AMRK Review 1

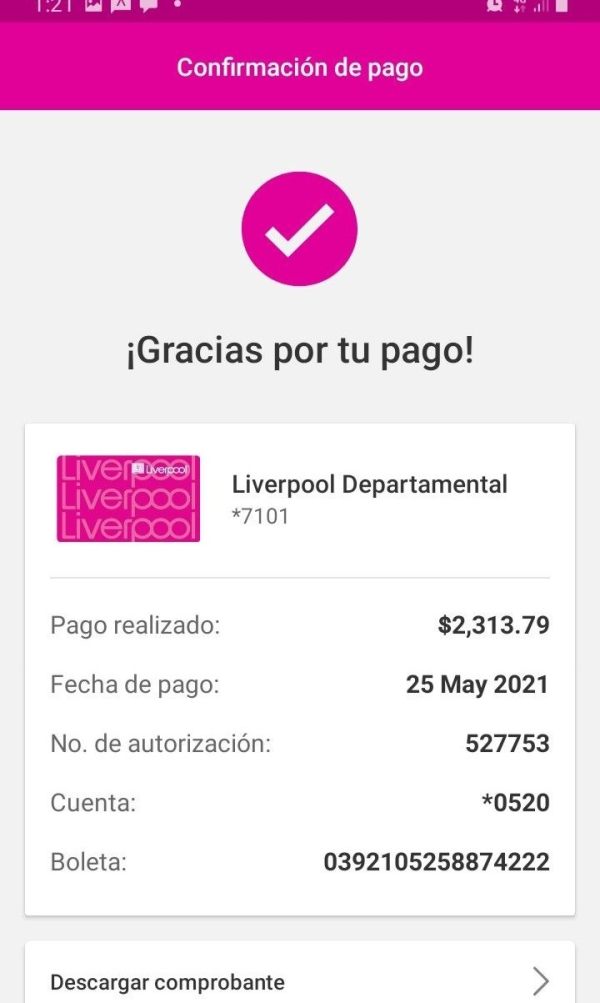

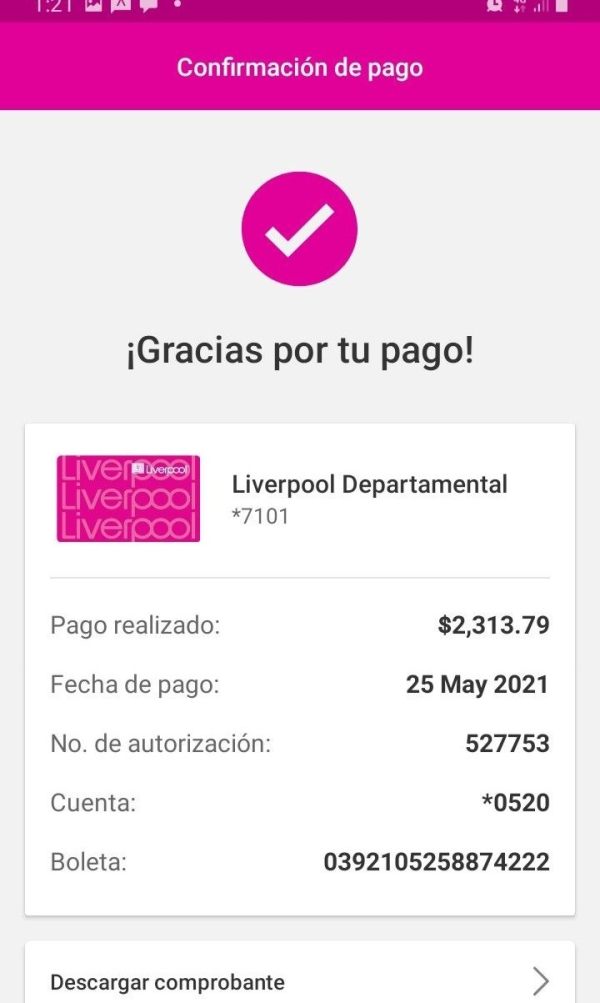

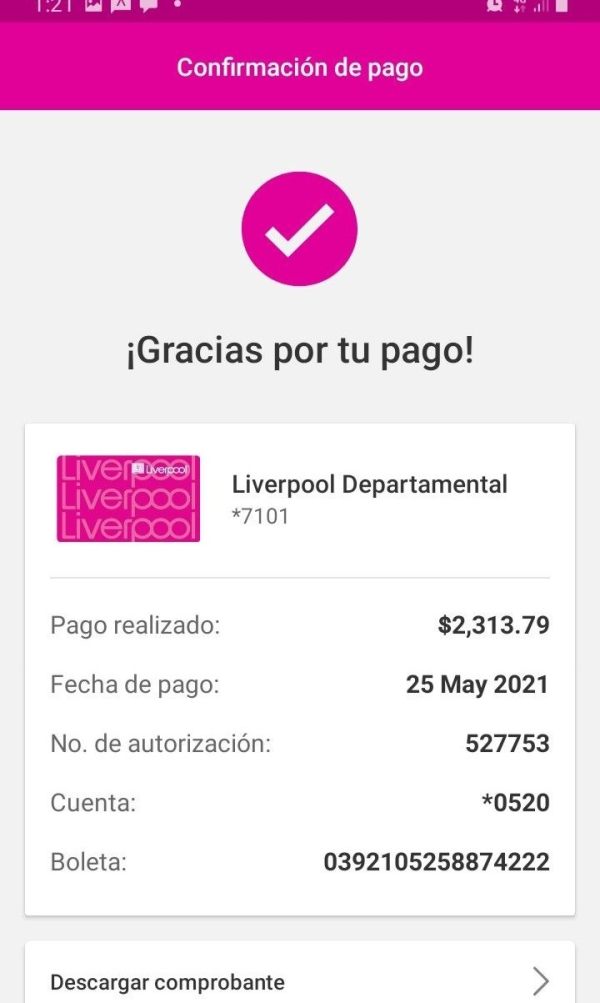

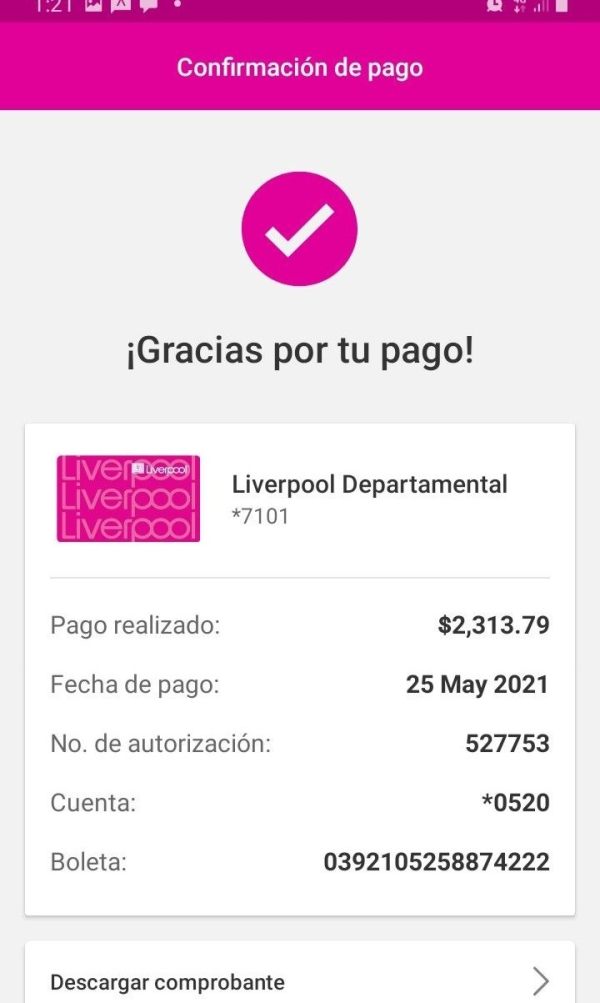

The money ($2313.79) that I decided to put in this broker, I realized that it was just a scam very late. When suddenly I earned too much in one day, and when I went to withdraw pomm, everything was lost.

