Po Trade 2025 Review: Everything You Need to Know

Executive Summary

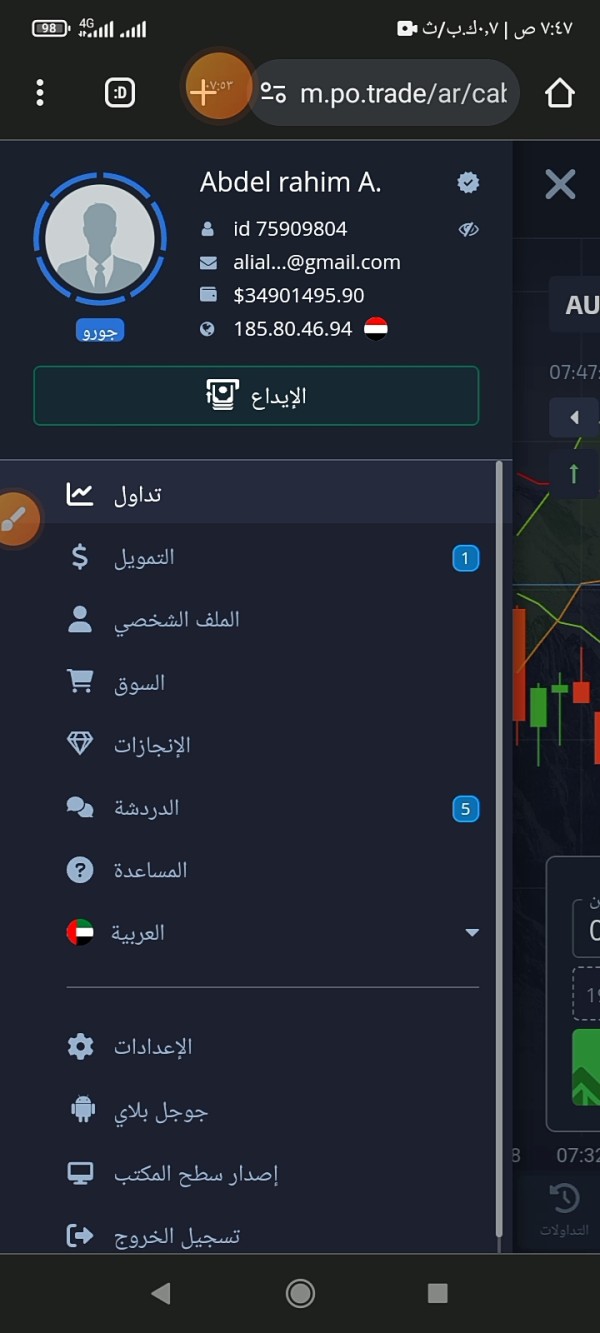

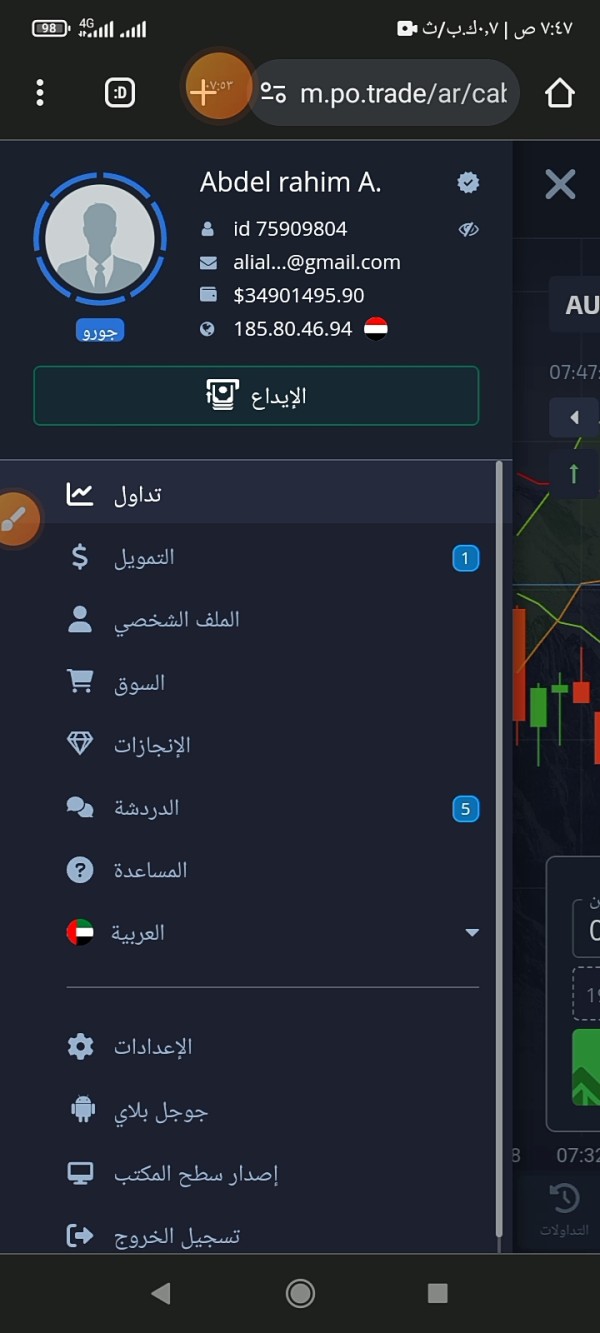

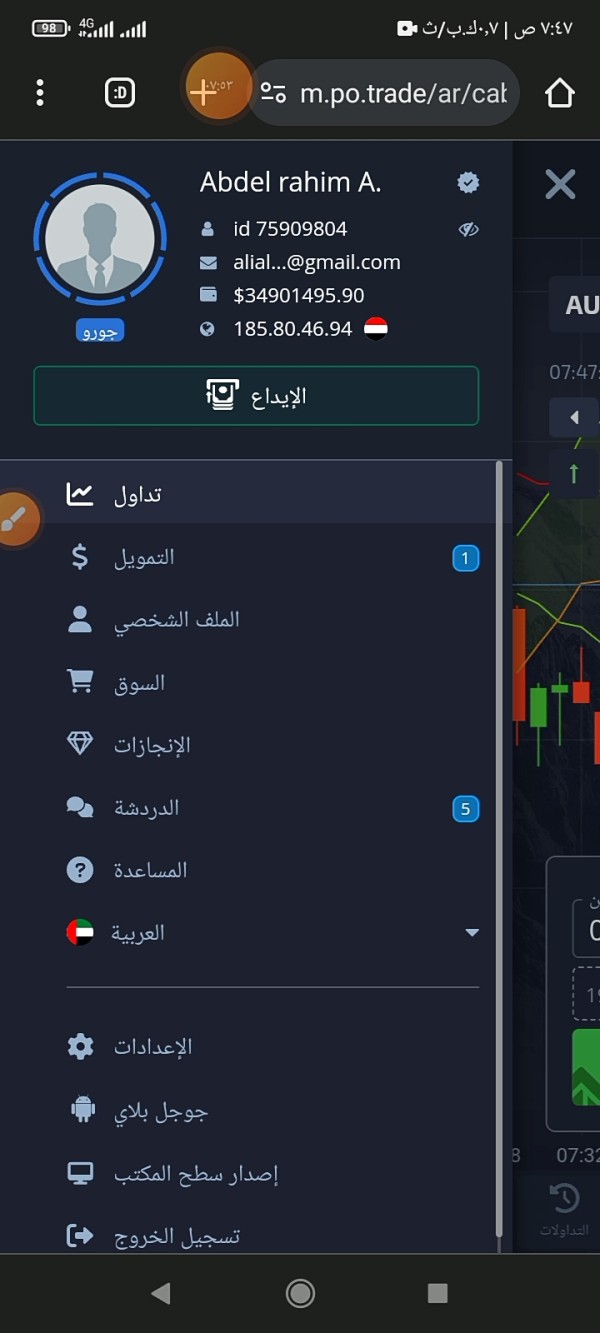

This comprehensive po trade review examines a relatively new online trading platform that has generated significant discussion within the trading community. Po Trade has not always received positive feedback from users. Po Trade, operated by Po Trade Ltd and established in 2019, presents itself as a multi-asset trading platform offering over 100 tradeable instruments across various financial markets including forex, commodities, indices, stocks, and cryptocurrencies.

