Ubuntu Invest 2025 Review: Everything You Need to Know

Summary

This ubuntu invest review gives you a complete look at Ubuntu Invest. Ubuntu Invest is an online trading platform that operates under FSCA regulation in South Africa, and based on what we found and user feedback, it shows both good and bad sides in the competitive trading world. The platform lets you trade multiple types of assets including stocks, commodities, indices, and forex through the MetaTrader 5 platform. This makes it a multi-asset investment solution.

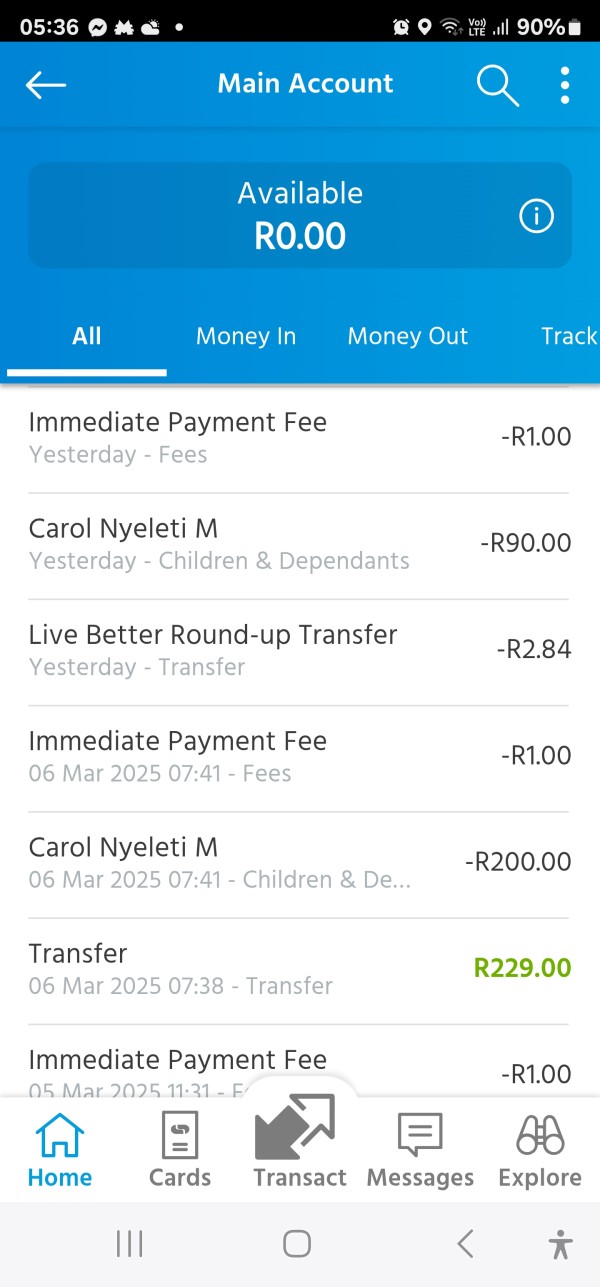

Ubuntu Invest has a TrustIndex user rating of 3.8. This shows that users have both positive and negative experiences with the platform, which mainly serves beginner and intermediate traders who want different investment options. However, user feedback shows problems with technical issues, withdrawal delays, and customer service quality that you should think about carefully. The FSCA regulation (License No. FSP 51420) gives some oversight. But service quality may change depending on where you live.

Ubuntu Invest offers basic trading tools through MT5 and access to multiple assets. However, the platform has problems with user trust and service delivery that hurt its position in the market.

Important Notice

Regional Entity Differences: Users in different parts of the world may see different rules, service quality, and platform features when using Ubuntu Invest services. The rules and protection measures may be very different based on where you live and which Ubuntu Invest entity serves your area.

Review Methodology: This complete review uses public information, regulatory filings, user feedback from different review sites, and standard industry assessment criteria. The analysis uses data from multiple sources to give you an objective overview of Ubuntu Invest's services and performance, and all information reflects the most current data available when this was published.

