CapPlace 2025 Review: Everything You Need to Know

Executive Summary

This CapPlace review gives you a complete look at a CFD broker that started in 2006. CapPlace offers trading services across many different types of investments, presenting itself as a platform that works for traders at every skill level. The company gives you access to over 350 trading tools including forex, commodities, and cryptocurrencies through Contracts for Difference (CFDs).

CapPlace works under MISA regulation and offers trading with leverage up to 1:200. The platform requires a minimum deposit of $250, which makes it easy for new traders to start. CapPlace uses an advanced Webtrader platform that helps you trade online across many different financial tools.

User feedback shows mixed feelings about how reliable and trustworthy the platform is. The broker offers many trading tools and good leverage options, but people worry about customer service quality and whether they can trust the platform. The trust score among users is only 40, which means the company needs to work hard to build trader confidence.

CapPlace targets international investors who want different trading opportunities. The company especially focuses on those interested in multi-asset trading strategies, though its long history and regulatory status don't solve all concerns. Potential traders should think carefully about the platform's problems along with its benefits before making investment decisions.

Important Disclaimer

Trading with CapPlace involves serious risks. Regulatory policies change across different countries, which might affect your trading experience and fund security, and between 74-89% of retail investor accounts lose money when trading CFDs with providers like CapPlace.

This review uses publicly available information and user feedback from 2025 to give you a fair and honest assessment. You should do your own research and think about your financial situation before using any trading platform, since regulatory oversight by MISA may mean different things depending on where you live and your local financial regulations.

Rating Framework

Broker Overview

CapPlace started in 2006 as a CFD broker that serves traders at all experience levels. The company works as a complete trading platform that focuses on forex and other financial tools through Contracts for Difference, and with almost twenty years of operation, CapPlace has built its services to meet the changing needs of the online trading community.

The broker's business model focuses on giving you online trading platforms that let you trade forex, commodities, and cryptocurrencies. According to forexdailyinfo.com, "CapPlace is a leading online trading platform, developed in providing traders of all levels with advanced analytical tools, a user-friendly interface and access to a diverse range of financial instruments through Contracts for Difference (CFDs)."

CapPlace uses an advanced Webtrader platform that supports many trading functions and works with different trading strategies. The platform covers many types of assets, offering over 350 trading tools across forex, commodities, and cryptocurrency markets, and the broker operates under MISA regulation, though specific license numbers weren't detailed in available documentation. This regulatory framework gives some level of oversight, but how well MISA regulation works may change depending on regional implementation.

Regulatory Jurisdiction: CapPlace operates under MISA regulation. Specific regulatory requirements and policies may differ across various regions where the broker offers services.

Deposit and Withdrawal Methods: Specific deposit and withdrawal methods weren't detailed in available documentation. Potential users need to contact the broker directly for complete payment options.

Minimum Deposit Requirements: The platform requires a minimum deposit of $250. This positions it as accessible for beginning traders looking to enter the financial markets with relatively modest capital requirements.

Bonus and Promotional Offers: Current bonus structures and promotional activities weren't specified in available documentation. Potential users should ask the broker directly about available incentives.

Tradeable Assets: CapPlace gives you access to over 350 trading tools spanning multiple asset categories including forex pairs, commodities, and cryptocurrency CFDs. This offers traders significant diversification opportunities.

Cost Structure: The broker operates with variable spreads. Specific commission structures and additional fees weren't detailed in available documentation, so traders should verify complete fee schedules before opening accounts.

Leverage Ratios: Maximum leverage offered reaches 1:200. This enables high-risk trading strategies for experienced traders while requiring careful risk management practices.

Platform Options: The broker uses an advanced Webtrader platform designed to provide complete trading functionality through web-based access.

Geographic Restrictions: Specific regional limitations weren't detailed in available documentation. Regulatory compliance may restrict services in certain jurisdictions.

Customer Support Languages: Available customer service language options weren't specified in current documentation. This requires direct inquiry for language support capabilities.

