Apel Review 1

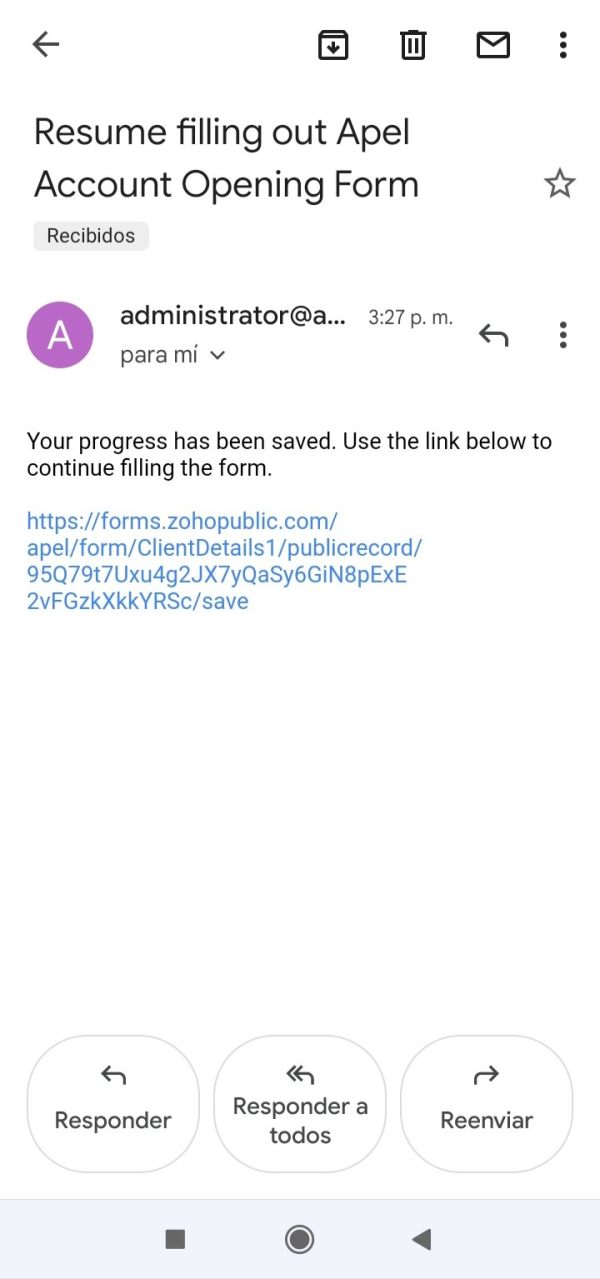

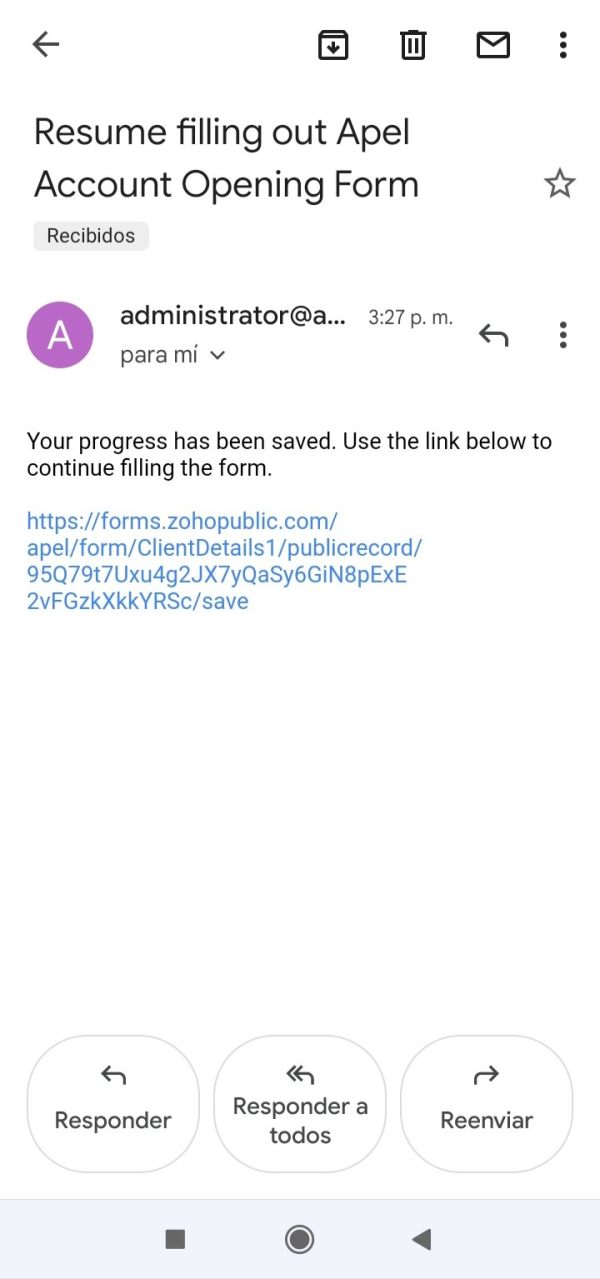

I made my deposit of $600, and they sent me an email saying that I could access, and after that I filled out some information where I was supposed to enter and it was not like that, they are abusers

Apel Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I made my deposit of $600, and they sent me an email saying that I could access, and after that I filled out some information where I was supposed to enter and it was not like that, they are abusers

This apel review looks at a financial services provider that calls itself a complete solution for forex and CFD trading. Apel presents itself as a one-stop financial services company offering various asset classes and trading opportunities, based on the information we could find. However, our evaluation shows significant information gaps that make a complete assessment challenging.

The broker seems to target both individual and institutional investors interested in forex markets. Specific details about their service offerings remain limited though. While some user feedback suggests Apel provides a positive working environment with personal growth opportunities, the lack of detailed regulatory information, trading conditions, and platform specifications raises concerns for potential clients.

Our analysis shows that while Apel may offer financial services across multiple asset classes, prospective traders should exercise caution due to insufficient transparency regarding crucial aspects such as regulatory oversight, trading costs, and platform capabilities. This comprehensive review aims to provide clarity on what is known about Apel while highlighting areas where information remains unavailable.

This review is based on limited available information about Apel as a financial services provider. Due to the scarcity of detailed regulatory information, trading conditions, and platform specifications, this evaluation may not capture the complete picture of the broker's offerings.

Readers should be aware that the absence of comprehensive data regarding licensing, safety measures, and operational transparency makes it difficult to provide a definitive assessment. We recommend conducting additional due diligence before making any trading decisions based on this review.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 5/10 | Average |

| Tools and Resources | 4/10 | Below Average |

| Customer Service and Support | 6/10 | Above Average |

| Trading Experience | 5/10 | Average |

| Trust and Safety | 3/10 | Poor |

| User Experience | 6/10 | Above Average |

Apel positions itself as a comprehensive financial services provider offering solutions across multiple asset classes. The company appears to focus on delivering integrated financial services, though specific details about its founding date and operational history are not readily available in public sources. Based on available information, Apel aims to serve as a one-stop destination for traders seeking exposure to various financial markets.

The broker's business model appears to center around providing access to forex and CFD trading. The specific structure of their operations, including whether they operate as a market maker or use an ECN model, remains unclear though. User feedback suggests that Apel maintains a focus on professional development and client growth, indicating a service-oriented approach to business operations.

