Is foxiv safe?

Business

License

Is Foxiv Safe or a Scam?

Introduction

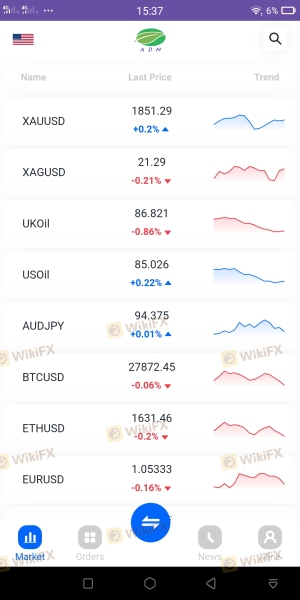

Foxiv is a relatively new player in the forex trading market, positioning itself as a broker offering a diverse range of trading instruments, including forex, commodities, and cryptocurrencies. With the rapid growth of online trading, many brokers have emerged, making it essential for traders to evaluate the legitimacy and safety of these platforms. This article aims to provide a comprehensive analysis of Foxiv, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. By employing a structured approach that includes data analysis and narrative insights, we will determine whether Foxiv is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors for traders to consider. Regulation ensures that brokers adhere to specific standards, providing a level of protection for traders funds. In the case of Foxiv, it is important to note that the broker lacks valid regulation from any recognized financial authority.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulatory oversight raises significant concerns regarding the safety of funds and the broker's compliance with industry standards. Furthermore, Foxiv claims to be associated with the National Futures Association (NFA) in the United States; however, investigations reveal that this claim is misleading. The NFA does not recognize Foxiv as a member, indicating a potential attempt to mislead traders about its legitimacy. This lack of regulation and questionable claims suggest that traders should exercise extreme caution when considering Foxiv as a trading platform.

Company Background Investigation

Foxiv has a brief history, having been established in 2023, which raises questions about its operational stability and experience in the market. The company claims to be headquartered in London, but there is limited publicly available information regarding its ownership structure and management team. The absence of transparency regarding the company's background and executives can be a red flag for potential investors.

The management team‘s qualifications and experience are crucial in assessing a broker's reliability. Unfortunately, Foxiv does not provide detailed information about its leadership, making it difficult for traders to gauge the expertise behind the platform. Moreover, the company’s website lacks comprehensive disclosures about its operational practices, further contributing to doubts about its transparency and reliability.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for traders to assess potential costs and profitability. Foxiv presents a variety of trading instruments, but the overall fee structure remains ambiguous, which can lead to unexpected costs for traders.

| Fee Type | Foxiv | Industry Average |

|---|---|---|

| Spread on Major Pairs | Not Specified | Varies |

| Commission Structure | Not Specified | Varies |

| Overnight Interest Rate | Not Specified | Varies |

The lack of clear information regarding spreads, commissions, and overnight interest rates raises concerns. Transparency in these areas is critical for traders to make informed decisions. The absence of specified fees may indicate hidden costs that could erode trading profits. Potential traders should be wary of entering into agreements without a clear understanding of the associated costs.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker. Foxiv‘s website does not provide detailed information about its fund security measures. It is unclear whether the broker employs segregated accounts to protect clients’ funds, which is a standard practice among regulated brokers to ensure that client deposits are kept separate from the companys operational funds.

Additionally, there is no mention of investor protection mechanisms or negative balance protection policies, which are critical for safeguarding traders in volatile market conditions. The lack of transparency regarding these safety measures raises further concerns about the security of funds with Foxiv. Historical incidents involving fund safety issues could not be found, but the absence of robust safety protocols could expose traders to risks.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews about Foxiv indicate a mixed experience among users. While some traders appreciate the demo account feature and the variety of available trading instruments, others have expressed dissatisfaction with customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Limited Channels |

| Transparency Issues | High | Poor Communication |

Common complaints include difficulties in withdrawing funds and slow response times from customer support. For instance, some users reported being asked to deposit additional funds before they could withdraw their profits, raising red flags about the brokers practices. These complaints highlight a potential pattern of issues that could deter traders from engaging with Foxiv.

Platform and Execution

The trading platform offered by Foxiv is a proprietary system, which may not be as widely recognized or reliable as industry-standard platforms like MetaTrader 4 or 5. User experiences regarding platform performance vary, with some traders reporting stability issues and concerns about order execution quality.

The speed and reliability of order execution are critical in forex trading, where market conditions can change rapidly. Any evidence of slippage or high rejection rates could indicate potential manipulation or inefficiencies in the trading environment. Traders should be cautious and conduct thorough testing of the platform before committing significant capital.

Risk Assessment

Using Foxiv as a trading platform entails several risks that traders should consider. The lack of regulation, transparency issues, and mixed customer feedback contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Security Risk | High | Lack of fund protection mechanisms |

| Customer Service Risk | Medium | Mixed reviews regarding support quality |

To mitigate these risks, traders should consider using smaller amounts for initial trades, thoroughly research the broker, and stay informed about the latest user experiences.

Conclusion and Recommendations

In conclusion, the analysis of Foxiv reveals significant concerns regarding its legitimacy and safety as a trading platform. The lack of valid regulation, transparency issues, and mixed customer experiences indicate that Foxiv may not be a safe choice for traders.

For those considering trading with Foxiv, it is crucial to exercise caution and conduct thorough research. Traders may want to explore alternative brokers that offer robust regulatory oversight and transparent trading conditions. Some reputable options include brokers regulated by top-tier authorities, which provide a safer trading environment.

Ultimately, the investigation suggests that Foxiv is not a safe trading option, and potential users should be wary of engaging with this broker without further due diligence.

Is foxiv a scam, or is it legit?

The latest exposure and evaluation content of foxiv brokers.

foxiv Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

foxiv latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.