Barclays 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Barclays review examines one of the world's largest international banking institutions and its trading services. Barclays Capital Inc. operates as a regulated financial services provider under SEC and FINRA oversight. The firm offers institutional-grade market access and execution capabilities across global financial markets. It specializes in providing deep liquidity in cash and derivative products, alongside customized fund solutions across multiple asset classes.

However, user feedback presents significant concerns about service quality. According to Trustpilot data, Barclays maintains a concerning 2.2-star rating. A shocking 82% of users provide 1-star reviews. This stark disconnect between regulatory standing and customer satisfaction creates a complex evaluation landscape for potential clients.

The platform primarily targets institutional investors and high-net-worth individuals seeking sophisticated trading infrastructure and global market access. While Barclays offers comprehensive financial services including strategy and execution in global rates and FX products, the consistently poor user ratings suggest significant operational challenges. Potential clients must carefully consider these issues before engagement.

Important Notice

The services and regulatory framework of Barclays may vary significantly across different jurisdictions and regional entities. Barclays operates through various subsidiaries worldwide. Each subsidiary is subject to local regulatory requirements and offers potentially different service levels. This review focuses primarily on Barclays Capital Inc., which operates under United States SEC and FINRA regulation.

This evaluation is based on comprehensive analysis of user feedback, market research, and publicly available information from multiple review platforms including Trustpilot and Reviews.io. Potential clients should conduct independent verification of current terms, conditions, and service availability in their specific jurisdiction before making any trading decisions.

Rating Framework

Broker Overview

Barclays Capital Inc. represents a significant presence in the global financial services industry. It operates as part of the broader Barclays banking group. The institution provides comprehensive investment banking and retail banking services, with particular strength in institutional trading and market-making activities. The firm's business model centers on delivering strategy and execution capabilities across global rates and foreign exchange products. This is supported by deep liquidity provision in both cash and derivative instruments.

The company's service portfolio extends beyond traditional trading to include debt instruments across the capital structure and customized fund solutions spanning multiple asset classes. Barclays positions itself as a vertically integrated business offering global solutions to sophisticated investors. Their research division provides data-driven analysis and actionable insights, supported by research analysts covering global sectors, markets, and economies.

However, the regulatory framework under SEC and FINRA oversight contrasts sharply with user experience feedback. While the institutional infrastructure appears robust, with comprehensive market access and sophisticated execution capabilities, the stark user satisfaction metrics suggest significant operational challenges. These challenges involve service delivery and client relationship management that potential users must carefully evaluate.

Regulatory Oversight: Barclays Capital Inc. operates under comprehensive United States financial regulation through both the Securities and Exchange Commission and the Financial Industry Regulatory Authority. This provides institutional-level regulatory protection for client assets and trading activities.

