Emcm 2025 Review: Everything You Need to Know

Executive Summary

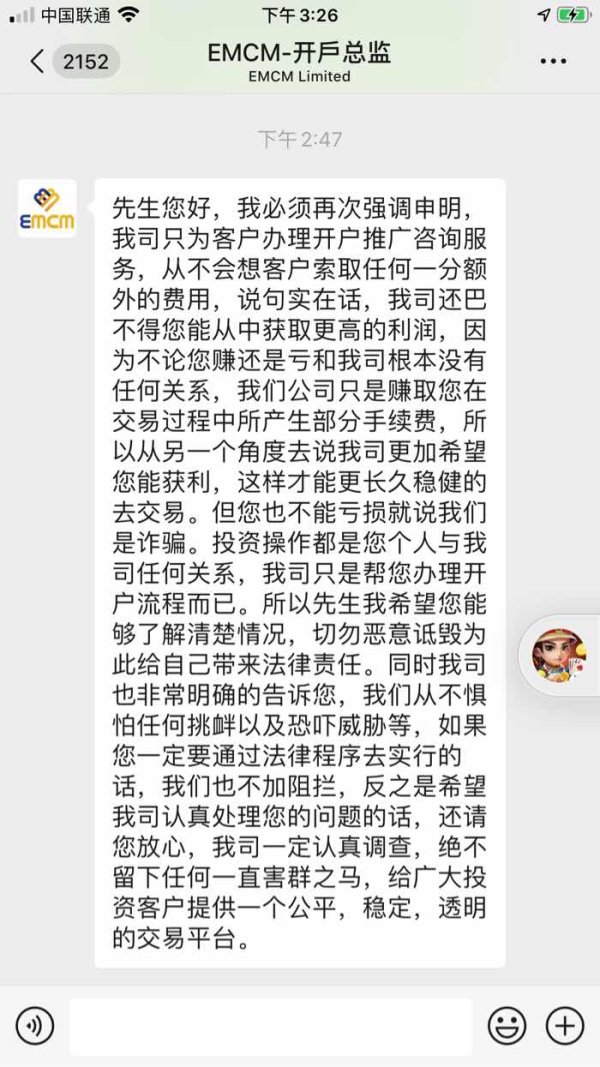

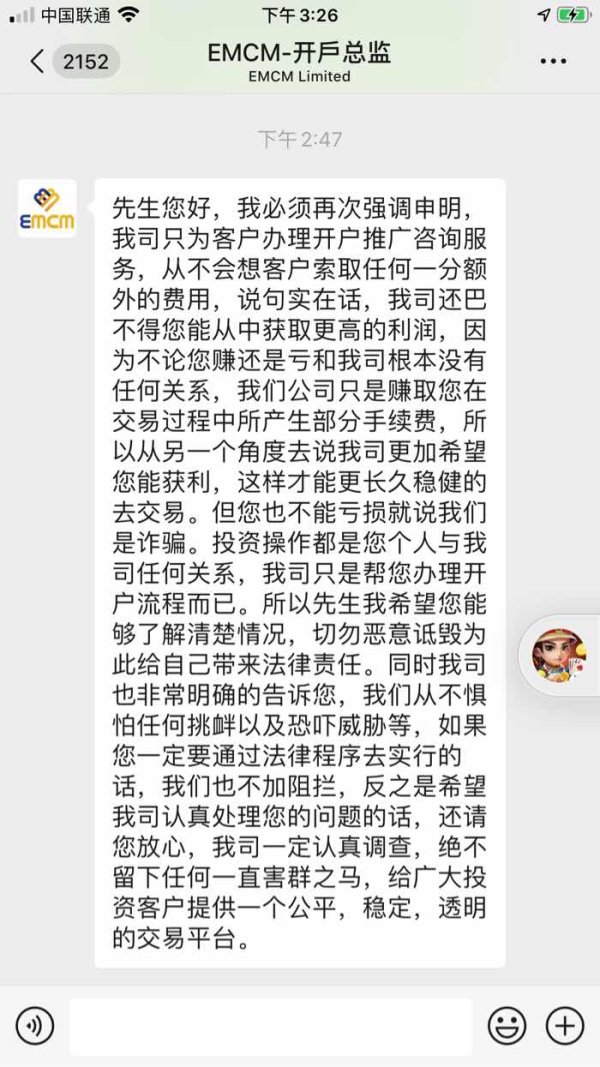

This Emcm review gives a careful look at a company that works in many different business areas. This creates big confusion about what the company actually does and whether it follows proper rules. EMCM mainly makes liquids, powders, gels, and other products for other companies through contracts. This raises questions about how it connects to forex trading services at all.

