AVIC 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive AVIC review examines the Chinese-based financial services provider that operates as a broker dealer in the Asian market. AVIC Securities is headquartered in China and represents a specialized financial institution focusing primarily on the Chinese securities market. While the company maintains a presence in the Asian financial landscape, our analysis reveals significant information gaps regarding specific trading conditions, regulatory frameworks, and operational details that potential investors should carefully consider.

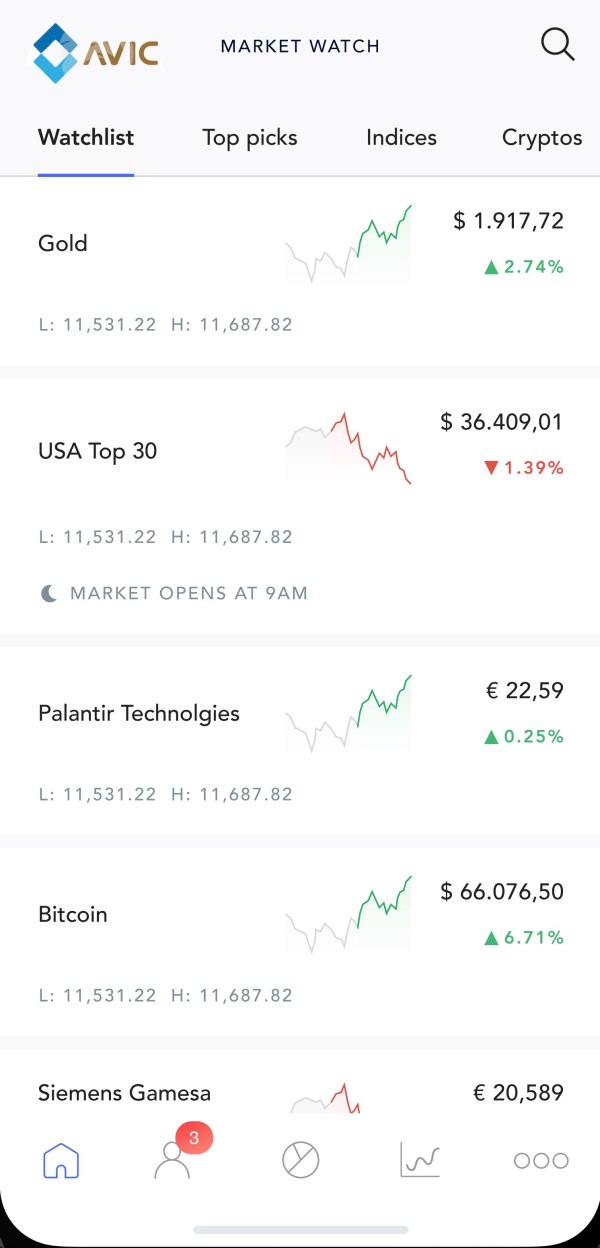

AVIC Securities distinguishes itself through its focus on Chinese market securities. The company particularly emphasizes the aviation and high-technology sectors, aligning with China's broader economic development strategies. The broker appears to cater to investors seeking exposure to Chinese equities, though comprehensive trading platform information and detailed service offerings remain limited in publicly available documentation. Given the restricted availability of detailed operational data, regulatory information, and user feedback, this review maintains a cautious and neutral stance while highlighting the areas where AVIC Securities operates within the Chinese financial ecosystem.

Important Notice

Regional Entity Differences: AVIC Securities operates primarily within the Chinese regulatory framework. This may differ significantly from international brokerage standards and regulations found in other jurisdictions. Potential clients should be aware that trading conditions, regulatory protections, and service offerings may vary considerably from brokers operating under different regulatory regimes such as FCA, CySEC, or ASIC oversight.

Review Methodology: This evaluation is based on publicly available information. It may not reflect the complete scope of AVIC Securities' services or current operational status. Due to limited accessible data regarding specific trading conditions, regulatory details, and user experiences, readers should conduct additional due diligence before making any investment decisions.

