BS Trading Review 1

Unable to withdraw funds, customer service does not respond, applied for one or two days and still no withdrawal

BS Trading Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Unable to withdraw funds, customer service does not respond, applied for one or two days and still no withdrawal

This bs trading review shows a troubling picture of an online forex broker. BS Trading has attracted significant negative attention in the trading community. The company operates as a Vanuatu-based forex broker under the regulatory oversight of the Vanuatu Financial Services Commission. They offer trading opportunities in FX pairs, CFDs, and select cryptocurrencies. The broker advertises some appealing features such as a remarkably low minimum deposit requirement of just $1 and high leverage options. However, the overall assessment paints a troubling picture.

Multiple industry reports have flagged the broker. Some sources list it among reported scam companies in 2025. Customer feedback consistently highlights poor service quality and substandard product offerings. The broker claims tight spreads and an average trading speed of 0ms. Despite these claims, the lack of transparency regarding crucial trading conditions and the mounting negative reviews raise serious red flags for potential investors.

BS Trading appears to target high-risk tolerance traders. They particularly focus on those seeking low-barrier entry into forex markets. However, the regulatory framework provided by VFSC may offer limited protection compared to more established regulatory jurisdictions. This makes the broker suitable only for traders who fully understand and accept the associated risks.

Traders should be aware that BS Trading operates under the regulatory oversight of the Vanuatu Financial Services Commission. This may provide limited investor protection compared to more stringent regulatory frameworks found in major financial jurisdictions. The regulatory environment in Vanuatu typically offers fewer safeguards regarding fund security and dispute resolution mechanisms.

This review is based on publicly available information and user feedback collected from various industry sources. The assessment may not represent the complete experience of all users. Individual trading experiences may vary significantly. Potential clients are strongly advised to conduct their own due diligence and consider the regulatory limitations before engaging with this broker.

| Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 4/10 | Low minimum deposit of $1, but lack of transparency on account types and commission structure |

| Tools and Resources | 5/10 | Basic offering of forex, CFDs, and cryptocurrencies with limited platform information |

| Customer Service | 3/10 | Consistently poor customer service feedback from users |

| Trading Experience | 5/10 | Claims 0ms average trading speed but lacks transparency on slippage and execution quality |

| Trust and Reliability | 2/10 | Listed among reported scam companies with significant trust concerns |

| User Experience | 4/10 | Poor overall satisfaction due to service quality and product issues |

BS Trading positions itself as an online foreign exchange broker operating from Vanuatu. The company operates under the regulatory framework of the Vanuatu Financial Services Commission. They focus on providing forex and CFD trading services to retail traders. The company emphasizes accessibility through extremely low entry barriers. While specific establishment dates are not clearly documented in available materials, the broker has gained attention primarily for its controversial reputation rather than positive market presence.

The broker operates on a business model that targets traders seeking minimal initial investment requirements. They offer forex pairs, CFDs on various instruments, spot metals, indices, and a selection of cryptocurrencies. However, the lack of detailed information about the company's history, management team, and operational transparency raises concerns about its legitimacy and long-term viability.

BS Trading attempts to differentiate itself through competitive spreads and high leverage options according to available information. However, the bs trading review landscape suggests that these advertised benefits may come with significant hidden costs and risks. These issues are not immediately apparent to prospective clients.

Regulatory Jurisdiction: BS Trading operates under the supervision of the Vanuatu Financial Services Commission. VFSC is a regulatory body known for providing more lenient oversight compared to major financial regulators like the FCA, ASIC, or CySEC.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in available documentation. This represents a significant transparency concern for potential clients.

Minimum Deposit Requirement: The broker advertises an extremely low minimum deposit of $1. This makes it accessible to traders with limited capital.

Bonus and Promotions: Available materials do not provide specific information about bonus structures or promotional offerings.

Tradeable Assets: BS Trading offers access to foreign exchange pairs, contracts for difference, spot metals, various indices, and a selection of cryptocurrencies. This provides a moderate range of trading instruments.

