SCEID 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

SCEID emerges as a broker presenting potentially low-cost trading options primarily aimed at new and inexperienced traders who may not have the tools to effectively evaluate broker legitimacy. Catering primarily to the UK market and leveraging suspicious regulatory licenses, the firm touts its ability to facilitate multiple financial instruments, including Forex trading. However, its unregulated status poses significant risks for these investors, as the absence of oversight raises alarms regarding the security of their funds and potential hidden fees. This article will provide an in-depth review of SCEID, including a comprehensive risk assessment and insights into whether it is a viable trading option.

⚠️ Important Risk Advisory & Verification Steps

Investment in SCEID may expose you to significant risks, including:

- Lack of Regulation: SCEID is not regulated by any reputable authority which puts client funds at severe risk.

- Suspicious Licenses: Its questionable operational licenses could indicate potential for deceitful business practices.

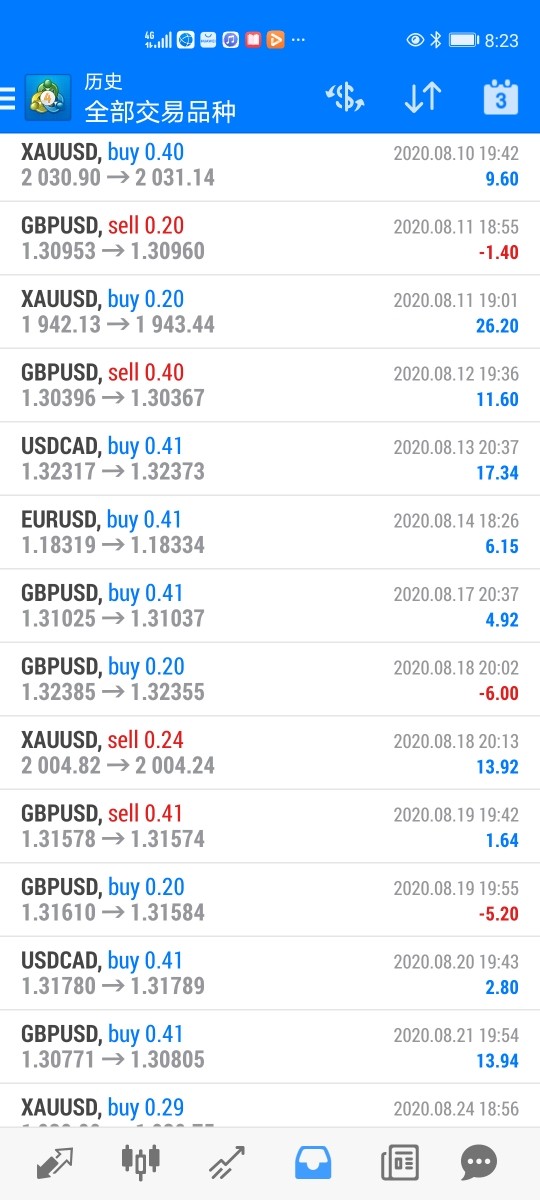

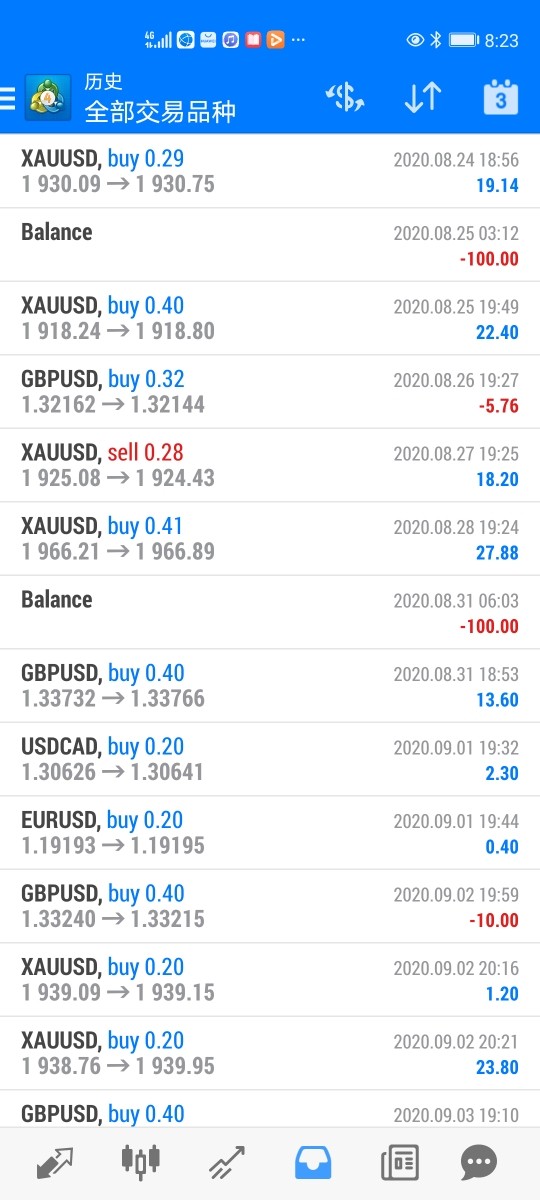

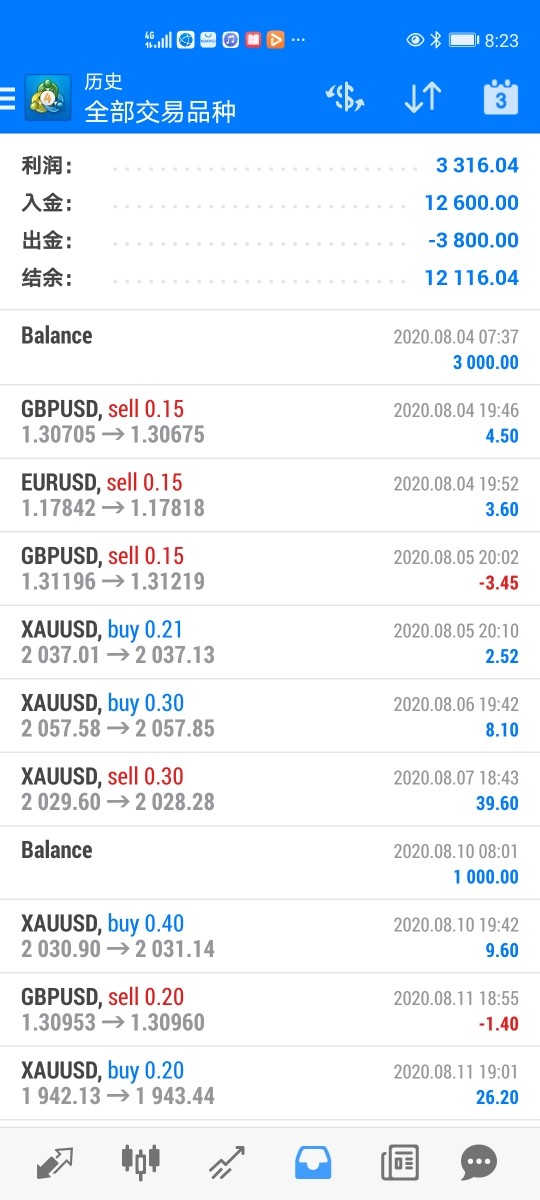

- Negative User Feedback: Numerous reports highlight withdrawal issues and exorbitant fees, contributing to an overall low trust factor among users.

Before engaging with SCEID, consider these verification steps:

- Research the Broker‘s Reputation: Look for reviews, ratings, and any existing complaints against SCEID.

- Understand the Fee Structure: Carefully read terms associated with withdrawal, trading, or additional service charges.

