Global GT 2025 Review: Everything You Need to Know

Executive Summary

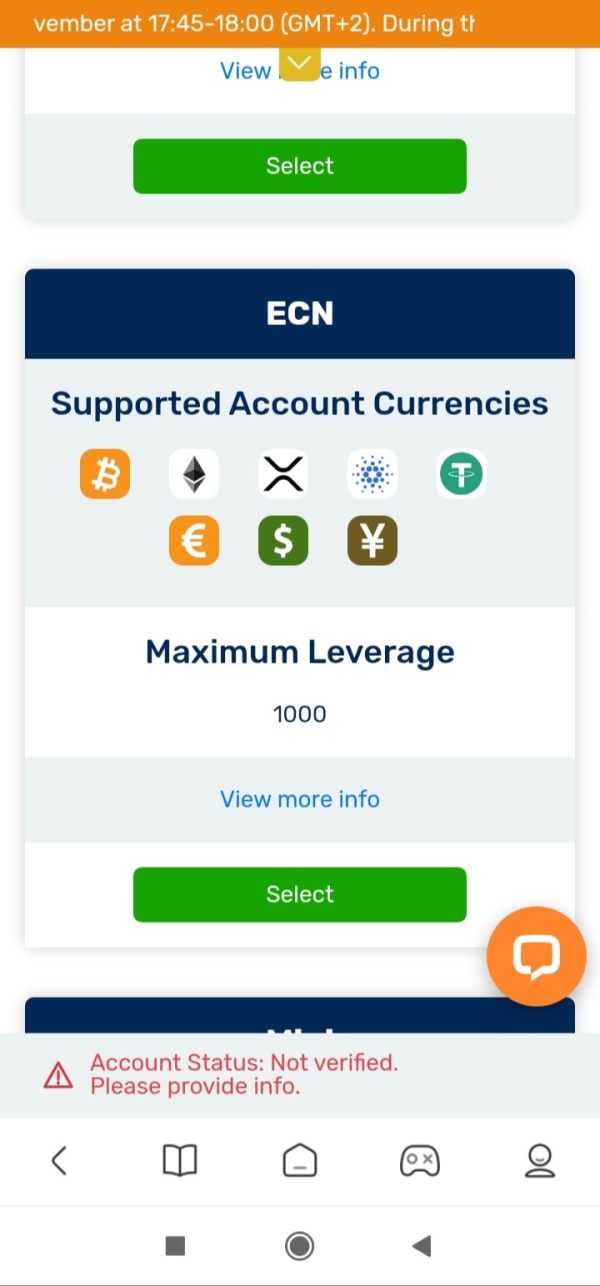

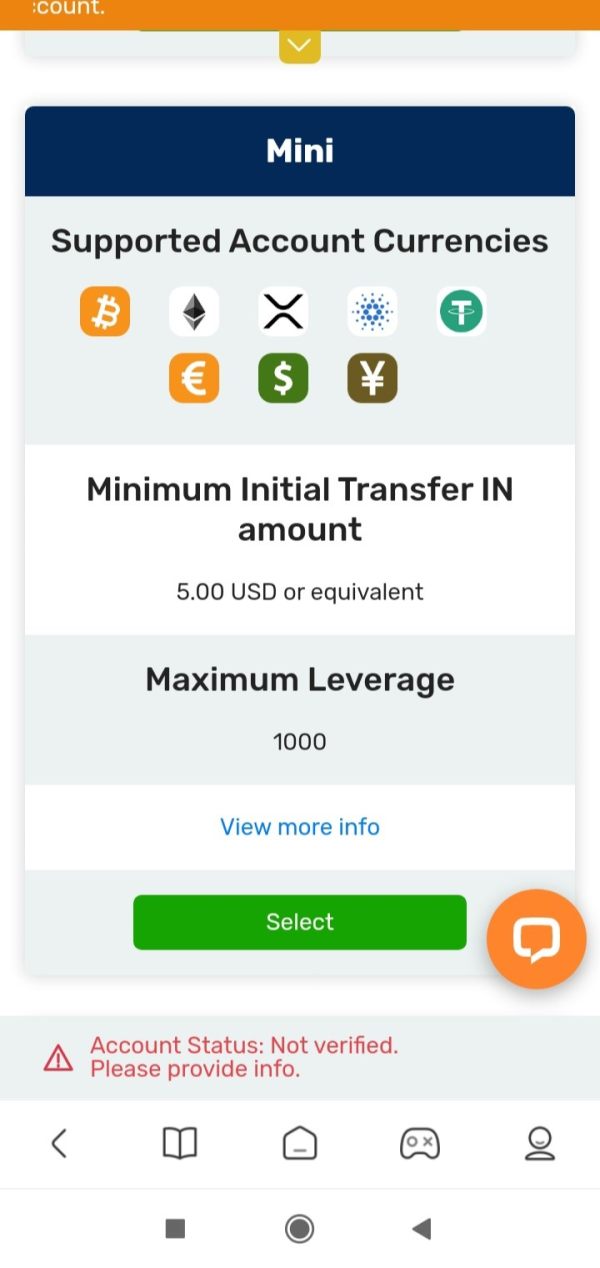

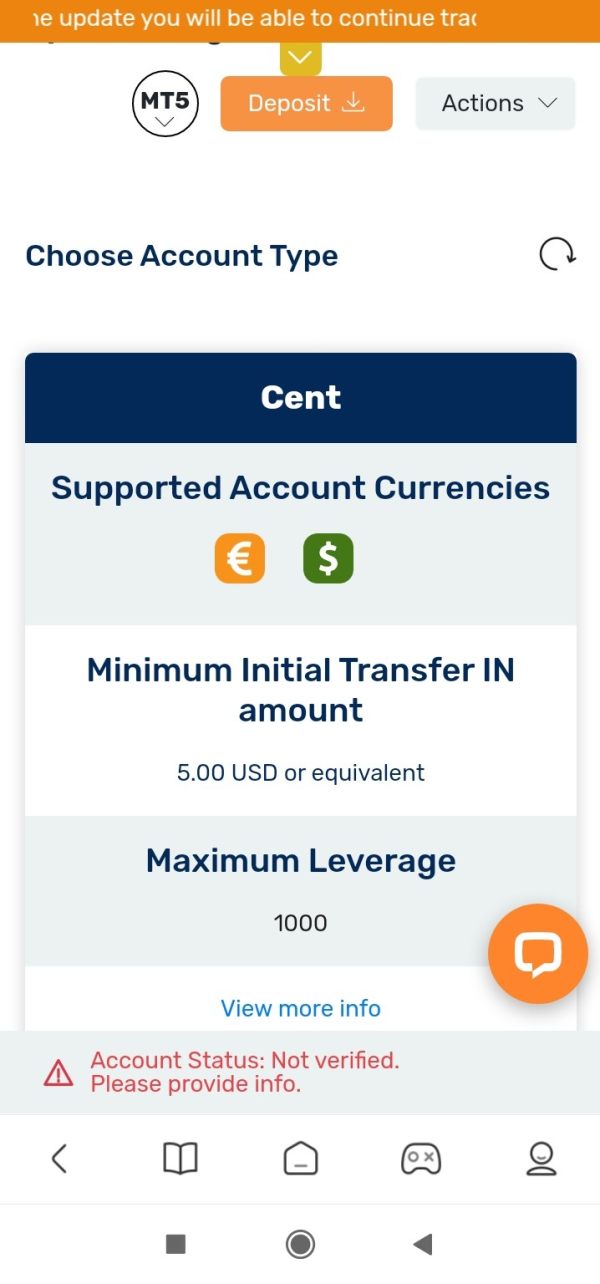

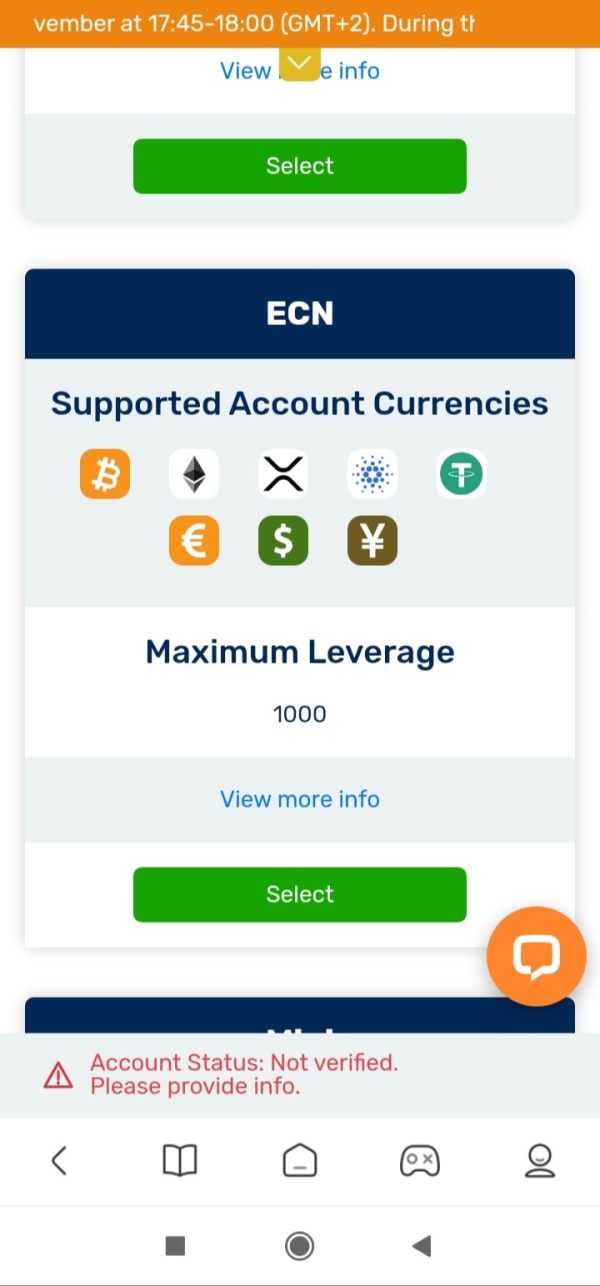

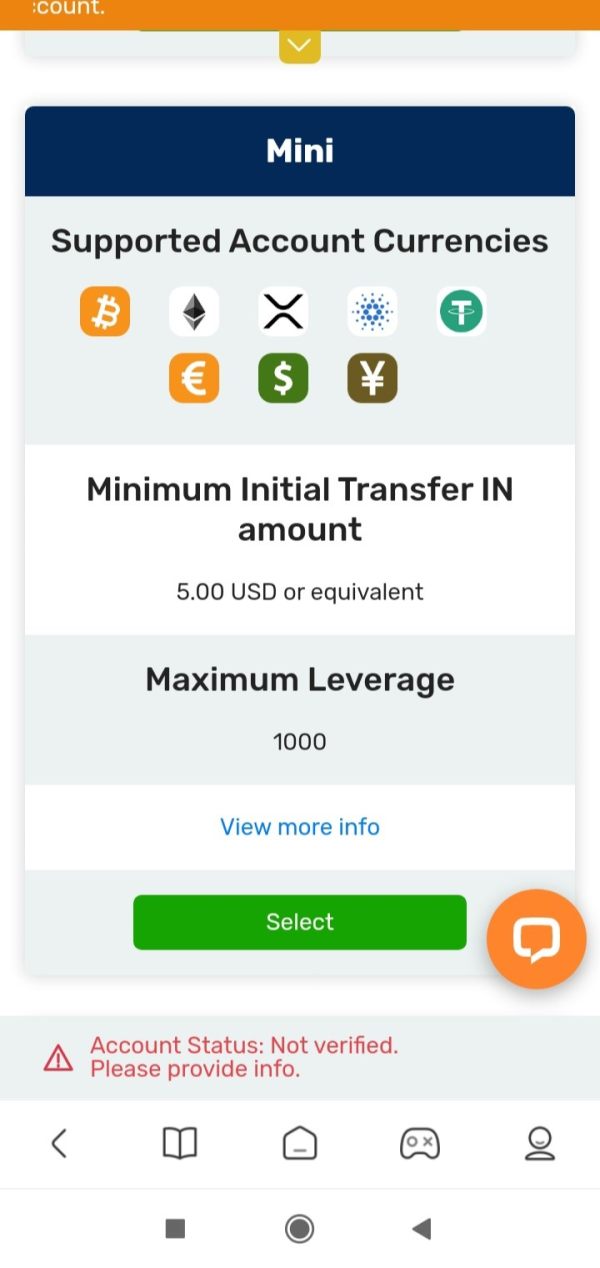

This global gt review presents a comprehensive analysis of Global GT, a South Africa-based hybrid broker that has been operating since 2019. The broker offers trading services across multiple asset classes including forex, CFDs, stocks, indices, precious metals, energy, and cryptocurrencies through the MetaTrader 5 platform. Global GT positions itself as a provider for high-leverage trading with ratios up to 1:1000 and ECN account spreads starting from zero.

However, our evaluation reveals significant concerns regarding regulatory transparency. Specific regulatory information is not clearly disclosed in available materials. The broker targets investors seeking high-leverage trading opportunities, but the lack of comprehensive regulatory oversight raises important considerations for potential clients. While Global GT offers diverse trading instruments and competitive trading conditions, the absence of detailed user feedback and regulatory clarity suggests a cautious approach is warranted when considering this broker.