However, our analysis reveals substantial concerns regarding the broker's regulatory status and overall reliability. The platform operates without proper regulatory oversight. It is registered in Saint Vincent and the Grenadines under registration number 793LLC2021 - a jurisdiction known for its limited regulatory framework. This lack of supervision has raised serious questions among traders about the platform's legitimacy and the safety of client funds.

Despite offering a diverse range of trading products, Po Trade's reputation has been significantly undermined by user concerns. The broker appears to target traders seeking diversified trading opportunities, but potential clients must carefully weigh the risks associated with using an unregulated platform against any perceived benefits.

Important Notice

Regulatory Differences Across Regions: Po Trade operates under registration in Saint Vincent and the Grenadines. This jurisdiction has minimal regulatory oversight for financial services. Traders should be aware that this registration does not provide the same level of protection as brokers regulated by major financial authorities such as the FCA, ASIC, or CySEC. Different countries may have varying legal requirements and consumer protections. Users should verify their local regulations before engaging with this platform.

Review Methodology: This evaluation is based on publicly available information, user feedback from various sources, and industry analysis. Given the limited transparency from the broker, some assessments rely on user reports and third-party observations rather than official company disclosures.

Rating Overview

Broker Overview

Po Trade entered the online trading scene in 2019 as a relatively new player in the competitive forex and CFD market. The company operates under Po Trade Ltd. It maintains its registration in Saint Vincent and the Grenadines with registration number 793LLC2021. This Caribbean jurisdiction has become increasingly popular among online brokers due to its relaxed regulatory environment, though this often comes at the cost of trader protection and oversight.

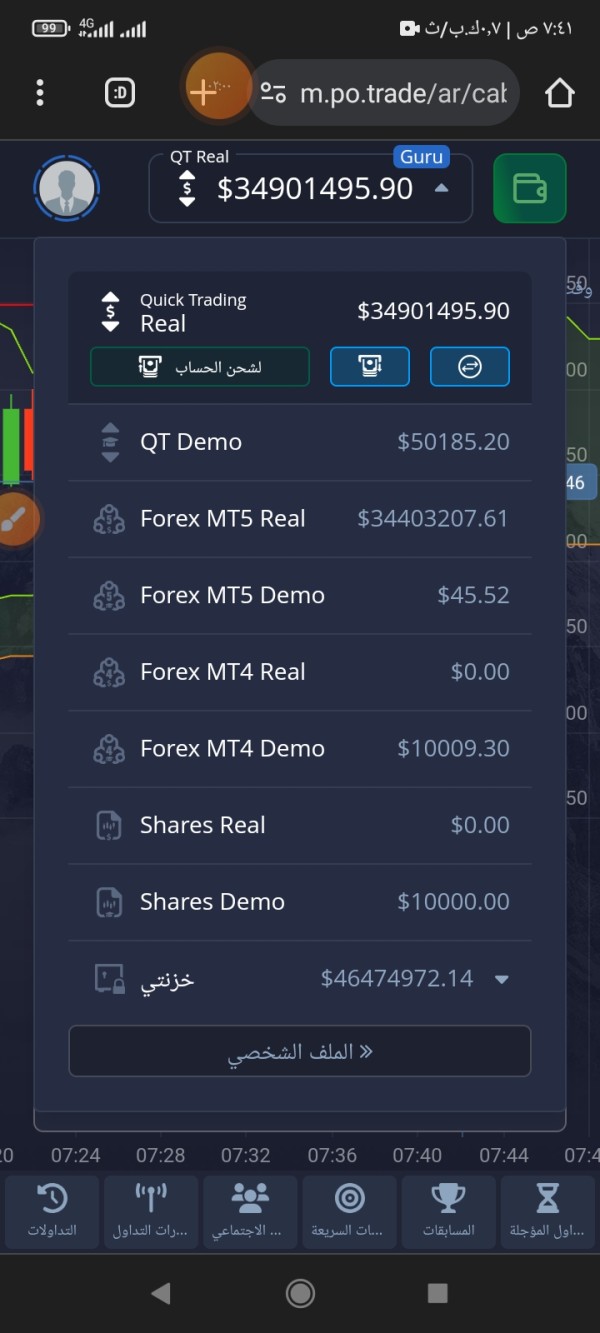

The broker positions itself as a comprehensive trading platform offering access to multiple asset classes. According to available information, Po Trade provides trading opportunities across foreign exchange markets, commodities trading, stock indices, individual equities, and cryptocurrency markets. The platform claims to offer over 100 different tradeable instruments. This suggests a broad scope of investment opportunities for its clients.

