Is BlueMax safe?

Business

License

Is BlueMax Safe or Scam?

Introduction

BlueMax Capital, a forex broker registered in Belize, positions itself as a player in the online trading market, offering various financial instruments through the popular MetaTrader 4 platform. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. Regulatory compliance, company transparency, and customer feedback are critical factors that can influence a trader's decision. This article aims to evaluate the safety and legitimacy of BlueMax Capital by investigating its regulatory status, company background, trading conditions, client fund security, and overall user experience. The assessment is based on a comprehensive review of available information from various financial analysis platforms and user reviews.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its safety for traders. BlueMax Capital operates under an offshore license from the International Financial Services Commission (IFSC) in Belize, which is known for its lenient regulatory framework. While the IFSC requires brokers to maintain a minimum of $500,000 in net tangible assets and segregate client funds, the level of oversight is significantly lower compared to more stringent regulators like the FCA in the UK or ASIC in Australia.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | Not specified | Belize | Active but lenient |

The lack of robust regulatory oversight means that investors may not have adequate protection in the event of disputes or insolvency. Historical compliance records reveal that many brokers operating under similar licenses have faced issues related to fund mismanagement and client complaints. This raises concerns about whether BlueMax is safe for trading, as the absence of strong regulatory backing could lead to potential risks for investors.

Company Background Investigation

BlueMax Capital, operating under the name BlueMax Global Ltd., has been in the market since 2018. However, the company's ownership structure and management team remain somewhat opaque. While the firm claims to have offices in Belize, Hong Kong, and the UK, there is little verifiable information regarding its operational history or the professional backgrounds of its executives. This lack of transparency can be a red flag for potential investors.

The company's website does not provide detailed information about its management team, which further complicates the assessment of its credibility. A transparent broker typically shares information about its founders, key personnel, and their qualifications. In this case, the absence of such information raises questions about the company's commitment to transparency and regulatory compliance. Therefore, traders should be cautious and consider whether BlueMax is safe for their investments.

Trading Conditions Analysis

The trading conditions offered by BlueMax Capital are another critical aspect to evaluate. The broker provides various account types with different minimum deposit requirements, ranging from $1,000 to $200,000. While the leverage offered can go up to 1:400, traders should be aware that high leverage can amplify both profits and losses, thereby increasing the overall risk.

| Fee Type | BlueMax Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.2 pips | From 0.1 pips |

| Commission Structure | Varies by account | Typically $6 per lot |

| Overnight Interest Range | Not specified | Varies by broker |

The overall fee structure appears reasonable; however, the high minimum deposit requirements may deter many potential traders. Additionally, the absence of clear information regarding overnight interest rates and other potential fees can create confusion. Traders should ensure they fully understand the cost implications before committing to an account. Given these factors, it is essential to consider whether BlueMax is safe for trading, especially for those who may be new to forex trading.

Client Fund Security

The safety of client funds is a crucial concern for any forex trader. BlueMax claims to implement measures to protect client funds, including maintaining segregated accounts. However, the effectiveness of these measures is questionable, given the broker's offshore status and the regulatory environment in Belize.

Moreover, there have been reports of withdrawal issues and complaints from users regarding the difficulty in accessing their funds. Such incidents can significantly diminish trust in a broker. Traders should be particularly cautious when dealing with brokers that have a history of fund security issues, as it raises concerns about whether BlueMax is safe for their investments.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a broker. Reviews of BlueMax Capital reveal a mixed bag of experiences, with some users reporting satisfactory service, while others have raised serious complaints regarding fund withdrawals and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

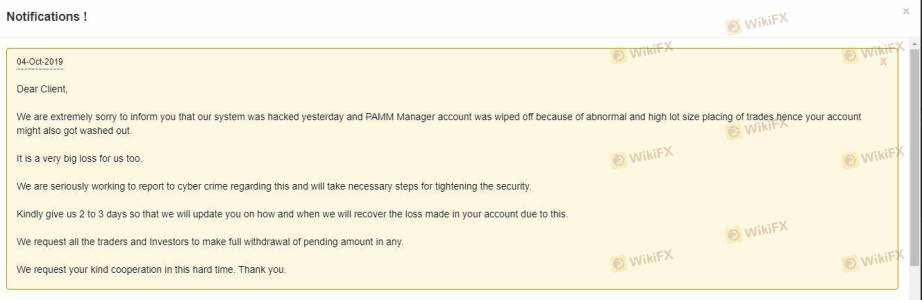

Several users have reported that their accounts were frozen or that they faced significant delays in withdrawing funds. In one notable case, a user claimed that their account was wiped out due to a cyber attack, which highlights potential vulnerabilities in the broker's security measures. Such complaints suggest that traders should approach BlueMax with caution and consider whether BlueMax is safe for their trading activities.

Platform and Execution

The trading platform offered by BlueMax Capital is MetaTrader 4, a widely used platform known for its robust features and user-friendly interface. However, the platform's performance and execution quality are critical factors that can impact a trader's experience. Reports of slippage and rejected orders have surfaced, which can be particularly detrimental during volatile market conditions.

While BlueMax's use of a reputable platform like MT4 is a positive aspect, any signs of manipulation or execution issues could undermine the overall trading experience. Therefore, traders must remain vigilant and assess whether BlueMax is safe for their trading needs, especially considering the potential risks involved.

Risk Assessment

The comprehensive evaluation of BlueMax Capital reveals several risks that traders should be aware of. The combination of its offshore regulatory status, lack of transparency, and mixed customer feedback contributes to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore license with limited oversight |

| Fund Security Risk | High | Reports of withdrawal issues and complaints |

| Execution Risk | Medium | Potential slippage and rejected orders |

To mitigate these risks, traders should consider using smaller amounts for initial investments and thoroughly researching the broker's reputation before committing significant capital. It is crucial to remain informed about any developments that may affect the broker's operations and to ensure that BlueMax is safe for their trading activities.

Conclusion and Recommendations

In conclusion, the investigation into BlueMax Capital raises several concerns regarding its safety and legitimacy. The broker's offshore regulatory status, lack of transparency, and mixed customer experiences suggest that traders should exercise caution. While BlueMax may offer some appealing trading conditions, the associated risks may outweigh the benefits for many investors.

For traders seeking safer alternatives, it is advisable to consider brokers regulated by reputable authorities such as the FCA or ASIC, which provide stronger investor protections and a more transparent trading environment. Ultimately, whether BlueMax is safe for trading remains a contentious issue, and potential clients should conduct thorough due diligence before making any commitments.

Is BlueMax a scam, or is it legit?

The latest exposure and evaluation content of BlueMax brokers.

BlueMax Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BlueMax latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.