AMRK Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The money ($2313.79) that I decided to put in this broker, I realized that it was just a scam very late. When suddenly I earned too much in one day, and when I went to withdraw pomm, everything was lost.

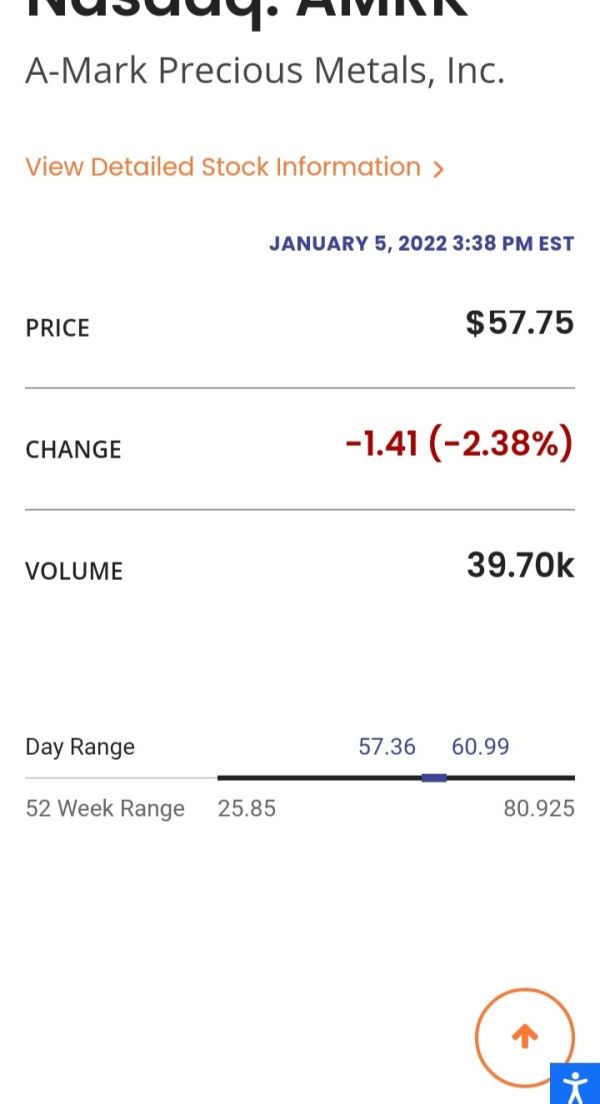

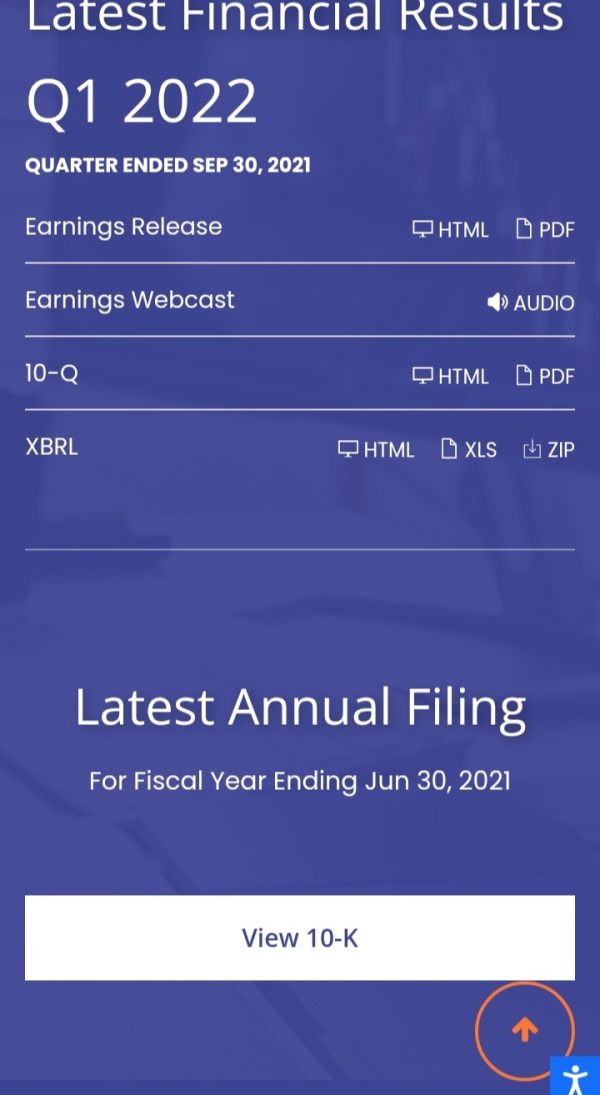

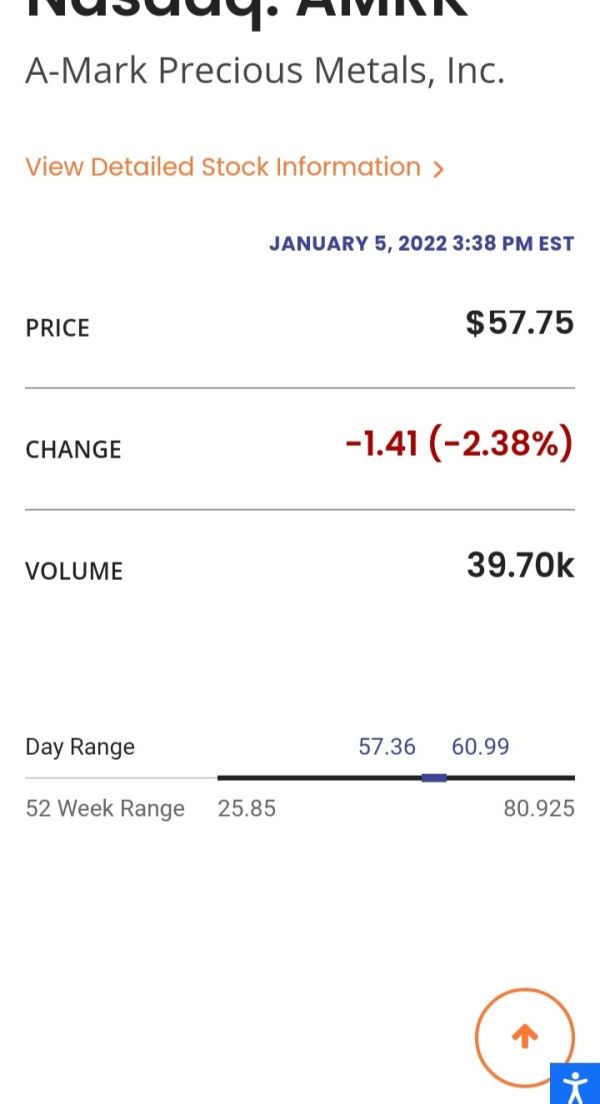

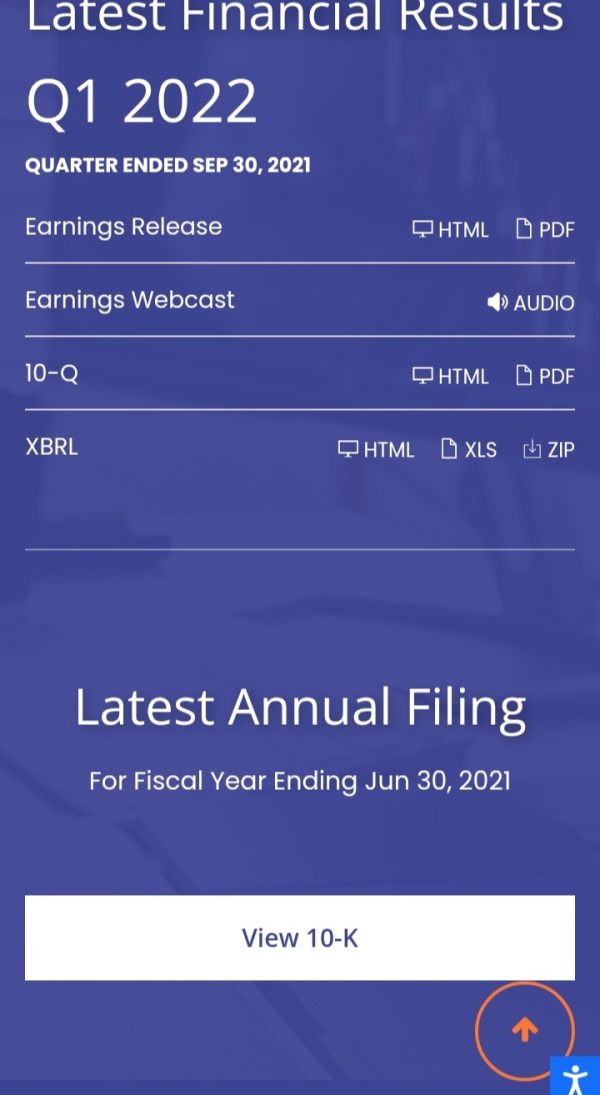

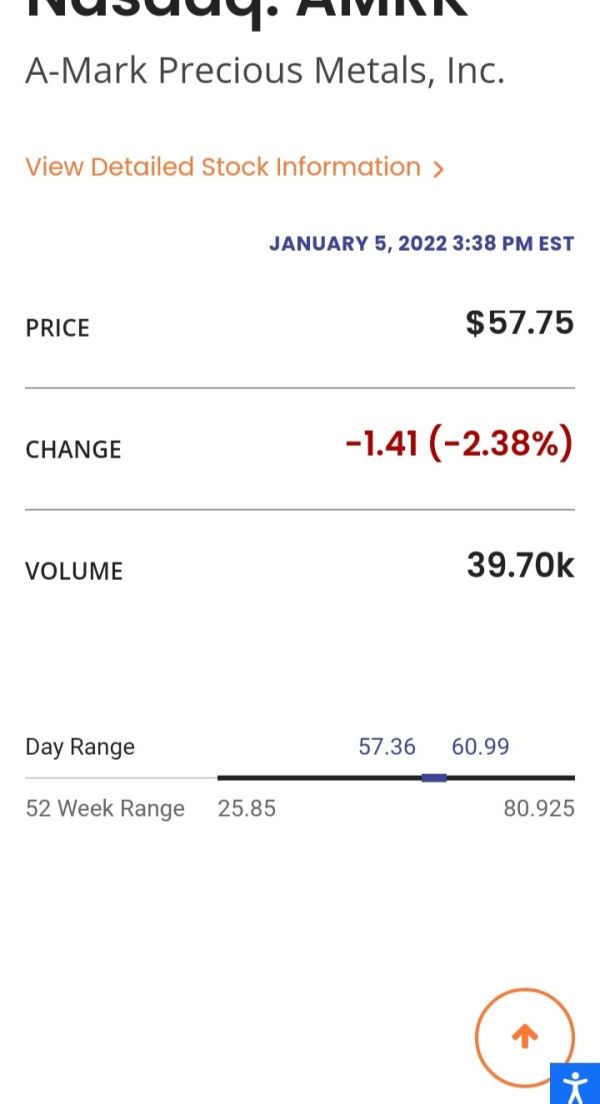

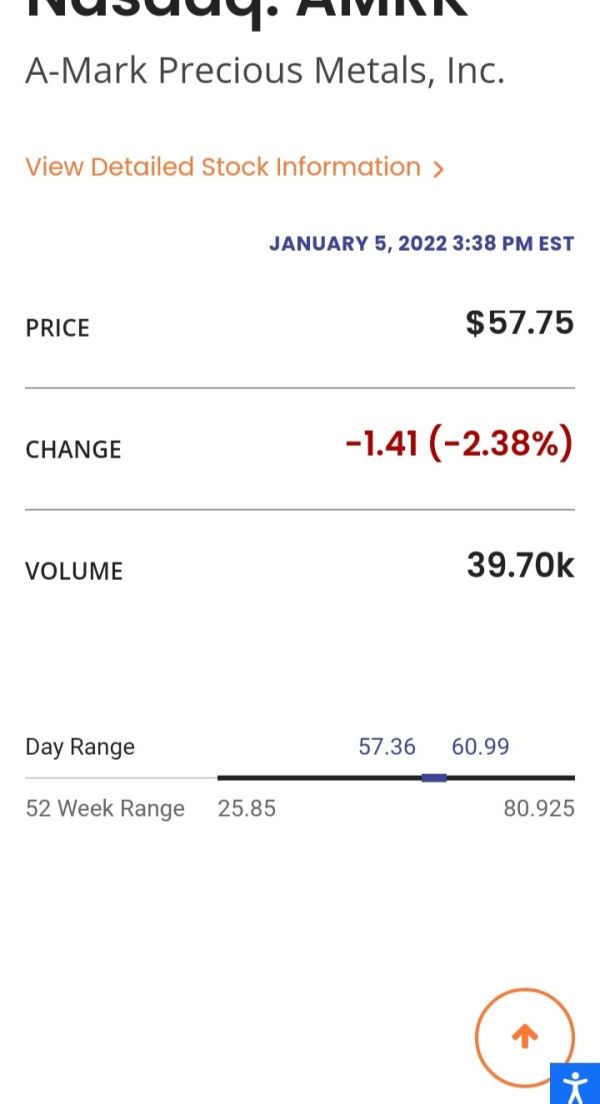

This comprehensive amrk review examines A-Mark Precious Metals. It's a specialized brokerage that focuses on precious metals trading. AMRK operates from El Segundo, California as a full-service precious metals trading company. The company specializes in wholesale transactions of gold, silver, platinum, and palladium. Market data shows the company employs between 51 to 200 staff members. It generates revenue in the range of $5 to $10 billion USD, which indicates substantial market presence in the precious metals sector.

AMRK's business model centers on providing comprehensive precious metals trading services. The company positions itself as a significant player in the wholesale precious metals market. AMRK has