Amtop 2025 Review: Everything You Need to Know

Summary: The overall sentiment regarding Amtop is overwhelmingly negative, with multiple sources labeling it as a scam and an unregulated broker. Key findings indicate that Amtop operates under false pretenses, using cloned regulatory information to mislead potential investors.

Note: It is crucial to acknowledge that Amtop may operate under various entities across different jurisdictions, which adds complexity to its legitimacy. This review aims to present a fair and accurate assessment based on the latest data available.

Rating Box

How We Score Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding the broker's practices.

Broker Overview

Founded in 2022, Amtop is a forex broker that claims to be headquartered in London. However, it has been identified as a clone firm, using the regulatory details of a legitimate company to deceive traders. The broker purports to offer the widely-used MetaTrader 5 platform, alongside a range of trading instruments, including forex, cryptocurrencies, and commodities. Notably, Amtop is not regulated by any major authorities, which raises significant concerns about the safety of client funds.

Detailed Section

Regulatory Status

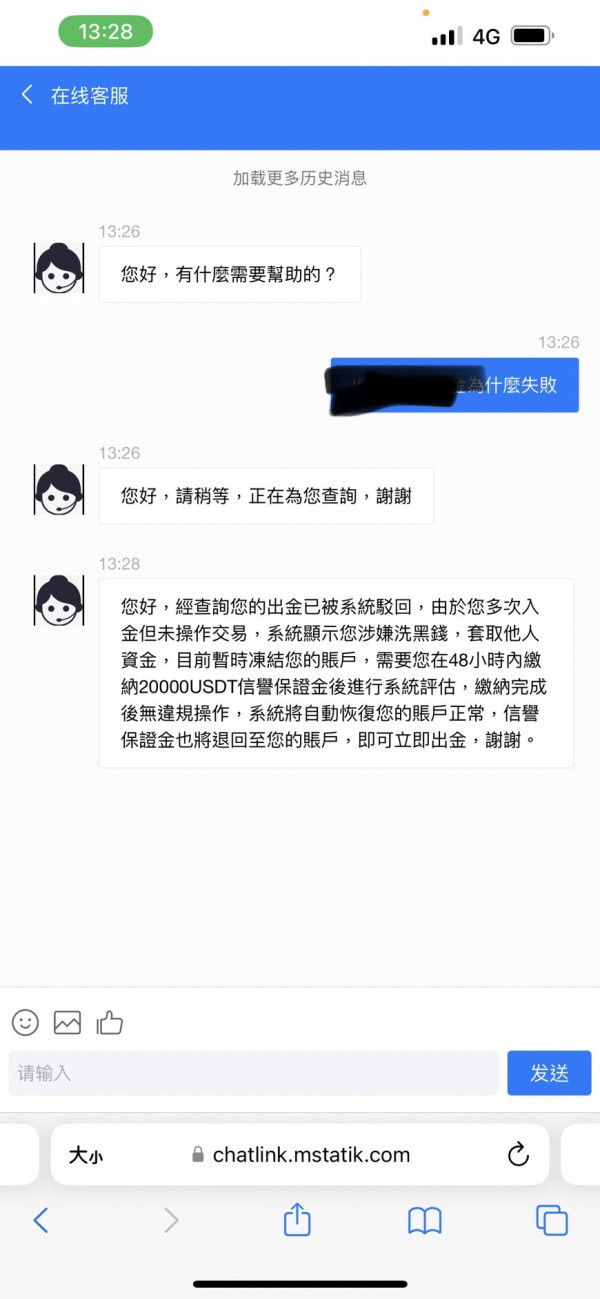

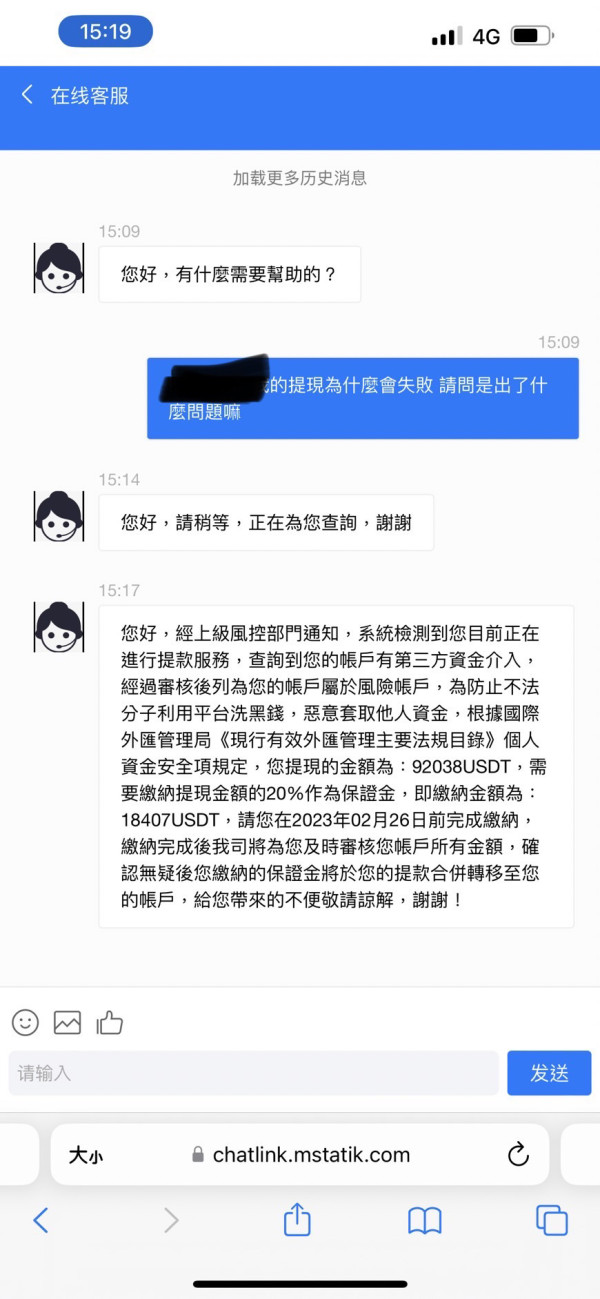

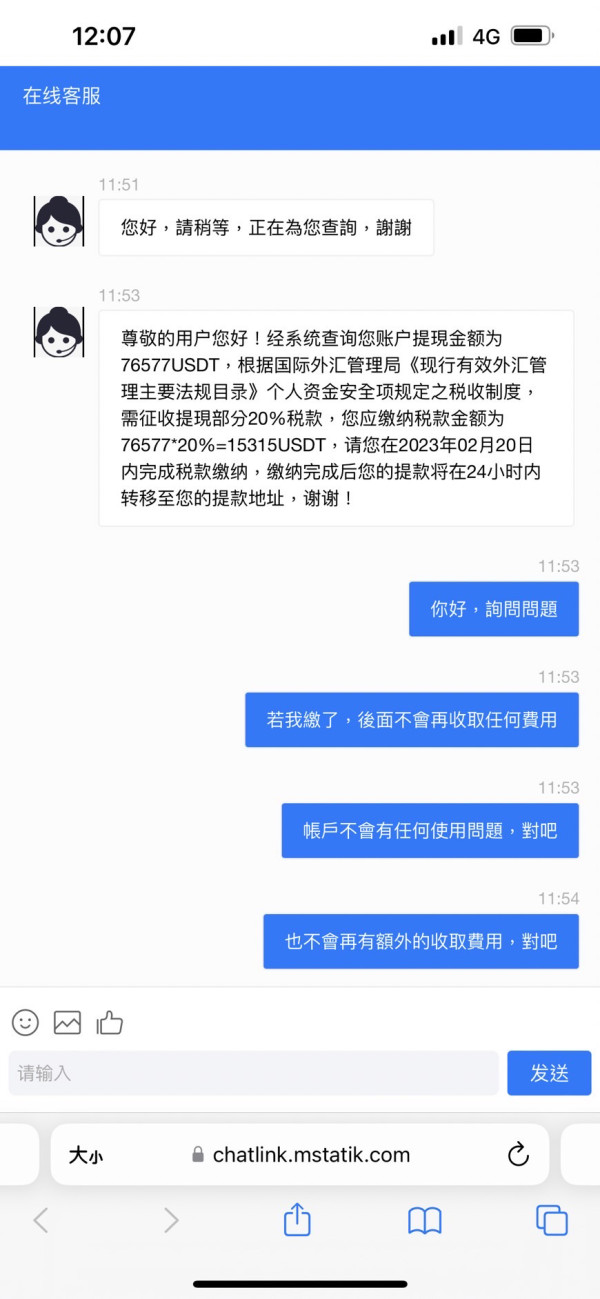

Amtop claims to operate under the supervision of the UKs Financial Conduct Authority (FCA) and other regulatory bodies, but investigations reveal that it is not registered with any legitimate authority. The FCA has issued warnings against Amtop, categorizing it as a clone firm that misuses the details of a legitimate broker, Amt Futures Limited. This lack of regulation means that clients are at risk of losing their investments without any recourse.

