OnePro 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive OnePro review reveals a brokerage firm that positions itself as a professional trading platform. However, it has notable limitations in transparency and regulatory clarity that traders should know about. OnePro operates as a forex and CFD broker offering MetaTrader 4 platform access. The company targets primarily professional traders seeking advanced trading capabilities. According to available information from Digital Global Times and TechBullion, the platform has garnered attention for its focus on professional-grade services and user experience.

The broker's key highlights include its MetaTrader 4 platform integration and claims of robust customer service support. However, our analysis reveals significant gaps in regulatory transparency and limited publicly available information about trading conditions. This raises important considerations for potential clients who want to understand what they're getting into. While some sources suggest positive user feedback regarding customer service quality and order execution, the overall picture presents a mixed landscape that requires careful evaluation.

OnePro appears to cater specifically to experienced traders who prioritize platform functionality over comprehensive educational resources or beginner-friendly features. The broker's positioning suggests a focus on delivering professional trading tools rather than serving as an all-encompassing trading solution for diverse trader segments.

Important Disclaimers

Regional Entity Differences: Due to incomplete regulatory information available for OnePro, traders in different jurisdictions should thoroughly research applicable local regulations and compliance requirements before engaging with the platform. The regulatory landscape for this broker appears limited. There are references to Financial Services Commission (FSC) oversight but specific license details are lacking.

Review Methodology: This evaluation is based on publicly available information from industry sources including TechBullion, Digital Global Times, and ScamBrokersReviews. Given the limited transparency of detailed trading conditions and regulatory documentation, traders should conduct additional due diligence before making investment decisions.

Rating Framework

Broker Overview

OnePro operates as a specialized brokerage firm focusing on forex and contracts for difference (CFD) trading services. According to TechBullion's analysis, the platform has positioned itself as "a benchmark for professional traders." This suggests a targeted approach toward experienced market participants rather than retail beginners. The broker's business model appears centered on providing professional-grade trading infrastructure through established platforms rather than developing proprietary trading solutions.

The company's background information remains somewhat limited in publicly available sources. Establishment dates and detailed corporate history are not extensively documented in the reviewed materials. This lack of comprehensive background disclosure represents a notable gap in transparency that potential clients should consider when evaluating the broker's credibility and longevity in the competitive forex market landscape.

OnePro's primary service offering revolves around MetaTrader 4 platform access, enabling traders to engage in forex and CFD trading across various market instruments. The platform's focus on professional traders suggests higher account minimums and advanced features. However, specific details about account tiers and professional qualifications remain unclear from available documentation. The broker's regulatory framework operates under Financial Services Commission (FSC) oversight, though specific license numbers and detailed regulatory compliance information were not clearly specified in the reviewed sources.

Regulatory Jurisdiction: OnePro operates under Financial Services Commission (FSC) regulation. However, specific license numbers and detailed compliance frameworks are not clearly documented in available sources. This regulatory setup may provide basic oversight but lacks the comprehensive transparency typically associated with top-tier regulatory bodies.