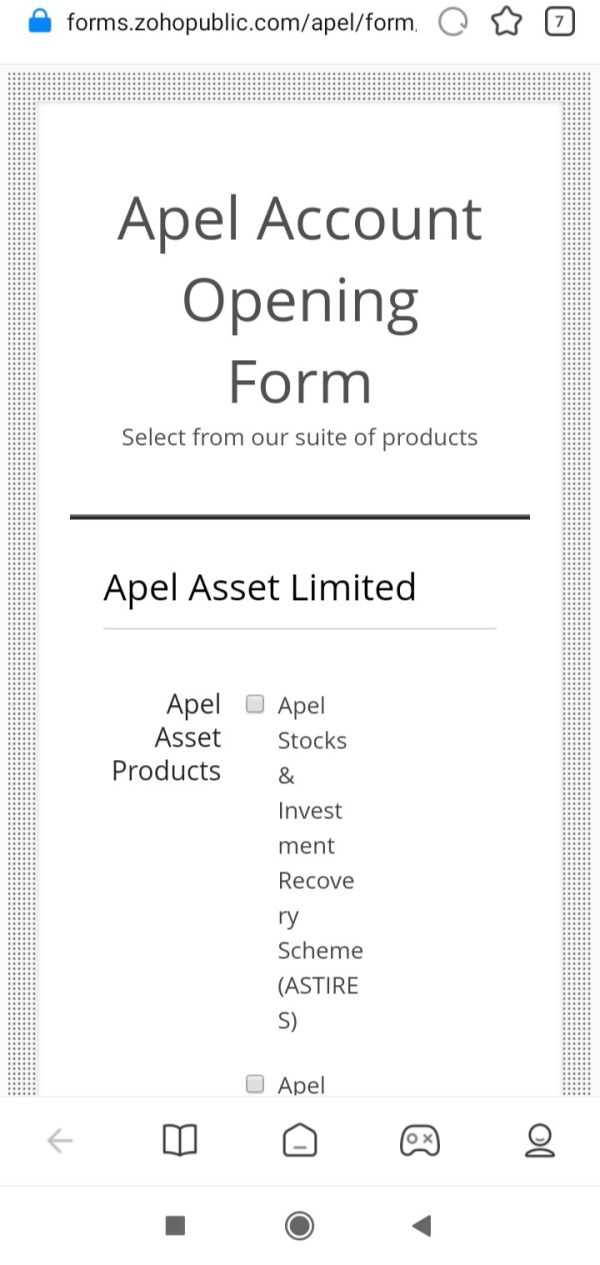

According to available sources, Apel offers trading opportunities across multiple asset classes, with particular emphasis on forex markets and CFDs. However, detailed information about their trading platforms, technological infrastructure, and regulatory framework is notably absent from public sources. This apel review aims to provide transparency about both available information and significant knowledge gaps that potential clients should consider.

Regulation: Specific regulatory information not detailed in available sources

Minimum Deposit: Information not specified in available materials

Deposit Methods: Specific deposit and withdrawal methods not outlined

Bonuses: Promotional offerings not detailed in current information

Tradable Assets: Multiple asset classes including forex and CFDs mentioned

Spreads: Cost structure and spread information not specified

Leverage: Leverage ratios not detailed in available sources

Platforms: Specific trading platform information not available

Restrictions: Geographic limitations not specified in available materials

Customer Support: Support language options not detailed in current information

This apel review highlights the significant information gaps that exist regarding essential trading conditions and operational details.