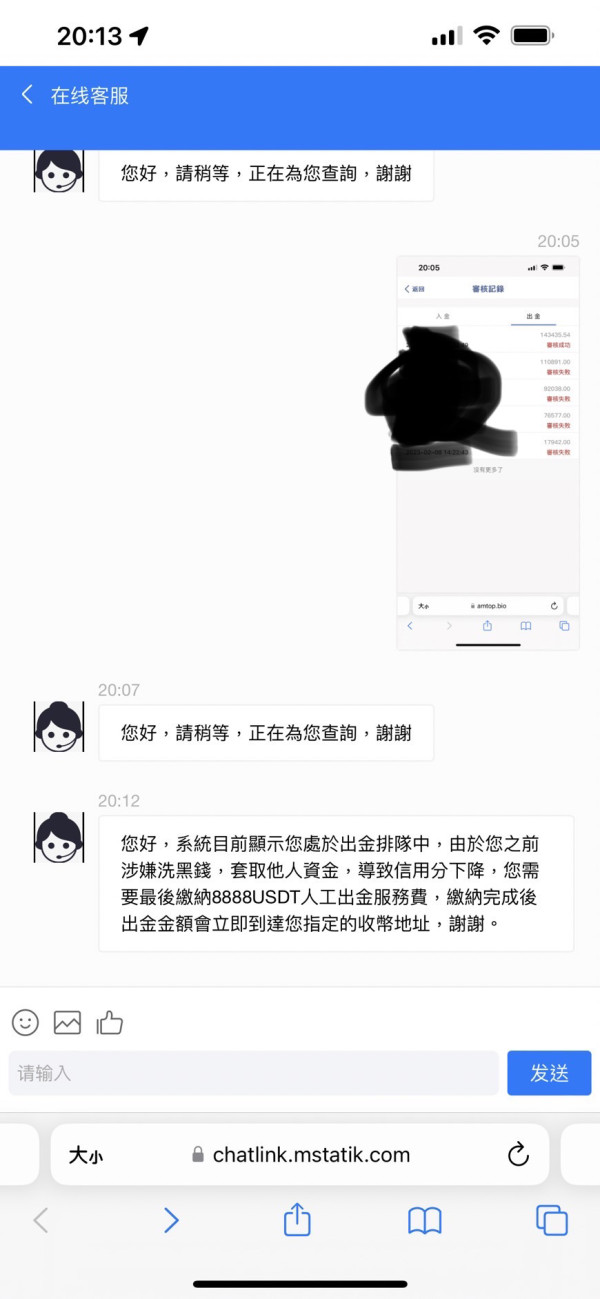

Deposit/Withdrawal Methods

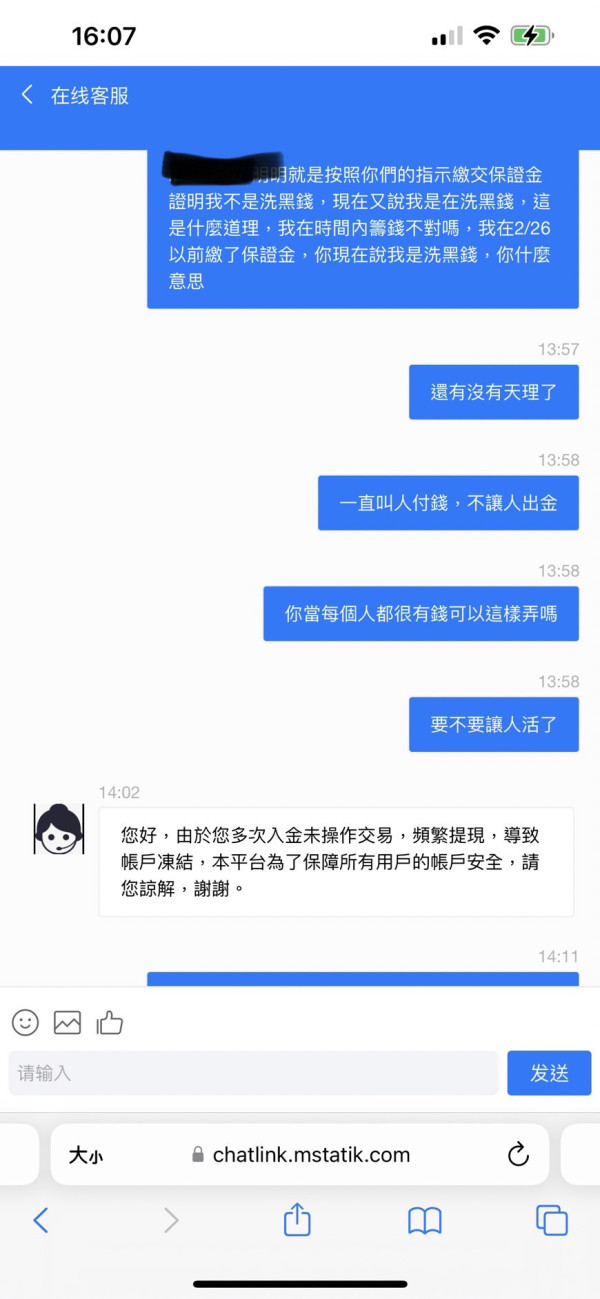

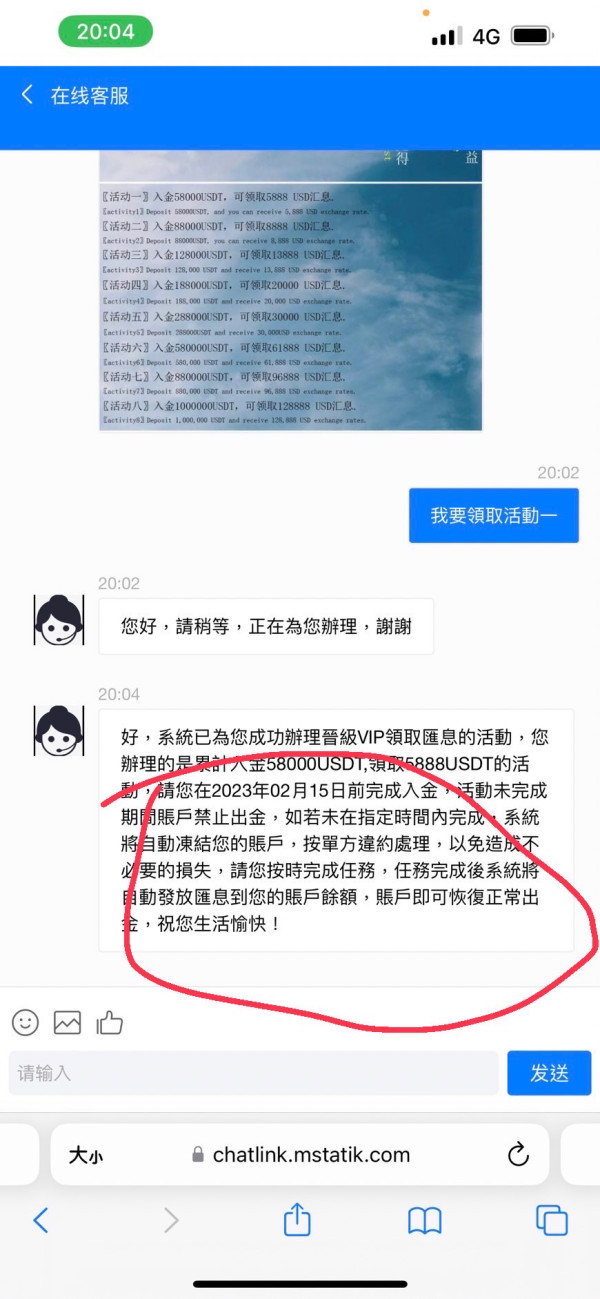

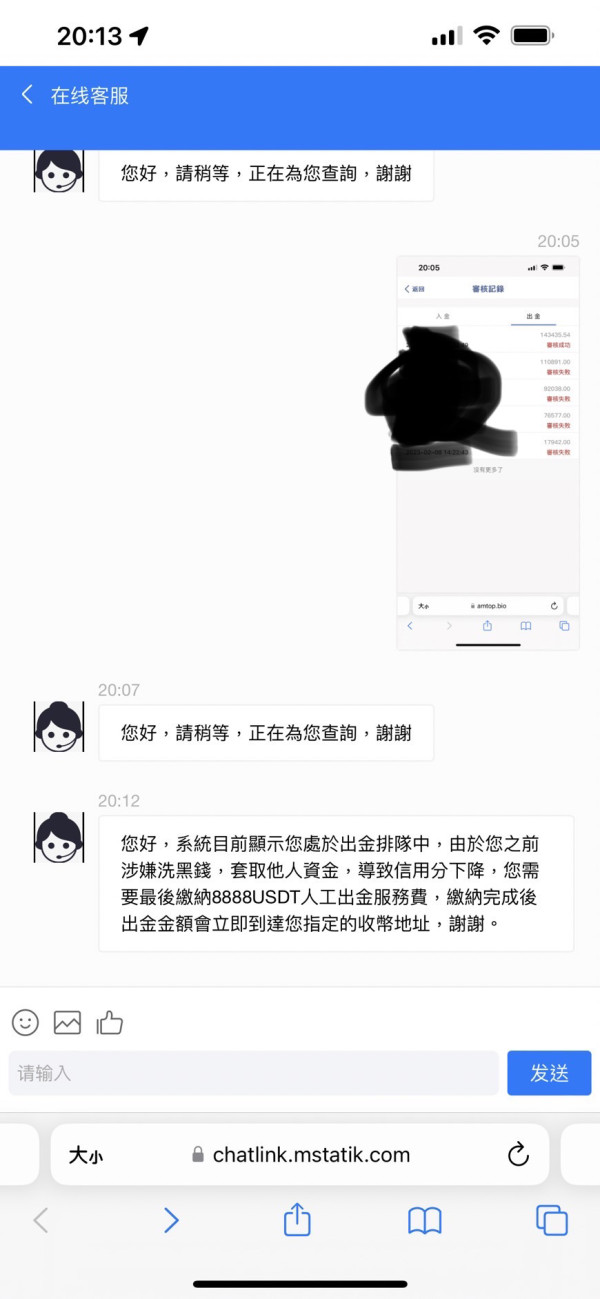

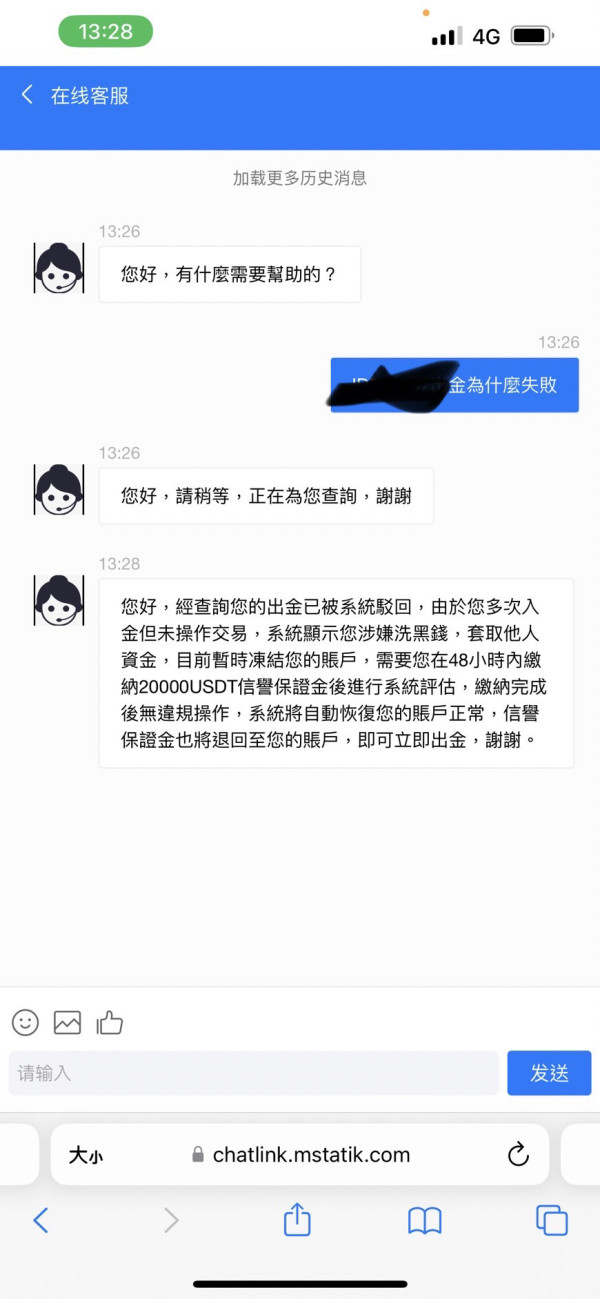

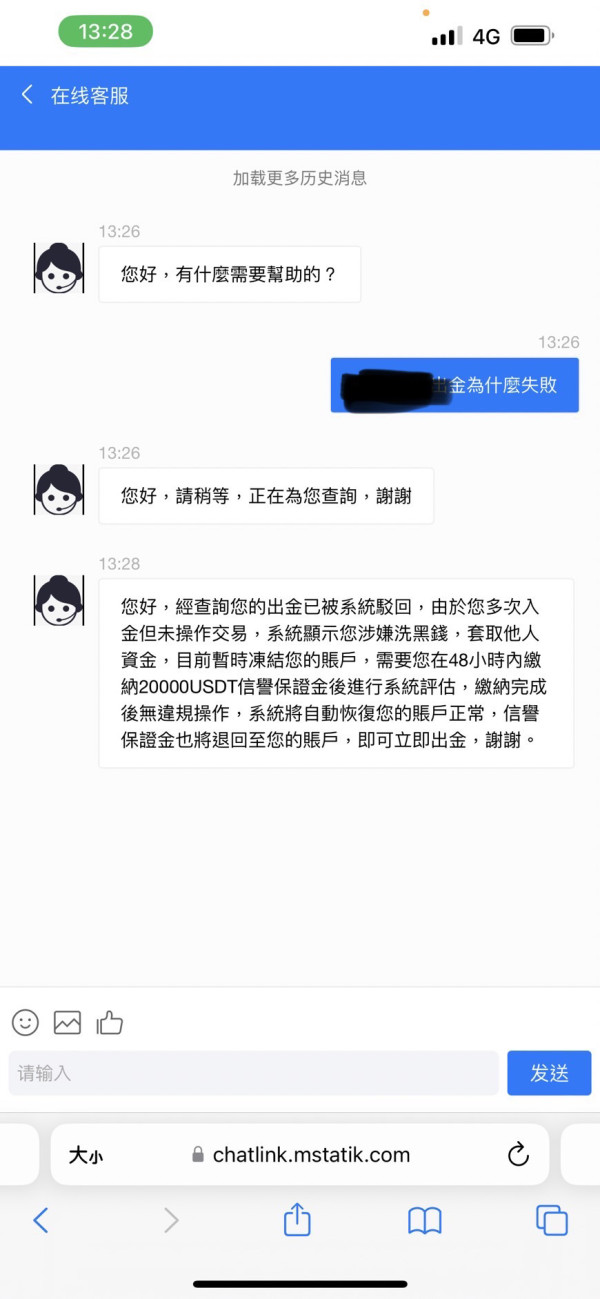

Amtop reportedly accepts deposits via international wire transfers and cryptocurrencies such as Bitcoin and Ethereum. However, many users have reported difficulties in withdrawing funds, with claims that withdrawal requests are often denied or delayed. The use of cryptocurrencies is particularly concerning, as transactions are irreversible, making it nearly impossible for users to recover their funds once deposited.