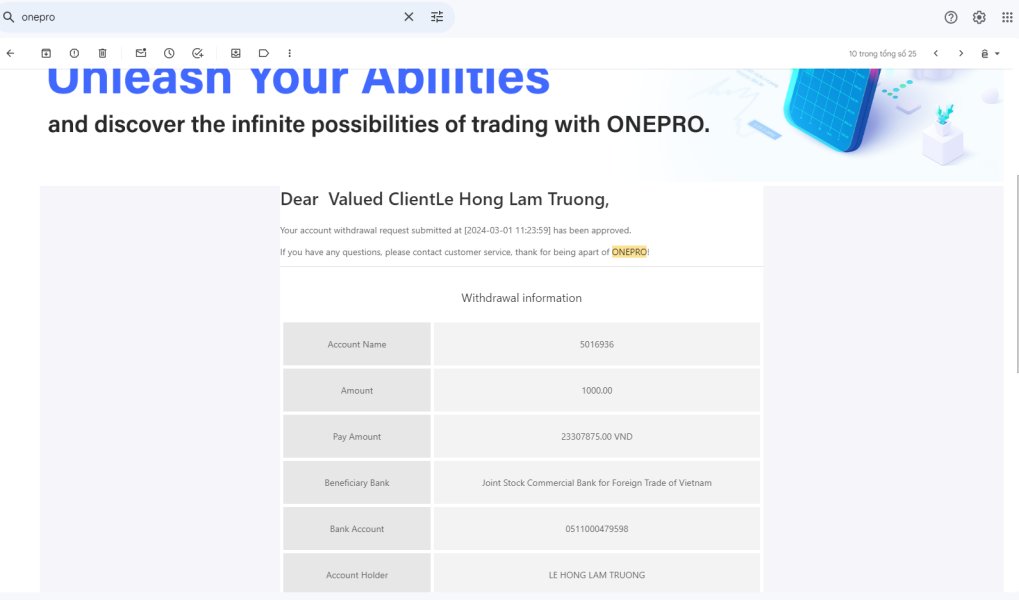

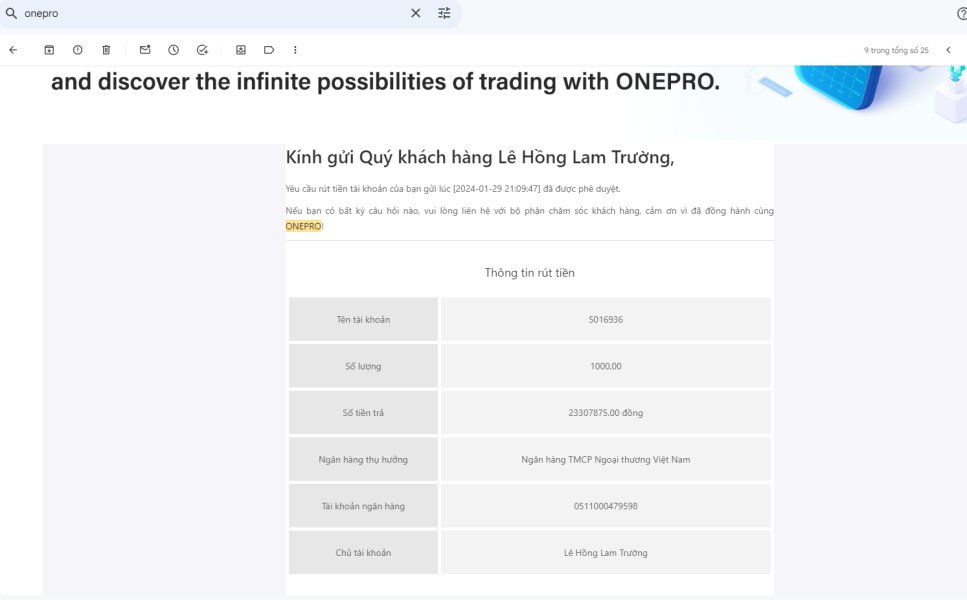

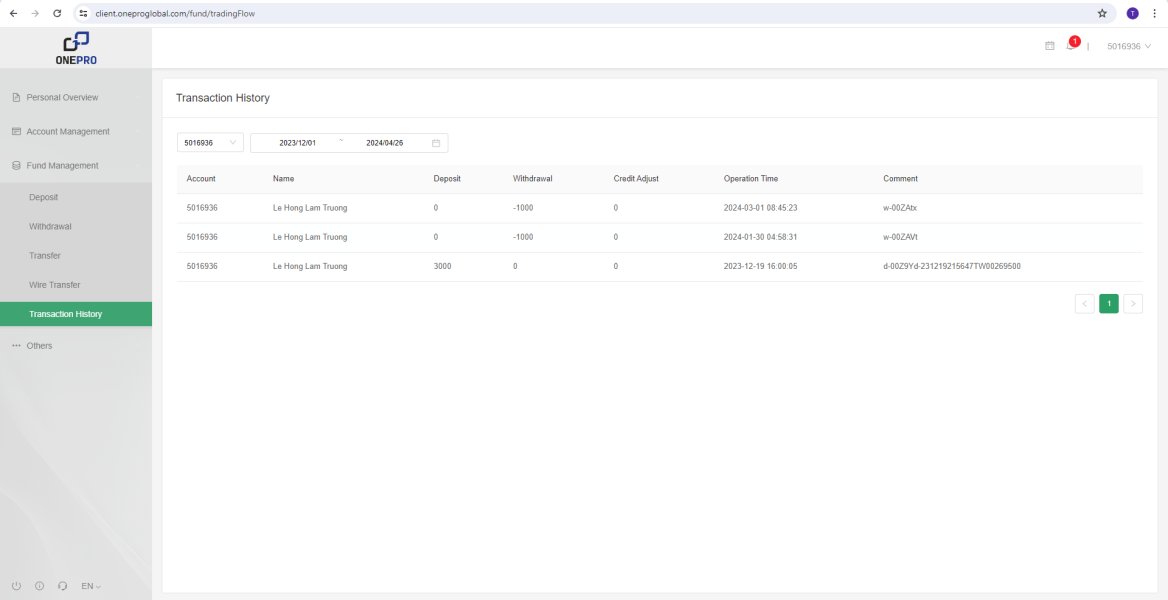

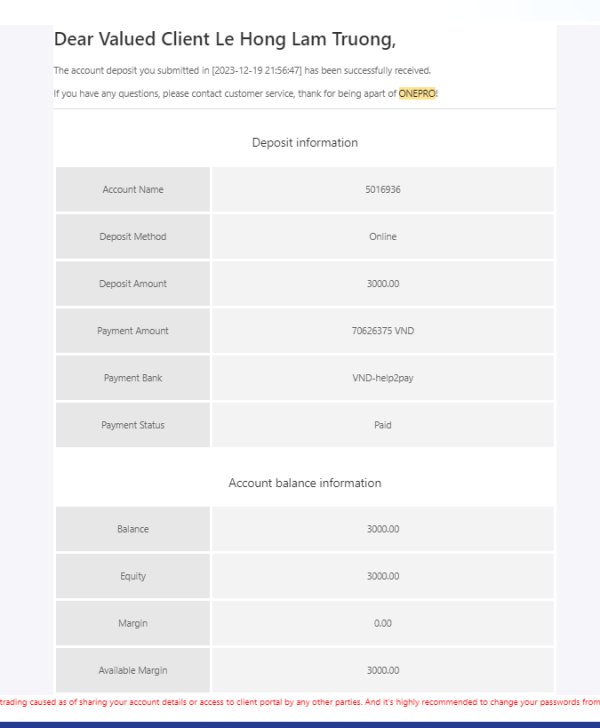

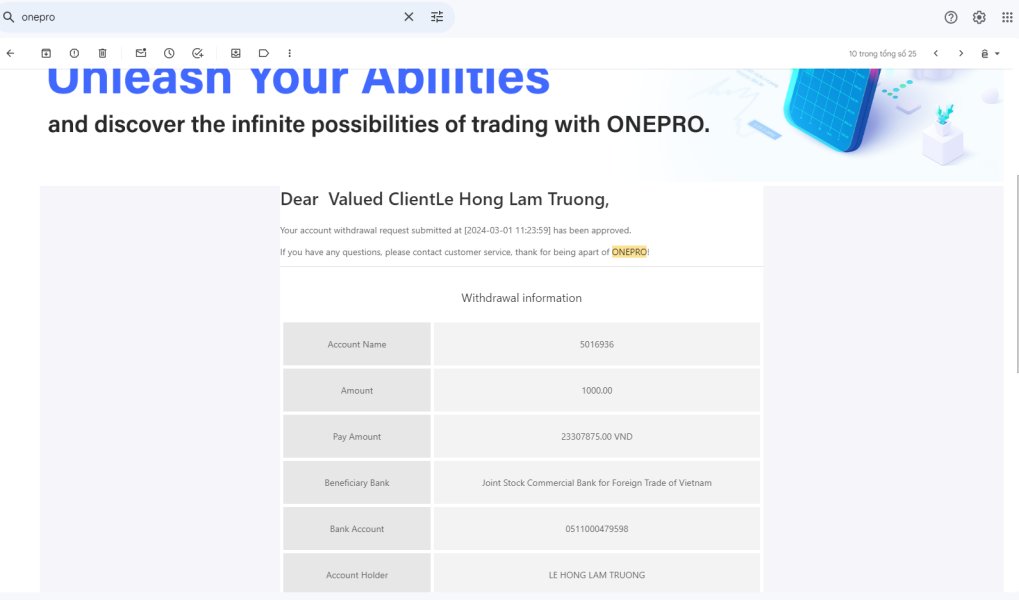

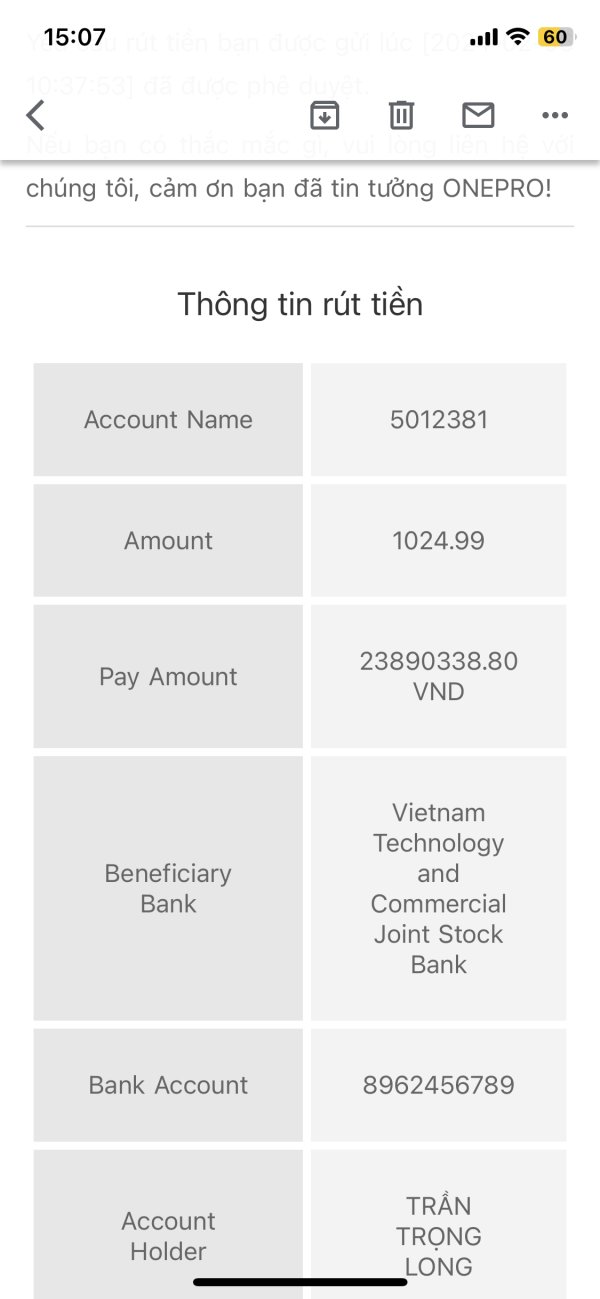

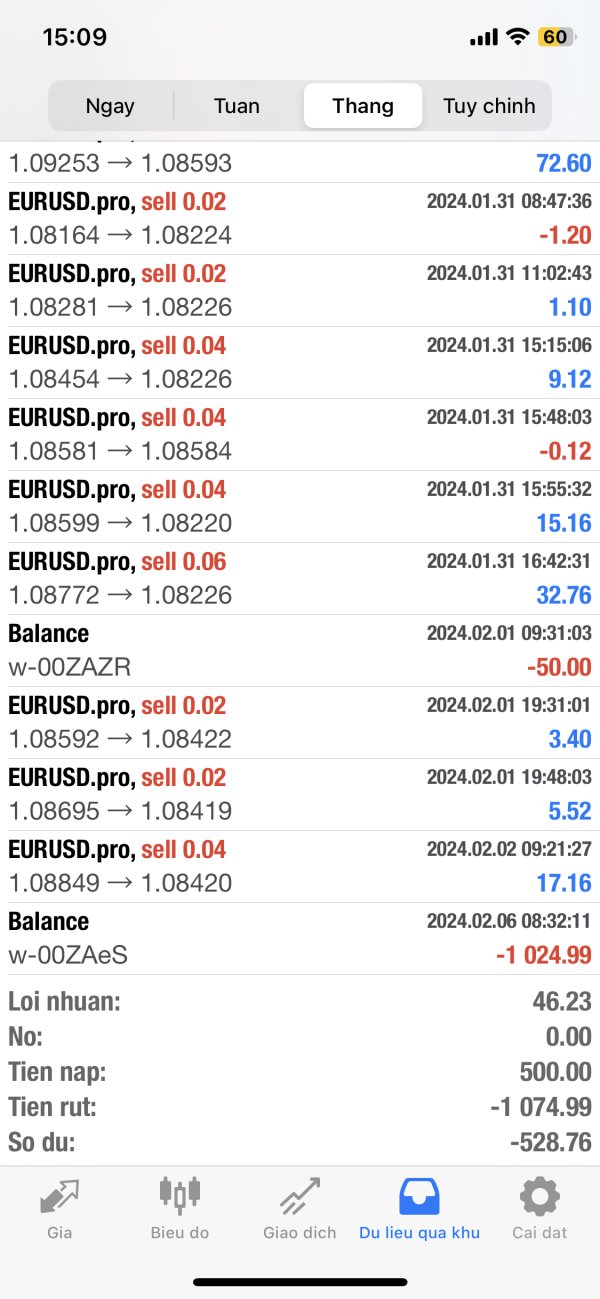

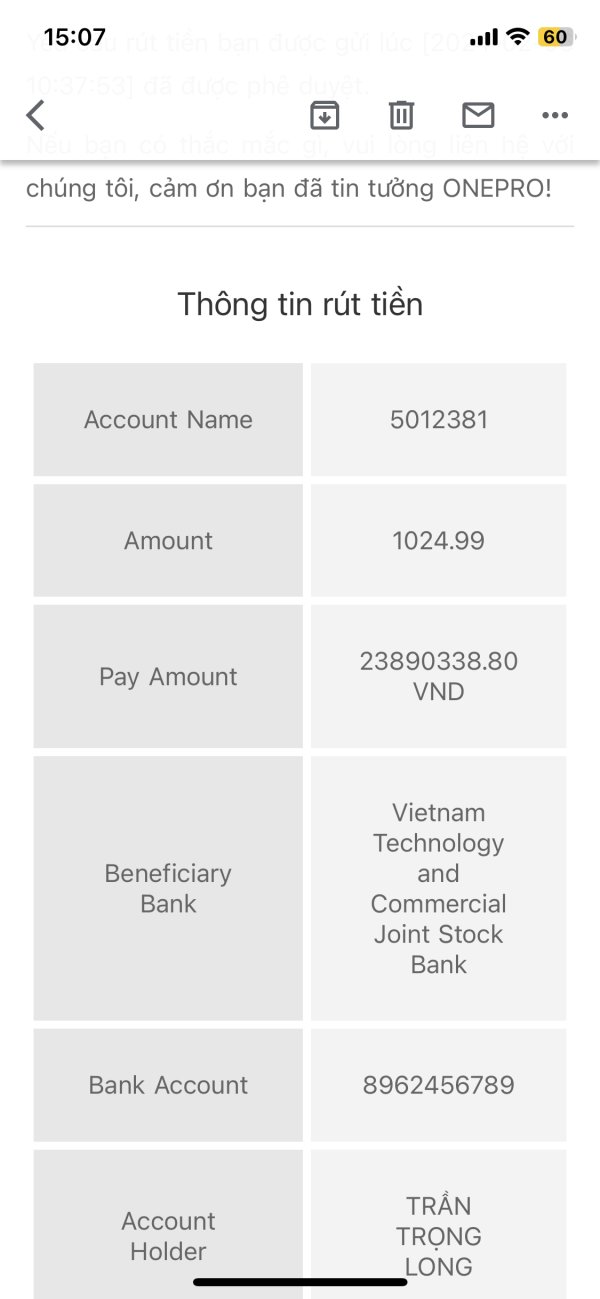

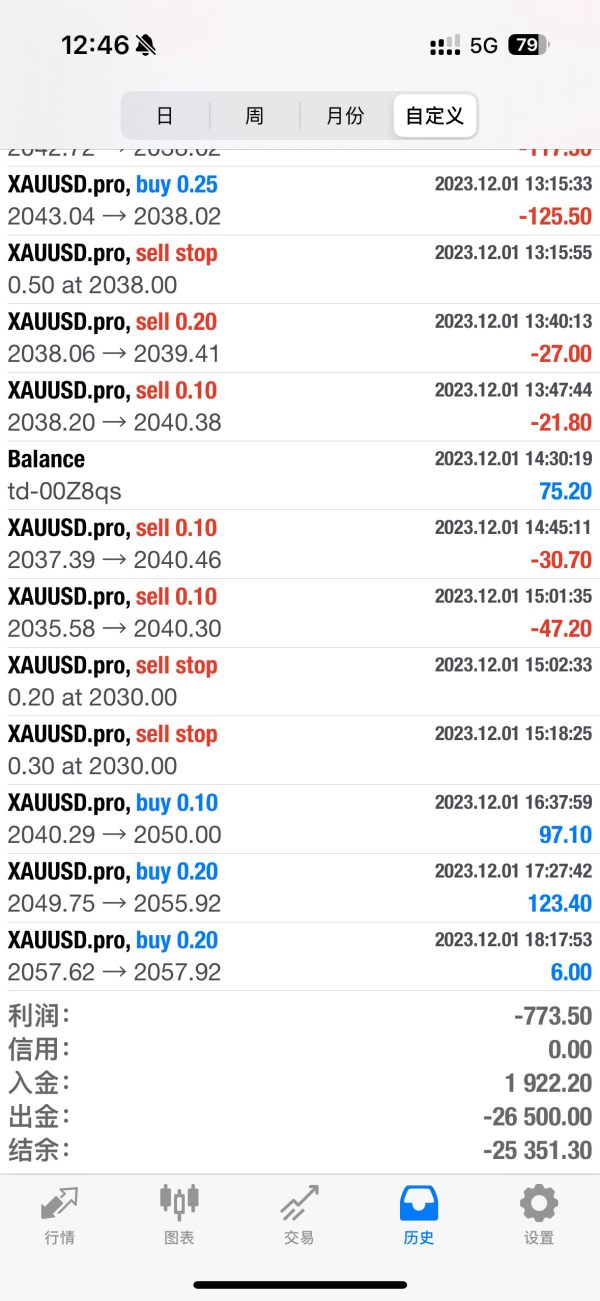

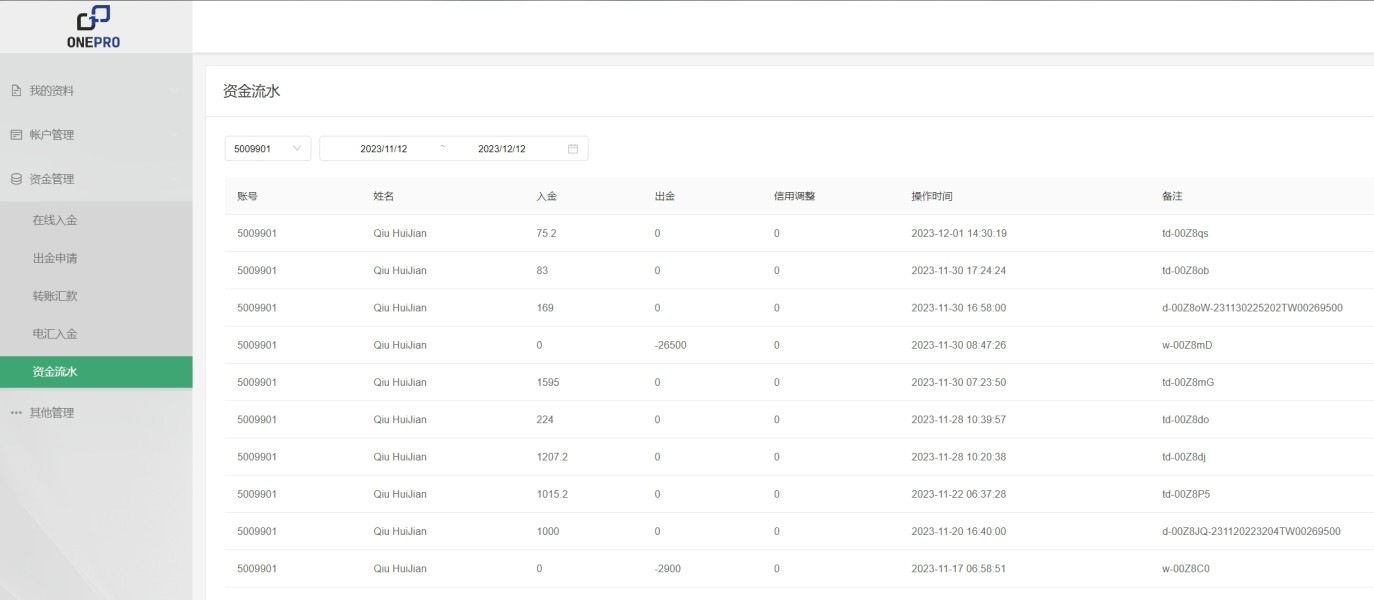

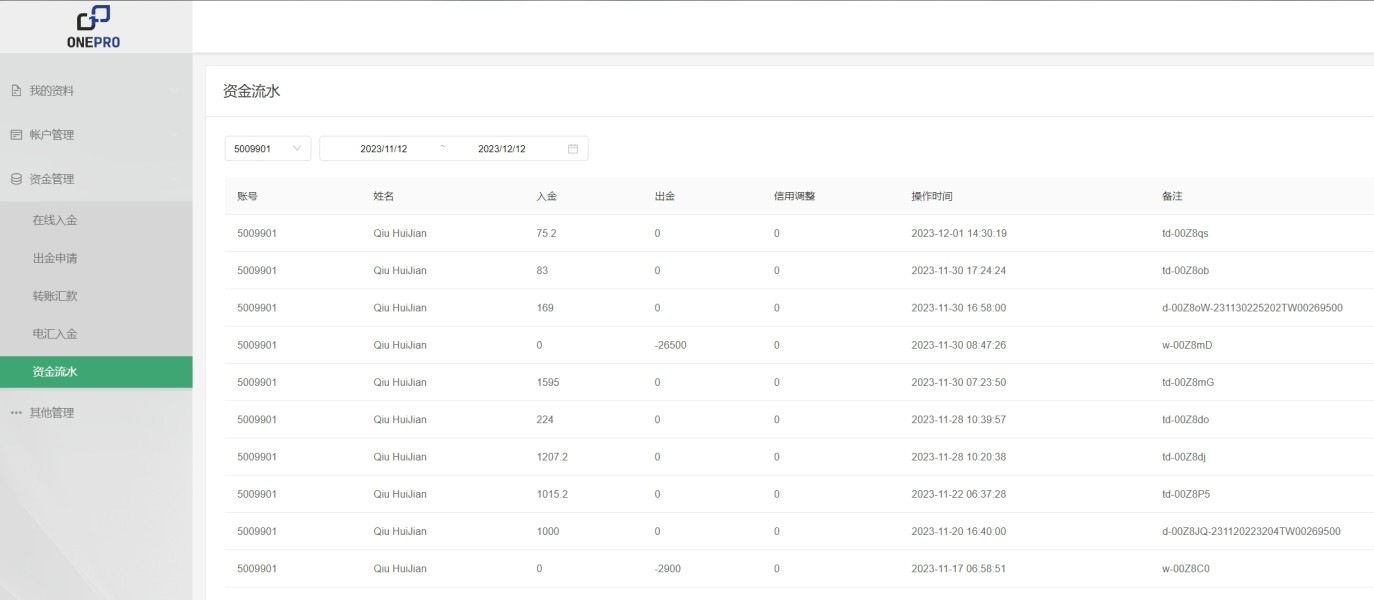

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods, processing times, and associated fees for deposits and withdrawals was not detailed in the reviewed sources. This represents a significant information gap for potential clients.

Minimum Deposit Requirements: The platform's minimum deposit thresholds are not specified in available documentation. This makes it difficult for traders to assess accessibility and account tier structures.

Bonus and Promotional Offers: No specific information about welcome bonuses, promotional campaigns, or incentive programs was available in the reviewed materials.

Tradeable Assets: OnePro provides access to forex currency pairs and contracts for difference (CFDs). However, the specific range of instruments, number of currency pairs, and CFD categories remain unspecified in available sources.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs was not available in the reviewed documentation. This creates uncertainty about the platform's competitiveness in pricing.

Leverage Options: Specific leverage ratios and margin requirements were not detailed in available sources. The professional trader focus suggests potentially higher leverage options subject to regulatory constraints.