Rating Framework

Broker Overview

Ubuntu Invest works as an online trading platform based in Sandton, South Africa. The company focuses on giving multi-asset investment services to retail and institutional clients, and it has made a place for itself in the South African financial services market by offering access to different asset classes including stocks, cryptocurrencies, commodities, indices, and foreign exchange markets. According to company information, Ubuntu Invest wants to make global financial markets accessible through technology-driven solutions.

The platform's business model focuses on giving complete trading services through established trading infrastructure. It mainly uses the MetaTrader 5 platform to serve its clients, and Ubuntu Invest operates under the regulatory oversight of the Financial Sector Conduct Authority (FSCA) in South Africa with license number FSP 51420, which gives a foundation of regulatory compliance for its operations.

The broker targets different types of clients from new investors who want exposure to multiple asset classes to more experienced traders who need advanced trading tools. This ubuntu invest review shows that the platform positions itself as an easy entry point for South African investors who want to participate in both local and international markets through one trading account.

Regulatory Jurisdiction: Ubuntu Invest operates under the regulation of the Financial Sector Conduct Authority (FSCA) in South Africa with license number FSP 51420. This regulatory framework gives consumer protection measures and operational oversight according to South African financial services legislation.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available documentation. Clients should contact the broker directly for complete information about funding options and processing procedures.

Minimum Deposit Requirements: The minimum deposit requirements are not specified in available materials. This means potential clients need to ask Ubuntu Invest directly for current account opening requirements.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in publicly available information. Prospective clients should verify any promotional terms directly with the broker.