Cost Structure: The broker claims to offer tight spreads. However, specific commission structures and hidden fees are not transparently disclosed in available documentation.

Leverage Options: High leverage options are advertised. Specific ratios and risk warnings are not clearly detailed though.

Platform Options: Specific trading platform information is not adequately detailed in available sources. This raises questions about technological infrastructure.

Regional Restrictions: Geographic limitations and restricted jurisdictions are not clearly outlined in available materials.

Customer Support Languages: Language support options for customer service are not specified in accessible documentation. This indicates potential communication barriers for international clients.

This bs trading review reveals significant gaps in transparency that should concern potential traders.

The account structure offered by BS Trading presents a mixed picture that requires careful consideration. The broker's most notable feature is its exceptionally low minimum deposit requirement of just $1. This theoretically makes forex trading accessible to virtually anyone. The low barrier to entry could appeal to complete beginners or traders looking to test the platform with minimal financial exposure.

However, the lack of detailed information about different account types represents a significant concern. Most reputable brokers offer tiered account structures with varying features, benefits, and requirements. The absence of clear account categorization suggests either a very simplified offering or a lack of transparency in presenting account options to potential clients.

The account opening process details are not adequately documented. This raises questions about verification procedures, compliance measures, and the overall professionalism of the onboarding experience. Legitimate brokers typically provide clear, step-by-step guidance for account establishment. They include required documentation and verification timelines.

User feedback consistently indicates problems with customer service and product quality. This directly impacts the account management experience. Poor service quality can significantly affect account holders' ability to resolve issues, access support when needed, or receive adequate guidance during critical trading situations.

Compared to other low-minimum-deposit brokers in the market, BS Trading's offering appears limited and potentially problematic. While the $1 minimum deposit is competitive, the lack of transparency regarding account features, conditions, and ongoing requirements makes it difficult for traders to make informed decisions about account suitability.

This bs trading review suggests that while the low entry barrier might seem attractive, the overall account conditions may not provide the professional trading environment that serious traders require.

BS Trading's tools and resources offering appears limited based on available information. The broker provides access to basic trading instruments including foreign exchange pairs and contracts for difference. This covers fundamental market categories that most traders expect. The inclusion of spot metals, indices, and select cryptocurrencies expands the available trading universe somewhat. However, the specific selection and quality of these instruments remain unclear.

The absence of detailed information about research and analysis resources represents a significant shortcoming. Professional traders rely heavily on market analysis, economic calendars, technical analysis tools, and research reports to make informed trading decisions. The lack of transparency regarding these essential resources suggests that BS Trading may not provide the comprehensive analytical support that traders need.

Educational resources are crucial for trader development and risk management. These are not adequately documented in available materials. Reputable brokers typically offer extensive educational libraries, webinars, tutorials, and market commentary to help traders improve their skills and understanding of market dynamics.

Automated trading support is not clearly addressed in available documentation. This includes expert advisor compatibility and algorithmic trading tools. The limitation could significantly impact traders who rely on automated strategies or systematic trading approaches.

The overall impression is that BS Trading offers a basic selection of tradeable instruments without the comprehensive suite of tools and resources that characterize professional trading environments. This limitation, combined with the negative user feedback regarding overall service quality, suggests that traders seeking robust analytical and educational support may find the platform inadequate for their needs.

Customer service represents one of BS Trading's most significant weaknesses based on available user feedback and industry reports. Multiple sources consistently highlight poor service quality as a major concern. Users report inadequate support responsiveness and unprofessional handling of client inquiries and issues.

The lack of detailed information about customer service channels raises immediate red flags about accessibility and support availability. Reputable brokers typically provide multiple contact methods including phone support, live chat, email assistance, and comprehensive FAQ sections. The absence of clear communication channels suggests potential difficulties in reaching support when needed.

Response time issues appear to be a recurring theme in user complaints. Specific metrics are not available in the documentation though. Slow response times can be particularly problematic in forex trading, where market conditions change rapidly and timely support can be critical for resolving trading issues or account problems.