Key Features: Maximum leverage of 1:1000, ECN spreads from zero, MT5 platform, multiple asset classes including cryptocurrencies.

Target Audience: Traders seeking high-leverage opportunities with access to diverse markets, particularly those comfortable with elevated risk profiles.

Important Notice

This global gt review is based on publicly available information and market analysis. Potential clients should be aware that regulatory information for Global GT is not clearly specified in available documentation, which may present varying levels of risk depending on different legal jurisdictions. The absence of comprehensive regulatory disclosure could impact investor protection and dispute resolution mechanisms.

Our evaluation methodology incorporates analysis of trading conditions, platform features, asset offerings, and available market feedback. However, the limited availability of detailed user testimonials and regulatory specifics means this assessment relies heavily on publicly disclosed trading terms and general market positioning. Prospective traders should conduct additional due diligence and consider consulting with financial advisors before making trading decisions.

Rating Framework

Broker Overview

Company Background and Establishment

Global GT operates as a hybrid broker established in 2019. The company has headquarters located in South Africa. The company has positioned itself within the competitive online trading landscape by offering a multi-asset trading environment that caters to both retail and potentially institutional clients. As a relatively new entrant in the brokerage industry, Global GT focuses on providing access to global financial markets through technology-driven solutions.

The broker's business model centers on offering diverse trading opportunities across traditional and emerging asset classes. Global GT emphasizes its role as a bridge between traders and international markets, providing execution services across forex, contract for differences, equity indices, precious metals, energy commodities, and digital assets. This comprehensive approach reflects the broker's strategy to capture market share in the increasingly competitive online trading sector.

Trading Infrastructure and Asset Coverage

Global GT utilizes the MetaTrader 5 platform as its primary trading interface. The platform provides clients with access to advanced charting tools, automated trading capabilities, and comprehensive market analysis features. The platform choice reflects industry standards and offers familiarity for experienced traders while maintaining accessibility for newcomers to electronic trading.

The broker's asset coverage spans multiple categories including major, minor, and exotic forex pairs, global stock indices, individual equity CFDs, precious metals such as gold and silver, energy commodities including crude oil and natural gas, and various cryptocurrency pairs. This diversified offering positions Global GT as a comprehensive trading solution, though specific details regarding the exact number of instruments and market depth are not extensively detailed in available documentation.

Regulatory Environment

Available documentation does not specify comprehensive regulatory oversight details. This represents a significant consideration for potential clients evaluating broker selection criteria.