The company does not give clear information about regulations. It also lacks clear documents about trading services, which creates major concerns for people who want to trade forex. Our research shows that EMCM might have real manufacturing businesses, but its place in the forex market stays unclear and could be problematic.

The company has gotten attention from traders who look for reviews and complaint information. This suggests either active marketing to forex traders or confusion about what services it actually offers. This review targets forex traders who care about following regulations and want transparency, especially those who need clear proof of broker credentials and legitimate operations before putting money at risk.

Important Notice

Regional Entity Differences: EMCM has not given clear information about its regulatory status in different countries. This may greatly affect trading decisions for users in various regions around the world.

The lack of clear regulatory documents makes it hard to figure out what protections and rights traders have in different countries. Review Methodology: This evaluation uses publicly available information, user feedback patterns, industry standards, and company background research.

Because there is limited clear information about EMCM's forex trading services, this review stresses the importance of careful research before working with the company.

Rating Framework

Broker Overview

EMCM shows a complex business profile that mainly focuses on contract manufacturing services for various drug and chemical products. The company specializes in making liquids, powders, gels, and other substances through contracted manufacturing deals, according to available information.

This core business model raises immediate questions about the company's involvement in forex trading services. The manufacturing focus appears disconnected from providing financial services, which creates confusion for traders looking for reliable broker services.

The company's online presence suggests a well-established manufacturing operation with various technology capabilities and support services. However, the connection to forex trading services remains unclear in publicly available documents, and this disconnect between the company's apparent main skill in manufacturing and its potential forex trading offerings creates uncertainty for traders seeking reliable broker services.

The absence of clear start dates, specific forex trading history, or detailed service development in available materials makes it difficult to judge EMCM's experience and credibility in the financial services sector. This Emcm review emphasizes the critical importance of understanding a broker's main business focus and past performance in forex markets before making trading decisions.

The company's complex business structure may show efforts to diversify, but it also makes the evaluation process harder for potential forex clients seeking specialized trading services.

Regulatory Jurisdiction: Available materials do not specify particular regulatory authorities overseeing EMCM's potential forex trading operations. This creates significant compliance concerns for prospective traders who need to know which rules and protections apply to their accounts.