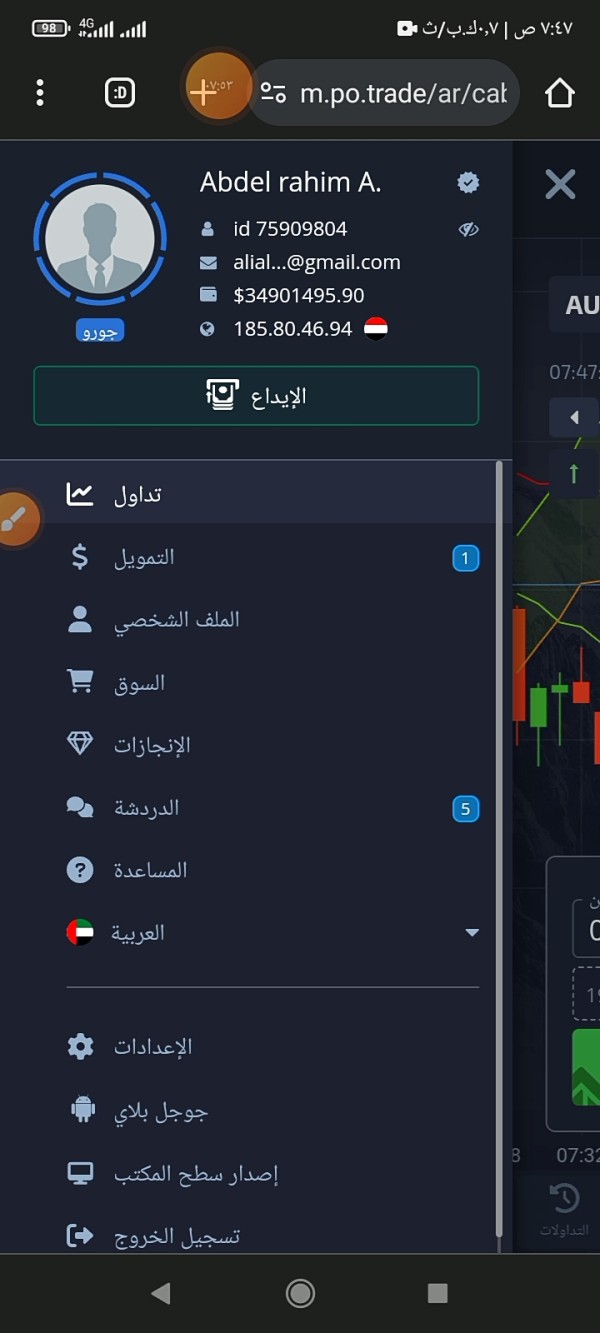

However, the company's business model and operational structure remain somewhat unclear due to limited public disclosure. Unlike brokers regulated by major financial authorities, Po Trade is not required to publish detailed financial reports or undergo regular audits. This makes it challenging for potential clients to assess the company's financial stability and operational integrity. This po trade review aims to provide clarity on these crucial aspects based on available information and user experiences.

Regulatory Status: Po Trade operates without regulation from major financial authorities. The company's registration in Saint Vincent and the Grenadines provides minimal oversight and does not offer the investor protections typically associated with regulated brokers.

Trading Assets: The platform reportedly offers access to over 100 trading instruments spanning multiple asset classes. These include forex pairs, commodities, stock indices, individual stocks, and cryptocurrencies. However, specific details about available instruments and trading conditions remain unclear.

Account Requirements: Critical information regarding minimum deposit requirements, account types, and opening procedures has not been disclosed in available sources. This makes it difficult for potential clients to assess accessibility and suitability.

Promotional Offers: No specific information about bonuses, promotions, or special offers has been identified in current sources. This suggests either limited promotional activities or poor marketing transparency.

Cost Structure: Essential pricing information including spreads, commissions, overnight fees, and other trading costs has not been clearly communicated. This raises concerns about transparency in fee structures.

Leverage Options: Leverage ratios and margin requirements have not been specified in available documentation. This is unusual for a trading platform and may indicate poor regulatory compliance or transparency standards.