This complete CapPlace review continues with detailed analysis of each rating category to give traders thorough evaluation criteria.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

CapPlace's account conditions present a mixed picture for potential traders. The broker's minimum deposit requirement of $250 shows accessibility for beginning traders, representing a reasonable entry point compared to many competitors in the CFD trading space, and according to available information, this threshold allows newcomers to test the platform without substantial initial capital commitment.

Specific account type varieties and their distinctive features weren't detailed in available documentation. This lack of transparency about different account tiers and their respective benefits represents a significant information gap that potential users should address through direct broker contact, and the account opening process specifics were similarly not outlined in accessible materials.

User feedback about account conditions appears generally positive. Several traders indicate satisfaction with the entry-level requirements, and the $250 minimum deposit has been described by users as reasonable and achievable for most retail traders seeking market access. When compared to other brokers in the industry, CapPlace's low barrier to entry attracts newcomers, though the absence of detailed account type information may deter more experienced traders seeking premium services.

Special account features such as Islamic accounts or professional trader classifications weren't mentioned in available documentation. This CapPlace review notes that potential users requiring specific account accommodations should verify availability directly with the broker's customer service team.

CapPlace excels in providing trading tool diversity, offering over 350 trading tools across multiple asset classes. This extensive selection covers forex pairs, commodities, and cryptocurrency CFDs, enabling traders to implement diversified trading strategies within a single platform, and the breadth of available tools represents one of the broker's strongest competitive advantages.

The advanced Webtrader platform serves as the primary trading interface. Specific analytical tools and charting capabilities weren't detailed in available documentation, and research and analysis resources, including market commentary, economic calendars, and technical analysis tools, weren't specifically outlined in accessible materials, representing an information gap for potential users.

Educational resources and their scope weren't detailed in current documentation. Such materials often prove crucial for trader development and platform adoption, and similarly, automated trading support capabilities, including Expert Advisor compatibility and algorithmic trading features, weren't specified in available information.

User feedback about trading tools shows general satisfaction with the tool variety. According to user reports, the diverse selection of tradeable assets meets various trading strategy requirements and allows for portfolio diversification, though specific feedback about research tools and educational materials wasn't extensively documented in available sources.

Customer Service and Support Analysis (Score: 6/10)

CapPlace maintains a dedicated customer support team. Specific service channels and availability details weren't comprehensively outlined in available documentation, and user experiences with customer service present mixed results, with response times and service quality receiving varied feedback from the trading community.

Available information suggests that some users have experienced longer-than-expected response times when seeking assistance. Service quality assessments indicate inconsistency in problem resolution effectiveness, with some traders expressing satisfaction while others report challenges in receiving adequate support for their inquiries.

Multilingual support capabilities weren't specified in available documentation. This potentially limits accessibility for international traders who require assistance in languages other than English, and operating hours for customer service were similarly not detailed, creating uncertainty about support availability across different time zones.

User feedback compilation reveals mixed experiences with customer support. Some traders report satisfactory assistance when issues arise, while others express frustration with response delays and resolution effectiveness, and one user comment noted, "Customer service response could be faster and more efficient," reflecting broader concerns about support quality consistency.

Trading Experience Analysis (Score: 7/10)

The trading experience on CapPlace centers around their advanced Webtrader platform, which users generally describe as stable with occasional performance issues. Platform stability receives mixed reviews, with most traders reporting satisfactory performance during normal market conditions, though some users note occasional delays during high-volatility periods.

Order execution quality has generated varied user feedback. Some traders report concerns about slippage and requoting during market movements, and these execution issues, while not universally experienced, represent areas where the platform could improve to enhance overall trading satisfaction.

Platform functionality appears comprehensive based on user reports. Specific feature details weren't extensively documented in available materials, and the web-based interface design receives moderate praise for accessibility, though some users suggest improvements in navigation and feature organization could enhance usability.

Mobile trading experience details weren't specified in available documentation. This represents a significant information gap given the importance of mobile trading capabilities in today's market environment, and trading environment stability, including spread consistency and liquidity provision, receives attention from users who monitor these factors closely.

Technical performance data and specific execution statistics weren't provided in available documentation. This CapPlace review notes that traders prioritizing execution speed and minimal slippage should verify current performance metrics directly with the broker before committing to the platform.