Deposit and Withdrawal Methods

Global GT provides both traditional fiat currency and cryptocurrency deposit and withdrawal options. This reflects modern trading preferences and the growing integration of digital assets in mainstream trading.

Minimum Deposit Requirements

Specific minimum deposit thresholds are not detailed in available information. Direct broker contact is required for clarification.

Promotional Offerings

Current bonus and promotional structures are not specified in accessible documentation.

Trading Assets

The broker offers forex currency pairs. It also provides CFDs on stocks, major global indices, precious metals including gold and silver, energy commodities, and cryptocurrency trading pairs across multiple digital assets.

Cost Structure Analysis

Trading costs feature spreads beginning from zero on ECN accounts. However, specific commission rates and fee structures require additional clarification from the broker directly.

Leverage Provisions

Maximum leverage ratios reach 1:1000. This positions Global GT among brokers offering higher leverage options in the market.

Platform Technology

MetaTrader 5 serves as the primary trading platform. It provides comprehensive technical analysis tools, automated trading support, and multi-asset trading capabilities.

Geographic Restrictions

Specific regional limitations are not detailed in available documentation.

Customer Support Languages

Language support details are not specified in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis

Global GT's account structure presents both advantages and areas requiring clarification. The broker's offering of leverage up to 1:1000 positions it competitively within the high-leverage segment of the market, appealing to traders seeking amplified market exposure. The ECN account option with spreads starting from zero suggests competitive pricing for active traders, though the absence of detailed commission information limits comprehensive cost analysis.

However, significant information gaps exist regarding account tier differentiation, minimum deposit requirements across different account types, and specific features that distinguish various account offerings. The lack of transparent account opening procedures and verification requirements in available documentation creates uncertainty for potential clients planning their trading setup.

Without comprehensive user feedback regarding account management experiences, deposit and withdrawal processing times, or customer satisfaction with account-related services, this global gt review cannot provide definitive assessment of practical account operation quality. The incomplete information disclosure suggests potential clients should request detailed account specifications directly from Global GT before making commitment decisions.

The integration of MetaTrader 5 as the primary trading platform represents a significant strength in Global GT's offering. MT5 provides comprehensive technical analysis capabilities, automated trading support through Expert Advisors, and multi-asset trading functionality that aligns with the broker's diverse instrument coverage. The platform's established reputation and widespread adoption in the trading community offers familiarity and reliability advantages.

Global GT's multi-asset approach spanning forex, CFDs, indices, precious metals, energy commodities, and cryptocurrencies demonstrates commitment to providing comprehensive market access. This diversity enables traders to implement cross-asset strategies and portfolio diversification within a single trading environment.

However, available information does not detail additional research resources, market analysis tools, educational materials, or proprietary trading aids that might enhance the trading experience beyond standard MT5 functionality. The absence of information regarding economic calendars, market news feeds, trading signals, or educational content limits assessment of the broker's value-added services. Without user testimonials regarding tool effectiveness or expert evaluations of resource quality, the complete picture of Global GT's analytical support remains unclear.

Customer Service and Support Analysis

Customer service evaluation for Global GT faces significant limitations due to insufficient available information regarding support infrastructure, response times, and service quality metrics. The absence of detailed customer service channel descriptions, operating hours, multilingual support capabilities, and staff expertise levels prevents comprehensive assessment of support effectiveness.

Available documentation does not specify whether Global GT provides 24/7 support, live chat functionality, phone support, email response times, or dedicated account management services. This information gap is particularly concerning for traders who require reliable support during market hours or when facing technical issues that could impact trading activities.

Without user feedback regarding problem resolution experiences, support staff knowledge levels, or satisfaction with customer service interactions, this evaluation cannot provide definitive assessment of Global GT's support quality. The lack of transparency regarding customer service capabilities suggests potential clients should directly test support responsiveness and expertise before committing to trading activities.

Professional traders often require sophisticated support for platform issues, account management, and trading-related inquiries. This makes comprehensive customer service evaluation essential for broker selection decisions.