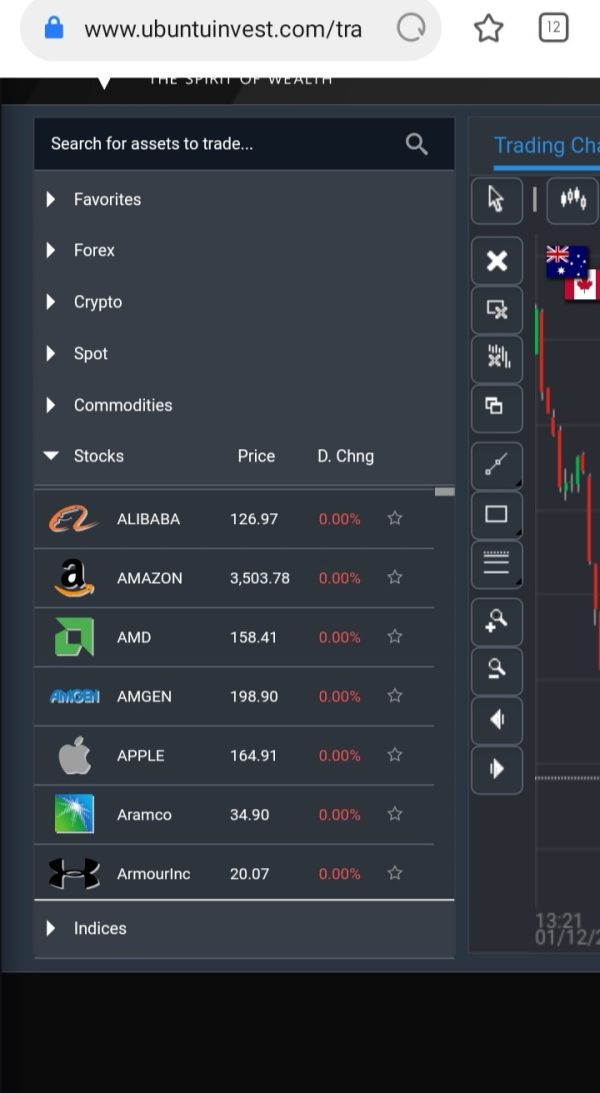

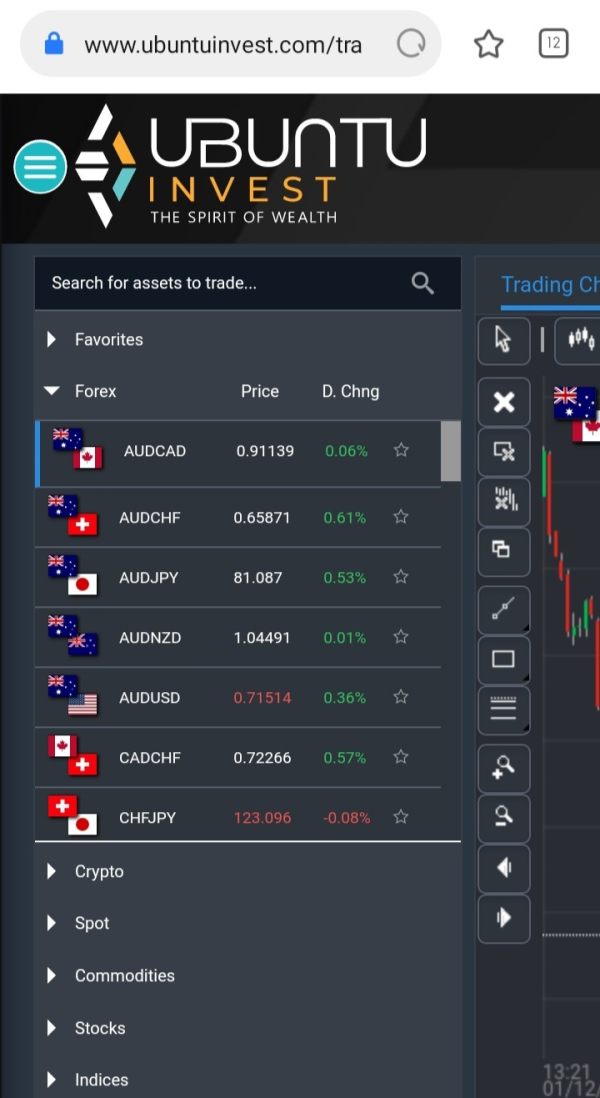

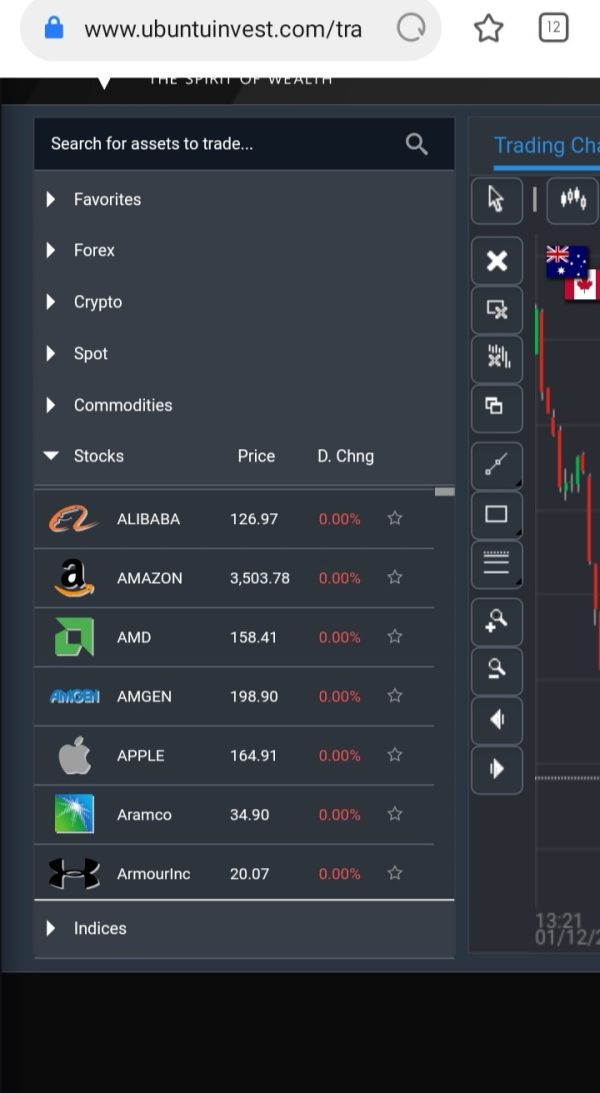

Tradeable Assets: The platform gives access to multiple asset classes including stocks, commodities, indices, and foreign exchange markets. This diverse offering lets clients build varied investment portfolios across different market sectors.

Cost Structure: Specific information about spreads, commissions, and fee structures is not detailed in available documentation. This ubuntu invest review recommends contacting the broker directly for complete pricing information.