Platform Options: The primary trading platform is MetaTrader 4. This provides standard MT4 functionality including expert advisors, technical analysis tools, and automated trading capabilities.

Geographic Restrictions: Specific information about restricted territories and regional availability was not detailed in reviewed sources.

Customer Support Languages: Supported languages for customer service were not specified in available documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: Not Rated)

The evaluation of OnePro's account conditions faces significant limitations due to insufficient publicly available information about fundamental account features. This OnePro review cannot provide a comprehensive assessment of account types, minimum deposit requirements, or tiered account structures because such details are not adequately documented in accessible sources.

Without clear information about account opening procedures, verification requirements, or special account features such as Islamic accounts, potential clients face uncertainty about basic accessibility factors. The lack of transparent pricing information, including spreads and commission structures, further complicates account condition evaluation. Professional trader positioning suggests potentially higher account minimums. However, specific thresholds remain undisclosed.

The absence of detailed account condition information represents a significant transparency gap that may concern traders accustomed to comprehensive disclosure from established brokers. While some platforms provide extensive account comparison tools and detailed fee schedules, OnePro's limited public information makes informed decision-making challenging for potential clients seeking specific account features or cost structures.

OnePro's tools and resources offering centers primarily around MetaTrader 4 platform access. This provides traders with a well-established and widely recognized trading environment. MT4's comprehensive feature set includes advanced charting capabilities, technical analysis tools, expert advisor support, and automated trading functionality that professional traders typically require for sophisticated strategies.

However, the platform's tool diversity appears limited compared to brokers offering multiple platform options, proprietary trading tools, or extensive research resources. The focus on MT4, while solid for experienced traders familiar with the platform, may not satisfy clients seeking cutting-edge technology or alternative trading interfaces. No specific information about additional trading tools, market analysis resources, or educational materials was available in reviewed sources.

The absence of detailed information about research capabilities, market analysis resources, or educational content suggests a more streamlined approach focused on platform access rather than comprehensive trading support. While this may suit experienced traders who rely on external analysis, it could limit appeal for traders seeking integrated research and educational resources.