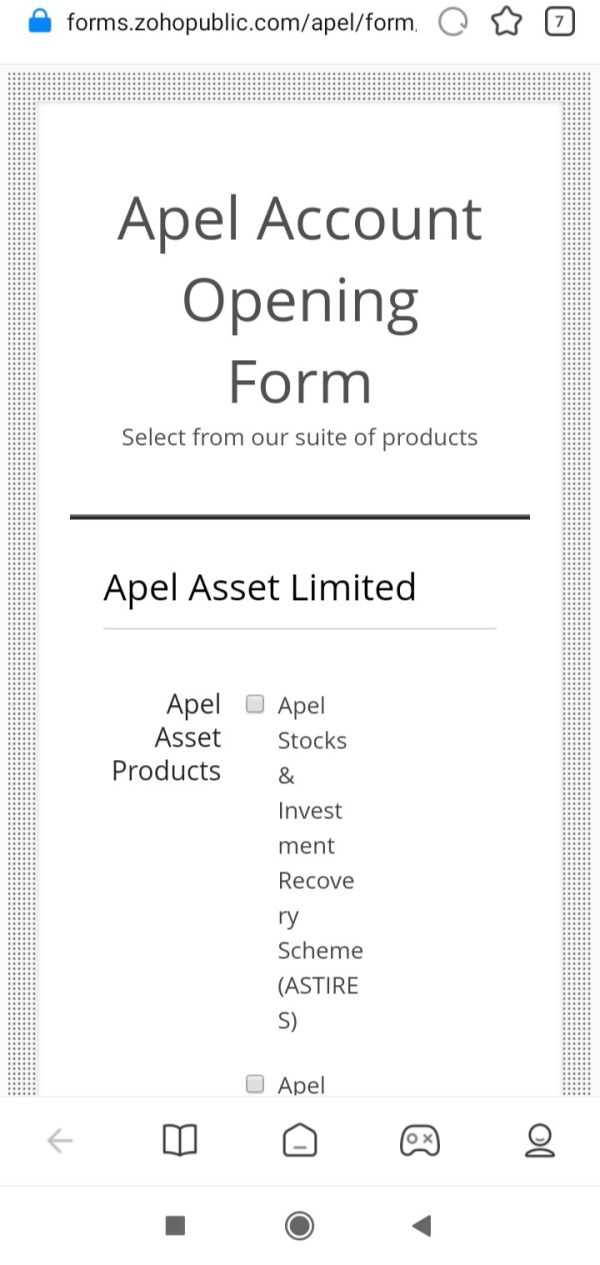

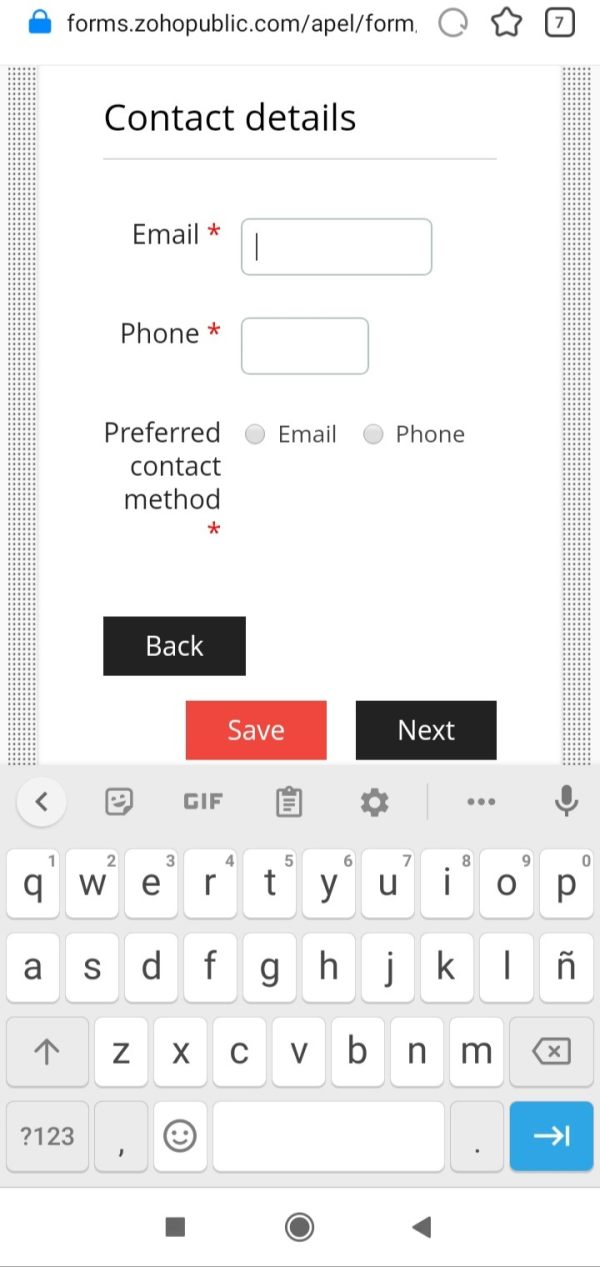

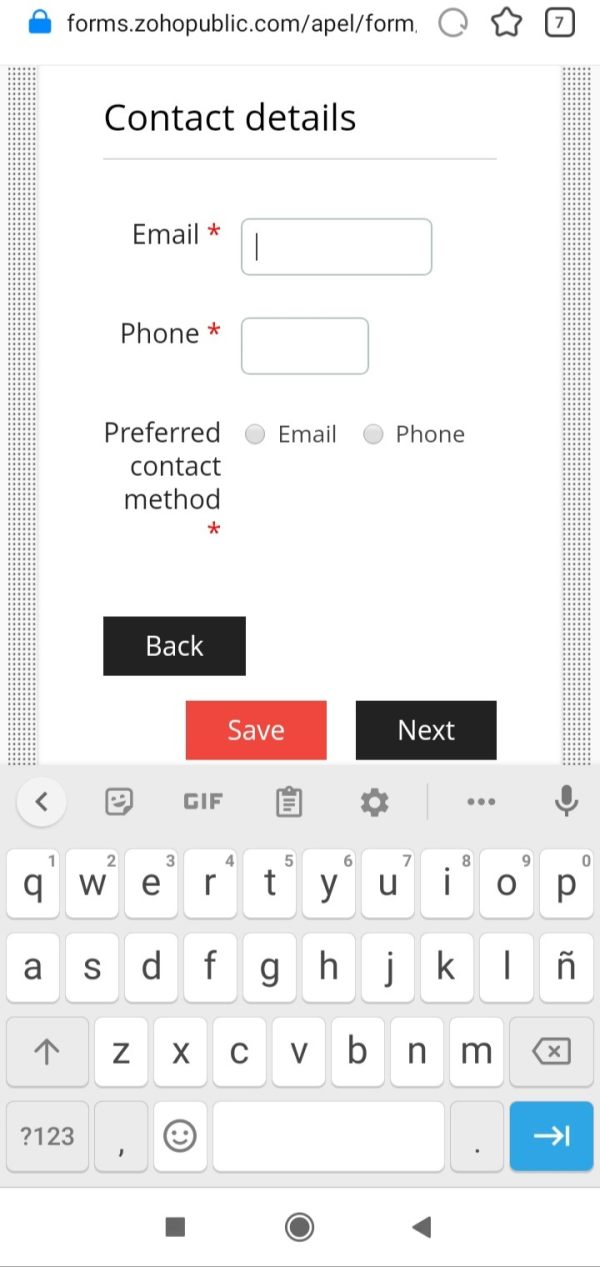

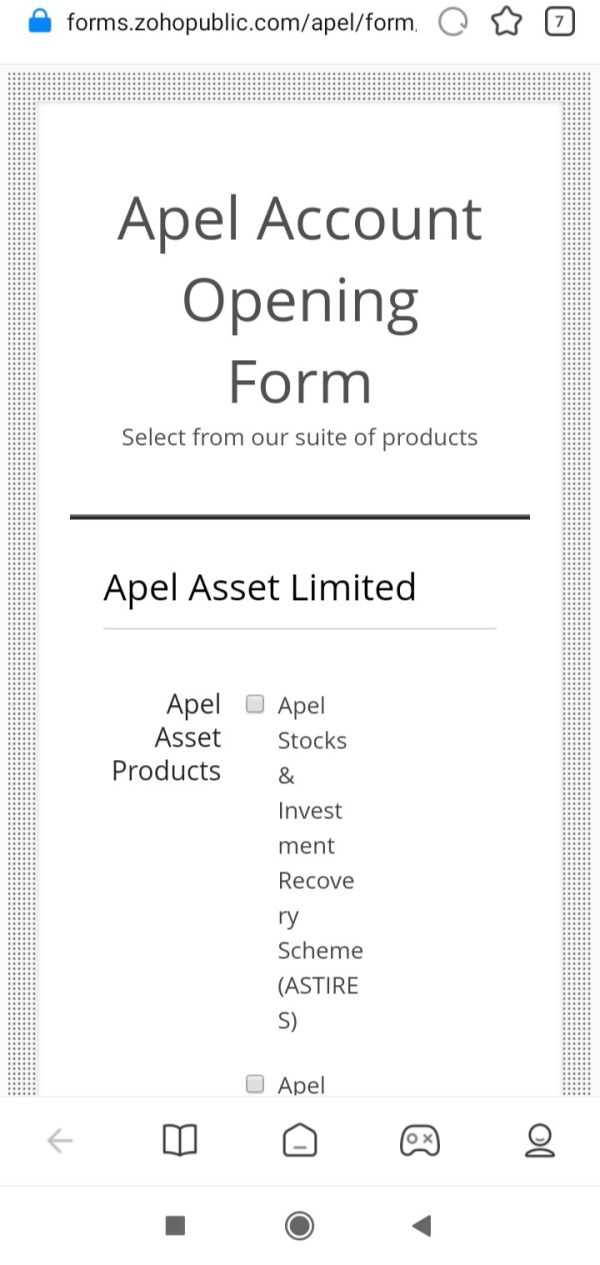

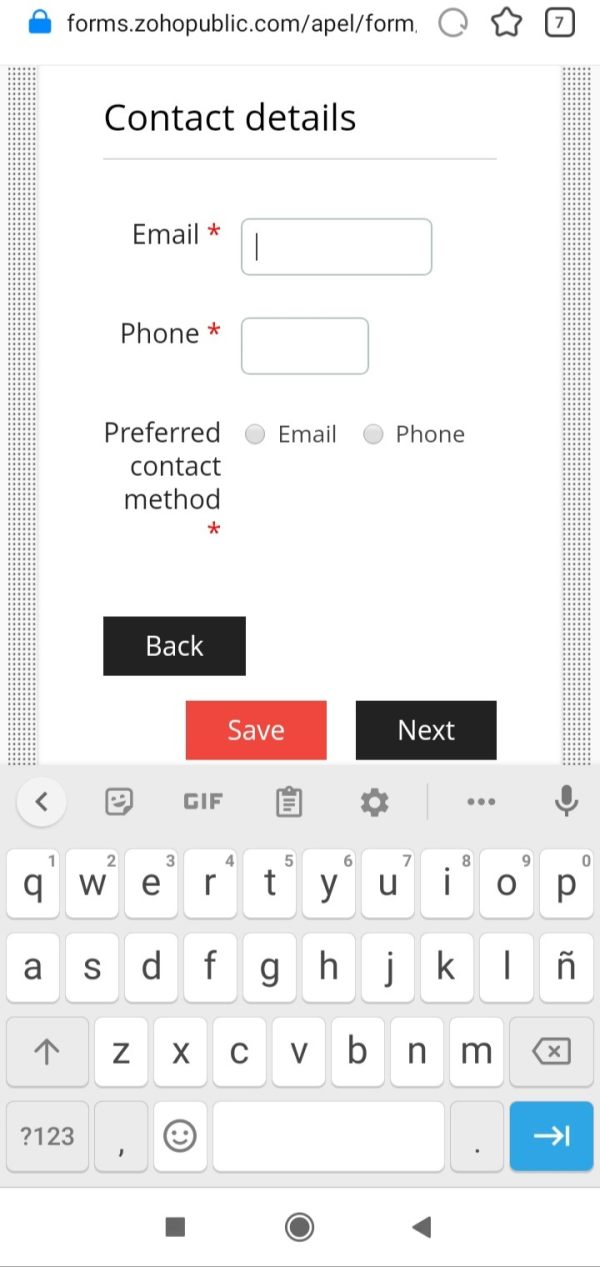

The account conditions offered by Apel remain largely undisclosed in available public information. Without specific details about account types, minimum deposit requirements, or account tier structures, it becomes challenging to assess the accessibility and suitability of their offerings for different trader profiles. Traditional brokers typically offer multiple account types ranging from basic retail accounts to professional and institutional options, but Apel's specific account architecture is not documented in available sources.