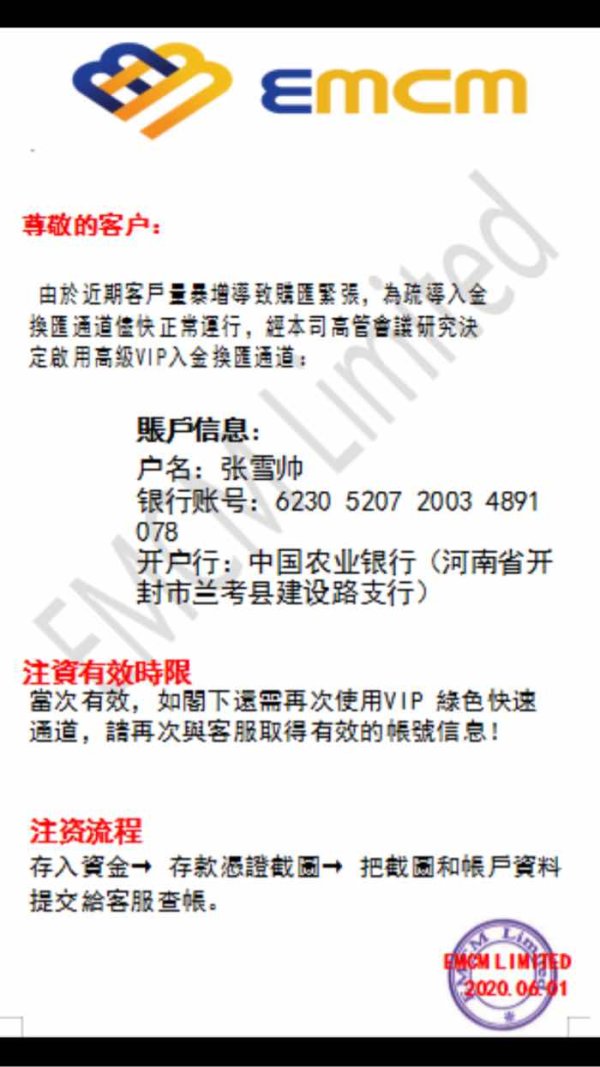

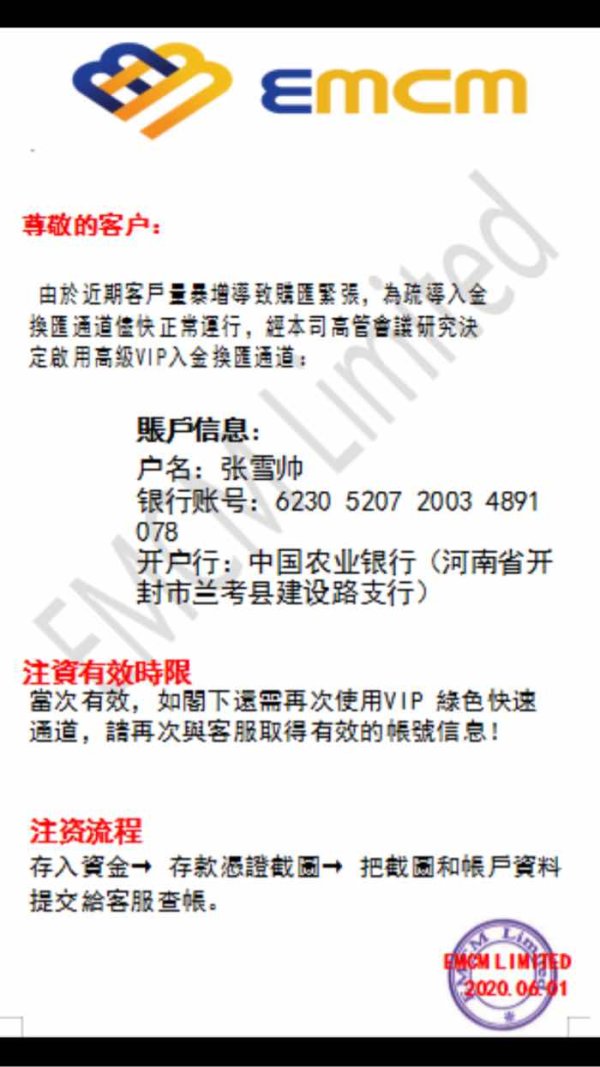

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and fees for trading accounts is not detailed in accessible documentation.

Minimum Deposit Requirements: Exact minimum deposit amounts and account tier structures are not specified in available materials. This makes it difficult to assess accessibility for different trader segments with varying capital levels.

Bonus and Promotions: Information about promotional offerings, bonus structures, or special incentives for new traders is not available in current documentation.

Available Trading Assets: The range of tradeable instruments, including currency pairs, commodities, indices, and other financial products, is not clearly outlined in accessible materials.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not provided in available documentation. This makes cost comparison challenging for traders evaluating different broker options.

Leverage Ratios: Specific leverage offerings and margin requirements for different account types and trading instruments are not specified in current materials.

Platform Options: Trading platform choices, including proprietary solutions, MetaTrader availability, and mobile applications, are not detailed in accessible documentation.

Regional Restrictions: Geographic limitations and country-specific restrictions are not clearly outlined in available materials.

Customer Support Languages: Available customer service languages and communication channels are not specified in current documentation.

This Emcm review highlights the concerning lack of essential trading information that prospective clients typically require for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of EMCM's account conditions faces significant challenges due to the absence of detailed information in accessible documentation. Standard forex broker assessments typically examine multiple account tiers, each designed for different trader experience levels and capital commitments, but EMCM's available materials do not provide clear specifications about account types, minimum balance requirements, or tier-specific benefits that traders can expect.

Professional forex brokers usually offer comprehensive account structures ranging from micro accounts for beginners to premium accounts for high-volume traders. The lack of such detailed account information in EMCM's documentation raises questions about the company's commitment to transparent client onboarding and service provision, and essential features like Islamic account availability, demo account access, and account upgrade pathways are not addressed in current materials.

