BeFX 2025 Review: Everything You Need to Know

Summary

BeFX is a forex broker operating primarily in the Latin American market. It earns a neutral overall assessment in our comprehensive evaluation. This befx review reveals a broker that has been serving the region for approximately seven years, positioning itself as a market maker in an unregulated environment. The platform offers trading across multiple asset classes including forex, commodities, stocks, and indices through a modern trading interface.

One of the most significant characteristics of BeFX is its substantial minimum deposit requirement of 1,000,000 Chilean pesos. This amount equals approximately $1,000, which clearly targets middle to high net worth investors rather than retail beginners. The broker provides access to various financial instruments through CFD trading. However, specific details about trading costs, spreads, and platform specifications remain limited in available documentation.

User feedback indicates that the company is generally perceived as trustworthy. No significant fraud allegations surfaced in our research. However, the lack of formal regulatory oversight may concern some international investors seeking maximum security for their trading capital. The broker's focus on the Latin American market suggests a regional expertise, though this specialization may also limit its appeal to global traders seeking internationally recognized regulatory protection.

Important Notice

This befx review focuses specifically on BeFX's operations in the Latin American market. The broker maintains its primary presence in this region. Potential traders should note that BeFX operates without formal regulatory oversight from major international financial authorities, which may affect the level of investor protection available compared to regulated alternatives.

Our evaluation methodology relies on publicly available information, user feedback, and industry data. This review does not include personal trading experience with the platform. Traders from different jurisdictions should carefully consider their local regulations and investor protection requirements before choosing BeFX as their trading partner. This consideration is particularly important given the absence of international regulatory backing.

Rating Framework

Broker Overview

BeFX operates as a market maker in the Latin American forex and CFD trading space. The company has established its presence in the region approximately seven years ago. The company is headquartered in Chile and has built its business model around serving Spanish-speaking traders in South America. While specific founding dates are not detailed in available documentation, the broker has maintained consistent operations throughout its operational period.

The company's business approach centers on providing direct market access through its proprietary trading infrastructure. It operates without formal regulatory oversight from major international financial authorities. This positioning allows BeFX to offer flexible trading conditions while maintaining competitive operational costs, though it may raise concerns for traders seeking maximum regulatory protection.

BeFX's trading ecosystem encompasses multiple asset classes. The broker offers clients access to forex pairs, commodity CFDs, stock indices, and individual equity CFDs through a modern web-based trading platform. The broker's technology infrastructure supports real-time trading execution, though specific performance metrics and platform details are not extensively documented in available sources. The company's regional focus enables it to provide localized customer service and payment solutions tailored to Latin American market requirements.

Regulatory Status: Available documentation does not specify particular regulatory authorities overseeing BeFX operations. This indicates the broker operates in an unregulated capacity within its target markets.

Deposit and Withdrawal Methods: Specific information regarding available payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in accessible sources.

Minimum Deposit Requirements: BeFX requires a minimum initial deposit of 1,000,000 Chilean pesos. This amount equals approximately $1,000 USD, positioning the broker toward more substantial retail and semi-professional traders.

Bonus and Promotional Offers: Current promotional activities, welcome bonuses, or ongoing trading incentives are not specified in available documentation.

Tradeable Assets: The broker provides access to foreign exchange pairs, commodity contracts for difference, stock index CFDs, and individual equity CFDs across multiple markets.

Cost Structure: Detailed information regarding spreads, commissions, overnight financing charges, and other trading costs is not comprehensively available in current sources.

Leverage Options: Maximum leverage ratios and margin requirements for different asset classes are not specified in accessible documentation.

