Is Amtop safe?

Business

License

Is Amtop Safe or Scam?

Introduction

Amtop is an online forex broker that has been gaining attention in the trading community, primarily due to its claims of providing a wide range of financial services and trading instruments. Positioned as a global player in the forex market, Amtop presents itself as a platform for both retail and institutional clients seeking diverse trading opportunities. However, the rise of online trading has also led to an increase in fraudulent activities, making it crucial for traders to carefully evaluate the credibility and safety of brokers like Amtop. In this article, we will investigate whether Amtop is safe or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk factors. Our assessment is based on a thorough review of various online resources, including user feedback and expert evaluations.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its legitimacy and safety. Regulated brokers are subject to strict oversight by financial authorities, which helps ensure fair trading practices and the protection of client funds. In the case of Amtop, the broker claims to operate under the regulations of the UK Financial Conduct Authority (FCA). However, upon further investigation, it becomes evident that Amtop is not listed as a regulated entity by the FCA, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Regulated |

The lack of a valid license from a recognized regulatory body is a major red flag. The FCA has issued warnings against Amtop, labeling it a "clone firm" that misuses the details of legitimate brokers to deceive potential clients. This deception not only undermines trust but also poses substantial risks to traders, as unregulated brokers do not offer the same level of protection for client funds. In summary, the absence of regulatory oversight suggests that Amtop is not safe for trading, making it essential for traders to be cautious.

Company Background Investigation

Examining the company background provides further insight into the credibility of a broker. Amtop claims to have established its operations in the UK, but there is little verifiable information about its history, ownership structure, or management team. The lack of transparency regarding the company's founding and operational practices is concerning. A legitimate broker typically provides detailed information about its management team, including their professional backgrounds and industry experience. This information is crucial for establishing trust with potential clients.

Moreover, the absence of a clear company history and ownership structure raises questions about the broker's accountability. Without transparency, it becomes challenging for traders to assess the reliability of Amtop. Given these factors, it is evident that Amtop lacks the foundational attributes necessary for a safe trading environment.

Trading Conditions Analysis

Trading conditions play a significant role in determining the overall trading experience. A reputable broker should offer transparent information regarding fees, spreads, and commissions. Unfortunately, Amtop does not provide clear details about its trading conditions, which is a common trait among unregulated brokers. The lack of information on spreads, commissions, and overnight interest rates is alarming, as it leaves traders in the dark about the potential costs associated with trading on the platform.

| Fee Type | Amtop | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear fee structures suggests that Amtop may impose hidden fees or unfavorable trading conditions, which could significantly impact traders' profitability. Such practices are not only unethical but also indicative of a potentially fraudulent operation. Traders should be wary of engaging with brokers that do not provide transparent trading conditions.

Customer Funds Safety

The safety of customer funds is paramount in the trading industry. Reputable brokers implement measures such as segregated accounts, investor protection schemes, and negative balance protection to safeguard client deposits. Unfortunately, Amtop does not provide any information regarding its fund safety measures. The lack of segregated accounts means that client funds may not be protected from the broker's operational risks, which is a serious concern.

Furthermore, the absence of investor protection schemes raises the stakes for traders. In the event of insolvency or fraud, clients may find it challenging to recover their investments. Historical issues related to fund safety and security further exacerbate concerns regarding Amtop's reliability. Given these factors, it is clear that Amtop does not prioritize the safety of customer funds, making it a risky choice for traders.

Customer Experience and Complaints

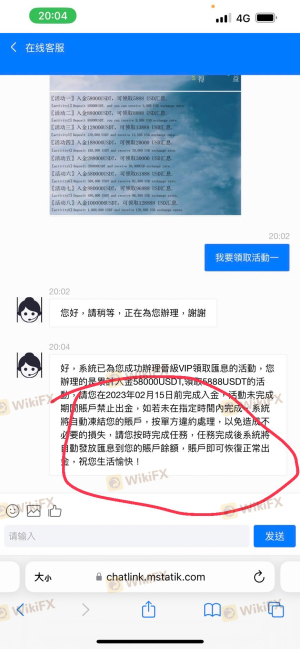

Analyzing customer feedback is essential for understanding a broker's reliability. Reviews and testimonials from actual users can reveal common complaints and the broker's response to issues. Unfortunately, feedback regarding Amtop is largely negative. Many users report difficulties in withdrawing funds, with complaints about excessive fees or delays in processing withdrawals.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Inadequate |

| Customer Service Quality | High | Poor |

One notable case involved a trader who experienced significant delays in withdrawing their funds, only to be told that additional fees were required for the transaction to be processed. Such experiences highlight the potential risks of trading with Amtop, as they indicate a lack of responsiveness and accountability from the broker. Overall, the customer experience raises serious doubts about Amtop's commitment to client satisfaction and safety.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a seamless trading experience. A reputable broker typically offers a robust platform with stable execution and minimal slippage. However, Amtop's claims of providing access to popular platforms like MetaTrader 5 are questionable. Many users report issues with platform stability, order execution, and even outright failures to execute trades.

The presence of such problems raises concerns about potential platform manipulation or technical failures that could adversely affect traders' positions. Given the critical importance of reliable execution in forex trading, the issues surrounding Amtop's platform further reinforce the notion that it may not be a safe option for traders.

Risk Assessment

Using Amtop for trading presents several risks that potential clients should consider. The lack of regulation, transparency, and customer fund safety measures contribute to a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Risk | High | Lack of fund protection |

| Operational Risk | Medium | Platform instability |

To mitigate these risks, traders should consider diversifying their investments and opting for regulated brokers with proven track records. Conducting thorough research and reading user reviews can also help identify potential pitfalls before committing funds.

Conclusion and Recommendations

In conclusion, the investigation into Amtop reveals significant red flags that suggest it may not be a safe broker for traders. The absence of regulation, lack of transparency, and numerous complaints regarding customer service and fund withdrawals all point to the conclusion that Amtop is likely a scam.

For traders seeking reliable options, it is advisable to consider established brokers that are regulated by reputable authorities and offer transparent trading conditions. Alternatives include brokers with strong reputations, robust customer support, and proven track records of fund safety. Ultimately, exercising caution and due diligence is crucial when navigating the complex landscape of online forex trading.

Is Amtop a scam, or is it legit?

The latest exposure and evaluation content of Amtop brokers.

Amtop Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Amtop latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.