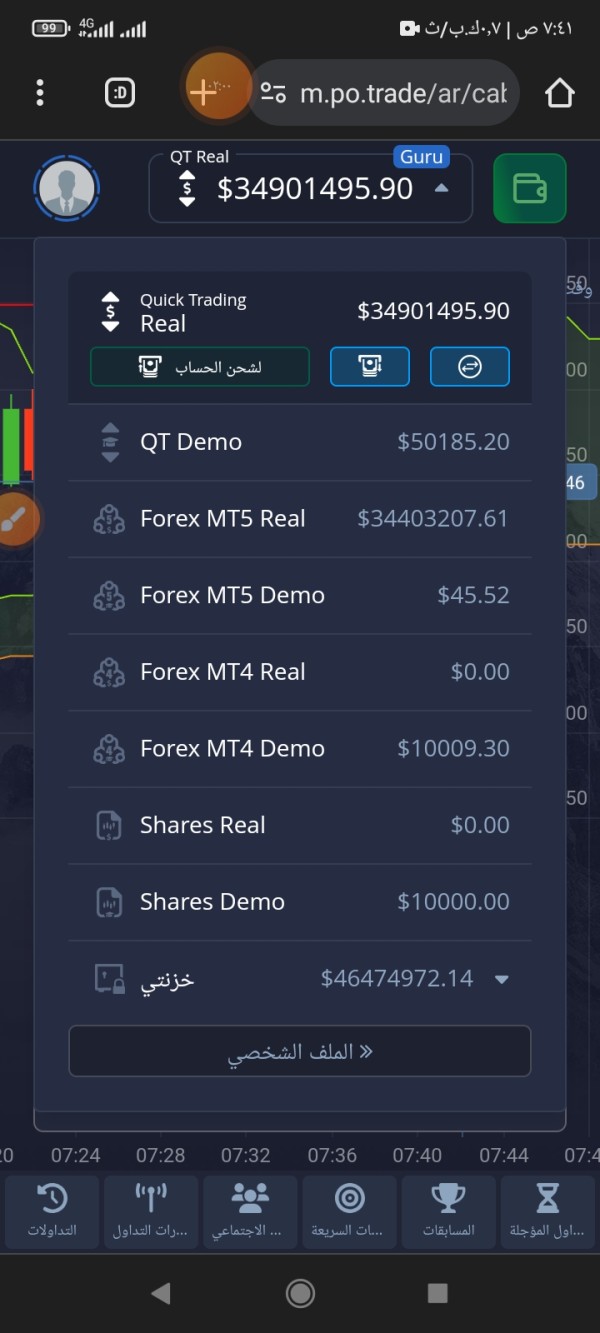

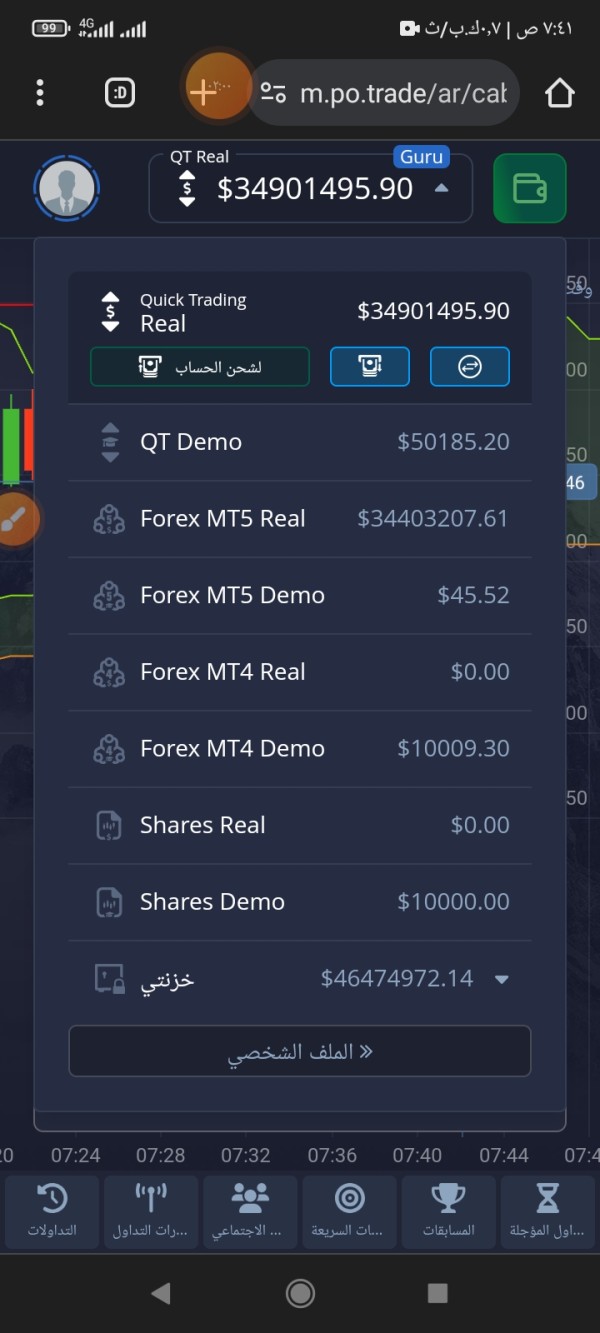

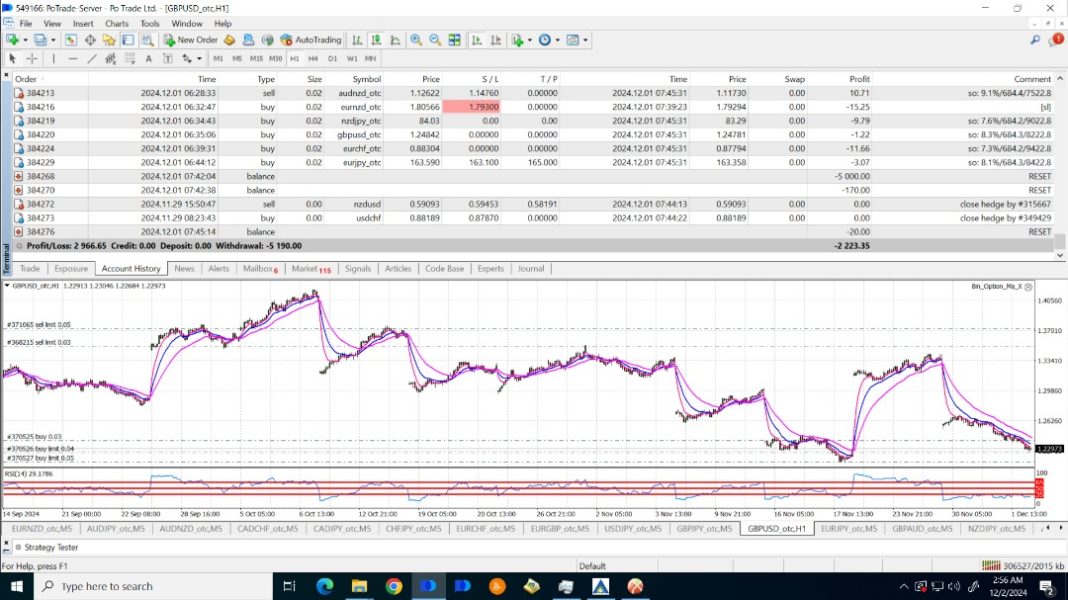

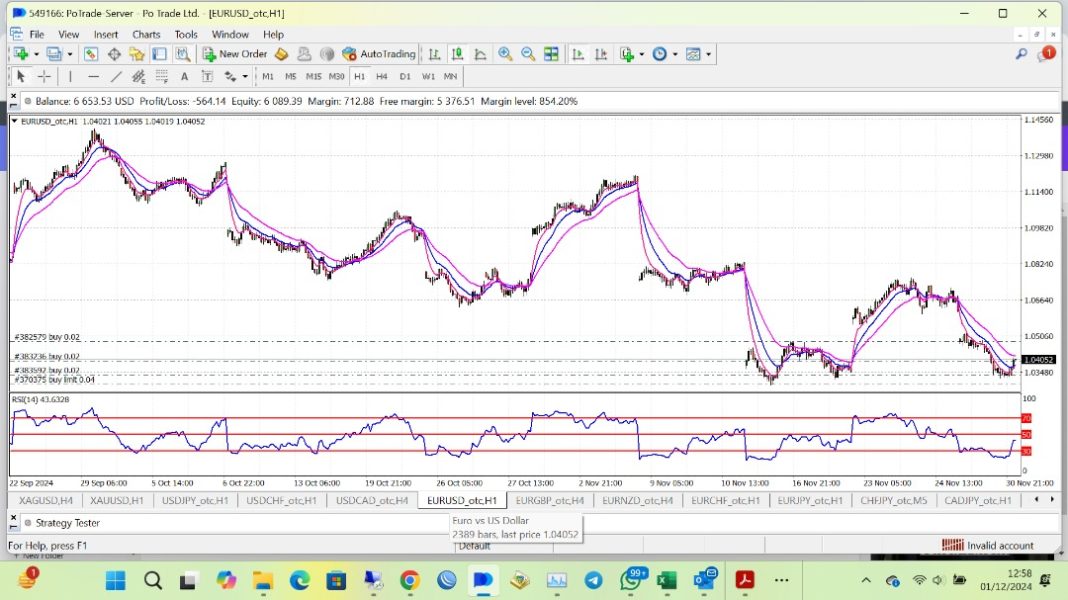

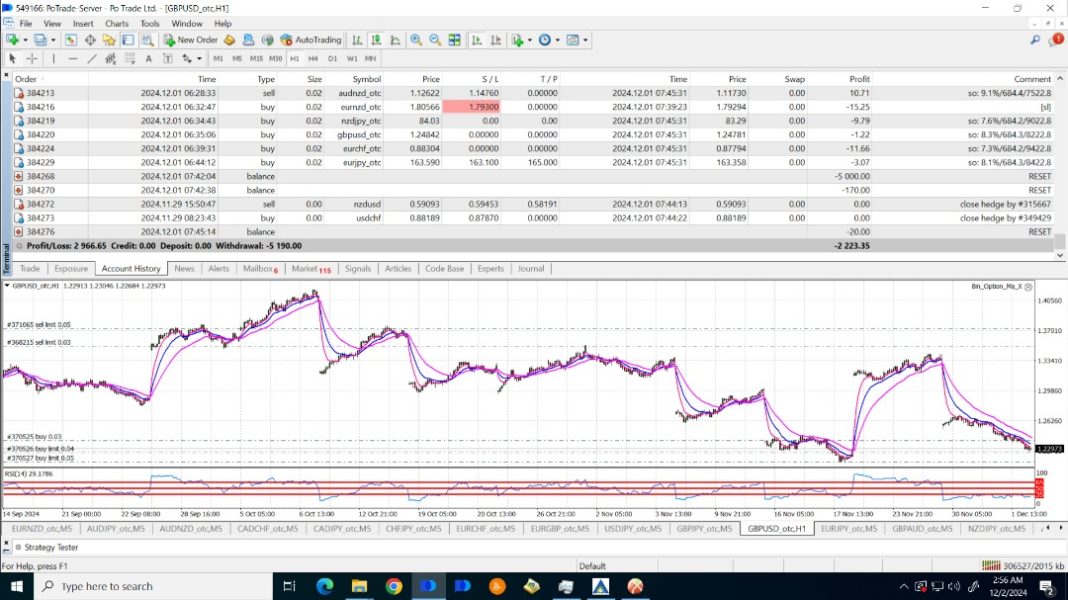

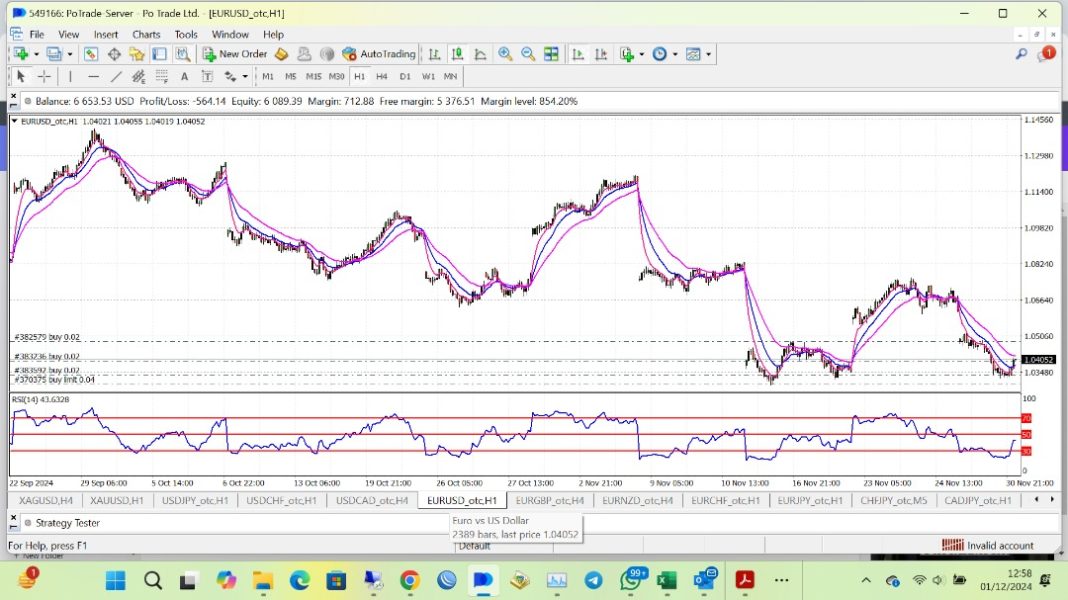

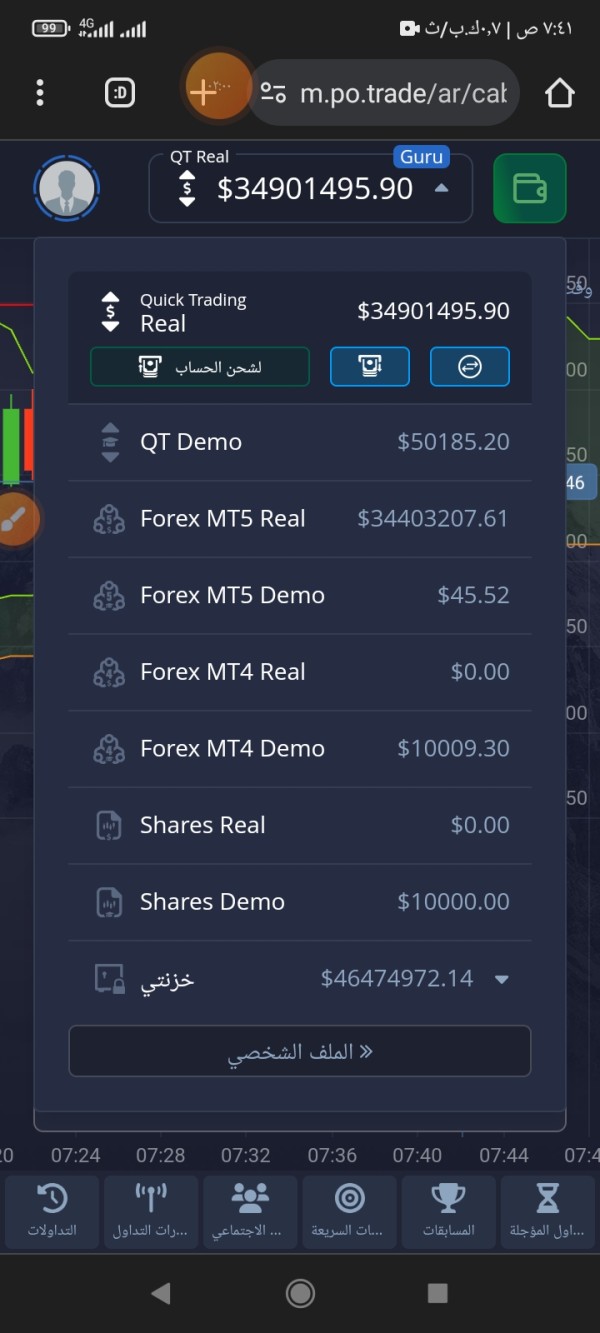

Platform Technology: Specific details about trading platforms, whether proprietary or third-party solutions like MetaTrader, have not been clearly communicated in this po trade review research.

Geographic Restrictions: Information about restricted countries or regional limitations has not been disclosed. This potentially creates legal compliance issues for international traders.

Customer Support Languages: Available support languages and communication channels have not been specified. This may impact user experience for international clients.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by Po Trade present significant concerns primarily due to the lack of transparent information disclosure. According to available sources, the broker has failed to provide clear details about fundamental account features that traders typically expect from legitimate brokers.

The absence of information regarding minimum deposit requirements makes it impossible for potential clients to assess whether the platform is accessible to their budget constraints. Most reputable brokers clearly communicate their account tiers, minimum funding requirements, and the benefits associated with different account levels. This transparency gap raises questions about Po Trade's commitment to clear client communication.

Furthermore, the lack of detailed information about account types suggests either a very limited offering or poor marketing communication. Professional traders typically require different account structures for various trading strategies. The absence of such information in this po trade review indicates potential limitations in service diversity.

The account opening process and verification requirements remain unclear. This could lead to unexpected delays or complications for new clients. Without proper documentation of these procedures, traders cannot adequately prepare for the onboarding experience or understand what documentation may be required.