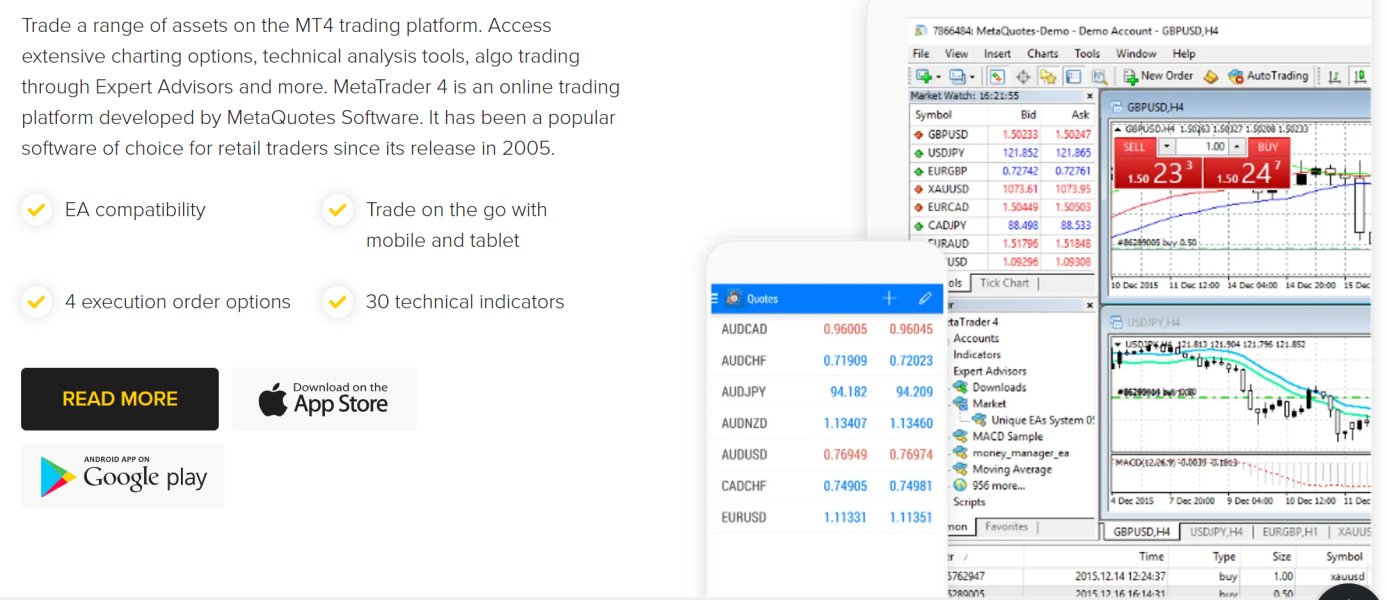

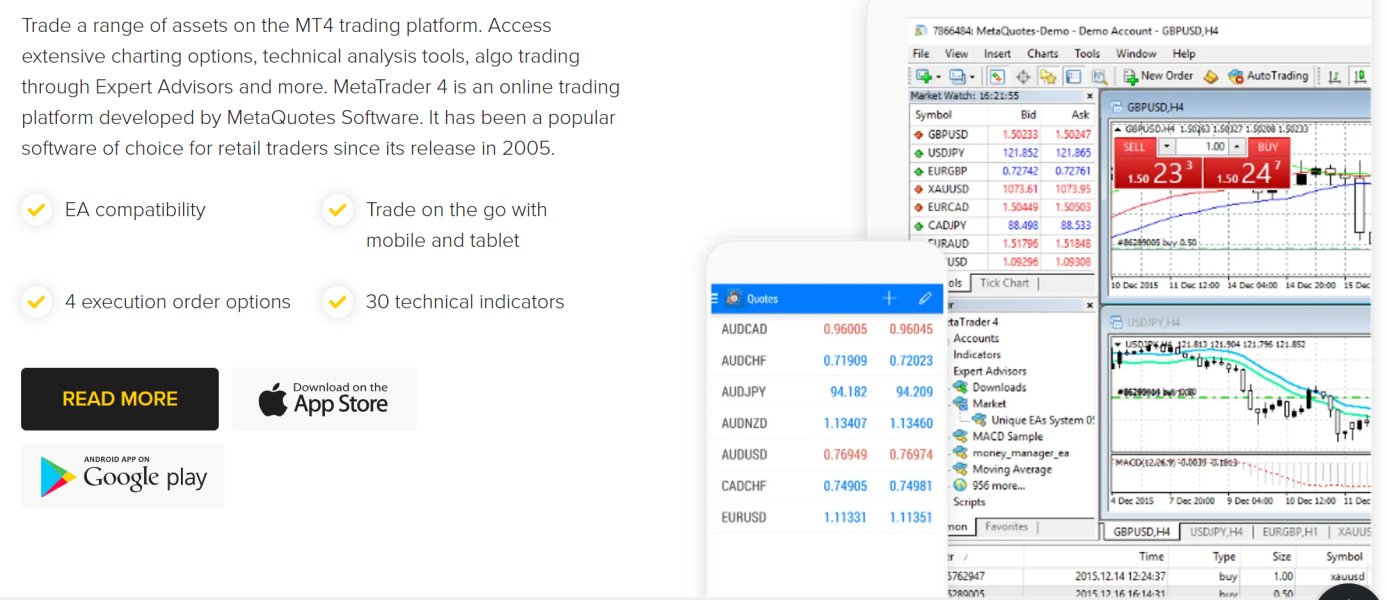

Platform Selection: BeFX offers a modern web-based trading platform. However, specific technical details, charting capabilities, and advanced features are not extensively documented.

Geographic Restrictions: Information regarding restricted countries or regional limitations is not detailed in available sources.

Customer Support Languages: Specific languages supported by customer service teams are not explicitly mentioned in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

BeFX's account structure reflects a clear focus on more substantial retail investors. The minimum deposit requirement of 1,000,000 Chilean pesos serves as a significant entry barrier. This threshold effectively excludes many beginning traders and positions the broker toward clients with more substantial trading capital. While this approach may ensure a more serious client base, it limits accessibility for those seeking to start with smaller amounts.

The lack of detailed information about different account tiers, special features, or graduated service levels suggests a relatively straightforward account structure. Available documentation does not specify whether Islamic accounts, professional trader classifications, or other specialized account types are offered. The absence of clear information about account opening procedures, required documentation, or verification timeframes creates uncertainty for potential clients.

