BCRPRO 2025 Review: Everything You Need to Know

Executive Summary

BCRPRO is a new forex broker that claims registration with the Vanuatu Financial Services Commission. However, specific regulatory details remain unclear and raise significant trust concerns among users who have tried their services. This bcrpro review reveals a broker that offers some competitive trading conditions but faces serious credibility issues. Potential traders must carefully consider these problems before choosing this platform.

The broker provides MT4 trading platform access with standard accounts featuring zero commission. ECN accounts come with relatively low commission structures that might appeal to some traders. However, user feedback consistently highlights withdrawal difficulties and questionable business practices that create major red flags. According to multiple sources, BCRPRO has received a Trustpilot rating of 2.8, with most users providing low ratings. These poor ratings stem primarily from withdrawal complications and poor customer service experiences that frustrate traders.

The platform targets traders seeking low-commission trading environments. It particularly appeals to those interested in forex, commodities, and indices trading who want to minimize their costs. However, the lack of proper regulatory oversight and numerous user complaints about fund accessibility make this broker a high-risk choice. The absence of detailed licensing information, combined with widespread user distrust, suggests that BCRPRO may not meet the standards expected from reputable forex brokers who operate transparently.

Given the current market landscape and regulatory requirements, traders are advised to exercise extreme caution when considering BCRPRO as their trading partner. This warning especially applies to those prioritizing fund security and reliable withdrawal processes.

Important Disclaimers

Regional Entity Differences: BCRPRO claims registration in Vanuatu under the Vanuatu Financial Services Commission (VFSC). However, verification of active licensing remains problematic and raises serious questions about their legitimacy. Traders should understand that Vanuatu's regulatory framework may offer different investor protections compared to major financial jurisdictions like the US or UK. According to Global Fraud Protection, "VFSC Has Never Licensed Them," which raises serious questions about the broker's regulatory claims and suggests potential misrepresentation.

Review Methodology: This evaluation is based on available user feedback, industry reports, and publicly accessible information that we could gather. The assessment has not been verified through direct trading experience with the platform, so some details may be incomplete. Information accuracy depends on the reliability of source materials and may not reflect the most current operational status of the broker.

Rating Framework

Broker Overview

BCRPRO emerged in 2024 as a forex broker claiming to provide comprehensive online trading services. The company presents itself as headquartered in the United States while asserting regulatory compliance through Vanuatu Financial Services Commission registration, though these claims appear questionable. However, multiple investigation sources, including DNB Forex Price Action and Global Fraud Protection, have raised substantial questions about the legitimacy of these claims. Some sources directly label the operation as potentially fraudulent, which should alarm potential users.

The broker's business model focuses on providing access to forex, commodities, and indices trading through the popular MetaTrader 4 platform. Despite claims of offering competitive trading conditions, the company has failed to provide verifiable regulatory information that would prove their legitimacy. This creates significant transparency concerns that experienced traders would find troubling. According to Scams Report, the broker has been flagged for suspicious activities, and numerous user complaints suggest systematic issues with fund withdrawals and customer service quality that go beyond normal business problems.

The trading environment offered by BCRPRO includes standard and ECN account types. Standard accounts feature zero commission structures while ECN accounts promote low spreads starting from zero pips, which sounds attractive to cost-conscious traders. However, the absence of detailed regulatory documentation and the prevalence of negative user experiences suggest that potential traders should approach this broker with considerable caution. This bcrpro review indicates that while the platform may appear attractive due to its commission structure, the underlying operational concerns significantly outweigh these apparent benefits for most traders.

Regulatory Status: BCRPRO claims registration with the Vanuatu Financial Services Commission (VFSC). However, verification efforts have failed to confirm active licensing, which is a major red flag for potential users. Global Fraud Protection explicitly states that "VFSC Has Never Licensed Them," indicating potential regulatory misrepresentation that could put trader funds at risk.

