Amitell Capital 2025 Review: Everything You Need to Know

Executive Summary

This amitell capital review presents a complete analysis of a Singapore-based investment firm that has created major controversy in the financial community. Amitell Capital PTE LTD was established in 2016. The company positions itself as a private investment company focusing on consumer goods and investment management, but our investigation reveals major concerns regarding the firm's regulatory status and user feedback.

The company operates from Singapore with a reported team of 11-50 employees. It maintains a presence on professional networks with 844 followers. Despite its established corporate structure, Amitell Capital faces serious allegations from users and has received poor ratings from financial review platforms, which raises red flags for potential investors. According to expert reviews published in 2024, the firm has earned only 1 out of 5 stars from financial analysts.

Our analysis indicates that this platform may be suitable only for investors with very high risk tolerance. The lack of clear regulatory information and negative user feedback patterns suggest that most retail investors should exercise extreme caution when considering this firm for their investment needs.

Important Notice

Regional Entity Differences: Amitell Capital operates primarily from Singapore. The company has not provided clear information about regulatory oversight across different jurisdictions, so investors should be aware that investment risks may vary significantly depending on their location and the regulatory protections available in their region.

Review Methodology: This evaluation is based on available public information, user feedback from various platforms including Reddit and financial review websites, company background data from professional databases, and expert analysis from financial review platforms. Due to limited transparency from the company itself, some aspects of this review rely on third-party assessments and user-reported experiences.

Rating Framework

Broker Overview

Amitell Capital PTE LTD emerged in the Singapore financial landscape in 2016 as a private investment firm. According to PitchBook data, the company positions itself as an investment management entity with a focus on consumer goods sectors, operating with a relatively small team of 11-50 employees and establishing a corporate presence that includes 11 associated members on LinkedIn who list Amitell Capital as their current workplace.

The company's business model appears to center around private investment activities. Specific details about their investment strategies and target markets remain unclear from publicly available information, and despite being operational for nearly a decade, Amitell Capital has maintained a relatively low profile in the broader financial services industry, with limited public disclosure about their funding rounds, investor base, or detailed operational specialties.

However, this amitell capital review must highlight significant concerns that have emerged about the firm's operations. Financial review experts have raised serious questions about the company's legitimacy, with some platforms categorizing it unfavorably, and the contrast between the company's professional presentation and the negative feedback from users and analysts creates a concerning picture that potential investors must carefully consider before engaging with this firm.

Regulatory Status: Available information does not clearly specify which regulatory authorities oversee Amitell Capital's operations. This represents a significant concern for potential investors seeking regulated investment services.

