Foxi 2025 Review: Everything You Need to Know

Executive Summary

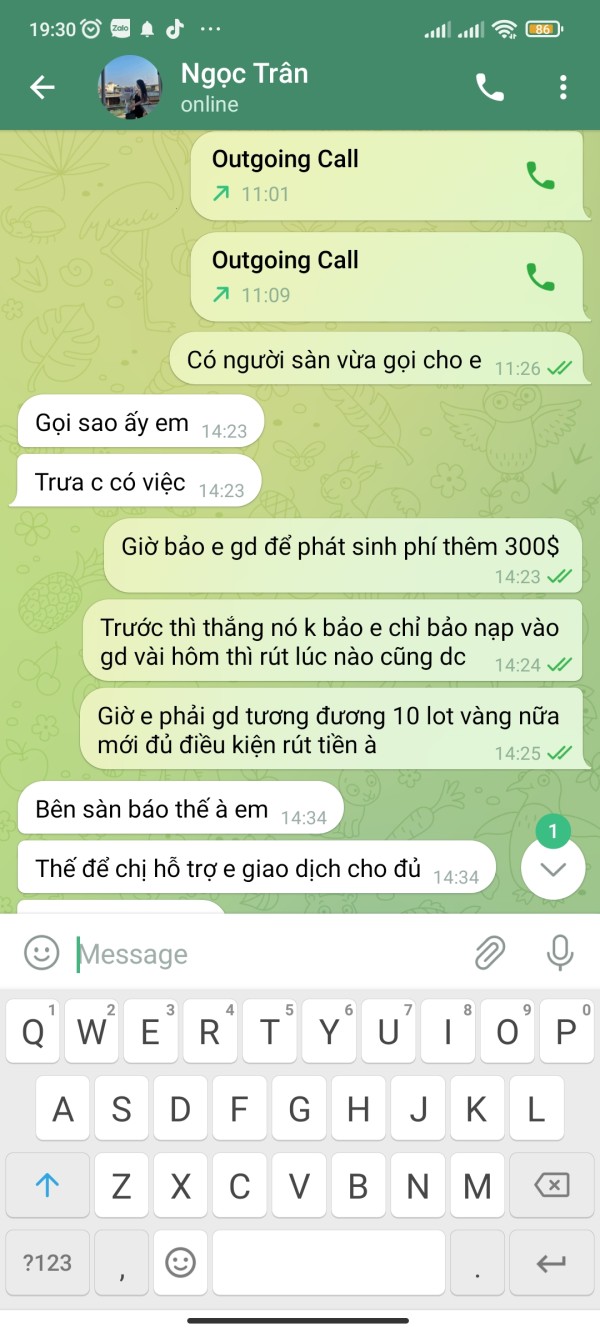

This comprehensive Foxi review reveals concerning findings about Foxi Markets. The broker claims to offer forex and CFD trading services through popular platforms, but our investigation shows serious problems with their regulatory claims. Foxi Markets presents itself as a regulated entity under the Financial Conduct Authority and Australian Securities and Investments Commission. However, verification with both regulators indicates that the licensees with identical names are no longer authorized and regulated.

The platform has been flagged with a "SCAM" operating status. This raises significant red flags for potential investors who might consider using their services. Despite these serious concerns, Foxi Markets does offer access to Meta Trader 4 and Meta Trader 5 platforms, supporting multiple asset classes including stocks, forex, commodities, indices, and digital assets.

However, the lack of verified regulatory oversight and the scam designation make this broker unsuitable for traders seeking legitimate and secure trading environments. This Foxi review strongly advises caution when considering this platform for trading activities, as the risks far outweigh any potential benefits.

Important Notice

Regulatory Verification Warning: Foxi Markets claims regulation by both the UK's Financial Conduct Authority and Australia's Australian Securities and Investments Commission. However, our verification process with both regulatory bodies confirms that while licensees with similar names exist in their registers, these entities are no longer authorized or actively regulated.