The absence of clear account opening procedures, verification requirements, and ongoing account maintenance conditions creates uncertainty for potential clients. Standard industry practices include detailed documentation of required identification, proof of residence, and financial verification processes, but without this information, traders cannot adequately prepare for the account establishment process or understand their obligations and rights as clients.

This Emcm review emphasizes that the lack of transparent account condition information significantly hampers the ability to make informed trading decisions. It may indicate insufficient preparation for serving the forex trading community effectively.

The assessment of EMCM's trading tools and resources reveals a significant information gap that concerns professional forex market participants. Established forex brokers typically provide comprehensive analytical tools, including advanced charting packages, technical indicators, economic calendars, and market research resources, yet EMCM's available documentation does not detail specific trading tools or analytical resources available to clients.

Modern forex trading requires access to real-time market data, sophisticated charting capabilities, and automated trading support through expert advisors or algorithmic trading platforms. The absence of information about these essential tools suggests either inadequate service preparation or insufficient transparency in service communication, and professional traders also expect access to market sentiment indicators, volatility analysis tools, and correlation matrices for effective risk management.

Educational resources represent another critical component of comprehensive broker services, including webinars, trading guides, video tutorials, and market analysis content. The lack of detailed educational resource information in EMCM's materials may indicate limited commitment to client development and success, while research services such as daily market commentary, weekly outlooks, and fundamental analysis reports are standard offerings that appear to be unaddressed in current documentation.

The evaluation also considers mobile trading capabilities, social trading features, and third-party tool integration. None of these are clearly outlined in accessible EMCM materials, creating uncertainty about the company's technological capabilities and service scope.

Customer Service and Support Analysis

EMCM's customer service evaluation encounters substantial limitations due to insufficient information about support channels, availability, and service quality standards. Professional forex brokers typically maintain multiple communication channels including live chat, telephone support, email assistance, and comprehensive FAQ resources, but the absence of detailed customer service information in EMCM's documentation raises concerns about client support capabilities and responsiveness.

Effective forex broker customer service requires 24/5 availability during market hours, multilingual support capabilities, and specialized assistance for technical, account, and trading-related inquiries. The lack of specific information about support hours, response time commitments, and available communication languages creates uncertainty about service accessibility for international clients, and professional brokers usually provide dedicated account managers for higher-tier clients and specialized technical support for platform-related issues.

Service quality indicators such as average response times, customer satisfaction ratings, and problem resolution procedures are not detailed in available EMCM materials. These metrics are essential for evaluating a broker's commitment to client satisfaction and operational efficiency, while the absence of clear escalation procedures, complaint handling processes, and regulatory compliance reporting also creates concerns about accountability and transparency.

Furthermore, educational support services, including trading coaching, platform training, and market analysis assistance, are not addressed in current documentation. This potentially limits client development opportunities and overall trading success.

Trading Experience Analysis

The evaluation of EMCM's trading experience faces significant challenges due to the absence of detailed platform information and user feedback in accessible documentation. Professional forex trading requires stable, fast-executing platforms with comprehensive order management capabilities, advanced charting tools, and reliable market data feeds, yet EMCM's materials do not provide specific information about platform stability, execution speeds, or technical performance metrics.

Modern forex traders expect seamless order execution with minimal slippage, competitive spreads that remain stable during volatile market conditions, and robust platform infrastructure that maintains functionality during high-volume trading periods. The lack of performance data, uptime statistics, and execution quality metrics in EMCM's documentation makes it impossible to assess the trading environment's suitability for serious forex market participation.

Mobile trading capabilities have become essential for contemporary forex traders who require full platform functionality across devices and operating systems. The absence of detailed mobile platform information, including feature parity with desktop versions, offline capabilities, and cross-device synchronization, creates uncertainty about trading flexibility and accessibility, while advanced trading features such as one-click trading, trailing stops, and algorithmic trading support are not addressed in available materials.

This Emcm review highlights that the lack of comprehensive trading experience information significantly impairs the ability to evaluate platform suitability for different trading styles, experience levels, and strategic approaches to forex market participation.