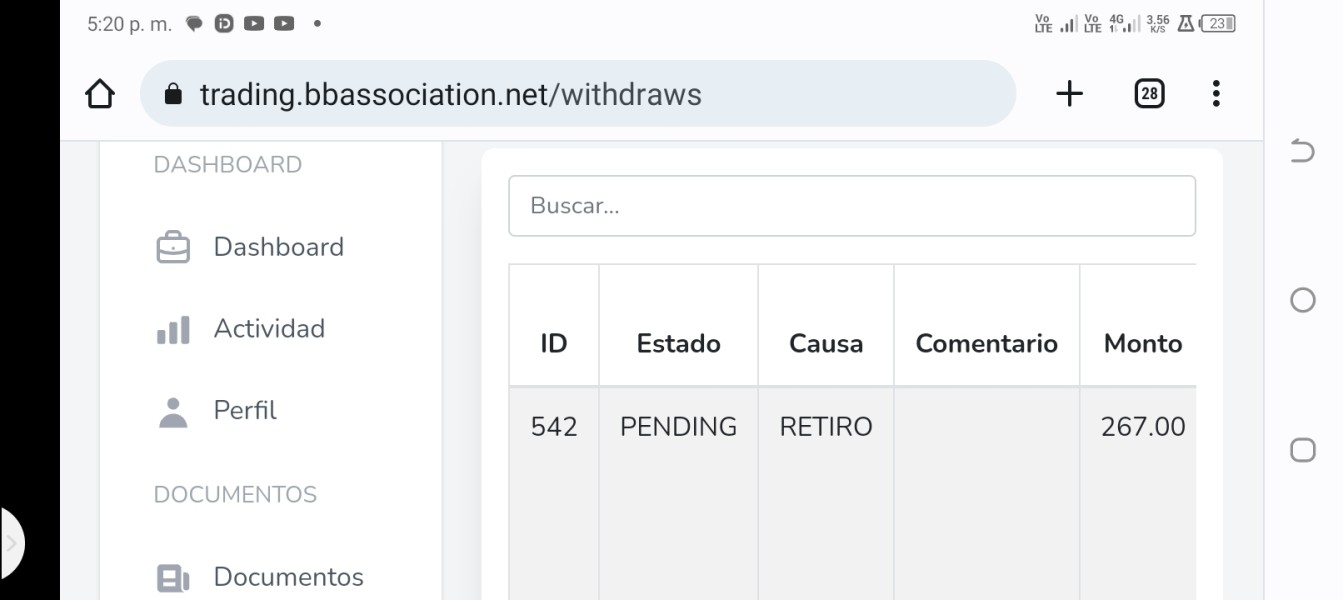

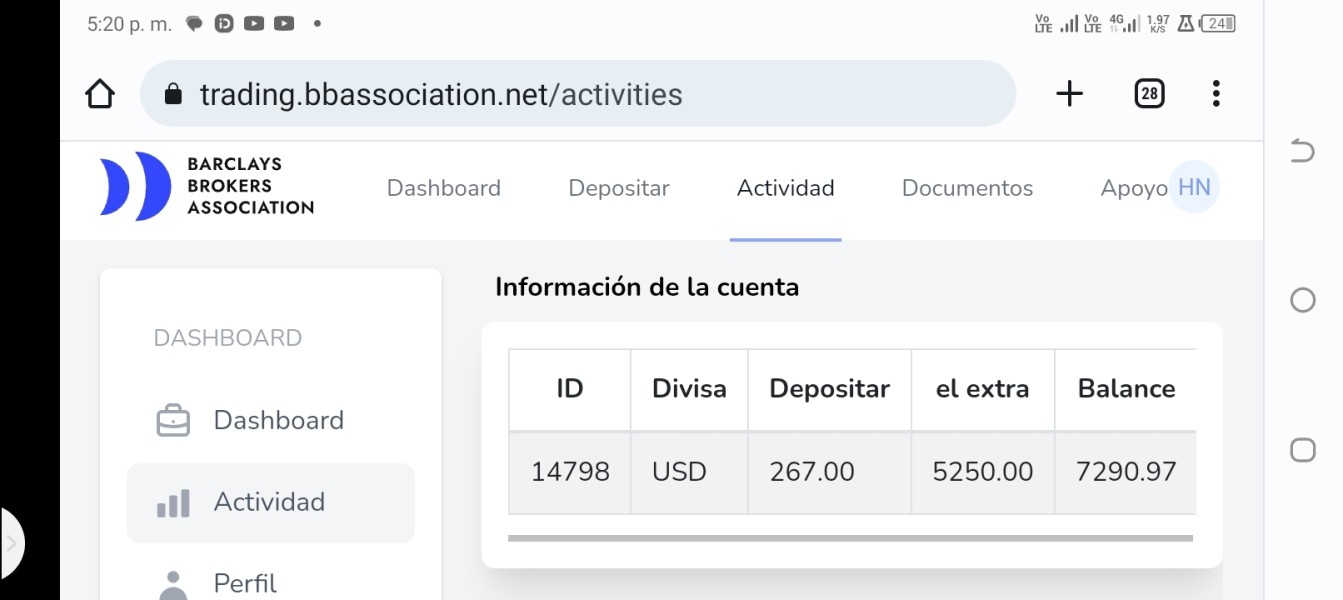

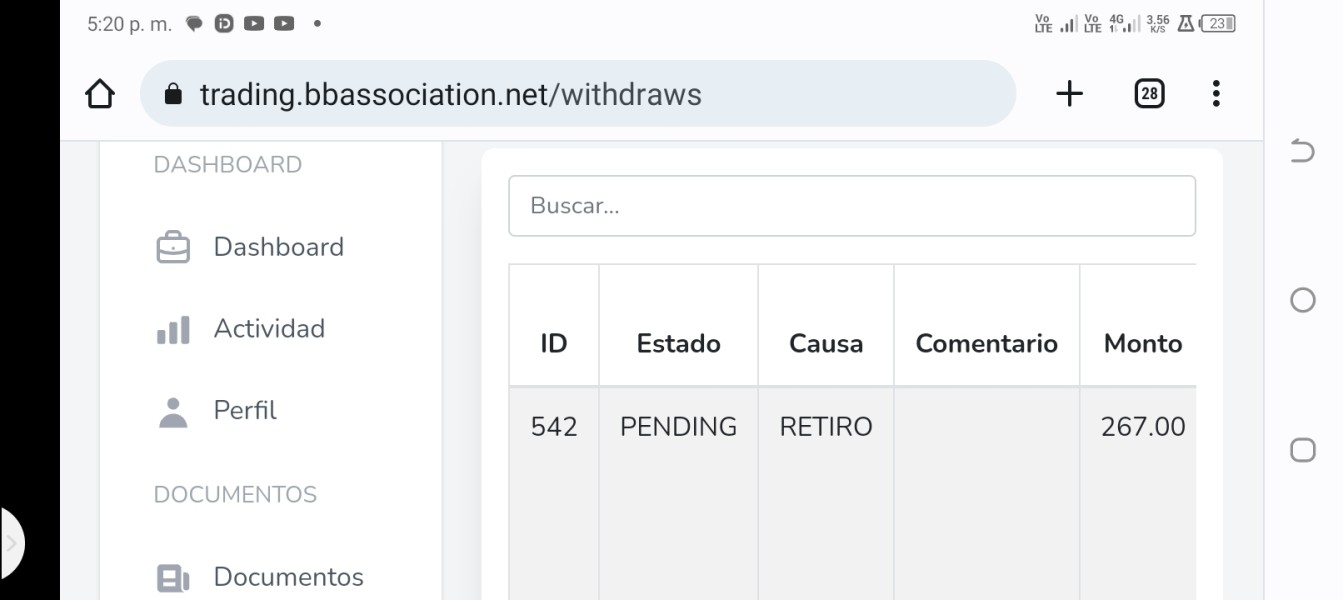

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal procedures is not detailed in available public documentation. This requires direct inquiry with the institution for current processing methods and timeframes.

Minimum Deposit Requirements: Current minimum deposit thresholds are not specified in accessible materials. This suggests these may vary based on account type and client classification.

Promotional Offerings: Available sources do not detail current bonus or promotional structures. This indicates these may be limited or targeted toward specific client segments.