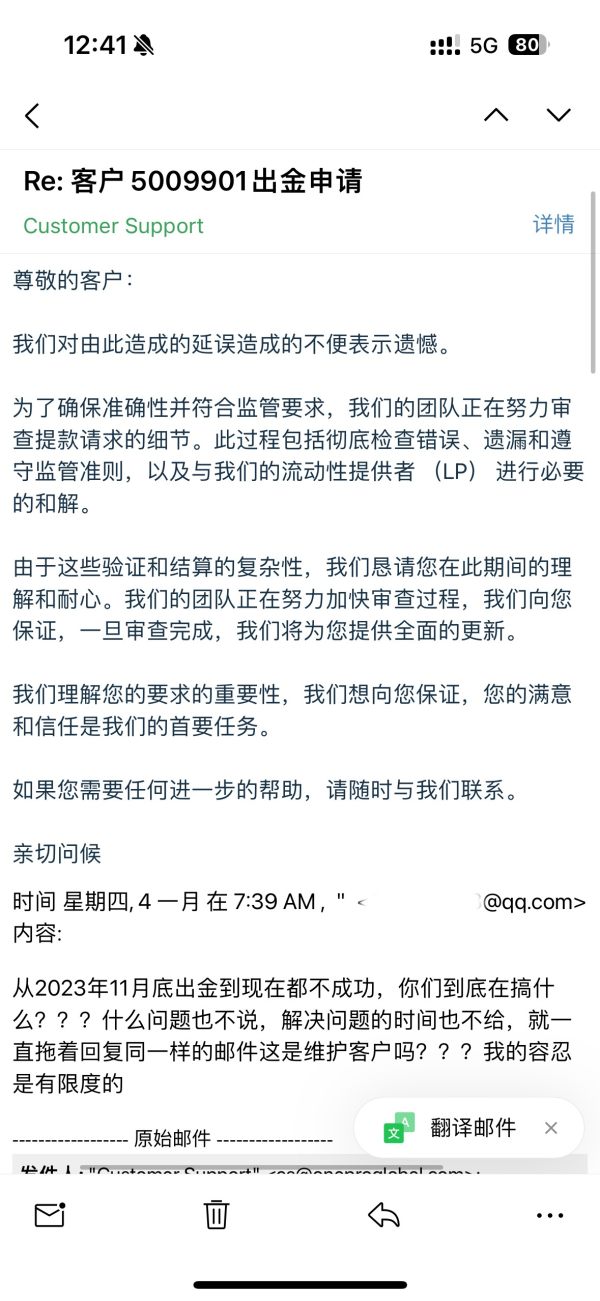

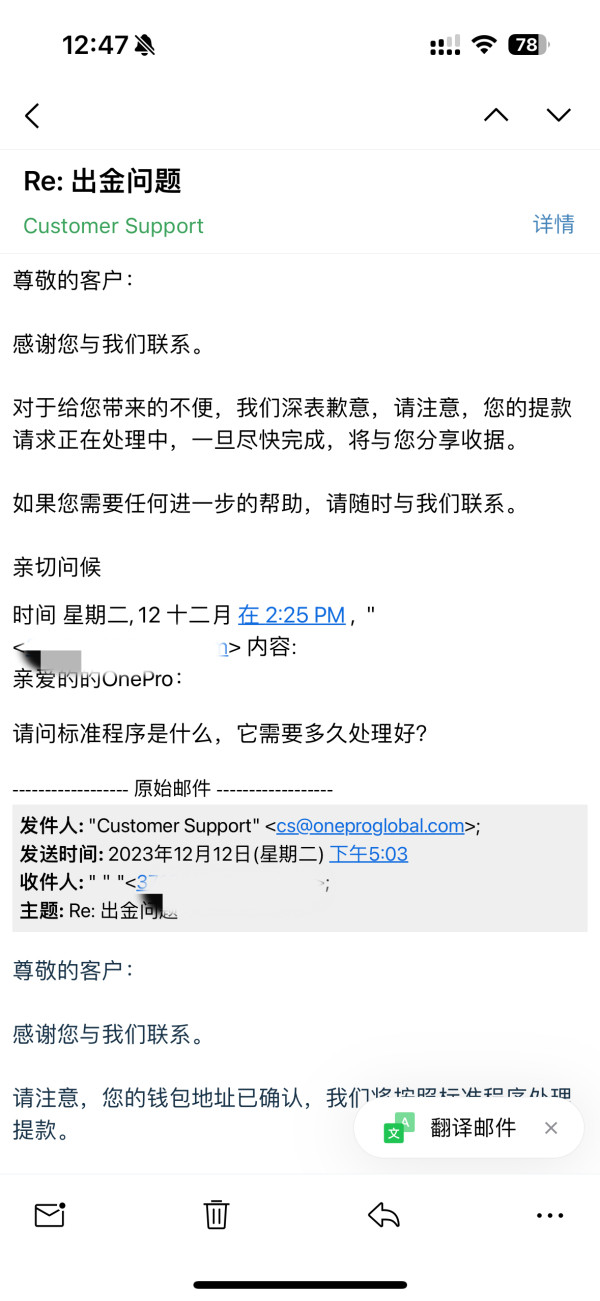

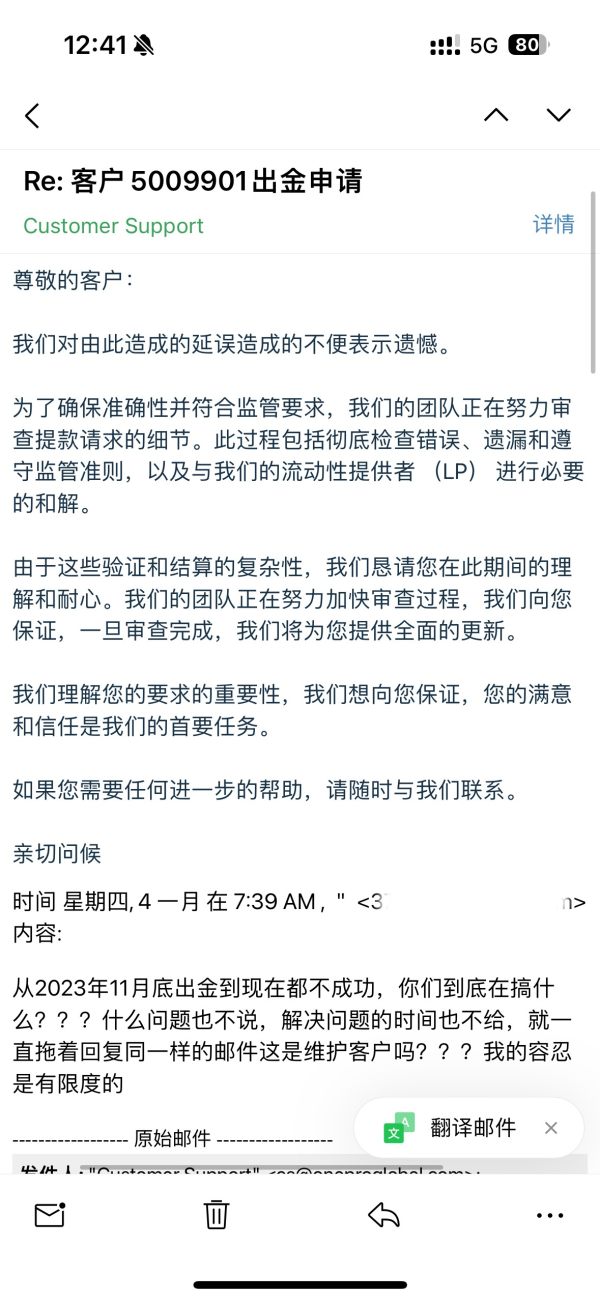

Customer Service and Support Analysis (Score: 8/10)