Minimum Deposit

The minimum deposit requirement for opening an account with Amtop is not clearly defined, which is a red flag. Legitimate brokers typically provide transparent information regarding account types and associated costs, but Amtop fails to do so, leaving potential investors in the dark.

While there is no clear information regarding bonuses or promotions offered by Amtop, it is common for unregulated brokers to entice new clients with attractive bonus offers that come with high turnover requirements. These conditions often make it difficult for traders to withdraw their funds, further trapping them in the brokers scheme.

Trading Instruments

Amtop claims to offer a variety of trading instruments, including currency pairs, cryptocurrencies, and commodities. However, the lack of transparency regarding trading conditions, spreads, and commissions makes it difficult for traders to assess the true costs of trading with this broker.

Costs (Spreads, Fees, Commissions)

The absence of clear information about spreads, fees, and commissions is another major drawback of trading with Amtop. Legitimate brokers typically provide detailed breakdowns of their costs, allowing traders to make informed decisions. This lack of transparency is indicative of the broker's untrustworthiness.

Leverage

Amtop advertises leverage up to 1:500, which is significantly higher than the limits set by regulatory authorities in the UK and EU (1:30). High leverage can amplify both profits and losses, posing a substantial risk to inexperienced traders.

Amtop claims to support the MetaTrader 5 platform, but users have reported issues with downloading and accessing the trading software. The absence of a reliable trading platform is a critical concern for potential investors.

Restricted Regions

There is no clear information regarding the regions from which Amtop accepts clients. However, the FCA warning suggests that the broker is targeting clients in highly regulated countries, which raises ethical concerns.

