BlueMax 2025 Review: Everything You Need to Know

Executive Summary

BlueMax presents itself as an online forex trading broker offering various trading services through multiple platforms. This bluemax review provides a comprehensive analysis of the broker's offerings based on available public information. The company operates from London, United Kingdom, and claims to provide forex and commodities CFD trading services with zero spreads through MT4 and MT Mobile platforms.

However, our investigation reveals significant transparency concerns that raise red flags. BlueMax lacks clear regulatory information, which raises questions about client fund protection and operational oversight. The broker targets small to medium-sized investors seeking diversified asset trading opportunities, but the absence of detailed fee structures, minimum deposit requirements, and comprehensive customer service information limits our ability to provide a full assessment.

With an average user rating of 3 out of 5, BlueMax appears to offer a mixed experience for traders. While the zero spread offering and MT4 platform access may attract traders, the lack of regulatory clarity and limited transparency regarding operational details warrant careful consideration before engaging with this broker. Potential clients should proceed with extreme caution when evaluating this trading platform.

Important Notice

This review is based on publicly available information and user feedback. BlueMax operates across multiple regions including the United Kingdom, but specific regulatory information remains unclear from available sources. Different sources may present varying information about the broker's services and conditions that could impact your trading decisions.

Our evaluation methodology relies on publicly accessible data, user testimonials, and industry standard assessment criteria. Given the limited transparency in some operational aspects, potential clients should conduct additional due diligence before making any trading decisions. We strongly recommend verifying all information independently before opening any trading accounts.

Rating Framework

Broker Overview

BlueMax Capital positions itself as a leading online forex trading broker. The company operates from Saint John Street 145-157, EC1V 4PW, London, United Kingdom, and claims to specialize in online forex trading with PAMM solutions for forex fund management. However, specific information about its establishment date remains unclear from available sources, which raises questions about the company's operational history.

The broker's business model centers around providing access to currency, indices, and commodities trading through established platforms. BlueMax emphasizes its zero spread offering as a key competitive advantage, though detailed information about commission structures and overall cost frameworks remains limited in publicly available materials. This lack of transparency makes it difficult for traders to understand the true cost of trading with this broker.

The trading infrastructure relies primarily on MetaTrader 4 and MT Mobile platforms, which are industry-standard solutions widely recognized for their functionality and reliability. The broker offers access to forex pairs and commodities CFDs, targeting traders interested in diversified asset exposure. However, specific details regarding regulatory oversight, licensing, and compliance frameworks are not clearly disclosed in available information sources, which represents a significant consideration for potential clients evaluating the broker's credibility and operational transparency.

This bluemax review aims to address these transparency gaps while providing an honest assessment based on available data. We encourage traders to carefully consider these limitations when making their investment decisions.

Regulatory Status: Available information does not clearly specify regulatory authorities overseeing BlueMax's operations, despite the company's London-based headquarters. This lack of regulatory transparency raises important questions about client protection frameworks and should be a major concern for potential traders.

Deposit and Withdrawal Methods: Specific information about supported deposit and withdrawal methods is not detailed in available sources. This limits our ability to assess the convenience and accessibility of fund management processes, which is crucial for active traders.

Minimum Deposit Requirements: The minimum deposit threshold for account opening is not specified in publicly available information. This makes it difficult for potential clients to assess entry barriers and plan their initial investment accordingly.

Bonuses and Promotions: Current promotional offerings, welcome bonuses, or trading incentives are not detailed in available materials. This suggests either limited promotional activities or insufficient transparency in marketing communications, both of which could impact trader value.

Tradeable Assets: BlueMax offers access to forex currency pairs and commodities contracts for difference. The broker provides traders with exposure to major asset classes commonly sought by retail investors, though specific instrument details remain limited.

Cost Structure: The broker advertises zero spreads, which appears attractive for cost-conscious traders seeking to minimize transaction costs. However, detailed commission structures, overnight financing rates, and other potential trading costs are not comprehensively disclosed in available information, making it challenging to assess the complete cost framework that traders will face.

Leverage Ratios: Specific leverage offerings are not detailed in available sources. This is concerning given the importance of leverage information for risk management and regulatory compliance in forex trading.

Platform Options: BlueMax supports MT4 and MT Mobile platforms, giving traders access to established and widely-used trading environments. These platforms provide standard charting and analysis tools that most forex traders are familiar with and comfortable using.

Geographic Restrictions: The broker appears to operate in multiple regions including the UK, though specific geographic limitations or service restrictions are not clearly outlined. This lack of clarity could create problems for international traders seeking to understand their eligibility for services.