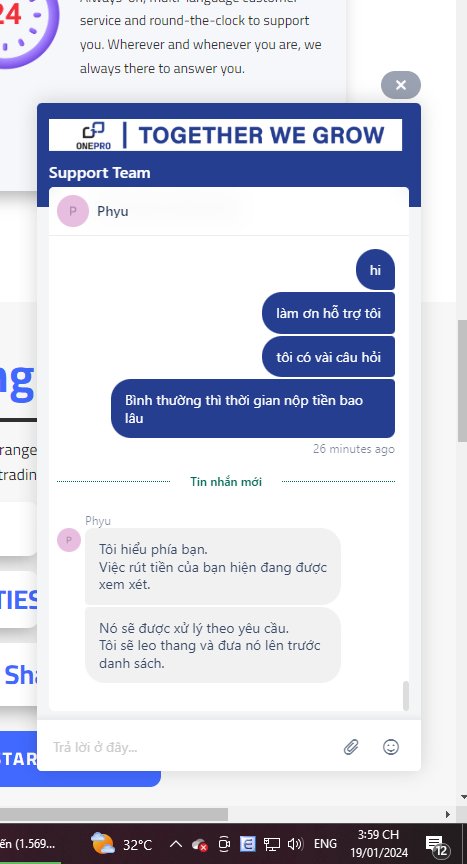

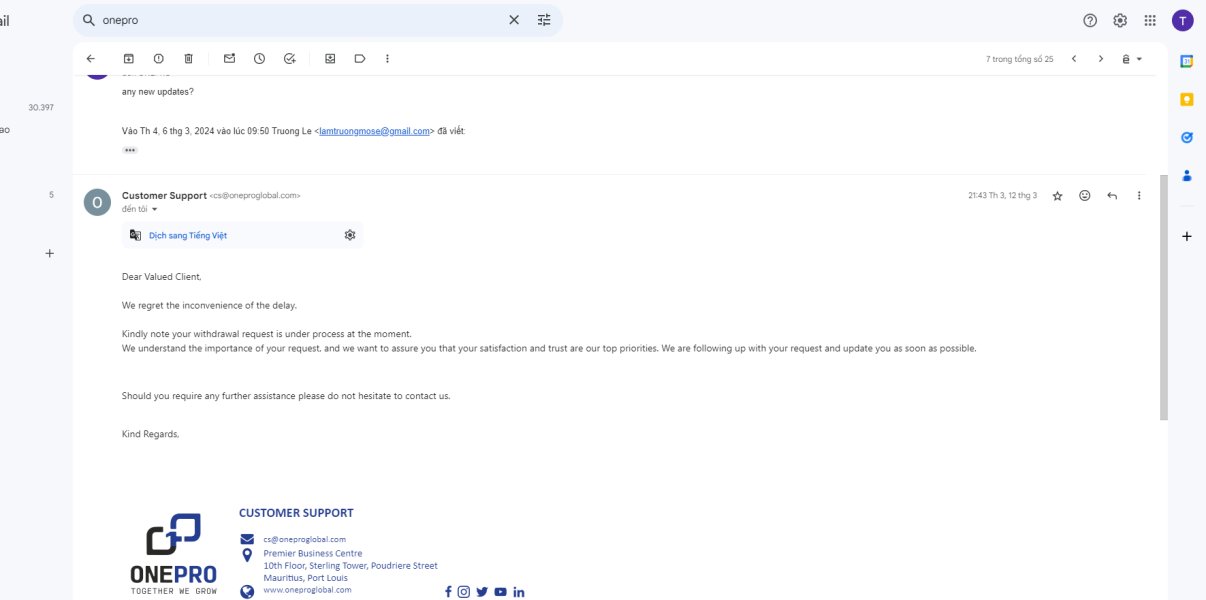

Available user feedback indicates that OnePro's customer service team demonstrates strong performance in responsiveness and service quality. According to sources reviewed, the support team receives positive recognition for professional handling of client inquiries and efficient problem resolution. This suggests well-trained staff and effective support processes.

The positive customer service feedback represents one of OnePro's stronger areas based on available information. Users report satisfactory experiences with support interactions, indicating that the broker prioritizes client service quality despite limitations in other transparency areas. This focus on customer service quality can be particularly valuable for professional traders who require reliable support for complex trading scenarios.

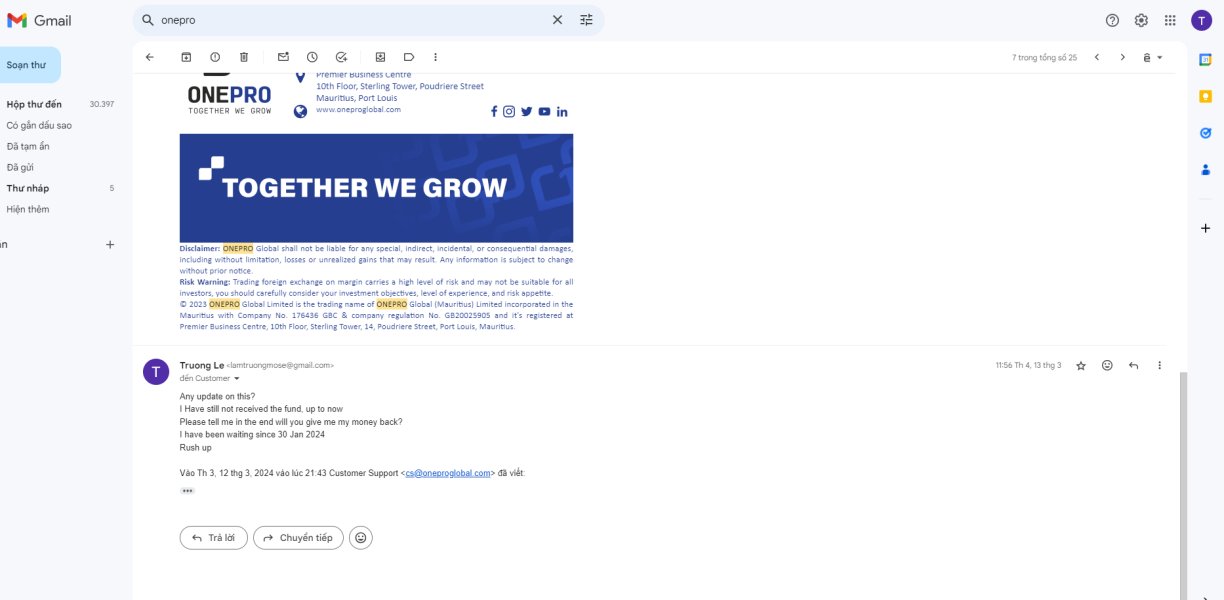

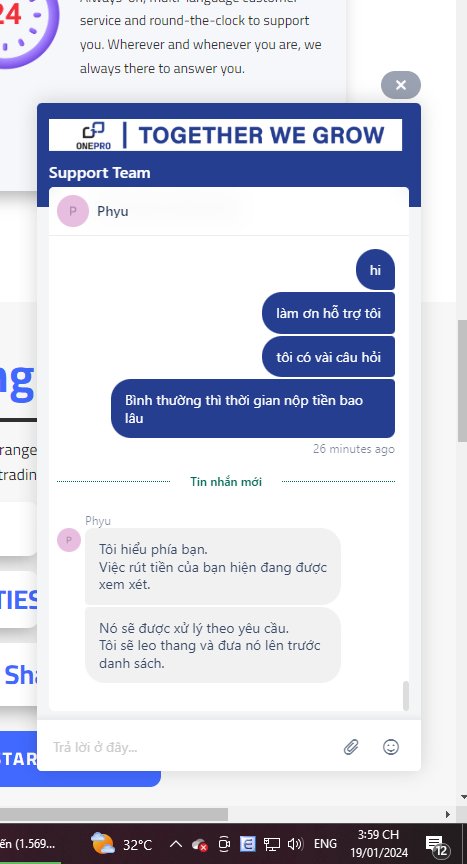

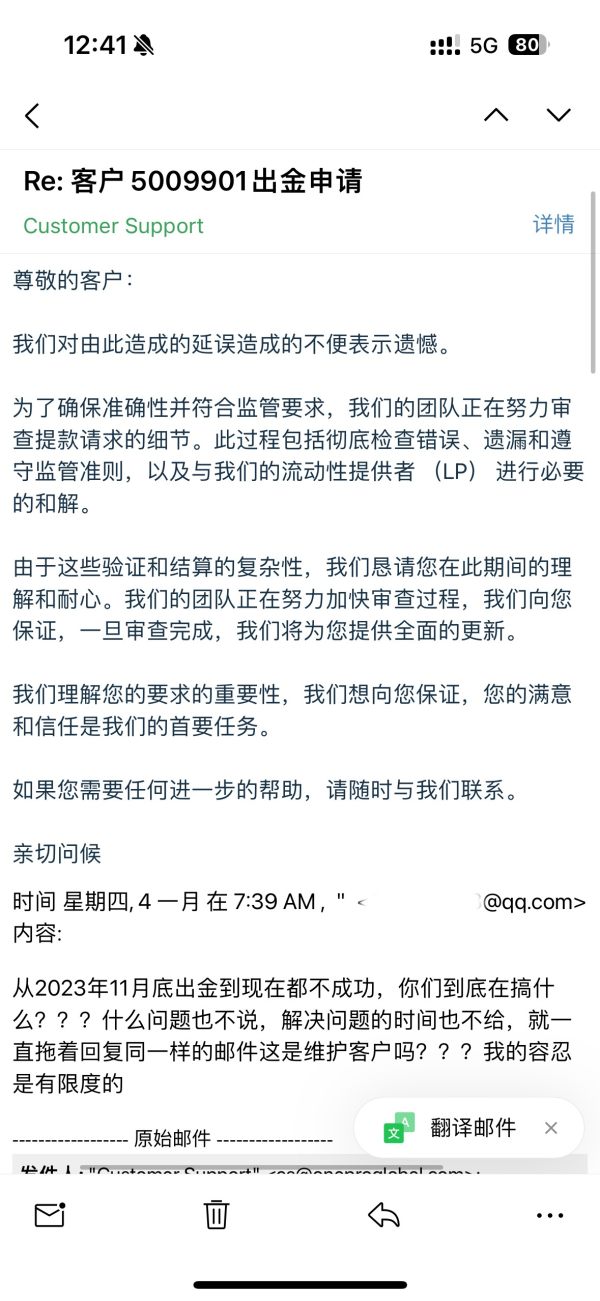

However, specific details about support channel availability, operating hours, multilingual support options, and response time guarantees were not detailed in available sources. While user feedback suggests positive experiences, the lack of comprehensive support structure information makes it difficult to assess service accessibility across different time zones or language requirements that international traders might need.

