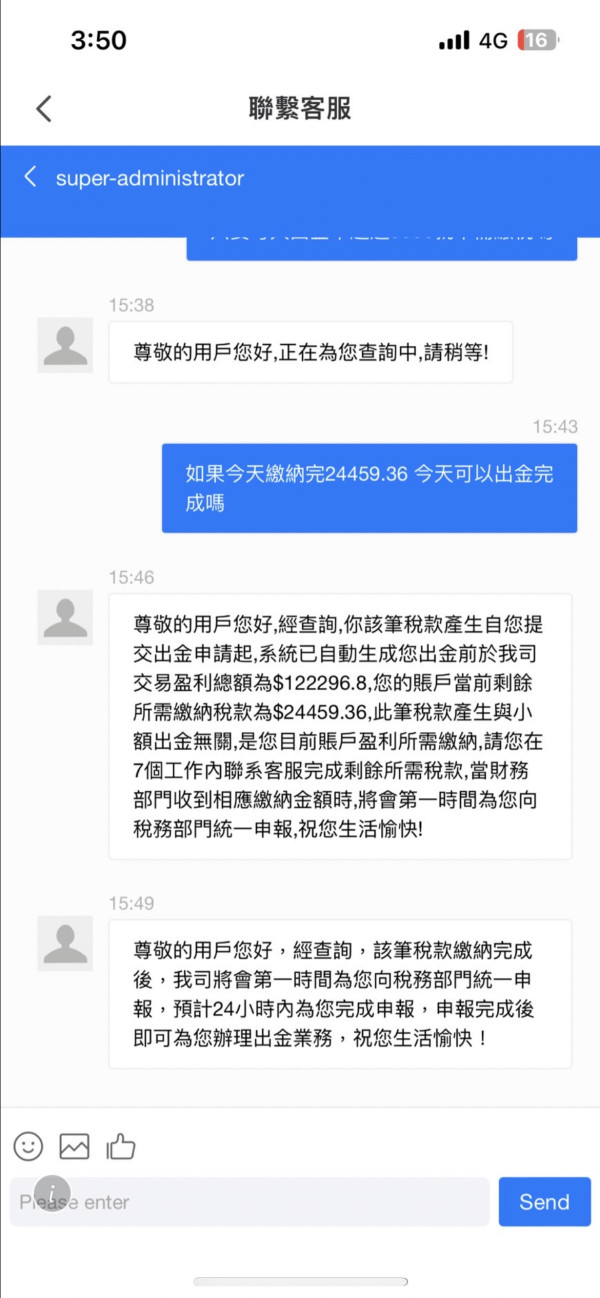

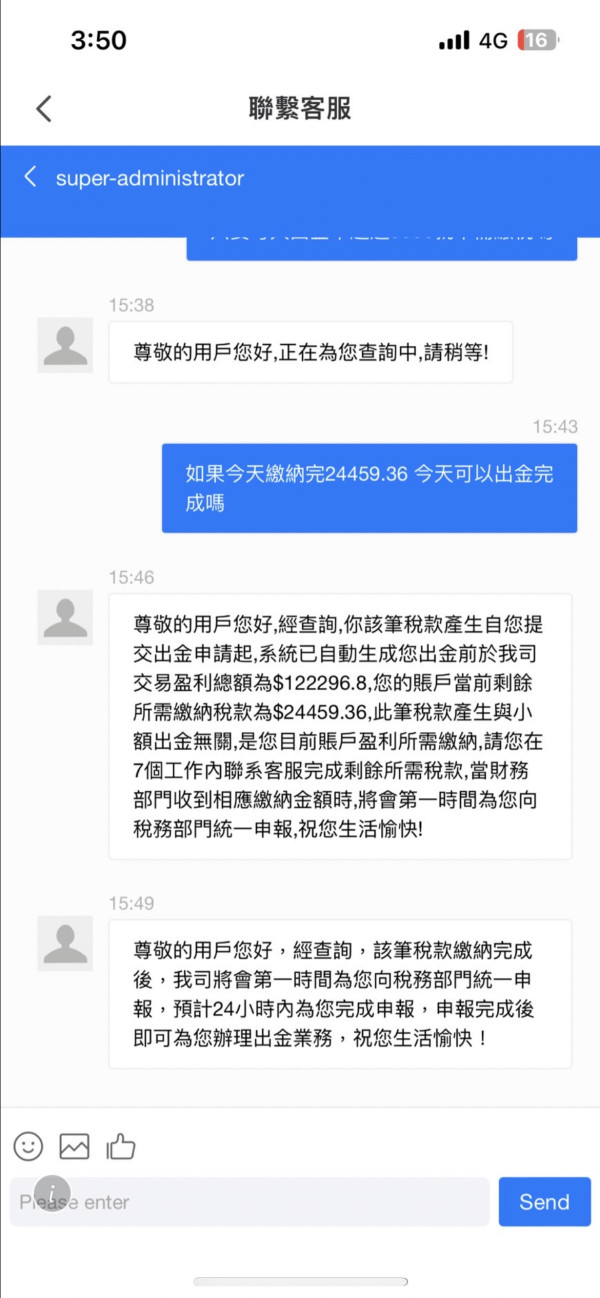

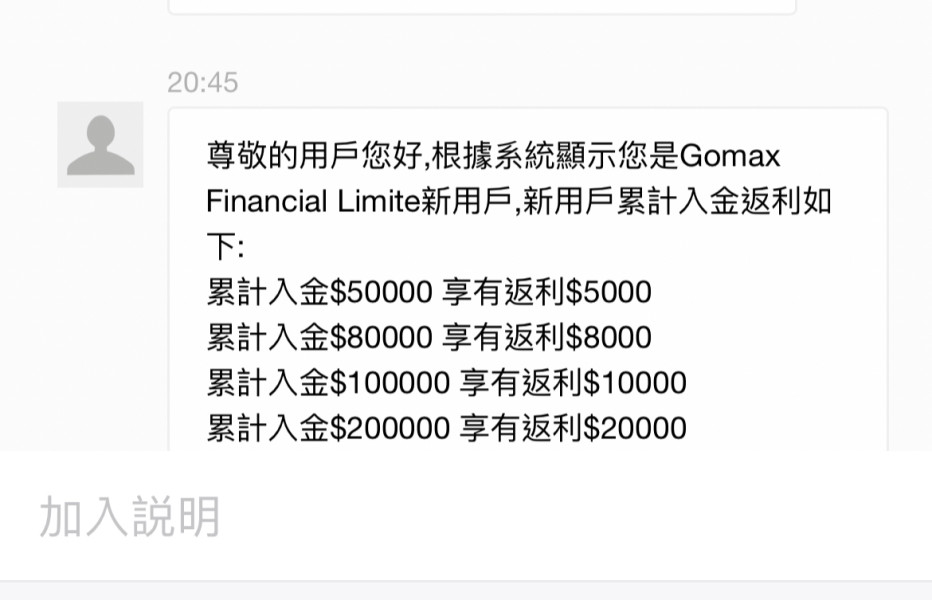

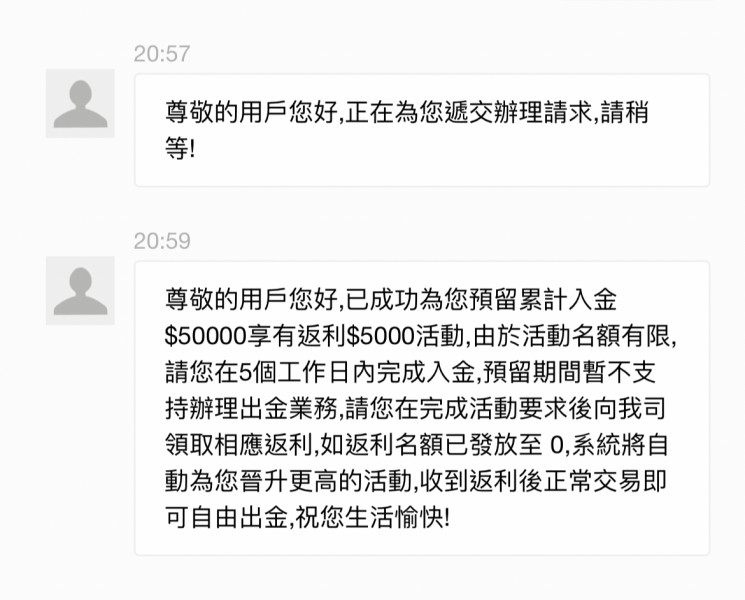

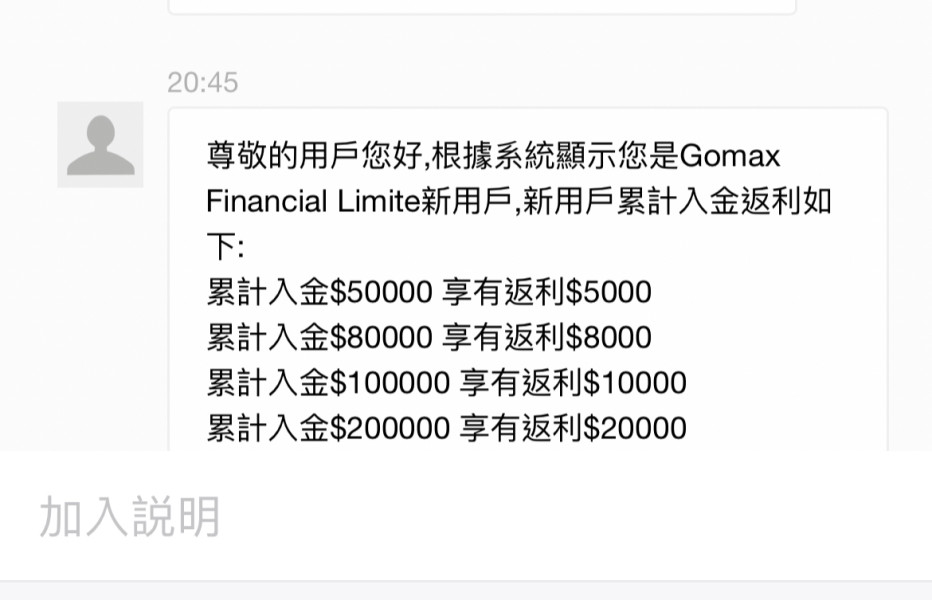

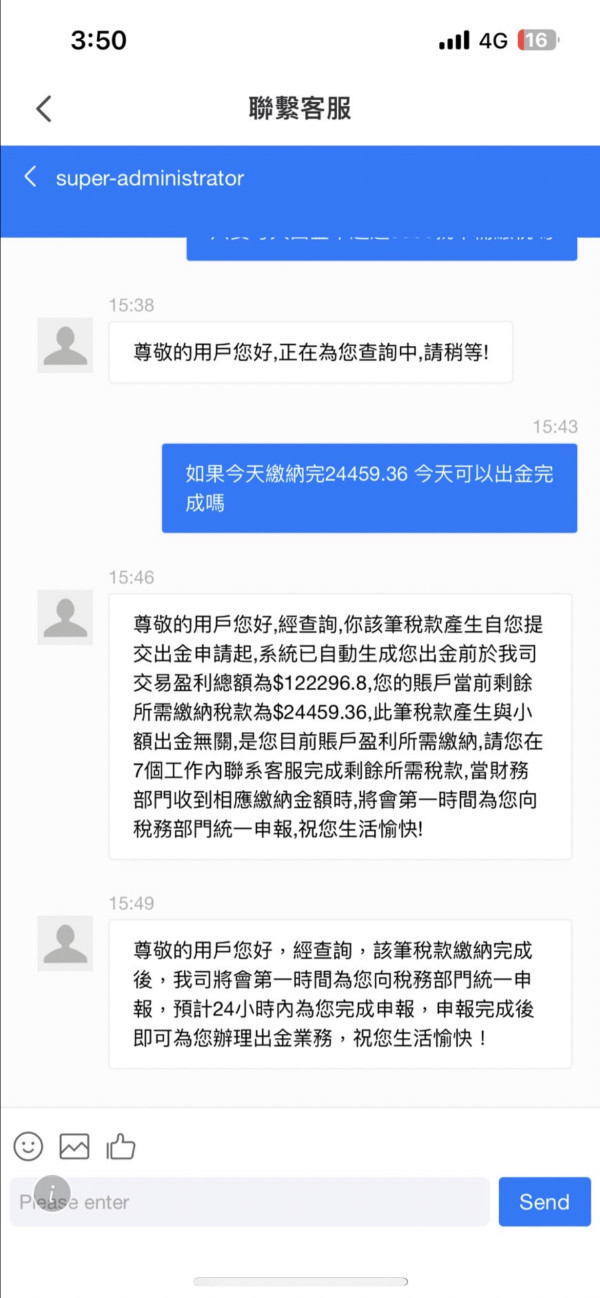

Trust and reliability represent perhaps the most critical concerns surrounding Gomax operations. Multiple sources indicate serious questions about the broker's credibility and business practices, with allegations of fraudulent activities and CFD-related scams that have been associated with the broker. Allegations of fraudulent activities and CFD-related scams have