Is Capstone safe?

Business

License

Is Capstone A Scam?

Introduction

Capstone is a broker that has garnered attention in the foreign exchange (forex) market, positioning itself as a platform for traders seeking to engage in various financial instruments, including forex, CFDs, and commodities. Given the vast array of brokers available, it is essential for traders to perform due diligence to ensure that they are partnering with a reputable and trustworthy trading entity. The forex market, while lucrative, is also fraught with risks, including potential scams and unregulated brokers that may jeopardize traders' funds. This article aims to provide a comprehensive analysis of Capstone, focusing on its regulatory status, company background, trading conditions, customer security measures, and client experiences, thereby answering the critical question: Is Capstone safe?

To conduct this investigation, we relied on a combination of regulatory databases, user reviews, and expert analysis from various financial platforms. This multifaceted approach allows us to present a balanced view of Capstone's safety profile, helping traders make informed decisions.

Regulation and Legitimacy

Understanding the regulatory landscape is crucial when evaluating any broker, as it directly impacts the safety of traders' funds and the overall integrity of the trading environment. Capstone's regulatory status has raised concerns among industry experts and potential clients. Notably, Capstone is not regulated by any top-tier financial authority, which is a significant red flag for traders seeking security and trustworthiness.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 494799 | Australia | Suspicious Clone |

The lack of regulation by recognized authorities such as the U.S. Securities and Exchange Commission (SEC) or the UK's Financial Conduct Authority (FCA) means that Capstone operates in a less stringent regulatory environment. This absence of oversight raises questions about the broker's compliance with industry standards and its commitment to safeguarding clients' interests. Furthermore, allegations of operating under a "clone" license have surfaced, indicating that Capstone may not be the legitimate entity it claims to be. Consequently, potential clients should proceed with caution and consider the implications of trading with an unregulated broker. In summary, the evidence suggests that Capstone is not safe due to its lack of regulatory oversight.

Company Background Investigation

A thorough understanding of Capstone's history, ownership structure, and transparency levels is vital to assess its reliability. Capstone was established in 2020 and claims to offer a wide range of financial services. However, details regarding its ownership and management team are sparse, which raises concerns about the broker's transparency and accountability.

The management team's background is crucial in determining the broker's credibility. Unfortunately, there is limited publicly available information about the individuals behind Capstone, making it challenging to evaluate their experience and expertise in the financial sector. This lack of information could be indicative of a broader issue regarding the broker's transparency and willingness to provide clients with the necessary information to make informed decisions.

Moreover, the companys operational history is relatively short, which may not provide sufficient evidence of its stability and reliability in the long term. The absence of comprehensive information regarding its management and operational practices further complicates the assessment of whether Capstone is safe for traders. In light of these factors, prospective clients are encouraged to approach Capstone with skepticism and consider alternative brokers with a more transparent operational history.

Trading Conditions Analysis

When assessing a broker's trustworthiness, it's essential to examine its trading conditions, including fees, spreads, and overall cost structure. Capstone claims to offer competitive trading conditions; however, the specifics of its fee structure warrant closer scrutiny.

| Fee Type | Capstone | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.2 pips |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | High | Moderate |

The spreads offered by Capstone, particularly for major currency pairs, are higher than the industry average, which may indicate a less favorable trading environment for clients. Moreover, the commission structure is not clearly defined, which can lead to unexpected costs for traders. High overnight interest rates could also pose significant risks for traders holding positions longer than a day.

These factors contribute to an overall perception that Capstone may not provide the most competitive trading conditions, raising further questions about its legitimacy. Traders should be cautious of brokers that do not offer clear and transparent fee structures, as this can often lead to hidden costs that erode potential profits. Thus, it is imperative to consider whether Capstone is safe based on its trading conditions and associated costs.

Client Funds Security

The security of client funds is a paramount concern for any trader, and evaluating a broker's measures to protect these funds is critical. Capstone's approach to client funds security is concerning, as it lacks robust measures such as segregated accounts and investor protection schemes.