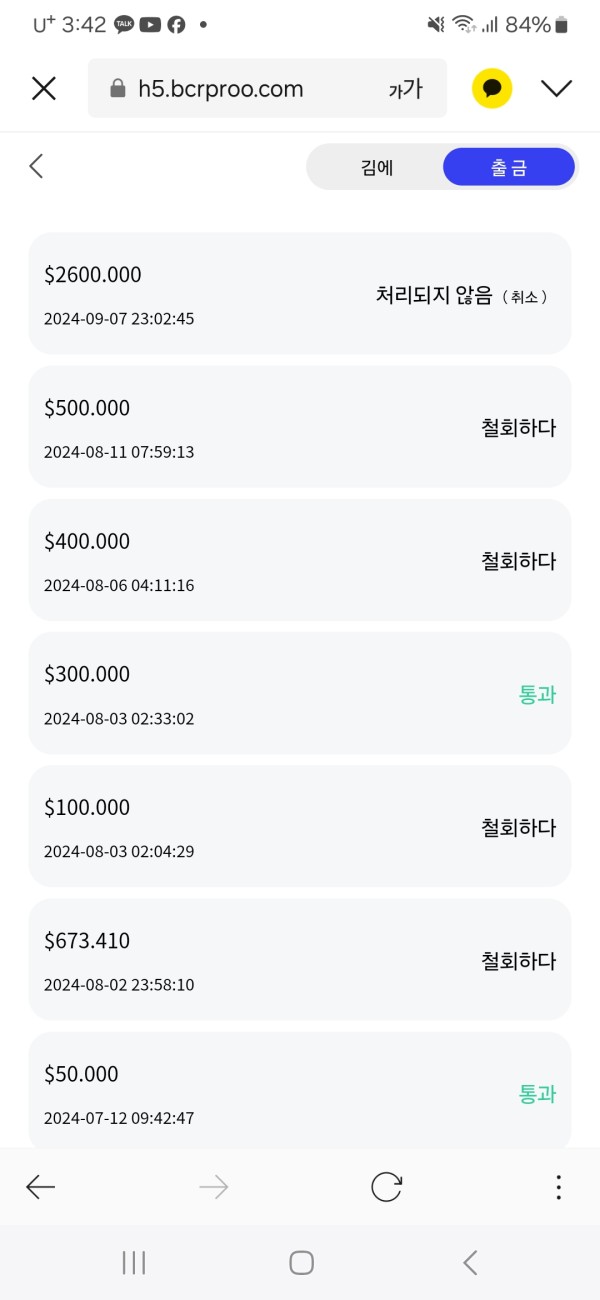

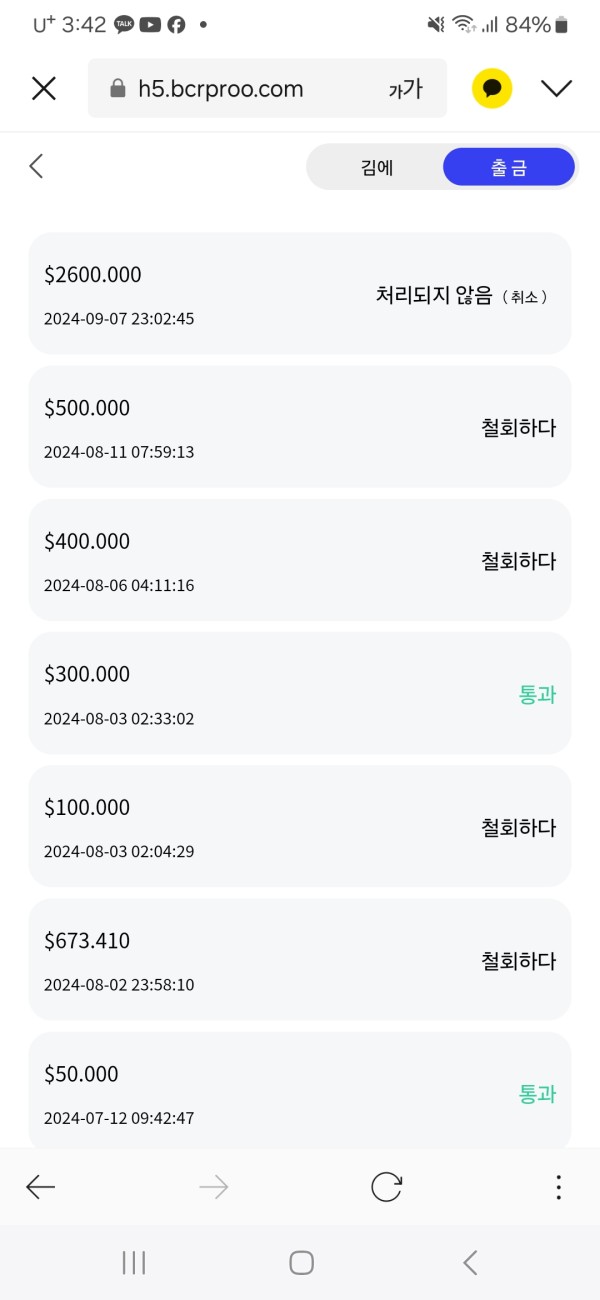

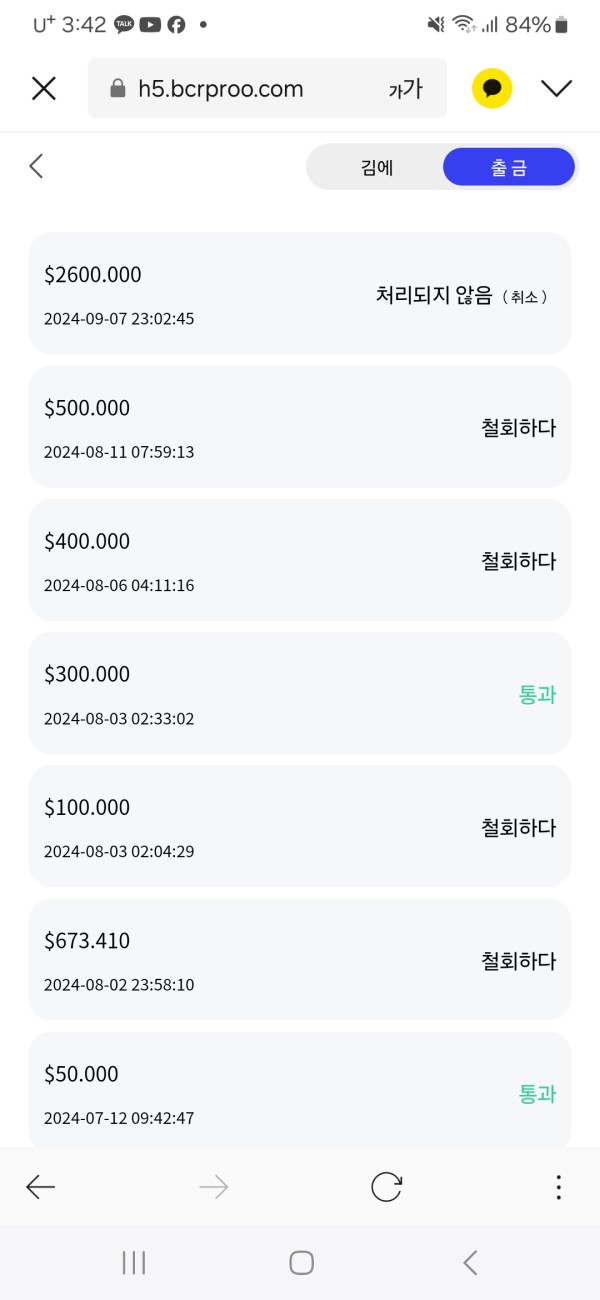

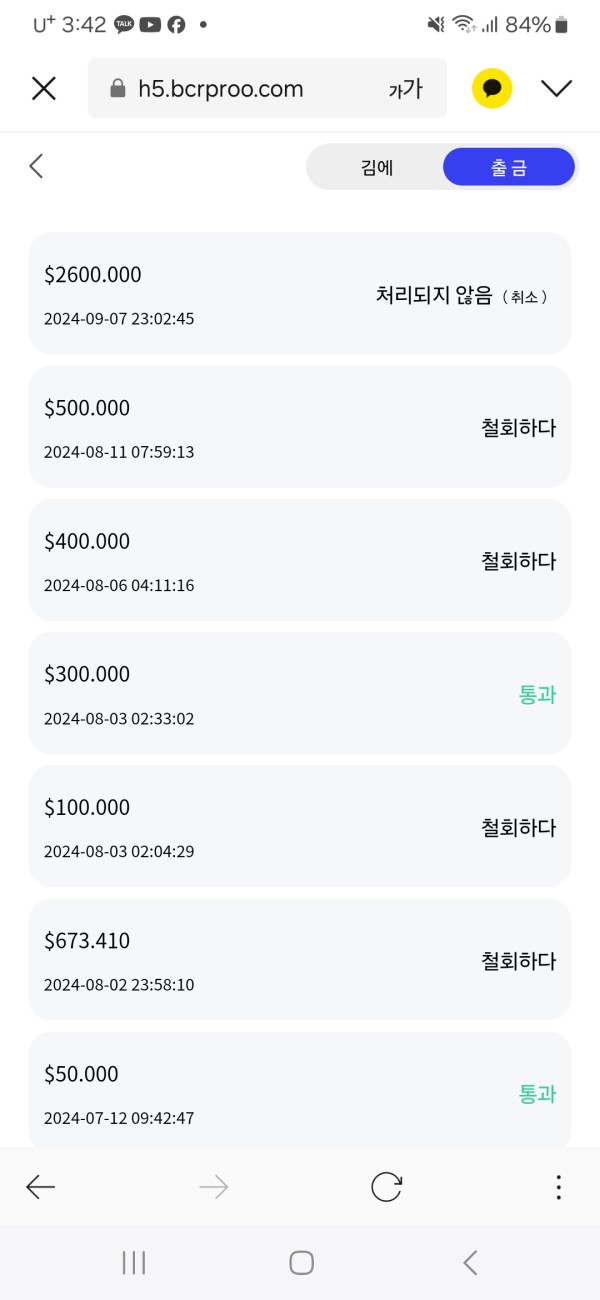

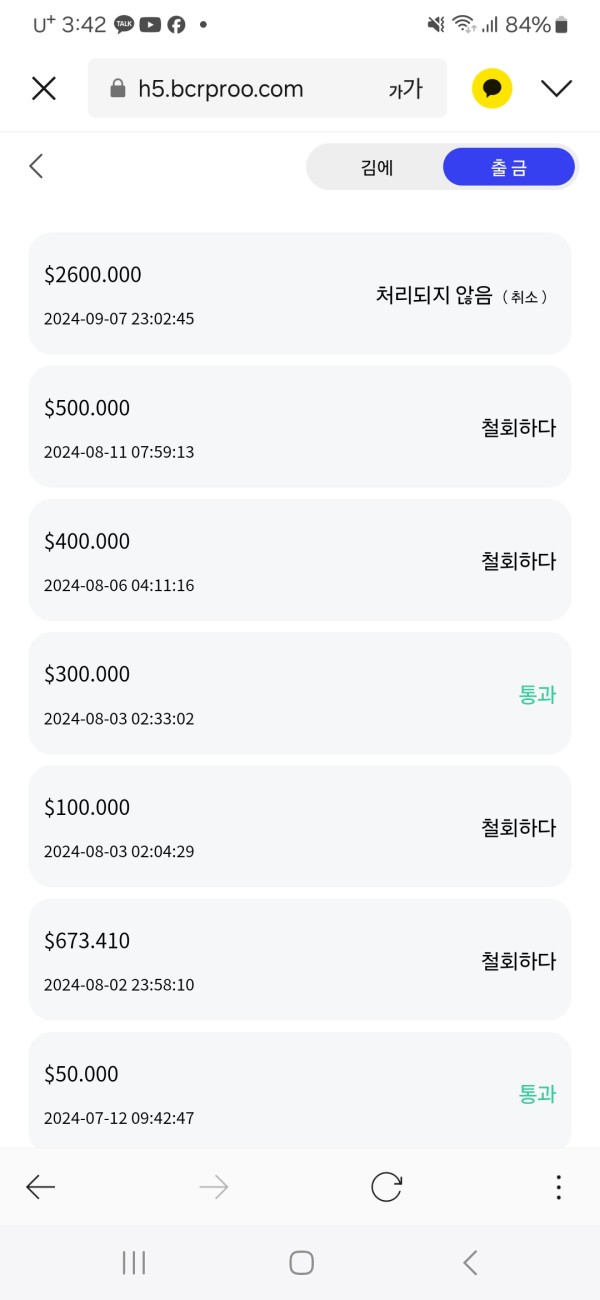

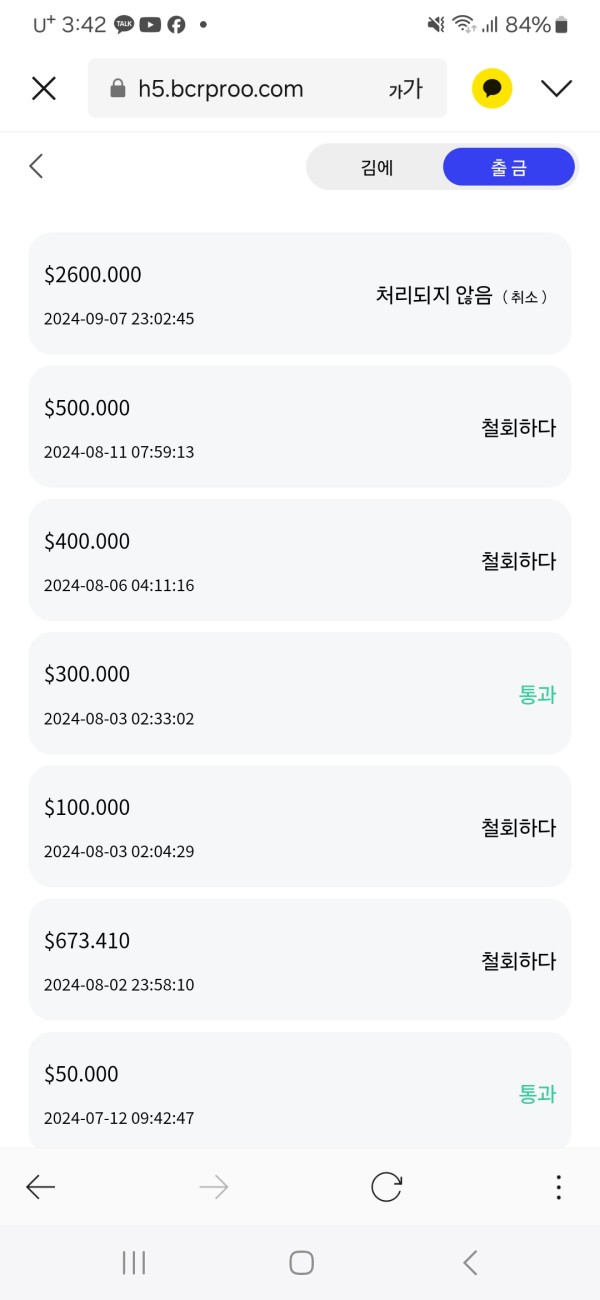

Deposit and Withdrawal Methods: Specific information regarding supported payment methods has not been detailed in available sources. User complaints consistently focus on withdrawal difficulties rather than deposit accessibility issues, suggesting that getting money out is much harder than putting it in.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in the available information. This limits potential traders' ability to assess entry barriers and plan their initial investment properly.