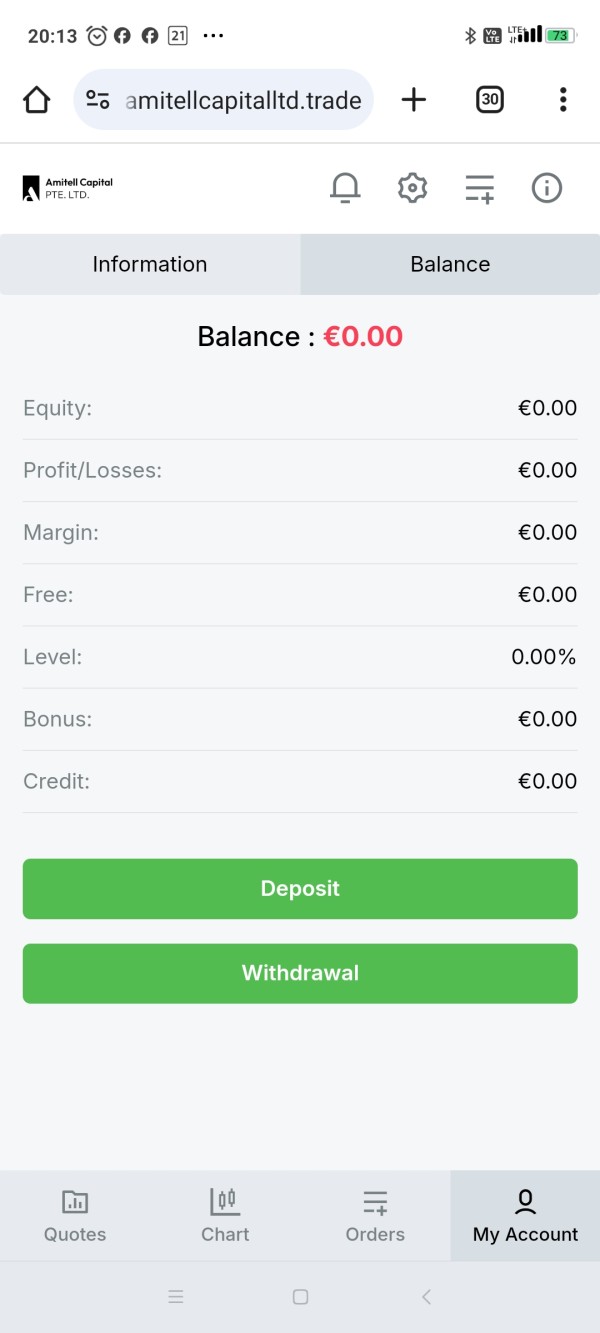

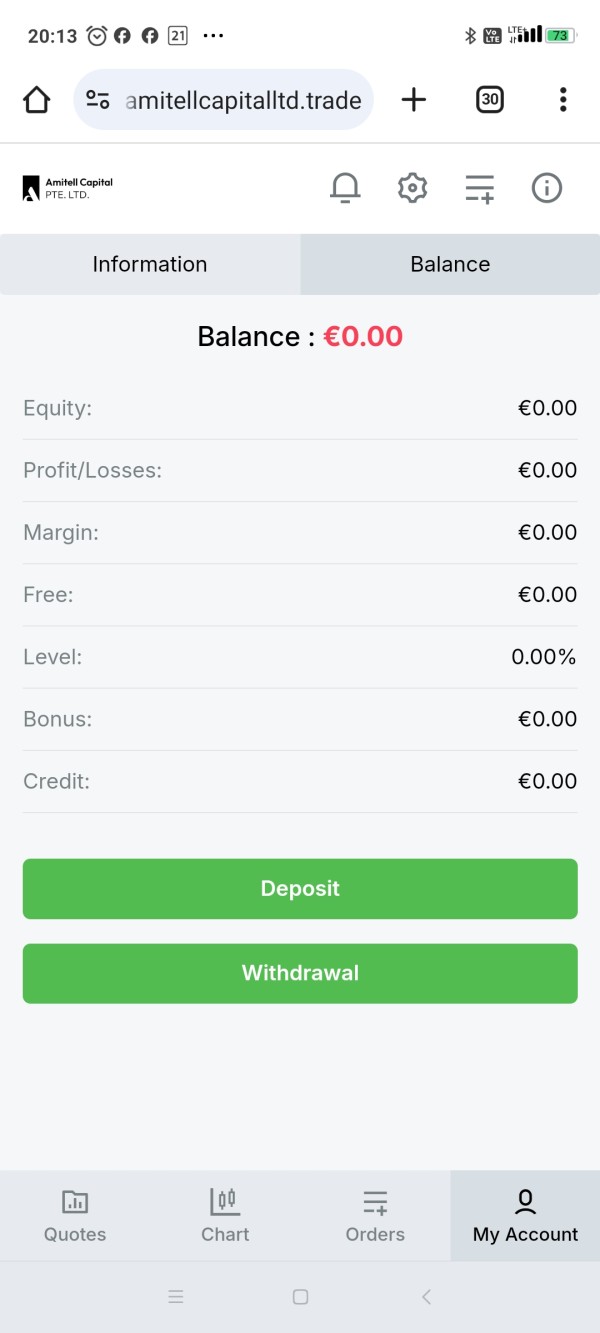

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods has not been disclosed in publicly available materials. This makes it difficult for potential clients to understand the financial transaction processes.

Minimum Deposit Requirements: The company has not published clear information about minimum deposit requirements for different account types or investment products.

Bonuses and Promotions: No information about promotional offers or bonus structures has been identified in the available documentation.

Tradeable Assets: While the company describes itself as focusing on consumer goods investments, specific details about available trading instruments, asset classes, or investment products remain undisclosed.

Cost Structure: Critical information about fees, spreads, commissions, and other costs associated with using Amitell Capital's services is not readily available in public documentation. This raises transparency concerns.

Leverage Options: Information about leverage ratios or margin requirements has not been specified in available materials.

Platform Options: Details about trading platforms, software, or technological infrastructure offered to clients have not been disclosed in publicly accessible information.

Geographic Restrictions: The company has not clearly outlined which regions or countries are restricted from accessing their services.

Customer Support Languages: Available support languages and communication options have not been specified in the reviewed materials.

This amitell capital review emphasizes that the lack of detailed operational information represents a significant transparency issue. Potential investors should carefully consider this concern.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions offered by Amitell Capital present several concerning aspects that contribute to our below-average rating. The company has not provided transparent information about different account types, their respective features, or the specific requirements for opening accounts with the firm, which makes it extremely difficult for potential investors to understand what they can expect when engaging with the company's services.

Minimum deposit requirements remain unspecified in publicly available documentation. This is unusual for a legitimate investment firm, as most reputable financial services providers clearly outline their account tiers, minimum investment amounts, and the benefits associated with different account levels. The absence of this fundamental information raises questions about the company's operational transparency and commitment to client communication.

The account opening process has not been detailed in available materials. This leaves potential clients uncertain about verification requirements, documentation needs, or timeline expectations, and there is no mention of specialized account options such as Islamic accounts or institutional-grade services that are typically offered by established investment firms.

This amitell capital review finds that the lack of clear account condition information significantly undermines investor confidence. It suggests potential operational deficiencies that serious investors should carefully consider before proceeding.

The tools and resources category receives a poor rating due to the significant lack of information about what Amitell Capital provides to its clients. Professional investment firms typically offer comprehensive suites of trading tools, market analysis resources, and educational materials to support their clients' investment decisions, but our research found no detailed information about such offerings from this company.