Segregated accounts are essential for ensuring that client funds are kept separate from the broker's operational funds, providing an additional layer of security in case of financial difficulties. Furthermore, the absence of negative balance protection means that traders could potentially lose more than their initial investment, leading to significant financial repercussions.

In the past, there have been reports of financial disputes and issues related to fund withdrawal delays, which further complicates the perception of Capstone as a reliable broker. Given these factors, it is clear that Capstone is not safe for traders who prioritize the security of their investments. Traders are encouraged to seek brokers that offer comprehensive security measures, including fund segregation and investor protection.

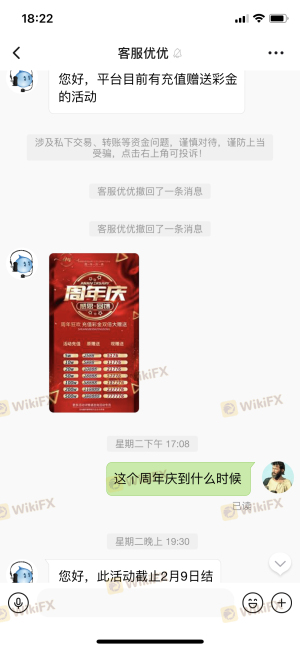

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding a broker's reputation and the overall client experience. Reviews of Capstone reveal a mixed bag of experiences, with many users expressing dissatisfaction with the broker's services. Common complaints include withdrawal delays, lack of responsive customer support, and unclear fee structures.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Inadequate |

| Unclear Fees | High | Poor |

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and financial strain. The trader reported that customer support was unresponsive, exacerbating the issue. Such experiences highlight the potential risks associated with trading through Capstone and raise further concerns about whether Capstone is safe for clients.

Platform and Trade Execution

An effective trading platform is essential for a seamless trading experience. Capstone utilizes the widely used MetaTrader 4 platform, which is known for its user-friendly interface and robust features. However, performance issues, including occasional lags and execution delays, have been reported by users.

The quality of order execution is also a critical factor in evaluating a broker's reliability. Instances of slippage and rejected orders have raised concerns among traders, suggesting that Capstone may not provide the level of execution quality expected from a reputable broker. These issues could significantly impact trading outcomes and lead to losses, further questioning the broker's integrity.

Given these performance concerns, it is important for traders to consider whether Capstone is safe for executing their trades, especially in a fast-paced market environment where timely execution is crucial.

Risk Assessment

Engaging with any broker comes with inherent risks, and evaluating these risks is essential for informed decision-making. Capstone presents several risk factors that potential clients should carefully consider before proceeding.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises significant concerns. |

| Financial Risk | Medium | Lack of transparency in fees and withdrawal issues. |

| Operational Risk | High | Reports of execution issues and platform instability. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers that are regulated and have a proven track record of reliable service. Additionally, implementing risk management strategies, such as setting stop-loss orders and trading with only a portion of available capital, can help minimize potential losses.

In conclusion, the evidence suggests that Capstone is not safe for traders due to its unregulated status, lack of transparency, and numerous client complaints.

Conclusion and Recommendations

In light of the comprehensive analysis presented, it is clear that Capstone raises several red flags that warrant caution. The absence of regulatory oversight, coupled with a history of client complaints and unresolved issues, strongly indicates that Capstone is not safe for traders seeking a reliable forex broker.

For those considering entering the forex market, it is advisable to explore alternative brokers that are fully regulated and offer transparent trading conditions. Brokers such as IG, OANDA, or Forex.com provide a more secure trading environment, backed by stringent regulatory frameworks and positive client feedback. Ultimately, making informed choices based on thorough research is essential for safeguarding investments and achieving trading success.

Is Capstone a scam, or is it legit?

The latest exposure and evaluation content of Capstone brokers.

Capstone Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Capstone latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.