Bonus and Promotional Offers: Current promotional structures and bonus programs have not been detailed in the source materials. This suggests either absence of such offerings or lack of transparent marketing practices that would help traders understand what they're getting.

Tradeable Assets: The platform provides access to forex pairs, commodities, and indices for traders who want diverse market exposure. However, the specific range and variety of instruments available have not been comprehensively detailed in the source materials, making it hard to compare with other brokers.

Cost Structure: Standard accounts feature zero commission trading while ECN accounts offer spreads starting from zero pips with undisclosed commission rates. However, the lack of detailed fee schedules raises transparency concerns about hidden costs that could surprise traders later.

Leverage Options: Specific leverage ratios and margin requirements have not been detailed in the available source materials. This limits traders' ability to assess risk management parameters and plan their trading strategies effectively.

Platform Selection: BCRPRO exclusively offers the MetaTrader 4 platform, which is popular among traders worldwide. However, this represents a limited technological offering compared to brokers providing multiple platform options that cater to different trading styles.

Geographic Restrictions: Specific information regarding restricted jurisdictions and service availability has not been detailed in the source materials. This makes it unclear which countries can access their services legally.

Customer Support Languages: The range of supported languages for customer service has not been specified in available information. This bcrpro review finds significant gaps in customer service transparency that could affect international traders.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

BCRPRO's account structure appears straightforward but lacks the depth and transparency expected from reputable brokers. The standard account offering zero commission trading initially seems attractive, particularly for high-frequency traders concerned about transaction costs who want to maximize their profits. However, the ECN account details remain insufficiently detailed, with spreads claimed to start from zero but without clear information about the commission structure. This lack of clarity typically accompanies such tight spreads and should concern potential users.

The absence of specific minimum deposit requirements creates uncertainty for potential traders trying to assess their investment entry points. This lack of transparency extends to other crucial account features, including swap rates, margin requirements, and account maintenance fees that could significantly impact trading costs. Users have reported confusion about actual trading costs beyond the advertised zero commission structure, suggesting hidden fees may exist.

Account opening procedures and verification requirements have not been clearly documented. This suggests potential complications in the onboarding process that could frustrate new users trying to start trading. The broker's failure to provide comprehensive account documentation raises questions about operational transparency and compliance with standard industry practices that protect traders.

Compared to established brokers offering multiple account tiers with clear benefit structures, BCRPRO's limited account information represents a significant disadvantage. This makes it difficult for traders seeking detailed trading condition analysis before committing funds to make informed decisions. This bcrpro review identifies account transparency as a major concern area that potential users should carefully consider.

The trading infrastructure at BCRPRO centers exclusively around the MetaTrader 4 platform. While MT4 is industry-standard, this represents a limited technological offering that may not satisfy all trader preferences. MT4 provides basic charting capabilities and supports expert advisors, but the absence of additional platform options restricts traders who prefer alternative interfaces or advanced analytical tools for their strategies.

Educational resources appear notably absent from BCRPRO's offerings. There's no evidence of webinars, tutorials, or market analysis content that could help traders improve their skills. This limitation particularly impacts novice traders who typically rely on broker-provided educational materials to develop their trading skills and understanding of market dynamics. The absence of research tools, market news feeds, and analytical resources further diminishes the platform's value proposition for serious traders.

Technical analysis capabilities remain limited to MT4's standard offerings. The platform lacks enhanced charting packages or third-party analytical tool integration that advanced traders often require. The lack of economic calendars, market sentiment indicators, or proprietary research content places BCRPRO at a significant disadvantage compared to full-service brokers who provide comprehensive market analysis.

Automated trading support through MT4's expert advisor functionality exists for traders who prefer algorithmic strategies. However, there are no broker-provided strategy development resources or signal services that could help traders optimize their automated approaches. The overall tool ecosystem appears minimal, focusing solely on basic trading execution rather than comprehensive trading support that modern traders expect.

Customer Service and Support Analysis (Score: 3/10)