established recognition within California's investment and asset management sector. However, specific regulatory oversight details require further clarification. The platform appears designed for investors specifically interested in precious metals exposure. It offers access to the four primary precious metals markets.

This review must note that comprehensive information regarding trading platforms, regulatory status, and detailed service offerings remains limited in available public sources. This may impact potential users' ability to make fully informed decisions about the platform's suitability for their trading needs.

Regional Entity Differences: Potential users should exercise caution when considering AMRK's services. Specific regulatory information was not detailed in available sources. The legal status and safety measures for cross-regional trading operations require independent verification before engaging with the platform.

Review Methodology: This evaluation is based on publicly available market information and company data. Due to limited comprehensive information in accessible sources, some aspects of the platform's operations may not be fully represented in this analysis. Prospective users are advised to conduct additional due diligence and verify all information independently before making trading decisions.

| Dimension | Score | Evaluation Basis |

|---|---|---|

| Account Conditions | N/A | Specific account conditions not detailed in available sources |

| Tools and Resources | N/A | Trading tools and resources information not provided in accessible materials |

| Customer Service and Support | N/A | Customer service details not available in reviewed sources |

| Trading Experience | N/A | Trading experience specifics not documented in available information |

| Trust and Reliability | N/A | Detailed regulatory and trust information not specified in sources |

| User Experience | N/A | User experience details not available in accessible materials |

A-Mark Precious Metals represents a well-established entity in the precious metals trading sector. It operates from its headquarters in El Segundo, California. The company has positioned itself as a comprehensive precious metals trading organization. It focuses specifically on wholesale transactions involving gold, silver, platinum, and palladium. Company information shows AMRK operates as a publicly traded entity under the ticker symbol AMRK. This suggests a level of corporate transparency and regulatory compliance with securities regulations.

The company's substantial revenue range of $5 to $10 billion USD indicates significant market operations. It suggests an established client base within the precious metals trading community. AMRK maintains an employee count ranging from 51 to 200 individuals. This appears to provide adequate staffing levels to support its operations, though specific details about customer service capabilities and support structures remain unclear from available sources.

Specific information about the types of trading platforms offered, technological features, and user interface characteristics was not detailed in accessible sources. The company's primary focus on precious metals trading distinguishes it from broader forex and CFD brokers. This potentially appeals to investors seeking specialized exposure to precious metals markets rather than diversified trading opportunities across multiple asset classes.

Regulatory Status: Specific regulatory oversight information was not detailed in available sources. This requires potential users to independently verify the company's regulatory compliance and licensing status before engaging with their services.