been associated with the broker. These create significant red flags for potential clients considering this platform for their trading activities and suggest serious underlying problems with the company's operations.

The regulatory oversight provided by NFA registration offers some level of compliance framework. However, the effectiveness of this oversight in addressing user concerns and preventing problematic practices appears limited based on available feedback from actual users who have experienced problems. Regulatory compliance alone does not guarantee ethical business practices or satisfactory customer treatment. This is evidenced by ongoing user complaints and negative experiences that continue despite regulatory oversight.

Company transparency issues are evident in the limited availability of detailed information about corporate structure, ownership, and operational practices. Reputable brokers typically provide comprehensive information about their business operations, regulatory compliance, and corporate governance to build trust with potential clients. While Gomax appears to maintain minimal transparency in these critical areas. This lack of openness raises questions about what the company may be trying to hide from potential clients.

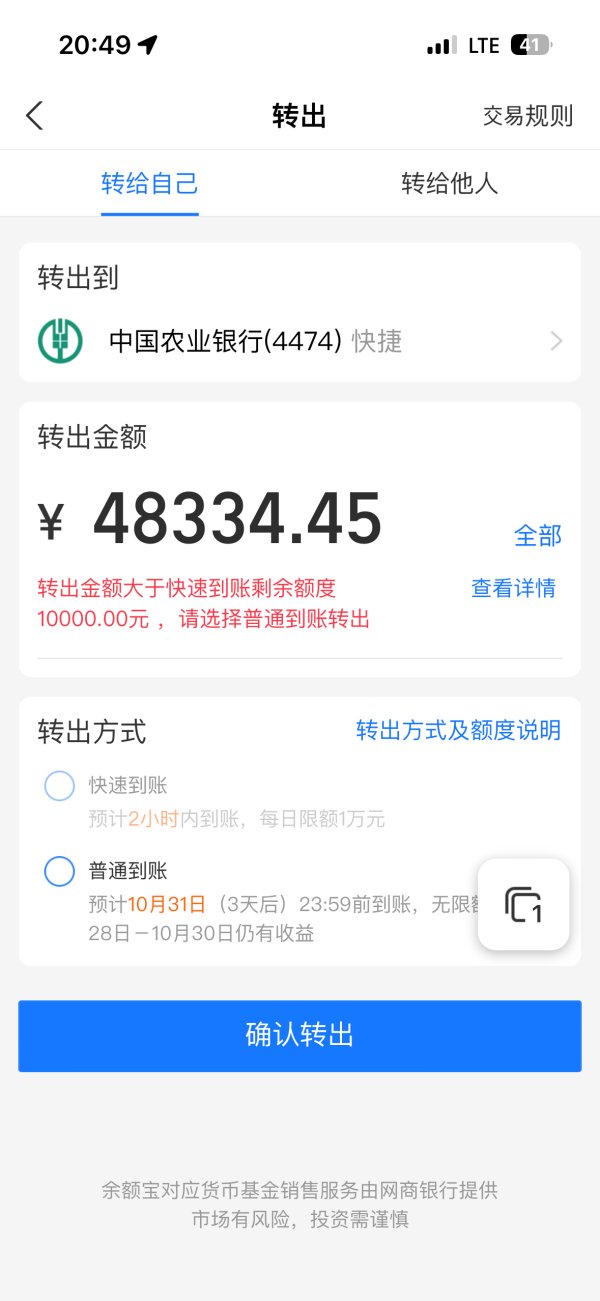

Fund safety measures and client protection protocols are not clearly detailed in available sources. This raises concerns about how client funds are protected and whether adequate safeguards exist to protect trader deposits from company financial problems or operational issues. The absence of clear information about segregated accounts, insurance coverage, or other protective measures represents a significant transparency gap. These missing details impact trust assessment and create uncertainty about fund safety for potential clients.

