UEXO 2025 Review: Everything You Need to Know

Summary

UEXO is a new forex broker that started in 2022. The company has grown quickly but gets mixed reviews from users on different platforms. Trustpilot reviews show that traders have noticed the broker, but their experiences are very different from each other. This uexo review shows that UEXO calls itself a multi-asset trading provider. The company offers Contract for Difference trading across seven different types of assets like forex, stocks, and cryptocurrencies.

The broker's main strength is its varied trading platforms. UEXO offers the UEXO-Trader platform on both web and mobile apps. Expert reviews show that UEXO focuses on small and medium investors who want different trading tools and flexible platforms. But the broker has only been around for a short time and gets mixed feedback, so new clients should be careful about what they expect.

Information from fincapital-reviews and other industry sources shows that UEXO works from Seychelles. This location usually has easier rules than major financial centers. Some traders might like this setup, but it also raises questions about how well investors are protected.

Important Notice

Jurisdictional Variations: UEXO Global Ltd is registered in Seychelles and works under relaxed rules. People thinking about investing should think carefully about what this means, especially for solving disputes and protecting investors. The Seychelles rules might offer different protections than more established financial areas.

Review Methodology: This detailed review uses user feedback from many platforms like Trustpilot, expert analysis from financial review websites, and public company information. Our method focuses on verified user experiences but recognizes the limits of reviewing newer companies with short operating histories.

Rating Framework

Broker Overview

UEXO Global Ltd started in the competitive forex market in 2022. The company set up its main office in Seychelles. UEXO has positioned itself as a complete CFD trading provider that focuses on giving multi-asset trading abilities to regular investors. Even though it just entered the market, UEXO has tried to stand out through platform variety and asset diversity, but its track record is still limited because it has only been operating for a short time.

The broker's business model centers on providing Contract for Difference trading across seven different asset types. According to published information from 2024, UEXO emphasizes easy access and platform flexibility while targeting traders who want diverse investment opportunities in one trading environment. The company's Seychelles registration suggests it wants operational flexibility while keeping regulatory compliance costs lower.

UEXO works mainly through its own UEXO-Trader platform. The platform supports both web-based and mobile trading apps. The platform design seems made to work with different trading styles, from casual retail investors to more active traders who want exposure to multiple assets. However, detailed technical specifications and performance metrics are still limited in available public documentation, making it hard to fully assess the platform for this uexo review.

Regulatory Jurisdiction: UEXO Global Ltd operates under Seychelles registration and follows local regulatory oversight. The Seychelles regulatory environment usually offers more flexible operational parameters than major financial centers, though this may affect investor protection standards.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal options was not detailed in available sources. Traders need to contact the broker directly for complete payment method information.

Minimum Deposit Requirements: Available documentation does not specify minimum deposit thresholds. This suggests possible variation based on account types or regional considerations.

Bonus and Promotional Offers: Current promotional activities and bonus structures were not mentioned in accessible sources. This indicates either no such programs exist or limited marketing of these features.

Tradeable Assets: The platform provides CFD trading across seven asset categories, specifically including foreign exchange pairs, stock indices, individual equities, and cryptocurrency instruments. This offers reasonable diversification for retail traders.

Cost Structure: Detailed spread information, commission schedules, and fee structures were not specified in available sources. This represents a significant information gap for potential clients doing research.

Leverage Ratios: Specific leverage offerings across different asset classes remain unspecified in current documentation. Traders need to ask directly for accurate leverage information.

Platform Options: UEXO-Trader platform supports multiple device types including desktop web browsers and mobile applications. This provides basic accessibility across common trading environments.

Geographic Restrictions: Specific regional limitations or service availability restrictions were not detailed in accessible sources.

Customer Service Languages: Available customer support languages were not specified in current documentation.

This uexo review highlights significant information gaps that potential clients should address through direct broker communication before making trading decisions.