Deposit and Withdrawal Methods: Information regarding available deposit and withdrawal methods was not specified in accessible materials. This necessitates direct inquiry with the company for operational details.

Minimum Deposit Requirements: Specific minimum deposit requirements were not documented in available sources. Potential clients need to contact AMRK directly for account opening specifications.

Promotional Offers: Details regarding bonus promotions or special offers were not available in reviewed materials. This suggests either absence of such programs or limited public disclosure of promotional activities.

Tradeable Assets: The company specializes in four primary precious metals: gold, silver, platinum, and palladium. It focuses on wholesale trading operations rather than offering diversified asset classes typical of general forex brokers.

Cost Structure: Specific information regarding spreads, commissions, and fee structures was not detailed in available sources. This makes it difficult to assess the competitiveness of trading costs compared to other precious metals trading platforms.

Leverage Options: Leverage ratios and margin requirements were not specified in accessible materials. This requires direct communication with the company for trading condition details.

Platform Options: Specific trading platform information was not available in reviewed sources. This leaves questions about technological capabilities and user interface features unanswered.

Geographic Restrictions: Regional limitations and availability restrictions were not documented in available information.

Customer Support Languages: Supported languages for customer service were not specified in accessible materials.

This amrk review highlights the need for potential users to conduct comprehensive due diligence and direct communication with the company to obtain detailed operational information.

The evaluation of AMRK's account conditions faces significant limitations due to insufficient publicly available information regarding specific account types, requirements, and features. Without detailed documentation of account structures, it becomes challenging to assess the competitiveness and suitability of their offerings compared to industry standards.

The absence of clear information about minimum deposit requirements, account tiers, and special features represents a significant information gap. These features include Islamic accounts or professional trading accounts. Potential users interested in precious metals trading would typically expect transparency regarding account opening procedures, verification requirements, and ongoing account maintenance conditions.

The lack of specific details about account benefits, trading privileges, and any potential restrictions limits the ability to evaluate whether AMRK's account conditions align with different investor profiles and trading objectives. The company's focus on wholesale precious metals trading suggests their account structures may differ significantly from typical retail forex broker offerings.

Without access to user feedback regarding account opening experiences, verification processes, or ongoing account management satisfaction, it remains difficult to provide a comprehensive assessment of this crucial aspect of their service offering.

The assessment of AMRK's trading tools and resources encounters substantial limitations due to the absence of detailed information in available sources. For a precious metals trading platform, the quality and comprehensiveness of analytical tools, market research, and educational resources typically play crucial roles in supporting trader decision-making processes.

Without specific documentation of available trading tools, charting capabilities, or analytical resources, potential users cannot adequately evaluate whether AMRK provides the necessary infrastructure to support informed trading decisions in precious metals markets. The precious metals sector often requires specialized analytical tools and market insights that differ from traditional forex trading resources.

Educational resources represent another critical component for precious metals traders. This is particularly important given the unique characteristics and market dynamics of gold, silver, platinum, and palladium markets. The absence of information regarding educational materials, market analysis, or research publications limits the ability to assess AMRK's commitment to trader education and support.

The availability of automated trading support, API access, or third-party tool integration remains unclear from available sources. This represents potential limitations for traders seeking advanced technological capabilities in their precious metals trading activities.

Evaluating AMRK's customer service capabilities proves challenging due to limited publicly available information regarding support channels, response times, and service quality metrics. For a precious metals trading platform handling potentially substantial transactions, robust customer support infrastructure typically represents a critical operational component.

The absence of specific information about available communication channels creates uncertainty about the level of support available to clients. These channels include phone support, email assistance, live chat capabilities, or dedicated account management services. Precious metals trading often involves complex transactions requiring knowledgeable support staff capable of addressing specialized queries.

Response time expectations and service availability hours remain undocumented in accessible sources. This makes it difficult for potential users to understand support accessibility during critical trading periods or emergency situations. The precious metals markets operate across global time zones, making support availability particularly important for international clients.