- Monitor Performance: Keep an eye on order execution and the overall trading experience.

- Utilize Regulatory Websites: Verify information through sites like FCA or SEC to ensure that the broker meets compliance standards.

- Stay Skeptical of Too-Good-To-Be-True Offers: If something sounds excessively favorable, it’s typically a cause for concern.

Rating Framework

Broker Overview

Company Background and Positioning

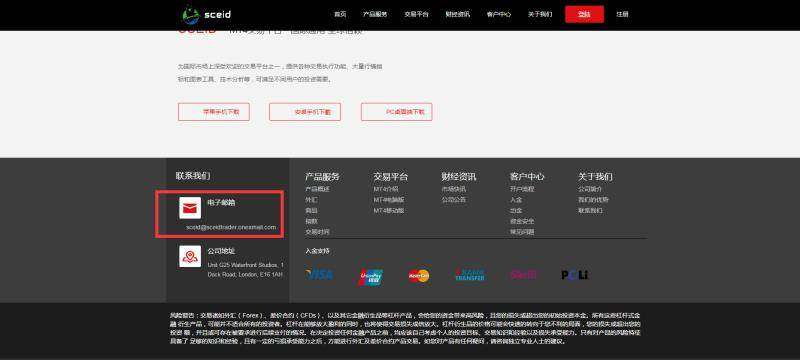

Founded recently and registered in the UK, SCEID operates in a competitive market but lacks the regulatory support that most brokers have. There is scarcity of information regarding its founding, and its legitimacy is questionable due to the absence of oversight from recognized authorities which often help bolster trust. The operational status of the broker has prompted skepticism among investors, both new and experienced.

Core Business Overview

SCEID's main business activities focus on providing access to various asset classes, primarily through Forex trading. However, it does so under dubious regulatory licenses, raising red flags about the safety of traders' funds. The broker promotes trading via a proprietary platform, claiming robust technological support for executing trades across multiple markets. Unfortunately, user reviews indicate that the claimed technological support might not be as reliable as advertised.

Quick Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

SCEID operates without regulation from reputed bodies such as the FCA or SEC. This absence of oversight raises suspicions regarding the broker's operational legitimacy. Reports from various sources indicate that SCEID's regulatory licenses lack credibility, leading to concerns about possible fraudulent practices.

User Self-Verification Guide

To ensure that you are trading with a legitimate broker, consider the following steps:

- Visit Regulatory Websites: Check if the broker is listed on the regulatory websites relevant to your country, such as the FCA or ASIC.

- Look for Reviews: Search for reviews from other traders to gauge the broker's reputation.

- Monitor Online Forums: Engage in discussions about the broker on platforms where users report their experiences.

- Check their Licenses: Validate the brokers regulatory licenses directly though applicable government agencies.

Industry Reputation and Summary

User feedback provides a grave insight into the trustworthiness of SCEID. Negative experiences are prevalent, especially concerning fund withdrawals and overall customer service. This necessitates a cautious approach for potential investors.

Trading Costs Analysis

Advantages in Commissions

SCEID markets itself as providing competitive commission structures, appealing particularly to new traders seeking to keep initial costs low. This edge in commission rates makes it potentially attractive for beginners.