Rating Framework

Broker Overview

AVIC Securities operates as a broker dealer within China's financial services sector. The company positions itself as a specialized provider focusing on Chinese market securities and investment opportunities. The company's headquarters in China places it at the center of one of the world's largest and most dynamic financial markets, though specific establishment dates and detailed company history remain unclear from available public information.

The broker's business model centers on providing access to Chinese securities markets. It places particular emphasis on companies within the aviation industry and broader technology sectors. This specialization aligns with China's strategic economic priorities and may appeal to investors seeking targeted exposure to these high-growth sectors. However, the specific scope of services, trading instruments, and client categories served by AVIC Securities requires further clarification through direct company contact.

While AVIC Securities maintains its presence in the Chinese financial landscape, the available information suggests limited international marketing or service provision. This may restrict its accessibility to global investors. The company's operational framework appears designed primarily for domestic Chinese market participation, though this AVIC review cannot definitively confirm geographic restrictions or international service availability without additional detailed information from the broker itself.

Regulatory Framework: Available information does not specify the exact regulatory bodies overseeing AVIC Securities' operations. As a Chinese broker dealer, it likely operates under China Securities Regulatory Commission oversight. Potential clients should verify current regulatory status and applicable protections.

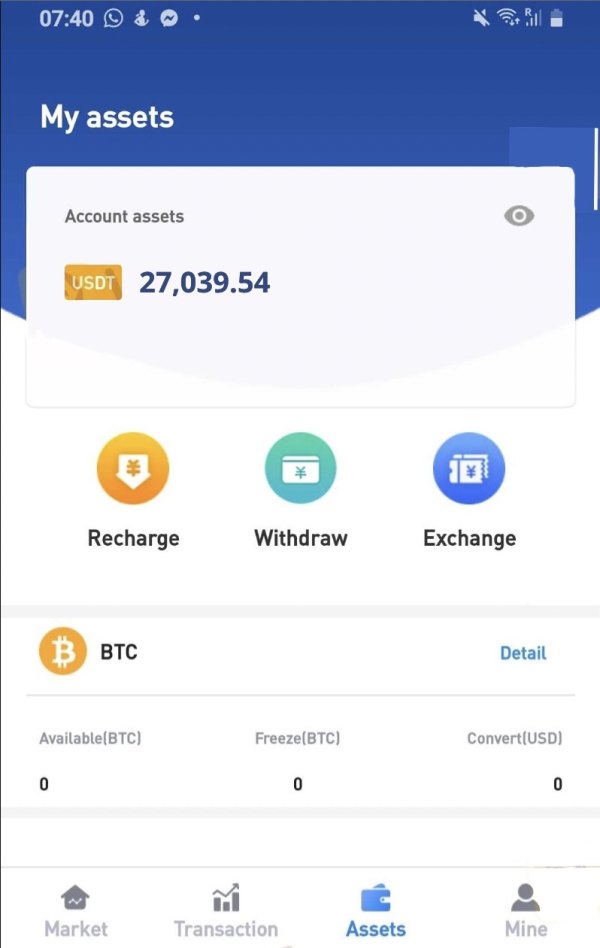

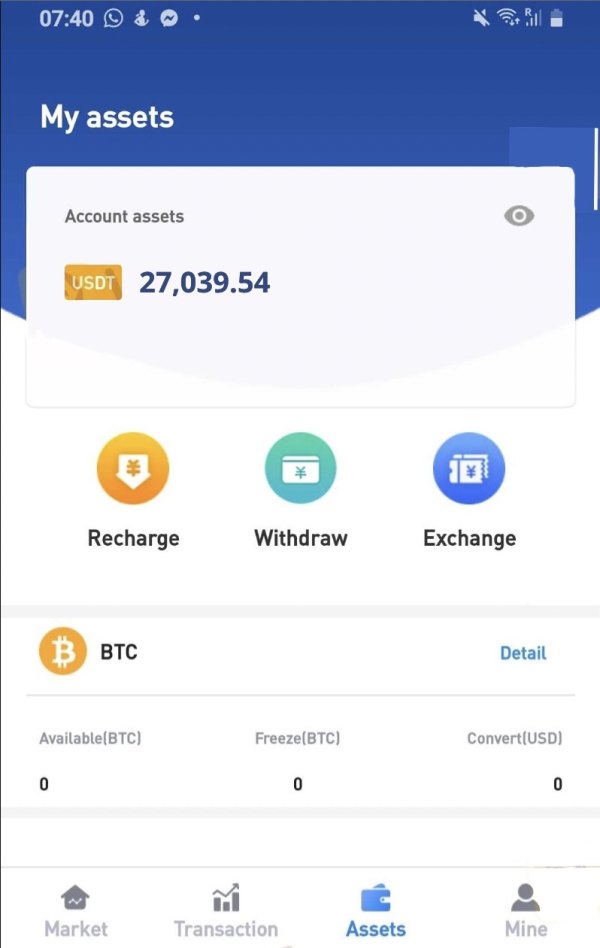

Funding Methods: Specific deposit and withdrawal methods are not detailed in accessible information. Chinese brokers typically support domestic banking systems and payment methods, though international funding options remain unclear.

Minimum Investment Requirements: No specific minimum deposit amounts or account funding requirements are specified in available materials. This necessitates direct inquiry with the broker for current terms.

Promotional Offerings: Information regarding welcome bonuses, promotional campaigns, or special offers is not available in current documentation. This suggests either limited promotional activity or restricted public disclosure.