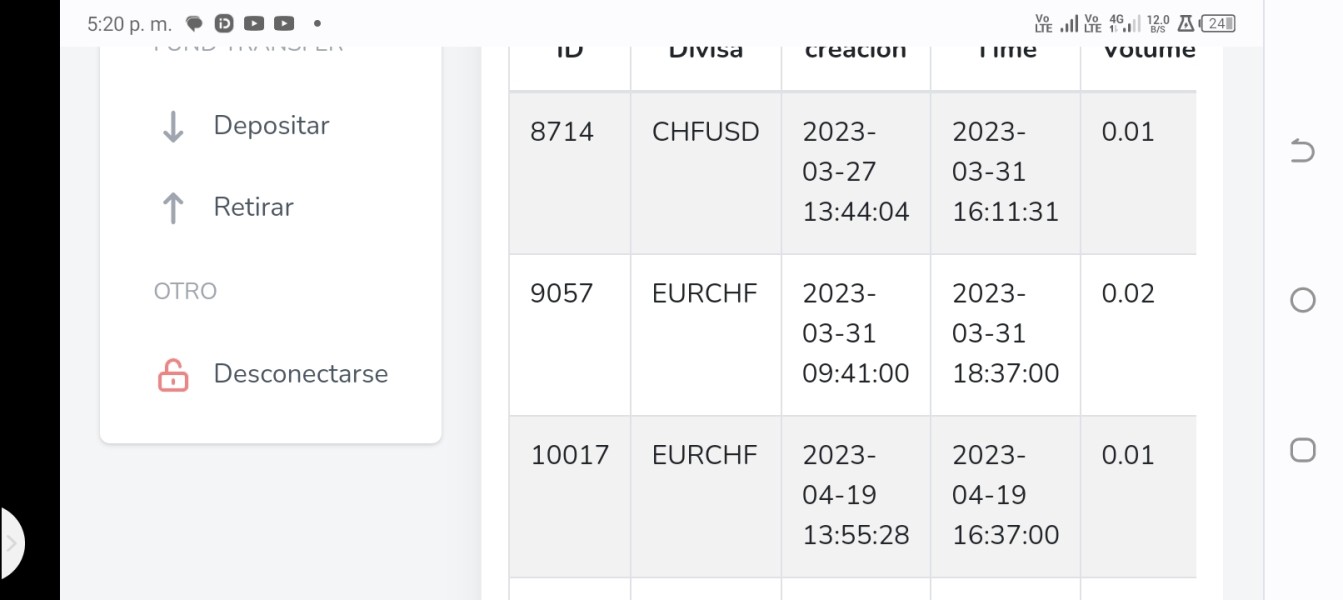

Tradeable Assets: The platform provides access to foreign exchange markets, derivative products, fixed income securities, and customized fund solutions across multiple asset classes. It emphasizes institutional-grade instruments and global market exposure.

Cost Structure: Detailed fee schedules and commission structures require direct consultation. This Barclays review found limited publicly available pricing information, suggesting institutional-style negotiated fee arrangements.

Leverage Ratios: Specific leverage offerings are not detailed in current public materials. These likely vary based on regulatory requirements and client qualification criteria.

Platform Options: Trading platform specifications are not comprehensively detailed in available sources. This requires direct inquiry for current technology offerings and system capabilities.

