Capstone 2025 Review: Everything You Need to Know

Executive Summary

This complete capstone review looks at Capstone Investment Advisors. The company is a financial services firm that started in 2004 and has its main office at 7 World Trade Center. Based on what we know, Capstone works mainly as an investment management company that focuses on risk management and derivatives trading. Paul Britton founded the firm and it reportedly manages about $11 billion in assets under management.

However, our study shows big information gaps about specific trading conditions, regulatory oversight, and client services that potential users should think about carefully. The company has been around since 2004, which shows some level of market presence. But the lack of detailed trading specifications, fee structures, and regulatory transparency raises questions about whether it works well for retail forex traders. The firm seems to serve mainly institutional clients and smart investors rather than individual retail traders who want traditional forex brokerage services.

Since there is limited public information about trading platforms, account types, and customer support infrastructure, potential clients should be very careful before working with this provider.

Important Notice

Regional Differences: This review uses publicly available information about Capstone Investment Advisors. Since we lack specific regulatory information in available sources, users across different areas should check on their own that the company follows their local financial regulations before starting any business relationship.

Review Methodology: This evaluation uses limited publicly available information. Readers should know that complete details about trading conditions, regulatory status, and service offerings may not be fully shown in this analysis because of information limits.

Rating Framework

Based on available information, here are our ratings across six key areas:

Broker Overview

Capstone Investment Advisors started in 2004. This makes it a company that has been in the financial services sector for a long time. According to Wikipedia sources, the company has its headquarters at 7 World Trade Center and Paul Britton founded it. The firm came after Mako Global Derivatives, which shows a background in derivatives trading and risk management.

The company's main business model seems focused on investment management and derivatives trading. It has reported assets under management of about $11 billion USD. This large AUM figure suggests the firm mainly serves institutional clients and high-net-worth individuals rather than retail forex traders. The company's location at the World Trade Center complex puts it in New York's top financial district, though this alone does not guarantee regulatory compliance or service quality.

Available sources do not give specific information about trading platforms, asset classes offered to retail clients, or primary regulatory oversight. This capstone review must therefore acknowledge big information limitations that potential clients should address through direct contact with the firm.

Regulatory Regions

Available sources do not specify the regulatory areas under which Capstone Investment Advisors operates. Its U.S. headquarters suggests potential oversight by American financial authorities.