Leverage Ratios: Leverage offerings are not specified in available materials. They may vary based on asset class and regulatory requirements.

Platform Options: Ubuntu Invest provides trading services through the MetaTrader 5 platform. This gives clients access to advanced charting, analysis tools, and automated trading capabilities.

Regional Restrictions: Specific geographical restrictions are not detailed in available information.

Customer Service Languages: Available customer service languages are not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions evaluation for Ubuntu Invest shows significant information gaps that impact the overall assessment. Available documentation does not give specific details about account types, tier structures, or the features that come with different account levels, and this lack of transparency makes it hard for potential clients to understand what services and benefits they can expect based on their investment level or trading frequency.

Minimum deposit requirements remain unspecified in publicly available materials. This prevents prospective clients from properly planning their initial investment, and the absence of clear information about account opening procedures, verification requirements, and timeline expectations further complicates the client onboarding process. Additionally, specialized account options such as Islamic accounts, professional trader accounts, or institutional services are not detailed in current documentation.

The platform's approach to account management and client segmentation appears limited based on available information. This ubuntu invest review identifies the need for more complete account condition disclosure to help potential clients make informed decisions about platform suitability for their trading needs and investment objectives.

Ubuntu Invest shows solid performance in the tools and resources category mainly through its provision of the MetaTrader 5 platform. MT5 offers complete charting capabilities, technical analysis tools, and support for automated trading strategies through Expert Advisors, and the platform's multi-asset functionality aligns well with Ubuntu Invest's diverse asset offering, allowing clients to manage stocks, forex, commodities, and indices from a single interface.

The MetaTrader 5 platform provides essential trading tools including advanced order types, risk management features, and real-time market data. However, based on user feedback mentioning technical issues, the platform's stability and performance may occasionally impact the trading experience, and the availability of mobile trading through MT5 mobile applications extends accessibility for clients requiring on-the-go trading capabilities.

While the core trading platform offers solid functionality, specific information about additional research resources, market analysis, educational materials, or proprietary trading tools is not detailed in available documentation. The platform appears to rely mainly on MetaTrader 5's built-in capabilities rather than developing extensive proprietary resources or educational content for client support.

Customer Service and Support Analysis (6/10)

Customer service evaluation for Ubuntu Invest presents mixed results based on available user feedback and operational information. While specific customer service channels, operating hours, and response time targets are not detailed in available documentation, user experiences show areas requiring improvement in service delivery and technical support.

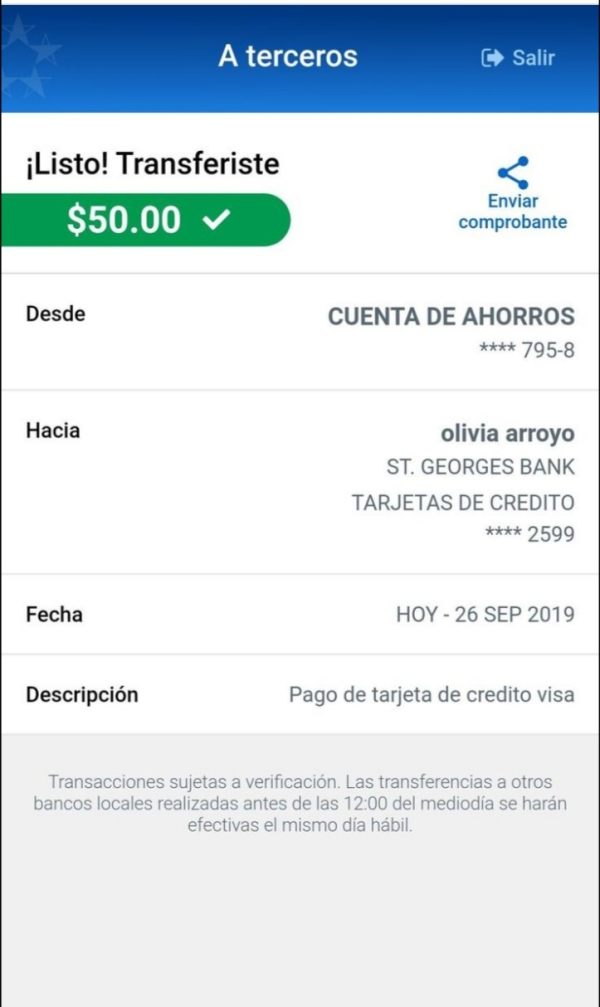

User feedback highlights concerns about withdrawal processing delays. This suggests that back-office operations may face efficiency challenges, and some clients have reported technical difficulties that required customer service intervention, though the resolution effectiveness appears inconsistent based on varying user experiences. The platform's ability to handle customer inquiries and resolve issues promptly remains a concern for potential clients.