Trustworthiness Analysis (Score: 4/10)

CapPlace's trustworthiness presents the most significant concern area, with user trust scores reaching only 40 out of 100. This low confidence level reflects broader community concerns about platform legitimacy and operational reliability, and the MISA regulatory status provides some oversight, though specific license verification details weren't readily available in documentation.

Fund security measures and client money protection protocols weren't detailed in available information. This creates uncertainty about investor protection standards, and company transparency about ownership, financial statements, and operational procedures appears limited based on accessible documentation, contributing to user trust concerns.

Industry reputation assessment reveals mixed signals. The broker's long operational history since 2006 provides some credibility, while recent user feedback suggests declining confidence levels, and the absence of detailed regulatory information and transparent operational disclosures compounds trust-related concerns among potential users.

Third-party evaluations and industry report ratings weren't extensively available in current documentation. Independent verification of regulatory status and operational legitimacy should be prioritized by potential users given the low trust scores reported by existing clients.

User Experience Analysis (Score: 6/10)

Overall user satisfaction with CapPlace shows moderate levels with significant room for improvement. User feedback compilation reveals neutral to mixed experiences, with positive aspects including tool variety and accessibility, while negative factors center on customer service and platform reliability concerns.

Interface design and usability receive moderate ratings from users. Most describe the platform as functional but not particularly intuitive, and navigation improvements and enhanced user interface design could significantly improve the overall experience for both novice and experienced traders.