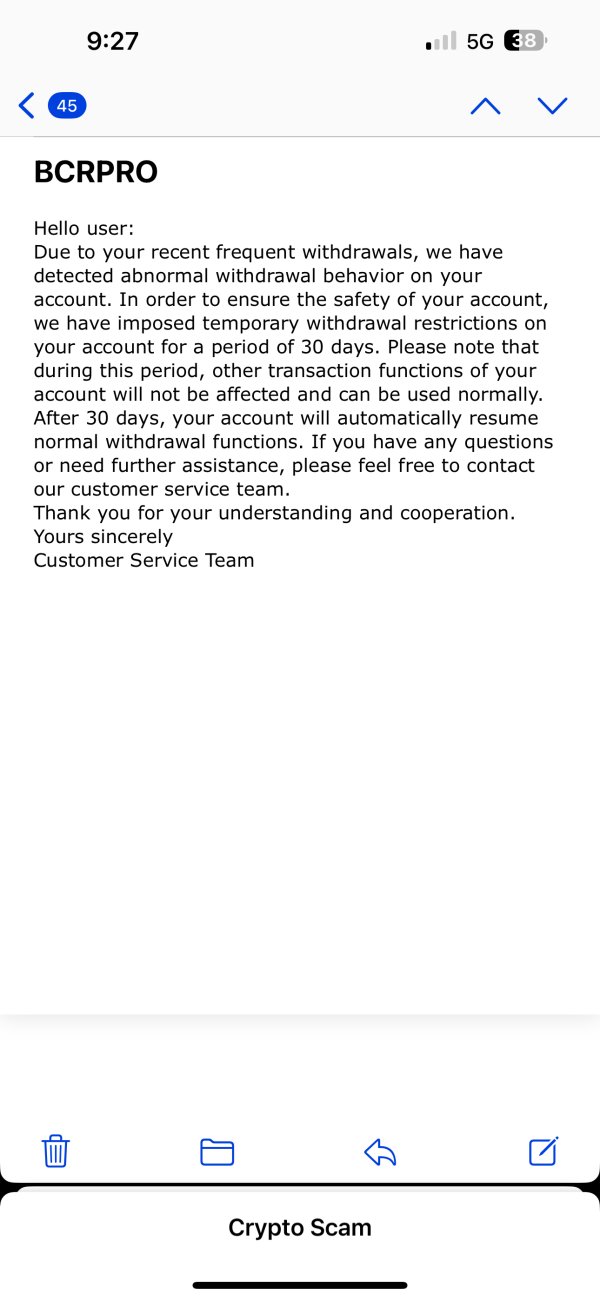

Customer service quality emerges as a critical weakness in user feedback about BCRPRO. Multiple sources indicate prolonged response times and inadequate problem resolution, particularly regarding withdrawal requests and account-related issues that are crucial for trader satisfaction. Users consistently report frustration with customer support accessibility and effectiveness, which creates serious concerns about getting help when needed.

The specific communication channels available for customer support have not been clearly documented. This suggests potential limitations in contact methods that could make it difficult to reach support staff during urgent situations. Response time expectations and service level commitments appear absent from the broker's operational framework, creating uncertainty about support availability during critical trading periods when immediate assistance is essential.

Professional competency of support staff receives negative feedback from users. Reports indicate limited ability to resolve complex account or trading issues that experienced traders might encounter. The absence of specialized support for different trader categories or account types suggests a basic support structure inadequate for diverse trading needs and experience levels.

Multi-language support capabilities remain unspecified. This potentially limits accessibility for international traders who may not be comfortable communicating in English. The overall support infrastructure appears insufficient for a modern trading environment where immediate assistance is crucial for active traders who need quick problem resolution.

Trading Experience Analysis (Score: 4/10)

Platform stability and execution quality receive consistently negative feedback from BCRPRO users. Reports indicate frequent connectivity issues and slow order execution speeds that significantly impact trading effectiveness, particularly during volatile market conditions when timing is critical. These technical problems undermine confidence in the platform's reliability for serious trading activities and could result in missed opportunities or unexpected losses.

Order execution quality suffers from reported slippage issues and requoting problems. However, specific performance metrics have not been documented, making it difficult to assess the true extent of these issues. Users express dissatisfaction with fill rates and execution speeds, suggesting inadequate liquidity provision or technological infrastructure limitations that could affect trading profitability.

The trading environment lacks advanced features expected by professional traders. This includes sophisticated order types, advanced charting capabilities, and real-time market data quality that serious traders rely on for their strategies. Mobile trading experience details remain unspecified, limiting assessment of cross-platform functionality that modern traders expect for managing positions on the go.

Spread stability and liquidity provision receive negative user feedback. This indicates potential market-making practices that disadvantage traders during important market movements when liquidity typically becomes more expensive. The overall trading environment appears substandard compared to established brokers offering institutional-grade execution quality that professional traders require. This bcrpro review highlights execution quality as a significant concern that could impact trading results.

Trust and Security Analysis (Score: 2/10)

Regulatory compliance represents BCRPRO's most significant weakness. Multiple sources question the validity of claimed Vanuatu Financial Services Commission registration, which is fundamental to broker legitimacy. Global Fraud Protection's explicit statement that "VFSC Has Never Licensed Them" raises serious concerns about regulatory misrepresentation and potential fraud that could put trader funds at serious risk.

Fund security measures remain undocumented. There's no evidence of segregated client accounts, deposit insurance, or other standard investor protection mechanisms that reputable brokers provide to safeguard trader funds. The absence of transparent financial reporting and management team information further undermines confidence in the broker's operational integrity and ability to protect client assets.

Corporate transparency suffers from limited public information about company ownership, financial backing, and operational history. The lack of audited financial statements or regulatory filing documentation suggests potential regulatory non-compliance and operational opacity that should concern potential users. This makes it impossible to verify the company's financial stability or track record.