Detailed Rating Analysis

Account Conditions Analysis

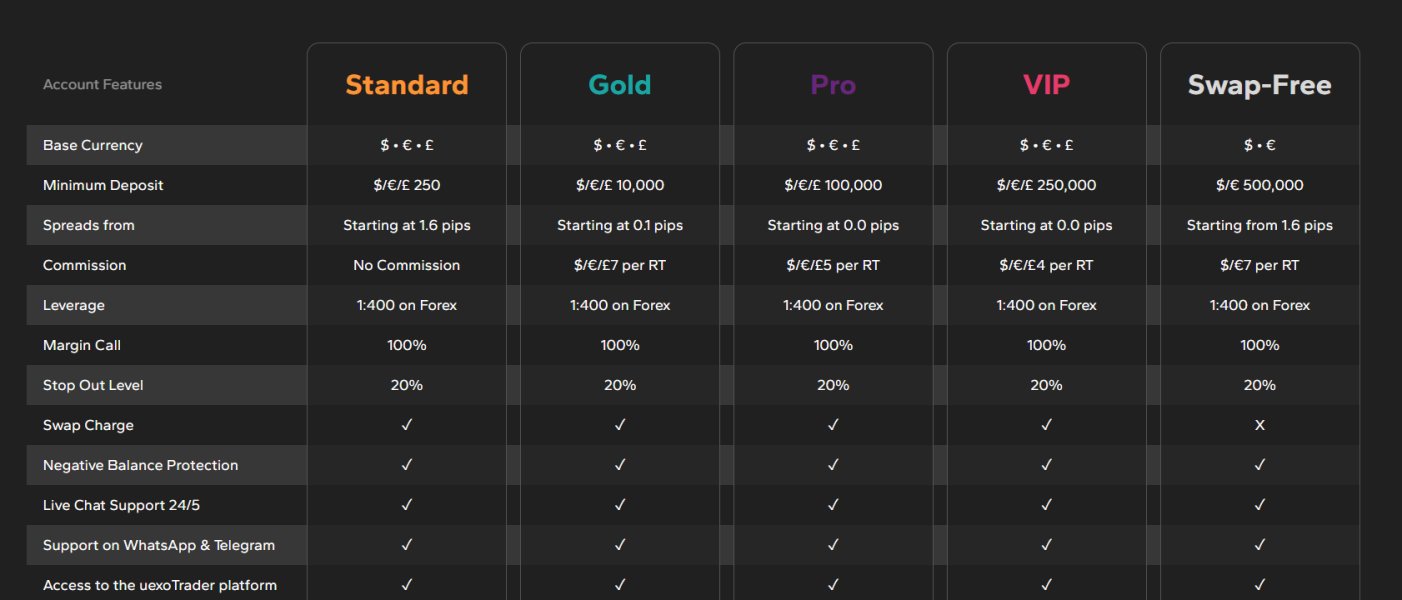

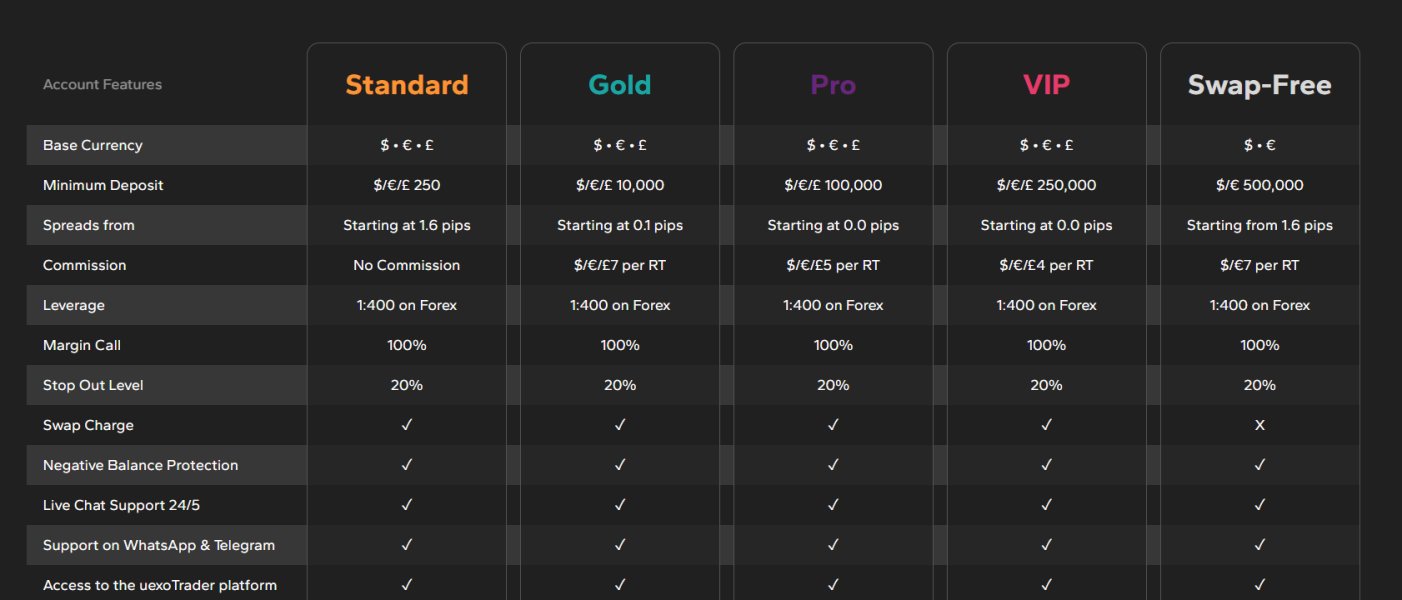

UEXO's account structure information remains very limited in publicly available sources. This creates challenges for a complete evaluation. The broker seems to offer standard retail trading accounts, though specific account tiers, their distinguishing features, and associated benefits are not clearly documented in accessible materials. This lack of transparency about account specifications represents a significant consideration for potential clients.

The absence of clearly stated minimum deposit requirements across different account types suggests either flexible entry thresholds or incomplete public disclosure. Industry standards typically range from $100 to $500 for retail accounts, but UEXO's specific positioning within this spectrum remains unclear. Similarly, account opening procedures and required documentation are not detailed in available sources.

Special account features such as Islamic accounts for Sharia-compliant trading, professional trader classifications, or institutional account options are not mentioned in current documentation. This uexo review notes that the lack of detailed account condition information may reflect the broker's recent market entry, though it also raises questions about operational transparency and client communication standards.

User feedback specifically addressing account conditions was not prominent in available review sources. This suggests either limited user engagement with account-specific features or insufficient documentation of such experiences. Potential clients should prioritize obtaining detailed account information directly from UEXO before committing to any trading relationship.

UEXO shows reasonable strength in platform diversity through its UEXO-Trader system. The system works with both web-based and mobile trading environments. The platform's multi-asset capability across seven different categories gives traders consolidated access to forex, stocks, and cryptocurrency CFDs, representing a competitive feature set for diversification-focused investors.