The "Traps" of Non-Trading Fees

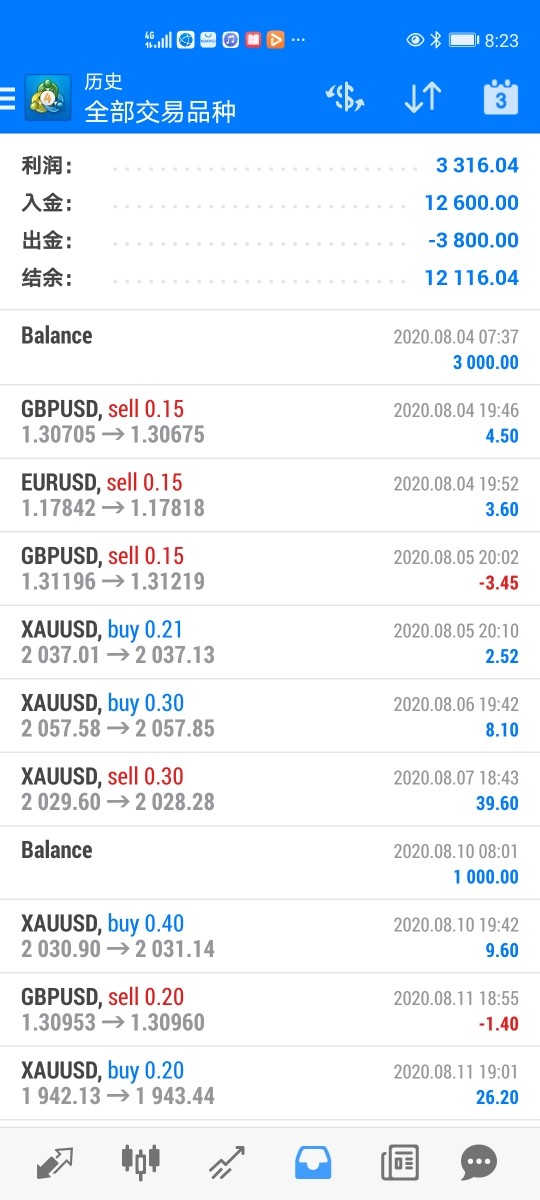

Despite its competitive commission structure, SCEID hides multiple fees that can significantly eat into profits, as highlighted by users:

I was charged $30 for each withdrawal. It felt like a big hit after my initial investments."

This practice might mislead clients into believing they're receiving better deals than they actually are. Attention to such hidden fees is crucial for cost-effective trading.

Cost Structure Summary

While beginner traders may find SCEID appealing due to lower commission costs, the overall fee structure—with various hidden charges—creates a financial trap that can derail the trading experience.

SCEID offers a selection of trading platforms, including web-based and mobile trading options. However, the variety of tools within these platforms lacks depth and sophistication, particularly for more advanced traders.

The resources available through SCEID are modest, with limited educational tools or trading strategies that could enhance user experience. Users have pointed out deficiencies in educational resources:

"Theres little guidance on trading strategies; I was left to figure things out on my own."

These gaps in support heighten the risks involved in trading with this broker.

Many users report frustration with the performance of the trading platforms. Complaints often mention lag during high volatile periods and issues with order execution. Overall, user feedback reflects a challenging experience that reduces confidence in SCEIDs technology.