Research and analysis resources, which are fundamental for informed investment decisions, have not been described in any available company materials. This absence is particularly concerning for an investment management firm, as clients typically expect access to market research, financial analysis, and investment insights as part of the service package.

Educational resources, another crucial component for investor support, appear to be entirely absent from the company's public offerings. Most legitimate investment firms provide educational content, webinars, tutorials, and market commentary to help clients improve their investment knowledge and decision-making capabilities.

Automated trading support and advanced analytical tools, which are standard offerings in the modern investment landscape, have not been mentioned in any available documentation. The complete absence of information about technological tools and resources suggests either a very limited service offering or poor communication about available features.

Customer Service and Support Analysis (Score: 4/10)

Customer service and support capabilities represent another area of concern for Amitell Capital. The available information does not provide clear details about customer support channels, availability hours, or service quality standards, which is essential for an investment firm handling client funds and providing financial services to maintain client relationships and address urgent concerns.

Response times and service quality metrics have not been published. This makes it impossible for potential clients to understand what level of support they can expect, and user feedback available from various platforms suggests that service quality may be substandard, though specific details about customer service experiences are limited in the reviewed materials.

Multi-language support options have not been specified. This could be problematic for international clients seeking services in their preferred language, and given Singapore's multicultural business environment, the lack of clear language support information is surprising and potentially limiting for client acquisition.

The absence of detailed customer service information, combined with negative user feedback patterns, suggests that Amitell Capital may not prioritize customer support as a core business function. This deficiency could significantly impact client satisfaction and retention.

Trading Experience Analysis (Score: 4/10)

The trading experience offered by Amitell Capital cannot be adequately assessed due to insufficient information about platform stability, execution quality, and trading environment characteristics. These factors are crucial for investors who need reliable access to markets and efficient order processing.

Platform stability and speed metrics have not been published or verified through independent testing. User feedback does not provide specific information about platform performance, latency issues, or system reliability during market volatility, which makes it difficult for potential clients to evaluate whether the platform can meet their trading requirements.

Order execution quality, including information about slippage, fill rates, and execution speed, remains undocumented in available materials. Professional traders and active investors typically require detailed information about execution characteristics to make informed decisions about broker selection.

The functionality and features of trading platforms have not been described in sufficient detail. Modern investors expect comprehensive charting tools, technical analysis capabilities, and intuitive interfaces that support efficient decision-making and portfolio management.

Trust and Safety Analysis (Score: 2/10)

Trust and safety represent the most concerning aspect of this amitell capital review. The company has received a very poor rating in this category due to multiple red flags that suggest significant risks for potential investors, and the lack of clear regulatory oversight information is particularly troubling for an investment firm handling client funds.

Regulatory credentials and licensing information have not been clearly presented in publicly available materials. Most legitimate investment firms prominently display their regulatory status, license numbers, and compliance certifications to build investor confidence, so the absence of this information raises serious questions about the company's regulatory standing.

Industry reputation has been significantly damaged by negative reviews and expert assessments. Financial review platforms have assigned poor ratings to the company, with some experts raising concerns about the firm's legitimacy and operational practices, and these professional assessments carry significant weight in evaluating investment firm credibility.

Fund safety measures and client protection protocols have not been described in available documentation. Investors typically expect detailed information about segregated accounts, insurance coverage, and regulatory protections that safeguard their investments.

User Experience Analysis (Score: 3/10)

User experience with Amitell Capital appears to be significantly below industry standards based on available feedback and expert assessments. Overall user satisfaction ratings are poor, with multiple sources indicating negative experiences and concerns about the company's operations.

Interface design and usability information has not been provided in sufficient detail to evaluate the user-friendliness of the company's platforms or services. Modern investors expect intuitive, well-designed interfaces that facilitate efficient portfolio management and decision-making.

Registration and verification processes have not been clearly outlined. This leaves potential clients uncertain about onboarding procedures and requirements, as smooth, transparent onboarding experiences are essential for building initial client confidence and satisfaction.

User feedback compilation reveals predominantly negative sentiments, with concerns about service quality, transparency, and overall reliability. The pattern of negative feedback from multiple sources suggests systemic issues that may affect user satisfaction across different aspects of the service offering.

The target user profile appears to be limited to investors with extremely high risk tolerance. These investors must be willing to accept significant uncertainties about regulatory protection and service quality.

Conclusion

This comprehensive amitell capital review concludes that Amitell Capital presents significant concerns that make it unsuitable for most investors. The combination of poor transparency, negative expert assessments, lack of clear regulatory information, and concerning user feedback creates a risk profile that exceeds acceptable levels for typical investment activities.

The company may only be appropriate for investors with exceptionally high risk tolerance who fully understand and accept the potential for total loss of invested funds. However, even risk-seeking investors should carefully consider whether the potential benefits justify the numerous red flags identified in this analysis.

The primary advantages include the company's established corporate presence since 2016 and its Singapore-based operations. However, these limited positives are significantly outweighed by concerns including allegations of fraudulent activity, absence of regulatory clarity, poor expert ratings, negative user feedback, and lack of operational transparency that are essential for investor protection.