Without user feedback or testimonials regarding customer service experiences, problem resolution effectiveness, or overall satisfaction with support quality, this amrk review cannot provide definitive insights into the practical reality of their customer service capabilities. Multilingual support availability also remains unclear, potentially limiting accessibility for international precious metals traders.

The analysis of AMRK's trading experience faces significant constraints due to insufficient information about platform performance, execution quality, and user interface characteristics. Trading experience evaluation typically encompasses platform stability, order execution speed, and overall technological reliability. All of these remain undocumented in available sources.

Platform stability represents a crucial factor for precious metals traders, particularly given the volatility and time-sensitive nature of precious metals markets. Without specific information about system uptime, technical reliability, or platform performance during high-volume trading periods, potential users cannot assess the technological robustness of AMRK's trading infrastructure.

Order execution quality remains undocumented in accessible materials. This includes fill rates, slippage characteristics, and execution speed. For precious metals trading, where price movements can be significant and rapid, execution quality directly impacts trading profitability and overall user satisfaction.

Mobile trading capabilities and cross-platform functionality information was not available in reviewed sources. This limits the assessment of trading flexibility and accessibility. The absence of user feedback regarding actual trading experiences, platform usability, or technical performance creates substantial gaps in understanding the practical reality of trading with AMRK.

Assessing AMRK's trustworthiness encounters significant challenges due to limited regulatory information and transparency details in available sources. Trust evaluation typically relies on regulatory oversight, fund security measures, and corporate transparency. These are areas where specific information remains scarce.

The absence of detailed regulatory compliance information raises questions about oversight mechanisms and investor protection measures. While the company appears to operate as a publicly traded entity under the AMRK ticker symbol, specific financial services regulation and precious metals trading oversight details require clarification.

Fund security measures were not documented in available sources. These include segregation of client funds, insurance coverage, and protection mechanisms. For precious metals trading involving potentially substantial investments, fund security represents a paramount concern for potential users.

Corporate transparency regarding ownership structure, financial reporting, and operational procedures remains unclear from accessible materials. The company's substantial reported revenue suggests established operations. However, detailed transparency regarding business practices and risk management procedures requires further investigation.

Industry reputation and third-party evaluations were not available in reviewed sources. This limits the ability to assess peer recognition and professional standing within the precious metals trading community.

The evaluation of AMRK's user experience faces substantial limitations due to insufficient information about interface design, usability features, and actual user feedback. User experience assessment typically encompasses registration processes, platform navigation, and overall satisfaction metrics. These are areas where specific information remains unavailable.

Interface design and platform usability characteristics were not documented in available sources. This makes it difficult to assess the accessibility and user-friendliness of AMRK's trading environment. For precious metals traders, intuitive platform design can significantly impact trading efficiency and decision-making processes.

Registration and verification procedures remain unclear from accessible materials. This creates uncertainty about account opening complexity and documentation requirements. The onboarding experience often influences initial user impressions and long-term platform satisfaction.

Fund management experience lacks specific documentation in available sources. This includes deposit and withdrawal processes, transaction processing times, and operational efficiency. These operational aspects significantly impact overall user satisfaction and platform practicality.

Without comprehensive user feedback, satisfaction surveys, or testimonials, this amrk review cannot provide definitive insights into the actual user experience reality. The absence of both positive and negative user reviews limits the ability to identify common strengths and potential areas for improvement.

This comprehensive amrk review reveals A-Mark Precious Metals as a specialized precious metals trading entity with substantial market presence. This is evidenced by its significant revenue range and established corporate structure. However, the evaluation highlights considerable information gaps regarding operational details, regulatory compliance, and user experience factors that are crucial for trader decision-making.

AMRK appears most suitable for investors specifically seeking precious metals exposure through gold, silver, platinum, and palladium trading. It particularly appeals to those interested in wholesale market access. The company's substantial revenue and established corporate presence suggest operational stability. However, specific service quality metrics remain unclear.

The primary advantages include specialization in precious metals markets and apparent corporate stability. Significant drawbacks involve limited transparency regarding regulatory oversight, trading conditions, and customer service capabilities. Potential users should conduct thorough due diligence and direct communication with AMRK to obtain essential operational details before making trading decisions.

FX Broker Capital Trading Markets Review