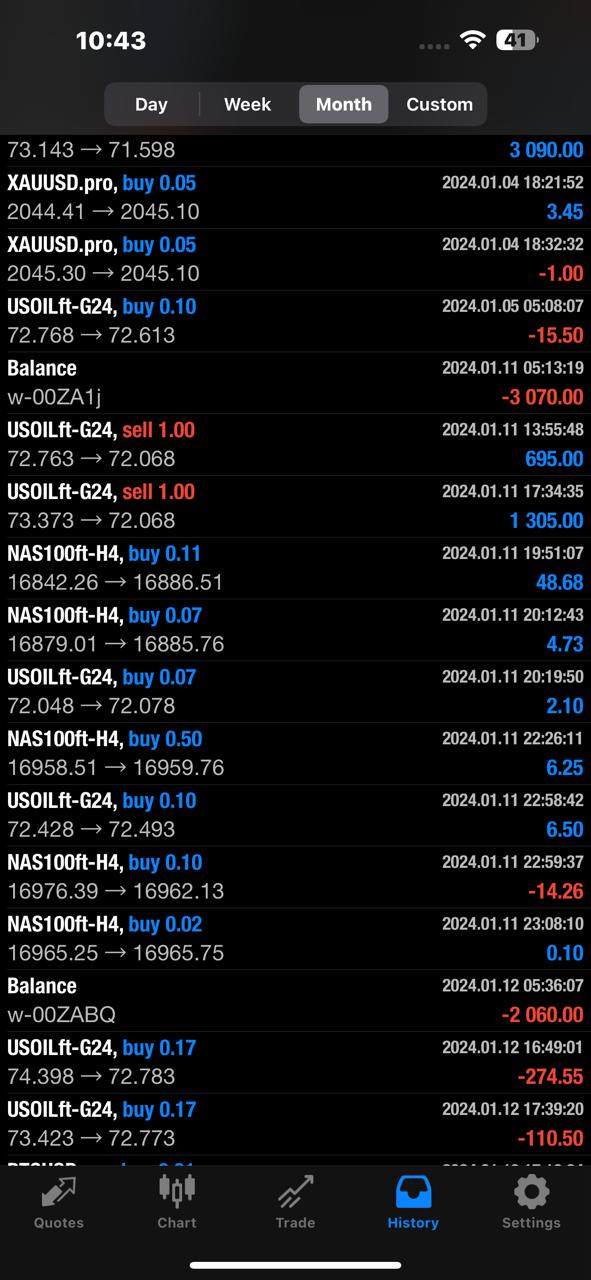

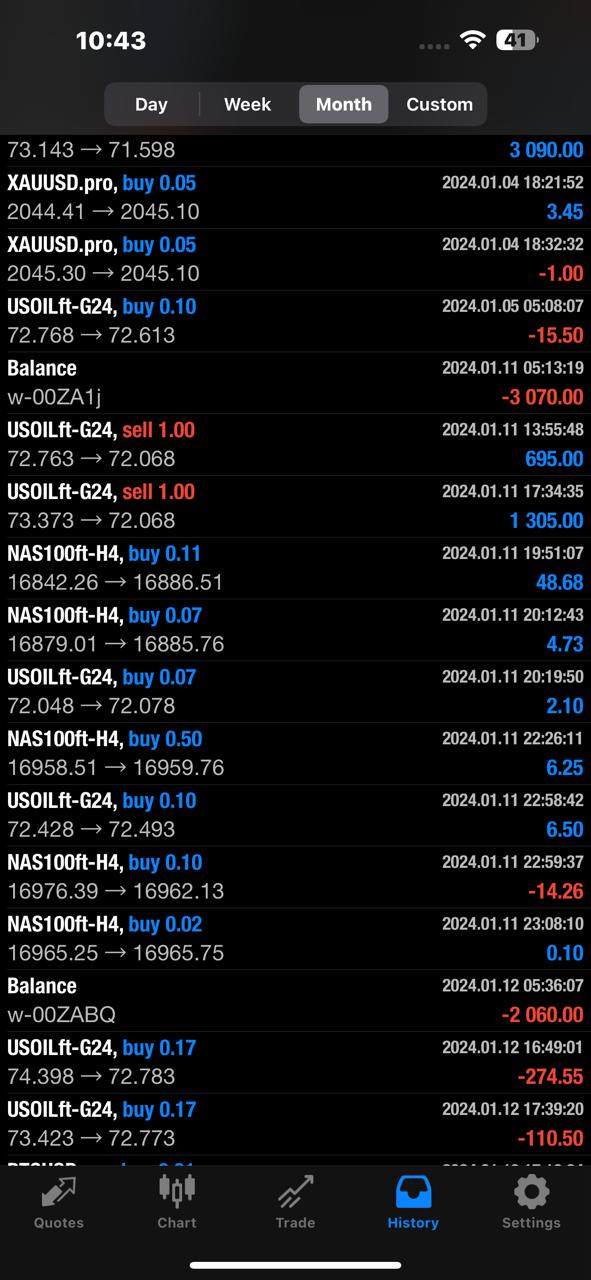

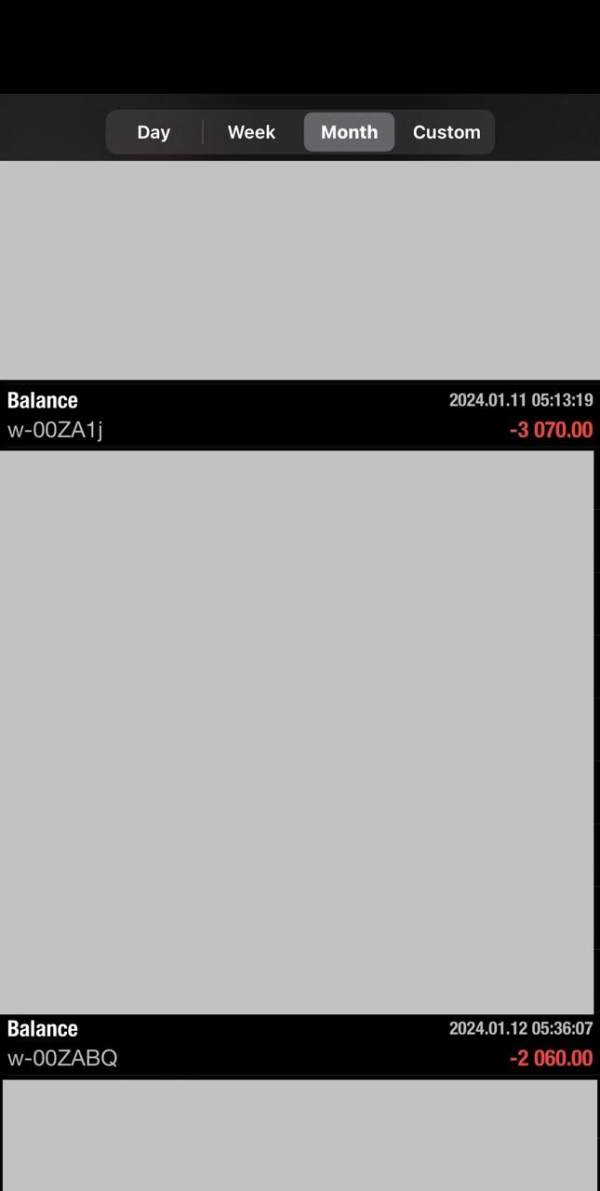

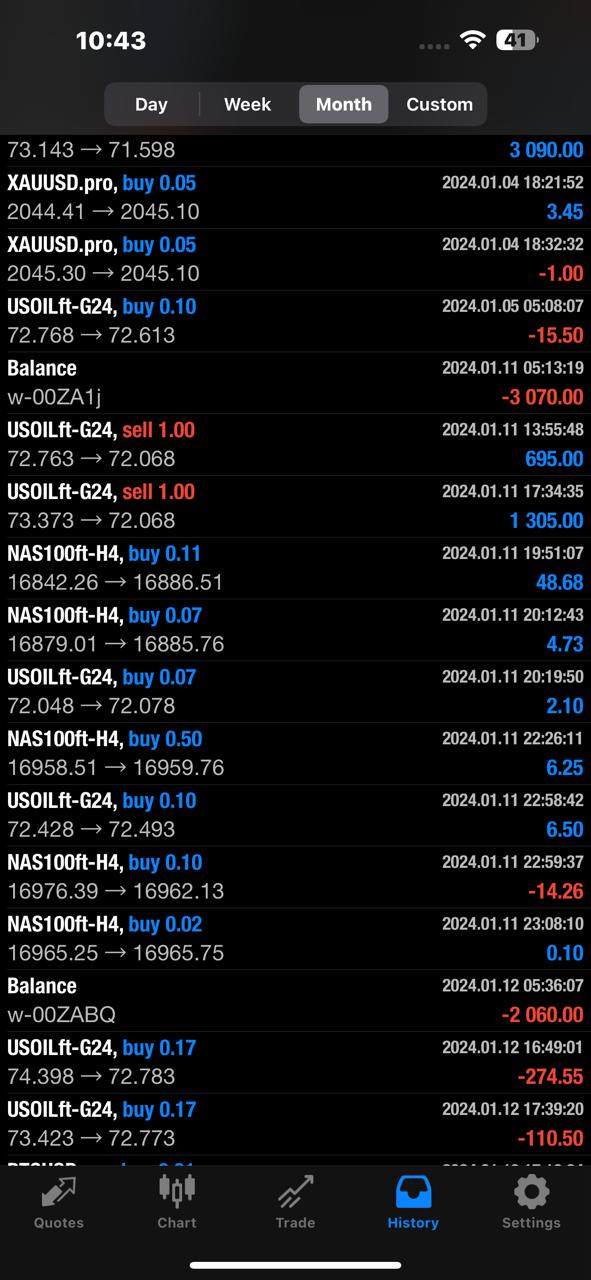

Trading Experience Analysis (Score: 7/10)

User feedback suggests that OnePro delivers satisfactory trading experience with particular emphasis on order execution quality. Reports indicate reliable order processing and execution, which represents a crucial factor for professional traders who require consistent performance during market volatility. This OnePro review notes that execution quality appears to meet professional standards based on available user reports.

The MetaTrader 4 platform foundation provides a stable trading environment with proven reliability and comprehensive functionality that experienced traders expect. MT4's robust architecture supports various trading strategies, automated systems, and technical analysis approaches that professional traders typically employ in their market activities.

However, specific performance metrics such as execution speeds, slippage rates, or uptime statistics were not available in reviewed sources. While user feedback suggests positive trading experiences, the absence of detailed performance data makes it challenging to compare OnePro's execution quality against industry benchmarks or competitor offerings. Mobile trading experience and platform customization options also lack detailed documentation.

Trust and Regulation Analysis (Score: 5/10)

OnePro's regulatory framework operates under Financial Services Commission (FSC) oversight. However, the specific license details and compliance documentation are not comprehensively disclosed in available sources. This regulatory setup provides basic oversight but may not offer the same level of protection and transparency associated with top-tier regulatory bodies such as FCA, CySEC, or ASIC.

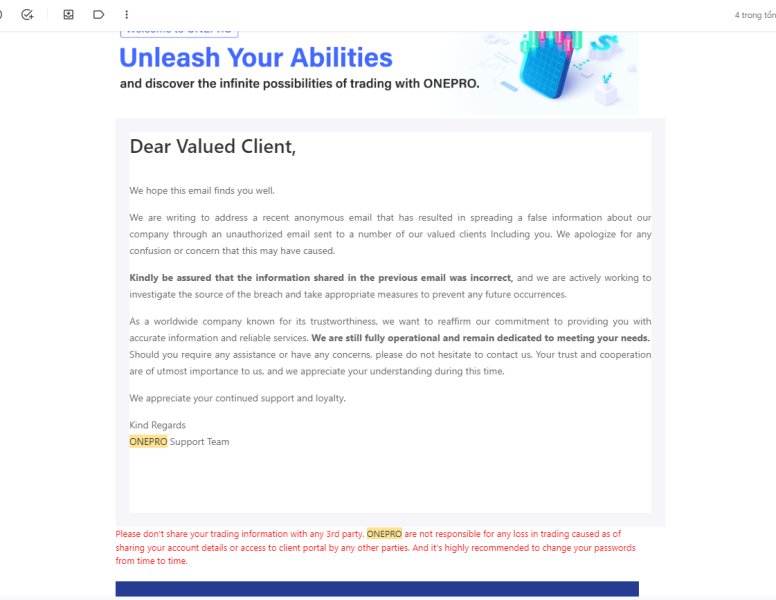

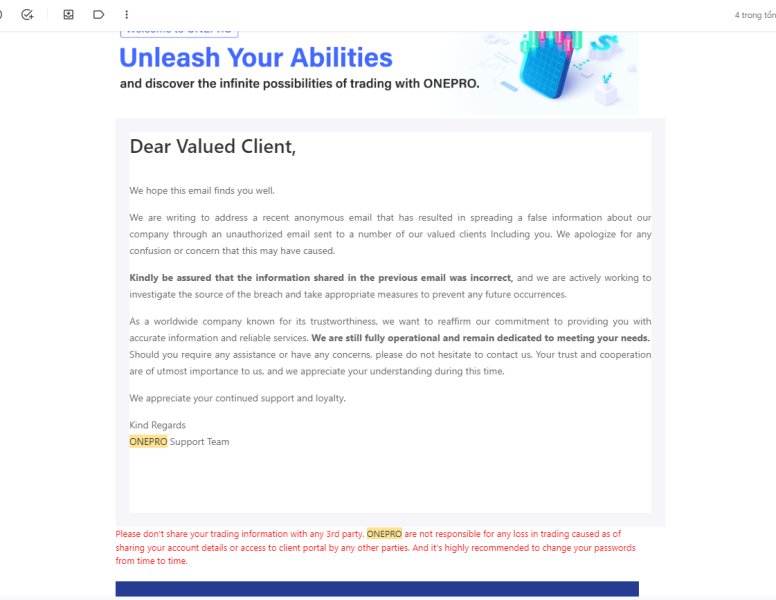

The limited availability of detailed regulatory information raises concerns about transparency and compliance verification. Professional traders typically require clear regulatory documentation, segregated account information, and comprehensive risk disclosures that appear to be insufficiently detailed in OnePro's publicly available materials. This transparency gap may concern traders prioritizing regulatory protection and institutional credibility.

Some sources, including ScamBrokersReviews, have raised questions about the platform's legitimacy and transparency. However, specific allegations or regulatory actions were not detailed in the reviewed materials. These concerns, combined with limited regulatory disclosure, suggest that potential clients should exercise enhanced due diligence when evaluating the broker's trustworthiness and regulatory compliance standards.