Available Customer Service Languages

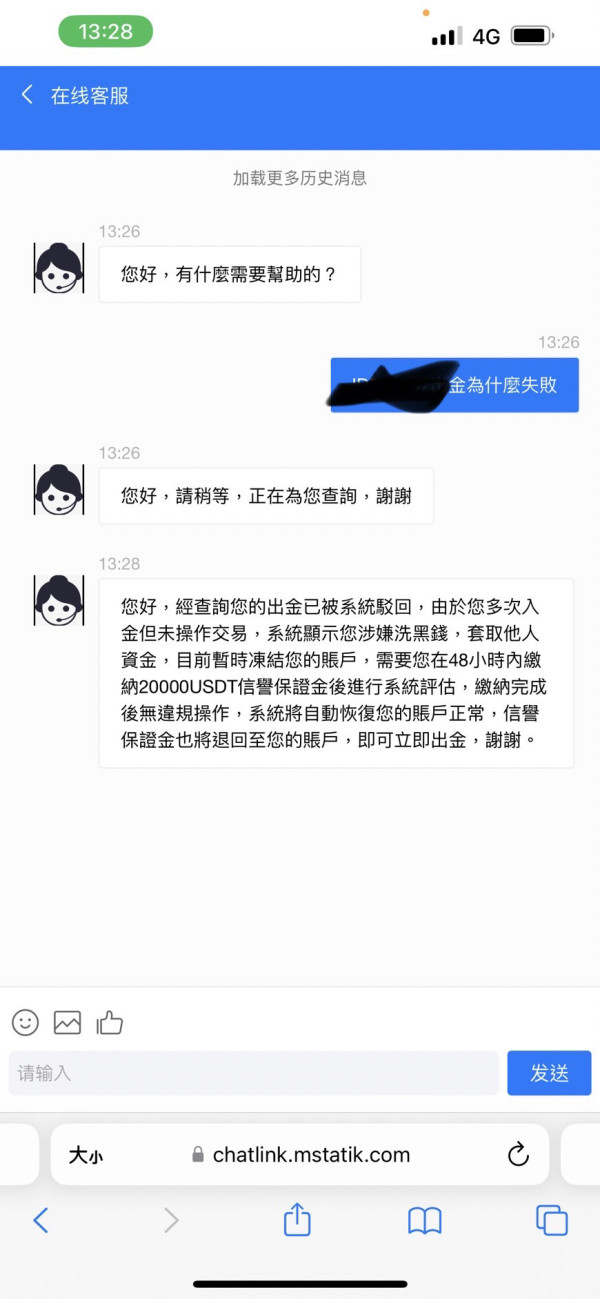

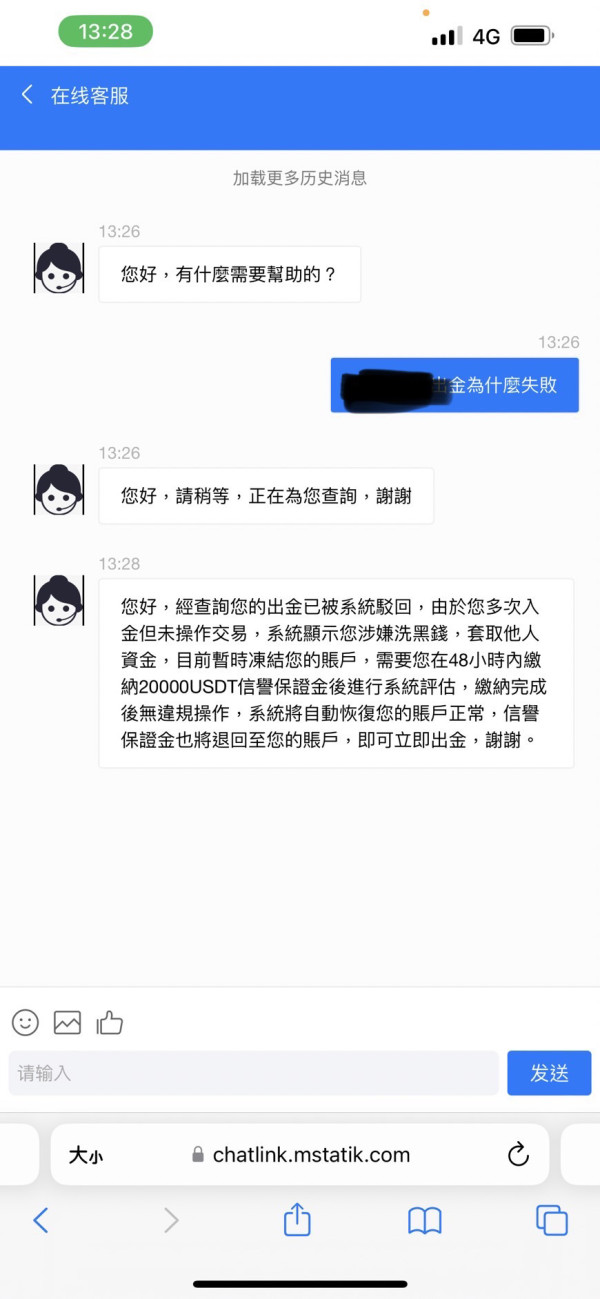

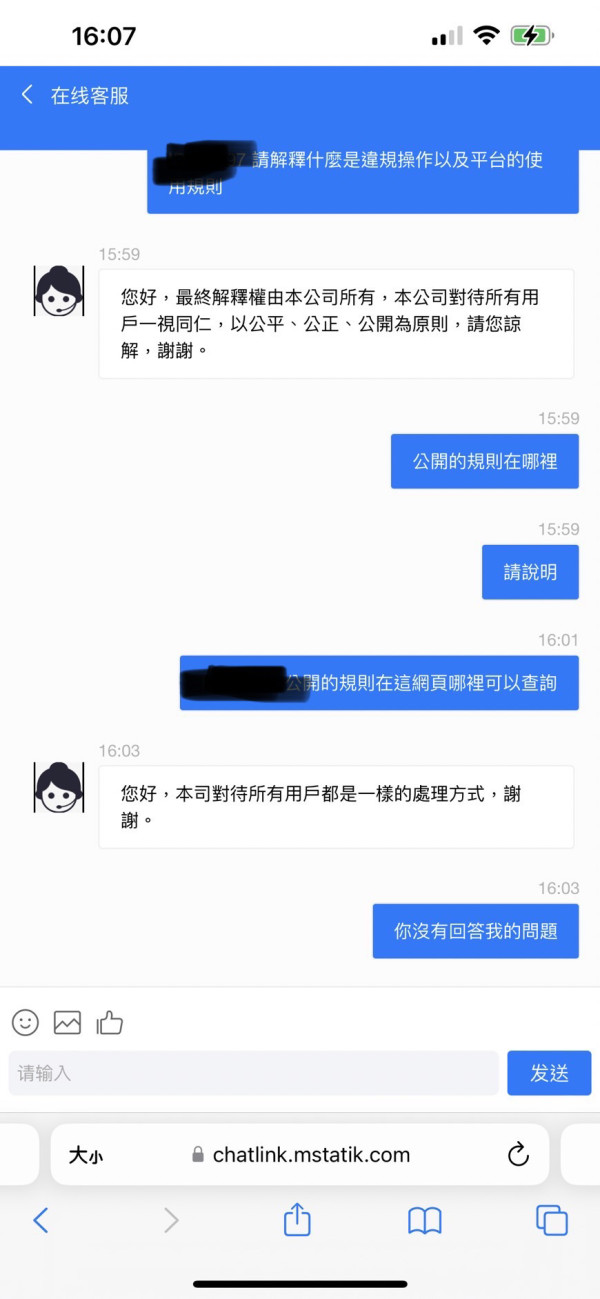

Amtop claims to offer customer support in multiple languages, including English and Chinese. However, user reviews indicate that the customer service experience is poor, with many clients reporting difficulties in reaching support and resolving issues.

Repeated Rating Box

Detailed Breakdown

- Account Conditions: The lack of transparency regarding account types and minimum deposits is alarming. Users have reported being misled about the account features.

- Tools and Resources: The promised access to MetaTrader 5 has not been substantiated, with users unable to access the platform effectively.

- Customer Service and Support: Numerous complaints highlight a lack of responsive customer service, making it difficult for users to resolve their issues.

- Trading Setup (Experience): Users have expressed frustration with the trading experience, citing difficulties in accessing the platform and executing trades.

- Trustworthiness: With no regulation and multiple warnings from authorities, Amtop's trustworthiness is highly questionable.

- User Experience: Overall, the user experience has been rated poorly due to the broker's lack of transparency and responsiveness.

In conclusion, the evidence suggests that trading with Amtop is fraught with risks, and potential investors should exercise extreme caution. The combination of unregulated status, poor user reviews, and lack of transparency paints a concerning picture of this broker. As indicated in this Amtop review, it is advisable to seek out regulated and reputable alternatives for trading.