However, the depth and quality of analytical tools, research resources, and educational materials remain unclear from available sources. Modern trading platforms typically integrate technical analysis tools, economic calendars, market news feeds, and educational content, but UEXO's specific offerings in these areas are not well-documented. This information gap limits the ability to assess the platform's suitability for traders requiring comprehensive analytical support.

The broker's approach to automated trading support, including Expert Advisor compatibility or algorithmic trading features, is not specified in current documentation. Additionally, advanced order types, risk management tools, and portfolio analysis capabilities are not detailed in accessible sources.

Mobile platform functionality appears to mirror web-based capabilities, though specific feature comparisons and mobile-exclusive tools are not documented. The absence of detailed user feedback regarding platform performance, stability, and feature satisfaction in available reviews suggests limited user engagement or insufficient review documentation across major platforms.

Customer Service and Support Analysis

Customer service quality emerges as a mixed aspect of UEXO's operations based on available user feedback. Trustpilot reviews show varying user experiences with support responsiveness and problem resolution effectiveness, though specific details about support channel availability and response timeframes are not comprehensively documented in accessible sources.

The broker's customer support infrastructure, including available contact methods such as live chat, email support, or telephone assistance, is not clearly outlined in current documentation. Similarly, support availability hours, weekend coverage, and regional support variations remain unspecified, creating uncertainty for potential clients regarding assistance accessibility.

Language support capabilities are not detailed in available sources, though the broker's international positioning suggests multi-language support may be available. However, the quality and native fluency of support staff across different languages cannot be assessed from current documentation.

User complaints visible in review platforms suggest some clients have experienced difficulties with support responsiveness and issue resolution. The frequency and severity of such problems are not quantified in available sources. The absence of detailed case studies or problem resolution examples limits the ability to assess UEXO's support quality comprehensively.