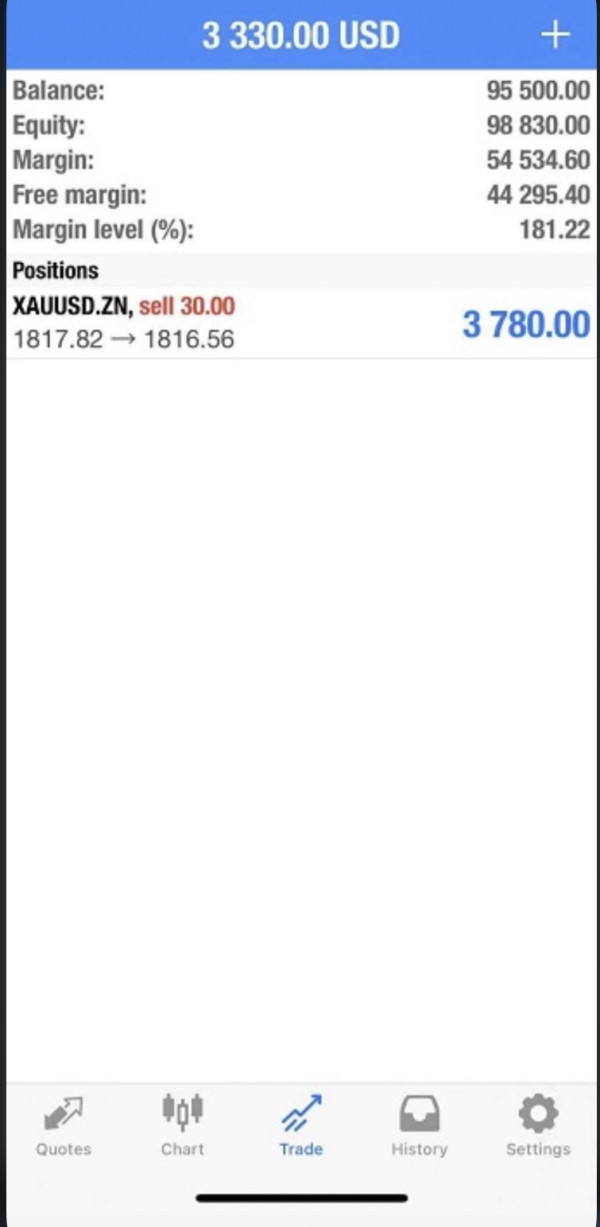

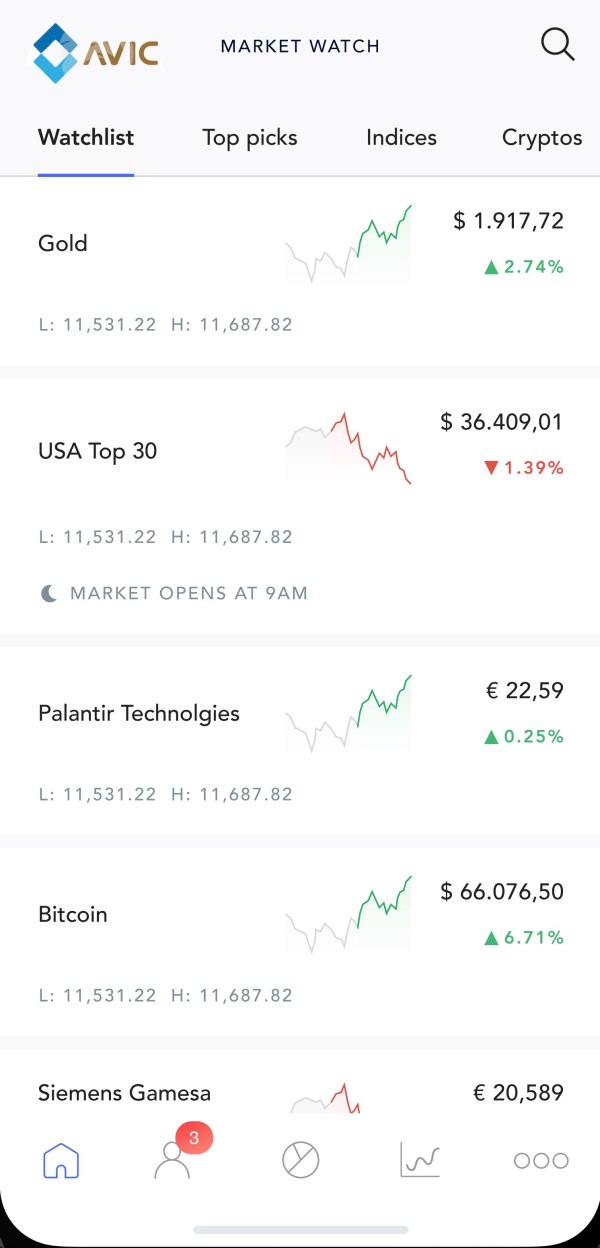

Available Instruments: Focus appears to be on Chinese equities, particularly in aviation and technology sectors. The complete range of tradeable instruments requires confirmation through direct broker contact.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs is not provided in available materials. This represents a significant information gap for potential clients.

Leverage Options: Leverage ratios and margin requirements are not specified in accessible documentation. This is crucial information for risk assessment and trading strategy development.

