Insun 2025 Review: Everything You Need to Know

In this comprehensive review of Insun, we delve into the mixed feedback surrounding this forex broker. While some users appreciate the potential for cashback and rebates, many others express concerns over the broker's legitimacy and customer service. The lack of regulation raises significant red flags, making this broker a contentious choice in the forex trading landscape.

Note: It's essential to consider that Insun operates across various jurisdictions, which may affect user experiences and regulatory oversight. This review aims to provide a fair and accurate assessment based on available information.

Ratings Overview

We evaluate brokers based on user feedback, expert opinions, and factual data to provide a balanced assessment.

Broker Overview

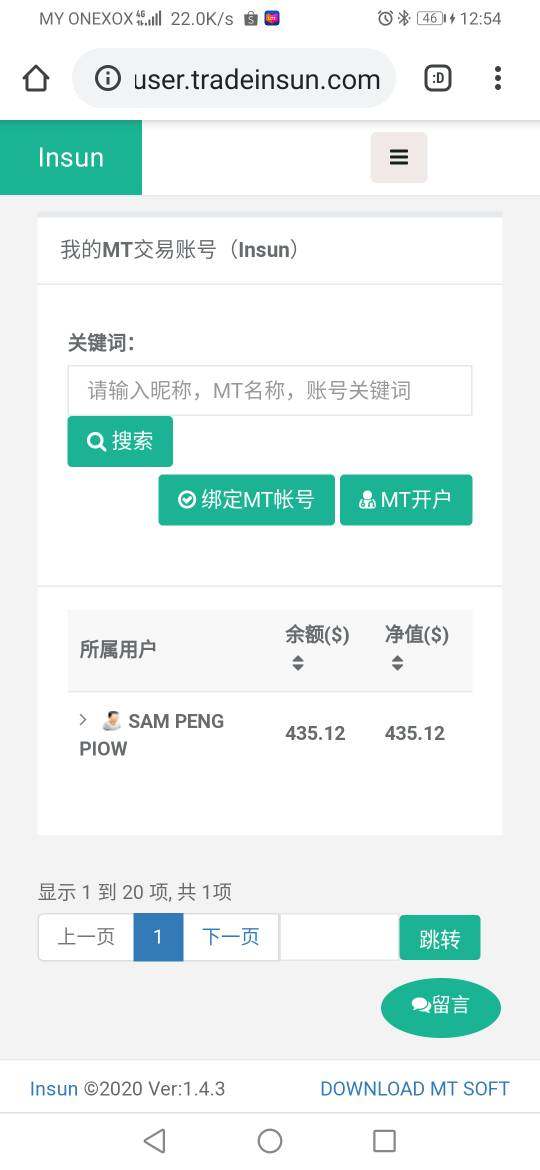

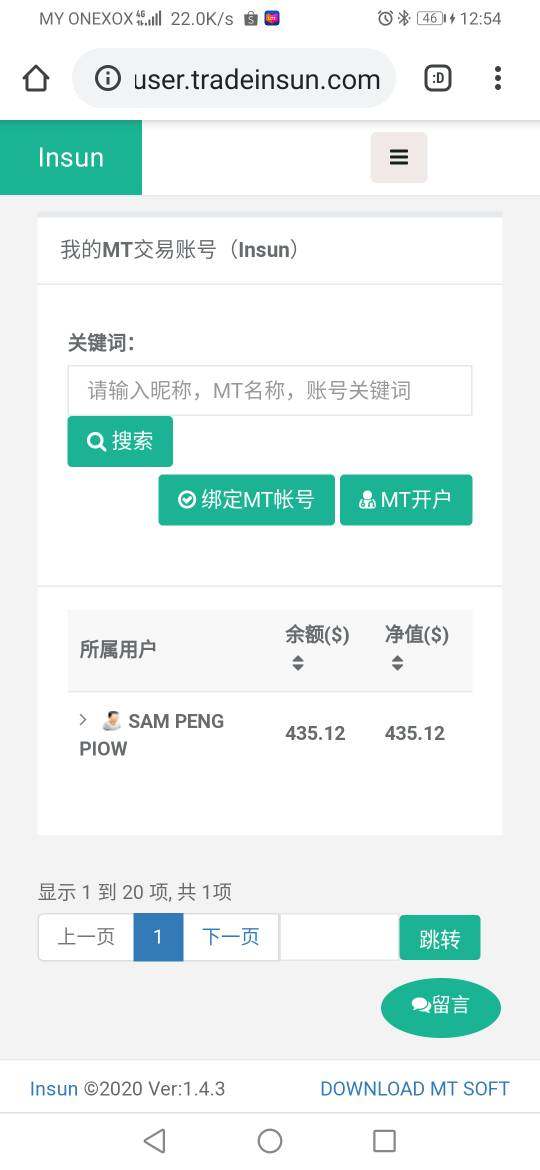

Founded in 2007, Insun is a forex broker that offers trading on the MetaTrader 4 (MT4) platform. It provides access to a variety of financial instruments, including forex pairs, indices, commodities, and metals. However, a significant concern is that Insun is not regulated by any major financial authority, which is a crucial factor for many traders when choosing a broker.

Insun's trading conditions include a minimum deposit requirement of $0 and a minimum trade size of $0, appealing to new traders. The broker also promotes a cashback program, which claims to return a portion of the trading costs to its users. However, the details surrounding this cashback mechanism can be unclear and may not be as beneficial as presented.