User Experience Analysis

Overall user satisfaction with Gomax services appears to be notably poor based on available feedback and reports from trading community sources. Negative reviews significantly outnumber positive experiences, creating a pattern of dissatisfaction that extends across multiple aspects of the broker's service delivery and customer interaction, suggesting systemic problems rather than isolated issues. Negative reviews significantly outnumber positive experiences. This creates a pattern of dissatisfaction that extends across multiple aspects of the broker's service delivery and suggests widespread operational problems.

Interface design and platform usability information is not comprehensively available in current sources. However, user feedback suggests potential issues with platform functionality and user-friendly design that could make trading more difficult and frustrating than necessary. Modern traders expect intuitive interfaces and efficient navigation. Problems in these areas can significantly impact the overall trading experience and user satisfaction, making even basic trading tasks unnecessarily complicated.

Registration and account verification processes appear to be problematic based on user reports. Complaints about unclear procedures and potentially lengthy verification times create immediate negative impressions for new clients and may indicate broader organizational inefficiencies. Efficient onboarding processes are essential for positive first impressions and early customer satisfaction. Problems in this area can create immediate negative experiences for new clients that may persist throughout their relationship with the broker.

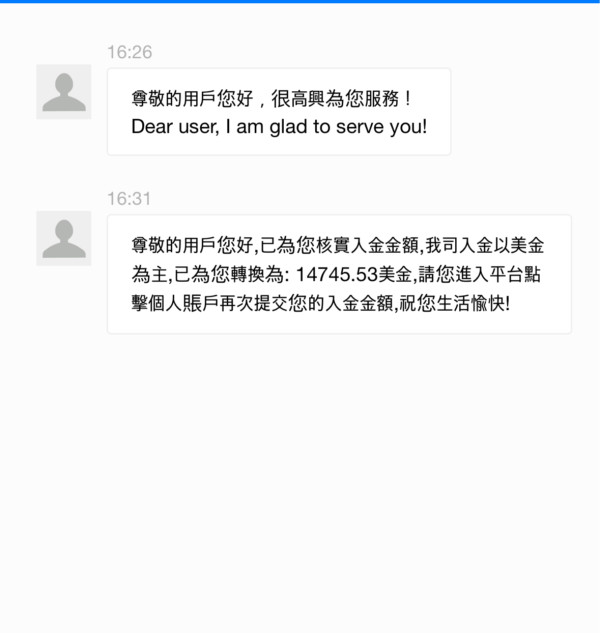

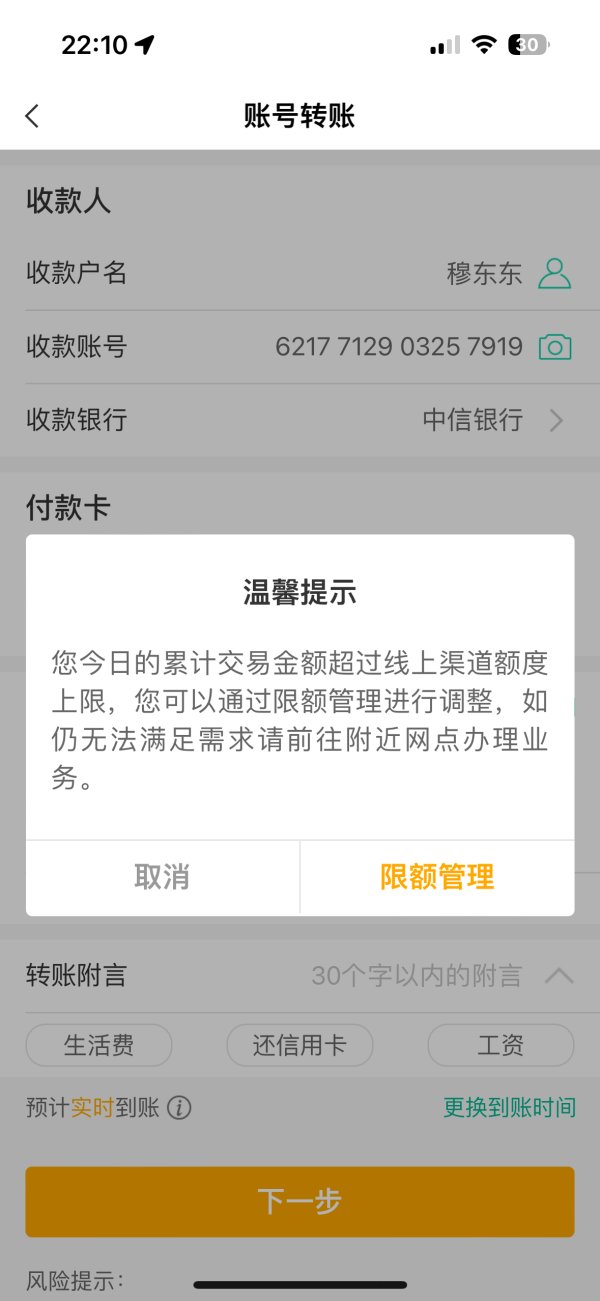

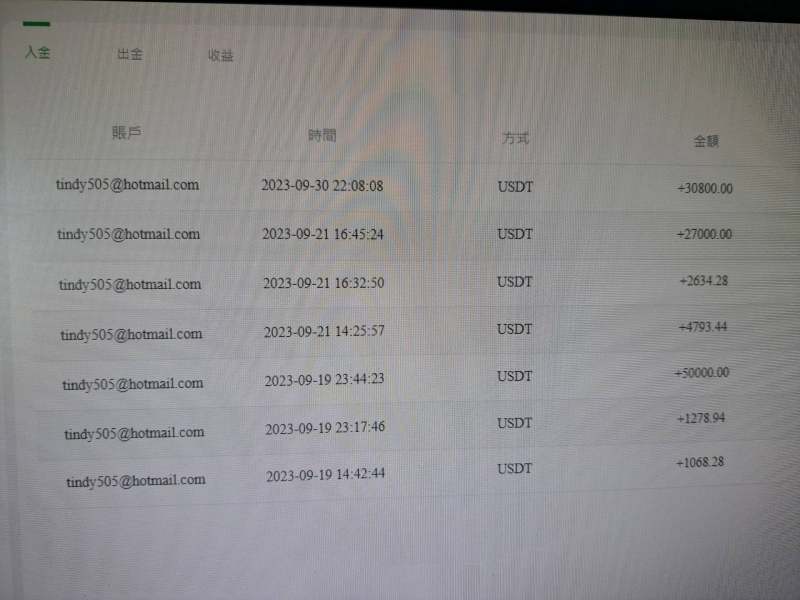

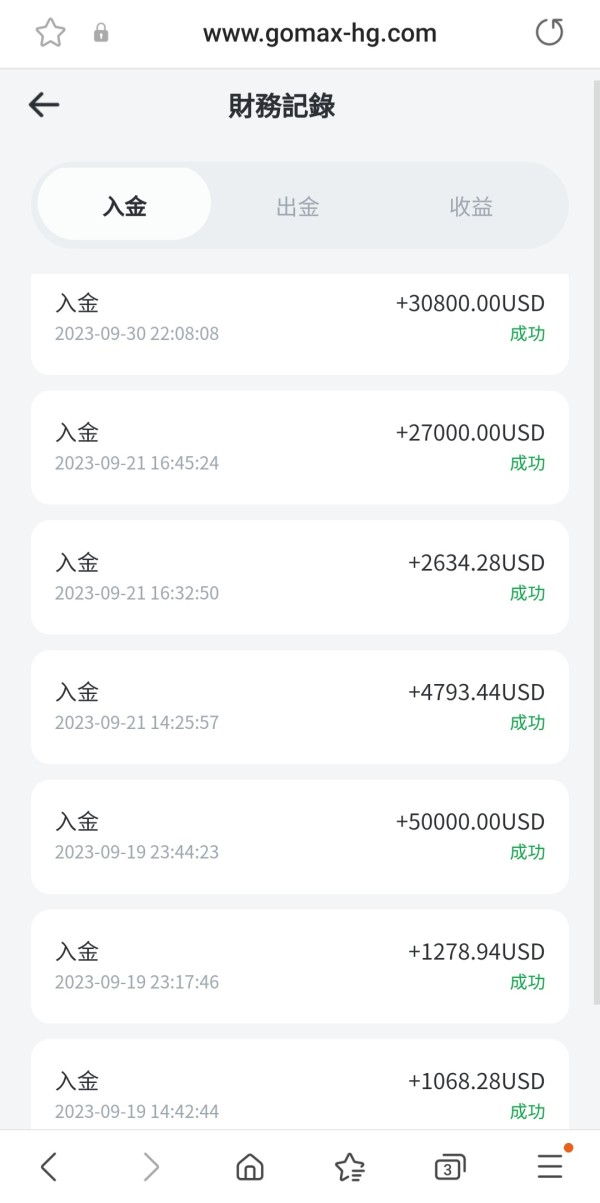

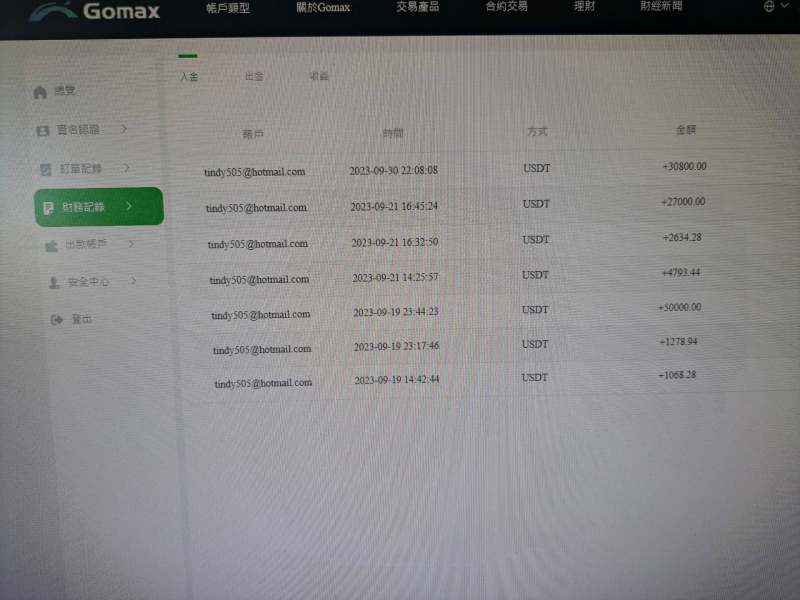

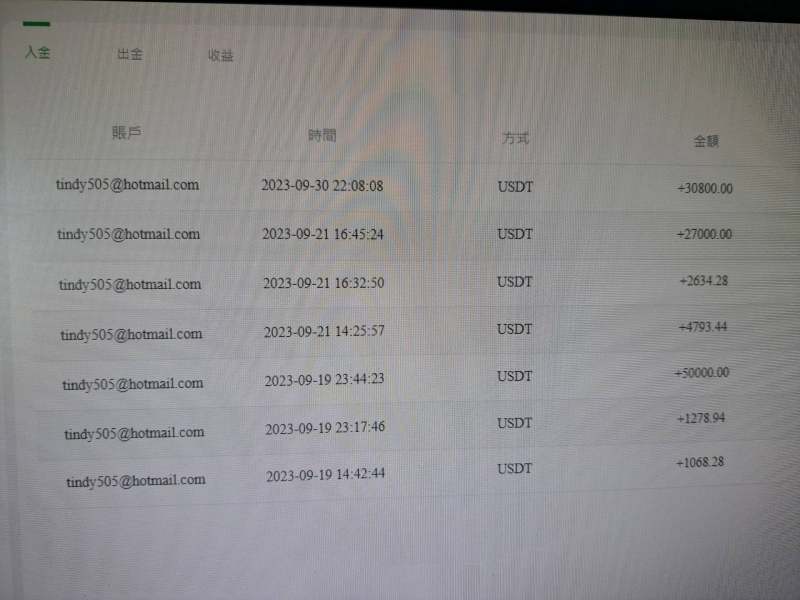

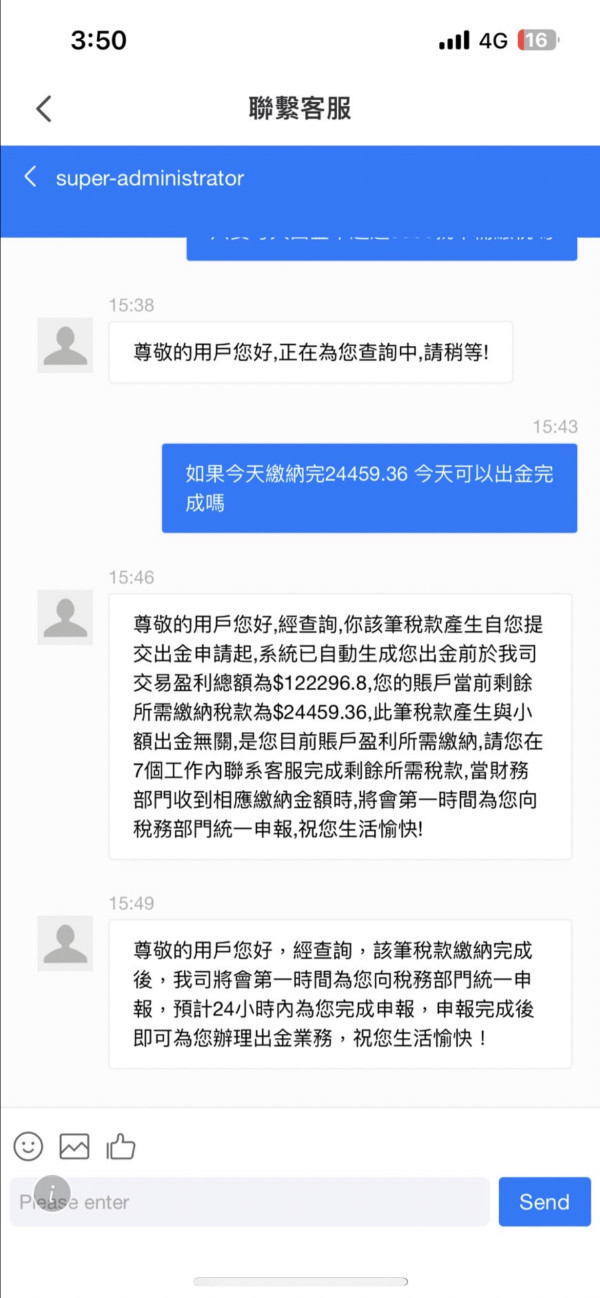

Fund management and withdrawal experiences represent another area of concern based on available user feedback. Reports suggest potential difficulties in accessing funds or processing withdrawal requests efficiently, which creates serious concerns for traders who need reliable access to their