Detailed Rating Analysis

Account Conditions Analysis

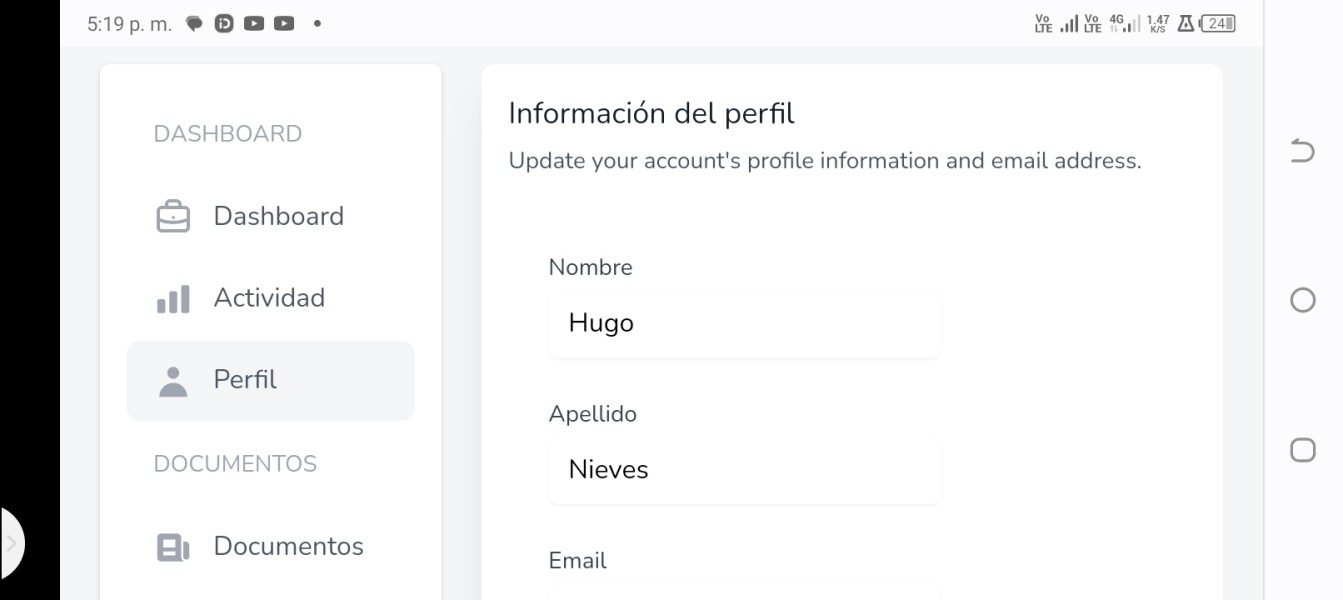

The specific account conditions and structures offered by Barclays remain largely undisclosed in publicly available materials. This creates challenges for potential clients seeking transparent account information. The lack of readily accessible account details suggests the institution may operate primarily through relationship-based service models rather than standardized retail account offerings.

Without clear information on minimum deposit requirements, account tiers, or specific feature sets, potential clients face uncertainty about eligibility and account access requirements. The absence of detailed account opening procedures in public documentation indicates a potentially complex onboarding process. This may require extensive documentation and qualification procedures.

The institutional focus of Barclays' services suggests account conditions may be heavily customized based on client size and trading requirements rather than following standardized retail models. This approach, while potentially offering tailored solutions for qualified clients, creates opacity for those seeking straightforward account information and comparison capabilities.

This Barclays review notes that the limited transparency in account conditions represents a significant barrier for retail traders and smaller institutional clients. These clients require clear, accessible information about trading account features and requirements before making platform decisions.

Barclays demonstrates substantial strength in providing comprehensive market tools and institutional-grade resources. According to available information, the firm offers strategy and execution capabilities across global rates and FX products. This is supported by deep liquidity in both cash and derivative markets. The infrastructure suggests sophisticated trading tools designed for professional market participants.

The research capabilities appear particularly robust, with data-driven analysis and actionable insights provided through dedicated research analysts covering global sectors, markets, and economies. The firm's research division offers industry sector analysis backed by deep expertise. It also provides company, sector, and strategy insights designed to support institutional investment decisions.

However, the accessibility and usability of these tools for different client segments remains unclear from available documentation. While the institutional-grade capabilities suggest powerful analytical and execution resources, the poor user satisfaction ratings indicate potential challenges. These challenges involve tool implementation or client support for effective utilization.

The vertically integrated business model suggests comprehensive resource availability, but the disconnect between apparent capability and user satisfaction raises questions. These questions concern the practical accessibility and effectiveness of these tools for typical trading clients seeking reliable, user-friendly market analysis and execution resources.

Customer Service and Support Analysis

Customer service represents a critical weakness for Barclays based on extensive user feedback analysis. Trustpilot data reveals a concerning 2.2-star rating with 82% of users providing 1-star reviews. This indicates systemic issues in customer service delivery and client relationship management across the platform's user base.

The Reviews.io platform similarly reflects poor customer service experiences, suggesting consistent problems across multiple touchpoints and service channels. Users report difficulties with responsiveness, problem resolution capabilities, and overall service quality. These issues significantly impact the trading experience and client satisfaction levels.

The stark contrast between Barclays' institutional market position and customer service ratings suggests potential resource allocation issues. There may be prioritization of large institutional clients over retail and smaller business accounts. This service disparity creates significant concerns for potential clients who require reliable, responsive customer support for their trading activities.

The consistently poor customer service feedback across multiple review platforms indicates systemic operational challenges that extend beyond isolated incidents. This suggests fundamental issues in service delivery models and client relationship management that potential clients must carefully consider when evaluating platform suitability for their trading requirements.