Detailed Breakdown

-

Regulatory Environment

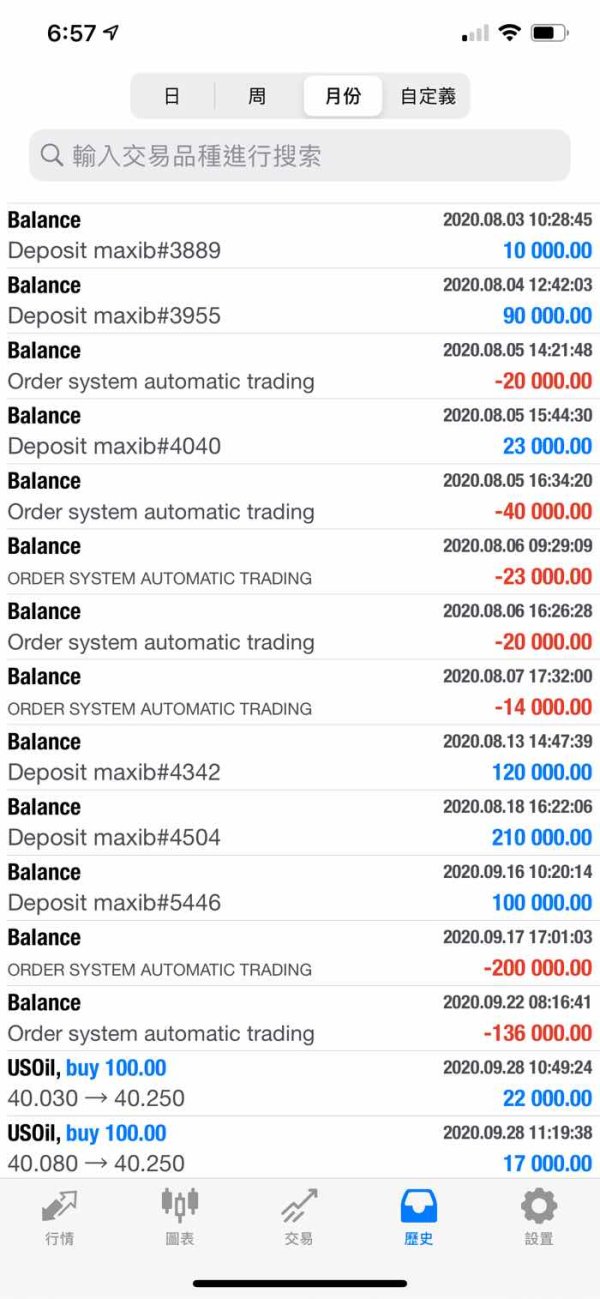

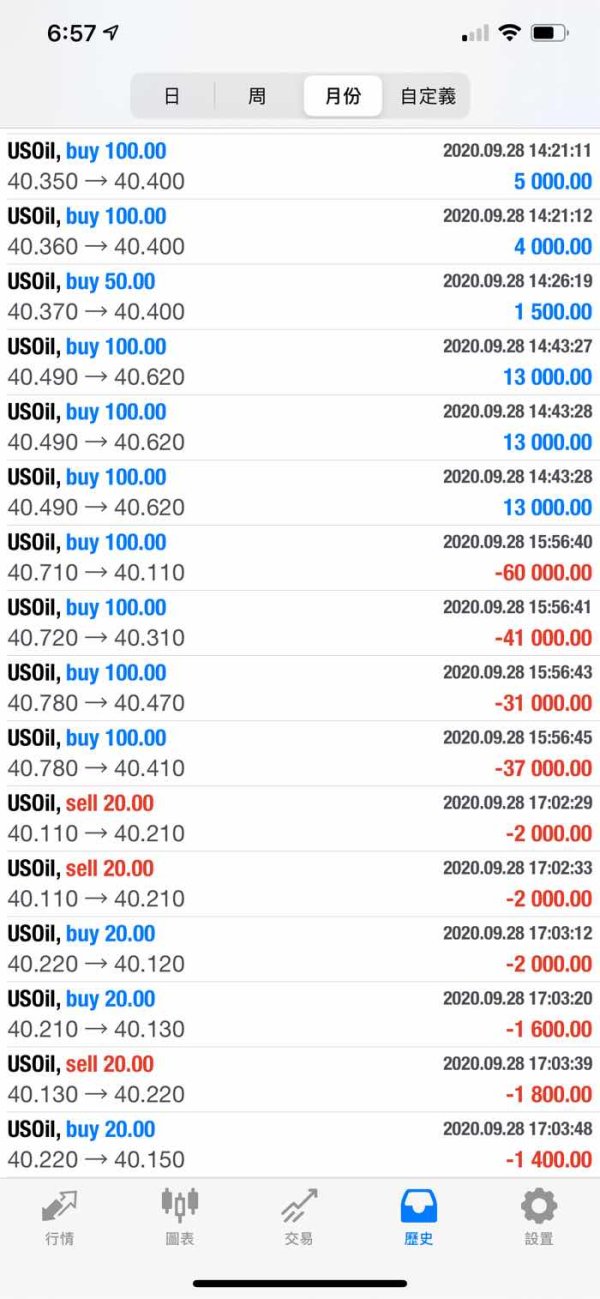

Insun operates in a largely unregulated environment, which poses risks for traders. According to various sources, including Forex Peace Army, the broker has been blacklisted in multiple jurisdictions, including Hong Kong and Belgium, due to its lack of regulatory compliance. This lack of oversight raises concerns about fund safety and withdrawal processes.

