Is PANPACIFIC safe?

Pros

Cons

Is Panpacific Safe or a Scam?

Introduction

Panpacific Capital Group, often referred to as Panpacific, is a forex broker that claims to offer a wide range of trading services, including forex, commodities, and cryptocurrencies. Established relatively recently, the broker positions itself within the competitive landscape of online trading. However, with the proliferation of scams in the forex market, it is imperative for traders to exercise caution when choosing a broker. Evaluating the credibility of a broker like Panpacific is crucial to safeguarding one's investments and ensuring a secure trading environment. This article aims to provide a comprehensive analysis of Panpacific, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk assessment. The information presented is derived from various sources, including user reviews, regulatory databases, and financial analysis platforms.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors to consider when determining if it is safe to trade with them. Panpacific currently operates without valid regulation, as its claimed National Futures Association (NFA) license is deemed unauthorized. This lack of oversight raises significant concerns about the safety of clients' funds and the broker's adherence to industry standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0555359 | United States | Unauthorized |

The importance of regulation cannot be overstated; it serves as a safety net for traders, ensuring that brokers adhere to strict operational guidelines designed to protect investors. Unregulated brokers, like Panpacific, are not subject to the same scrutiny and can operate with little to no accountability. This absence of regulation could lead to potential misconduct, including the misappropriation of client funds and lack of transparency in trading conditions. The history of compliance for Panpacific is non-existent, given its short operational timeline and the absence of any regulatory endorsements.

Company Background Investigation

Panpacific Capital Group is a relatively new entrant in the forex brokerage space, with its establishment dating back to 2022. The company's headquarters are located in Roseville, California, USA, but it lacks a clear ownership structure and detailed company history. The absence of transparency regarding the management team and their professional backgrounds raises further questions about the broker's credibility.

The management teams experience is critical in assessing the broker's reliability. Unfortunately, there is limited information available about the individuals behind Panpacific, which adds to the uncertainty surrounding the broker. A lack of detailed information about the company's operations and its leadership can be a significant red flag for potential investors. Furthermore, the company's commitment to transparency and information disclosure appears to be lacking, making it difficult for traders to make informed decisions regarding their investments.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Panpacific claims to provide a range of trading instruments, including forex pairs, commodities, and cryptocurrencies, with leverage ratios reaching up to 1:400. However, the overall fee structure and trading conditions remain ambiguous.

| Fee Type | Panpacific | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 1.5% - 3% |

The lack of clarity regarding spreads, commissions, and overnight interest rates is concerning. Traders may find themselves facing unexpected costs that can significantly impact their trading profitability. Moreover, the absence of a clearly defined commission model and spread information raises doubts about the broker's transparency and fairness in pricing. As such, potential clients should approach Panpacific with caution, as the trading conditions could be unfavorable.

Client Fund Safety

The safety of client funds is paramount when assessing a forex broker. Panpacific does not appear to implement robust measures to protect client funds, such as segregated accounts or negative balance protection. Segregated accounts are essential as they ensure that client funds are kept separate from the broker's operational funds, providing an extra layer of security in the event of insolvency.

Furthermore, the absence of investor protection schemes raises additional concerns. In regulated environments, brokers are often required to participate in compensation schemes that protect clients in case of broker failure. Panpacifics lack of such measures indicates a higher risk for traders, as there are no guarantees for fund recovery in the event of a dispute or bankruptcy. Historical data on fund safety issues with Panpacific is sparse, but the absence of regulatory oversight is a significant warning sign.

Customer Experience and Complaints

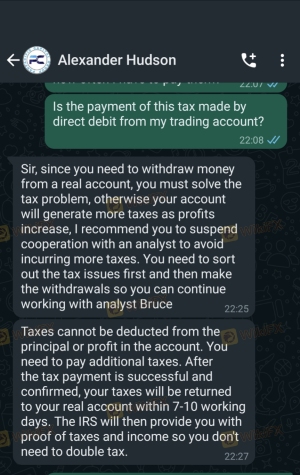

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews about Panpacific generally reflect a mix of experiences, with many users expressing concerns regarding the broker's transparency and responsiveness. Common complaints include difficulties in withdrawing funds and a lack of communication from the customer service team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Transparency Concerns | Medium | Average |

One notable case involved a trader who reported being unable to withdraw funds after several attempts, citing vague explanations from customer support. Such experiences highlight the potential risks associated with trading with an unregulated broker like Panpacific. The company's response to complaints appears to be inadequate, further aggravating client dissatisfaction.

Platform and Trade Execution

The trading platform offered by Panpacific is another crucial aspect of its service. The broker utilizes a proprietary trading software known as AppGlobalEasy, which lacks the robust features and reliability of industry-standard platforms like MetaTrader 4 or 5.

Users have reported mixed experiences with the platform's performance, including issues related to order execution speed and slippage. A high rate of slippage can lead to significant trading losses, particularly in volatile market conditions. Additionally, the absence of any evidence suggesting platform manipulation is a concern, as it raises questions about the broker's integrity and commitment to fair trading practices.

Risk Assessment

When evaluating the overall risk of trading with Panpacific, several factors come into play. The lack of regulation, unclear trading conditions, and negative customer experiences contribute to a high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Potential platform issues and slippage |

To mitigate these risks, traders should conduct thorough research, consider using smaller amounts for initial trades, and be prepared for the possibility of losing their investment. Seeking alternatives with established regulatory oversight is also advisable.

Conclusion and Recommendations

In conclusion, the evidence suggests that Panpacific poses significant risks for potential traders. The broker's lack of regulation, unclear trading conditions, and mixed customer experiences raise serious concerns about its legitimacy and trustworthiness. Therefore, it is crucial for traders to exercise caution when considering whether to engage with Panpacific.

For those looking for safer alternatives, it is recommended to explore brokers that are well-regulated and have a proven track record of reliability. Brokers such as FXOpen and FP Markets offer a more transparent and secure trading environment, making them suitable choices for both novice and experienced traders. Ultimately, the decision to trade with Panpacific should be made with careful consideration of the associated risks and a clear understanding of the broker's limitations.

In summary, is Panpacific safe? The overwhelming evidence points to a conclusion of caution, making it advisable for traders to remain vigilant and prioritize their financial security.

Is PANPACIFIC a scam, or is it legit?

The latest exposure and evaluation content of PANPACIFIC brokers.

PANPACIFIC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PANPACIFIC latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.