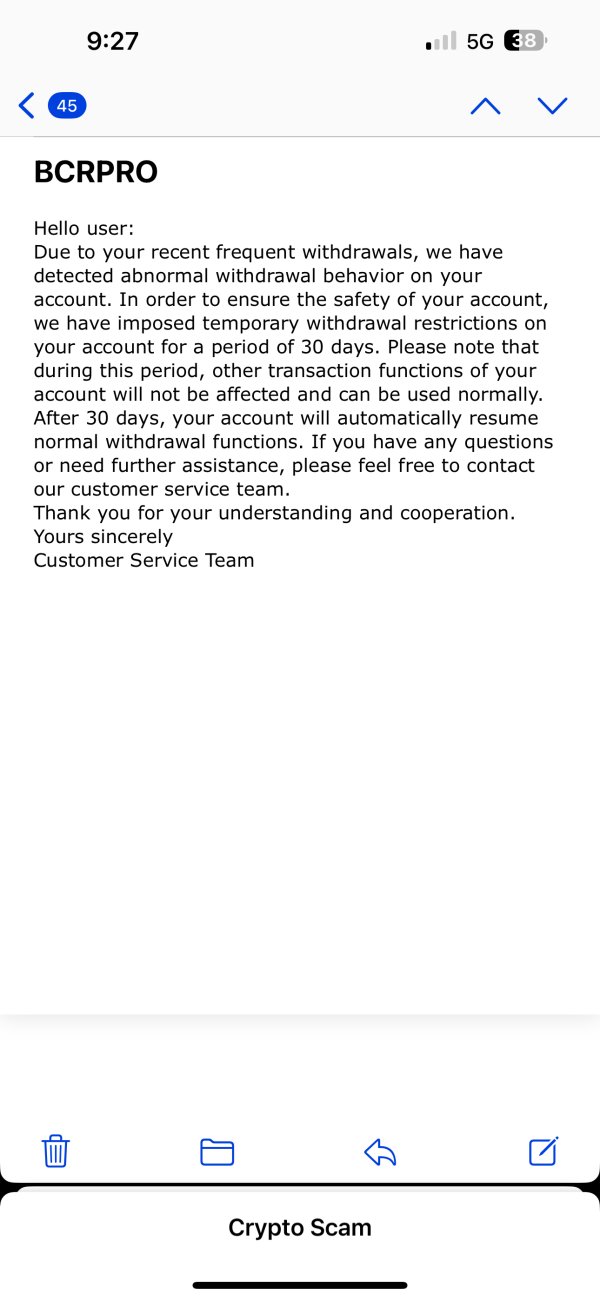

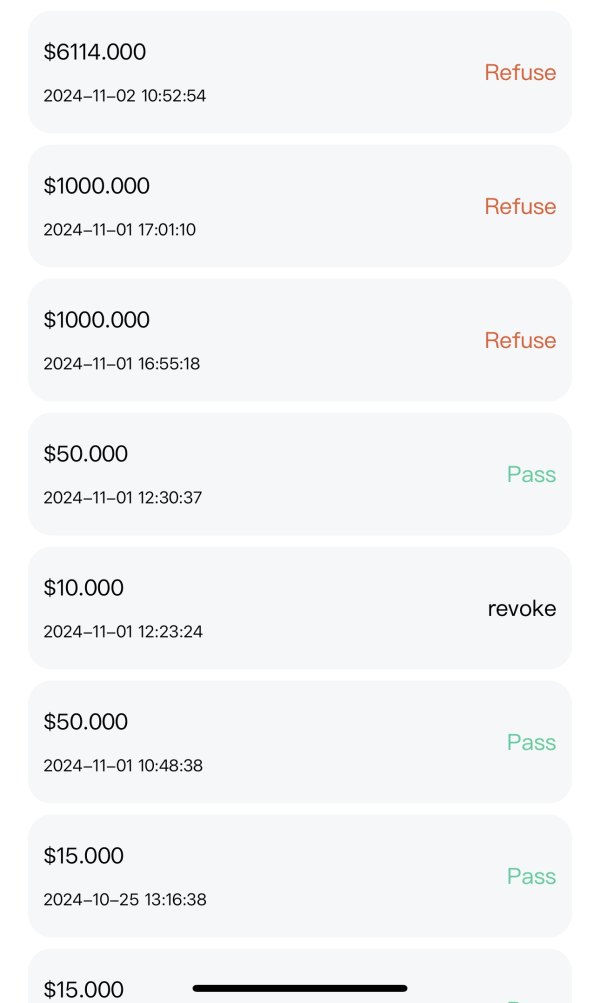

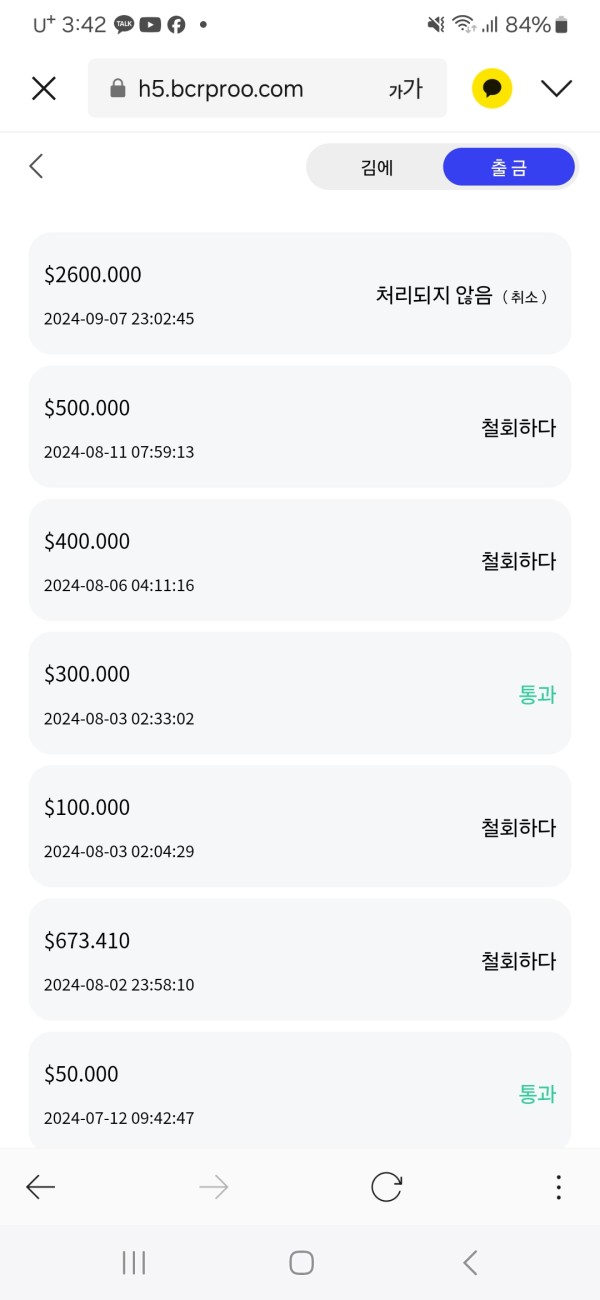

Industry reputation reflects overwhelmingly negative user experiences. Multiple fraud alert publications and user complaint websites feature BCRPRO prominently, which is a serious red flag for potential users. The prevalence of withdrawal complaints and fund retention allegations indicates systematic operational problems that extend beyond isolated incidents and suggest fundamental business practice issues.

User Experience Analysis (Score: 3/10)

Overall user satisfaction remains predominantly negative. Trustpilot ratings of 2.8 reflect widespread dissatisfaction among actual users who have tried the platform. The majority of user reviews focus on withdrawal difficulties and fund accessibility problems, indicating systematic issues with the broker's operational procedures that affect the most important aspect of trading - getting your money back.

Platform usability benefits from MT4's familiar interface that most traders recognize. However, it suffers from reported stability issues and limited customization options that could frustrate users trying to optimize their trading environment. The registration and verification process details remain unclear, potentially creating obstacles for new user onboarding that could delay account activation.