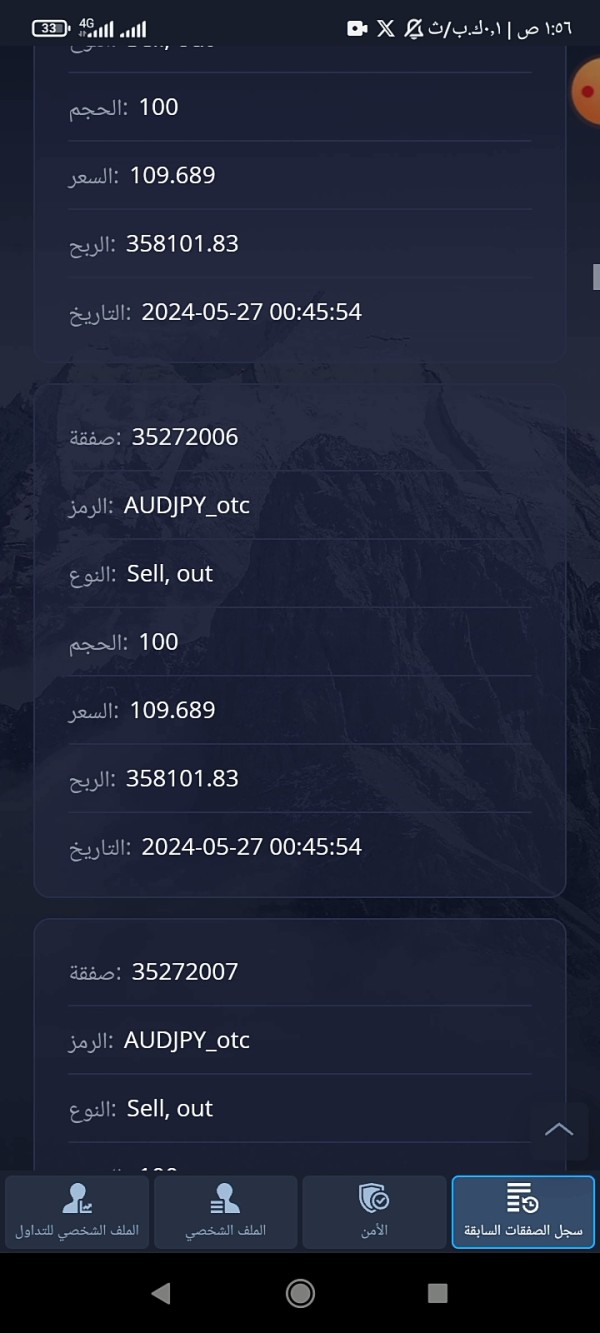

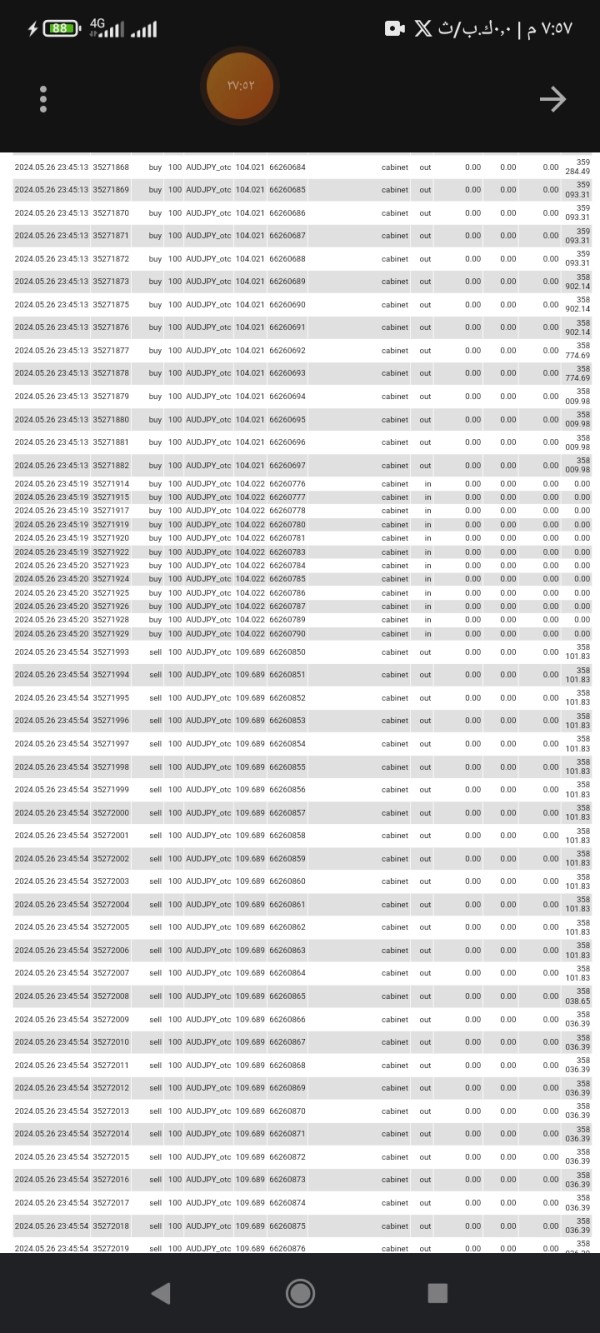

Po Trade's tools and resources receive a moderate rating based on the reported availability of over 100 tradeable instruments across multiple asset classes. This diversity suggests that the platform may cater to traders with varying interests and strategies. It serves both forex specialists and those seeking exposure to cryptocurrency markets.

The range of available assets including forex, commodities, indices, stocks, and cryptocurrencies indicates a comprehensive approach to multi-asset trading. This breadth of offerings can be particularly valuable for traders seeking portfolio diversification or those who prefer to manage all their trading activities through a single platform.

However, the evaluation is significantly limited by the lack of information about specific trading tools, analytical resources, and educational materials. Modern trading platforms typically provide advanced charting capabilities, technical indicators, economic calendars, and market analysis to support informed trading decisions.

The absence of details about research resources, market commentary, or educational content suggests either limited offerings in these areas or poor communication about available resources. Additionally, information about automated trading support, API access, or third-party tool integration has not been identified. This may limit the platform's appeal to sophisticated traders.

Customer Service Analysis (5/10)

Customer service evaluation for Po Trade reveals mixed signals based on limited available information and user feedback patterns. While specific details about support channels, response times, and service quality are not comprehensively documented, user discussions suggest varying experiences with the platform's customer support infrastructure.

The lack of clearly communicated support channels raises immediate concerns about accessibility when traders encounter issues or require assistance. Professional brokers typically provide multiple contact methods including live chat, email support, phone lines, and comprehensive FAQ sections. These ensure client needs are addressed promptly.

Response time information has not been disclosed. This makes it impossible to assess whether the broker meets industry standards for customer inquiry resolution. In the competitive trading industry, prompt and effective customer service is crucial for maintaining client satisfaction and resolving time-sensitive trading issues.

User feedback patterns suggest some negative experiences with customer service quality. However, specific details about common issues or resolution effectiveness are not extensively documented. This limited feedback availability may itself indicate challenges in service delivery or client communication effectiveness.

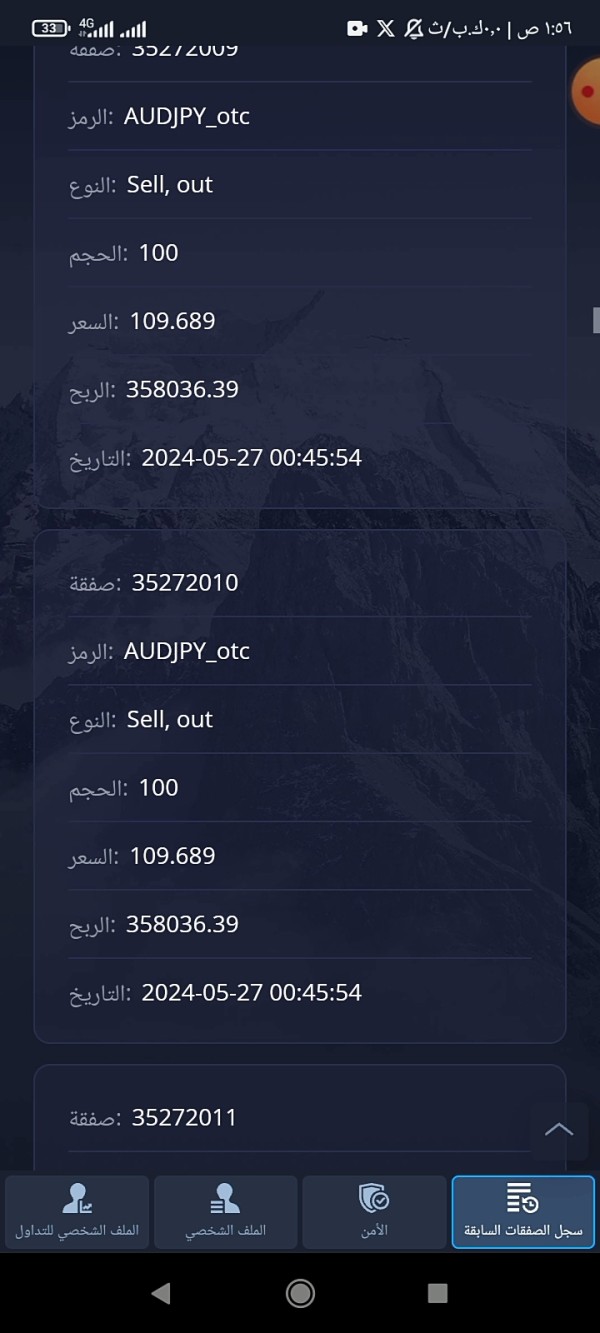

Trading Experience Analysis (4/10)