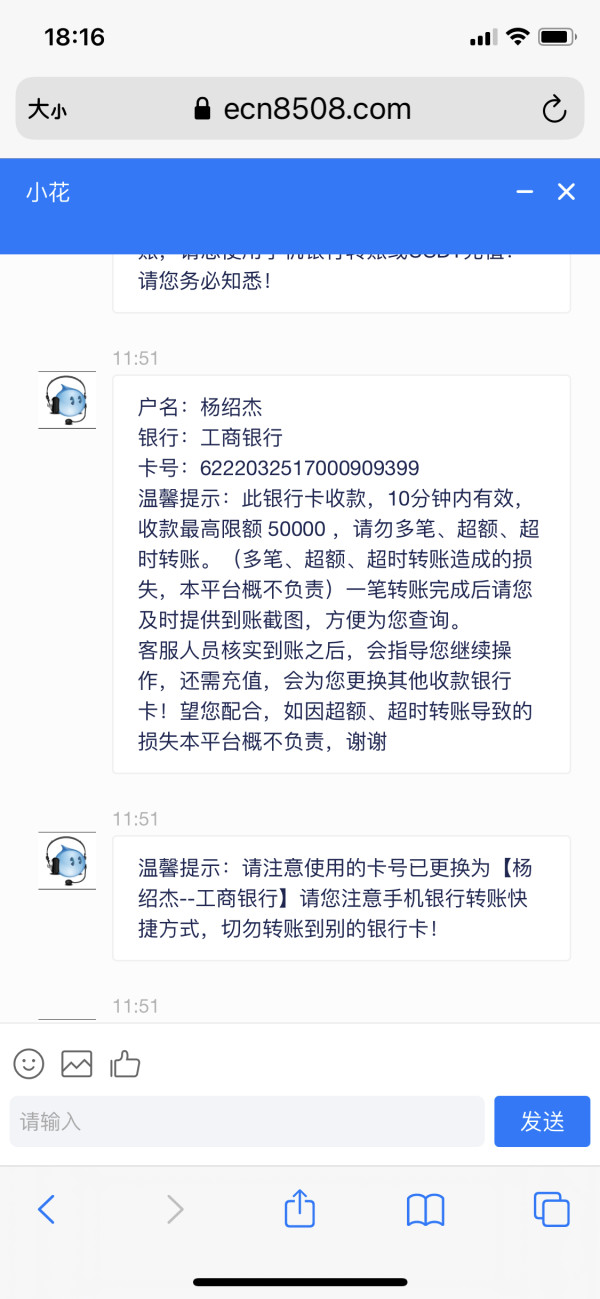

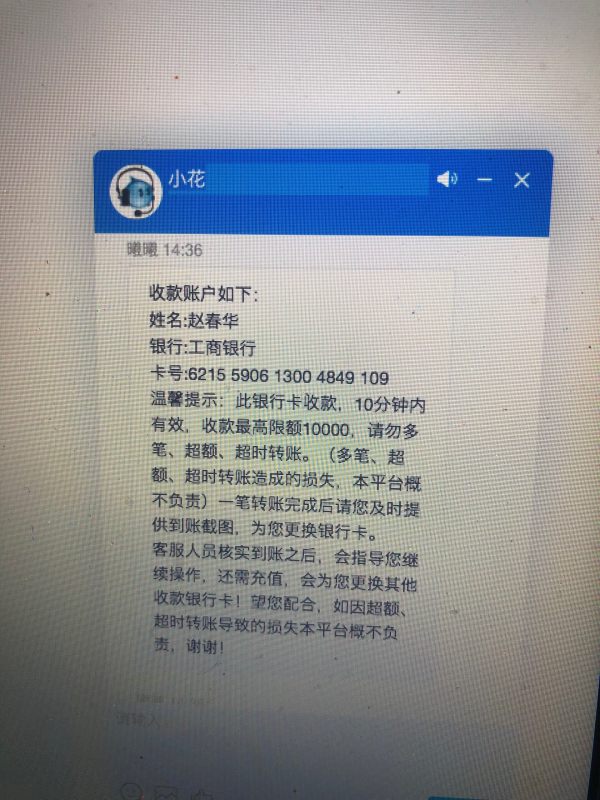

Deposit and Withdrawal Methods

Specific information about funding methods and withdrawal procedures is not detailed in available sources. This requires direct verification with the provider.

Minimum Deposit Requirements

Minimum account opening requirements are not specified in the publicly available materials reviewed for this analysis.

No information about promotional offers or bonus structures is available in the sources examined for this capstone review.

Available Trading Assets

The range of tradeable instruments and asset classes is not detailed in available public information. The firm's derivatives background suggests potential focus on complex financial instruments.

Cost Structure

Fee schedules, spread information, and commission structures are not specified in available sources. This represents a significant information gap for potential clients.

Leverage Ratios

Maximum leverage ratios and margin requirements are not detailed in publicly available materials.

Specific trading platform offerings and technology infrastructure details are not provided in available sources.

Geographic Restrictions

Regional availability and geographic limitations are not specified in the materials reviewed.

Customer Service Languages

Multi-language support capabilities are not detailed in available information.

Detailed Rating Analysis

Account Conditions Analysis

The absence of detailed account condition information in publicly available sources presents a big challenge for this capstone review. Traditional forex brokers typically offer multiple account levels with varying minimum deposits, leverage options, and fee structures. However, Capstone's clear focus on institutional investment management suggests their account structures may differ a lot from retail forex offerings.

Without specific information about account types, minimum opening balances, or special account features such as Islamic accounts, potential clients cannot properly assess whether Capstone's offerings align with their trading needs. The firm's large assets under management figure suggests account minimums may be much higher than typical retail brokers.

The lack of publicly available information about account opening procedures, verification requirements, or account management features further complicates evaluation. Prospective clients should directly contact the firm to understand available account structures and their related terms and conditions.

Available sources do not provide specific information about trading tools, analytical resources, or educational materials offered by Capstone. Given the firm's institutional focus and derivatives background, any tools provided are likely geared toward smart investors rather than retail traders seeking basic forex education.

The absence of information about charting packages, economic calendars, research reports, or automated trading support represents a big gap in this evaluation. Traditional retail forex brokers typically offer complete suites of analytical tools and educational resources, but Capstone's institutional orientation may result in different resource priorities.

Without details about proprietary research, third-party integrations, or technological capabilities, potential clients cannot assess the firm's analytical infrastructure. The lack of information about mobile applications, API access, or algorithmic trading support further limits evaluation possibilities.

Customer Service and Support Analysis

Customer service information is notably absent from available sources. This prevents complete evaluation of support quality and availability. Traditional forex brokers typically provide multiple contact channels, extended operating hours, and multilingual support capabilities.

The absence of information about response times, service quality metrics, or support channel availability represents a big evaluation limitation. Without details about phone support, live chat capabilities, or email response procedures, potential clients cannot assess service accessibility.

The lack of information about support team expertise, problem resolution procedures, or escalation processes further complicates service quality assessment. Given the firm's institutional focus, support structures may be designed for smart clients with different service expectations than retail traders.

Trading Experience Analysis

Available sources provide no specific information about trading platform performance, execution quality, or user interface design. This absence of technical performance data greatly limits evaluation of the actual trading experience Capstone provides.