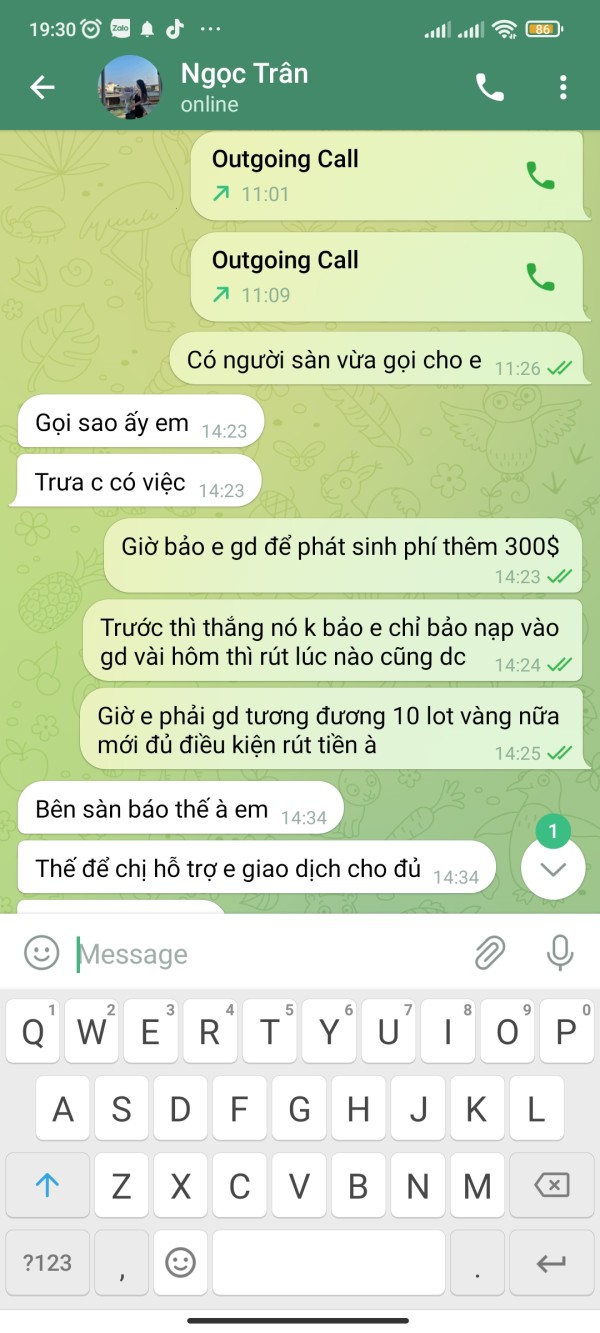

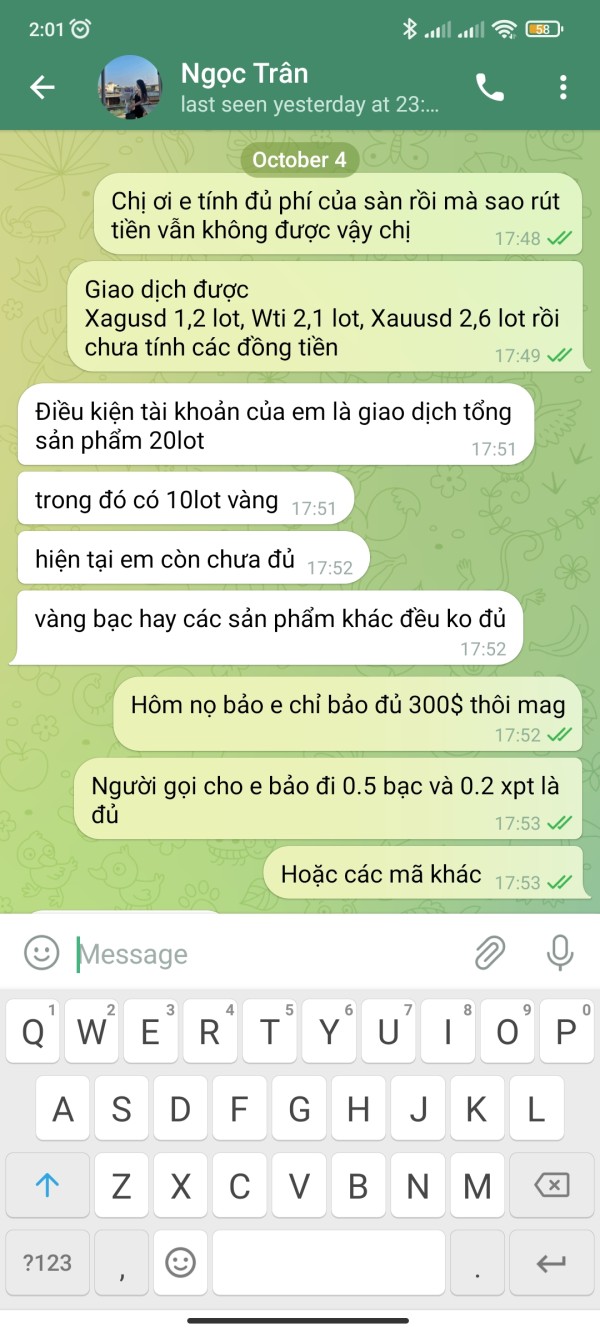

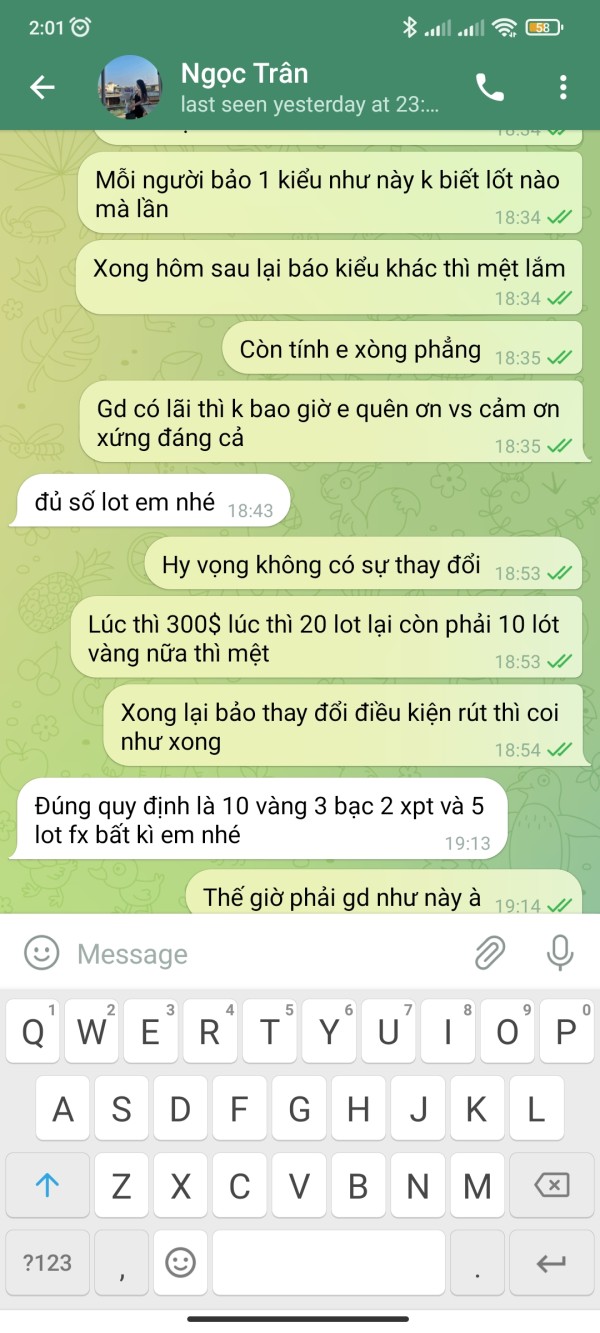

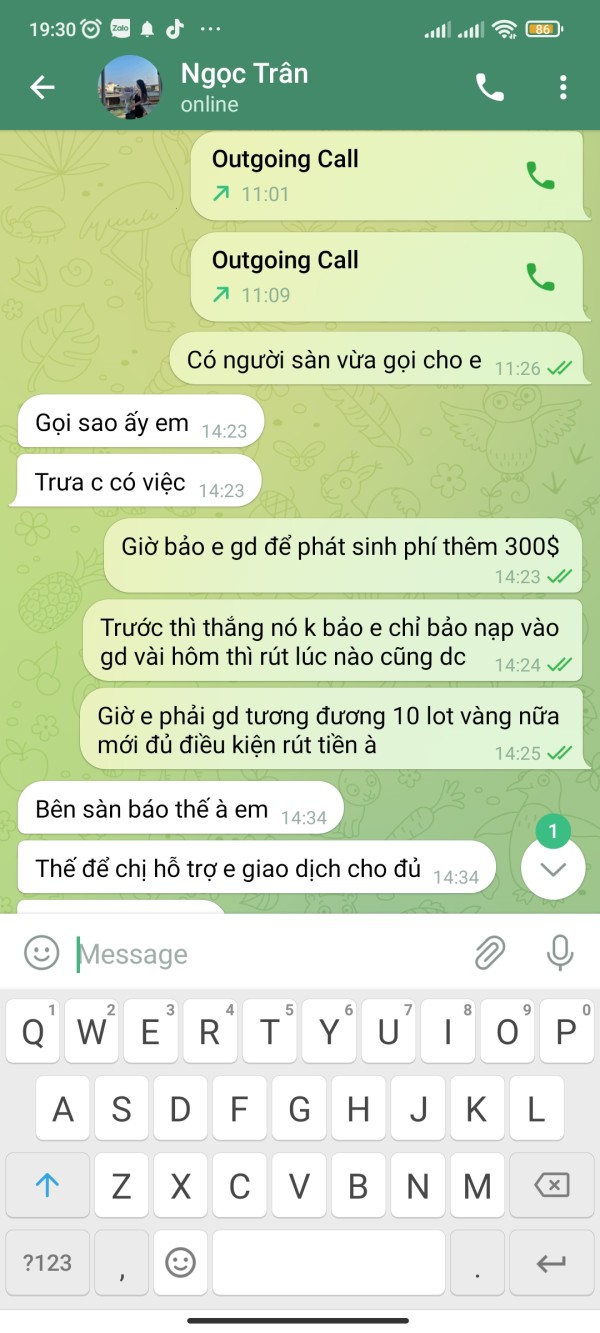

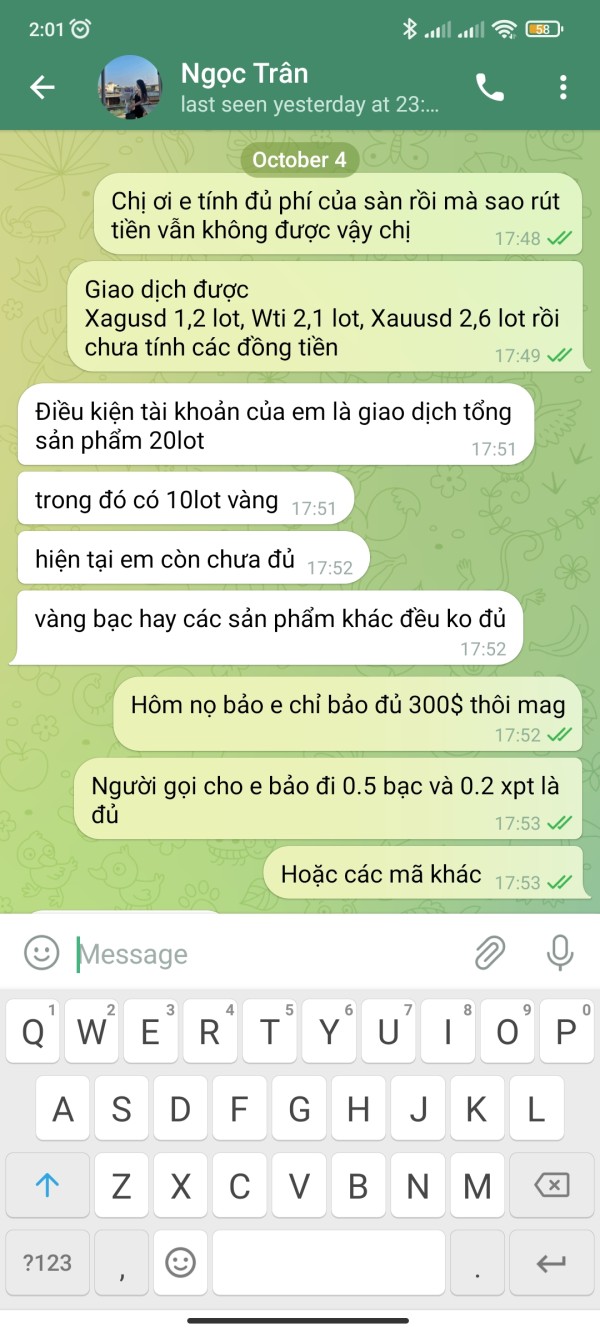

Traders should exercise extreme caution when dealing with unverified regulatory claims. This type of misrepresentation is a major red flag in the trading industry.

Review Methodology: This evaluation is based on publicly available information, regulatory database searches, and platform analysis. We have not conducted direct testing of the platform due to the identified regulatory concerns and scam designation, which would put funds at unnecessary risk.

Overall Rating Framework

Broker Overview

Foxi Markets positions itself as a comprehensive trading platform offering access to multiple financial markets through established trading platforms. The broker