Trading Experience Analysis

The MetaTrader 5 platform foundation provides Global GT with established trading infrastructure known for stability, comprehensive functionality, and professional-grade execution capabilities. MT5's advanced charting tools, technical indicators, and automated trading support create a robust environment for various trading strategies and experience levels.

Global GT's competitive leverage offerings up to 1:1000 and ECN spreads starting from zero suggest favorable trading conditions for active traders seeking cost-effective execution. The multi-asset platform enables diverse trading strategies and portfolio approaches within a unified interface, potentially enhancing operational efficiency.

However, critical trading experience factors remain unclear due to insufficient information regarding execution speeds, slippage rates, requote frequencies, and platform stability during high-volatility periods. Without user feedback on order execution quality, platform performance during market stress, or mobile trading functionality, comprehensive trading experience assessment is limited.

The absence of detailed information regarding liquidity providers, execution models, and technology infrastructure prevents evaluation of execution quality factors that significantly impact trading outcomes. This global gt review emphasizes the importance of testing platform performance through demo accounts before live trading commitment.

Trust and Reliability Analysis

Trust assessment for Global GT reveals significant concerns primarily related to regulatory transparency limitations. The absence of clearly disclosed regulatory oversight information creates uncertainty regarding investor protection mechanisms, dispute resolution procedures, and compliance standards that typically provide trader confidence.

Regulatory authorization and oversight represent fundamental trust factors in broker evaluation. They establish legal frameworks for client fund protection, operational standards, and recourse mechanisms in case of disputes. Without comprehensive regulatory disclosure, potential clients cannot adequately assess the legal protections available for their trading activities and deposited funds.

Available information does not detail client fund segregation practices, insurance coverage, audit procedures, or other financial security measures that established brokers typically implement to protect client interests. The absence of third-party ratings, industry certifications, or independent evaluations further limits trust assessment capabilities.

Without substantial user testimonials, industry recognition, or transparent operational history, Global GT's reliability profile remains difficult to establish definitively. The limited transparency regarding corporate governance, financial backing, and regulatory compliance suggests heightened due diligence requirements for prospective clients.

User Experience Analysis

User experience evaluation for Global GT faces substantial limitations due to insufficient available feedback from actual clients and limited documentation of user interface design, platform usability, and overall satisfaction metrics. Without comprehensive user testimonials, review aggregations, or independent user surveys, assessment of practical trading experience quality remains incomplete.

Available information does not detail the account opening process complexity, verification procedures, platform learning curve, or user interface design quality that significantly impact trader satisfaction. The absence of mobile application reviews, platform customization options, and user workflow efficiency feedback prevents comprehensive usability assessment.

Critical user experience factors such as deposit and withdrawal processing times, customer service responsiveness in real scenarios, platform stability during peak trading hours, and overall trader satisfaction levels are not adequately documented in accessible materials. Without user-generated content regarding common challenges, platform advantages, or operational pain points, this evaluation cannot provide definitive user experience assessment.

The limited availability of user feedback suggests either a smaller client base, restricted marketing reach, or insufficient emphasis on client testimonial collection. All of these may indicate areas for potential improvement in user engagement and satisfaction measurement.

Conclusion

This global gt review reveals a broker offering competitive trading conditions including high leverage up to 1:1000 and ECN spreads from zero, supported by the established MetaTrader 5 platform and diverse multi-asset coverage. However, significant transparency concerns regarding regulatory oversight and limited user feedback availability require careful consideration.

Global GT appears most suitable for experienced traders comfortable with elevated risk profiles who prioritize high-leverage trading opportunities and multi-asset access over comprehensive regulatory transparency. The broker's competitive trading terms and platform selection demonstrate potential value for active traders, though the regulatory information gaps suggest heightened due diligence requirements.

Primary advantages include competitive leverage ratios, zero-spread ECN options, MT5 platform integration, and comprehensive asset class coverage spanning traditional and digital markets. Key limitations encompass regulatory transparency concerns, insufficient user feedback availability, and incomplete disclosure of operational details including customer service capabilities and fee structures.

Potential clients should conduct thorough independent research, test platform functionality through demo accounts, and consider consulting financial advisors before making trading commitments with Global GT.