The absence of detailed information about customer service availability, multilingual support options, and escalation procedures indicates potential gaps in service infrastructure. This ubuntu invest review notes that improved customer service disclosure and performance could significantly enhance the overall client experience and platform credibility in the competitive trading market.

Trading Experience Analysis (6/10)

The trading experience evaluation reveals both strengths and challenges in Ubuntu Invest's platform delivery. The MetaTrader 5 platform provides a familiar and functional trading environment for clients experienced with this widely-used platform, but user feedback indicates technical issues that can impact trading activities and overall platform reliability.

Platform stability concerns mentioned in user reviews suggest that traders may occasionally experience disruptions that could affect order execution and market access. While MT5 generally offers robust functionality for trade management, analysis, and automated trading, the implementation quality and technical support appear to vary based on user experiences.

Order execution quality, spread competitiveness, and slippage management are not specifically detailed in available documentation. This makes it difficult to assess the platform's performance during various market conditions, and the trading environment's overall reliability and consistency remain areas where this ubuntu invest review identifies potential improvement opportunities to enhance client satisfaction and trading outcomes.

Trust and Safety Analysis (4/10)

Trust and safety assessment reveals significant concerns that impact Ubuntu Invest's credibility in the market. While the platform operates under FSCA regulation with license FSP 51420, user feedback includes serious allegations with some clients referring to the platform as fraudulent, and these trust concerns significantly impact the platform's reputation and potential client confidence.

The regulatory framework provided by FSCA offers some consumer protection measures. But the effectiveness of these protections in addressing user concerns appears limited based on available feedback, and specific information about client fund segregation, deposit insurance, and security measures is not detailed in available documentation, creating uncertainty about asset protection protocols.

Withdrawal delays mentioned in user feedback raise additional concerns about the platform's operational integrity and financial management practices. The combination of negative user experiences and limited transparency about safety measures contributes to the lower trust rating, so potential clients should carefully consider these factors and conduct thorough due diligence before engaging with the platform.

User Experience Analysis (5/10)

User experience evaluation reflects the mixed nature of client interactions with Ubuntu Invest, as evidenced by the 3.8 TrustIndex rating. This moderate rating indicates a combination of positive and negative experiences among the platform's user base, suggesting inconsistent service delivery and platform performance.

The platform appears to serve beginner and intermediate traders adequately in terms of basic functionality and asset access. However, user complaints about technical issues and withdrawal processing indicate that the operational execution does not consistently meet client expectations, and the user interface and platform navigation experience are not specifically detailed in available feedback, limiting assessment of these crucial usability factors.

Registration and account verification processes are not comprehensively documented. Though user experiences suggest potential areas for streamlining and improvement, the overall user journey from account opening through active trading appears to face various friction points that impact satisfaction levels. Enhanced operational efficiency and technical reliability could significantly improve the user experience rating for Ubuntu Invest.

Conclusion

This comprehensive ubuntu invest review reveals a trading platform with both opportunities and significant challenges. Ubuntu Invest operates as a regulated entity under FSCA oversight, providing access to multiple asset classes through the established MetaTrader 5 platform, but user trust concerns, service delivery issues, and operational challenges impact the platform's overall market position.

The platform appears most suitable for beginner and intermediate traders seeking diversified asset exposure in the South African market. However, they should carefully consider the associated risks and limitations, and the main advantages include regulatory oversight, multi-asset access, and MT5 platform availability, while primary disadvantages include withdrawal delays, technical support deficiencies, and trust concerns raised by user experiences.

Potential clients should conduct thorough due diligence, consider alternative platforms, and carefully evaluate their risk tolerance before engaging with Ubuntu Invest's services.