claims to provide services across various asset classes, presenting itself as a one-stop solution for retail traders seeking diversified investment opportunities.

However, the company's background information, including its establishment date and corporate structure, remains unclear in available documentation. This lack of transparency is concerning for potential clients who need to verify the legitimacy of their chosen broker. The platform operates primarily through Meta Trader 4 and Meta Trader 5 platforms, which are industry-standard trading interfaces known for their reliability and comprehensive trading tools.

Foxi Markets advertises access to forex pairs, stock indices, individual equities, commodities, and cryptocurrency markets. This suggests a broad trading scope designed to appeal to various trader preferences and strategies, but the regulatory issues overshadow these offerings. However, this Foxi review must emphasize that the broker's regulatory status presents significant concerns that cannot be overlooked.

While Foxi Markets asserts regulation by prestigious authorities like the FCA and ASIC, verification reveals that the claimed regulatory licenses are no longer valid or active. This discrepancy between claimed and actual regulatory status has resulted in the platform being designated with a "SCAM" operating status, fundamentally undermining its credibility in the competitive forex and CFD trading landscape.

Regulatory Status: Foxi Markets claims oversight by the Financial Conduct Authority in the United Kingdom and the Australian Securities and Investments Commission. However, regulatory verification indicates these licenses are no longer valid, which is a serious concern for potential clients.