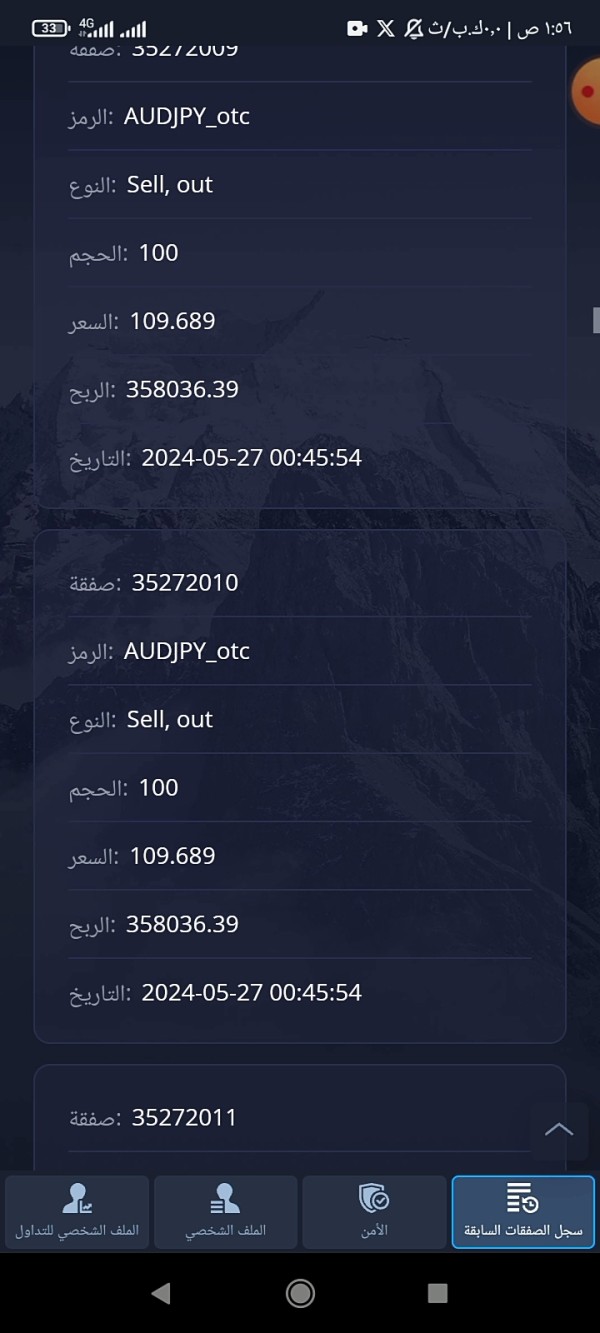

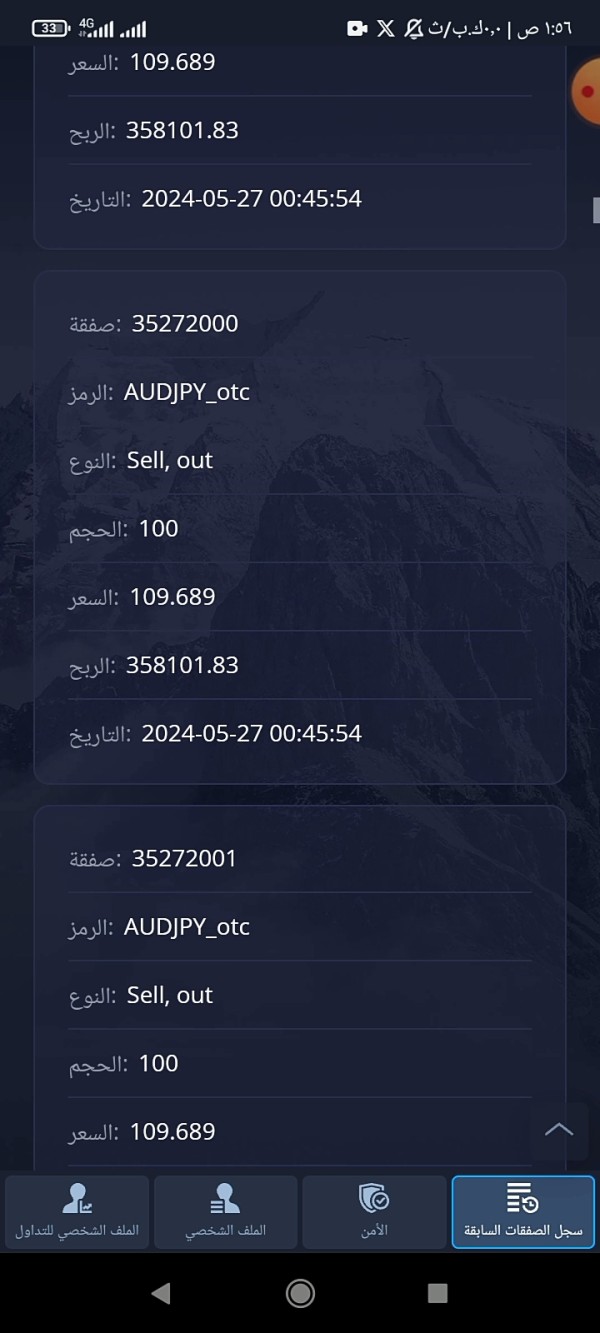

The trading experience evaluation for Po Trade is significantly hampered by the lack of detailed information about platform performance, execution quality, and technical capabilities. These factors are fundamental to successful trading outcomes and trader satisfaction.

Platform stability and execution speed data have not been publicly disclosed. This makes it impossible to assess whether the broker can deliver reliable performance during volatile market conditions. Professional traders require consistent platform uptime and fast order execution to implement their strategies effectively.

Information about order execution policies, including whether the broker operates as a market maker or uses straight-through processing, has not been clearly communicated. This transparency gap prevents traders from understanding potential conflicts of interest or execution advantages that may affect their trading outcomes.

The absence of details about mobile trading capabilities, platform customization options, and advanced order types suggests either limited functionality or poor communication about available features. Modern traders increasingly rely on mobile access and sophisticated order management tools to execute their strategies effectively.

According to this po trade review, the overall trading experience appears compromised by insufficient transparency about critical platform features and performance metrics. Traders need this information to make informed decisions about broker selection.