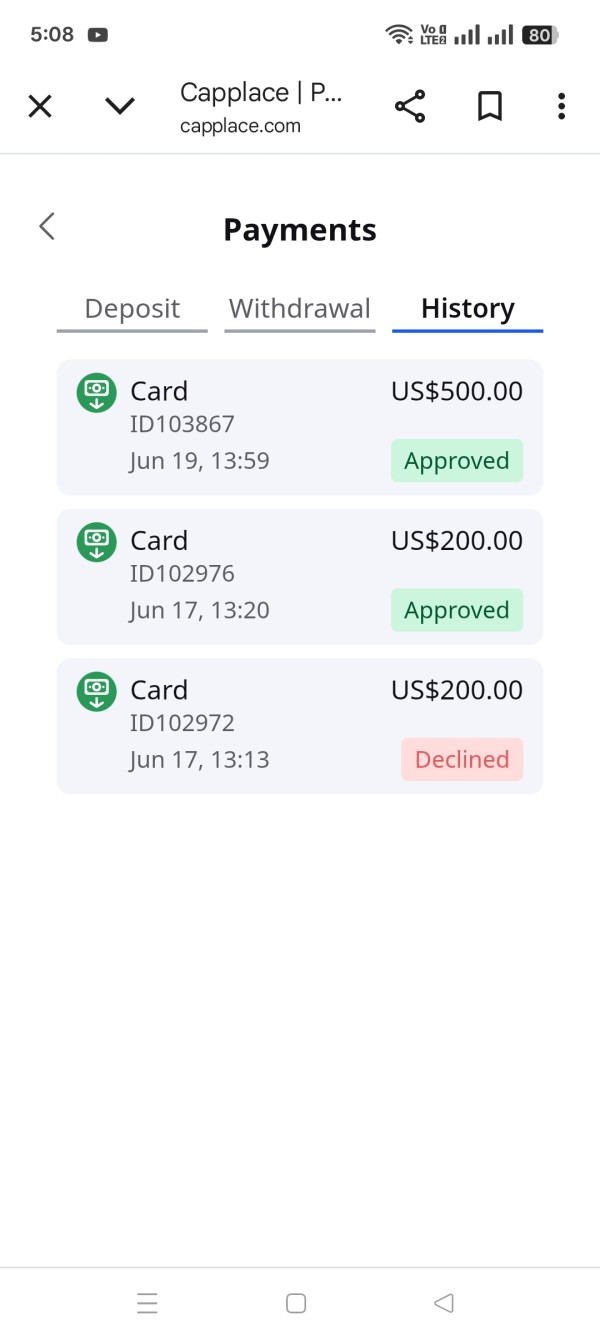

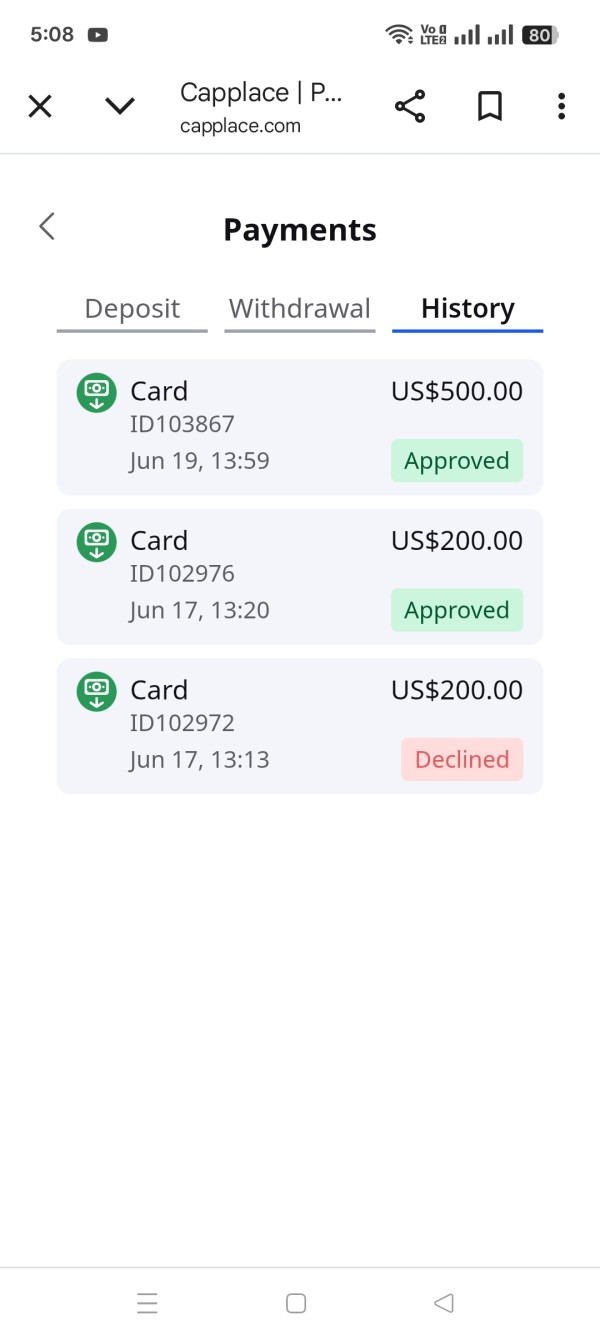

Registration and verification process details weren't specified in available documentation. Account opening is described as reasonably straightforward, and fund operation experiences, including deposit and withdrawal processes, weren't extensively detailed in accessible user feedback.

Common user complaints focus primarily on customer service responsiveness and occasional platform performance issues. Some users also express concerns about transparency and communication from the broker about policy changes and platform updates.

User demographic analysis suggests the platform attracts traders seeking diversified investment opportunities with modest initial capital requirements. However, retention concerns arise from trust and service quality issues that may impact long-term user satisfaction.

Conclusion

This CapPlace review reveals a CFD broker with both strengths and significant areas for improvement. CapPlace offers an extensive selection of trading tools and maintains accessible entry requirements, but concerns about trustworthiness and customer service quality present notable challenges for potential users.

The platform best serves beginning traders and diversification-focused investors who prioritize tool variety and low minimum deposits. Traders prioritizing platform reliability, superior customer service, and transparent operations may find better alternatives in the current market.

Key advantages include the diverse range of over 350 trading tools and competitive leverage options up to 1:200. Primary disadvantages center on low user trust scores, inconsistent customer service quality, and limited transparency about operational procedures and fund security measures.

Potential users should carefully weigh these factors and conduct additional research before committing funds to the platform. This is particularly important given the significant concerns raised about trustworthiness and service quality consistency.