User Experience Analysis

Overall Experience Overview

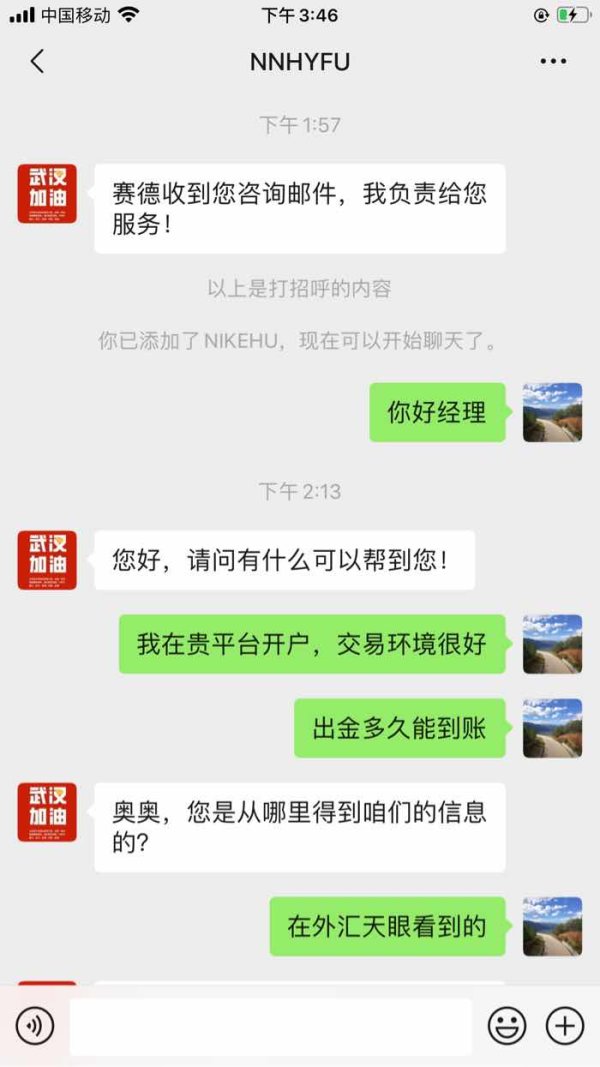

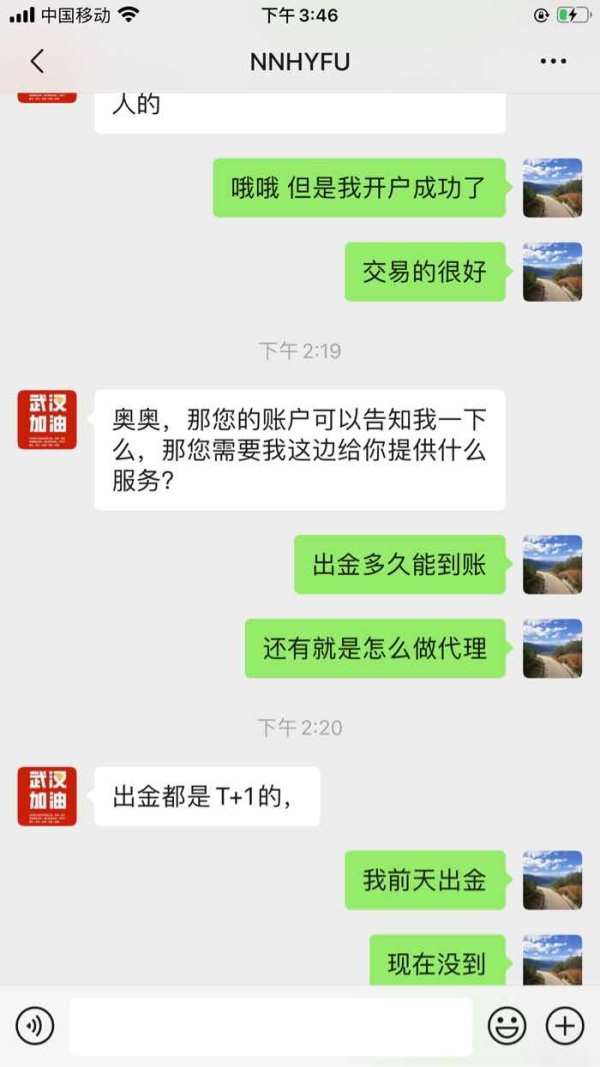

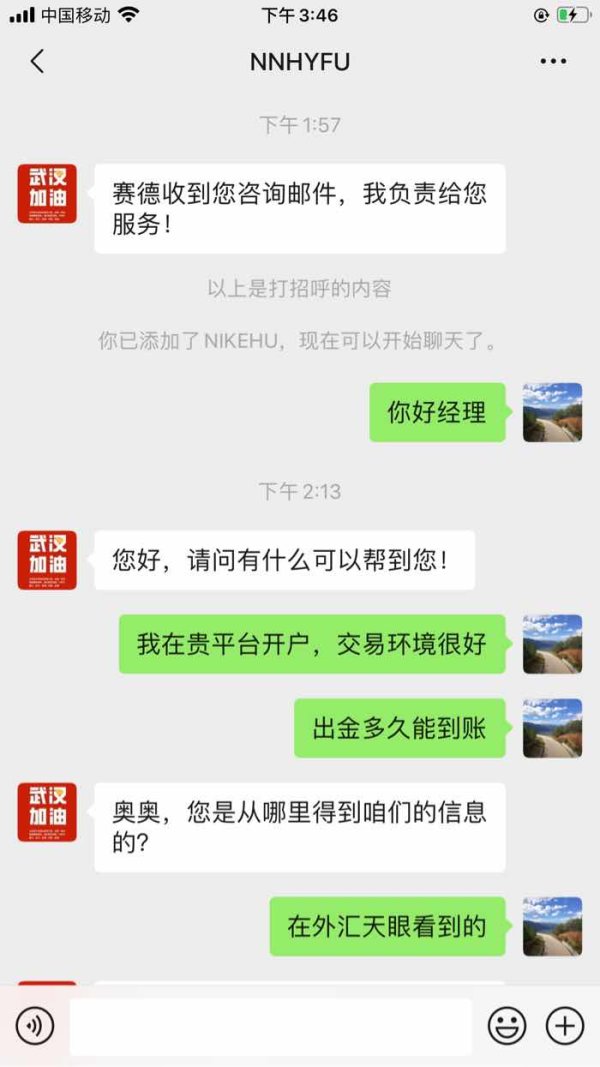

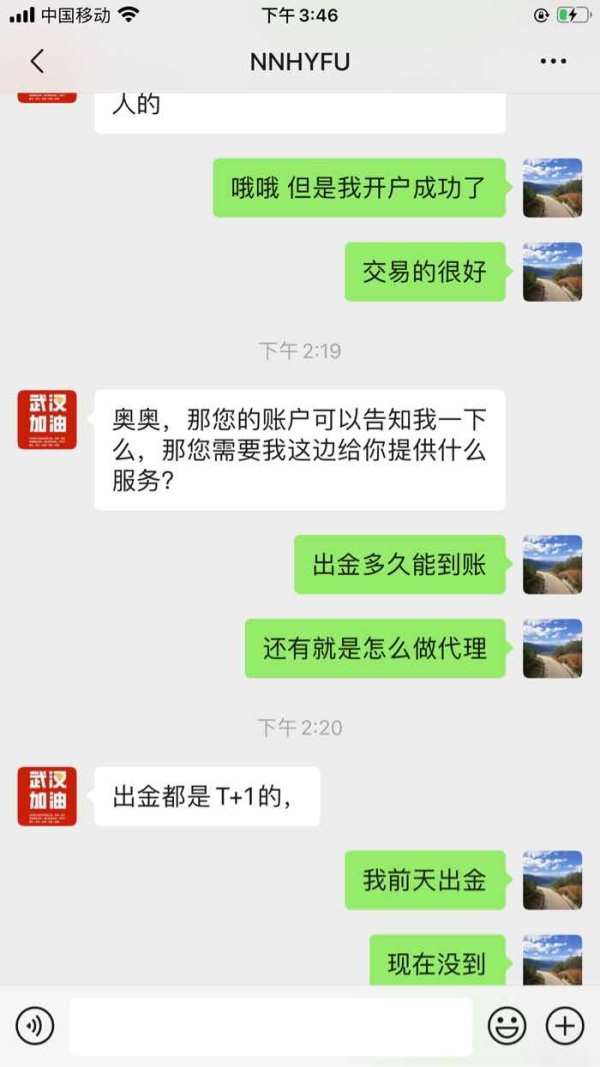

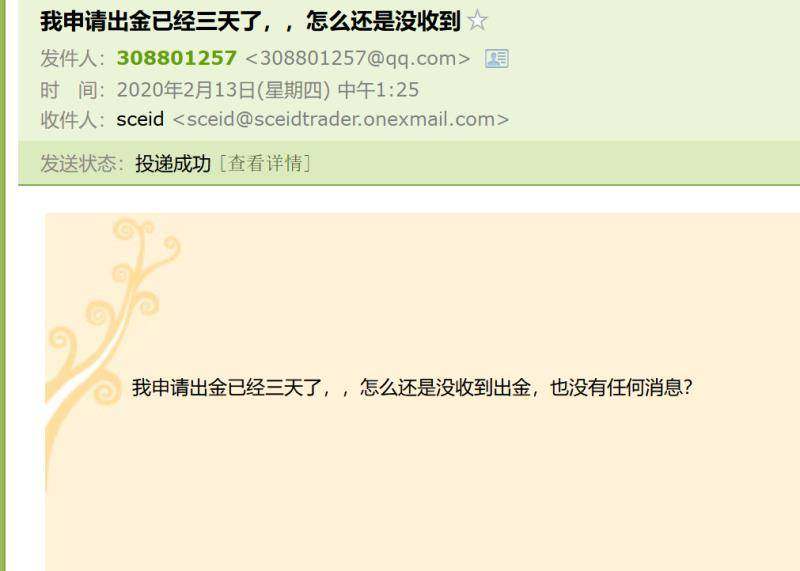

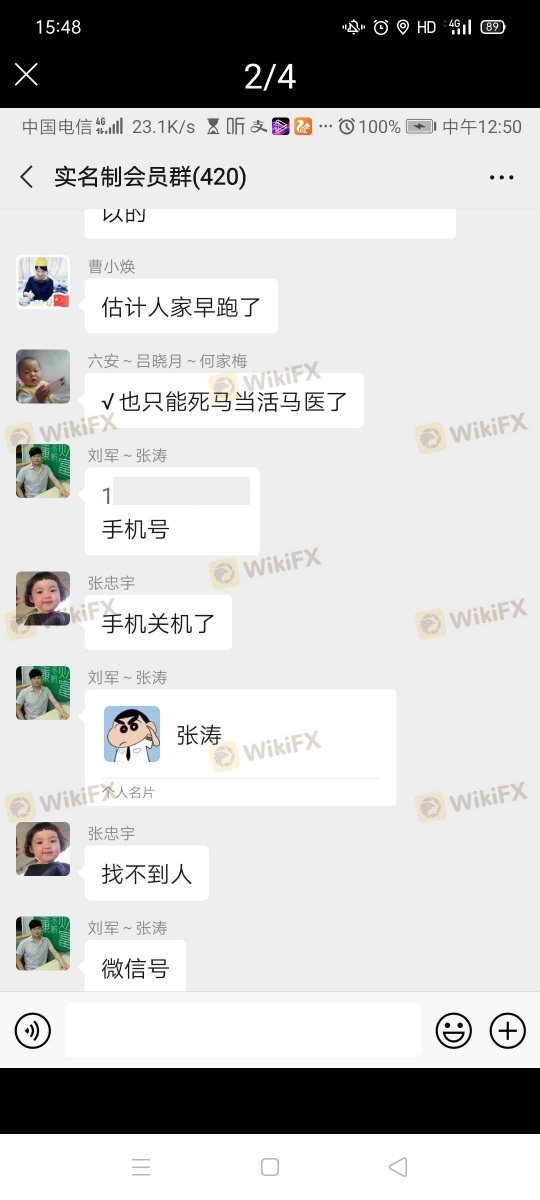

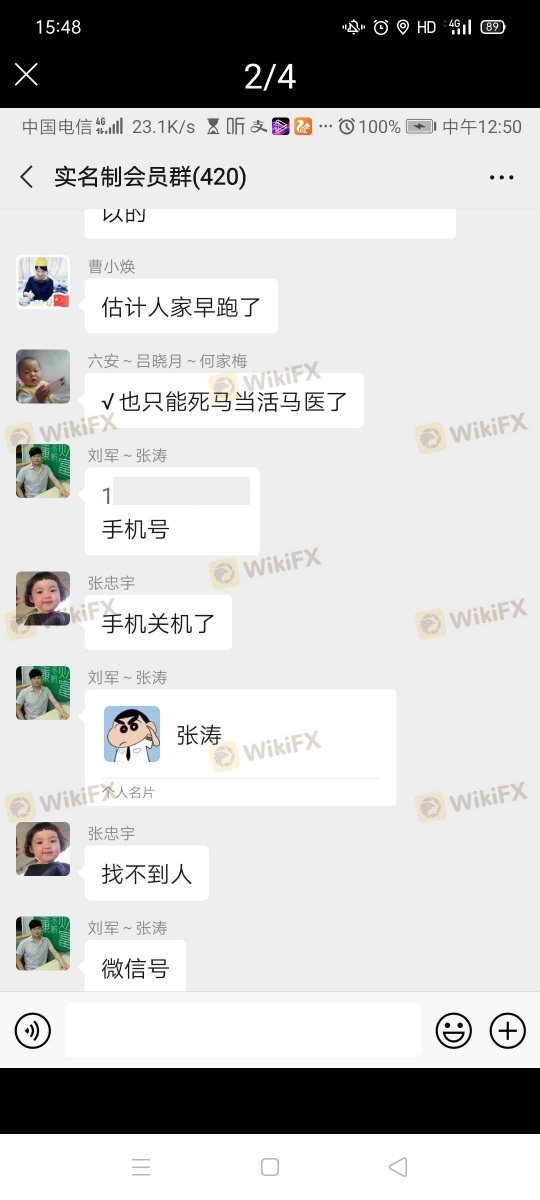

Users of SCEID frequently express dissatisfaction, rooted primary in the sluggish responsiveness of customer service and the complicated withdrawal processes. Surveyed feedback suggests that some traders feel stuck in limbo regarding their funds.

User Reviews and Feedback

User reviews indicate a consistent theme:

"Getting funds out is a hassle; customer support is essentially non-responsive."