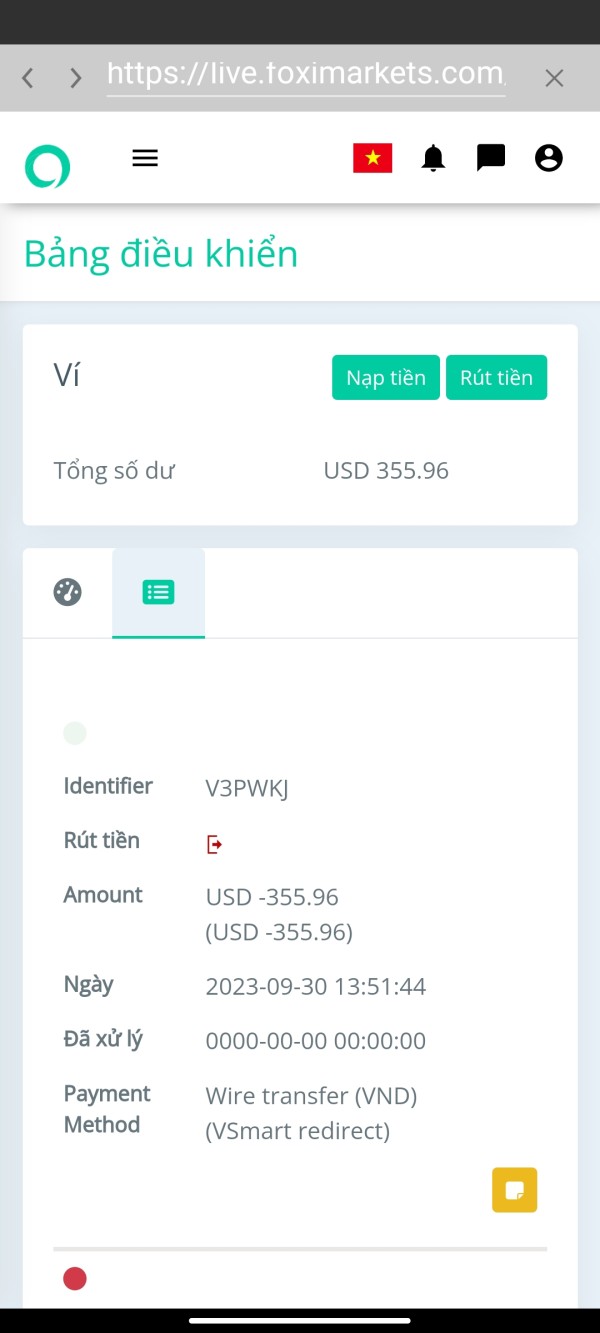

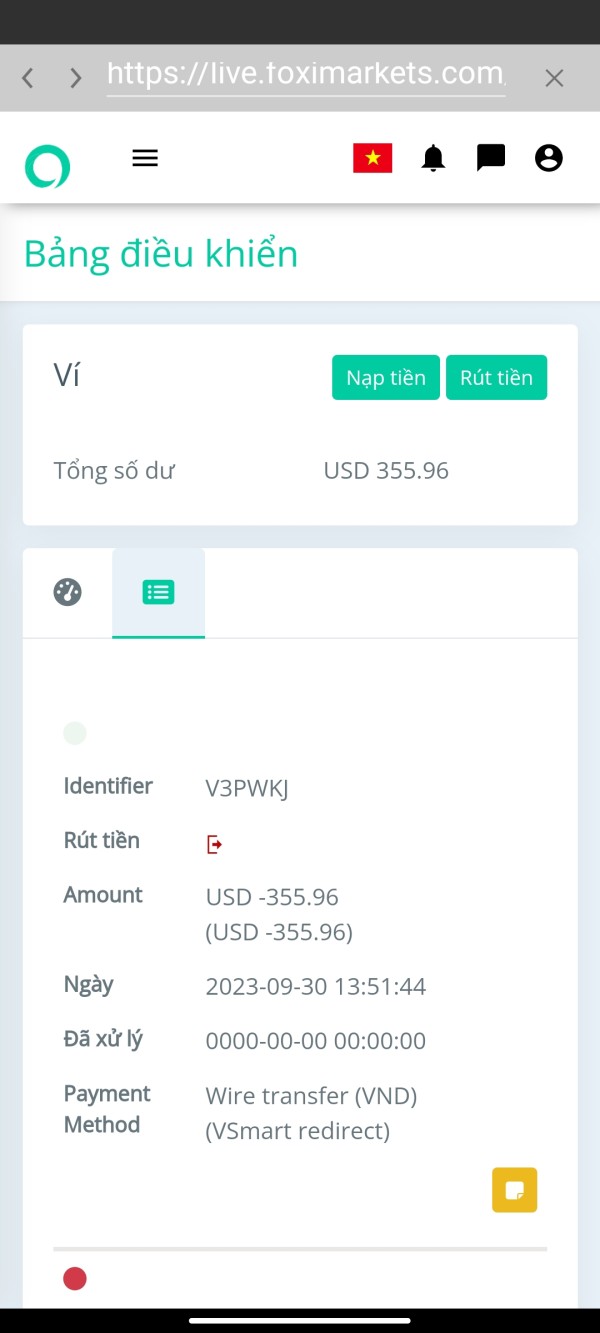

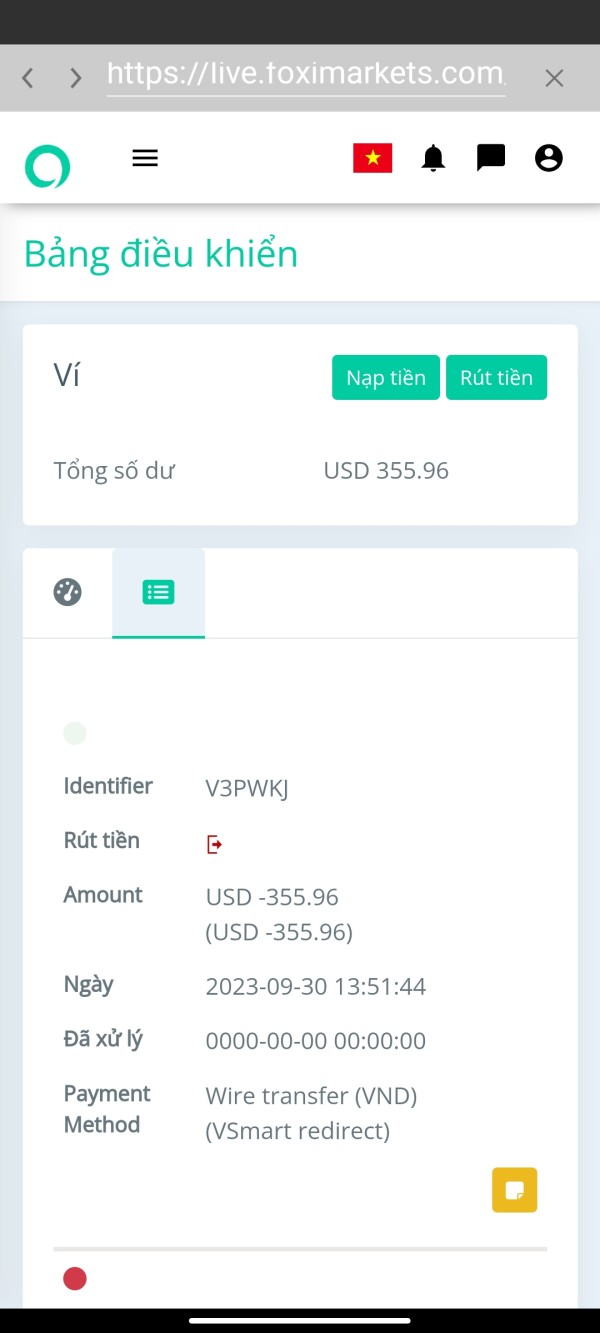

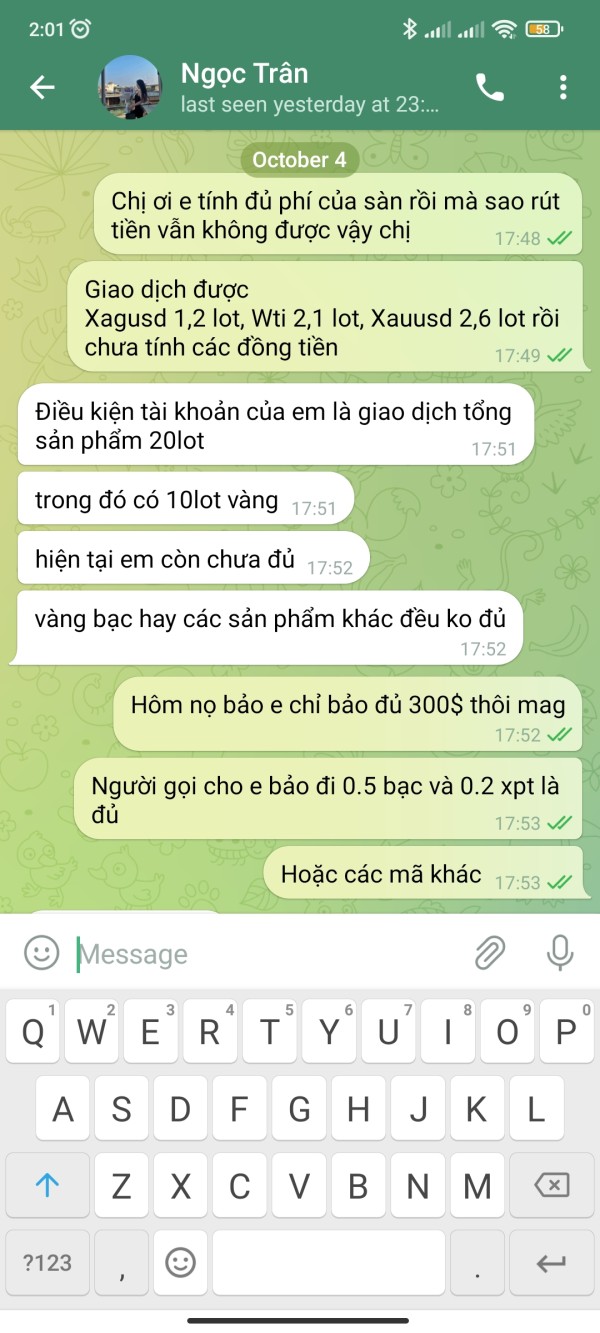

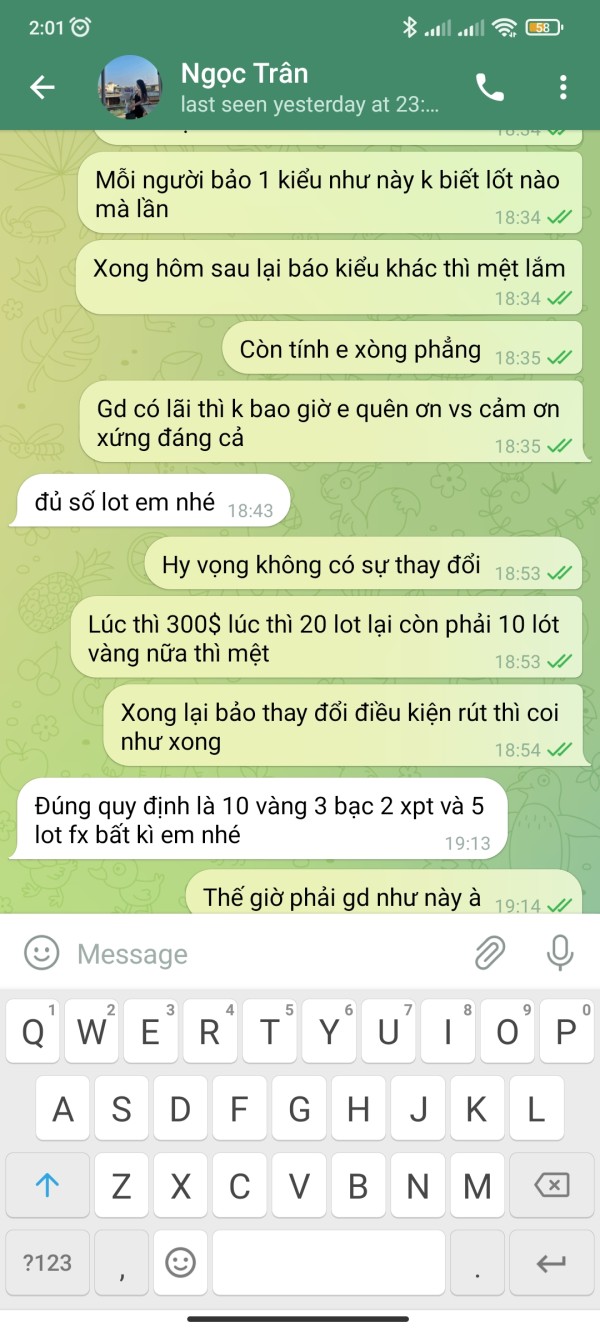

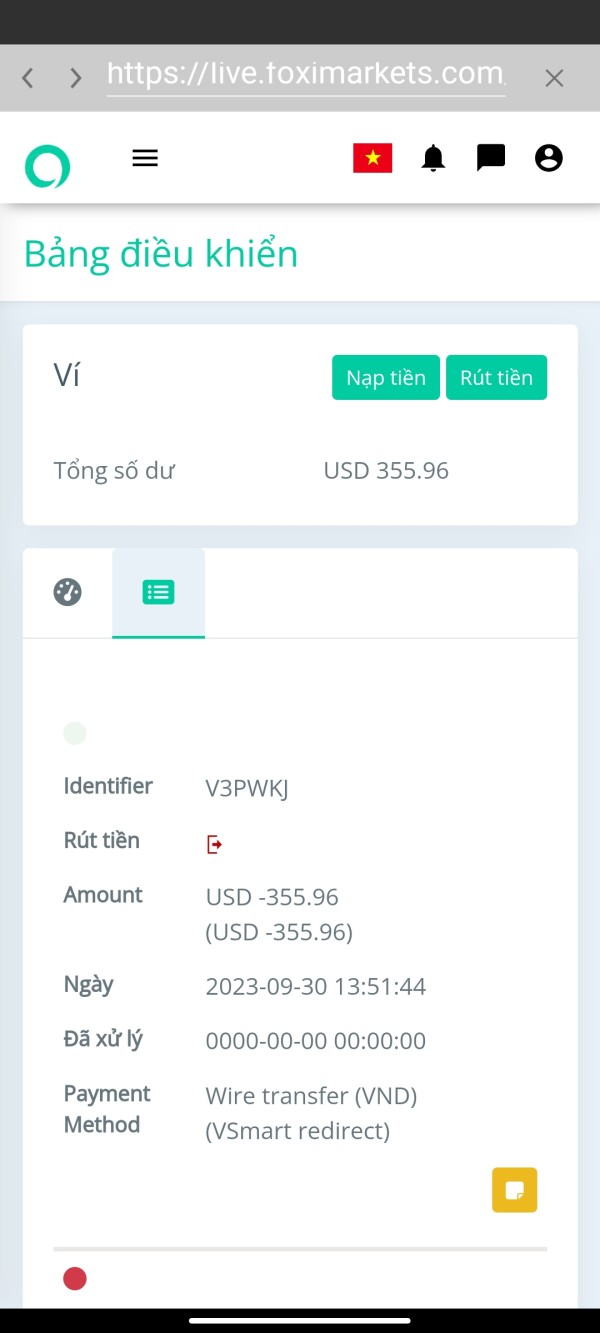

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available materials. This raises transparency concerns for potential clients who need to understand how they can fund their accounts and access their money.

Minimum Deposit Requirements: The minimum deposit threshold for opening an account with Foxi Markets is not specified in accessible documentation. This lack of basic information is unusual for legitimate brokers who typically provide clear account requirements.

Promotional Offers: Information about welcome bonuses, promotional campaigns, or special trading incentives is not available in current materials. Most legitimate brokers clearly outline their promotional offerings to attract new clients.

Available Trading Assets: The platform supports multiple asset classes including forex currency pairs, stock market indices, individual company shares, commodity futures, and cryptocurrency markets. This range of assets could appeal to diverse trading strategies if the broker were properly regulated.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not clearly outlined in available resources. Transparent pricing is essential for traders to calculate their potential profits and losses accurately.

Leverage Options: Specific leverage ratios offered to different account types and regions are not mentioned in accessible documentation. This information is crucial for risk management and regulatory compliance in different jurisdictions.