Without information about order execution speeds, platform stability, slippage rates, or rejection frequencies, potential clients cannot assess trading infrastructure quality. The lack of details about platform features, customization options, or mobile trading capabilities further restricts capstone review completeness.

The absence of user feedback about platform reliability, execution quality, or technical support represents a large evaluation gap. Traditional forex brokers typically provide detailed platform specifications and performance metrics, but such information is not available for Capstone in reviewed sources.

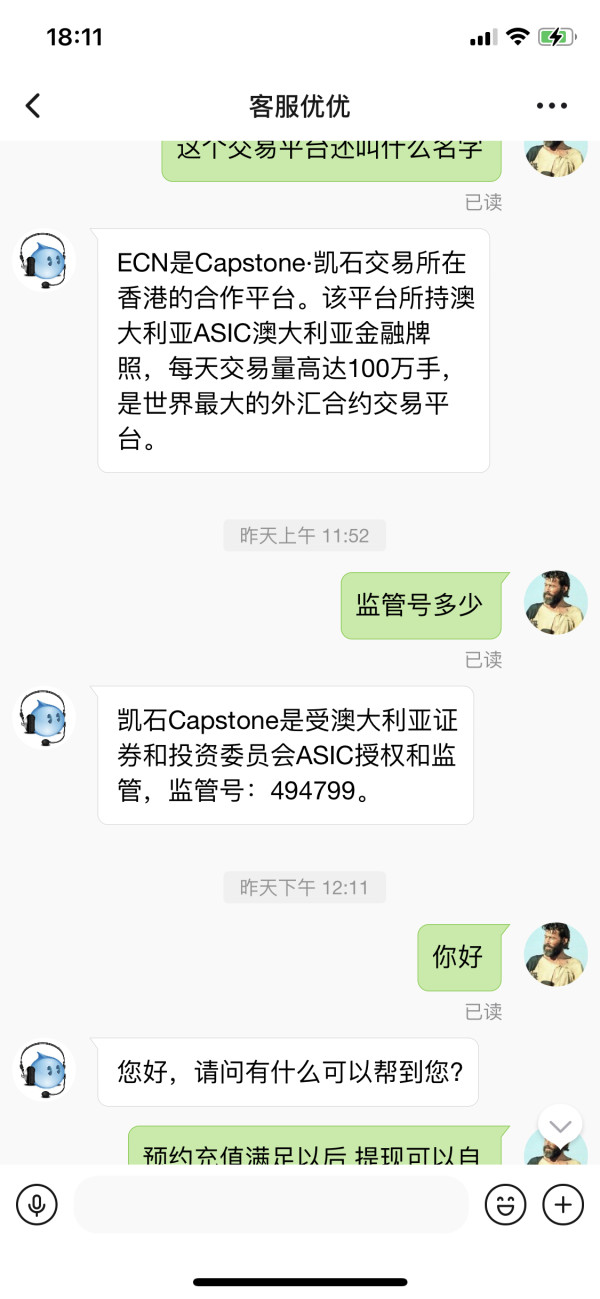

Trust and Regulation Analysis

The regulatory transparency gap represents perhaps the most important concern in this evaluation. While Capstone's U.S. headquarters suggests potential regulatory oversight, specific regulatory registrations, compliance status, and oversight mechanisms are not detailed in available sources.

Without information about regulatory licenses, client fund protection measures, or compliance procedures, potential clients cannot properly assess safety and legitimacy. The absence of details about segregated accounts, insurance coverage, or regulatory complaint procedures further complicates trust assessment.

The lack of information about regulatory history, enforcement actions, or compliance violations prevents complete risk evaluation. Given the critical importance of regulatory oversight in financial services, this information gap represents a large concern for potential clients.

User Experience Analysis

Available sources provide no specific information about overall user satisfaction, interface design quality, or account management procedures. This absence of user experience data greatly limits evaluation of client satisfaction and service quality.

Without information about registration processes, account verification procedures, or platform usability, potential clients cannot assess the practical aspects of engaging with Capstone. The lack of user testimonials, satisfaction surveys, or experience reports further restricts evaluation capabilities.

The absence of information about common user complaints, service improvement initiatives, or client retention metrics represents a large evaluation gap that potential clients should address through independent research and direct inquiry.

Conclusion

This capstone review reveals big information limitations that potential clients must carefully consider. While Capstone Investment Advisors' establishment in 2004 and large assets under management suggest market presence and institutional credibility, the absence of detailed information about trading conditions, regulatory oversight, and client services raises important questions.

The firm appears mainly oriented toward institutional clients and smart investors rather than retail forex traders. Potential clients seeking traditional forex brokerage services should carefully evaluate whether Capstone's institutional focus aligns with their trading needs and experience level.

Given the large information gaps identified in this analysis, prospective clients should conduct thorough due diligence. This includes direct communication with the firm to clarify service offerings, regulatory status, and trading conditions before making any commitment.