Customer Service Languages: Available information does not specify supported languages for customer service. This limits assessment of accessibility for international clients and could impact the quality of support available to non-English speaking traders.

This bluemax review highlights these information gaps as areas requiring clarification from potential clients before making any trading commitments.

Detailed Rating Analysis

Account Conditions Analysis 4/10

BlueMax's account conditions present a mixed picture with significant information gaps that impact our evaluation negatively. The broker's advertised zero spread offering represents a potentially attractive feature for cost-conscious traders, particularly those engaging in high-frequency trading strategies where spread costs can accumulate significantly over time.

However, the absence of detailed information about account types, minimum deposit requirements, and comprehensive fee structures creates uncertainty for potential clients that cannot be ignored. Most reputable brokers provide clear tiering of account options with distinct features, benefits, and requirements that help traders choose the right service level. The lack of such transparency makes it difficult for traders to understand what services they can access at different investment levels, which represents a significant weakness in the broker's offering.

The account opening process details are not clearly outlined in available sources. This could indicate either a streamlined approach or insufficient transparency in onboarding procedures, both of which present challenges for potential clients.

Additionally, the absence of information about special account features such as Islamic accounts, professional trader classifications, or institutional services suggests limited customization options. Without clear commission structures accompanying the zero spread claims, traders cannot accurately calculate total trading costs, which is essential for strategy development and performance evaluation. This bluemax review identifies these transparency gaps as significant weaknesses in the account conditions offering that should concern potential clients.

BlueMax's tools and resources offering centers around the MT4 and MT Mobile platforms. These platforms provide traders with access to industry-standard trading environments that most forex traders recognize and trust.

MetaTrader 4 remains one of the most widely-used platforms in retail forex trading, offering comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. The MT Mobile platform extends trading access to smartphones and tablets, enabling traders to monitor positions and execute trades while away from desktop environments, which addresses the growing demand for flexible trading solutions among retail investors who require constant market access.

However, available information does not detail additional proprietary tools, research resources, or educational materials that might differentiate BlueMax from competitors in meaningful ways. Many established brokers provide market analysis, economic calendars, trading signals, and educational content to support trader development and decision-making processes, but BlueMax appears to lack these value-added services.

The absence of information about research departments, market commentary, or analytical resources suggests limited value-added services beyond basic platform access. Similarly, educational resources such as webinars, tutorials, or trading guides are not mentioned in available materials, which could limit the broker's appeal to novice traders seeking learning opportunities and professional development.

Automated trading support through MT4's Expert Advisor functionality provides some advanced capabilities for experienced traders. However, specific details about supported strategies, VPS services, or algorithmic trading resources are not clearly outlined, which limits the assessment of advanced trading capabilities.

Customer Service and Support Analysis 5/10

Customer service evaluation for BlueMax is challenging due to limited publicly available information about support channels, response times, and service quality metrics. The broker's London headquarters suggests potential for professional service standards, though specific operational details remain unclear and unverified.

Available sources do not specify supported communication channels such as live chat, telephone support, email ticketing systems, or callback services. This lack of transparency makes it difficult for potential clients to understand how they can access assistance when needed, particularly during urgent trading situations or technical difficulties that require immediate resolution.

Response time commitments, service availability hours, and multilingual support capabilities are not detailed in accessible information sources. For international traders, language support and timezone coverage represent critical factors in service quality assessment, yet these elements remain unspecified and could create significant barriers to effective communication.

The absence of user feedback specifically addressing customer service experiences limits our ability to evaluate real-world service quality accurately. Many broker reviews include detailed customer testimonials about support interactions, resolution effectiveness, and overall satisfaction levels, but such information is not readily available for BlueMax, which raises questions about the broker's transparency and client satisfaction.

Professional traders often require dedicated account management, priority support channels, or specialized technical assistance for complex trading strategies. However, information about tiered service levels or premium support options is not available in current sources, suggesting limited customization in customer service offerings.

Trading Experience Analysis 6/10

The trading experience evaluation for BlueMax benefits from the broker's use of established MT4 and MT Mobile platforms. These platforms generally provide reliable and familiar environments for forex traders with proven track records in the industry.

MetaTrader 4's proven stability, comprehensive functionality, and widespread adoption contribute positively to the overall trading experience assessment. Platform performance metrics such as execution speeds, uptime statistics, and server reliability are not specifically detailed in available information, though the broker claims an average trading speed of 0ms, which would be exceptionally fast if accurately measured and verified through independent testing.