money. Problems with fund access can create serious concerns for traders. These issues represent major red flags for broker reliability and trustworthiness that could indicate more serious underlying problems.

Common user complaints center around service quality, transparency issues, and reliability concerns. These create a consistent pattern of negative feedback that significantly impacts the broker's reputation and credibility within the trading community, making it difficult to recommend for serious trading activities. These widespread concerns suggest systemic issues rather than isolated problems. This pattern makes this broker a high-risk choice for potential clients who value reliable service and transparent operations.

Conclusion

This comprehensive gomax review reveals significant concerns about the broker's operations, service quality, and overall reliability. These issues make it difficult to recommend for forex and CFD trading activities, despite some potentially attractive features like competitive spreads. While the advertised spreads starting from 0.0 pips may appear attractive, the numerous red flags surrounding customer service, transparency, and user satisfaction far outweigh any potential cost advantages that might initially appeal to traders.

The broker may appeal to traders seeking low-cost trading options. However, the risks associated with poor customer service, limited transparency, and negative user experiences make this a questionable choice for serious trading activities that require reliable execution and professional support. Traders should exercise extreme caution and thoroughly investigate alternatives before considering Gomax for their trading needs. The pattern of negative feedback and operational concerns suggests that any potential savings from low spreads could be quickly offset by service problems and execution issues.

The main advantages include competitive spread offerings and NFA regulatory oversight. However, significant disadvantages encompass poor customer feedback, limited transparency, service quality issues, and trust-related concerns that create substantial risks for potential clients seeking reliable trading services, making this broker difficult to recommend despite its regulatory compliance.