Is BCRPRO safe?

Pros

Cons

Is BCRPro a Scam?

Introduction

BCRPro positions itself as an online trading platform that claims to offer a wide range of financial instruments, including forex, cryptocurrencies, and commodities. In the ever-evolving landscape of forex trading, traders must exercise caution and due diligence when selecting a broker. The potential for scams and fraudulent activities in the online trading space is significant, making it imperative for investors to thoroughly assess the credibility and reliability of any broker they consider working with. This article employs a comprehensive investigative approach, utilizing multiple sources and expert analyses to evaluate BCRPro's legitimacy, regulatory status, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

The regulatory status of a broker is crucial in assessing its legitimacy and the safety of clients' funds. BCRPro claims to operate under licenses from various regulatory bodies. However, a closer examination reveals significant discrepancies in its regulatory claims. The table below summarizes the core regulatory information associated with BCRPro:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Not Verified |

| VFSC | N/A | Vanuatu | Not Verified |

| CNMV | N/A | Spain | Warning Issued |

Despite BCRPro's assertions of regulatory compliance, the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC) do not list BCRPro as a licensed entity. Furthermore, the Comisión Nacional del Mercado de Valores (CNMV) of Spain has issued warnings against BCRPro, indicating that it operates without the necessary authorization. This lack of regulatory oversight raises serious concerns about the broker's credibility and the protection of client funds.

Company Background Investigation

BCRPro's company history and ownership structure are essential for understanding its operational integrity. The broker claims to have been established recently, with its domain registered in April 2024. This short operational history is a red flag, as legitimate brokers typically have a well-documented history and established reputations. Additionally, there is limited information available regarding the management team behind BCRPro. Transparency in management is a hallmark of reputable brokers, and the absence of such information raises questions about the broker's intentions.

The lack of clear ownership and management details can lead to a lack of accountability, making it difficult for clients to seek redress in case of disputes. Furthermore, the broker's website does not provide adequate information about its operational practices or financial stability, further undermining its credibility. Overall, the opaque nature of BCRPro's company background is concerning and warrants caution from potential investors.

Trading Conditions Analysis

Understanding the trading conditions offered by BCRPro is essential for evaluating its attractiveness as a broker. The broker claims to provide competitive spreads and commission structures, but customer feedback suggests otherwise. Below is a comparative analysis of the core trading costs associated with BCRPro:

| Cost Type | BCRPro | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.5 pips | 1.2 pips |

| Commission Model | 0% - $6/lot | $5/lot |

| Overnight Interest Range | High | Moderate |

While BCRPro advertises spreads starting from 1.5 pips, this is higher than the industry average of 1.2 pips. Additionally, the commission structure appears to be inconsistent, with some accounts facing high fees on trades. Such discrepancies can lead to unexpected costs for traders, impacting their overall profitability. Furthermore, complaints about hidden fees and unclear pricing policies have surfaced, indicating a lack of transparency that is detrimental to traders.

Client Fund Safety

Client fund safety is paramount in the forex trading environment. BCRPro claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, the absence of regulatory oversight raises questions about the effectiveness of these measures. Segregated accounts are designed to keep client funds separate from the broker's operational funds, ensuring that clients' money is safeguarded in the event of the broker's financial difficulties. Yet, without regulatory verification, the actual implementation of such practices remains uncertain.

Moreover, BCRPro does not provide information regarding negative balance protection, which is essential for mitigating the risks associated with leveraged trading. Historical disputes or issues related to fund safety have not been disclosed, further complicating the assessment of BCRPro's commitment to safeguarding client assets. Overall, the lack of transparency regarding fund safety measures is a significant concern for potential investors.

Customer Experience and Complaints

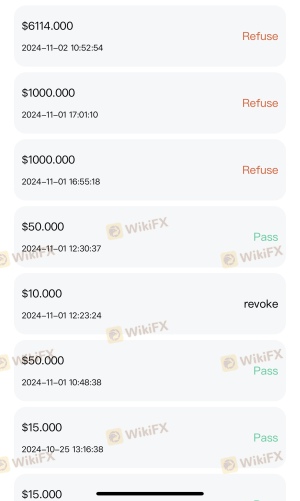

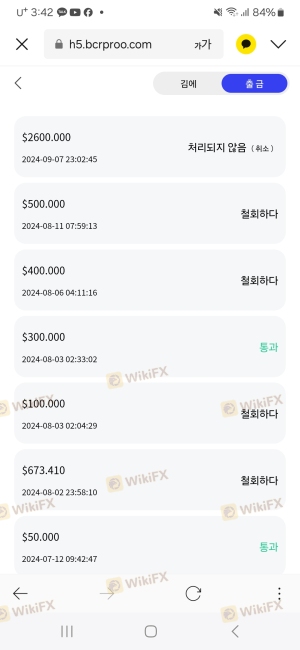

Customer feedback is a vital component in evaluating the reliability of a broker. BCRPro has received numerous negative reviews across various platforms, highlighting common complaints related to withdrawal difficulties, poor customer service, and aggressive sales tactics. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service Quality | Medium | Poor |

| Misleading Information | High | Lack of Clarity |

Many users have reported challenges when attempting to withdraw their funds, often facing unexpected delays or outright refusals. Complaints about unresponsive customer service further exacerbate the situation, leading to frustration and dissatisfaction among clients. Additionally, several reviews have pointed to instances of misleading information regarding trading conditions and expected returns, which can mislead potential investors.

For instance, one user reported being unable to withdraw funds after multiple attempts, only to receive vague responses from customer support. Such experiences indicate systemic issues within BCRPro that could pose significant risks to traders.

Platform and Trade Execution

The performance and reliability of the trading platform are critical factors in a trader's experience. BCRPro claims to offer a user-friendly platform with fast execution speeds. However, user feedback suggests that the platform is plagued by performance issues, including frequent downtimes and slow order processing. These issues can lead to slippage and missed trading opportunities, which are detrimental to traders, especially during volatile market conditions.

Furthermore, there are allegations of potential platform manipulation, with some users reporting instances where their trades were unexpectedly rejected or altered. Such practices, if true, would be highly unethical and indicative of a fraudulent operation. Traders should be cautious and consider the platform's reliability before committing their funds.

Risk Assessment

Engaging with BCRPro involves various risks that potential investors should carefully consider. Below is a summary of the key risk areas associated with trading through BCRPro:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation and oversight |

| Fund Safety Risk | High | Unclear fund protection measures |

| Customer Service Risk | Medium | Poor response to complaints |

| Platform Reliability | High | Frequent downtimes and execution issues |

The overall risk profile associated with BCRPro is concerning, particularly regarding regulatory compliance and fund safety. Traders are advised to exercise extreme caution and consider alternative, more reputable brokers.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that BCRPro exhibits several red flags that warrant serious concern. The lack of regulatory oversight, combined with numerous negative customer experiences, raises significant doubts about the broker's legitimacy. Potential investors should be wary of engaging with BCRPro, as the risks associated with trading on this platform appear to outweigh any potential benefits.

For traders seeking reliable alternatives, it is advisable to consider brokers with established regulatory frameworks, transparent fee structures, and positive customer feedback. Reputable options include brokers regulated by ASIC or FCA, which offer robust investor protection and a higher level of trustworthiness. Always prioritize safety and transparency when choosing a trading partner in the forex market.

Is BCRPRO a scam, or is it legit?

The latest exposure and evaluation content of BCRPRO brokers.

BCRPRO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BCRPRO latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.