Trading Experience Analysis

The trading experience evaluation for UEXO faces limitations due to insufficient detailed performance data in available sources. Platform stability, execution speed, and order fill quality represent critical factors for trader satisfaction, yet specific performance metrics or user experience data are not comprehensively documented in accessible reviews or technical assessments.

UEXO-Trader platform functionality appears to support standard trading operations across multiple asset classes. Advanced features such as one-click trading, partial position closing, or sophisticated order management capabilities are not detailed in current documentation. The platform's charting capabilities, technical indicator availability, and customization options remain largely unspecified.

Mobile trading experience quality, including app stability, feature parity with web platforms, and mobile-specific functionality, lacks detailed documentation in available sources. User feedback specifically addressing mobile platform performance is not prominent in accessible review platforms, limiting mobile experience assessment capabilities.

The broker's execution model, whether market maker or STP/ECN, is not clearly specified in available documentation. This makes it difficult to assess potential conflicts of interest or execution quality expectations. Slippage rates, requote frequency, and execution speed data are not available in current sources, representing significant information gaps for this uexo review.

Trustworthiness Analysis

UEXO's trustworthiness profile presents mixed indicators that warrant careful consideration. The broker's Seychelles registration provides legal operational framework, though this jurisdiction typically offers less stringent regulatory oversight compared to major financial centers such as the UK's FCA or Cyprus's CySEC. This regulatory positioning may appeal to some traders seeking operational flexibility but also introduces considerations regarding dispute resolution mechanisms and investor protection standards.

Third-party rating platforms show moderate scores. Trustpilot reviews indicate mixed user experiences and WikiFX provides lower confidence ratings. These external assessments suggest user satisfaction challenges and potential trust considerations that prospective clients should carefully evaluate before engaging with the broker.

The company's financial transparency, including published financial statements, audit reports, or regulatory compliance documentation, is not readily accessible in public sources. Similarly, client fund segregation practices, insurance coverage, and investor compensation schemes are not detailed in available documentation, representing significant transparency gaps.

UEXO's brief operational history since 2022 limits the availability of long-term performance data and crisis management examples. The absence of documented negative events or regulatory actions may reflect either clean operational history or insufficient market presence duration for comprehensive assessment.

User Experience Analysis

Overall user satisfaction with UEXO appears moderate based on available feedback from review platforms. Trustpilot reviews suggest mixed experiences, with some users expressing satisfaction with platform functionality while others report challenges with various aspects of the trading relationship. However, the limited volume of detailed user feedback makes comprehensive satisfaction assessment challenging.

Platform interface design and usability are not extensively documented in available user reviews. The multi-device support suggests attention to accessibility considerations. Registration and account verification processes are not detailed in accessible sources, creating uncertainty regarding onboarding experience quality and timeframe expectations.

Funding operation experiences, including deposit processing times, withdrawal procedures, and associated fees, lack comprehensive documentation in available user feedback. This information gap represents a significant consideration for potential clients who prioritize efficient fund management capabilities.

Common user complaints visible in available reviews appear to center around customer service responsiveness and problem resolution effectiveness. The frequency and severity of such issues are not quantified in accessible sources. The target user profile appears to align with small to medium-sized investors seeking diversified CFD trading opportunities, though specific user demographics and satisfaction patterns are not well-documented.

Conclusion

This comprehensive uexo review reveals UEXO as an emerging forex broker with both potential strengths and notable considerations. The broker's multi-asset platform offerings and device accessibility represent competitive advantages for traders seeking diversified CFD exposure. However, significant information gaps regarding costs, account conditions, and operational details create challenges for thorough research.

UEXO appears most suitable for small to medium-sized investors comfortable with newer market entrants and willing to accept the inherent risks associated with less established brokers. The Seychelles regulatory framework may appeal to traders prioritizing operational flexibility, though this positioning also introduces trust and protection considerations.

The broker's primary advantages include platform diversity and multi-asset accessibility. Key disadvantages include limited transparency, mixed user feedback, and regulatory considerations. Potential clients should prioritize obtaining detailed operational information directly from UEXO and carefully consider their risk tolerance before engaging with this relatively new market participant.