Trust and Reliability Analysis (2/10)

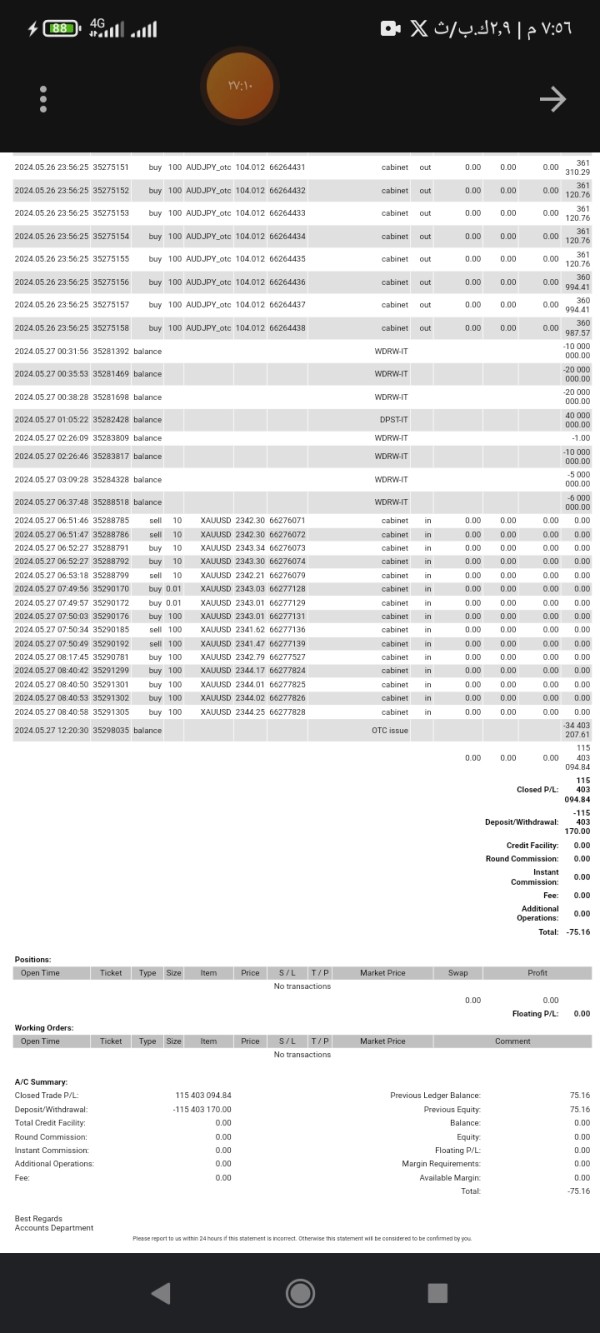

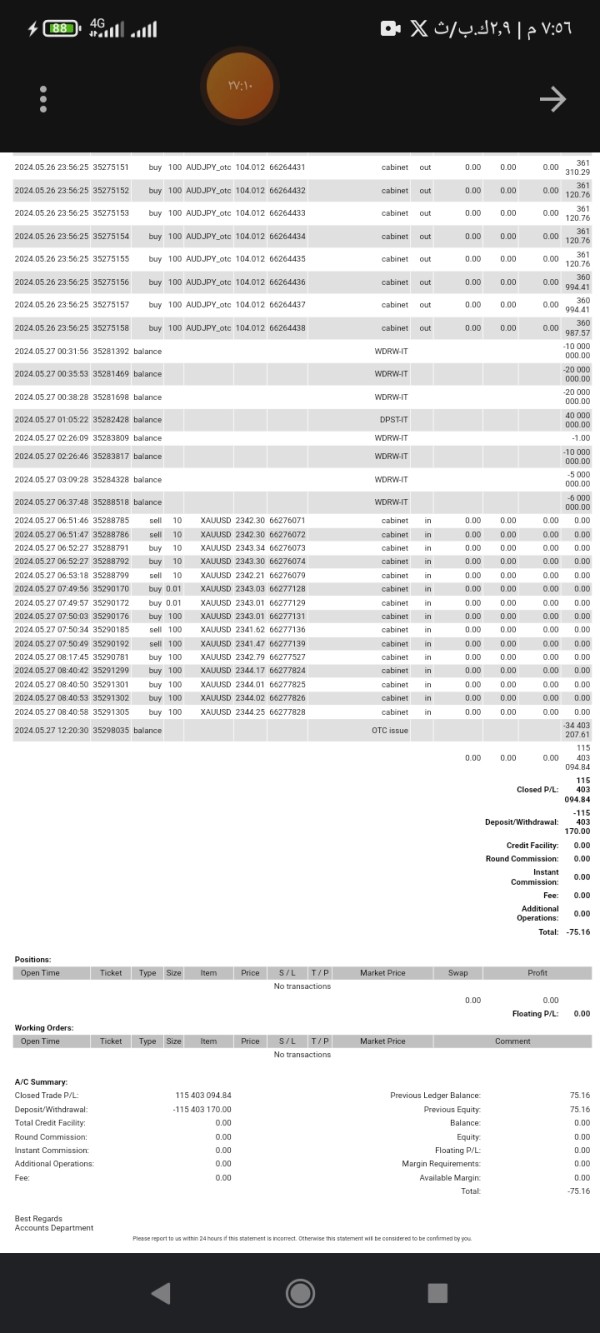

Trust and reliability represent Po Trade's most significant weakness, primarily due to the broker's unregulated status and the resulting concerns about client fund safety and operational oversight. The company's registration in Saint Vincent and the Grenadines provides minimal regulatory protection compared to brokers supervised by major financial authorities.

The absence of regulatory oversight means Po Trade is not required to maintain segregated client accounts, participate in compensation schemes, or undergo regular financial audits. These protections are standard among regulated brokers. They serve as crucial safeguards for trader funds and interests.

User discussions and industry analysis have raised questions about the platform's legitimacy and long-term viability. The lack of transparent financial reporting and regulatory accountability creates uncertainty about the company's operational stability and commitment to client protection.

The broker's limited operational history, combined with insufficient transparency about company ownership, financial backing, and business practices, further undermines confidence in its reliability. Established brokers typically provide comprehensive information about their corporate structure and regulatory compliance. This helps build trust with potential clients.

User Experience Analysis (5/10)

User experience assessment for Po Trade reveals mixed feedback patterns with significant concerns about platform legitimacy and reliability overshadowing any potential positive features. The overall user satisfaction appears to be negatively impacted by uncertainty about the broker's regulatory status and operational transparency.

Available user feedback suggests that while some traders may appreciate the variety of available trading instruments, concerns about the platform's legitimacy have created significant hesitation among potential users. This uncertainty affects the overall user experience regardless of platform functionality.

The registration and verification process experiences have not been extensively documented. This makes it difficult to assess whether new users encounter smooth onboarding procedures or face unexpected complications. Clear and efficient account setup processes are crucial for positive first impressions.

Interface design and platform usability information has not been comprehensively shared in user reviews. This suggests either limited user adoption or insufficient feedback collection. Modern traders expect intuitive interfaces and responsive design across desktop and mobile platforms.

Common user complaints appear to center around concerns about platform legitimacy and regulatory status rather than specific technical issues. This indicates that trust concerns may be preventing many traders from fully evaluating the platform's functional capabilities.

Conclusion

This comprehensive po trade review reveals a trading platform that faces significant challenges in establishing credibility and trust within the competitive online trading industry. While Po Trade offers a diverse range of trading instruments across multiple asset classes, the broker's unregulated status and lack of transparency create substantial concerns for potential clients.

The platform may appeal to traders specifically seeking access to over 100 different trading instruments. However, the absence of regulatory oversight and limited operational transparency make it unsuitable for most traders, particularly beginners who require additional protection and support. The lack of clear information about trading conditions, costs, and platform features further complicates the evaluation process for potential clients.

Primary advantages include the reported variety of tradeable assets and multi-asset platform approach. Significant disadvantages encompass the unregulated status, limited transparency, unclear trading conditions, and user concerns about legitimacy and reliability. Based on this analysis, traders are advised to exercise extreme caution. They should consider regulated alternatives that provide better protection and transparency standards.