Account funding requirements appear rigid. There is no indication of promotional reduced minimums or graduated entry options. This befx review notes that competitive brokers often provide multiple account levels to accommodate different trader profiles, making BeFX's approach relatively inflexible by comparison. The high minimum deposit may reflect the broker's unregulated status and need to maintain operational stability through larger client deposits.

BeFX provides access to trading through what is described as a modern trading platform. This suggests contemporary web-based technology designed for current market conditions. However, specific details about charting capabilities, technical indicators, drawing tools, and analytical features are not comprehensively documented in available sources.

The platform's support for multiple asset classes indicates reasonable diversification capabilities. This allows traders to access forex, commodities, stocks, and indices from a single interface. This multi-asset approach can be valuable for traders seeking portfolio diversification or those wanting to capitalize on different market conditions across various sectors.

Educational resources, market analysis, research reports, and trading guides are not specifically mentioned in available documentation. This may limit the platform's value for less experienced traders. The absence of detailed information about automated trading support, expert advisors, or algorithmic trading capabilities suggests these features may not be prominently offered or marketed.

Customer Service and Support Analysis (6/10)

Available information provides limited insight into BeFX's customer service infrastructure, support channels, or service quality metrics. The broker's regional focus on Latin America suggests Spanish-language support capabilities. However, specific languages, operating hours, and contact methods are not detailed in accessible documentation.

User feedback indicates general satisfaction with the company's trustworthiness. However, specific experiences with customer service responsiveness, problem resolution, or technical support quality are not extensively documented. The absence of detailed customer service information makes it difficult to assess the broker's commitment to client support or the effectiveness of its help desk operations.

Response time expectations, escalation procedures, and specialized support for different account types or trading issues are not specified. This lack of transparency around customer service capabilities may concern traders who prioritize responsive support. This is particularly true for those engaging in active trading strategies where quick issue resolution is essential.

Trading Experience Analysis (7/10)

The modern trading platform provided by BeFX appears designed to meet contemporary trading requirements. However, specific performance metrics, execution speeds, or stability data are not available in current documentation. User feedback suggests general satisfaction with platform functionality, indicating adequate performance for typical trading activities.

Order execution quality, including slippage characteristics, requote frequency, and execution speed during volatile market conditions, is not specifically detailed in available sources. The broker's market maker model suggests they provide liquidity directly. This can offer consistent execution but may raise questions about potential conflicts of interest during significant market movements.

Platform features such as one-click trading, advanced order types, mobile accessibility, and real-time data quality are not comprehensively documented. The befx review indicates that while users find the platform functional, detailed technical specifications and performance benchmarks would provide greater clarity for potential clients evaluating trading capabilities.

Trustworthiness Analysis (5/10)

BeFX operates without formal regulatory oversight from major international financial authorities. This significantly impacts its trustworthiness assessment. While user feedback suggests the company is generally perceived as reliable with no major fraud allegations, the absence of regulatory protection creates inherent risks for client funds and dispute resolution.

Fund segregation policies, client money protection measures, and operational transparency are not detailed in available documentation. The lack of regulatory requirements means standard investor protections such as compensation schemes, mandatory auditing, or regulatory reporting may not apply to BeFX operations.

The company's seven-year operational history in the Latin American market provides some indication of business stability. However, without regulatory oversight or published financial statements, assessing long-term viability remains challenging. Third-party audits, industry certifications, or professional indemnity insurance coverage are not mentioned in available sources.

User Experience Analysis (6/10)

Overall user satisfaction appears moderate based on available feedback. Clients generally express trust in the company's operations. However, comprehensive user experience data including satisfaction surveys, retention rates, or detailed testimonials are not extensively available in current documentation.

The platform's modern design suggests attention to user interface considerations. However, specific usability features, navigation efficiency, or mobile experience quality are not detailed. Account opening procedures, verification processes, and onboarding experiences are not comprehensively documented, making it difficult to assess the complete user journey.

Common user complaints, frequently requested features, or areas for improvement are not specifically highlighted in available sources. The befx review indicates that while basic satisfaction appears adequate, detailed user experience metrics would provide better insight into the broker's service quality and areas for potential enhancement.

Conclusion

BeFX presents as a regionally focused forex broker serving the Latin American market with a clear positioning toward more substantial retail investors. This befx review reveals a broker that maintains operational stability and user trust within its target market. However, significant limitations exist around regulatory oversight and transparency.

The broker is most suitable for middle to high net worth traders comfortable with unregulated environments and seeking exposure to multiple asset classes through CFD trading. Beginning traders or those with limited capital may find the high minimum deposit requirement prohibitive. Meanwhile, risk-averse investors may prefer regulated alternatives offering stronger investor protections.

Key advantages include user trust, multi-asset trading capabilities, and regional market expertise. Primary concerns center on the lack of regulatory oversight, limited transparency around trading conditions, and high entry barriers for smaller investors.