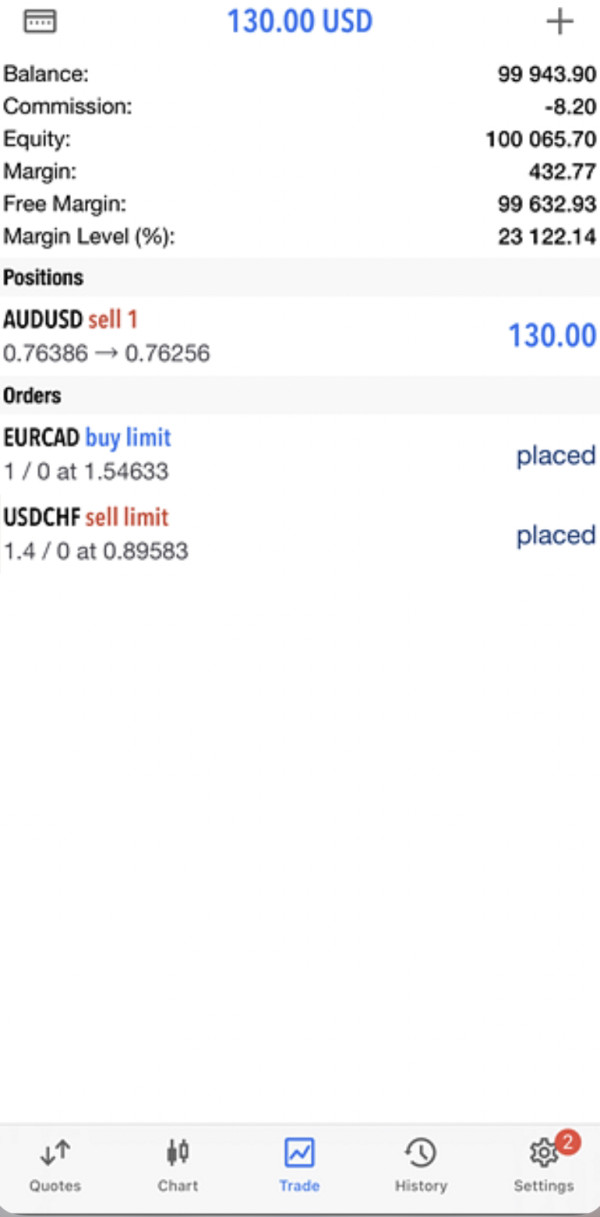

Platform Access: While the broader Chinese market offers various trading platforms including connections to international systems, AVIC Securities' specific platform offerings are not clearly detailed in available information.

Geographic Limitations: Service availability outside China is not clearly specified. The domestic focus suggests potential restrictions for international clients.

Support Languages: Customer service language options are not specified in available materials. Chinese language support would be expected given the company's domestic market focus. This AVIC review highlights the need for direct broker contact to obtain comprehensive service details and current operational information.

Account Conditions Analysis

The evaluation of AVIC Securities' account conditions faces significant limitations due to the absence of detailed information regarding account types, structures, and requirements in publicly available materials. This information gap represents a crucial concern for potential clients seeking to understand the broker's service offerings and accessibility.

Without specific details about account categories, minimum funding requirements, or special account features, potential investors cannot adequately assess whether AVIC Securities aligns with their investment goals and financial capabilities. The lack of transparency regarding account opening procedures, verification requirements, and ongoing account maintenance conditions further complicates the evaluation process.

Chinese broker dealers typically offer various account structures designed for different investor categories. These include individual retail accounts, institutional accounts, and potentially specialized accounts for qualified foreign institutional investors. However, without confirmation from AVIC Securities directly, assumptions about available account types remain speculative.

The absence of information regarding special account features, such as professional trading accounts, managed account options, or accounts designed for specific investment strategies, limits the ability to recommend AVIC Securities for particular investor profiles. Additionally, any potential restrictions based on investor location, citizenship, or investment experience cannot be determined from available materials.

This AVIC review emphasizes the critical need for prospective clients to obtain comprehensive account information directly from AVIC Securities before making any commitment to their services. The current information landscape provides insufficient detail for informed decision-making.

The assessment of AVIC Securities' trading tools and resources encounters substantial limitations due to the lack of specific information regarding the broker's technological offerings, research capabilities, and educational resources in accessible documentation.

Modern brokerage services typically encompass a comprehensive suite of trading tools including advanced charting capabilities, technical analysis indicators, market scanners, and automated trading support. However, without detailed information about AVIC Securities' specific tool offerings, potential clients cannot evaluate the broker's technological competitiveness or suitability for their trading strategies.

Research and analysis resources represent another critical component of broker evaluation. This is particularly important for investors focused on Chinese markets where local expertise and insights can provide significant value. The absence of information regarding AVIC Securities' research team, market analysis publications, or access to third-party research services creates uncertainty about the analytical support available to clients.

