FRXE 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

FRXE is an unregulated trading platform claiming to offer attractive trading conditions, including high leverage and low minimum deposits. Targeting inexperienced traders and those seeking potentially high returns, it promotes a range of assets like forex and cryptocurrencies. However, the absence of regulatory oversight raises significant trust issues among users. This broker has received numerous complaints, particularly regarding withdrawal challenges and poor customer service, which have culminated in a disappointing Trustpilot rating of 2.4 stars. While traders are drawn to the prospect of quick gains, the overwhelming consensus suggests caution due to the potential risks associated with trading through FRXE.

⚠️ Important Risk Advisory & Verification Steps

Before engaging with FRXE or any unregulated broker, keep the following in mind:

- High Risk of Financial Loss: The lack of regulatory oversight and inadequate user protection measures can lead to significant financial losses.

- Withdrawal Concerns: Multiple user complaints highlight persistent issues surrounding fund withdrawals.

To self-verify the credibility of a broker like FRXE, follow these steps:

- Investigate Registration: Search the brokers name on official regulatory websites such as the NFA's BASIC database.

- Review User Feedback: Look for reviews on platforms like Trustpilot or Forex Peace Army for potential red flags.

- Check Response to Complaints: Analyze how the broker responds to negative feedback and whether issues raised by users are acknowledged and addressed.

- Research License Requirements: Familiarize yourself with the requirements of reputable licensing authorities in your region.

Broker Overview

Company Background and Positioning

Founded in 2012, FRXE operates under the guise of FRXE Trading Ltd., registered in the Marshall Islands. The broker has positioned itself as a competitive option for traders seeking access to a variety of financial assets. However, its unregulated status raises significant alarms regarding the safety of traders' funds and the legitimacy of its operations.

Core Business Overview

FRXE primarily focuses on forex and cryptocurrency trading, offering a diverse selection of asset classes through the MT5 platform. Users can engage in various trading strategies, from forex currency pairs to bitcoin, however, the broker lacks verification from any reputable regulatory bodies, posing inherent risks inherent associated with unregulated trading.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Managing uncertainty in trading is vital, especially when dealing with unregulated platforms.