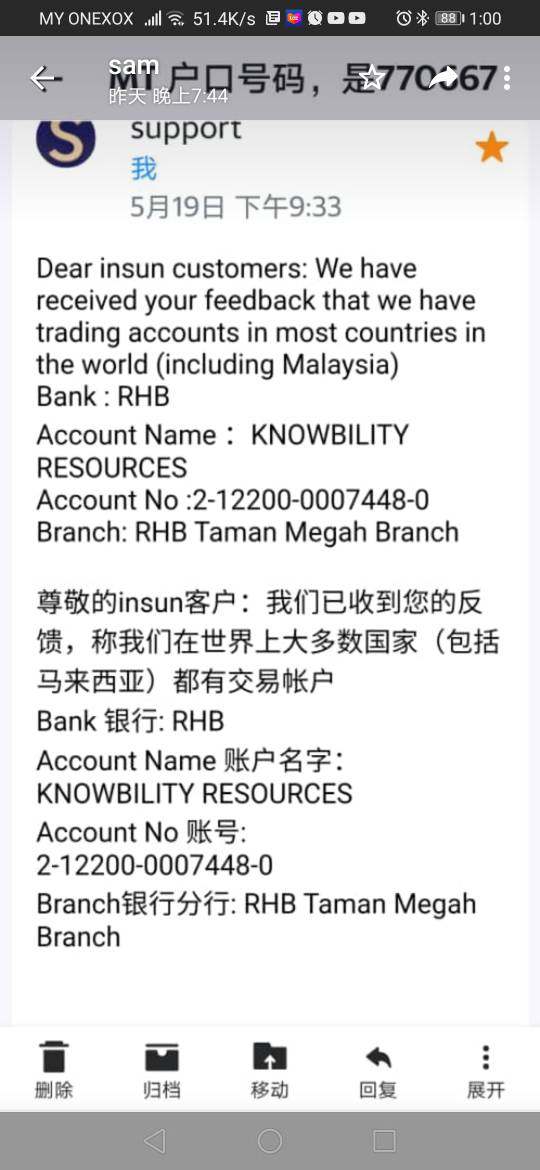

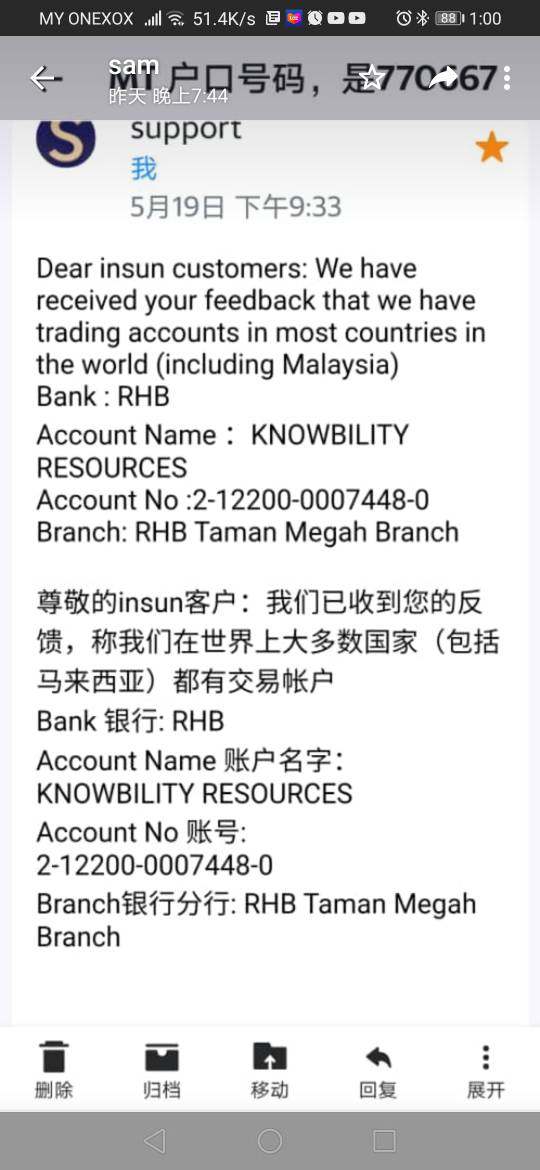

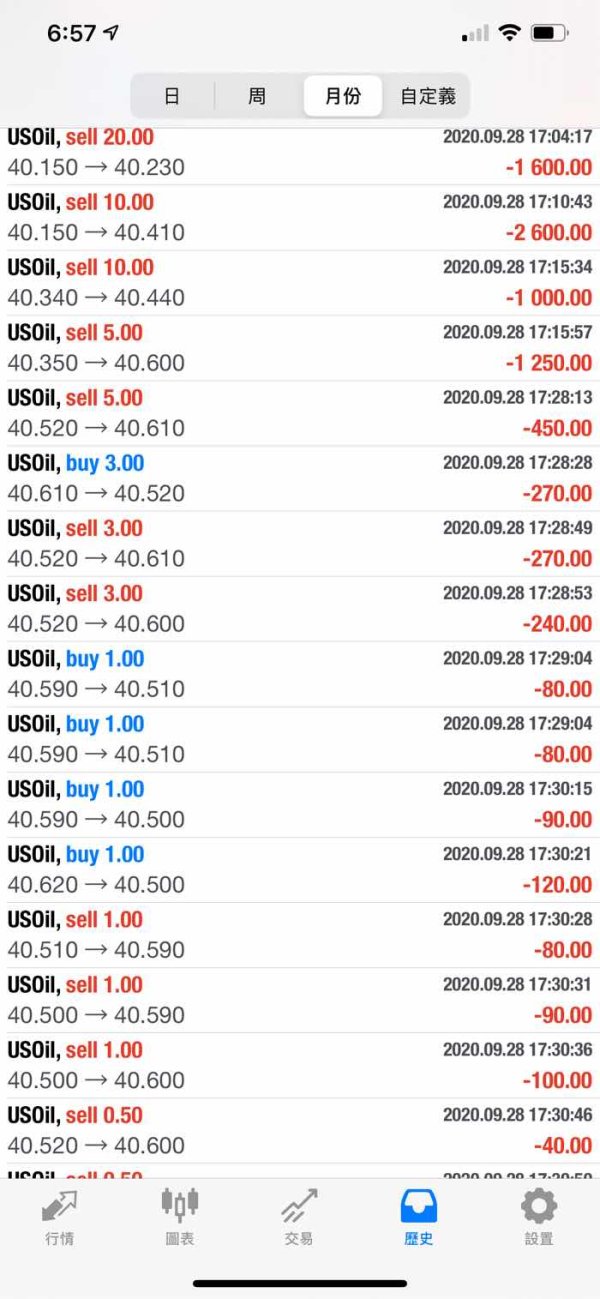

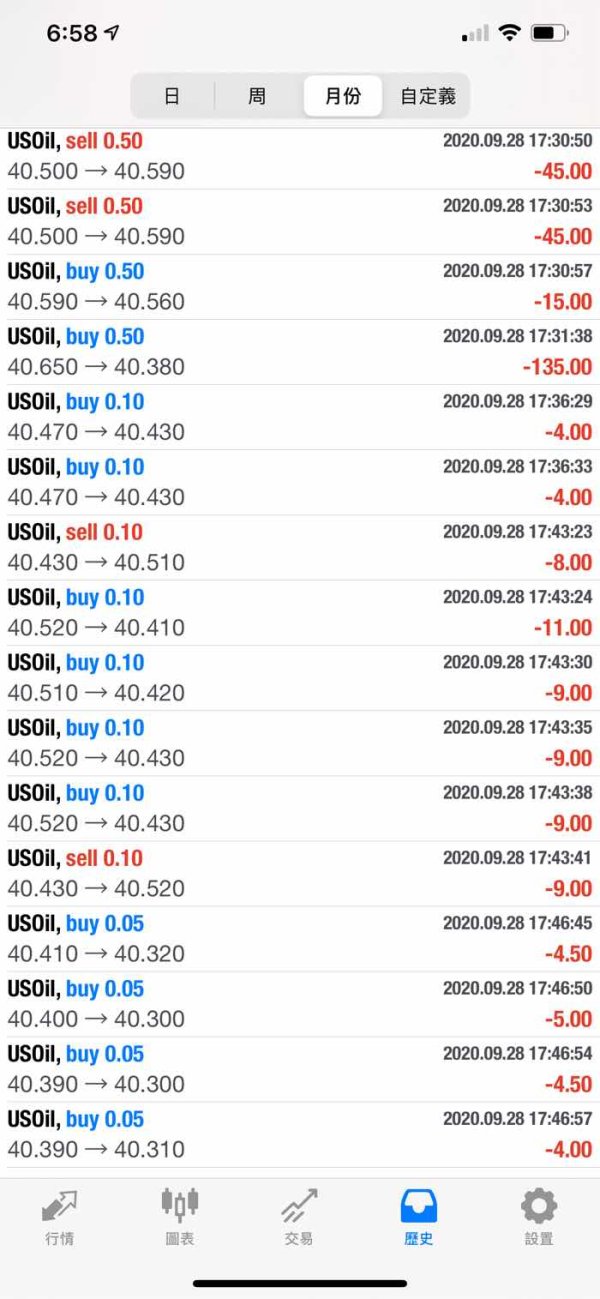

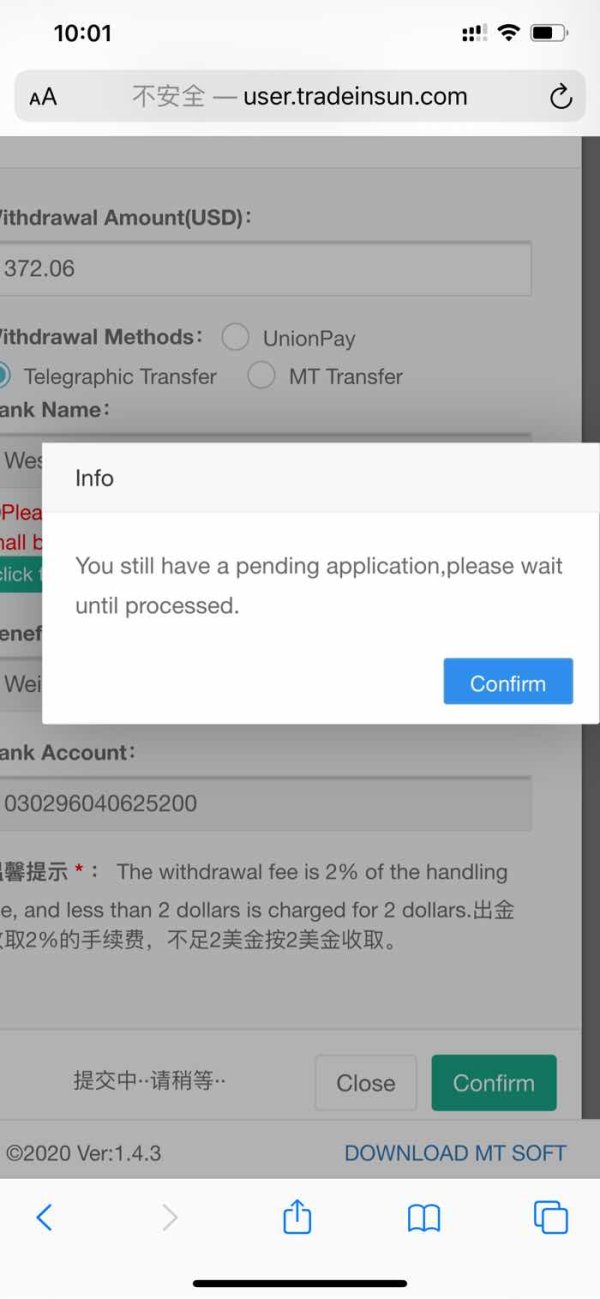

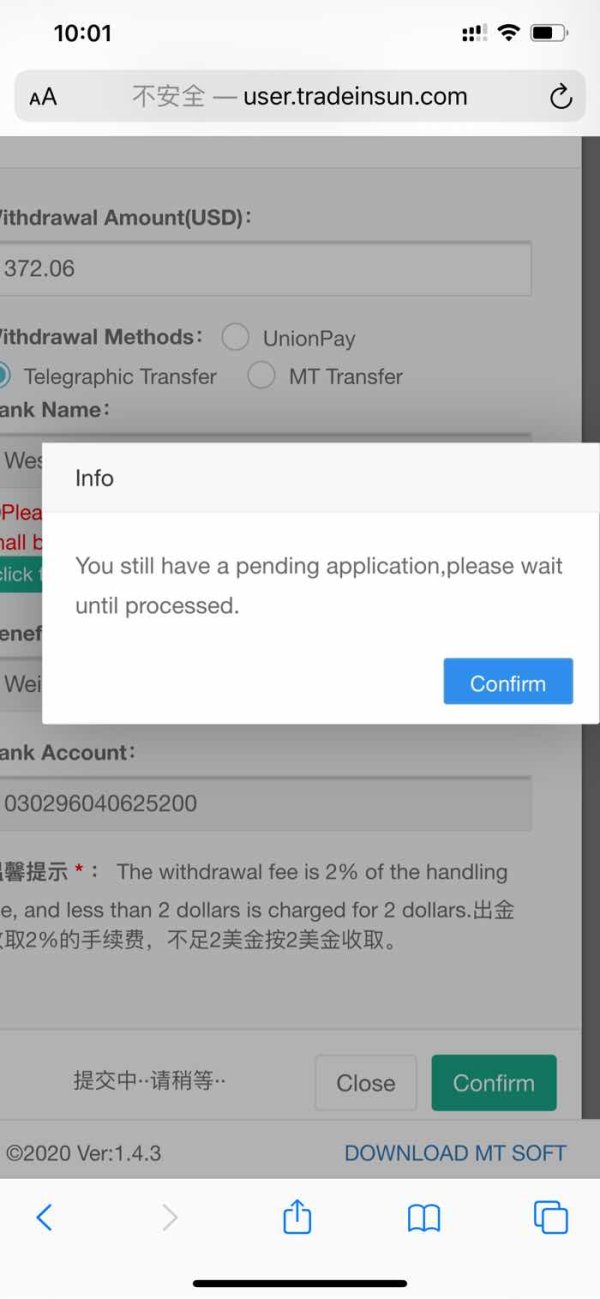

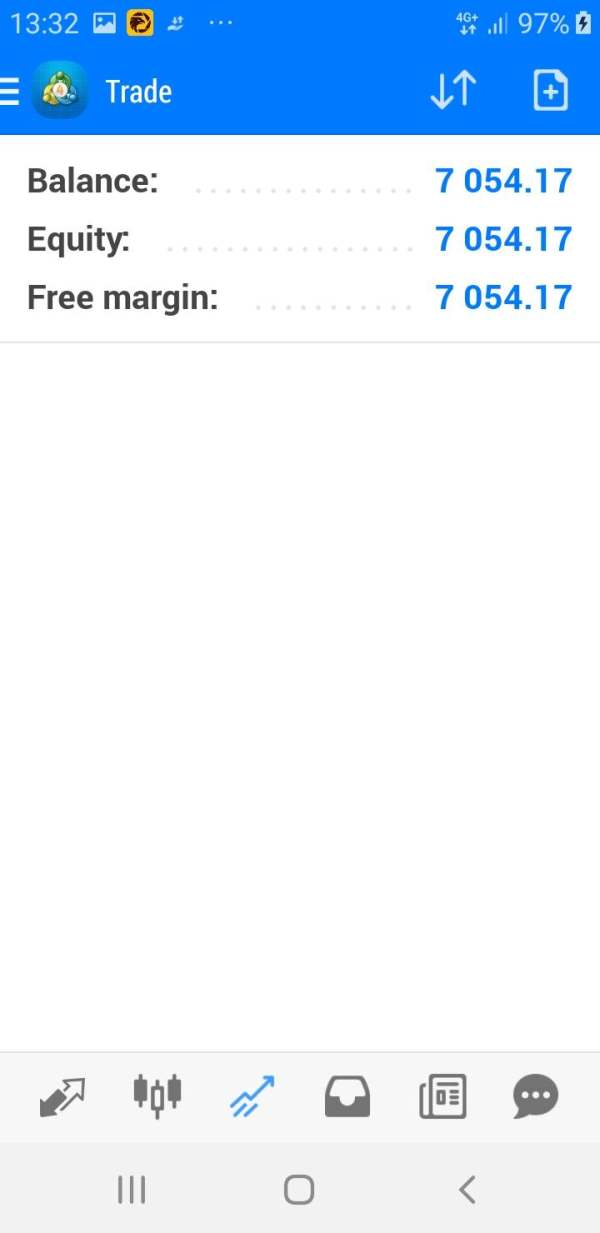

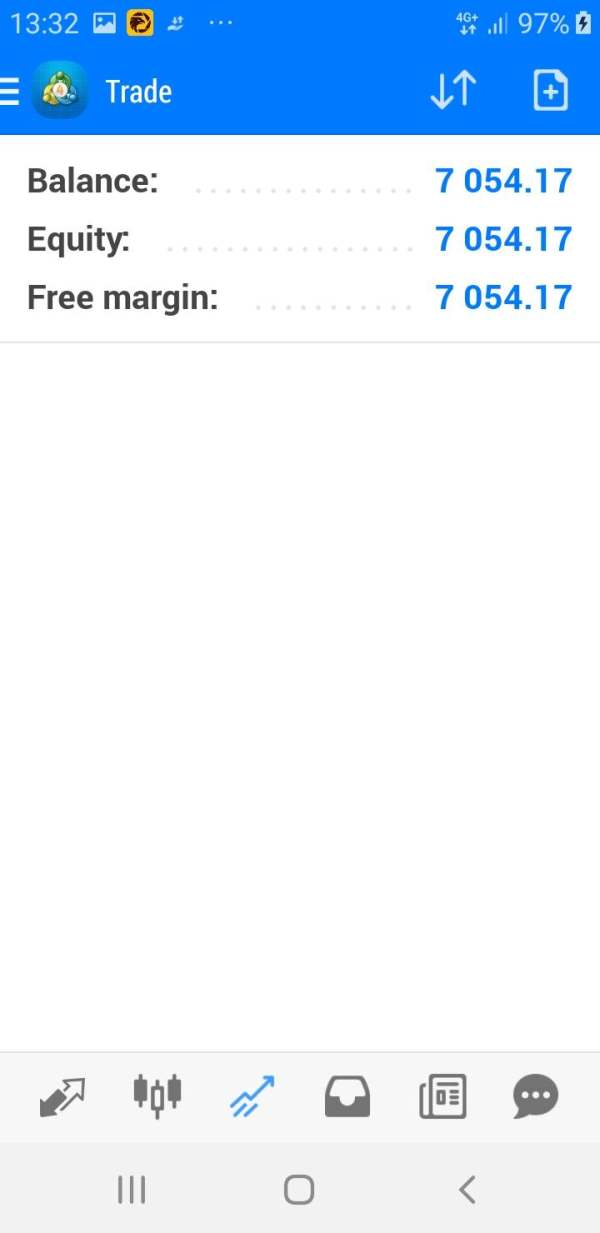

Deposit and Withdrawal Options

Insun does not specify the currencies accepted for deposits and withdrawals, which could complicate transactions for international users. The absence of clear information on deposit methods also raises questions about the broker's transparency.

Minimum Deposit

One of the attractive features of Insun is its minimum deposit requirement, which is set at $0. This allows traders to start with minimal financial commitment. However, the lack of a minimum deposit may also attract less serious traders, impacting the overall trading environment.

Promotions and Bonuses

Insun offers a cashback promotion that claims to provide rebates on trades. However, the specifics of how these rebates work are often vague, leading to skepticism among users. Many traders have reported that the rebate system is not as beneficial as advertised, with some expressing frustration over the clarity of the terms.

Asset Classes Available for Trading

Insun provides access to a variety of asset classes, including forex, indices, commodities, and metals. This diverse offering allows traders to explore different markets, but the quality of execution and spreads remains a concern due to the broker's questionable reputation.