Educational resources, including market education materials, webinars, tutorials, and trading guides, play an increasingly important role in broker selection. This is especially true for investors seeking to understand Chinese market dynamics and regulatory environments. The lack of available information about AVIC Securities' educational offerings limits the ability to assess their commitment to client development and market education.

The integration capabilities with third-party tools, APIs for algorithmic trading, and mobile platform functionality remain unclear from available materials. This represents significant information gaps for technology-focused traders and institutional clients requiring specific technological integrations.

Customer Service and Support Analysis

Evaluating AVIC Securities' customer service and support capabilities proves challenging due to the absence of detailed information regarding support channels, service quality, and client assistance frameworks in publicly available materials.

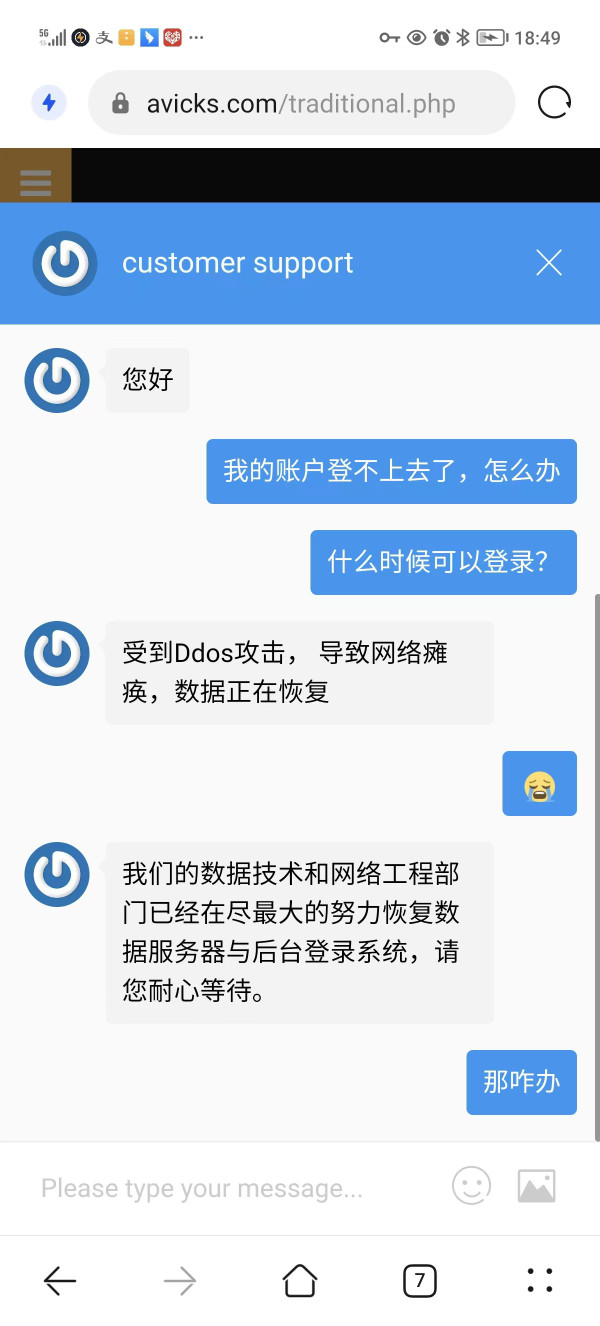

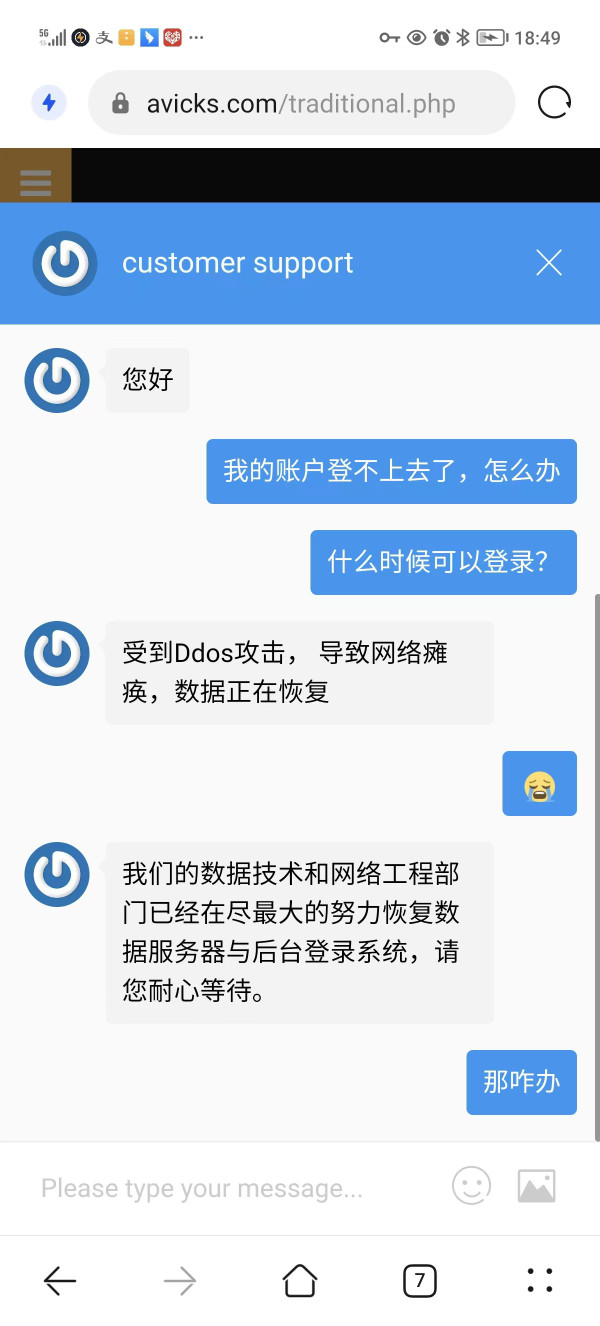

Effective customer support encompasses multiple communication channels including phone support, email assistance, live chat capabilities, and potentially in-person service options. The lack of specific information about AVIC Securities' support infrastructure prevents assessment of accessibility and convenience for potential clients across different time zones and communication preferences.

Response time commitments, service level agreements, and support availability hours represent crucial factors in broker selection. This is particularly important for active traders requiring timely assistance with trading issues or account concerns. Without documented service standards or client testimonials, the evaluation of AVIC Securities' support responsiveness remains incomplete.