However, without independent verification or detailed methodology, such claims require careful consideration and should not be taken at face value. The zero spread offering potentially enhances the trading experience by reducing transaction costs, particularly for scalping strategies or high-frequency trading approaches that rely on minimal spreads.

However, the absence of detailed information about order execution quality, slippage rates, and requoting frequency limits comprehensive assessment of the actual trading environment. Mobile trading capabilities through MT Mobile provide flexibility for active traders, though specific features, functionality comparisons with the desktop platform, and mobile-specific tools are not detailed in available sources, which could impact the mobile trading experience.

User feedback regarding mobile platform performance and reliability would strengthen this evaluation but is not readily accessible. The range of tradeable assets including forex and commodities CFDs provides reasonable diversification opportunities, though specific instrument availability, market depth, and liquidity information would enhance the trading experience assessment significantly.

This bluemax review rates the trading experience as above average primarily due to platform selection, while noting areas requiring additional transparency for a complete evaluation.

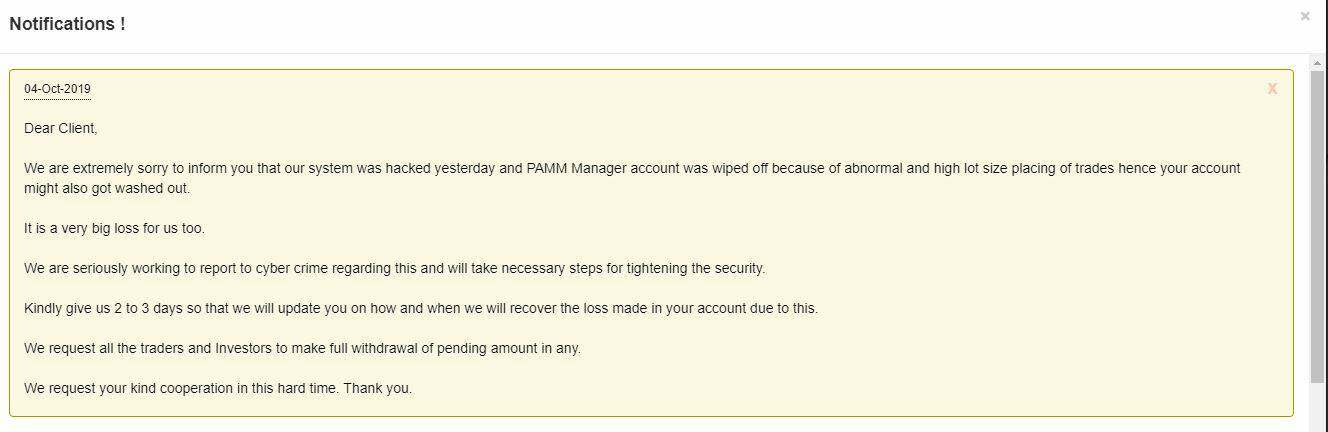

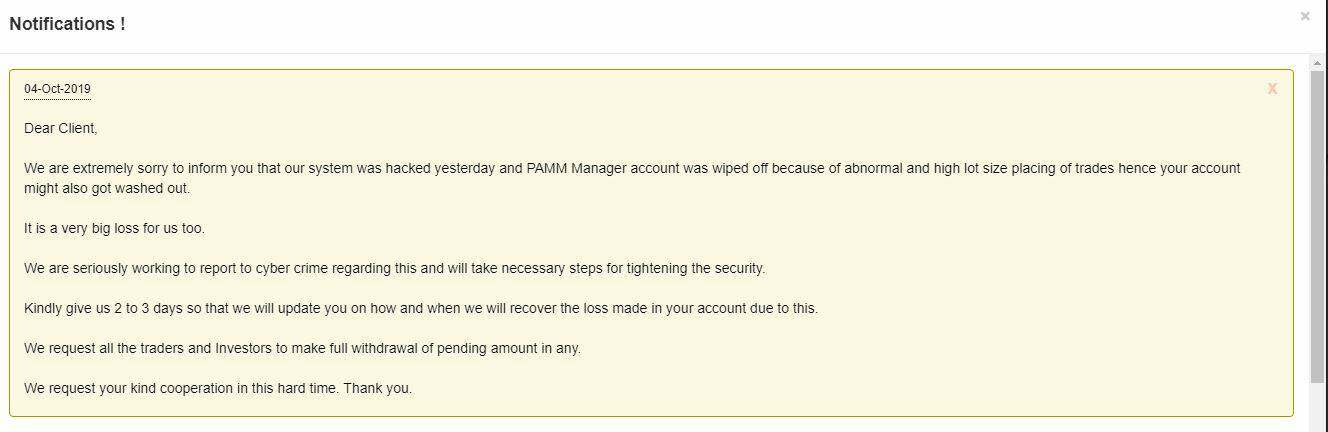

Trust and Regulation Analysis 3/10

Trust and regulatory assessment represents the most concerning aspect of BlueMax's evaluation. Significant gaps in transparency regarding oversight, licensing, and client protection frameworks create serious concerns about the broker's legitimacy and safety.