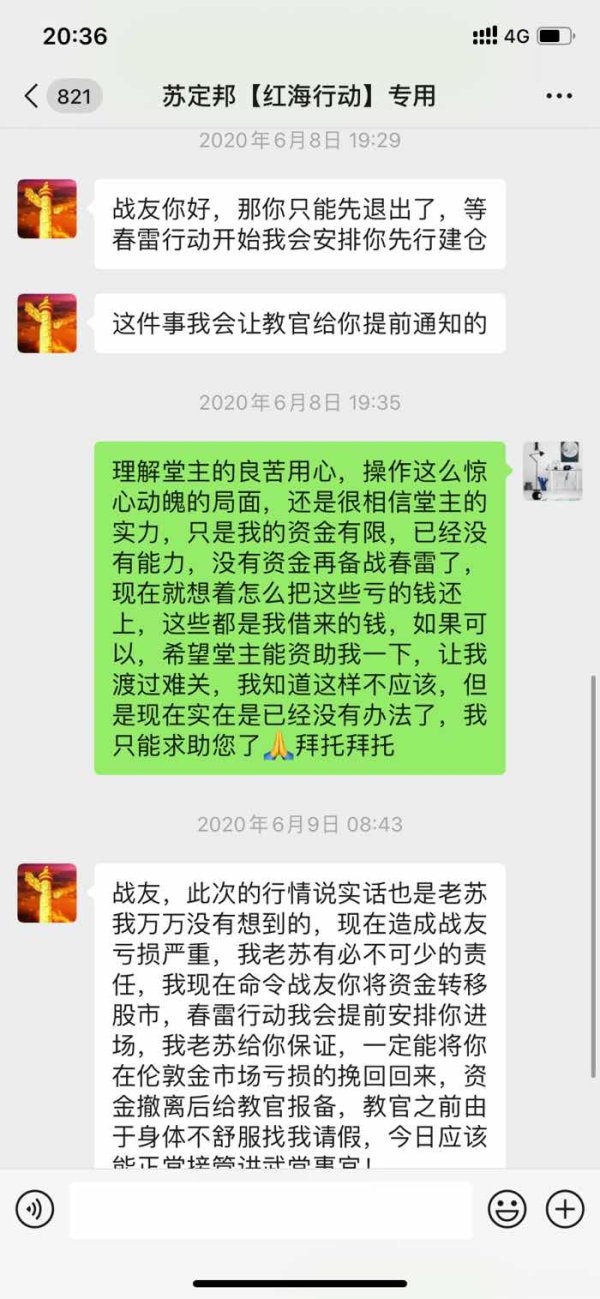

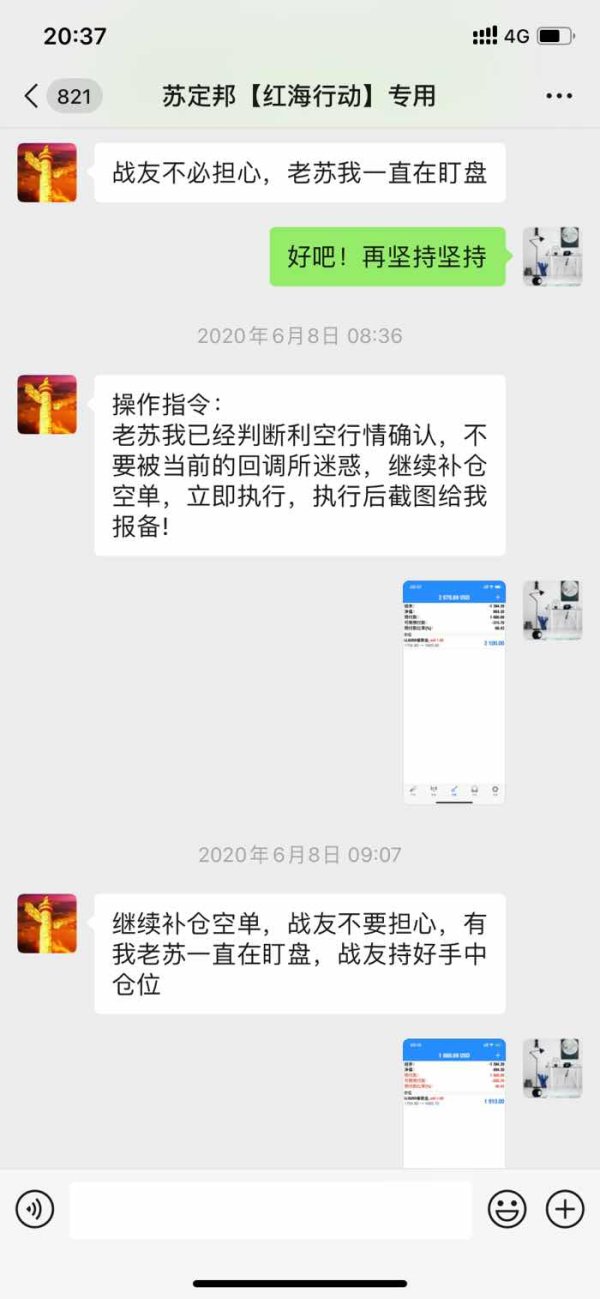

Trust Factor Analysis

The trust factor evaluation for EMCM reveals significant concerns that potential forex traders must carefully consider before engaging with the company. Regulatory oversight represents the foundation of broker trustworthiness, yet EMCM's available documentation does not provide clear information about financial services regulation, supervisory authorities, or compliance frameworks, and this absence of regulatory transparency creates substantial uncertainty about client protection, fund segregation, and dispute resolution mechanisms.

Established forex brokers typically maintain regulatory licenses from recognized authorities such as the FCA, CySEC, ASIC, or other respected financial supervisors. These regulatory relationships provide essential client protections including deposit insurance, segregated client funds, and standardized complaint procedures, but the lack of clear regulatory information in EMCM's materials suggests either inadequate regulatory compliance or insufficient transparency in communicating these critical protections to potential clients.

Financial transparency, including audited financial statements, capital adequacy ratios, and operational risk disclosures, is not detailed in accessible EMCM documentation. Professional forex brokers regularly publish financial health indicators and maintain transparent reporting relationships with regulatory authorities, while the company's complex business structure, spanning manufacturing and potentially financial services, creates questions about operational focus and resource allocation priorities.

The absence of clear information about fund segregation practices, insurance coverage, negative balance protection, and other essential safety measures significantly impacts the trust assessment. It raises concerns about client asset protection in various market scenarios.

User Experience Analysis

The user experience evaluation for EMCM encounters substantial limitations due to insufficient feedback data and detailed service information in accessible documentation. Comprehensive user experience assessment typically examines interface design, navigation efficiency, learning curves, and overall satisfaction metrics from actual client interactions, but the absence of detailed user testimonials, satisfaction surveys, and experience reports makes it difficult to evaluate EMCM's service delivery effectiveness.