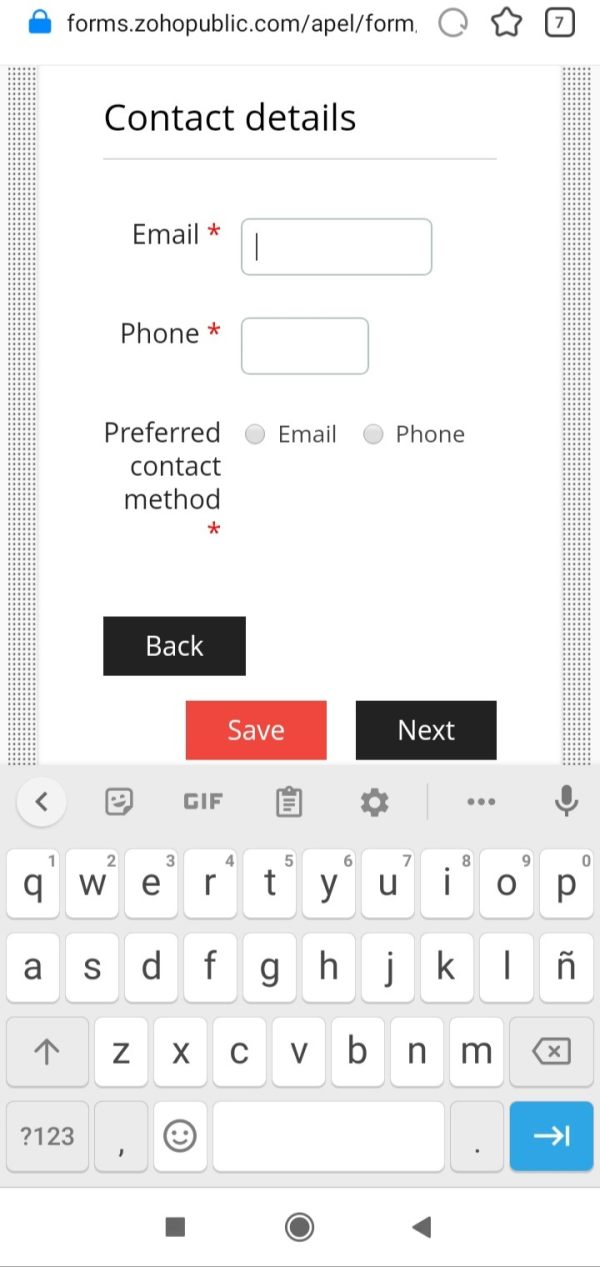

The absence of information regarding minimum deposit requirements makes it impossible to determine whether Apel caters to beginner traders or focuses primarily on high-net-worth individuals. Additionally, details about special account features such as Islamic accounts, demo accounts, or managed account options are not available. The account opening process, required documentation, and verification procedures also remain unspecified.

Without comprehensive account condition details, potential clients cannot adequately compare Apel's offerings with industry standards. This apel review emphasizes the need for greater transparency regarding account structures, fees, and requirements to enable informed decision-making by prospective traders.

The trading tools and resources available through Apel are not comprehensively detailed in available information sources. Most established brokers provide a range of analytical tools, charting capabilities, and market research resources to support trader decision-making, but Apel's specific offerings in this area remain unclear. The absence of information about proprietary tools, third-party integrations, or analytical capabilities represents a significant gap in available data.

Educational resources, which are crucial for trader development, are not specifically mentioned in available materials. Many brokers offer webinars, tutorials, market analysis, and educational content to support client growth, but whether Apel provides such resources is not documented. Similarly, information about automated trading support, expert advisors, or algorithmic trading capabilities is not available.

Research and analysis resources, including market commentary, economic calendars, and technical analysis tools, are standard offerings among established brokers but are not specifically outlined for Apel. The quality and comprehensiveness of available trading tools significantly impact the trading experience, making this information gap particularly relevant for potential clients.