Service quality concerns extend beyond mere response times to include the professional competence and problem-solving capabilities of support staff. User feedback indicates dissatisfaction with the ability of customer service representatives to effectively address concerns and provide meaningful solutions to trading-related problems.

The absence of information about multilingual support capabilities could present additional barriers for international clients. Global forex brokers typically provide support in multiple languages to serve their diverse client base effectively.

These customer service deficiencies, combined with the broker's questionable reputation in the industry, suggest that traders may face significant challenges when seeking assistance or attempting to resolve account-related issues. The poor customer service record represents a substantial risk factor that potential clients should carefully consider.

The trading experience offered by BS Trading presents several concerning aspects that require careful evaluation. The broker claims an average trading speed of 0ms, which would suggest extremely fast order execution. However, the lack of supporting documentation and transparency around execution quality metrics raises questions about the reliability of this claim.

Order execution quality depends on multiple factors beyond raw speed. These include slippage rates, requote frequency, and fill rates during volatile market conditions. Unfortunately, specific information about these critical execution metrics is not available in the documentation. This makes it impossible to assess the true quality of the trading environment.

Platform stability and functionality details are notably absent from available materials. Trading platform reliability is crucial for successful forex trading, as system outages or technical issues can result in significant financial losses. The lack of detailed platform information suggests potential concerns about technological infrastructure and system reliability.

Mobile trading capabilities are essential for modern forex traders who need access to markets while away from their primary trading stations. These are not adequately addressed in available documentation. The gap in information could indicate limited mobile functionality or poor mobile platform development.

The trading environment's overall quality appears questionable given the negative user feedback and the broker's controversial reputation. While tight spreads are advertised, the actual trading costs including potential hidden fees, overnight charges, and execution-related expenses are not transparently disclosed.

This bs trading review indicates that the trading experience may fall short of professional standards expected in the forex industry. This could potentially result in suboptimal trading conditions for clients.

Trust and reliability represent the most critical concerns surrounding BS Trading. Multiple red flags indicate serious credibility issues. The broker's inclusion in lists of reported scam companies for 2025 represents an immediate and severe warning signal for potential clients. Such listings typically result from investigations into fraudulent practices, client complaints, or regulatory violations.

The regulatory oversight provided by the Vanuatu Financial Services Commission, while technically legitimate, offers limited investor protection compared to more stringent regulatory frameworks. VFSC regulation is often viewed as less rigorous than oversight provided by major financial regulators such as the Financial Conduct Authority, Australian Securities and Investments Commission, or Cyprus Securities and Exchange Commission.

Fund safety measures and client protection protocols are not clearly documented in available materials. This represents a significant transparency failure. Reputable brokers typically provide detailed information about segregated client accounts, deposit insurance, and investor compensation schemes. The absence of such information raises serious questions about fund security.

Company transparency issues extend beyond regulatory matters to include basic corporate information. Limited details about company leadership, operational history, and business practices make it difficult for potential clients to assess the broker's legitimacy and stability.

The mounting negative industry reputation, combined with regulatory limitations and transparency failures, creates a concerning picture regarding the broker's trustworthiness. The lack of positive third-party endorsements or industry recognition further compounds these trust concerns.

These reliability issues suggest that BS Trading may not provide the secure and trustworthy trading environment that forex traders require for their financial activities.

Overall user satisfaction with BS Trading appears to be significantly below industry standards based on available feedback and industry reports. The consistent pattern of complaints regarding customer service quality and product offerings indicates systematic issues with the user experience. These extend beyond isolated incidents.

User feedback consistently highlights poor customer service as a primary concern. Traders report difficulties in obtaining adequate support when needed. This service quality issue directly impacts the overall trading experience and can create significant stress for users attempting to manage their trading activities effectively.

Product quality problems mentioned in user reviews suggest that the trading instruments, platform functionality, or execution quality may not meet reasonable expectations. Poor product quality can result in suboptimal trading outcomes and increased costs for users.