The absence of clearly stated regulatory authorities or license numbers raises fundamental questions about the broker's compliance status and operational legitimacy. Reputable forex brokers typically provide detailed regulatory information including specific license numbers, regulatory authority names, and compliance frameworks governing their operations, but BlueMax fails to meet these basic transparency standards.

The lack of such information for BlueMax creates uncertainty about client fund protection, dispute resolution mechanisms, and regulatory oversight of business practices. Fund safety measures such as segregated client accounts, deposit insurance, or compensation schemes are not detailed in available information, which should be a major red flag for potential clients.

These protections represent critical safeguards for traders, and their absence from promotional or informational materials suggests potential gaps in client protection frameworks. Company transparency regarding ownership structure, financial reporting, and operational history is limited in accessible sources, which further undermines confidence in the broker's credibility.

Established brokers often provide detailed company information, management team backgrounds, and operational transparency that builds client confidence, but such details are not readily available for BlueMax. The broker's London location might suggest potential regulatory oversight by UK authorities, but without explicit confirmation of regulatory status, this cannot be assumed or relied upon for client protection.

Industry reputation indicators such as awards, recognition, or third-party certifications are not mentioned in available materials. This lack of external validation further contributes to concerns about the broker's standing in the forex industry.

User Experience Analysis 5/10

User experience evaluation for BlueMax indicates mixed results based on available feedback. An average user rating of 3 out of 5 suggests moderate satisfaction levels among existing clients, though this rating indicates significant room for improvement across various operational aspects.

This rating suggests that while some traders find acceptable service levels, many others experience problems or limitations that prevent higher satisfaction scores. Interface design and usability assessment relies primarily on the MT4 and MT Mobile platforms, which generally provide familiar and functional trading environments for most traders.

However, specific customization options, user interface enhancements, or proprietary features that might improve the overall experience are not detailed in available information. The account registration and verification process details are not clearly outlined, making it difficult to assess onboarding convenience and efficiency, which represents the first impression most traders have of a broker.

Streamlined account opening procedures represent important factors in user experience, particularly for traders seeking quick market access in volatile markets. Fund management experience including deposit processing times, withdrawal procedures, and payment method convenience cannot be thoroughly evaluated due to limited available information about supported payment systems and processing timeframes.

Common user complaints or satisfaction drivers are not well-documented in accessible sources. This limits our ability to identify specific strengths or weaknesses in the user experience that could help potential clients make informed decisions.

Detailed customer testimonials addressing platform performance, customer service interactions, and overall satisfaction would strengthen this assessment but are not readily available. The broker's target audience of small to medium-sized investors suggests a focus on accessible trading solutions, though specific features designed for this demographic are not clearly highlighted in available materials.

Conclusion

BlueMax presents a mixed proposition for forex traders that requires careful consideration of both benefits and risks. The broker offers some attractive features alongside significant transparency concerns that warrant serious evaluation before making any trading commitments.

The broker's zero spread offering and MT4 platform access provide legitimate trading advantages, particularly for cost-conscious traders and those familiar with MetaTrader environments. However, the lack of clear regulatory information, limited transparency regarding fee structures and operational details, and insufficient customer service information create substantial uncertainties that impact the broker's overall credibility and safety profile.

The moderate user rating of 3 out of 5 reflects these mixed experiences among existing clients and suggests ongoing issues with service delivery. BlueMax may be suitable for small to medium-sized investors seeking diversified asset trading opportunities, particularly those prioritizing low-cost trading over comprehensive service packages and regulatory protection.

However, potential clients should conduct thorough due diligence regarding regulatory status, fund safety measures, and complete cost structures before committing funds to this platform. The broker's strengths in platform selection and cost competitiveness must be weighed against transparency concerns and limited operational clarity that could expose traders to unnecessary risks.

This bluemax review recommends that traders consider more established and transparent alternatives unless they are comfortable with the identified risks and limitations.