Trading Experience Analysis

The trading experience evaluation for Barclays faces significant limitations due to limited publicly available information about platform specifications, execution quality metrics, and user interface details. While the firm offers comprehensive market access and institutional-grade execution capabilities, specific details about trading platform performance, stability, and functionality remain largely undisclosed.

Available information suggests sophisticated execution infrastructure with global market access and deep liquidity provision. This indicates potentially robust trading capabilities for qualified users. The emphasis on institutional services implies advanced execution technology and market connectivity designed for professional trading requirements.

However, the poor user satisfaction ratings raise serious concerns about the practical trading experience delivered to clients. The disconnect between apparent institutional capabilities and user feedback suggests potential issues with platform accessibility, reliability, or user support. These issues significantly impact the actual trading experience.

This Barclays review emphasizes that without detailed platform specifications and given the consistently negative user feedback, potential traders face uncertainty about execution quality, platform stability, and overall trading experience reliability. This requires careful evaluation before platform commitment.

Trust Factor Analysis

Barclays maintains strong regulatory credentials through SEC and FINRA oversight. This provides institutional-level regulatory protection and compliance standards that support fundamental trust in the organization's operational framework. The regulatory standing offers significant protection for client assets and trading activities under established United States financial supervision.

However, the regulatory strength contrasts sharply with user trust levels reflected in review platforms. The 2.2-star Trustpilot rating with 82% of users providing 1-star reviews indicates severe trust issues among actual platform users. This suggests significant gaps between regulatory compliance and service delivery quality.

The institutional market position and long-standing industry presence provide some foundation for trust, particularly for sophisticated investors familiar with institutional banking relationships. The firm's global presence and comprehensive service offerings suggest operational stability and market credibility within professional investment communities.

Nevertheless, the consistently poor user feedback creates substantial trust concerns for potential clients, particularly those requiring reliable service delivery and responsive client support. The significant disconnect between regulatory standing and user satisfaction requires careful consideration of risk tolerance and service expectations before platform engagement.

User Experience Analysis

User experience represents the most significant challenge for Barclays based on comprehensive feedback analysis across multiple review platforms. Trustpilot and Reviews.io data consistently show poor user satisfaction levels. A staggering 82% of Trustpilot users provide 1-star ratings, indicating widespread dissatisfaction with the overall platform experience.

The consistently negative feedback suggests systemic issues affecting multiple aspects of user interaction, from account management and customer service to trading functionality and problem resolution. This pattern indicates fundamental challenges in user experience design and service delivery. These challenges extend beyond isolated technical issues.

The user base appears to include both retail and institutional clients, but the poor satisfaction ratings suggest that experience issues affect multiple client segments rather than being limited to specific user types or account levels. This broad-based dissatisfaction indicates systemic operational challenges requiring significant attention.

For potential users, the overwhelmingly negative user experience feedback represents a critical consideration that outweighs many other platform features. The consistent pattern of poor reviews suggests high likelihood of service delivery problems and user frustration that potential clients must carefully evaluate against their trading requirements and risk tolerance levels.

Conclusion

This comprehensive Barclays review reveals a complex evaluation landscape where strong regulatory oversight and institutional capabilities contrast sharply with poor user satisfaction and service delivery concerns. While Barclays Capital Inc. operates under robust SEC and FINRA regulation and offers sophisticated market access for institutional investors, the consistently negative user feedback raises serious concerns about practical service quality.

The platform appears most suitable for large institutional investors and high-net-worth individuals who can leverage relationship-based service models and have resources to navigate potential service challenges. However, retail traders and smaller institutional clients should carefully consider the poor user satisfaction ratings and limited transparency in account conditions before platform engagement.

The primary advantages include comprehensive regulatory protection, deep market liquidity, and institutional-grade execution capabilities. However, significant disadvantages encompass poor customer service ratings, limited account transparency, and consistently negative user experiences. These issues suggest systemic operational challenges requiring careful risk assessment before trading commitment.