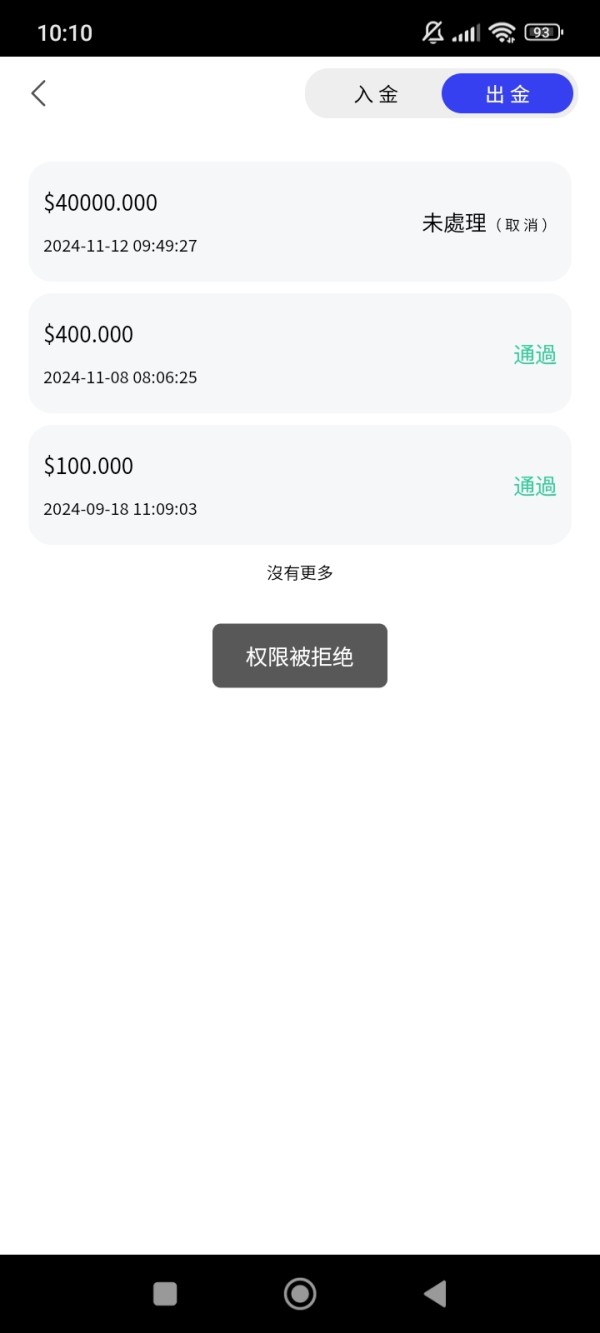

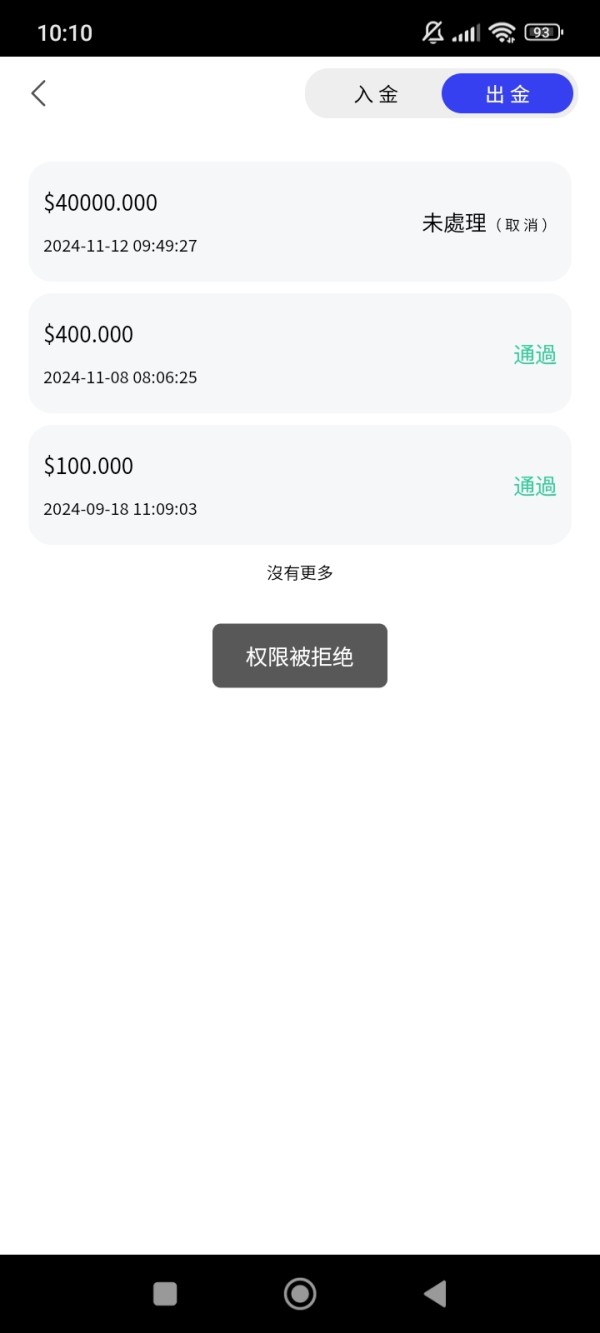

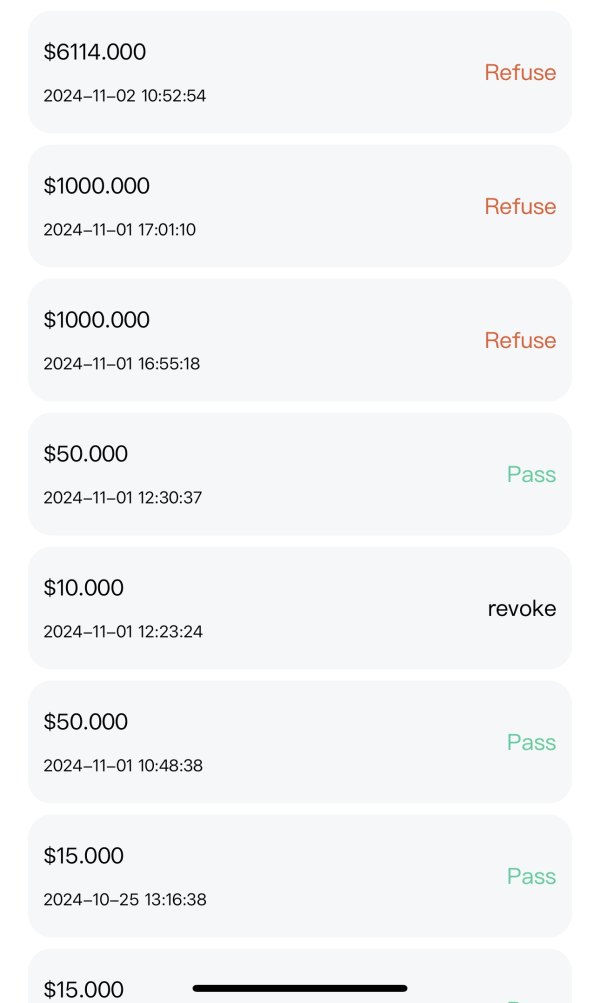

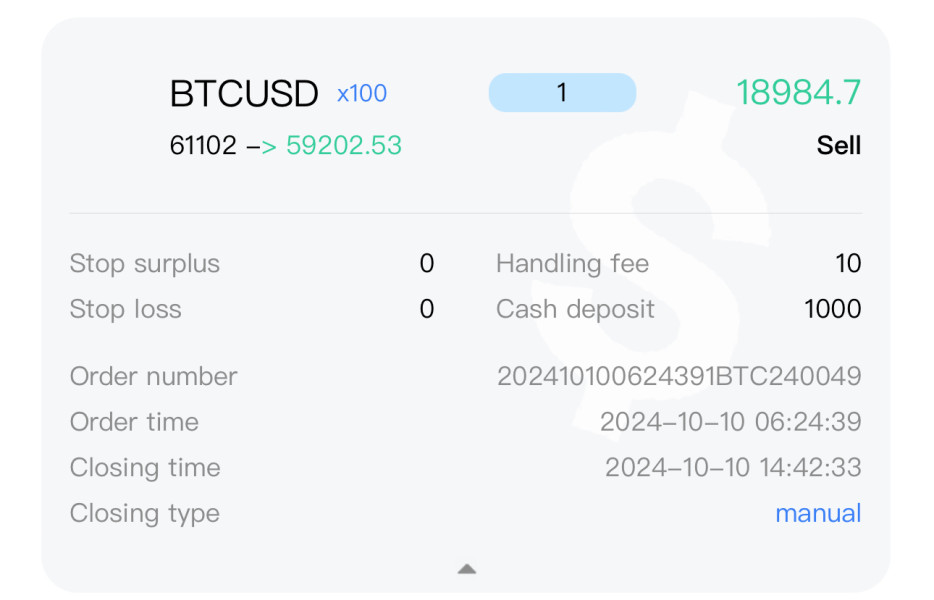

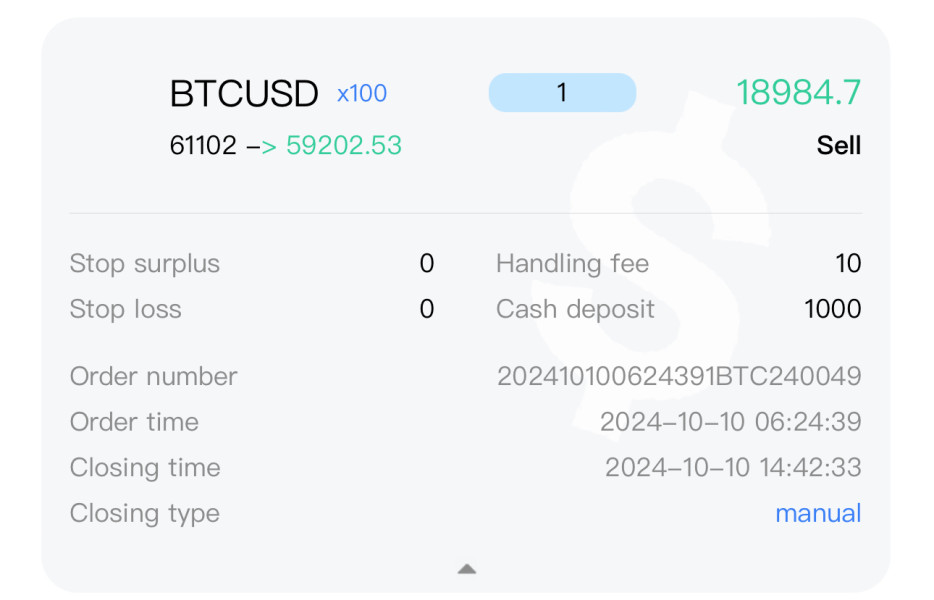

Fund operation experiences represent the most significant user complaint category. Numerous reports detail withdrawal delays, fund retention, and unresponsive customer service regarding financial transactions that are critical to trader confidence. These issues create substantial risk for traders prioritizing capital accessibility and the ability to withdraw profits when needed.

Common user complaints center on withdrawal processing times that extend far beyond industry standards. Users also report unexpected account restrictions and communication difficulties with support staff when trying to resolve account issues. The pattern of negative feedback suggests systematic operational deficiencies rather than isolated service issues that might be expected with any broker. Positive user experiences appear minimal in available feedback, with negative reviews significantly outnumbering favorable assessments across multiple review platforms.

Conclusion

This comprehensive bcrpro review reveals a forex broker with significant operational and regulatory concerns. These problems substantially outweigh any potential trading advantages that the platform might offer to cost-conscious traders. While BCRPRO offers competitive commission structures and MT4 platform access, the absence of verifiable regulatory compliance creates serious concerns about fund safety. Combined with widespread user complaints about withdrawal difficulties, this creates an unacceptably high risk environment for traders who value their capital security.

The broker appears unsuitable for traders prioritizing fund security, regulatory protection, and reliable customer service. The predominance of negative user experiences, particularly regarding fund accessibility, suggests systematic operational problems that extend beyond typical service issues found with legitimate brokers. These problems indicate fundamental business practice concerns that could put trader funds at risk.

Primary advantages include zero commission standard accounts and low ECN spreads that appeal to cost-conscious traders. However, critical disadvantages encompass questionable regulatory status, poor user experience, withdrawal difficulties, and inadequate customer support that create serious operational risks. Given the current evidence available from multiple sources, traders are strongly advised to consider more established, properly regulated alternatives. These alternatives provide transparent operations and reliable fund security measures that protect trader interests and ensure capital accessibility when needed.