Customer service quality appears to be one area where Apel receives some positive feedback. Specific details about support channels, availability, and response times are not comprehensively documented though. User evaluations suggest that the company maintains a focus on client service, but concrete information about support infrastructure remains limited.

The availability of multiple communication channels such as live chat, phone support, email assistance, and help desk services is not specifically outlined in available sources. Response time benchmarks, which are crucial for active traders who may need immediate assistance, are not documented. Additionally, information about multilingual support capabilities and the geographic coverage of customer service operations is not available.

Professional traders often require specialized support for complex issues, but whether Apel provides dedicated account management or premium support tiers is not specified. The quality of customer service can significantly impact the overall trading experience, particularly during volatile market conditions when immediate assistance may be required.

The overall trading experience offered by Apel cannot be comprehensively evaluated due to limited information about platform capabilities, execution quality, and technological infrastructure. Trading experience encompasses multiple factors including platform stability, order execution speed, slippage rates, and overall system reliability, but specific data about Apel's performance in these areas is not available. Platform functionality, including charting capabilities, order types, and analytical tools, significantly impacts trader satisfaction and success.

Details about the trading platforms offered by Apel, whether proprietary or third-party solutions like MetaTrader, are not specified in available sources. Mobile trading capabilities, which are increasingly important for modern traders, are also not documented. Order execution quality, including fill rates, slippage statistics, and execution speed metrics, are crucial factors for active traders but are not detailed for Apel.

The trading environment, including server locations, latency considerations, and system uptime statistics, also remains unspecified. This apel review highlights the importance of platform transparency for trader confidence and decision-making.

Trust and safety represent perhaps the most significant concern in this evaluation of Apel, as comprehensive regulatory information is not readily available in public sources. Regulatory oversight is fundamental to broker credibility and client protection, making the absence of clear licensing information a major red flag for potential clients. Established brokers typically provide detailed information about their regulatory status, licensing jurisdictions, and compliance frameworks.

Client fund segregation, which protects trader deposits from operational risks, is not specifically addressed in available materials. Similarly, information about deposit insurance, compensation schemes, or other protective measures is not documented. These safety measures are standard among reputable brokers and their absence raises questions about client protection.

Company transparency, including detailed information about ownership structure, financial statements, and operational history, is not readily available. The lack of comprehensive regulatory disclosure makes it difficult to verify the broker's legitimacy and operational standards. Without proper regulatory oversight and transparency, clients face increased risks regarding fund safety and operational integrity.

User experience evaluation is limited by the scarcity of detailed client feedback and platform usability information. While some sources suggest positive workplace experiences within the company, specific information about the client-facing user experience remains limited. The overall satisfaction levels of active traders and their feedback about platform usability are not comprehensively documented.

Interface design and platform navigation, which significantly impact daily trading activities, are not detailed in available sources. The registration and account verification process, including required documentation and approval timeframes, is not specified. Fund management operations, including deposit and withdrawal procedures, processing times, and associated fees, also lack detailed documentation.

Common user complaints or areas for improvement are not specifically outlined in available feedback, making it difficult to identify potential issues or limitations. The target user profile that would best suit Apel's services cannot be clearly defined without more comprehensive information about platform capabilities and service levels.

This apel review reveals a financial services provider with limited publicly available information, making comprehensive evaluation challenging. While Apel positions itself as a one-stop financial services company with opportunities across multiple asset classes, the significant gaps in available information regarding regulatory status, trading conditions, and platform capabilities raise important concerns for potential clients.

The broker may be suitable for investors interested in exploring forex and CFD markets, but the lack of transparency regarding crucial operational details suggests that prospective clients should exercise considerable caution. The positive feedback regarding workplace environment and professional development opportunities indicates some operational strengths, but these do not address the fundamental requirements for regulatory oversight and trading transparency that clients should expect from a financial services provider.

FX Broker Capital Trading Markets Review