Platform Options: Foxi Markets provides access to Meta Trader 4 and Meta Trader 5 platforms, both recognized industry standards for retail forex and CFD trading. These platforms offer comprehensive functionality and are familiar to most experienced traders.

Geographic Restrictions: Specific information about regional limitations or restricted countries is not detailed in available materials. Understanding geographic restrictions is important for compliance with local regulations and determining service availability.

Customer Support Languages: The range of languages supported by customer service teams is not specified in current documentation. Multilingual support is important for international clients who may need assistance in their native language.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by Foxi Markets present significant transparency issues that contribute to its poor rating in this category. Available documentation fails to provide clear information about account types, minimum deposit requirements, or specific account features that would typically be expected from a legitimate broker.

This lack of transparency makes it impossible for potential clients to make informed decisions about account selection. Legitimate brokers typically provide detailed information about different account tiers, their features, and associated costs. The absence of detailed account information extends to verification processes, account opening procedures, and special account options such as Islamic accounts for traders requiring Sharia-compliant trading conditions.

Without clear documentation of these fundamental aspects, traders cannot assess whether the broker meets their specific needs or regulatory requirements. Furthermore, the regulatory concerns surrounding Foxi Markets cast doubt on the legitimacy of any account conditions that might be offered.

The discrepancy between claimed and actual regulatory status suggests that account protections and guarantees typically associated with regulated brokers may not apply. This Foxi review emphasizes that the lack of verified regulatory oversight makes any account conditions potentially unreliable and risky for traders.

Foxi Markets receives a moderate score for tools and resources primarily due to its provision of Meta Trader 4 and Meta Trader 5 platforms. These platforms are industry standards that offer comprehensive charting tools, technical indicators, automated trading capabilities through Expert Advisors, and mobile trading applications.

The availability of both MT4 and MT5 provides traders with flexibility in choosing their preferred trading environment. Both platforms are well-established and trusted by traders worldwide for their stability and functionality. The platform's support for multiple asset classes including forex, stocks, commodities, indices, and cryptocurrencies suggests a reasonable breadth of trading opportunities.

This diversification allows traders to implement various strategies across different markets, potentially enhancing portfolio diversification and risk management capabilities. However, the score is limited by the lack of information about additional research tools, market analysis resources, educational materials, or proprietary trading tools that might enhance the trading experience.