Such experiences underscore the broker's failing in delivering essential trading services that allow customers to execute and manage their trades effectively.

Summary of Common Complaints

Common complaints center around difficulty in fund retrieval, with many traders awaiting long response times. The fear of losing their investment becomes amplified given these circumstances.

Customer Support Analysis

Support Channels Available

SCEID claims to provide multiple channels for customer support, including phone, email, and live chat. However, users frequently point out that these channels are not adequate, especially for urgent queries.

Responsiveness and Reliability

Feedback from users highlights significant delays:

"Ive tried to reach out for help multiple times, and no one answers back for days."

This unreliable support system compounds the level of frustration, directly impacting user trust.

Overall Support Summary

In terms of customer support, SCEID scores poorly, indicating a significant area for improvement. The lack of timely and effective support increases the risks of using this broker.

Account Conditions Analysis

Initial Deposit and Trading Conditions

SCEID's low minimum deposit requirement may be enticing for beginner traders trying to enter the market with minimal capital. However, ongoing conditions, including withdrawal policies, remain excessively restrictive.

Withdrawal Policy Concerns

Users consistently report unbearably long wait times when attempting to withdraw funds or close accounts. These experiences raise red flags for investors concerned about the broker's integrity.

Final Account Summary

While SCEID allows for flexible initial trading conditions, the stringent and often problematic account closure processes tend to tarnish its overall appeal, particularly for those who desire a transparent trading relationship.

Conclusion

While SCEID appears to be offering a low-cost option for beginner traders, the lack of regulatory oversight, numerous user complaints about fund withdrawals, and inadequate customer service create significant risks. Potential users should carry out detailed due diligence and consider whether they can accept the compromises implied by SCEID's operational practices. For investors valuing security, oversight, and reliability in trading, seeking alternatives may be a prudent decision.