Language support capabilities are particularly relevant for brokers operating in the Chinese market. Multilingual assistance may be necessary for international clients or overseas Chinese investors. The absence of information regarding language options and cultural competency in client service represents a notable information gap.

The availability of dedicated account management, premium support tiers for high-value clients, and specialized assistance for institutional customers cannot be determined from available materials. These service differentiators often distinguish professional brokerage services from basic trading platforms.

Problem resolution procedures, escalation pathways, and client complaint handling processes remain unspecified in accessible documentation. This limits the ability to assess AVIC Securities' commitment to client satisfaction and dispute resolution effectiveness.

Trading Experience Analysis

The analysis of trading experience with AVIC Securities faces significant constraints due to limited information regarding platform performance, execution quality, and overall trading environment characteristics in available documentation.

Platform stability and execution speed represent fundamental aspects of trading experience. These factors directly impact trader success and satisfaction. Without specific performance metrics, uptime statistics, or execution quality data, potential clients cannot assess AVIC Securities' technological reliability or competitive positioning in trade execution.

Order execution quality, including fill rates, slippage characteristics, and execution speed across different market conditions, remains unspecified in available materials. These factors are particularly crucial for active traders and institutional clients requiring consistent execution performance across varying market volatility levels.

The trading interface design, functionality depth, and user experience quality cannot be evaluated without access to platform demonstrations or detailed feature documentation. Modern trading platforms require intuitive design combined with comprehensive functionality to meet diverse client needs from basic investors to sophisticated traders.