User Experience Analysis (Score: Not Rated)

The overall user experience evaluation for OnePro faces limitations due to insufficient detailed feedback about interface design, platform usability, and comprehensive user journey assessment. While available sources indicate generally positive user feedback, specific aspects of user experience such as registration processes, account verification procedures, and platform navigation efficiency lack detailed documentation.

The professional trader focus suggests that OnePro prioritizes functionality over simplified user interfaces that might appeal to beginner traders. This approach may result in more complex but feature-rich experiences that suit experienced traders who value comprehensive tools over streamlined simplicity. However, without detailed user experience analysis, it's difficult to assess how well the platform balances professional functionality with user-friendly design.

Available positive feedback suggests satisfactory user experiences overall. However, specific pain points, common user complaints, or areas for improvement were not detailed in reviewed sources. The lack of comprehensive user experience documentation makes it challenging to provide targeted recommendations for specific trader types or experience levels.

Conclusion

OnePro presents itself as a professionally-oriented forex and CFD broker with strengths in customer service quality and MetaTrader 4 platform access. However, significant transparency limitations affect overall assessment. The broker appears most suitable for experienced traders who prioritize reliable execution and professional support over comprehensive educational resources or extensive regulatory transparency.

The platform's main advantages include positive user feedback regarding customer service responsiveness and satisfactory order execution quality. However, notable disadvantages include limited regulatory transparency, insufficient disclosure of trading conditions, and gaps in comprehensive platform information that may concern traders accustomed to detailed broker transparency.

This OnePro review recommends that potential clients conduct thorough due diligence, particularly regarding regulatory compliance and trading cost structures, before committing funds. Professional traders seeking reliable execution with established platform technology may find value. However, traders prioritizing comprehensive transparency and extensive educational resources might consider alternative options with more detailed public disclosure.