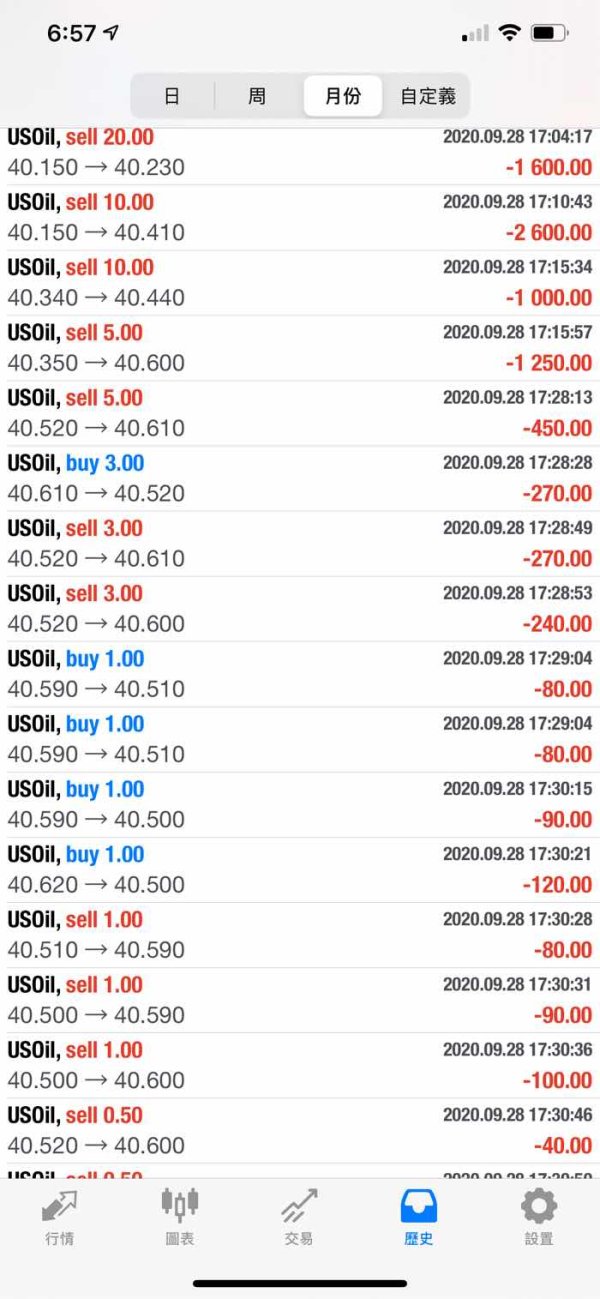

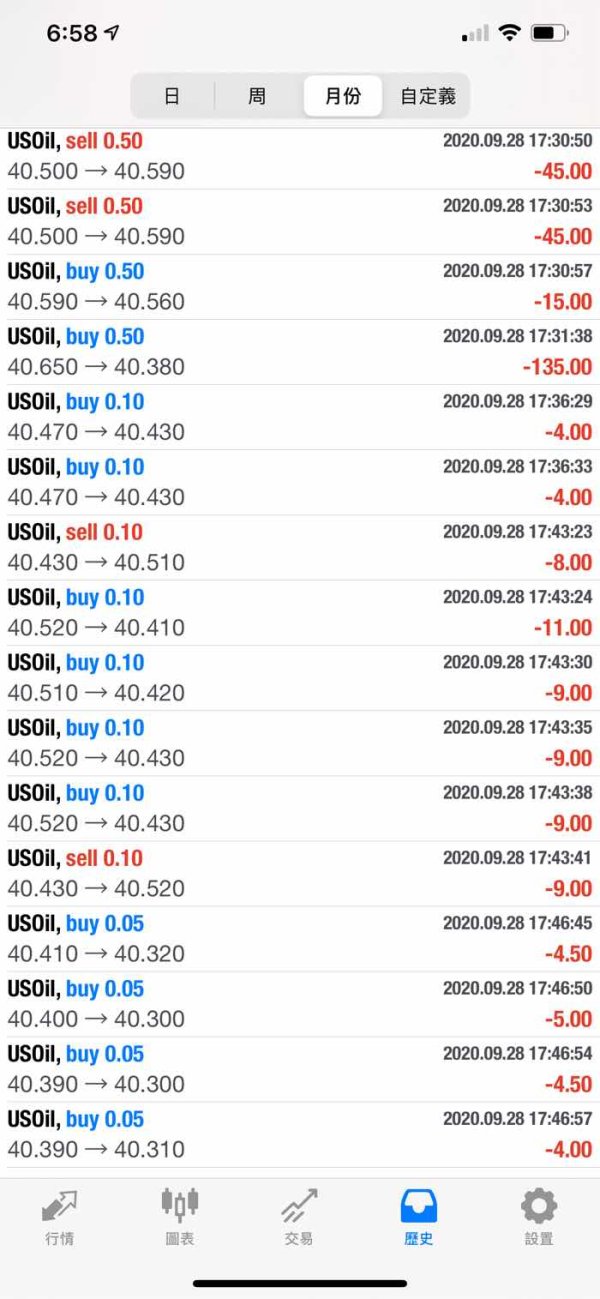

Costs (Spreads, Fees, Commissions)

The cost structure of trading with Insun is not clearly defined in the sources reviewed. Some users have reported high spreads and hidden fees, which can significantly affect profitability. The lack of transparency regarding costs further complicates the decision to trade with this broker.

Leverage Options

While specific leverage options are not detailed, the broker's general offerings suggest that it may provide competitive leverage ratios. However, traders should exercise caution, as high leverage can amplify both gains and losses, especially with an unregulated broker.

Trading Platforms Allowed

Insun primarily offers trading through the MT4 platform, which is widely recognized for its user-friendly interface and robust features. However, the lack of additional platforms may limit options for traders who prefer alternative trading environments.

Restricted Regions

The review sources indicate that Insun operates in various regions but does not specify any restricted areas. However, given its unregulated status, traders from jurisdictions with strict trading regulations should be cautious.