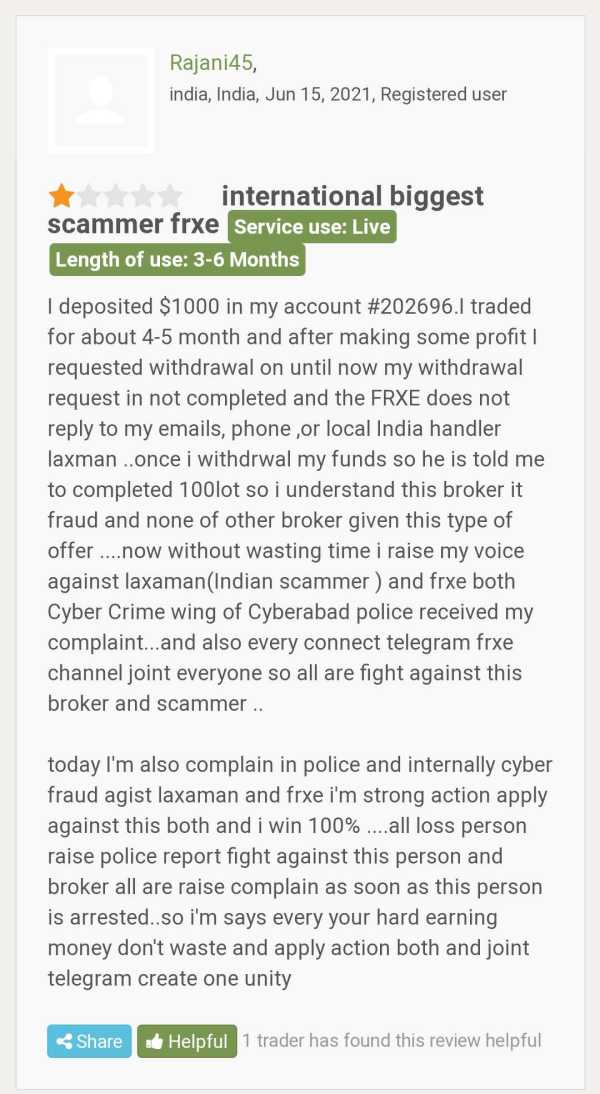

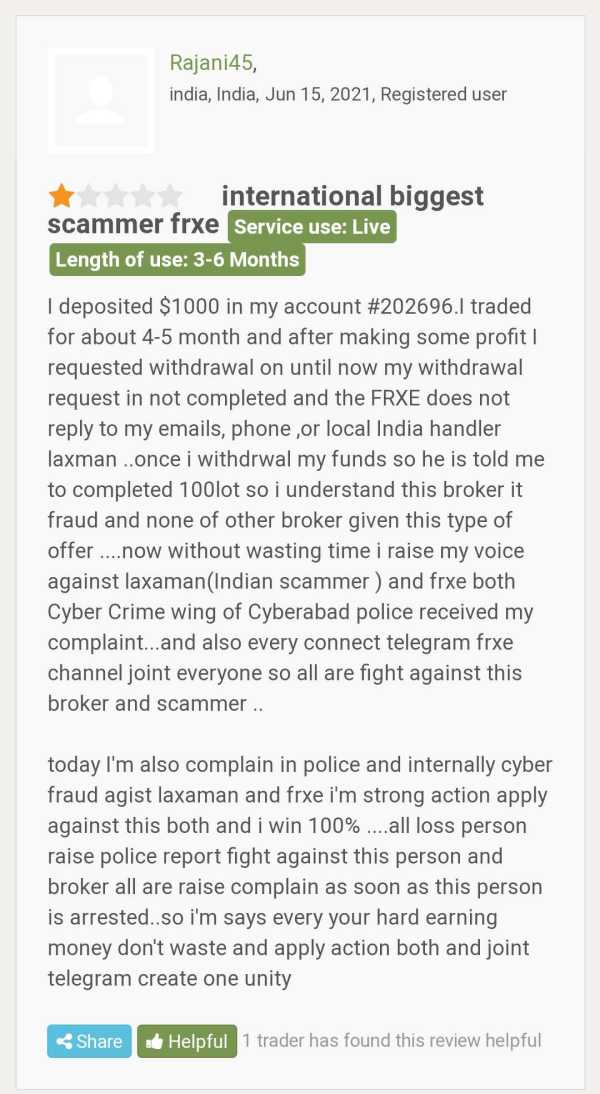

Unregulated status inherently contradicts any claims of reliability. FRXE is not recognized by any financial authority, which significantly increases the risks for traders. Moreover, the website offers no ancillary information to reassure potential users. Given the persistent warnings from multiple user reviews:

"This broker seems to be just a scam. I've been waiting for my withdrawal for months without any response." – Anonymous User

Given these risk factors, prospective traders are strongly advised to self-verify the legitimacy of FRXE through authoritative sources.

To empower users in their verification efforts, heres a step-by-step guide:

- Access Regulatory Websites: Visit websites like NFA or FCA.

- Use Search Functions: Look for the broker's registration number or name.

- Review Licensing Status: Confirm if they are licensed and in good standing.

- Read Complaints: Check forums and review websites for insights on user experiences.

Ultimately, the pervasive negative sentiment expresses deep concern for the safety of funds deposited with FRXE.

Trading Costs Analysis

The allure of low-cost commissions can be enticing, yet as with many unregulated platforms, hidden pitfalls are lurking.

FRXE touts a competitive commission structure, promising lower costs for traders. However, scrutiny reveals a different story regarding non-trading fees.

"I tried to withdraw and was charged a $30 'processing fee,' which they didnt mention when I deposited." – User Review

Such undeclared fees can serve as a significant deterrent to potential traders. Thus, it's prudent for traders to weigh these hidden costs against the benefits when choosing FRXE.

In summation, while FRXE presents low commissions, the cost structure, when put under scrutiny for withdrawal fees, creates a precarious scenario for a trader's financial health.

A hallmark of any broker's credibility lies in the tools and platforms offered.

FRXE utilizes the MT5 platform, a powerful tool celebrated among traders for its advanced functionalities and usability. However, the juxtaposition of featuring such a sophisticated platform while being unregulated raises questions about the broker's intentions.

Additionally, the quality and comprehensiveness of available resources—like educational material and market analytics—require thorough analysis. Many users have commented on the platform's ease of use, yet:

"Some features just don't work as promised; it's frustrating." – User Feedback

Despite being equipped with advanced tools, the quality of support and reliability diminishes the overall trading experience users can expect with the broker.

User Experience Analysis

Navigating the user experience comprises various aspects, notably onboarding and ongoing interactions with the trading platform.

First impressions matter, and the initial setup with FRXE has garnered attention for being relatively straightforward, yet users have voiced frustrations about subsequent trading hurdles.

User reviews denote an experience where trading functionalities are often affected by limited customer support. This sentiment is echoed in several testimonials:

"I started strong, but when I needed support, they disappeared." – Review from an Experienced Trader

Ultimately, while onboarding appears manageable, the broader trading journey introduces a plethora of issues that may hinder traders' confidence in utilizing the platform.

Customer Support Analysis

For traders, the quality of customer support can be the difference between a successful trade and a disastrous experience.

FRXE offers basic support channels such as email and phone. However, numerous user reports indicate a critical lack in response efficacy and timeliness:

"Waiting for replies from their support is like waiting for rain in a drought." – A Frustrated User's Take

Complaints surround both the cubical response times from support agents and their inability to resolve issues when they arise. Such constraints can negatively impact user confidence further into their trading experience.

Account Conditions Analysis

Account conditions can be attractive, yet without stringent verification processes, what seems appealing can often reflect deeper issues.

FRXE offers multiple account types with low minimum deposits, making it accessible to new traders. However, while leveraging up to 1:1000 may sound attractive for some, it could equally lead inexperienced traders towards substantial risks.

User feedback indicates concerns regarding trapped funds due to high withdrawal fees and unclear reservation clauses, highlighting potential disadvantages quickly overshadowing any benefits.

In summary, despite the allure of high leverage and minimal deposits, traders should approach FRXE's account conditions with a discerning eye.

Conclusion

In an environment rife with potential risk, the review of FRXE underscores essential points. This unregulated broker showcases many attractive features for traders but is deeply marred by trust issues, continuous negative user experiences, and alarming complaints regarding financial practices. The evidence suggests that, while the prospect of high returns may be appealing, prioritizing fund safety, regulatory compliance, and ethical trading practices offers a safer path forward. Given these substantial risks, engaging with FRXE may ultimately lead to disappointment, if not financial loss.

As you navigate your trading choices, prioritize diligence and ensure compliance with regulatory standards, which form a critical part of a secure trading experience. Seek out reputable, regulated platforms to bolster your trading endeavors.