Modern forex trading platforms require intuitive interfaces that accommodate both novice and experienced traders while providing advanced functionality without overwhelming complexity. The lack of detailed platform screenshots, feature demonstrations, and user workflow documentation in EMCM's materials creates uncertainty about interface quality and usability standards, while customization options, workspace personalization, and accessibility features are not addressed in current documentation.

Registration and verification processes significantly impact initial user experience, yet specific information about onboarding procedures, document requirements, and approval timeframes is not detailed in available materials. Professional brokers typically provide clear guidance about account opening steps, verification standards, and expected processing times to ensure smooth client onboarding experiences.

The evaluation also considers ongoing user support, including platform training resources, feature updates, and client communication practices. None of these are comprehensively addressed in EMCM's accessible documentation, potentially indicating limited attention to long-term client relationship management and satisfaction maintenance.

Conclusion

This Emcm review concludes with significant reservations about the company's suitability for forex trading purposes. The substantial lack of regulatory information, combined with unclear business focus and insufficient trading service documentation, creates considerable concerns for potential clients seeking reliable forex broker services, and the company's apparent primary focus on manufacturing operations, while potentially legitimate, does not align with the transparency and specialization expected from professional forex service providers.

Traders who prioritize regulatory compliance, transparent fee structures, and comprehensive trading support should exercise extreme caution when considering EMCM. The absence of essential information about account conditions, trading tools, customer service standards, and platform capabilities makes informed decision-making virtually impossible, while the company may have legitimate business operations in manufacturing, its connection to forex trading services remains unclear and potentially problematic for serious market participants seeking professional trading environments.