Quality brokers typically provide economic calendars, market research, trading signals, and educational content to support trader development and decision-making processes. The absence of these additional resources limits the overall value proposition for traders seeking comprehensive support.

Customer Service and Support Analysis (Score: 3/10)

Customer service evaluation for Foxi Markets is severely hampered by the lack of available information about support channels, response times, and service quality. Legitimate brokers typically provide multiple contact methods including live chat, telephone support, email assistance, and comprehensive FAQ sections.

The absence of detailed customer service information raises concerns about the broker's commitment to client support. Professional customer service is essential for resolving trading issues, account problems, and technical difficulties that traders may encounter. The regulatory issues surrounding Foxi Markets further compound customer service concerns, as clients may have limited recourse for dispute resolution or complaint handling.

Regulated brokers are typically required to maintain specific customer service standards and provide clear escalation procedures for unresolved issues. Additionally, the lack of information about multilingual support, operating hours, and specialized support for different account types suggests that customer service may be inadequate for international clients with diverse needs and time zone requirements.

Without proper customer support infrastructure, traders may find themselves unable to get help when they need it most. This creates additional risks beyond the regulatory concerns already identified in this Foxi review.

Trading Experience Analysis (Score: 5/10)

The trading experience offered by Foxi Markets receives a below-average rating due to mixed factors affecting platform performance and reliability. While the provision of Meta Trader 4 and Meta Trader 5 platforms provides a solid foundation for trading activities, concerns about the broker's legitimacy impact the overall trading environment assessment.

Meta Trader platforms are known for their stability, comprehensive functionality, and user-friendly interfaces. These platforms support various order types, automated trading through Expert Advisors, and extensive customization options that can enhance the trading experience for both novice and experienced traders. The platforms also offer advanced charting capabilities and technical analysis tools that are essential for making informed trading decisions.

However, this Foxi review must note that the regulatory concerns and scam designation raise questions about order execution quality, platform reliability under stress conditions, and the overall integrity of the trading environment. Without proper regulatory oversight, traders cannot be confident about fair execution, transparent pricing, or protection against potential manipulation.

The lack of information about execution speeds, slippage rates, and platform uptime further limits the assessment of the actual trading experience. These factors are crucial for successful trading, especially for strategies that require precise timing and execution.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent the most critical weakness in this Foxi review, earning the lowest possible score due to fundamental issues with regulatory claims and operational transparency. The broker's assertion of regulation by both the FCA and ASIC, followed by verification that these licenses are no longer valid, represents a serious misrepresentation that undermines all other aspects of the service.

This type of false regulatory claim is one of the most serious red flags in the trading industry. Regulatory oversight provides essential protections for traders, including segregated client funds, dispute resolution mechanisms, and operational standards. The "SCAM" operating status designation further reinforces concerns about the broker's legitimacy and trustworthiness, suggesting that regulatory authorities or industry watchdogs have identified significant issues with the broker's operations, claims, or business practices.

The lack of transparent information about company ownership, corporate structure, physical address verification, and financial statements compounds trust issues. Legitimate brokers typically provide comprehensive corporate information, regulatory documentation, and third-party audits to demonstrate their commitment to transparency and regulatory compliance.

Without these fundamental trust indicators, traders have no assurance that their funds are safe or that the broker will honor its obligations. This makes Foxi Markets unsuitable for serious trading activities regardless of any other features they might offer.

User Experience Analysis (Score: 4/10)

User experience assessment for Foxi Markets is limited by the lack of detailed user feedback and the overriding concerns about the broker's legitimacy. While the Meta Trader platform provision suggests that basic trading functionality may be available, the regulatory issues significantly impact the overall user experience evaluation.

The absence of information about website usability, account opening processes, verification procedures, and mobile application quality makes it difficult to assess the practical aspects of user interaction with the platform. Quality brokers typically invest in user-friendly interfaces, streamlined processes, and comprehensive support documentation to ensure a smooth experience for their clients.

The regulatory concerns and scam designation create an environment where users cannot have confidence in the security of their funds, the reliability of platform access, or the integrity of their trading data. These fundamental trust issues override any potential positive aspects of the user interface or platform functionality.

Even if the platforms work well technically, the underlying concerns about the broker's legitimacy make it impossible to recommend the service to traders. A positive user experience requires not just functional technology but also trust in the broker's integrity and regulatory compliance.

Conclusion

This comprehensive Foxi review reveals significant concerns that make this broker unsuitable for serious traders and investors. While Foxi Markets offers access to popular Meta Trader platforms and claims to support multiple asset classes, the fundamental issues with regulatory compliance and the "SCAM" operating status designation create unacceptable risks for potential clients.

The broker's misrepresentation of regulatory status, claiming oversight by prestigious authorities like the FCA and ASIC when these licenses are no longer valid, represents a serious breach of trust that undermines all other service aspects. This type of false claim is one of the most serious red flags in the trading industry and should be an immediate disqualifier for any trader considering this broker. Combined with the lack of transparency regarding account conditions, costs, and corporate structure, these issues make Foxi Markets an unsuitable choice for traders seeking legitimate and secure trading environments.

We strongly recommend that traders seeking reliable forex and CFD trading services consider properly regulated alternatives with verified credentials, transparent operations, and positive regulatory standing. The risks associated with unregulated brokers far outweigh any potential benefits, particularly when legitimate alternatives are readily available in the competitive trading industry.