The registration and verification process details are not adequately documented. The simplicity suggested by the low minimum deposit might indicate either streamlined onboarding or potentially inadequate verification procedures that could compromise security though.

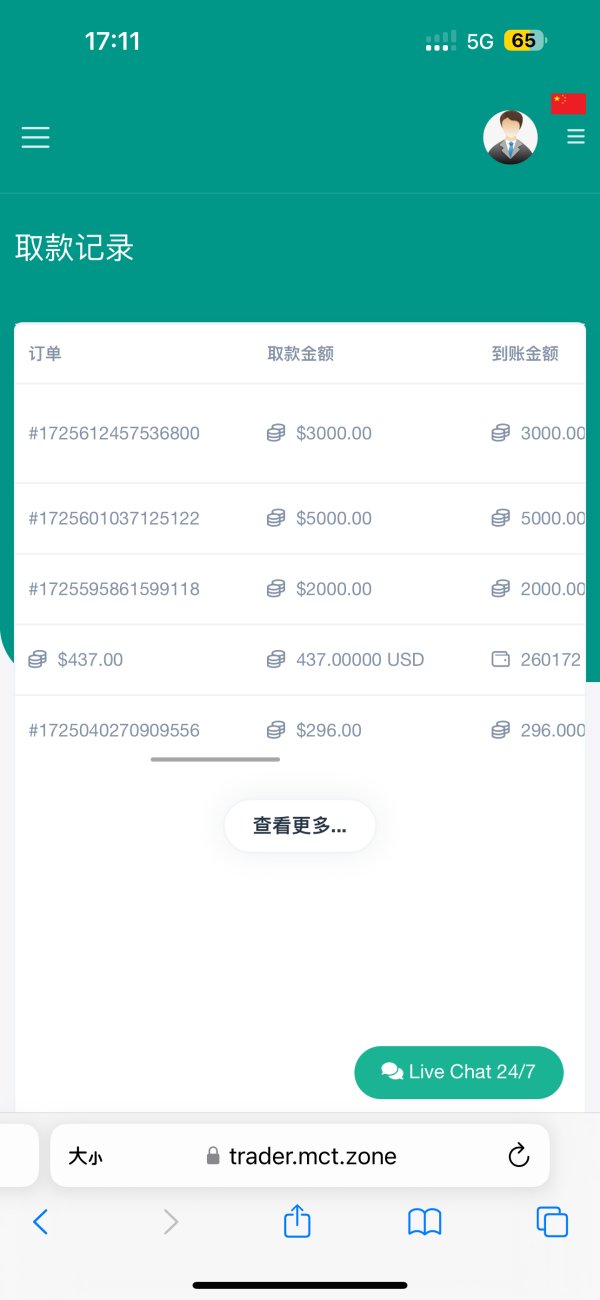

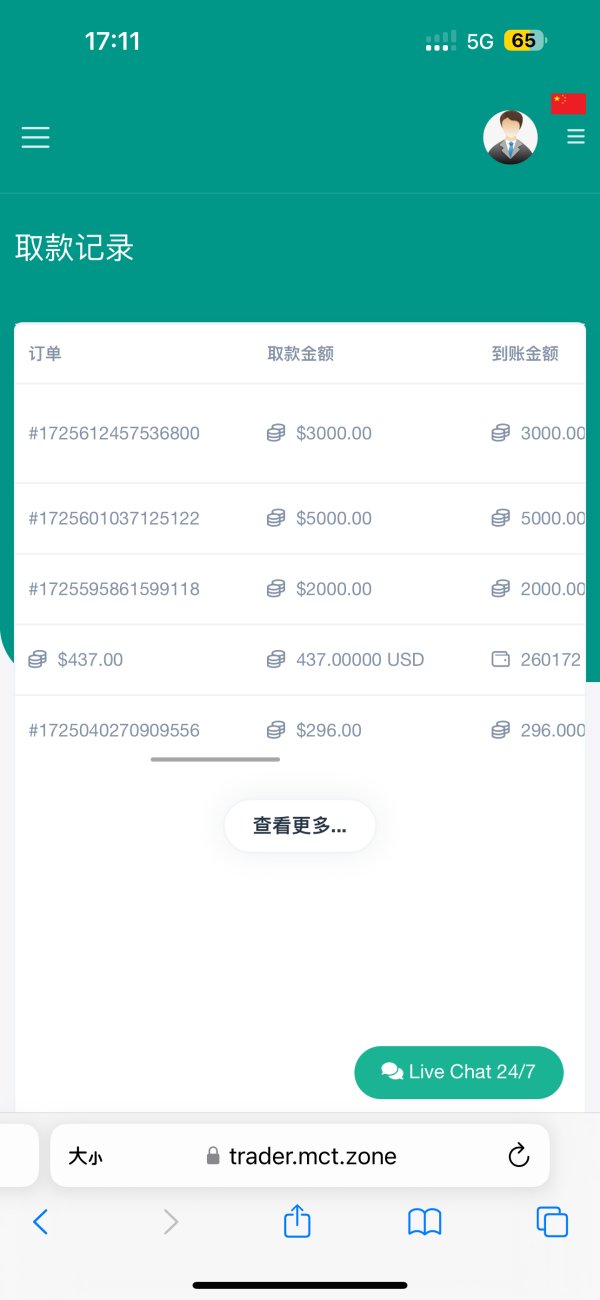

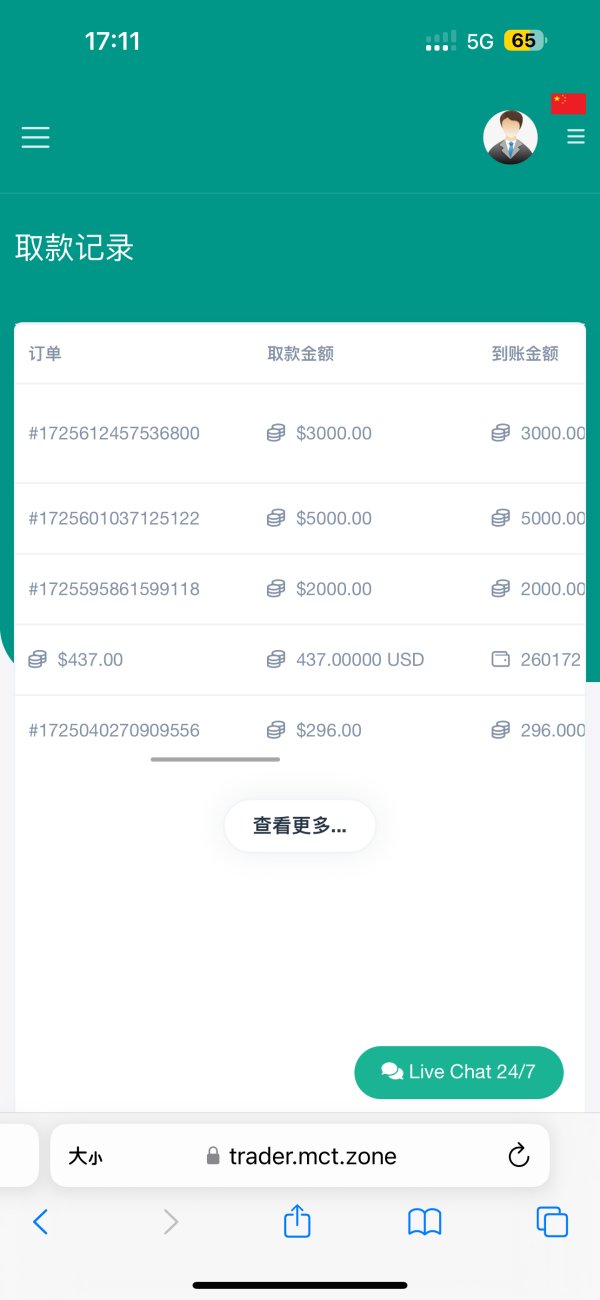

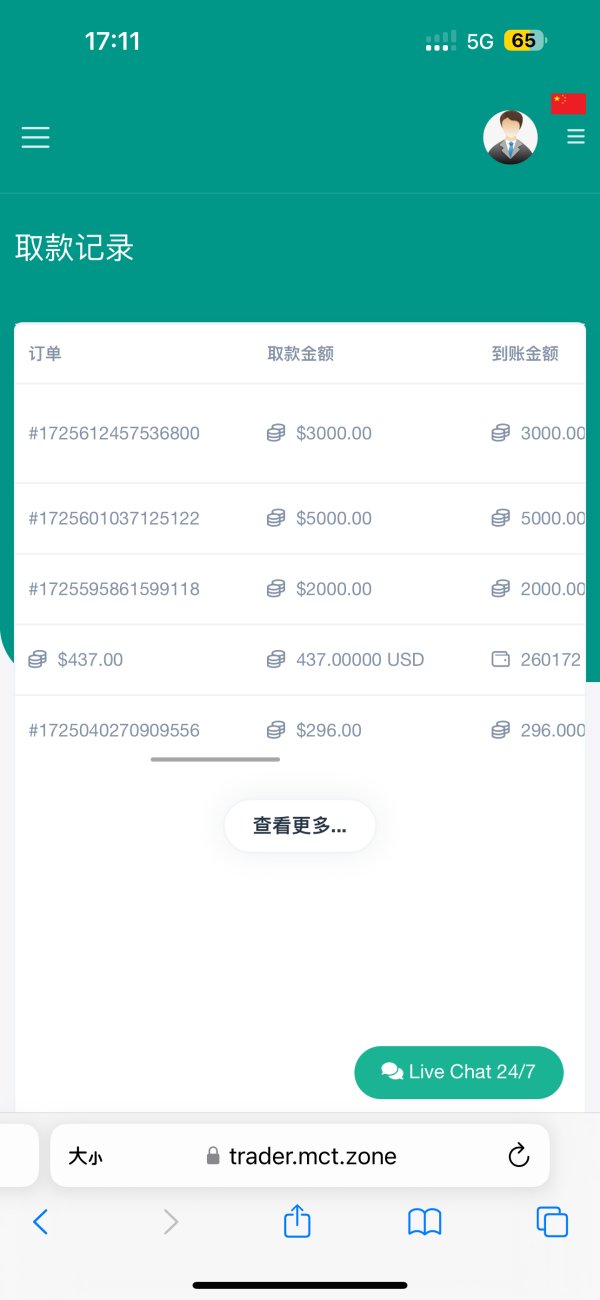

Fund operation experiences are not well-documented in available materials. Given the overall negative feedback pattern, users may encounter difficulties with deposit and withdrawal processes. Smooth fund operations are essential for trader confidence and satisfaction.

Common user complaints appear to center around service quality and product reliability. This suggests that BS Trading may not provide the professional trading environment that serious forex traders require. The absence of positive user testimonials or success stories in available documentation further reinforces concerns about user satisfaction.

The target user profile appears to be high-risk tolerance traders seeking low-barrier entry. Even these users may find the overall experience inadequate due to service and reliability issues though.

This comprehensive bs trading review reveals a broker with significant concerns that outweigh its limited advantages. BS Trading offers an attractive low minimum deposit of $1 and advertises competitive trading conditions. However, the overwhelming evidence suggests serious deficiencies in service quality, transparency, and reliability.

The broker is most suitable for traders with high risk tolerance who prioritize low entry barriers over service quality and regulatory protection. However, even risk-tolerant traders should carefully consider whether the potential benefits justify the documented concerns about customer service, transparency, and industry reputation.

The main advantages include the minimal deposit requirement and claimed tight spreads. The disadvantages encompass poor customer service, questionable reliability, limited regulatory protection, and inclusion in scam company reports. These factors combine to create a risk profile that may be unacceptable for most serious forex traders seeking a professional and secure trading environment.

FX Broker Capital Trading Markets Review