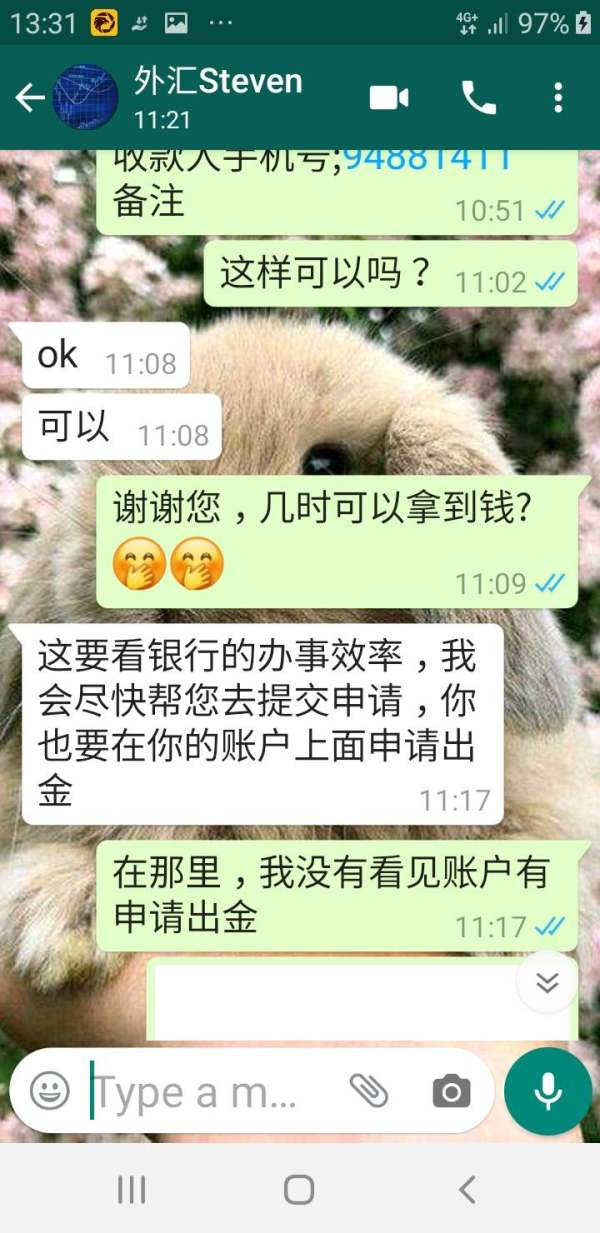

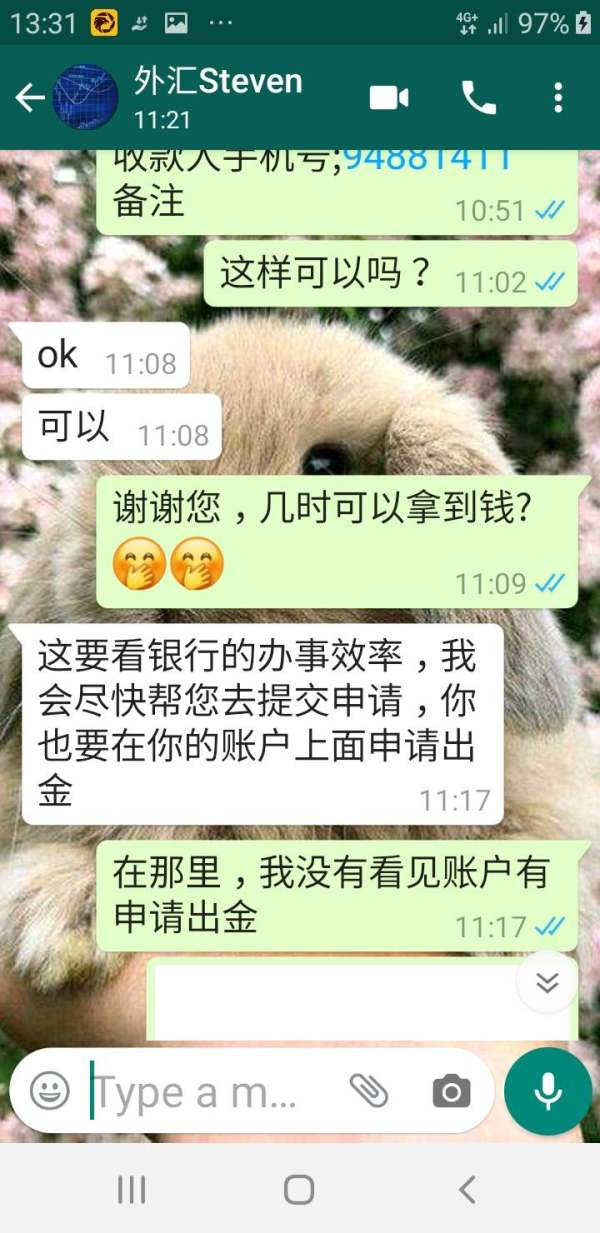

Available Customer Service Languages

Insun offers customer support primarily in English. However, user feedback indicates that the quality of customer service is lacking, with many users reporting difficulties in reaching support and receiving timely responses.

Final Ratings Overview

In conclusion, the Insun review reveals a broker that presents some appealing features, such as a low minimum deposit and a cashback program. However, the overwhelming concerns about its regulatory status, customer service, and overall trustworthiness make it a risky choice for traders. Potential users should carefully weigh these factors and consider alternative brokers with stronger regulatory oversight and better customer feedback.