Mobile trading capabilities, cross-device synchronization, and offline functionality represent increasingly important aspects of trading experience. Investors expect seamless access across multiple devices and locations. The absence of information regarding AVIC Securities' mobile platform offerings limits assessment of their adaptation to current market expectations.

Risk management tools, position monitoring capabilities, and automated trading features remain unspecified in accessible materials. This represents crucial functionality gaps for comprehensive trading experience evaluation. This AVIC review emphasizes the need for direct platform evaluation before making trading commitments.

Trust and Reliability Analysis

Assessing AVIC Securities' trustworthiness and reliability presents substantial challenges due to the absence of detailed regulatory information, compliance frameworks, and transparency measures in publicly available documentation.

Regulatory oversight and compliance represent the foundation of broker trustworthiness. These provide legal protections and operational standards that safeguard client interests. The lack of specific information regarding AVIC Securities' regulatory status, licensing details, and compliance history prevents adequate assessment of the legal protections available to potential clients.

Client fund protection measures, including segregated account structures, deposit insurance coverage, and bankruptcy protection procedures, remain unspecified in available materials. These safeguards are crucial for client confidence and represent standard expectations in regulated brokerage environments.

Corporate transparency, including financial reporting, ownership structure disclosure, and operational transparency, cannot be evaluated without access to detailed company information. Public companies typically provide greater transparency through regular financial disclosures, while private entities may offer limited visibility into their operational status.

Industry reputation, peer recognition, and regulatory standing require verification through independent sources and regulatory databases. The absence of readily available information regarding AVIC Securities' industry position and regulatory history necessitates additional due diligence by potential clients.

Third-party auditing, compliance certifications, and international standard adherence represent additional trust indicators that remain unclear from available documentation. Professional brokerage services typically maintain various certifications and undergo regular auditing to demonstrate operational integrity and client protection commitment.

User Experience Analysis

The evaluation of user experience with AVIC Securities encounters significant limitations due to the absence of user feedback, satisfaction surveys, and detailed interface information in accessible materials.

Overall user satisfaction typically encompasses platform usability, service quality, problem resolution effectiveness, and value proposition assessment. Without access to client testimonials, satisfaction ratings, or independent user reviews, the evaluation of AVIC Securities' user experience remains incomplete.

Interface design quality, navigation efficiency, and feature accessibility represent crucial components of user experience. This is particularly important for clients managing complex portfolios or requiring frequent trading activity. The lack of detailed platform information prevents assessment of design quality and usability standards.

Account opening and verification procedures often provide the first impression of broker efficiency and client focus. Without specific information regarding onboarding processes, documentation requirements, and verification timelines, potential clients cannot anticipate the initial service experience.

Fund management experience, including deposit processing, withdrawal procedures, and account funding options, significantly impacts overall user satisfaction. The absence of detailed information regarding financial transaction processes represents a notable evaluation gap.

Common user concerns, frequently reported issues, and typical complaint categories remain unidentified in available materials. This prevents proactive assessment of potential service limitations or operational challenges that clients might encounter during their relationship with AVIC Securities.

Conclusion

This comprehensive AVIC review reveals significant information limitations that prevent a definitive assessment of AVIC Securities' services and capabilities. While the broker operates within China's substantial financial market and focuses on Chinese securities, the absence of detailed information regarding trading conditions, regulatory framework, and user experience creates substantial uncertainty for potential clients.

AVIC Securities may appeal to investors specifically seeking exposure to Chinese markets. The company particularly focuses on aviation and technology sectors, though the lack of comprehensive service information necessitates extensive due diligence before engagement. The broker's domestic market focus and specialized sector expertise could provide value for appropriate investor profiles, but the current information landscape offers insufficient detail for confident recommendation.

Potential clients should prioritize direct contact with AVIC Securities to obtain comprehensive information regarding account conditions, trading platforms, regulatory protections, and service offerings before making any investment commitments. The significant information gaps identified in this review underscore the importance of thorough verification and detailed service evaluation through direct broker engagement.